MHInsider’s writer Patrick Revere has the knack, but the facts about pageviews displayed on the MHInsider/MHVillage website reveals he doesn’t have much of an audience. Their own published data on articles like the one featuring Tim Williams and the hot topic of manufactured home lending stands in stark contrast to the claims made in their media kit.

But that’s not the focus of this report and analysis. Rather, Tim Williams and 21st Mortgage Corporation related and surprising revelations are.

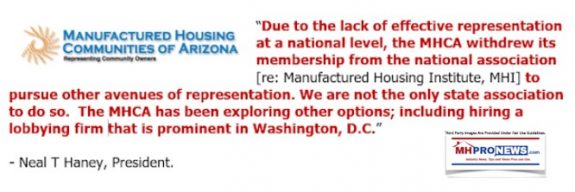

Talent can be applied to causes that are good and bad. MHInsider is purportedly a party line, de facto ‘house organ’ for the Manufactured Housing Institute (MHI), which in turn is dominated by Berkshire Hathaway owned brands like Clayton Homes, Vanderbilt Mortgage and Finance (VMF), and Tim Williams led 21st Mortgage Corporation.

Williams himself was a prior MHI Executive Committee chairman. The MHProNews photo in the featured image is one taken while he was the Arlington, VA based MHI’s chair.

Key parts of the pro-MHI, pro-Berkshire brands published quotes attributed by MHInsider to Williams are analyzed in this report.

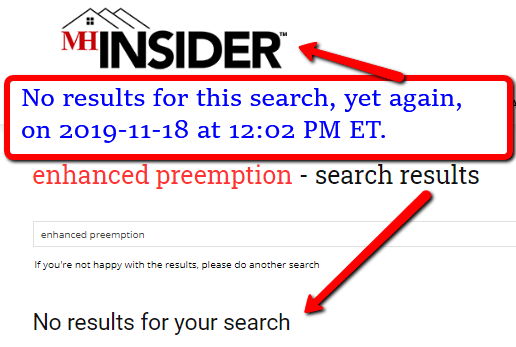

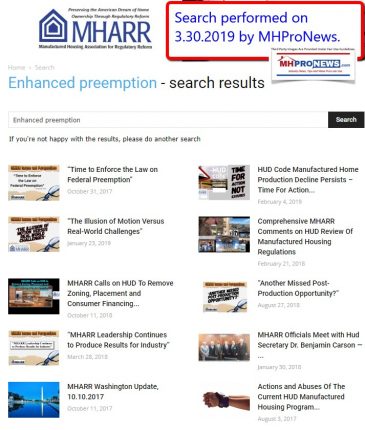

The article about Williams and manufactured home industry lending, zoning challenges, and other issues are arguably meant in a different manner than what it ironically reveals. For example, there issue of limits or bans on manufactured homes is raised by Williams. But there is oddly no mention of enhanced preemption, even though Williams’ stated, “That said, we really do have to start breaking down some zoning barriers.”

The following are pull quotes from the full MHInsider article which is linked here and here as download.

“In Knox County, Tennessee, the birthplace of Clayton, the largest builder of manufactured homes, and backed by Berkshire Hathaway and Warren Buffett, and we can’t get a manufactured home in the city of Knoxville?” Williams said. “If you can do it anywhere, you should be able to do it here. And we haven’t.”

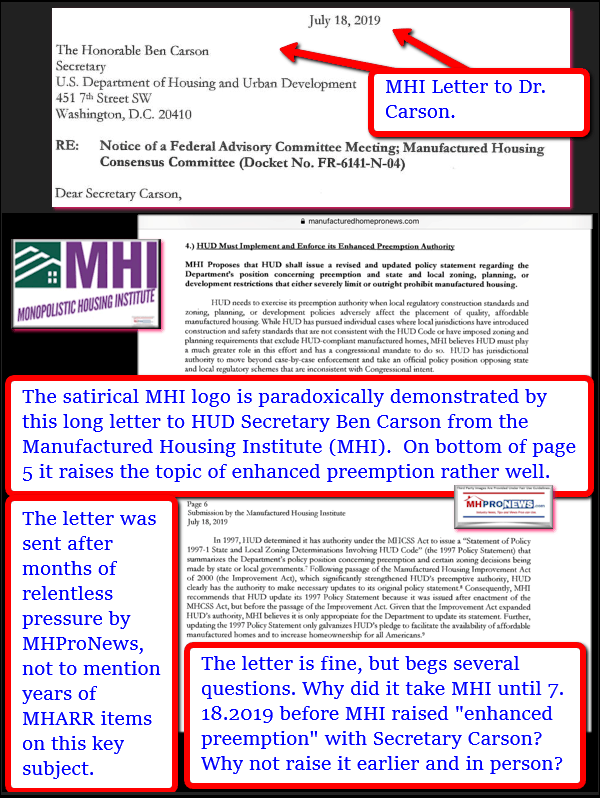

But wait. Didn’t MHI issue a recent written statement to HUD that stressed that “enhanced preemption” is the law and that they should be enforcing the law?

