“In its first hearing of the year, the @SenateBanking Committee focused on housing! NAHB Chief Economist Rob Dietz told Senators, “Building more homes and apartments is the only way to tame #inflation and ease America’s #housingaffordability crisis.” That’s according to the “The National Association of Home Builders [NAHB] represents more than 140,000 members who build the American Dream,” per the NAHB’s Twitter feed. “The #housingaffordability crisis continues. The NAHB/@WellsFargo Housing Opportunity Index (HOI) shows that just 38.1% of homes sold in Q4 2022 were affordable to families earning the U.S. median income of $90,000. Falling mortgage rates may provide relief” according to an NAHB tweet. “To help state and local HBAs break down barriers to building affordable housing, NAHB approved $60,000 in financial assistance to associations through the State and Local Issues Fund (SLIF) at the 2023 International Builders’ Show in Las Vegas last week.”

Part I. NAHB Data and Parallel or Divergent Manufactured Housing Institute (MHI) Insights

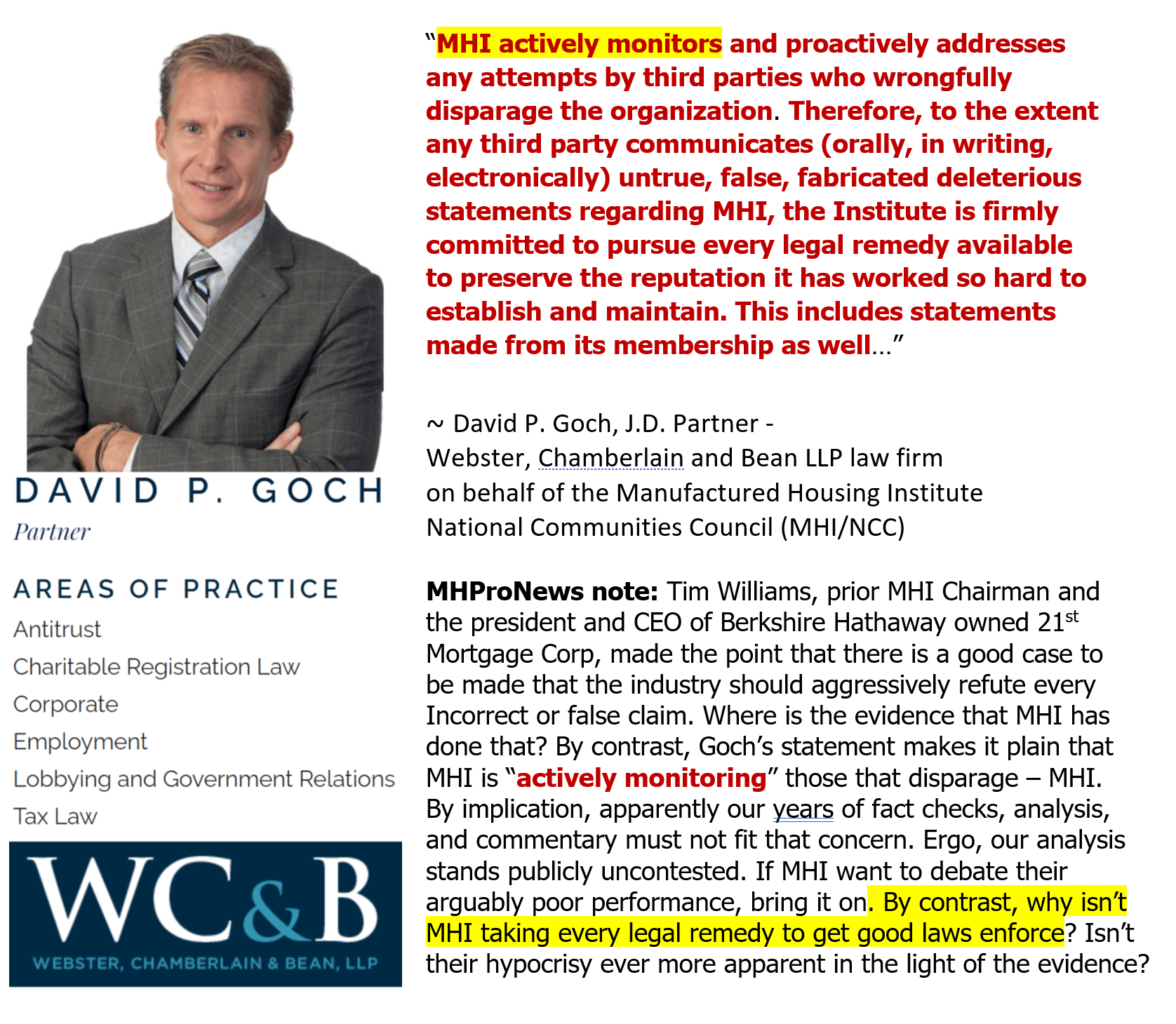

So, in those tweets, the NAHB is presenting the apparent path ahead for the Manufactured Housing Institute (MHI), if they were sincerely focused on robust growth. What if MHI approved $60K (or more) to a state association in order to press a legal case on behalf of enforcement of the Manufactured Housing Improvement Act (MHIA) “enhanced preemption” provision, that MHI has stated in writing that they support? Wouldn’t that be a good use of their resources and stated goals via a legal mechanism aimed at using an existing federal legal tool to overcome local zoning barriers that could be deployed in a favorable case?

But no. There is no known evidence that such is what MHI has been doing at all. The known evidence suggests that MHI apparently doesn’t mind writing about the MHIA and “enhanced preemption.” But MHI, and presumably their corporate masters, show no sign that they are looking to litigate on behalf of that federal legislation they claim that they support.

To help state and local HBAs break down barriers to building affordable housing, NAHB approved $60,000 in financial assistance to associations through the State and Local Issues Fund (SLIF) at the 2023 International Builders’ Show in Las Vegas last week. https://t.co/5oxfi4v7xW

— NAHB (@NAHBhome) February 10, 2023

In its first hearing of the year, the @SenateBanking Committee focused on housing! NAHB Chief Economist Rob Dietz told Senators, “Building more homes and apartments is the only way to tame #inflation and ease America’s #housingaffordability crisis.” https://t.co/RyPcDxhOgn

— NAHB (@NAHBhome) February 9, 2023

Against that backdrop is the following from the NAHB. It will be followed in Part II by a different but related snapshot of mainstream housing data from left-leaning CNBC, plus additional information with more MHProNews analysis and commentary.

