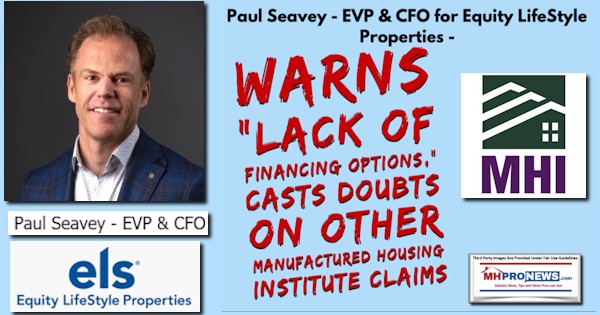

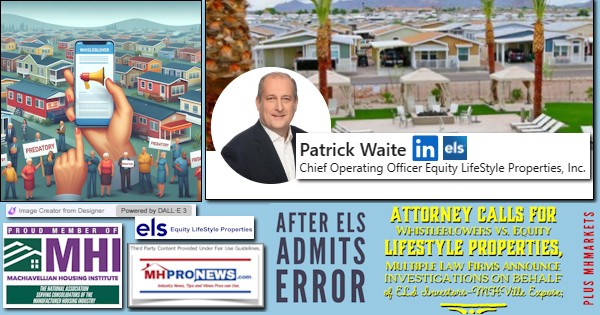

Among the interesting things mentioned during the final 2023 quarterly earnings call by Marguerite Nader-President, CEO Patrick Waite – EVP, COO Paul Seavey are the following: “Over the last 5 years, we have sold over…3,500 new homes in our communities.” “We assume occupancy in our stabilized MH portfolio will be flat during 2024.” “In 2024, we expect to have approximately $100 million of discretionary capital after meeting our obligations for dividend payments, recurring capital expenditures and principal payments.” “The full year guidance model makes no assumptions regarding acquisitions, other capital events or the use of free cash flow we expect to generate in 2024.” There is much more to unpack from our modestly edited to fix apparent typos transcripts of the Equity LifeStyle Properties, Inc. (ELS) Q4 2023 Earnings Call as reported by Seeking Alpha.

This manufactured home industry news report with analysis and commentary could shed light on the notion that talk isn’t always cheap. The wrong kind of talk, coupled with the wrong kind of ideas and actions, can be expensive.

Highlighting is added by MHProNews for items in Part I that we may refer to later and/or for other reasons. A few minor edits [bracket] have been performed by MHProNews in the following to fix apparent typos in the original. Readers of Part I should read all the remarks, not just the highlighted ones.

Part II will be our additional information with more MHProNews analysis and commentary segment.

Part I

Jan. 30, 2024 2:04 PM ET Equity LifeStyle Properties, Inc. (ELS) Stock

Equity LifeStyle Properties, Inc. (NYSE:ELS) Q4 2023 Results Conference Call January 30, 2024 11:00 AM ET

Company Participants

- Marguerite Nader – President, CEO

- Patrick Waite – EVP, COO

- Paul Seavey – EVP, CFO

Conference Call Participants

- Brad Heffern – RBC

- David Toti – Colliers Securities

- Eric Wolfe – Citi

- Jamie Feldman – Wells Fargo

- John Kim – BMO Capital Markets

- Josh Dennerlein – Bank of America

- Michael Goldsmith – UBS

- Nick Joseph – Citi

- Samir Khanal – Evercore ISI

Operator

Good day, everyone, and thank you all for joining us to discuss Equity LifeStyle Properties Fourth Quarter and Full Year 2023 results. Our featured speakers today are Marguerite Nader, our President and CEO; Paul Seavey, our Executive Vice President and CFO; and Patrick Waite, our Executive Vice President and COO.

In advance of today’s call, management released earnings. Today’s call will consist of opening remarks and a question-and-answer session with management relating to the company’s earnings release. [Operator Instructions] As a reminder, this call is being recorded.

Certain matters discussed during this conference call may contain forward-looking statements in the meaning of the federal securities laws. Our forward-looking statements are subject to certain economic risks and uncertainties. The company assumes no obligation to update or supplement any statements that become untrue because of subsequent events.

In addition, during today’s call, we will discuss non-GAAP financial measures as defined by SEC Regulation G. Reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures are included in our earnings release, our supplemental information and our historical SEC filings.

At this time, I would like to turn the call over to Marguerite Nader, our President and CEO.

Marguerite Nader

Good morning, and thank you for joining us today. I am pleased to report the final results for 2023. The strength of ELS can be seen in all facets of our business. We continued our record of strong core operations and FFO growth with full year growth in NOI of 5% and a 4.7% increase in normalized FFO per share. Our MH portfolio is 95% occupied. Importantly, more than 96% of our MH sites are occupied by homeowners. The underlying customer demand remains solid, and core operating revenue increased by 5.8% for the full year 2023 compared to 2022.

During the fourth quarter 2023, occupancy increased by 65 sites, and we ended the year with stable occupancy levels comparable to year-end 2022. We continue to experience robust demand for the lifestyle our communities provide with 905 new home sales during 2023. Our strategy of converting existing residents to home buyers continues to be successful with almost 1/4 of our home sales coming from individuals who already reside in our communities.

Home buying leads during the fourth quarter were up 7% compared to last year, driven by the availability of popular new home models and leveraging new technology to expand awareness of our homes for sale online. Due to the strength of our operating markets, we continue to see demand for new homes in our communities where we are selling homes on average for approximately $100,000. Our strongest performing communities for home sales were in Florida, which accounted for over 50% of total new home sales with an average sale price of more than $105,000. While home prices are $100,000 on average, they remain significantly lower than other housing options in the immediate vicinity of our communities.

In 2023, the mark-to-market rent increase for new homeowners has been approximately 13%. In 2023, our RV revenue from annual or seasonal customers increased 7.2% as compared to 2022. We saw continued strength in Florida and Arizona. Our transient business continued to be a large driver of our new customer base for both annual and seasonal revenue. We had over 1,000 transient customers convert to an annual or seasonal customer. Continuing to expose new customers to our properties through the transient stay is an important building block for our revenue stream.

Turning to 2024, we have issued guidance of $2.88 at the midpoint for next year. The demand for our MH communities continues to increase. Over the last 5 years, we have sold over 35 new homes — 3,500 new homes in our communities. These new homes further enhance the look of the community as new and existing homeowners throughout the portfolio showcased their pride of ownership.

Our guidance for 2024 reflects the strength in our business. Our guidance is built based on the operating environment at each property and continuous communication with our residents.

Next, I would like to update you on our 2024 dividend policy. The Board has approved setting the annual dividend rate of $1.91 per share, a 6.7% increase. The stability and growth of our cash flow, our solid balance sheet and the strong underlying trends in our business are the primary drivers of the decision to increase the dividend. Historically, we’ve been able to take advantage of opportunities due to the free cash flow generated from our operations. That will continue in 2024 as this dividend increase of $23.5 million is roughly equivalent to our anticipated increase in FFO for 2024.

In 2024, we expect to have approximately $100 million of discretionary capital after meeting our obligations for dividend payments, recurring capital expenditures and principal payments. Over the past 10 years, we have increased our dividend by an average of 11% per year, and this year’s dividend marks the 20th consecutive year of annual dividend growth.