If Clayton Homes, 21st Mortgage, and other Berkshire owned brands seriously wanted to use the full force of the Manufactured Housing Improvement Act (MHIA) “enhanced preemption” portion of the law to get HUD Code manufactured homes into Knox County, or Knoxville proper, are we seriously supposed to believe that they couldn’t do it?

Or are curious, thinking industry readers and professionals to believe that MHI couldn’t use their self-proclaimed clout to get the placement of HUD Code manufactured homes done in Knoxville, or elsewhere? He is fully informed on the issues, so what are objective thinkers to make of Williams’ statement?

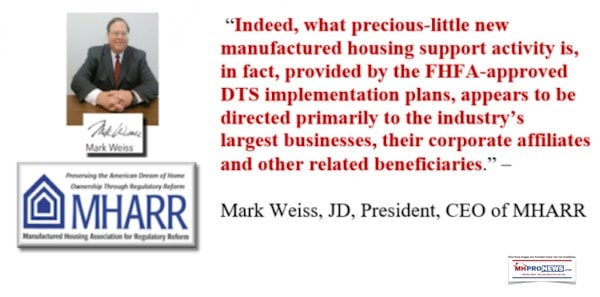

For newcomers, the quote from Mark Weiss, J.D., President and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR) explains why enforcing “enhanced preemption” is critical on the issue of zoning and related barriers.

But not flash back and look carefully at what Williams said. “If you can do it [i.e.: place HUD manufactured homes in the Knox County/Knoxville metro] anywhere, you should be able to do it here. And we haven’t.” Note that he didn’t say that they couldn’t. Williams said, they haven’t.

Again, since, MHI and MHARR both agree – on paper, anyway – that enhanced preemption ought to be fully enforced, are we to believe that the Bush, Obama, and Trump Administrations all refused to enforce the law? Or is something else occurring?

Surprising from Williams and MHInsider

What their article – carefully examined – surprisingly reveals is arguably the spin and machinations of the Omaha-Knoxville-Arlington axis.

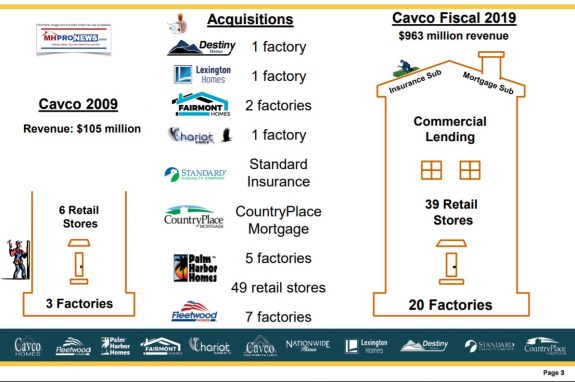

For instance. Instead of Williams talking about the Duty to Serve legal mandates for all HUD Code manufactured homes, they are trying to create a narrative of why the industry should pivot to a product that Clayton Homes is promoting.

However, short-term failures to gain market traction on the so-called ‘new class of home,’ since branded as “CrossModTM Homes” what they ironically reveal is that 21st wants to participate in the profits of making those Government Sponsored Enterprise (GSEs, Enterprises – i.e.: Fannie Mae and Freddie Mac) loans.