Housing Affordability Hits Record Low but Turning Point Lies Ahead

According to the NAHB/Wells Fargo Housing Opportunity Index (HOI), just 38.1% of new and existing homes sold between the beginning of October and end of December were affordable to families earning the U.S. median income of $90,000. This marks the third straight quarterly record low for housing affordability since the Great Recession, trailing the previous mark of 42.2% in the third quarter and 42.8% set in the second quarter.

“Rising mortgage rates, supply chain disruptions, elevated construction costs and a lack of skilled workers and lots all contributed to a declining housing market and worsening affordability conditions going back to the second quarter of last year,” said NAHB Chairman Alicia Huey, a custom home builder from Birmingham, Ala. “But we are anticipating a better affordability climate in the months ahead, with mortgage rates already posting a modest drop since the beginning of the year and expectations that the Federal Reserve will end its latest string of interest rate hikes by the end of the first quarter.”

“With mortgage rates anticipated to continue to trend lower later this year, affordability conditions are expected to improve, and this will increase demand and bring more buyers back into the market,” said NAHB Chief Economist Robert Dietz. “Ultimately, the best way to reduce housing costs is for policymakers to put into place the right policies that will allow builders to produce more affordable housing by fixing broken supply chains, easing excessive regulations and ensuring sufficient liquidity in the housing market.”

While the HOI shows that the national median home price fell to $370,000 in the fourth quarter, it is still the third-highest median price in the history of the series, after the $380,000 price recorded in the third quarter and the all-time high of $390,000 in the second quarter. Meanwhile, average mortgage rates reached a series high of 6.80% in the fourth quarter, surpassing the previous record-high of 5.72% in the third quarter.

The Most and Least Affordable Markets in the Fourth Quarter

Indianapolis-Carmel-Anderson, Ind., was the nation’s most affordable major housing market, defined as a metro with a population of at least 500,000. There, 75.9% of all new and existing homes sold in the fourth quarter were affordable to families earning the area’s median income of $94,100.

Top five affordable major housing markets:

- Indianapolis-Carmel-Anderson, Ind.

- Rochester, N.Y.

- Pittsburgh, Pa.

- Toledo, Ohio

- Dayton-Kettering, Ohio

Meanwhile, Bay City, Mich., was rated the nation’s most affordable small market, with 88.5% of homes sold in the fourth quarter being affordable to families earning the median income of $74,800.

Top five affordable small housing markets:

- Bay City, Mich.

- Wheeling, W.Va.-Ohio

- Elmira, N.Y.

- Davenport-Moline-Rock Island, Iowa-Ill.

- Cumberland, Md.-W.Va.

For the ninth straight quarter, Los Angeles-Long Beach-Glendale, Calif., remained the nation’s least affordable major housing market. There, just 2.2% of the homes sold during the fourth quarter were affordable to families earning the area’s median income of $91,100.

Top five least affordable major housing markets—all located in California:

- Los Angeles-Long Beach-Glendale

- Anaheim-Santa Ana-Irvine

- San Diego-Chula Vista-Carlsbad

- San Francisco-San Mateo-Redwood City

- San Jose-Sunnyvale-Santa Clara

The top five least affordable small housing markets were also in the Golden State. At the very bottom of the affordability chart was Salinas, Calif., where 5.0% of all new and existing homes sold in the fourth quarter were affordable to families earning the area’s median income of $90,100.

Top five least affordable small housing markets—all located in California:

- Salinas

- Santa Maria-Santa Barbara

- Napa

- San Luis Obispo-Paso Robles

- Santa Rosa-Petaluma ##

Part II Additional Information with More MHProNews Analysis and Commentary

As promised above, per left-leaning CNBC are the following bullets on 2.10.2023.

- In December, home prices nationally were 6.9% higher year over year, according to CoreLogic.

- That was the smallest annual gain since the summer of 2020, when the pandemic first induced a housing boom.

- The rate of decline from November to December, however, was much smaller than the monthly declines seen last summer.

Per the World Population Review website, for 2023: “Also coming into play to calculate this amount of the average family income are single and dual-income families or households. The average personal income in the United States is $63,214, with the median income across the country being $44,225.” The U.S. Census Bureau said on 9.13.2022 that “Real median household income was $70,784 in 2021, not statistically different from the 2020 estimate of $71,186.

U.S. housing stock is aging. Around half of all homes were built before 1980. Homes built since 2010 account for only 10% of the U.S. housing stock. As activists target new homes to reduce carbon emissions, let’s take stock of our problematic older homes. https://t.co/rfTZ6kk8rV

— NAHB (@NAHBhome) February 6, 2023

More on aging U.S. homes: New York has the oldest median home age at 62 years, followed by other Northeast states. Median home ages in high-growth areas like the South and desert West are the lowest. We must focus on remodeling or replacing existing homes. https://t.co/hEySAfVZzO