I want to take a moment to express my gratitude to our dedicated team members who have worked tirelessly to drive our success. I am proud of their hard work and commitment that contributed to the results for 2023.

I will now turn it over to Patrick to provide more details about property operations.

Patrick Waite

Thanks, Marguerite. In 2023, long-term residents and guests at our core MH, RV and Marina properties, continue to demonstrate consistent demand, which supported occupancy and strong rate growth. As we approach the February peak of our winter Sunbelt season, I want to provide some additional color on the drivers of the nearly 70% of our revenue that comes from residents and guests at our Sunbelt properties in Florida, California and Texas.

Since our IPO in February 1993, we’ve been talking about the aging of the baby boomers and migration trends to the Sunbelt. In 2023, baby boomers celebrated birthdays, ranging from the ages of 59 to 77. And we’re in the midst of 69 million baby boomers, supporting a pace of 10,000 people turning 65 every day in the U.S. That trend spans the 19-year period from 2010 to 2029.

Given our core residents and guests stay with us 10 years or more, we have another 15 to 20 years of engagement with the baby boomers, as a key driver of demand at our properties. I’d also point out that subsequent generational cohorts, Gen X, Millennials and Gen Z follow similar aging trends as the baby boomers. Note that millennials will start to retire in 20 years, and they represent a population of 74 million, or 5 million more than the baby boom generation.

Overall, the U.S. population, 55 plus, is projected to increase 6.4% over the next 5 years. While our Sunbelt properties in Florida, California, Arizona and Texas are projected to increase 8.5%, outpacing the national growth rate by 200 basis points. The leader in our Sunbelt states is Florida, our largest state, with strong 55-plus population growth of 9.4% over the next 5 years, outpacing the national average by approximately 300 basis points. Our second largest state is California with a 55 population projected to grow in line with the nation at 6.4% over the next 5 years.

Two important points of — about California. First, MH and RV properties offer great value to customers, given high-quality locations and high demand. And second, the submarkets where our properties are concentrated are projected to outpace the 55-plus population in California by 70 basis points, emphasizing the strength of our locations within the state. For these key Sunbelt markets that represent nearly 75% of ELS total property revenue, MH, RV and Marina annual customers comprise more than 90% of that revenue while seasonal and transient guests represent 10%, that makes us consistent with the balance of our portfolio. These revenues in our Sunbelt markets benefit from baby boomer demand and associated population growth trends.

Over the last 5 years across the Sunbelt, our MH portfolio has produced 6% revenue growth and our RV portfolio 6.3% revenue growth. Those stable long term revenue streams have consistently been our priority and have consistently provided year-over-year NOI growth. For perspective, our portfolio footprint and current operating characteristics as a result of an investment focus starting in 1993. We focus our acquisition strategy on key submarkets in Florida, California, Arizona and Texas, and those markets have represented 2/3 of our growth through acquisitions over the last 30 years.

A couple of final key points to highlight. The contribution of our long-term Sunbelt investments. Over the last 5 years, 70% of our new home sales and 2/3 of our completed development expansion have been from our Sunbelt portfolio. Those are among the many contributors to the stable operating results referenced above.

I’ll now turn it over to Paul.

Paul Seavey

Thanks, Patrick, and good morning, everyone. I will review our fourth quarter and full year 2023 results and provide an overview of our first quarter and full year 2024 guidance.

We reported normalized FFO of $0.71 per share for the fourth quarter and $2.75 per share for the full year. Full year growth in normalized FFO was 4.7%. Strong core portfolio performance generated 5% NOI growth for the full year. Core community-based rental income increased 6.8% for the full year compared to 2022. Our rate growth was the result of increases to in-place residents as well as marketing rents to market on turnover at an average increase of 13% during 2023. Also during 2023, we increased homeowner occupancy by 554 sites.

Full year core resort and marina-based rental income growth from annuals was 8.1%, with 7.6% from rate increases and 50 basis points from occupancy gains. RV and marina-base rental income from seasonals increased 2.6% for the full year compared to 2022. Base rent from transient was lower than prior year, mainly as a result of unfavorable weather patterns we’ve discussed throughout the year.

For the full year, net contribution from our membership business, which consists of annual subscription and upgrade sales revenues offset by sales and marketing expenses, was $57.2 million, an increase of 6.7% compared to the prior year. The net deferral impact for the full year was $17.7 million. Subscription revenues increased 3.7%.

During 2023, we sold almost 3,900 upgrades with an average sale price of approximately $9,250. Full year growth in core utility and other income is mainly the result of increases in utility income. Our recovery percentage of 44.9% increased approximately 90 basis points compared to 2022. Other income includes $3.1 million of revenue associated with sites leased to provide housing for displaced residents in Fort Myers, Florida.

Fourth quarter core operating expenses increased 8.7% compared to the same period in 2022 and were higher than our guidance as a result of real estate tax increases. Several counties in Florida increased assessed values and millage rates. We have filed appeals and noticed residents of pass-throughs of increased real estate taxes where lease terms allow it. The pass-throughs will be recognized as revenue in 2024.

Our noncore properties contributed $5.2 million in the quarter and $27.6 million for the full year. Property management and corporate G&A were $117 million for the full year. And other income and expenses net, which includes our sales operations, joint venture income as well as interest and other corporate income was $29.8 million for the year.

Our interest and amortization expenses were $132.3 million for the full year, and our full year weighted average debt balance was $3.5 billion. The weighted average rate was 3.8%. The press release and supplemental package provide an overview of 2024, 1st quarter and full year earnings guidance. The following remarks are intended to provide context for our current estimate of future results. All growth rate ranges in revenue and expense projections are qualified by the risk factors included in our press release and supplemental package.

Our guidance for 2024 full year normalized FFO is $2.88 per share at the midpoint of our guidance range of $2.83 to $2.93. We project core property operating income growth of 5.6% at the midpoint of our range of 5.1% to 6.1%. We project the noncore properties will generate between $14 million and $18 million of NOI during 2024. Our property management and G&A expense guidance range is slightly lower than our 2023 actual expense, primarily as a result of our assumptions for reduced administrative and payroll expenses. We’ve also provided guidance ranges for our weighted average debt balance and interest expense in the supplemental package. The full year guidance model makes no assumptions regarding acquisitions, other capital events or the use of free cash flow we expect to generate in 2024.

In the core portfolio, we project the following full year growth rate ranges. 4.8% to 5.8% for core revenues, 4.5% to 5.5% for core expenses and 5.1% to 6.1% for core rev NOI. Full year guidance assumes core MH rent growth in the range of 5.5% to 6.5%. We assume occupancy in our stabilized MH portfolio will be flat during 2024. Full year guidance for combined RV and marina rent growth is 4.9% to 5.9%. Annual RV and marina rent represents just over 2/3 of the full year RV and marina rent, and we expect 7% growth in rental income from annuals at the midpoint of our guidance range.

Our full year core expense growth assumptions include our current projections for future utility rate increases as well as a real estate tax increase assumption that is consistent with our long-term historical experience. Our first quarter guidance assumes normalized FFO per share in the range of $0.75 to $0.81, which represents approximately 27% of full year normalized FFO per share. Core property operating income growth is projected to be in the range of 6.7% to 7.3% for the first quarter.

