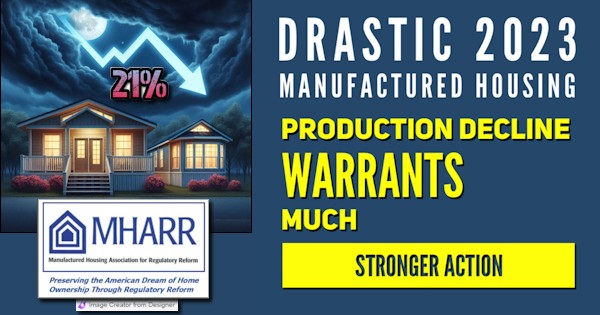

“Total housing starts [i.e.: both single family and multi-family housing] for 2023 were 1.41 million, a 9% decline from the 1.55 million total from 2022. Single-family starts in 2023 totaled 945,000, down 6% from the previous year. Multifamily starts in 2023 totaled 469,000, down 14.4% compared to the previous year.” That is according to the National Association of Home Builders (NAHB) in a media release dated 1.18.2024. So, compare that NAHB data for 2023 to the official totals gathered on behalf of the U.S. Department of Housing and Urban Development (HUD) as released by the Manufactured Housing Association for Regulatory Reform (MHARR). “Just-released [2.5.2024] statistics indicate that HUD Code manufacturers …Cumulative production for 2023 thus totals 89,169 homes, a 21% decrease from the 112,882 HUD Code homes produced during 2022.” By comparison, a year earlier, MHARR reported: “2022…conclude[d] with cumulative production of 112,882 homes, a 6.7% increase over the 105,772 homes produced during 2021.” Far more affordable manufactured housing is thus being outsold by far more costly conventional housing. While rising interest rates and higher costs have been named the key culprits in fewer sales for both conventional housing and manufactured housing, why did manufactured housing fall at a sharper rate of decline than conventional home building?

Where is the industry’s largest national association, the Manufactured Housing Institute (MHI), on these topics?

Good question. MHI’s email on 2.13.2024 didn’t mention the sharp production decline in 2023. Nor did some prior MHI emails. By comparison, MHARR addressed the matter on their website and their monthly update that was provided as part of a larger mainstream media news release posted below.

Via a news release, the following in Part I was distributed to 100s of mainstream media sites, and was picked up by Google News, Yahoo, Bing and dozens of others in the U.S., plus international news platforms. The news release is adapted to fit this page, but the content is much the same as in the original. Part II of this report will provide a brief commentary. Part III is Daily Business News on MHProNews macro-market and manufactured housing equities report.

Part I

‘Drastic’ Manufactured Housing Production Decline Revealed in 2023 Data, Assoc Warns More Ahead w/o Corrective Action

Manufactured Housing Association PR Laments “Catastrophe” for Lower Income Americans, Calls on Manufactured Housing Institute for ‘Corrective’ Steps in 2024

WASHINGTON, D.C., UNITED STATES, February 12, 2024 /EINPresswire.com/ — Drastic 2023 Manufactured Housing Production Decline Warrants Much Stronger Action, per MHARR.

The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production declined again in December 2023. Just-released statistics indicate that HUD Code manufacturers produced 6,360 new homes in December 2023, a .7% decrease from the 6,406 new HUD Code homes produced in December 2022. Cumulative production for 2023 thus totals 89,169 homes, a 21% decrease from the 112,882 HUD Code homes produced during 2022.

A further analysis of the official industry statistics shows that the top ten shipment states from January 2023 — with monthly, cumulative, current reporting year (2023) and prior year (2022) shipments per category as indicated — are:

The December 2023 statistics result in no changes to the top-ten shipment state list.