— NAHB (@NAHBhome) February 7, 2023

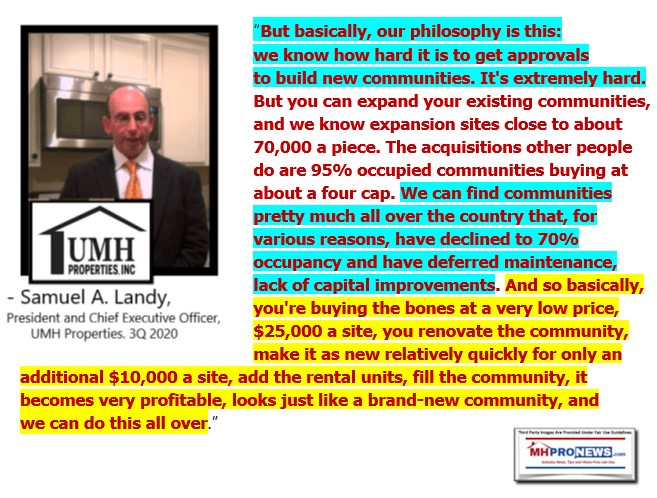

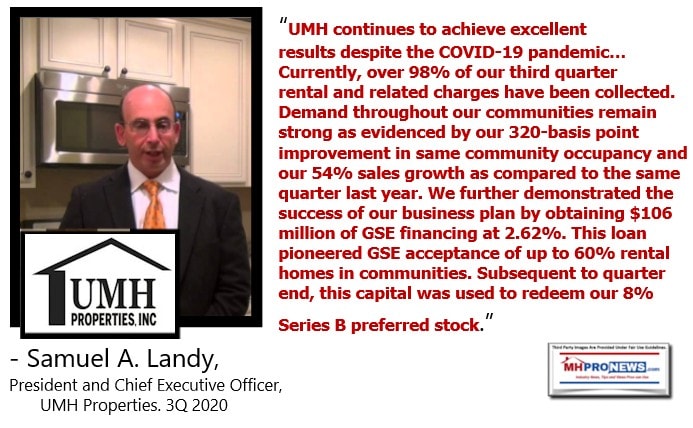

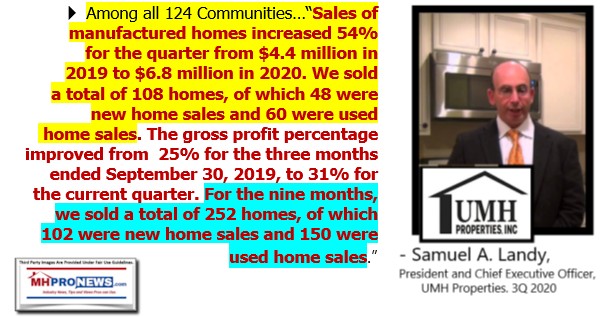

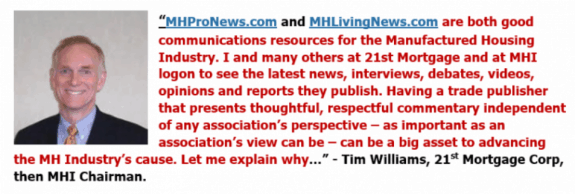

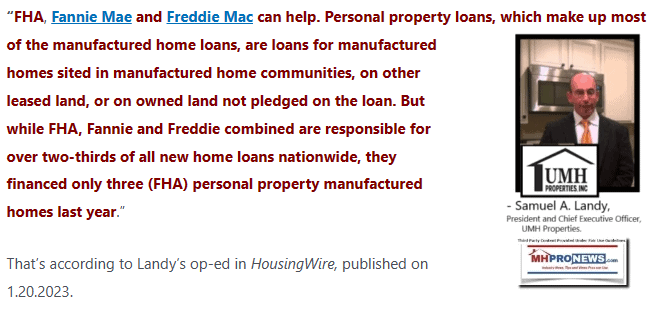

The mainstream housing data, be it from NAHB, NAR, or other sources, routinely shed direct or indirect light on the market potential for mainstream HUD Code manufactured housing. Recall that UMH Properties President and CEO, Sam Landy, said in an op-ed just weeks about that the “average income of a manufactured housing homebuyer is around $50,000,” while the average income of a buyer of a site-built home is about double that figure. More specifically, Landy said this.

That’s per Landy’s op-ed in HousingWire, published on 1.20.2023. Landy and his firm appear to be a loyal, MHI supporter, as well as an MHI ‘award’ winner.

“FHA, Fannie Mae and Freddie Mac can help. Personal property loans, which make up most of the manufactured home loans, are loans for manufactured

That’s according to Landy’s op-ed in HousingWire, published on 1.20.2023.

It would not be a surprise if Landy and MHI coordinated these comments. Let’s stipulate that they are accurate enough to make the following points.

- Yes, FHA, Fannie Mae and Freddie Mac could be making a substantial difference in boosting the sales of HUD Code manufactured homes. MHI has indicated that they desire those entities to do so.

- But frequent attendee at MHI meetings, Doug Ryan of Prosperity Now (previously known as CFED) and that nonprofit’s pro-manufactured housing affordable housing advocate, pointedly accused MHI in writing of the following.

3. Landy has previously spoken to their corporate business model in remarks during an earnings call. Landy asserted that it was hard to get approvals to build a new manufactured home community. True enough, but isn’t that due in part to MHI’s failure to press the enhanced preemption that is legally required by the MHIA of 2000? Once again, when the bigger picture is examined, reasonably accurate statements taken on a different light. They appear to be public posturing and paltering, because consolidation is viewed by several key MHI members as being of more importance than organic growth.

4. To the points Landy made in the prior pull quotes cited above about the difficulty getting new manufactured home communities developed, Legacy Housing (LEGH) has been buying properties and developing sites in Texas. Legacy demonstrates that organic growth is possible, and LEGH are an MHI member too.

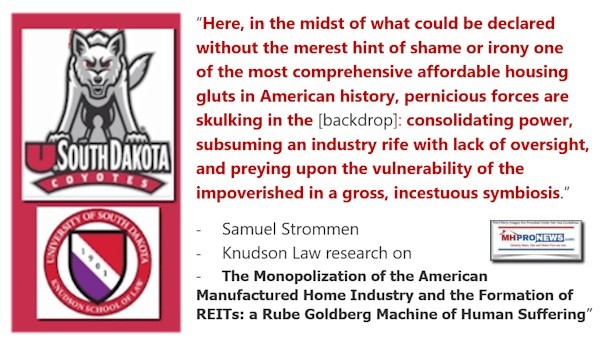

5. Based on those various remarks by MHI members, and MHI meeting attendees, there are clear disconnects that are apparent. On the one hand, Landy complained in his recent op-ed in HousingWire – arguably, aptly so on the surface – about the lack of GSE financing (Fannie, Freddie) or the lack of support from the FHA. But on the other hand, Landy bragged during the cited earnings call that his firm was getting the benefit of enormous loans at low rates from the GSEs. So too are numbers of MHI members who are focused on consolidation. That again begs the question: to what degree is Landy, MHI and others in the consolidation camp posturing and paltering? Doesn’t their own statements and business models reflect a preference to foster consolidation? If so, aren’t these potential examples of subtle market manipulation by MHI and its members that may violate antitrust laws and their own antitrust guidelines? Note that MHProNews has raised this concern about the sincerity of MHI’s adherence (or lack thereof) to their own antitrust guidelines for over 5½ years. MHI has yet to respond publicly to these concerns, despite several requests for comments to MHI and/or their attorneys.