First quarter growth in MH and combined RV and marina rents are generally in line with our full year assumptions. We project first quarter annual RV and Marina rent to be approximately $72.9 million at the midpoint of our guidance range. 2024 is a leap year. So as we do every 4 years, we will have a slightly higher allocation of annual RV rent to the month of February as a result of the extra day. The incremental rent represents approximately 100 basis points of the first quarter 2024 growth. Our guidance assumes first quarter seasonal and transient RV revenues perform in line with our current reservation pacing.

I’ll now provide some comments on the financing market and our balance sheet. We have no scheduled debt maturities in 2024. Our $300 million term loan has an in-place swap that fixes the all-in cost of debt at 1.8% until late March. Current all-in cost of floating at swap expiration is 6.7%. Current secured debt terms are 10 years at coupons between 5.5% and 6.25%, 60% to 75% loan-to-value and 1.4 to 1.6x debt service coverage. We continue to see strong interest from GSEs, life companies and CMBS lenders to lend for 10-year terms. High-quality, age-qualified MH assets continue to command best financing terms.

Our $500 million line of credit currently has approximately $435 million available. We have $500 million of capacity under our ATM. Our weighted average secured debt maturity is approximately 10 years. Our debt to adjusted EBITDA is 5.3x, and our interest coverage is 5.2x. We continue to place high importance on balance sheet flexibility, and we believe we have multiple sources of capital available to us.

Now we would like to open it up for questions.

Question-and-Answer Session

Operator

[Operator Instructions] Our first question comes from the line of Josh Dennerlein from Bank of America.

Josh Dennerlein

Just wanted to go into the guidance range for MH same-store NOI for 2024, a little bit more. Could you walk us through like what gets us to the low end and high end? And then just kind of curious if there was any changes for 3Q. I know you put out that 5.4% rate increase out with 3Q results, and I see the range is 5.5% to 6.5%. So just trying to reconcile that.

Paul Seavey

Yes, Josh, First of all, with respect to the range, we noticed in October the rate increase that we anticipate and the 5.5% to 6.5% is the overall increase. The difference that you see there is the occupancy that we increased in 2023. The impact of that included in our current guidance.

And then just overall, with respect to the MH business, I mean, we don’t report separately the MH from the RV, but I can tell you that as we think about the business, the rent line is, I’ll call it, stable solid. We do notice decelerating rate throughout the course of 2024. Primarily as a result of increases that we noticed later in ’23 and then an assumption for just following CPI, which is not going to increase as it did last year.

And then on the expense side, I think that the things that might have exposure for us, as we always talk about, we have some assumption for storm events at our properties, but we have incurred outsized expenses in the past related to weather events.

And the other thing that we’re watching very closely that we’ve talked about quite a bit over the last couple of years is the volatility in utility expense. That does seem to be settling, but it’s unclear whether there’s some sort of structural shift just overall in energy costs or whether we experienced a period of significant volatility and that seems to be easing.

Josh Dennerlein

One follow-up, Paul. You mentioned the occupancy uplift in your MH based rental income growth rate. That’s just what you’ve incurred in 2023. I think your policy has been not to include anything on a go-forward basis. Is that —

Paul Seavey

That’s correct. In the stabilized portfolio, it’s assumed to be flat yes.

Josh Dennerlein

Okay. Okay. I was missing that. Okay. Got it. And then I think real estate taxes, it looks like there was a big increase in 4Q driving up expenses. How should we think about your ability to kind of pass those increases on to customers, whether it’s through rate or just assessments or anything. Is that possible?

Paul Seavey

Yes. So the lease provisions in primarily the MH properties, which had a disproportionately large exposure to the increases that we experienced allow us to pass through more than 95% of the increase that we experienced. All of it, of course, is subject to the appeals that we have in process. And we have close to 30 properties that are under appeal. And it will be a bit of time during 2024 before we’ll have visibility into the results of those appeals.

But to the extent that there is success, of course, the pass-through to the residents would be adjusted.

Marguerite Nader

And Josh, those residents have been notified of that increase already.

Operator

And our next question comes from the line of Brad Heffern from RBC.

Brad Heffern

Can you talk through the seasonal and transient reservation outlook as we sit here today?

Paul Seavey

Yes. As I mentioned in my remarks, Brad, we use current reservation pacing to prepare our guidance for the first quarter seasonal and transient. The seasonal is tracking in line, and we’re reserved for more than 95% of the first quarter rent. We see more variability in transient rent, but the reservation pacing is generally in line with our budget expectations.

I will say that we’re not anticipating the recurrence of the impact of severe weather that impacted the first quarter 2023, particularly in California, the first quarter of ’23. The first of many atmospheric rivers that impacted California and had pretty meaningful effect from a few of those storms.

Brad Heffern

Okay. Got it. And just to clarify on the guidance, is the term loan swap expiration included in the guidance? And then is there any plan to either fix that rate again or take out that term loan?

Paul Seavey

Yes and no. So yes, it’s included in guidance. And no, there’s the assumption is that we flow.

Operator

And our next question comes from the line of Jamie Feldman from Wells Fargo.

Jamie Feldman

I just want to go back to the Florida interest — Florida real estate tax increase. Can you give more color on what municipalities or what counties — do you think this could flow through to other countries [i.e.: counties] that haven’t increased yet? Is this specific property types that seem to be getting hit? I think there’s a real read-through here for kind of the rest of residential. I just want to make sure we put some guardrails on what happened and what this could look like going forward?

Paul Seavey

Yes. We experienced outsized increases in Lee County, Charlotte County, and a couple of other counties, but those were significant counties. There was some, I guess, a higher or more significant impact to our MH portfolio than our RV portfolio. And I think that, as I mentioned in my remarks, that leads to the ability to pass through because those lease provisions tend to have pass-through provisions in them.

Marguerite Nader

And Jamie, some of that is a function of acquisitions that have traded in the recent past over the last 3 to 5 years that are driving up that increase.

Jamie Feldman

Okay. And then I guess, switching gears, if we could just talk a little bit more about the RV business. I mean you came in slightly below your full year guidance for growth. And as we estimated what annual could look like, it looks like it’s kind of less than a 2% growth rate. So I’m just wondering, can you give more color on how you’re getting to those numbers. I think in the past, you haven’t really baked in any down days for weather. Clearly, weather has been a bigger issue the last few years. Is that part of the story here? Are you making some new assumption for that? Or any other color you can provide on why the outlook for next year might look weaker than this past year.

Paul Seavey

I guess what I will say regarding that is first quarter, kind of just a moment ago walk through the assumptions for the first quarter. And then for the second, third and fourth quarters, we — our assumption is closer to flat on a combined basis for the seasonal and transient. That is somewhat different than our past experience.

I think that we’ve talked a lot about the lack of visibility that we have into the transient business as a result of the significant amount of revenue that’s earned and booked in a very short booking window. And with respect to the seasonal, the first quarter is the lion’s share of the seasonal rent. So the remainder of the year, again, the second, third and fourth quarters are closer to flat than we’ve had historically.

Jamie Feldman

Okay. And that’s — it sounds like that’s more just lack of visibility and no reason to reach. You’d rather kind of bump as the year progresses rather than cut. Is that the right way to think about that?