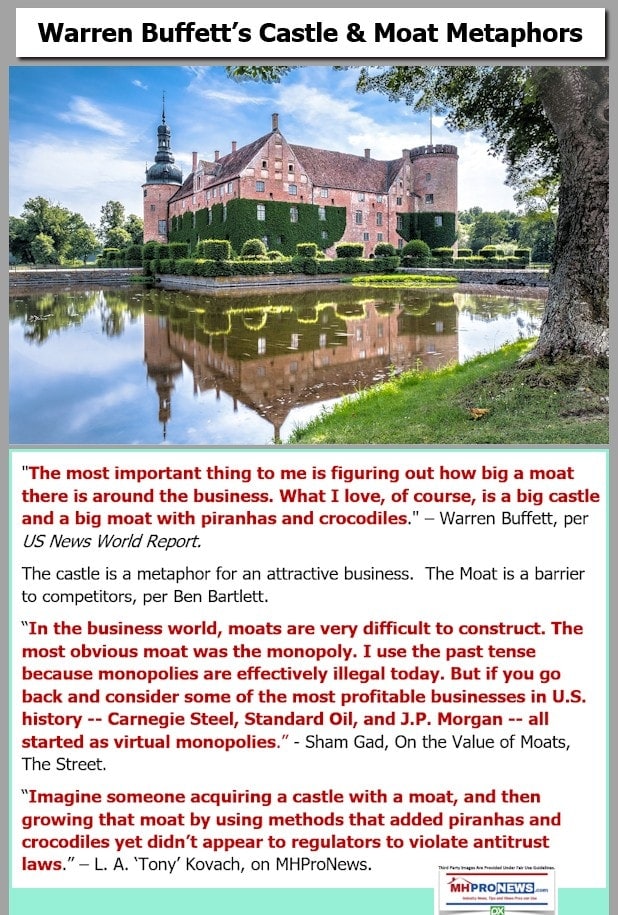

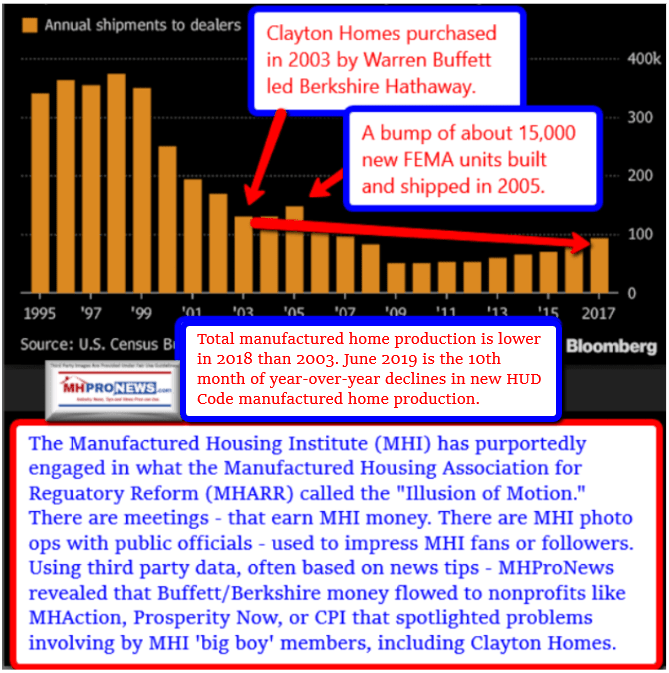

Rephrased, if the new programs for ‘new class of homes’ agreed to with Fannie, Freddie, and MHI backed by Clayton Homes doesn’t work, the Berkshire brands can benefit because they successfully diverted lending away from millions of existing HUD Code manufactured homes, as well as from the vast majority of HUD Code manufactured homes that are for sale. How so? Because using the logic of Kevin Clayton’s statement in the video below, it helps protects Berkshire’s “Moat.” Kevin himself said it, they can lose money – and “Warren” is okay with it – so long as it expands their “Moat.”

Note to new readers or those who’ve not done the deep dive into that video above: to grasp the meaning, it helps to read the related quotes and data – including from Tim Williams and Warren Buffett – at the related report at this link here.

Not agreeing with, but applying that Buffett/Berkshire logic as explained by Kevin Clayton, if the maneuvers by MHI’s ‘national lender of the year’ 21st Mortgage costs or undermines other manufactured housing lenders, isn’t that their goal? Isn’t harms done to independent producers or retailers, consumers or investors just another variant of what 21st-Clayton Homes and Berkshire did previously?

Posturing and Paltering?

What Williams and MHInsider have done is purportedly more spin or “paltering” at its finest. MHInsider’s own views data makes it clear that some 5 weeks after publishing, there are less than 700 views. By contrast, MHProNews had north of 62,000 pageviews reported by Webalizer on 2 of over a dozen cPanels on November 15 alone. 11.15.2019 was a day focused on finance related articles.

Back to MHInsider’s narrative.

“The opportunity is really in the product some of the manufacturers are promoting,” Williams said, referring to what many are calling the ‘New Class’ of manufactured homes, which have characteristics that allow them to sit beside site-built homes and be treated as such in appraisal and lending.”