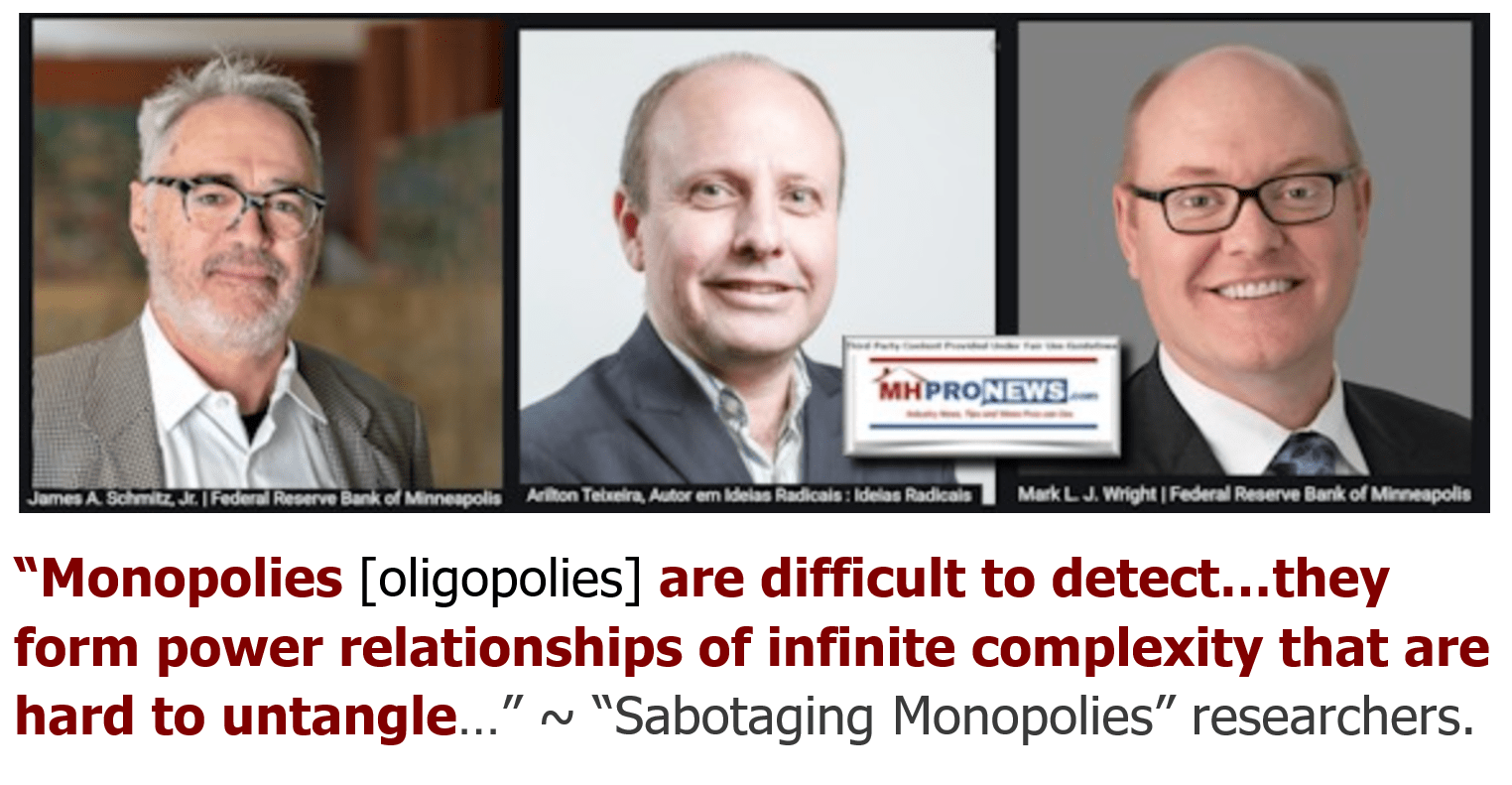

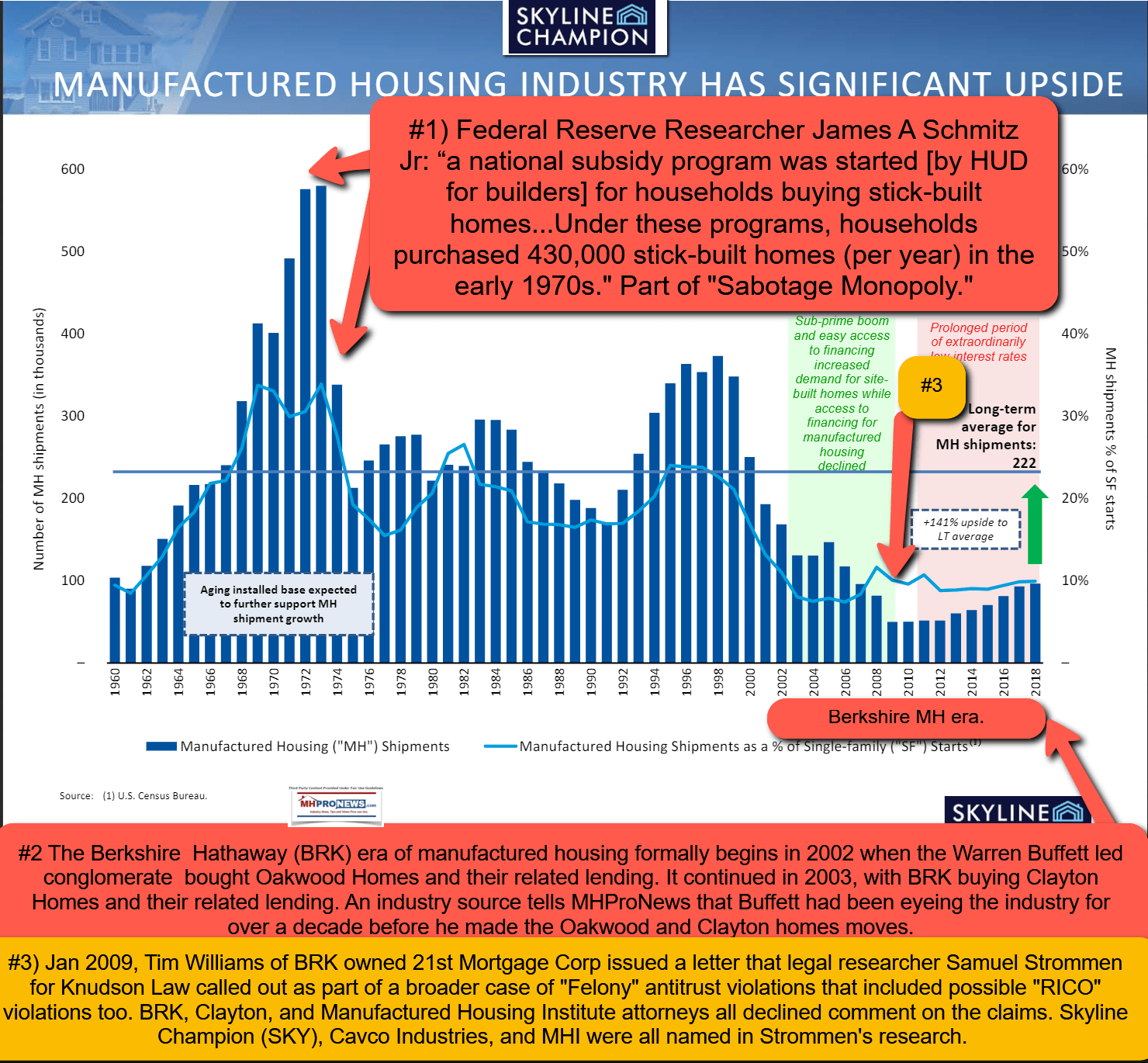

6. MHI periodically boasts to their members that they are working with the NAHB and other mainstream housing providers, as if that were a logical and good thing. But the NAHB is a competitor for manufactured housing. Per the analysis of Minneapolis Federal Reserve researchers, such as James A. “Jim” Schmitz Jr and those cited below, it would appear that MHI is sleeping with the competitors (enemies) of our industry. Like an unfaithful but boastful spouse, MHI then brags about that infidelity. But infidelity is what it is. There is no evidence that MHI can point to that prove that their working with conventional rental housing providers or new conventional housing builders has advanced ANY of the three most pressing issues found in manufactured housing today. Namely, the DOE Energy Rule, the lack of support for manufactured home personal property lending by FHA, Fannie, and Freddie, or the lack of legal efforts by MHI to sue to enforce any of their claimed stances on those three issues.

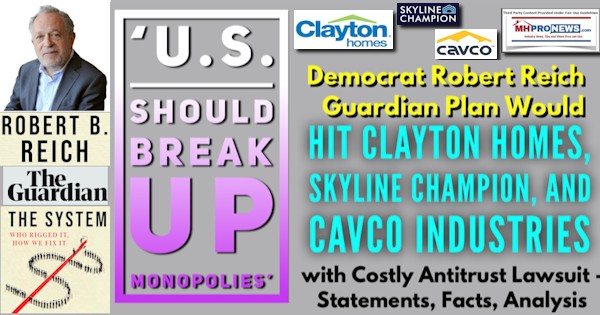

7. As a result of MHI openly sleeping with the industry’s apparent enemies, and doing so in a manner that benefits consolidators in manufactured housing, what is the discernable outcome? Per Schmitz, as well as insiders and outsiders in manufactured housing, the evidence points to possible “felony” antitrust violations that are leading to oligopoly style monopolization.