Paul Seavey

I don’t know that it’s so much trying to manage expectations as it is acknowledging kind of what we’ve seen in terms of the volatility in the business over the last couple of years.

Operator

And our next question comes from the line of Eric Wolfe from Citi.

Eric Wolfe

I think you mentioned in your prepared remarks that you expect around $100 million of free cash flow this year. I was just curious if you could tell us how much you expect to spend in nonrevenue-producing CapEx to get to that number. And then as far as the revenue producing CapEx this year, if you can give us a sense for that expected spend in the incremental return.

Paul Seavey

I’ll do the first part, Eric. So, to come to the $100 million, we have an assumption of $85 million of spend in recurring CapEx.

Marguerite Nader

And maybe, Patrick, you could touch on the rest.

Patrick Waite

Yes. I mean let me just walk through our total CapEx spend, but Paul just touched on the recurring piece. And recurring for us really is about 1/3 of our total spend falls into 2 buckets: asset preservation and improvements in renovations. The next bucket for us is property upgrades and development. That’s a little bit more than half the spend. And I’d just point out that, that includes hurricane CapEx, and we would note that in our disclosures. But important to keep in mind. And then the balance would be revenue producing, expansion and development property upgrades and repositioning. And the last bucket is site development, and that is about 10% of our total spend. And that’s going to be with respect to improvements to site new homes in our MH communities.

The developments, I’ll touch on that from a view of the current year and what we think we see coming up in, I guess, the last year and the current year 2024. We delivered just shy of 1,000 sites for the full year. That was in line with expectations. Just a reminder, our yields on those projects from a stabilized basis tend to be in the high single digits to low double-digit yields. That mix was about 1/3 MH and 2/3 RV as we look forward to 2024. We believe we’re in a position to deliver in the neighborhood of 1,000 sites again. But that will be more evenly balanced between MH and RV at least, that’s the visibility we have at this point.

Eric Wolfe

Got it. That’s very helpful. Thanks for the detail. So I guess my follow-up there is just, if you think about just an average year, is there any way to sort of quantify how much that spend is sort of contributing to same-store versus maybe the spend that’s not contributing being capitalized. Just trying to understand how it impacts earnings in a typical year.

Paul Seavey

Yes. I think, Eric, in terms of the growth, if you want to think about it that way inside the core portfolio, there’s an incremental contribution that we’ve seen in the, call it, 30 to 40 basis points year-to-year. And then overall, in terms of core NOI, it’s a few percentage points in terms of the portion of NOI that is generated by those expansions. Appreciate though that I’m talking about expansions that aren’t fully stabilized. I mean Patrick was giving stabilized yields, and it takes several years for those projects to reach a stabilized level.

Operator

And our next question comes from the line of Michael Goldsmith from UBS.

Michael Goldsmith

What are the factors that keep the property management and G&A expense essentially flat in 2024 when accounting for the accelerated vesting of stock-based compensation in 2023?

Paul Seavey

Yes. It’s primarily, as I mentioned in my remarks, primarily administrative and payroll expenses, Michael, just managing those closely year-over-year.

Michael Goldsmith

Got it. So it seems like despite wage growth in line with CPI or you’re still able to offset that through other angles? Or is it just reduced payroll within property management and G&A.

Paul Seavey

I think that we’ve been efficient with respect to our staffing. And I think that it’s just reflected in the projection for next year.

Marguerite Nader

And driven by those administrative fees that Paul mentioned.

Michael Goldsmith

Got it. And then there may be more anecdotes of municipalities becoming more accepting of adding MH communities as a component of affordable housing. Have you seen any change in the tone from the municipalities around MH? And then this is also an election year. Does a change in administration have any impact on the potential supply demand — the supply and the potential demand for your properties?

Marguerite Nader

Yes. I’ll take the second question first. And with respect to the election cycle, we have looked over the years at whether or not we see any change in the environment as a result of either a change at the federal level or at each individual state. And we really haven’t seen much, and I don’t anticipate seeing much in this coming year.

As it relates to municipalities, we continue to work with municipalities on conversions of vacant land to MH and RV. We haven’t seen an uptick in activity where we’ve seen resistance. We’re continuing to see resistance and where we were able to be successful, we continue to develop the land. So we’re not seeing what we would see as a wide spread acceptance of the development permits, but that may change in the coming years.

Operator

And our next question comes from the line of Samir Khanal from Evercore ISI.

Samir Khanal

I guess, Paul, you talked about seasonal business. But looking at — is there a way to sort of break that down in the transient business here? On the RV side? And how should we think about that over the course of the year? I guess, what are you assuming for transient? I mean you were down about 11%, I think, in ’23. So is this a business that sort of turns positive at this point in ’24? Help us think through this process?

Paul Seavey

Well, I guess, generally speaking, given the building blocks for Q1. So you can see what the combined seasonal and transient is. And then as we — and again, the first quarter is the largest quarter in terms of that seasonal business. So it’s far more modest in the remainder of the year. The transient and seasonal combined, as I said earlier, we essentially have a close to flat assumption for quarters 2, 3 and 4.

Samir Khanal

Right. But it’s sort of — you’re saying seasonal/transient. I was trying to dig more into the transient business, right? It’s because going to get to — go ahead.

Paul Seavey

Yes. Sorry. Sorry, Samir. I guess in our view, given the volatility that we’ve seen, there’s been consistency in how we’ve talked about seasonal and transient together. And so that’s how we presented the information.

Samir Khanal

Okay. And then I guess my second question is on – I don’t think we’ve touched on this, but insurance renewals. I know it’s an April 1 sort of date that you have, but maybe talk around sort of conversations you’ve had with providers and what’s sort of embedded in the guidance?

A –Marguerite Nader

Sure. So you’re right that our property level insurance policies renew on April 1 of this year. Our claims experience has been good so far this policy year, which is a positive. We have built in an assumption into our guidance but continue to work with our carriers on the renewal. And at this point, we’re not disclosing within guidance as we’re still negotiating that. We have no indications that coverage will be an issue, and we’ll continue with our past practice of updating on the – on our next call.

Operator

And our next question comes from the line of [Robin Lou] from Green Street.

Unidentified Analyst [i.e.: Robin Lou from Green Street]

Just on property taxes. I think you mentioned earlier that some of the Florida counties saw higher values from trades in the last few years, which is obviously a trend that you probably saw in other markets. Can you probably sort of give us an update on whether there are other markets where you are concerned about the tax headwind as well?

Paul Seavey

Well, I mentioned the counties — 2 of the counties. We also had some impact in Sarasota County. So Charlotte, Lee and Sarasota counties were 3 counties in Florida that were significant. In terms of other areas of the country, if that’s the direction of your question, we’ve seen less exposure or less activity in the way of increased assessed values in other parts of the country. It’s primarily Florida, that’s driving the change that we see.

Unidentified Analyst [i.e.: Robin Lou from Green Street]

And then on the transaction market, can you provide an update on what you’re seeing now in terms of cap rates across the 3 segments?