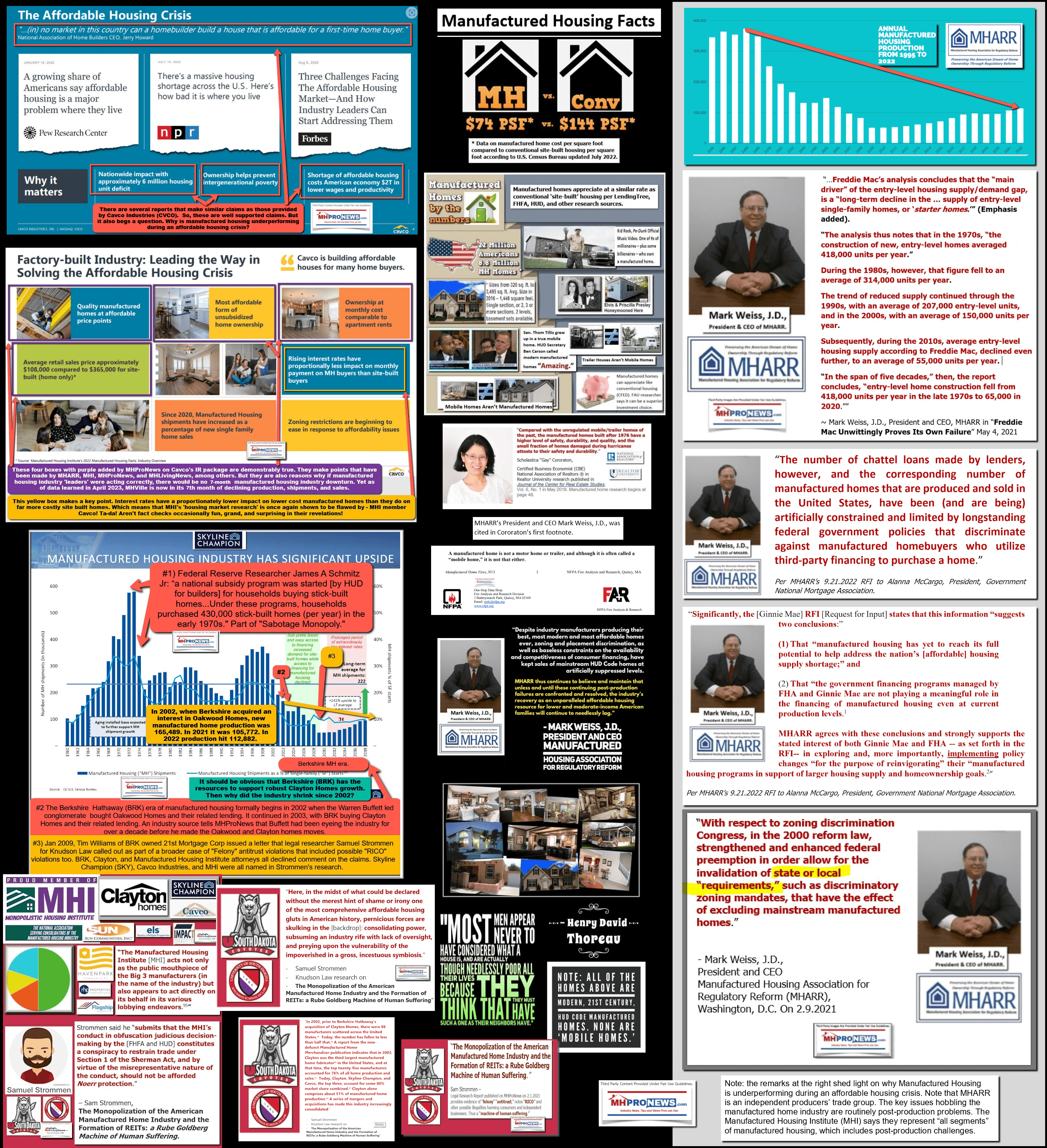

Aside from the impending DOE energy standards, which would only further undermine the industry and its ability to meet the nation’s dire need for affordable housing and homeownership, the sad reality is that the solution to most of the current production decline is actually quite straightforward. Put simply, the industry’s national post-production representation has failed, for far too long, to effectively and aggressively address and resolve the two main bottlenecks that have suppressed industry production and the availability of affordable manufactured housing – i.e., exclusionary zoning and the availability of competitive consumer financing, particularly within the industry’s dominant chattel lending sector. While the industry and its consumers have two good laws to correct these needless roadblocks – i.e., the enhanced preemption of the Manufactured Housing Improvement Act of 2000 and the Duty to Serve provision of the Housing and Economic Recovery Act of 2008 — the industry’s national post-production representation in Washington, D.C. has been unable to compel the full and proper implementation of these two laws. Accordingly, much stronger action by that representation is essential, while current and ongoing failures should be unacceptable to both the industry and consumers.

If the industry is to achieve any improvement in 2024 and beyond, all of these issues will need to be aggressively and effectively addressed, without apology, through strong defense, protection and advancement of the industry’s most affordable mainstream homes (rather than higher-priced substitutes) and strong advocacy on behalf of consumers and the industry. More meetings, conferences and seminars will not resolve these major bottlenecks. Much stronger action is long overdue.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.##

The link to the full MHARR Press Release is found below.