8. MHARR has called for regulatory hearings by Congress to probe the manufactured housing industry. MHProNews will monitor and report on the progress of such efforts.

9. Given that manufactured housing is not only underperforming but is once more in a downward spiral for a full 3 months, MHARR’s call for oversight hearings seem apt for any lawmakers serious about solving the affordable housing crisis through increased supply that could be provided by the free market.

To learn more about the interrelationship between these topics, click on the various linked reports. Note that per the latest data from Webalizer 2.23, the typical reader/visitor has over 10 page views per visit (session). That means that the typical visitor would visitor 8 or 9+ links in addition to this article.

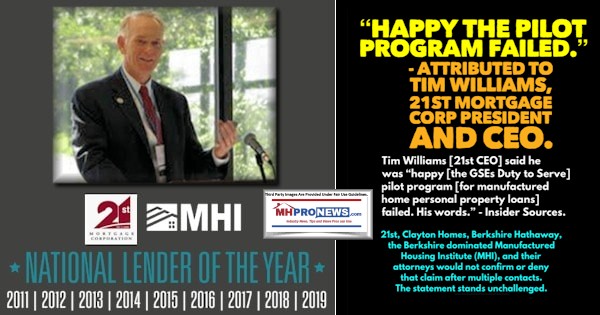

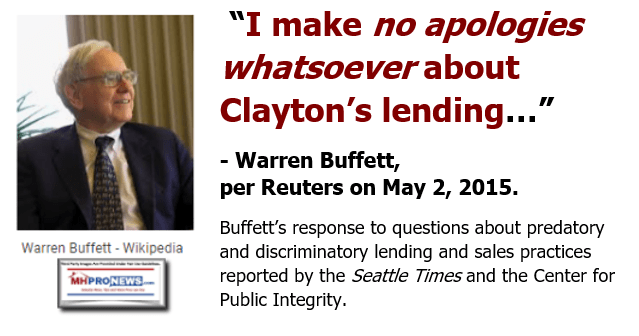

Because MHI and their dominating brands can’t have it both ways. UMH’s Landy said he wants to see the feds and the GSEs act upon getting more single family “personal property” or chattel loan lending in manufactured housing. But Berkshire Hathaway owned 21st Mortgage Corporation President and CEO Tim Williams said he was “happy” the GSEs’ “pilot program failed.” That’s double talk from two different MHI members. But that double talk fits the allegations made by Prosperity Now’s Ryan. That duplicity fits the pattern of sabotaging monopoly tactics that Schmitz and Strommen have written about and respectively documented. It fits the concerns raised by MHI’s smaller but feisty and fact-focused rival MHARR.