Marguerite Nader

Sure. Sure, Robin. So in 2023, there were really very few deals on the market. As I think you saw, we only closed on 1 transaction. We’re active in the market talking to owners, and we have not seen a lot of stress in the market. Sellers generally have very conservative balance sheets and they have their ability to take time on a transaction. I’d say, if you kind of broaden the time period out to the last 18 to 24 months, the cap rates ranging from 4% to 6% based on the quality of the property, with very high quality, age qualified MH trading much more aggressively. So not a lot of data points out there, but I anticipate that, that may change in 2024.

Unidentified Analyst [i.e.: Robin Lou from Green Street]

I know that this sizable MH portfolio traded at the end of last year. Did you by any chance participate in that?

Marguerite Nader

Well, we — it’s a very small industry. So we are knowledgeable about all the transactions and our look at all the deals that come that come — are in and around the industry. But when we close on something, we announced the closing and don’t really talk about what we’re looking at as we roll through the process.

Operator

And our next question comes from the line of John Kim from BMO Capital Markets.

John Kim

I wanted to ask about transient revenue. I know you’re saying it’s flat. There’s maybe some lower visibility. The number of transient sites went up sequentially by about 5% and year-over-year about 2%. I know that number could jump around quite a bit. But is this — is there a reason why the transient revenue shouldn’t grow by this amount, just given the number of sites available or have increased?

Paul Seavey

So part of the transient site change is from an expansion that we have in Florida. So that — and it’s at a newer property that we acquired. So that’s flowing through the noncore rather than the core. That’s I think roughly half of the transient site increase that we saw.

And then the other component of the transient site increase is shifting of sites that had been occupied as annuals in the quarter and we anticipate that those annuals will renew as we head back into the spring season. So they’re not expected to remain transient sights for a long period of time. It’s typical for us at the end of the year to have a decline in transient sites and then refill those sites in the — these are northern properties that I’m referring to, refill those sites next year as the spring season starts.

John Kim

Okay. That makes sense. I just had a second question on your FAD adjustments. The first part of that was non-revenue-enhancing CapEx? I think Paul, you mentioned $85 million of recurring CapEx, what you expect this year? Is that the same number on an apples-to-apples basis versus the $99.8 million that adjustment? And the second part is the announcement you made last week on the change in membership upgrade sales from a cash basis that you had previously on non-GAAP measures. Is this something that we should be contemplating, adding back to AFFO? And is that something that should be added back to your FAD and if not, why not?

Marguerite Nader

Yes. Why don’t I take the membership and then Paul, you can address the first part. But just from an operational standpoint and a cash flow standpoint, we’re really in the exact same position with respect to the membership upgrades. So our view is it doesn’t impact valuation, and it doesn’t impact the operations of the company. So we’re in the same position. And we provide — I don’t know the page, I think it’s —

Paul Seavey

Page 15.

Marguerite Nader

Page 15 provides the detail on the membership upgrades just like we have in the past. And then, Paul, maybe?

Paul Seavey

And then on the recurring CapEx, yes, the $85 million is comparable to the $100 million total that we reported for 2023.

John Kim

Okay. On the membership upgrade sales, is there any risk that income stream once you get it, do you ever return that capital back to members for any reason?

Marguerite Nader

No, it is nonrefundable.

Operator

And our next question comes from the line of David Toti from Colliers Securities.

David Toti

I just had a quick question. It seems that the average price of the homes that were sold in the period were lower on average. And there’s a bit of inventory buildup from last year. Would you say that these are ongoing signs of pressure in that segment? Or are these aberrational in the quarter?

Patrick Waite

Yes, it’s Patrick. I wouldn’t say it’s ongoing signs of pressure. And maybe I’ll just touch on leads have been consistent and that the fundamentals of our core customer have been remarkably stable. The average age of a new home buyer for us is 60. FICO scores are consistently over 700. One thing I’ll point out, and this is a little bit of a change that occurred through COVID is that we’re getting more direct purchases from people who have relocated from out of state that’s running at about 30% of our new home sales, pre-COVID was around 20%. So it’s that — it sounds like a gargantuan shift. But nevertheless, it has been a shift in behavior. And overall, the core customer has been consistently stable and I feel like the demand has been very consistent.

David Toti

Great. And then I just have one follow-up question, which is in terms of home sales inventors, do you know the conversion ratio or the renters that you capture with home sales?

Patrick Waite

Yes, it’s between 20% and 25% of our home sales, are to current residents. Now that typically is a renter, but can also include existing homeowners who are either looking to scale up to a more highly amenitized house or maybe looking for a more manageable space and moving down to a smaller home.

Marguerite Nader

And that’s a very important lead flow for us, but I think the team has done a great job of capitalizing on over the last 4 or 5 years and focusing on the existing residents and customers that are in our properties on a shorter-term basis and getting them to convert. So we’ve been successful in doing that over the last few years.

Operator

And our next question is a follow-up from the line of Jamie Feldman from Wells Fargo.

Jamie Feldman

I was just looking for some more detail on the marina rent growth assumptions I know it sits within the marine and RV line. But can you talk more about how the growth for marina specifically compares to your full year outlook for the 2 combined? And just any color you can provide on maybe what you think changes next year versus this year?

Patrick Waite

Yes. I mean I’ll touch on what we’re seeing in the business and maybe Paul follows up on anything that a more relevant to guidance. But the performance of the marina portfolio for us has been very consistent. It’s overwhelmingly annual for our slip revenue. It’s almost 100% on — and those are long-term customers that are typically with us in very similar trends to what we see on annual RV.

Our boat launches for the full year have been consistent. So that’s evidencing consistent demand from our core customers that they continue to get out on the water with their family and friends. And our rate growth has been reflective of the market and consistent. We don’t really see any headwinds that would be a challenge to that business or at least don’t currently see any.

Jamie Feldman

Okay. And then was there — Paul, were you able to comment on the guidance piece?

Paul Seavey

It’s essentially right in line with our expectations for the annual RV. There’s not much differential between the rate increase in the RV or the marine space from what we see.

Jamie Feldman

Okay. And then I appreciate your color on the transaction market. Can you talk about — I mean you bought 1 RV. I know it’s a small deal, but can you talk about yields on that and maybe there’s more opportunities in RV? And then also pricing on marinas, where would you say cap rates are generally? And do you think there’s more opportunity in those 2 property types versus MH in ’24?

Marguerite Nader

Yes. I mean on the RV that we bought in the year is roughly a 5 cap. It’s a small property, I would say that as you look to the marina space, there’s a wide disparity in cap rates based on the location. So it’s hard to pin one down. There also haven’t been a lot of transactions. So it’s difficult to find a data point that’s relevant. So I think you’d look to — in terms of where we’re interested in buying assets around assets we already own because those are the locations we want to be in, and I think you’ll see us continue to work on acquisitions in those areas. And I think, I guess, 2024 time will tell what the — how the cap rates come out and whether or not sellers are willing to sell at this point.

Jamie Feldman

Okay. If I could just sneak in one quick one. GSE financing rates, where would you peg them today on MH?

Paul Seavey

On a secured basis, they’re probably at the lower end of the range that I quoted for us as a borrower. So I quoted 5.5% to 6.25% for 10-year. Generally, a sponsor like ELS does command preferred pricing. So I’d peg it probably 5.5%, 5.75%.

Operator

And our next question is a follow-up from the line of Eric Wolfe from Citi.