More Manufactured Housing Association for Regulatory Reform (MHARR), Manufactured Housing Institute (MHI) and Association Related News

More Manufactured Housing Industry Related News

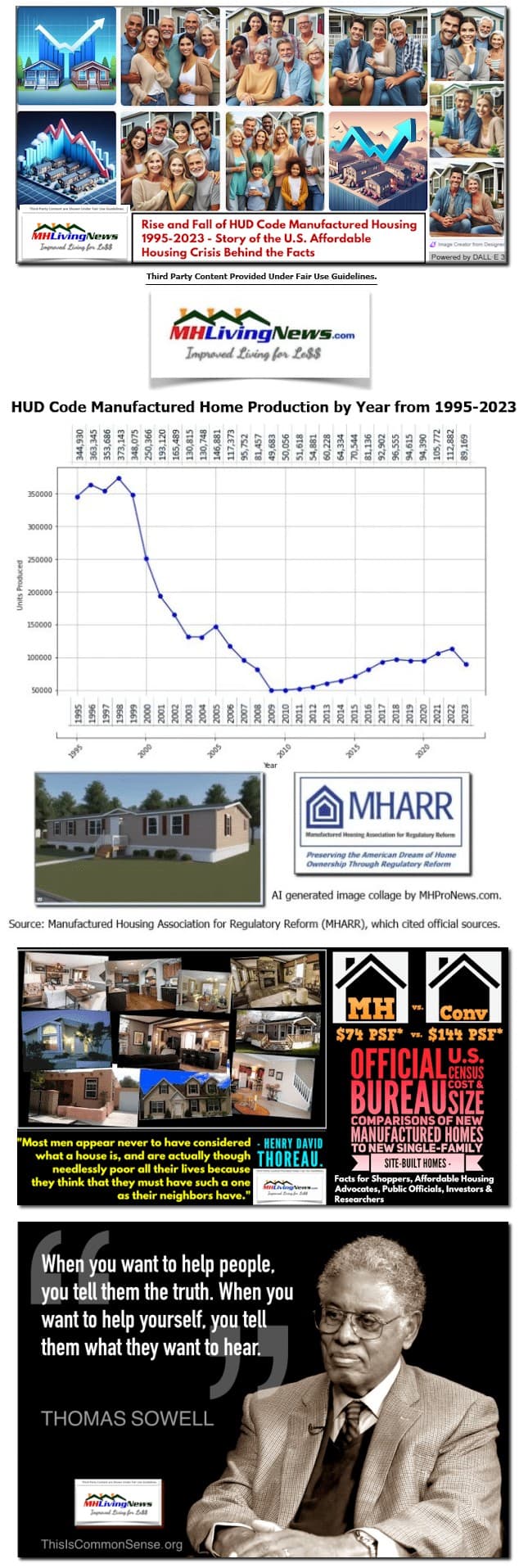

Mobile and Manufactured Home Living News (MHLivingNews.com) released their latest report entitled: “Rise and Fall of HUD Code Manufactured Housing 1995-2023 – Story of the U.S. Affordable Housing Crisis Behind the Facts.”

“The puzzle is why there’s so little (manufactured housing) being shipped when it’s a much better product than it used to be,” said Laurie Goodman, an Urban Institute fellow.” Millions of Americans need and want an affordable home. As the quote above from News Nation reported, manufactured housing: “has historically been a more affordable option.” “Advocates are pushing for legislative change but are met with opposition.” What that News Nation report by Katie Smith on 2.8.2024 began to tackle, this report with analysis and industry expert commentary will elaborate on.

Goodman is correct. Manufactured homes have improved – an important fact that numbers of independent researchers have made over the years. Some of that third-party research is found linked from the report below.