Why is the industry underperforming during an affordable housing crisis. The devil is in the details. See those details in the various reports linked herein. An hour or two of reading the evidence carefully can result in the ‘aha!’ moment that could lead to serious action that would solve the industry’s woes while leading to robust and profitable growth.

These facts and this publicly unchallenged analysis is the only known broad, evidence-based explanation for why manufactured housing is underperforming during an affordable housing crisis. It also sheds light on why most manufactured housing stocks also underperformed in 2022.

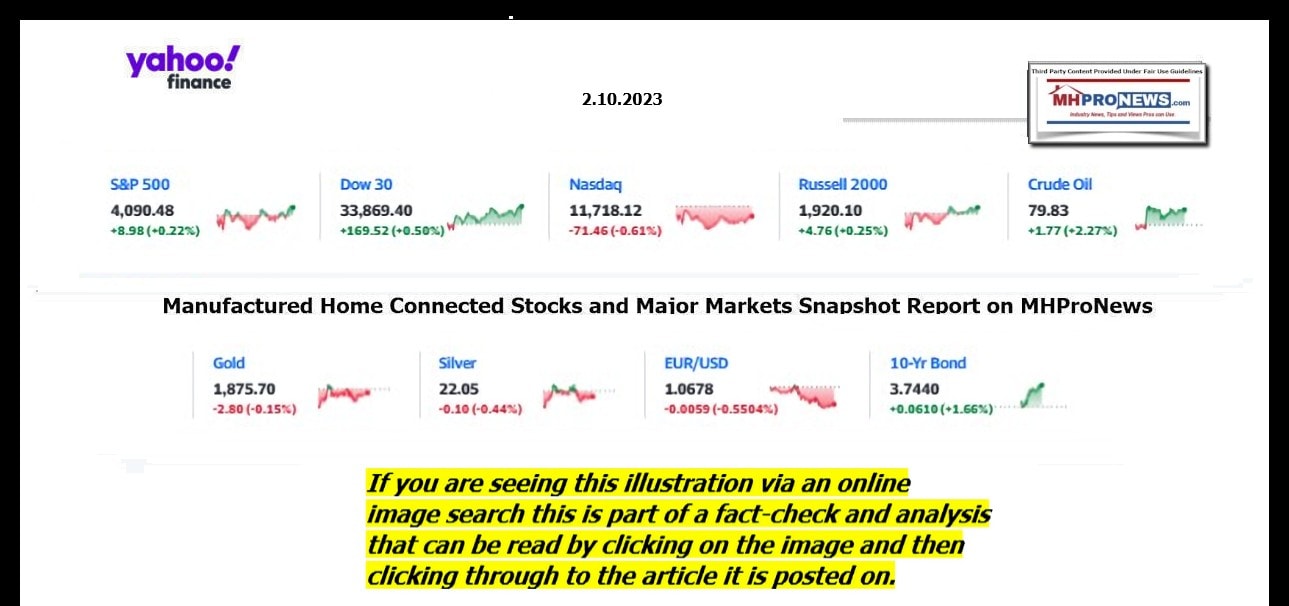

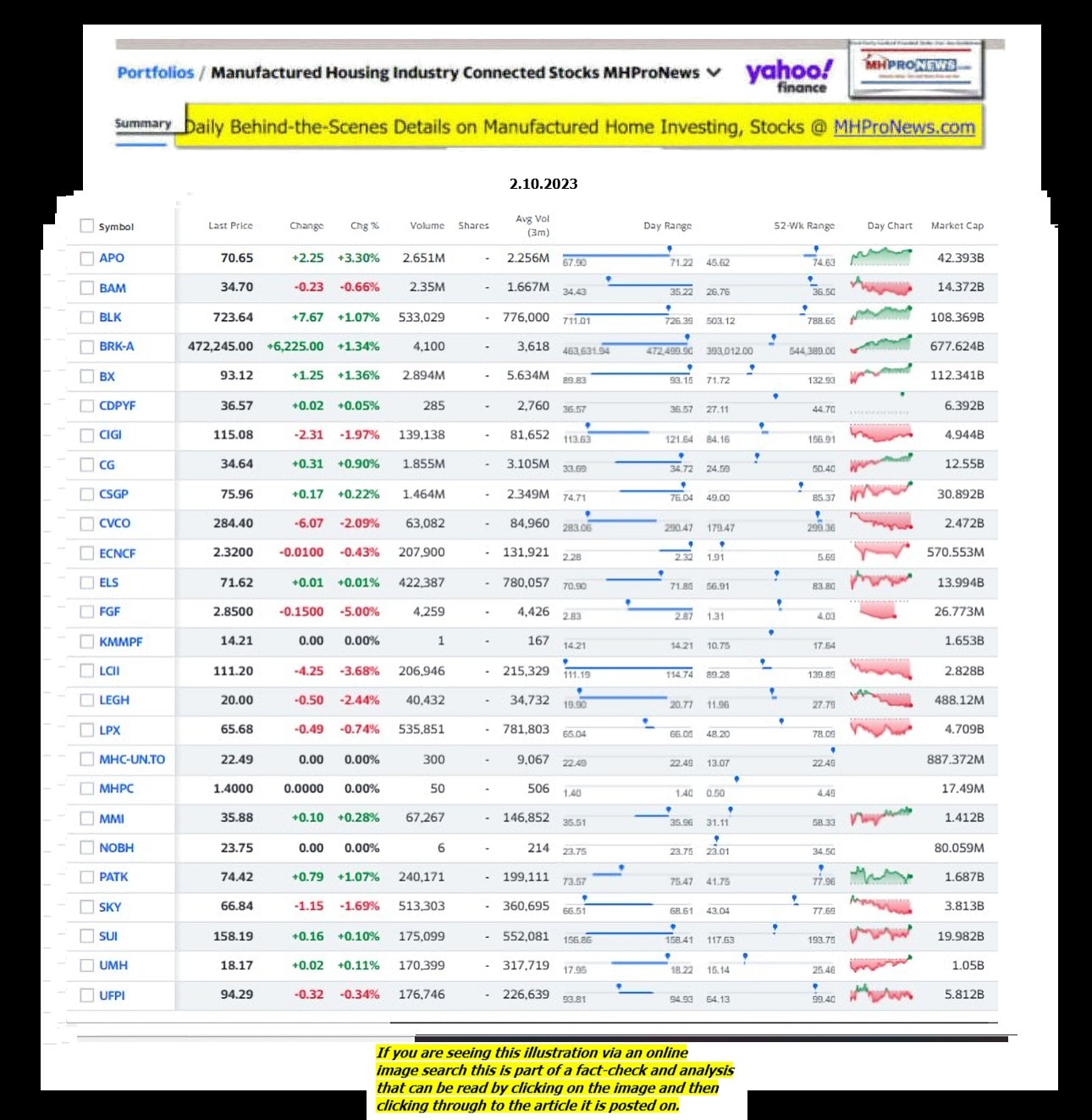

Part III. Daily Business News on MHProNews Markets Segment

The modifications of our prior Daily Business News on MHProNews format of the recap of yesterday evening’s market report are provided below. It still includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines. The macro market moves graphics will provide context and comparisons for those invested in or tracking manufactured housing connected equities.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 2.10.2023

- Advertiser exodus

- More than half of Twitter’s top 1,000 partners, including Coca-Cola, Jeep and Wells Fargo have stopped spending on platform, data show

- Congressman who raised issue of antisemitism on Twitter says he was bombarded with antisemitic tweets

- The last surviving Blockbuster has an ad timed for the Super Bowl

- White House says Biden’s Super Bowl interview with Fox is off

- Adidas says dropping Kanye West could cost it more than $1 billion in sales

- Hyundai starts EV subscriptions for those who only need a car sometimes

- Strong jobs, lower inflation push consumer sentiment to 13-month high

- The dark side of the sports betting boom

- SEC reaches $30 million settlement with Kraken

- South Africa’s energy crisis poses ‘existential threat’ to its economy

- Russia to cut oil output by 5% as sanctions bite

- News Corp is cutting 1,250 jobs

- SpaceX’s interplanetary rocket fires up engines in unprecedented test

- Gautam Adani will be playing defense for a while after mauling by short seller

- Super Bowl ticket prices are declining. They’ll still cost thousands of dollars

- Stock buybacks could beat last year’s record $1.2 trillion

- BTS agency HYBE buys stake in its K-pop rival

- A subsidy arms race is kicking off between Europe and America

- UK avoided recession last year by narrowest of margins. It might not be so lucky in 2023

- Coca-Cola partners with Rosalía on new drink

- Biden hasn’t committed to Super Bowl interview with Fox, source says

- Republicans held a hearing to prove Twitter’s bias against them. It backfired in spectacular fashion