“I am optimistic about the new product,” Williams said. “I’m optimistic about manufactured homes getting into better communities where they can sit right beside conventional housing.

“You really expect it to be a better house, and we have a great opportunity to help deliver that,” he said. “Manufacturers have done a great job over the recent years building a better product.”

“Traditional GSE lenders do not originate many manufactured home loans, because they only do GSE-conforming product. So if the borrower, the house, or site for the house doesn’t fit in the Fannie Mae or Freddie Mac box, then those lenders don’t offer an alternative,” Williams said. “Whereas us traditional manufactured home lenders have alternatives, but we must get qualified to participate with the GSE in order to support the ‘New House’ with lower rates and longer terms that are only available through the GSEs.

“And you still have to be profitable,” he added. “You have to cover costs, which are not $8,000 but are more than a chattel loan… you need to be able to build in a

profit.”

###

Boxed Themselves Into a Corner?

The related reports below the byline and notices make the following case.

On issue after issue that MHProNews and our MHLivingNews sister-site have been reporting in recent months and years, Williams, MHI’s Lesli Gooch, and other public statements by MHI connected leaders – upon analysis with other related comments – de facto prove our hypothesis. That would be that the posture and say the right things, but that somehow, magically, existing laws aren’t getting fully and properly enforced.

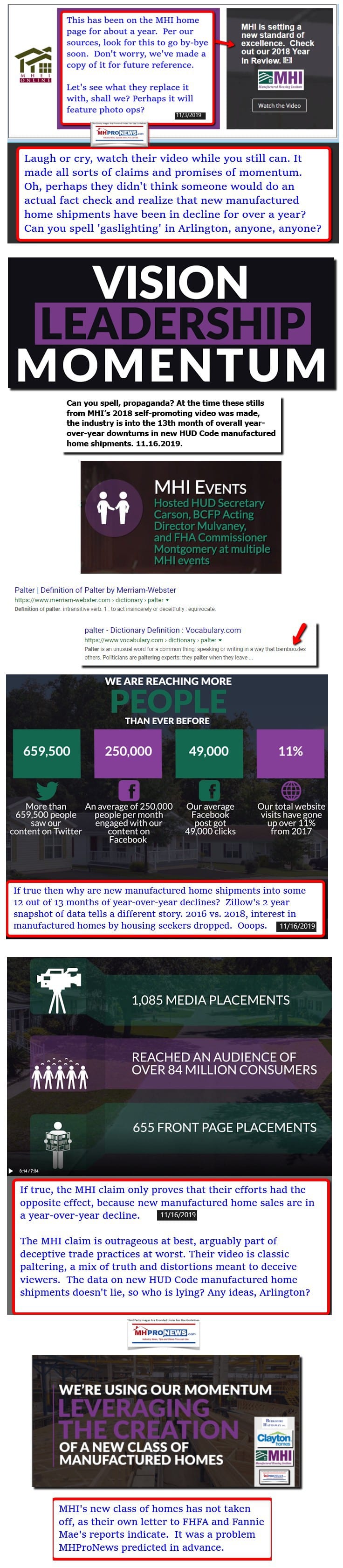

The screen captures above from MHI’s and MHI’s websites, contrasted with what MHARR has done, are quick, stark, visual examples.

MHI officially claims to be for enhanced preemption. But those words are not mentioned by Williams in this zoning related topic, or by MHI or MHInsider on their respective websites. Why not? Why the obvious disconnect? Why do the powers that be say one thing – as the snippet of the letter from MHI asking for preemption to be enforced indicates, – but then fail to vote for or actual do something about it when opportunities arise? The report linked from the text image box below makes that point in a specific fact-check and analysis.

MHI claims to be working for more lending, but in practice, their own statements and behavior routinely contradict their stated claims.

Once the pattern and puzzle pieces of evidence are placed side-by-side, the picture becomes clear.

- Who benefits from this pattern of activity?

- Bigger companies that want to consolidate the industry.

- Who is harmed? Millions of current and potential consumers, taxpayers, independent businesses, and investors who may think that they are investing in firms trying to maximize shorter term as well as longer term returns.

That’s your third episode today of manufactured housing “Industry News, Tips, and Views Pros Can Use,” © your runaway #1 biggest and most-read professional information resource, where “We Provide, You Decide.” © (News, fact-checks, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

Related Reports:

Click the image/text box below to access relevant, related information.

Unique Opportunities for More Competitive Lending for All HUD Code Manufactured Homes