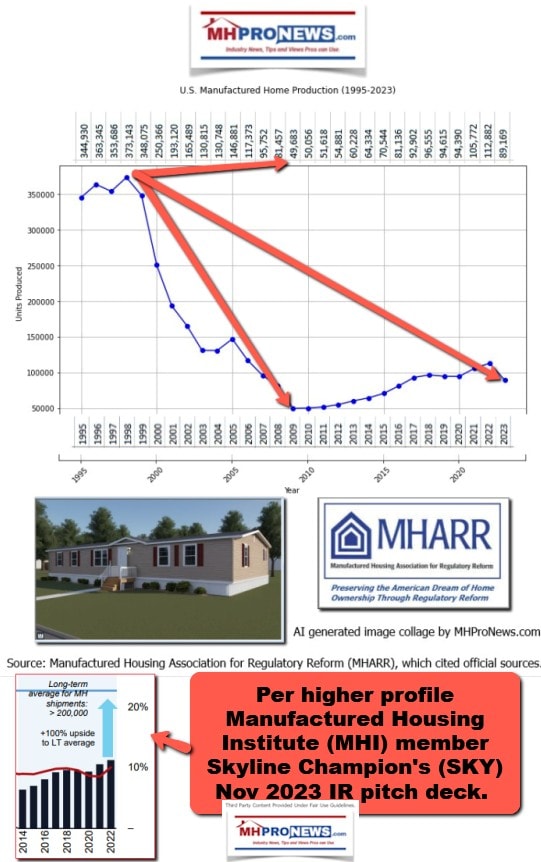

That new report on MHLivingNews is found at the link below. It cited the latest data released by MHARR. But it also cited a year-by-year total of all HUD Code manufactured home production from 1995 to 2023, along with other facts and analysis.

Antitrust research by Samuel Strommen and the Minneapolis Federal Reserve’s James Schmitz Jr. were reviewed, along with insights from HUD researchers Pamela Blumenthal and Regina Gray, among others.

Among the illustrations was an item produced by high profile Manufactured Housing Institute (MHI) member Cavco Industries. According to that source, the lack of affordable housing is costing the U.S. economy some $2 trillion dollars in reduced GDP annually in lower wages and productivity. Bing’s AI powered Copilot was used in several fact checks, but the article was written by what Copilot described as a human manufactured home expert with “accurate” and “astute” insights.

MHLivingNews has also published two reports that unpack research by Oxfam and insights from African born author Hanne Nabintu Herland: “The Billionaire World.” The legal research from Samuel Strommen into antitrust and consumer protection concerns entitled: “The Monopolization of the American Manufactured Home Industry and the Formation of REITs: a Rube Goldberg Machine of Human Suffering” is also unpacked in the report linked below.

Speaking of human suffering, HUD Secretary Marcia Fudge was recently quoted as saying that the “Rent is too damn high!” and that “landlord gouging” hurts Black and Brown households. That new report on MHProNews explorers Fudge’s remarks in a fact check and analysis linked below.

Publicly Traded Corporate Quarterly Earnings Calls and Reports Examined by MHProNews

The earnings call and/or quarterly and year end statements by Cavco Industries (CVCO), Skyline Champion (SKY), Nobility Homes (NOBH), and Equity LifeStyle Properties (ELS) are found in the following reports on MHProNews.

In an ELS related report, MHProNews examines the announced investigations by several law firms caused for possible harm to shareholders when Equity LifeStyle Properties (ELS) admitted in an SEC filing that they had erred and so notified investors.

About MHARR

The Manufactured Housing Association for Regulatory Reform (MHARR) was established on July 3, 1985 as the “Association for Regulatory Reform” (ARR). The Association changed to its current name in the summer of 1997.

Based in Washington D.C. since its founding, MHARR was formed to represent the views and interests of producers of manufactured housing.

About ManufacturedHomeLivingNews.com

Mobile Home Living News and Manufactured Home Living News explores the good, bad, meh, and ugly realities that keep the most proven form of affordable home ownership under-appreciated and misunderstood.

MHLivingNews.com provides third-party research and other resource collections and reports not found on other sites. It is the widely acknowledged best source for authentic news on mobile and manufactured home living, as well as the policies that impact this segment of housing that provides 22 million Americans with good, surprisingly appealing living.

About Manufactured Home Pro News

Manufactured Home Pro News (MHProNews) is the leading manufactured home industry focused trade media. MHProNews provides news, analysis, and industry expert commentary on the manufactured housing industry.

MHProNews covers topics such as affordable housing, regulatory reform, industry trends, stock performance, and business insights.

MHProNews also features interviews, editorials, and opinions from industry experts and professionals. MHProNews cites third-party sources in its claim to be the “#1 most-read trade media in manufactured housing” © and the fact-check or “reality check source for the manufactured housing industry.” Their tag lines and mottos include manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ###

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

L. A. “Tony” Kovach

MHProNews.com/MHLivingNews.com

Part II – Additional Information with More MHProNews Analysis and Commentary in Brief

As the opening paragraph in this report indicated, while all new housing starts/production reported a drop vs. the prior year, new conventional housing starts and new multifamily housing construction each declined at a lower rate than manufactured housing has.