Nick Joseph

Actually, Nick here with Eric. Marguerite, I’m just curious how you’re thinking about the Florida exposure and capital allocation there going forward? Obviously, you’ve had higher insurance in the real estate taxes, but are you thinking of those as more transitory headwinds? Or is it something more permanent that goes into underwriting and maybe changes some of your priorities there?

Marguerite Nader

Sure, Nick. Thanks. I think Florida is really high in demand. As you think about it, across the United States. [There] people are just flooding to Florida. There’s about 22 million people that live there. Third most populous state and I think it was the fastest-growing state last year. And really a large portion of the population is our age demographic of 55-plus. And then it also offers a favorable tax climate and then, of course, the chance to get out of the Northern winters. So our view on Florida is very positive. It’s where people want to be and we’ll continue to invest there.

And as you look at — and it’s actually the NOI chart that Citi compiles each year, it shows our average NOI as a company for the last 20 years and how we compare favorably to the REIT industry. And then when you consider in only Florida in that analysis, we’ve really shown that we’re doing better than our overall NOI just in Florida. So we’re long in Florida.

Nick Joseph

Yes, that makes sense. I guess it’s the go forward if insurance costs or real estate taxes keep outpacing elsewhere does that impact NOI growth in Florida going forward, recognizing the much demand you’re seeing there?

Marguerite Nader

Right. I think as Paul mentioned about the real estate tax and the ability to pass through, that’s always been a really positive thing for us in the state, primarily because the residents are able to go with us to the tax assessor to talk about the impact. That’s a very powerful message. So that helps to keep tax rates in check. And with respect to insurance, we have seen times where there’s been an increase in insurance premiums and then there’s a moderation as storm events kind of moderate. So we’ll be looking to see if we are able to take advantage of that.

But the main thing, as it relates to storms in Florida, after the storm clears, everyone is out and wants to get out there and be active in the floor to [i.e.: Florida] sunshine. So I think that will continue.

Operator

Since there are no further questions on the line at this time. This does conclude the question-and-answer session, and I’d like to hand the program back to Marguerite Nader for any further remarks.

Marguerite Nader

Thank you all very much for joining today. We look forward to updating you on our next quarter’s call. Take care.

Operator

Thank you, ladies and gentlemen, for your participation in today’s conference. This does conclude the program. You may now disconnect. Good day. ##

Part II – Additional Information with More MHProNews Analysis and Commentary

In no particular order of importance are the following observations.

- Per ELS’ website: “Our portfolio comprises more than 200 manufactured housing communities nationwide that feature attractive surroundings, premier amenities and high levels of service provided by our dedicated on-site management teams.” According to the information from their earning’s call above, ELS and reported: “905 new home sales during 2023″ and over 3500 in the last 5 years. While ELS is and has a history of being profitable, those numbers should be questioned, not applauded, shouldn’t they? Doing the math: in 2023 ELS sold only about 4.5 new homes per community. Over the last 5 years, that 3500 total new home sales would only be about 3.5 new homes sold per community per year. For ELS to brag about their “manufactured housing communities” with “premier amenities” and “high levels of service” during an affordable housing crisis, those modest numbers speak to a paltry result, don’t they? For more on this, see #6 below.

- Robin Lou from Green Street asked: “I know that this sizable MH portfolio traded at the end of last year. Did you by any chance participate in that?”

To which ELS President and CEO Marguerite Nader said: “Well, we — it’s a very small industry. So we are knowledgeable about all the transactions and our look at all the deals that come that come — are in and around the industry. But when we close on something, we announced the closing and don’t really talk about what we’re looking at as we roll through the process.”

That sizable MH portfolio is apparently the one in the report linked below.

3. Per Bing’s AI powered Copilot said the following about that deal.

However, beyond MHProNews, there is no explicit information available about other manufactured housing trade media outlets reporting on this specific sale. For further insights, additional research would be necessary.

In summary, while MHProNews provided comprehensive coverage, other industry-focused media sources did not report on Brookfield’s sale of these manufactured housing communities. …”

It is difficult to imagine how a $325 million dollar deal could be overlooked or ignored by other MHVille trade media, but apparently so. Just one more reason why MHProNews stays ‘read hot‘ and others are…not.

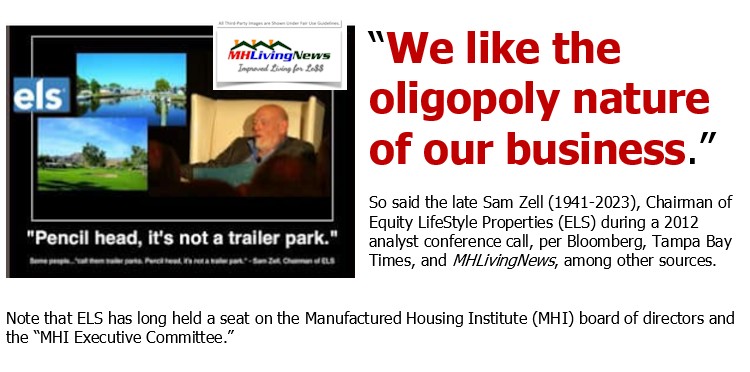

That said, note that no one in the ELS earnings call actually named Brookfield as the seller? ELS indicated that were quite aware of the deal but opted not to comment. This is an apparent example of what the late Sam Zell said.

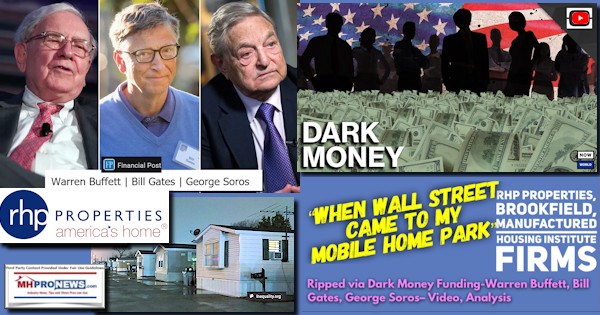

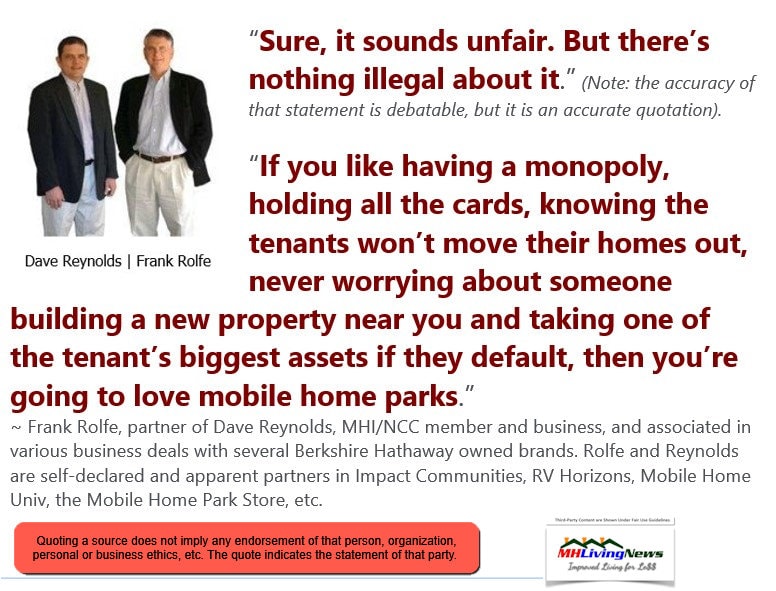

If someone among the ‘powers that be’ involved in MHVille want to keep something as ‘down low’ as possible, that desire appears to be respected by the other industry oligarchs, err, plutocrats, oh, feudal lords, uhm, Manufactured Housing Institute (MHI) insiders as much as possible. Isn’t that an example of the wink and a nod among MHI insiders at work? See the report linked here.