- Southwest explains its meltdown to Congress

- Lyft shares fall nearly 25% after forecasting revenue below estimates

Notice: the graphic below can be expanded to a larger size.

See instructions below graphic or click and follow the prompts.

Headlines from right-of-center Newsmax 2.10.2023

- White House: US Military Downs ‘Object’ Off Alaska

- DirecTV Censors Newsmax

- Mark Levin: AT&T ‘Silencing Critics’

- Mort Klein: ‘Hint of Antisemitism’ in DirecTV’s Move | video

- Ronna McDaniel: DirecTV’s Purge ‘Anti-free Speech’ | video

- See Ronna McDaniel’s Email That Shocked AT&T | video

- ‘Invincible’ Inspiration Papale: ‘Stand Up’ to DirecTV | video

- Cline: ‘Surprised, Angry’ About DirecTV Censorship | video

- Lou Holtz: DirecTV Being ‘Unfair’ to Viewers | video

- Kat Cammack: Protect ‘Sacred First Amendment’ | video

- Glenn Grothman: DirecTV Trying to Control Speech | video

- Judge Napolitano: Newsmax Should ‘File That Lawsuit’ | video

- More Stories on AT&T DirecTV Censorship

- Newsmax TV

- Rosendale: Biden Energy Failures Clear in Trump Ad | video

- Santos: ‘I’m Human,’ Judge Me on Actions | video

- Cline: IRS ‘Aggressively’ Targeting Americans

- Cammack: Weaponization Probe Should Be Bipartisan | video

- Lou Holtz: Chiefs Will Edge Eagles in Super Bowl | video

- Blaine Holt: ‘China at War With Us’ | video

- Grothman: AOC’s ‘Half-Fake’ Laptop Quip ‘Shocking’ | video

- Pollster McLaughlin: Biden Won’t Be Dem Nominee | video

- Mike Collins: Biden Social Security Claims False | video

- Dershowitz: If Hunter’s Innocent, He Should Fight Back | video

- Brian Mast: Balloon ‘a Hostile Act’ | video

- RNC’s McDaniel: Weaponization Panel Will Expose Biden | video

- More Newsmax TV

- Newsfront

- New Classified Document Found in FBI Search of Pence Home

- The FBI discovered an additional document with classified markings at former Vice President Mike Pence ’s Indiana home during a search Friday, following the discovery by his lawyers last month of sensitive government documents there…. [Full Story]

- White House: US Military Downs ‘Object’ Off Alaska

- The Pentagon shot down an unknown object flying in U.S. airspace off [Full Story]

- Biden Won’t Sit for Pre-Super Bowl Interview With Fox

- President Joe Biden will not sit down for an interview with Fox ahead [Full Story]

- Lawmakers Demand More Answers on Chinese Balloon

- Lawmakers are demanding more information about the suspected Chinese [Full Story]

- Chinese Spying Concerns Fuel New Calls for TikTok Ban

- Opposition is growing to Chinese-owned social media phenomenon [Full Story] | Platinum Article

- US Secrets at Risk by China’s Quantum Computing

- China claims it is just the third country to have successfully built [Full Story] | Platinum Article