- “Single-family starts in 2023 totaled 945,000, down 6% from the previous year.” – NAHB.

- “Multifamily starts in 2023 totaled 469,000, down 14.4% compared to the previous year.” – NAHB.

- “Cumulative production for 2023 thus totals 89,169 homes, a 21% decrease from the 112,882 HUD Code homes produced during 2022.” – MHARR.

To put this in even greater context, Copilot provided the following data.

So, far more expensive new conventional housing declined, but at a lower rate than HUD Code manufactured housing. During an affordable housing crisis, that’s a stunning set of facts. Then, pivot to this quote from the press release above.

“The puzzle is why there’s so little (manufactured housing) being shipped when it’s a much better product than it used to be,” said Laurie Goodman, an Urban Institute fellow.” Millions of Americans need and want an affordable home. That lack of manufactured housing production and shipments may “puzzle” Goodman, who has made an important point.

But those facts should NOT be a puzzle to regular, detail-minded, and truth-seeking readers of MHProNews and/or MHLivingNews. Those who take what the Manufactured Housing Institute (MHI) remarks at face value simply must look deeper. Why?

Because MHI corporate and top staff leaders and MHI member corporations’ investor relations (IR) pitches are often apparently contradictory. When they are inconsistent in their own claims, how does that support their credibility? The logical and honest answer should be, it doesn’t.

That disconnect between IR statements – which legally and by regulatory standards are supposed to be factually accurate – and other remarks by MHI leaders simply can’t be ignored. At least, they shouldn’t be ignored if someone seriously wants to understand why manufactured housing can be in sharp decline during an affordable housing crisis. Keep in mind that it wasn’t so long ago that Cavco’s William “Bill” Boor, now MHI’s chairman, said that manufactured housing had the opportunity to ‘catch up’ with conventional building.

U.S. manufactured home production totals by year are across the top of the chart below. In 1998, there were 373,143 new HUD Code homes produced. In 2023, it is only 89,169 new manufactured homes. As the “Rise and Fall of HUD Code Manufactured Housing 1995-2023 – Story of the U.S. Affordable Housing Crisis Behind the Facts” indicates, the reality is even worse, because the U.S. population has grown significantly since 1998. So, if manufactured housing production merely kept pace with population growth, those totals should have been increasing for that reason alone. MHI leaders and their claims are quoted in that report. The evidence is laid out in a logical fashion.

MHProNews has made the point for years that what MHI says often (but not always) looks similar to what MHARR says about the same subject.

For example. MHI says that they want “enhanced preemption” enforced. But if so, then why hasn’t MHI sued to get the federal law enforced? As MHProNews has uniquely pointed out, the tiny house industry has had several lawsuits in recent years to get their rights enforced. When MHI finally sued the DOE, logically, that should have been followed with suits to enforce the enhanced preemption issue of the Manufactured Housing Improvement Act of 2000 as well as to get the additional lending that federal law is supposed to provide the industry, but in a practical sense, doesn’t.

Indeed, the Institute for Justice has raised issues publicly on manufactured home installation that ought to have been part of MHI’s job. What is going on there in MHI’s Arlington, VA headquarters?

The items linked from the news release in Part I above detail those disconnects at MHI between corporate claims and those made by MHI leaders. They do so often through the lens of what an MHI member/leader has said, and then compare and contrast that to what they have done or are doing. The mounting evidence leads to a sobering conclusion.

MHI has become a tool for the consolidation of the manufactured housing industry. MHI’s own member firms have said as much in their own words, and often in their IR pitches. See those pitches and obvious disconnects in the various reports linked in Part I above. It harkens back to remarks made by an MHI insider to MHProNews, reported below. MHI leaders can’t have it both ways.

The Urban Institute’s Goodman’s apt quoted observation comes into focus. When millions of people need an affordable home, when manufactured homes are about half the construction cost per square foot of conventional housing (both plus land cost): “The puzzle is why there’s so little [manufactured housing] being shipped when it’s a much better product than it used to be.”

Beyond the documentary evidence, it seems that none of MHI’s leaders, attorneys, or even their designated media contact is able or willing to answer these concerns in a direct manner. They’ve been invited to respond multiple times over the course of years. So, what do MHI leaders do instead of answering published concerns? They routinely engage in distraction tactics. They pat each other on the back. MHI leaders give ‘awards’ to each other, even if some of those ‘award’ winning companies have a D or F rating from the Better Business Bureau (BBB). It is almost too bizarre to believe. But the facts are what they are.