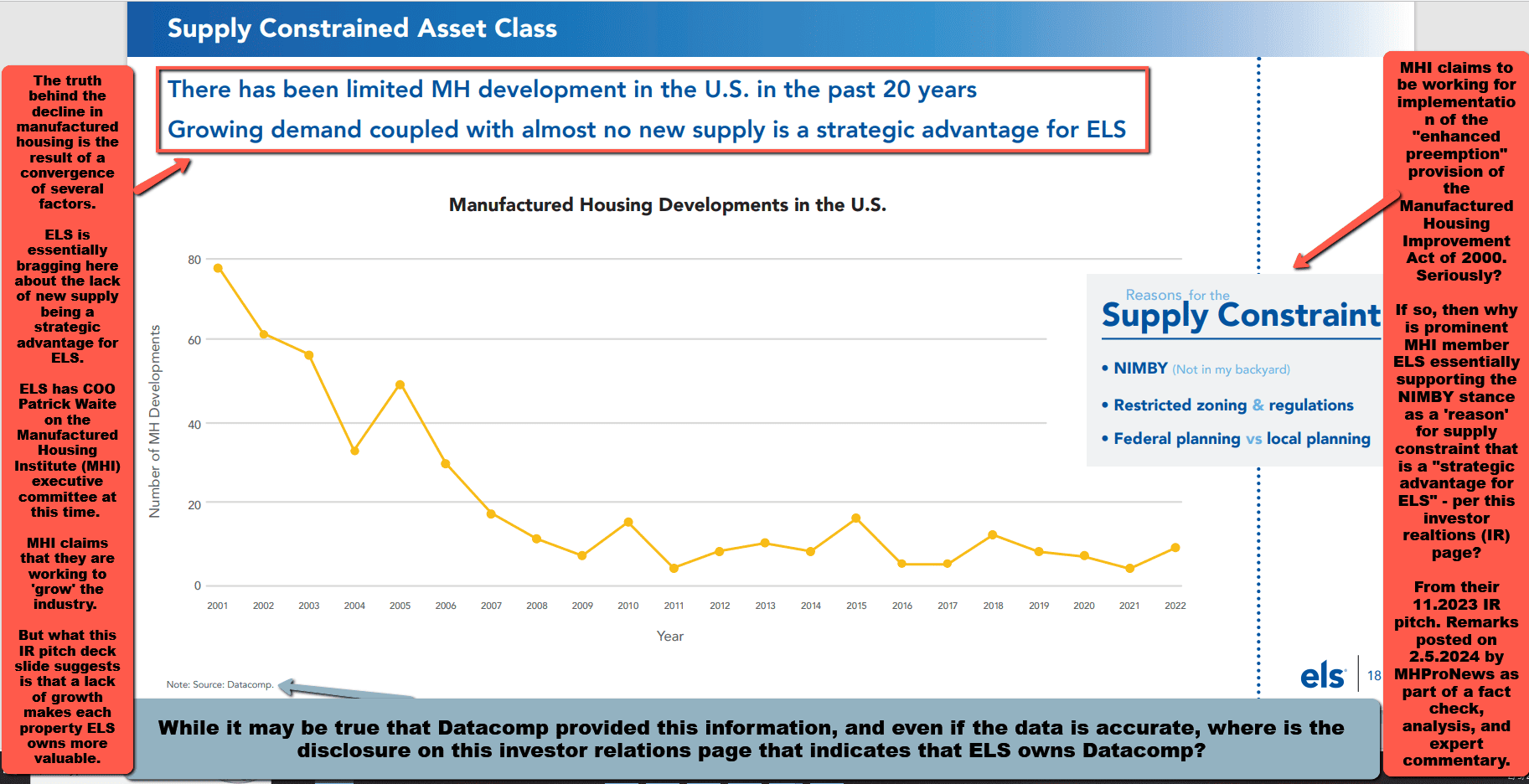

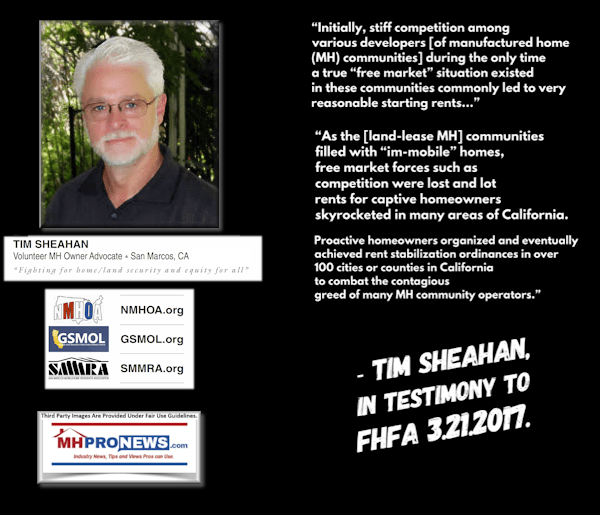

4. Cavco claimed in their Investors Relation’s pitch that resistance by local zoning boards to modern manufactured homes was easing. These remarks by ELS above indicates otherwise. Even expansion of existing land lease manufactured home communities continues to get pushback. Chalk up one more disconnect among members of MHI, who can’t seem to get their stories to investors straight. So is it any wonder that MHI can’t get or keep their stories to members and the industry straight. See the report linked here.

ELS President and CEO Marguerite Nader said in response:

As it relates to municipalities, we continue to work with municipalities on conversions of vacant land to MH and RV. We haven’t seen an uptick in activity where we’ve seen resistance. We’re continuing to see resistance and where we were able to be successful, we continue to develop the land. So we’re not seeing what we would see as a wide spread acceptance of the development permits, but that may change in the coming years.”

Note on the political side of that inquiry, there was no signal from Nader that the election outcome will bother them either way. Why should the oligarchs and their minions be bothered by the outcome of a mere presidential and general election?

5. In the report linked here, the point was made that depending on the MHI insider linked firm, tens of millions to even billions of dollars available for whatever some corporate leader might want. Note to clarify, not every MHI member firm is an MHI insider. Some are potential meals for future consolidation. Other more select firms are valued members of the MHI insider club a member told MHProNews that ‘made MHI a tool for themselves.’ That said, Eric Wolfe said: “I think you mentioned in your prepared remarks that you expect around $100 million of free cash flow this year.” That is more “free cash” than most any of the remaining independents left in the manufactured home industry outside of the consolidators.

Either than analysts don’t know, and/or they are happy to play along. While ELS in the above transcript is talking about the numbers of sales made in recent years, there is no mention that industry sales have trended downward. Who cares? They are in the manufactured home and RV land-lease biz with marina slips as a related function. The homes in their communities are a necessary widget in their bigger picture.