- Lou Holtz to Newsmax: Chiefs Will Win Super Bowl

- Legendary football coach Lou Holtz told Newsmax that being able to [Full Story]

- Related

- Rasmussen Poll: Most Say Eagles Will Win Super Bowl

- Super Bowl Snacks That Won’t Bust Your Budget or Waistline

- Damar Hamlin Put Prayer in Football Back in Spotlight

- Super Bowl Ads Will Tout Jesus ‘Gets Us’

- Super Bowl Ads Keep It Light With Nostalgia, Stars

- Trump Plays Politician, Declines to Pick Super Bowl Winner

- Russia’s Ukraine Assault Picks Up Near 1-Year Mark

- Russia unleashed strategic bombers, killer drones and rockets in a [Full Story]

- Related

- Zelenskyy: Russian Athletes at Olympics ‘Manifestation of Violence’

- Lavrov Says West Has Failed to ‘Isolate’ Russia

- Treasury to Crack Down on Russian Sanctions Evasion

- Polish PM: Decision on Jets for Ukraine Must Come From NATO

- Texas Gov. Abbott Outraged as 4 Suspects in Fentanyl Operation Are Released

- Texas Gov. Greg Abbott is slamming a decision to release four people [Full Story]

- US Posts $39 Billion Deficit for January

- The U.S. government posted a $39 billion budget deficit for January [Full Story]

- Florida Gov. DeSantis Assumes Control Over Disney District Board

- Florida lawmakers granted Gov. Ron DeSantis effective control of the [Full Story]

- Biden Admin Eyeing Increase to Pentagon Budget

- The Biden administration is eyeing another increase to the Pentagon’s [Full Story]

- Turkey-Syria Quake Death Toll Now Tops 23,700

- Rescuers scoured debris in a desperate search for survivors on Friday [Full Story]

- US Airlines Urge FAA to Extend 5G Deadline

- A group representing major U.S. airlines “strongly urged” the Federal [Full Story]

- Video Report: Israel Worried About Iran Aiding Syria

- On Friday’s “Wake Up America,” Newsmax’s Daniel Cohen reports on [Full Story] | video

- Markwayne Mullin Endorses Trump’s 2024 Run

- Markwayne Mullin, R-Okla., has endorsed former President Donald [Full Story]

- Missouri Agencies Investigating Transgender Care Center

- Multiple Missouri agencies have launched an investigation into a care [Full Story]

- Abortion Pill May Be Pulled in Texas Amid Lawsuit

- A Texas lawsuit with a key deadline this month could threaten the [Full Story]

- ‘Disinformation’ Groups Target Conservative News Outlets

- So-called “disinformation” tracking groups, many with a liberal bias, [Full Story]

- Terrorist Plows Into Bus Stop Killing Two Israelis

- Two Israelis including a child were killed and several injured when a [Full Story]

- Mark Levin: AT&T DirecTV ‘Silencing Critics’ by Targeting Newsmax

- Radio host Mark Levin criticized AT&T’s DirecTV for dropping Newsmax [Full Story]

- Consumer Sentiment Improves

- S. consumer sentiment improved further in February, but households [Full Story]

- Biden, Lula to Put Focus on Democracy, Climate During Visit

- When President Joe Biden and Brazilian President Luiz Incio Lula da [Full Story]

- Mars Rover Discovers Rippled Rocks Caused By Waves

- NASA’s Curiosity rover discovered wave-rippled rock textures on Mars, [Full Story]

- Fetterman Remains in Hospital, Doctors Rule Out New Stroke

- Doctors for Sen. John Fetterman, D-Pa., who suffered a stroke on the [Full Story]

- In Florida, Biden Aims at Seniors With Disputed Social Security Claim

- President Joe Biden traveled on Thursday to Florida and positioned [Full Story]

- Threats to Democracy on Tap for Biden’s WH Meet With Brazil’s Lula

- President Joe Biden will play host to Brazilian President Luiz Incio [Full Story]

- Second Republican N.J. Council Member Killed in One Week

- Russell D. Heller, a Republican councilman in Milford, New Jersey, [Full Story]

- GOP, Dems Spar as ‘Weaponization’ Probe Begins

- The new weaponization subcommittee created by House Republicans for [Full Story]

- Russia Has Lost Nearly Half of Tank Fleet in Ukraine War

- The Russian military has potentially lost half of its entire [Full Story]

- Democrats’ Move to Expel Santos Unlikely to Garner Enough Votes

- Democrats are looking to expel New York’s freshman Congressman George [Full Story]

- Florida Will Cover the Full Cost to Install Solar if You Live in Miami Beach

- Smart Solar Install

- Finance

- Walmart Pushes Back on Suppliers’ High Prices

- Walmart Inc. is warning major packaged goods makers that it can no longer stomach their price hikes, pitching its own private-label products to shoppers as less-expensive alternatives to suppliers’ name-brand goods…. [Full Story]

- Cline to Newsmax: IRS ‘Aggressively’ Targeting Americans

- Cryptocurrency Investors Could Lose All Their Money: Fed’s Waller

- AI Could Create More Rewarding Jobs: Microsoft CEO

- To Tap US Government Billions, Tesla Must Unlock EV Chargers

- More Finance

- Health

- Chemical in Plastics May Raise Diabetes Risk in Women

- Chemicals found in plastic personal care products, kids’ toys, and food and drink packaging could be raising the risk of type 2 diabetes among women, new research suggests. To study the impact of these chemicals, known as phthalates, researchers followed just over 1,300 U.S……. [Full Story]

- Emails to Your Doctor May Soon Be Charged

- Heart Attack Risk Spikes Around the Super Bowl: How to Stay Safe

- Super Bowl Snacks That Won’t Bust Your Budget or Waistline

- Cutting Calories May Slow Aging in Healthy Adults

Notice: the graphic below can be expanded to a larger size.

See instructions below graphic or click and follow the prompts.

====================================

Updated

-

-

- NOTE 1: The 3rd chart above of manufactured housing connected equities includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry finance lender.

- NOTE 2: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE 3: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

- Note 4: some recent or related reports to the REITs, stocks, and other equities named above follow in the reports linked below.

-

2023 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.