Historic Lessons from Champion and Fleetwood

In order to consolidate the industry, the powers that be in MHVille seem to have reasoned that they need to keep the industry underperforming. Champion and Fleetwood in the later 1990s tried to consolidate their segments of manufactured housing as the industry was growing or relatively high. That didn’t work. Some involved in MHVille apparently learned that lesson. To successfully consolidate the industry, they want the industry to underperform in terms of production, which steadily causes smaller firms to exit the industry. That’s why so-called barriers of entry, persistence, and exit in manufactured housing remain high. As apparently faithful MHI member Andy Gedo aptly put it: “a barrier to entry (what you [MHProNews/MHLivingNews] like to call a “moat”) that limits competition. Barriers to entry can sometimes be exploited through unfair competition to gain monopoly power in a market…”

One reason that this hasn’t already been blown wide open is because this arguably doesn’t just ‘benefit’ Clayton Homes and Berkshire Hathaway. Other firms are apparently cut in on this steady consolidation of MHVille scheme. The scheme can be inferred by behavior, argued antitrust legal researcher Samuel Strommen. The raft of national antitrust lawsuits filed in recent months against several MHI member firms and/or members of MHI state affiliates underscores Strommen’s thesis.

The manufactured home industry’s 21st century underperformance is stunning when viewed objectively. It begs for state and federal investigations of MHI and/or MHI’s leading brands. Consumers are harmed by this process, is the case made in several of the linked reports. Shareholders are harmed too, as several linked items indicate. Taxpayers are harmed because billions are spent on housing programs that could over time be phased out if HUD Code manufactured homes existing legislation was properly enforced. When Bing’s AI powered Copilot explored MHI’s remarks in an email to readers vs. what actually occurred, it said their message could be described as a “lie,” “false” and “misleading” (see below). More on these topics in the linked articles above.

As a programming notice, in an arguably related upcoming report, another specific higher-profile MHI member’s strategy will be explored in a report planned for later this week. Stay tuned. ##

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from 2.13.2024

- Courtesy Association of Flight Attendants-CWA

- He was a hero on Alaska Air 1282. Now he’s picketing for ‘livable’ wage

- Bitcoin euphoria is back as investors prepare for the quadrennial ‘halving’

- Aircraft grounded due to the COVID-19 pandemic, including planes operated by TUI, are pictured on the apron at Manchester Airport in Manchester, north west England on May 1, 2020.

- European travel giant Tui will leave the London Stock Exchange

- Paramount Global to lay off 800 employees after record Super Bowl ad revenue and ratings

- Pedestrians pass the New York Stock Exchange as snow falls on Tuesday, February 13, 2024 in New York.

- Dow nosedives by 700 points as hot inflation data stokes fears about higher-for-longer rates

- Super Bowl’s historic ratings show that the NFL is at the apex of its powers

- Food price increases used to be smaller at restaurants compared to grocery stores.

- Surging restaurant prices are making dining out even more of a luxury

- Jenny Cavnar makes history as the first woman to serve as an MLB team’s primary play-by-play announcer

- Inflation cooled last month, but some price hikes continue to cause pain

- Prices for some specially-packaged Valentine’s Day candy cost much more than the regular versions.

- Here’s why Valentine’s Day candy is so expensive

- Super Bowl LVIII sets record with a staggering 123.4 million viewers, American TV’s biggest audience since moon landing

- Carl Icahn buys a huge stake in JetBlue at bargain prices

- How Vince McMahon built an empire on fakery and taught Donald Trump to control a crowd

- Boeing orders nearly frozen in wake of Alaska Air incident

- Federal judge blocks Ohio law regulating kids’ access to social media

- Most employees think it’s OK to talk about mental health at work. Some still don’t do it, survey finds

- Uber, Lyft and Deliveroo workers in US and UK plan Valentine’s Day strike

- The Fed can still break markets. Here’s how

- Outside the US, teens’ social media experiences are more tightly controlled

- Japan’s Nikkei hits 34-year high

- Tiger Woods launches apparel partnership with Taylormade after 27-year Nike partnership ends

- Columbia University targeted by expanding House antisemitism investigation

- Rate cuts likely won’t happen until the summer, Atlanta Fed chief says