Posturing aside, the evidence suggests that the vaporization of the street retail side of the manufactured home industry is now of little consequence to ELS, though the loss of street retailers may be to hundreds of smaller ‘mom and pop’ community operators. A new generation of manufactured home employees exists that in many cases has little or no clue about the industry’s heydays when a single salesperson might sell as many homes in a month as the average ELS community did in a year (see Part II #1).

6. Similarly, the ELS transcript revealed that their inventory of new homes for sale had grown somewhat. Consider this portion of the latest ELS Q&A.

David Toti from Colliers Securities said:

ELS Executive Vice President (EVP) and Chief Operating Officer (COO) Patrick Waite said:

7. So, residents and new home customers and employees are similarly seemingly mere demographic details for corporate big wigs to discuss with less enthusiasm than they might their latest BMW, Mercedes, or Bentley. If residents were thrilled with their lifestyle, wouldn’t referrals mean that their communities would be essentially full with a waiting list for new homes? But that isn’t the case. Why are zoning boards still pushing back, if ELS and what Nader previously called “our” trade group (i.e.: MHI), the Manufactured Housing Institute (MHI), were doing their respective jobs properly in a way that genuinely results in satisfied residents? When critical thinking skills are applied to what has transpired among several of the “award winning” brands at MHI, and the numbers and remarks are examined more closely, a different image emerges than the one pitched, doesn’t it?

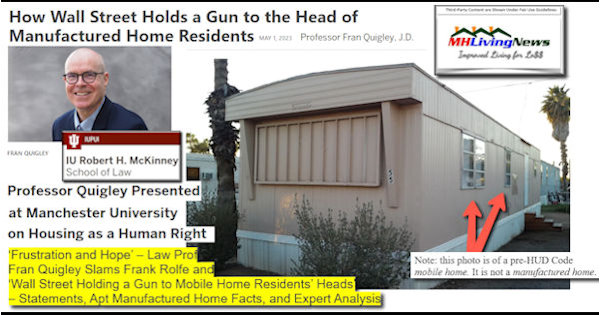

8. Doesn’t the growing number of lawsuits signal a warning sign that merited a question from analysts? ELS is in a sense named twice in these growing numbers of suits, because ELS owns Datacomp. And ELS is named too.

9. For all the discussion about premier properties, CapEx and how excess cash is going to be deployed, it seems that ELS has allowed some properties – per lawsuits and resident complaints – to be in less than stellar condition. Imagine if rising waters that made it difficult to access your home during or after a rain was the reputation of a condominium complex. What would the reputation of that condo be?

10. Certainly, there are things to be questioned about how MHAction operates and its ties to Buffett buck’s donor dollars that flow to them via the Tides. That said, despite the window dressing of MHI, awards, their board of directors where Waite sits on the executive committee, and their so-called MHI-NCC code of ethical conduct, ELS is one of the companies that has routinely been named by unhappy residents who feel that they are being unjustly pressured by predatory corporations. The hot embers are there to be flamed by MHAction because of the kinds of issues raised in complaints and concerns raised in the reports linked or posted below.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

The video below is by an apparent ELS resident. Per the YouTube Page the video below is posted: “Equity LifeStyle Properties ELS started a Seawall improvement project in June 2020 and then stopped the project leaving residents with an ugly mess in their back yards. It is April 2022 and things look the same as when ELS stopped work in 2020.”

A comment posted on the video above appears to be by another ELS resident. It said the following:

11. In what has been described as a feudalistic business model evolved in the 21st century in several parts (not all) of manufactured housing. That troubling image has consequences for investors. It is arguably a drag on the ethical companies in the manufactured home business. And it obviously is problematic and stressful for residents of so-called ‘predatory’ operators. The manufactured home industry today is in several vexing ways a mere shadow of its former glory, and there are insider brands at MHI who are at or near the center of this pattern. The posturing by “big boy” corporations that dominate MHI gives a measure of cover for what resident-advocate attorney Ishbel Dickens called “these types of abuses and shed light on the seamier side of the industry.”

Anyone who believes that these darker problems aren’t hurting the honorable operations in manufactured housing are kidding themselves. Oddly, this ‘feudalistic’ business model may prove to be less profitable than if new communities were being developed that offer residents the kind of stability and appeal that would attract referrals instead of complaints. Is there evidence for that notion? Yes, and it comes from Sun Communities when Gary Shiffman, who is arguably no saint, said that the compression of cap rates on existing communities has become so marked that new communities can be developed at a higher rate of return for investors.

12. When ELS purchased Datacomp and MHVillage, they also purchased what might be described as the ‘cover’ that MHInsider may offer for what Dickens described as the industry’s “seamier side.” Note that MHInsider doesn’t have to be a high traffic generator in order for it to do what ELS may have had in mind. Investors can be pointed to an article there, and the publication looks legitimate enough and ranks well enough that it may create a useful illusion.

13. Thankfully, there is the gift of memory. MHVillage/Datacomp/MHInsider’s Darren Krolewski himself said that the industry is harmed by the steady drum beat of negative news. What Krolewski didn’t say is how often some of the ‘leading’ brands at MHI were the source of that bad news. Is that textbook paltering?

14. ELS has plenty of ‘free cash’ and credit lines to make necessary adjustments to their business model. ELS, perhaps in conjunction with others at MHI, have plenty of cash that would allow them to take the necessary steps to grow the manufactured housing industry in a manner that would fit what ex-MHI President and CEO Chris Stinebert said is necessary for the industry’s recovery.

15. Day by day, the evidence of what is going wrong in manufactured housing mounts at MHProNews and/or at MHLivingNews. There is good news, honest and authentic potential to serve the public properly, to be sure. There may still be more home sites in the control of ‘mom and pop’ or independent operators who offer ‘good old fashioned’ ethical business practices than in the hands of consolidators like ELS. That is why there ought to be a ‘white hat’ trade group that draws a bright line distinction between themselves and the apparent black hat brands operating in the MHI and their aligned state association network. Ethical businesses have little in common with the oligopoly style monopolistic moat builders. This feudalistic “Castle and Moat” business model of oligopoly was cheered – “we like” it – by the late Sam Zell. More than enough evidence exists for public officials and/or more plaintiffs’ attorneys to come in and do their jobs. Indeed, there are reasons to believe that the current crop of class action suits may have found some level of inspiration in reports found on MHProNews/MHLivingNews. ELS President and CEO Marguerite Nader said: “Well, we — it’s a very small industry.” The question is WHY is it a small industry? Why is the industry performing so poorly compared to its great potential?

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

16. Unhappy employees, whistleblowers with knowledge and evidence, and others have plenty of good reasons to step up and be part of the solution instead of allowing the problems to fester and continue. The status quo may seem to reward a few for a time. But even oligarchs in MHVille may ultimately find themselves so mired in litigation (see linked reports) that their ‘strategy’ could backfire in the long run. See the related reports to learn more. ###

Still missing the late Robert “Bob” Van Cleef. RIP.

PS: Note: we plan to do a follow up special report on ELS. Watch for it.

PPS: Stay tuned to your #1 source for Manufactured Housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © Here you will find Intelligence for your MHLife.” © Tipsters? Forward or Submit items at this link here. Employees of a “predatory” MHI brand? Click here. ###

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’