If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

- Kohl’s is going all-in with Amazon

- Starting in July, you’ll be able to return your Amazon purchases at any Kohl’s store

- LIVE UPDATES US stocks close higher, S&P 500 and Nasdaq hit record highs

- Snap starts adding users again, stock pops 10%

- What Facebook scandals? Its earnings are expected to dominate

- Multiple Wells Fargo shareholders get kicked out of rowdy meeting

- The world’s biggest metal exchange is getting serious about child labor and conflict minerals

- Wing gets FAA approval in step toward drone delivery

- As US sanctions take effect, Asia scrambles to find oil sources that aren’t from Iran

- These drive-thru convenience stores are made out of recycled shipping containers

- Attorney: Man who made threatening calls to Boston Globe will plead guilty

- PERSPECTIVES Melinda Gates: How I learned to see agriculture (and everything else) as a gender issue

- BREAKING NEWS Henry Bloch, co-founder of H&R Block, dies at 96

- Boeing was supposed to make a big profit last quarter. That was before the 737 Max crisis

- PepsiCo’s latest green product is a high-tech water cooler

- Beyond Meat’s IPO plans give it a $1.2 billion valuation

- Burger King is testing out an Impossible Whopper. This is why

- Soylent was a tech company that sold food. Now it wants to go mainstream

- Here’s why McDonald’s is ditching its fancy burgers

- Carl’s Jr. tested out a CBD burger

- Tesla doubles down on controversial strategy for self-driving cars

- Tesla’s new Autopilot is amazing. But keep your eyes on the road

- Elon Musk: Tesla will have robo-taxis by next year

- Autopilot becomes a standard feature on most Teslas

- Singapore’s race to develop self-driving tech

Select Bullets from Fox Business…

- Stocks close at all time high; oil at 6 month high

- Large drug distributor settles with Trump admin over allegations it helped fuel opioid epidemic

- Kohl’s to accept Amazon returns for free throughout the US

- Apple CEO Tim Cook doesn’t think government can solve world issues alone

- Coca-Cola coffee drink gets wide rollout by end of 2019

- Warren Buffett thinks newspapers are ‘toast’. Here’s why

- Russell Wilson buys Amazon stock for Seahawks linemen, here’s how much

- Melinda Gates reveals the secret to 25 year marriage to Bill

- Trump threatens to ‘reciprocate’ EU tariffs after Harley’s profits plummet

- Teen sues Apple for $1B after its facial recognition software led to his false arrest

- Gas prices to jump over $3 in red states this summer, oil expert says

- Supreme Court weighs census citizenship question. What’s at stake?

- H&R Block co-founder, Henry Bloch, dies at 96

- Google-aligned Wing gets FAA approval for drone delivery

- This Japanese billionaire lost $130 million on bitcoin

- Amid minimum wage debate, Trump is giving Americans a raise right now

- Health care is hard, but it’s even harder when you’re stupid

- Varney: Green New Deal combines radical environmentalism and socialism

- Samsung’s PR woes over Galaxy Fold issues

- Economy’s impact on Trump’s 2020 reelection efforts

- How the Trump administration ending Iran oil sanction waivers complicates China trade talks

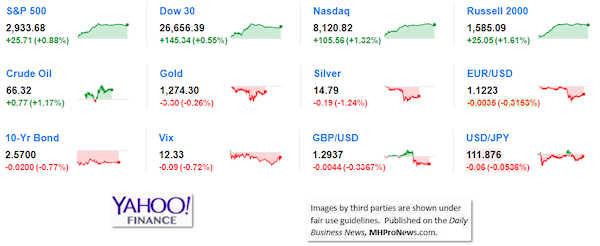

Today’s markets and stocks, at the closing bell…

Today’s Big Movers

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

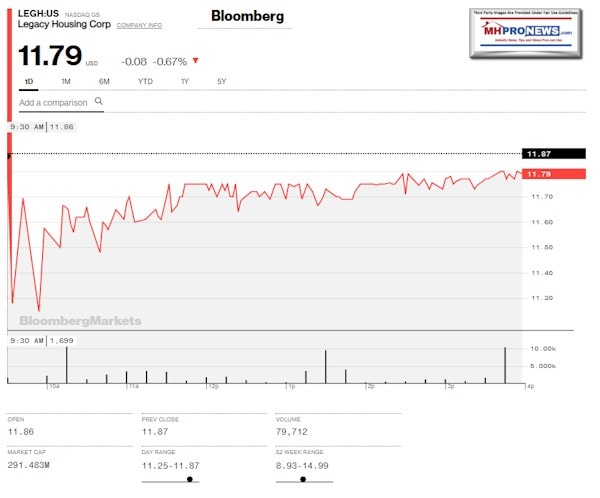

Nasdaq and Seeking Alpha (SA) largely stuck to the published announcement by Legacy Housing Corporation (LEGH) on April 12, when the still relatively new publicly-traded firm published their stock buy-back program.

SA did produce the following graphic, which compares some publicly traded firms that investors compare when considering Legacy Housing.

What’s odd, perhaps, is in publishing the comparison graphic above, that SA made no mention of Cavco’s ongoing challenge in navigating legal issues that began last November. Those issues have led to a series of changes in their firm’s management. You can access that report via the image-text box below.

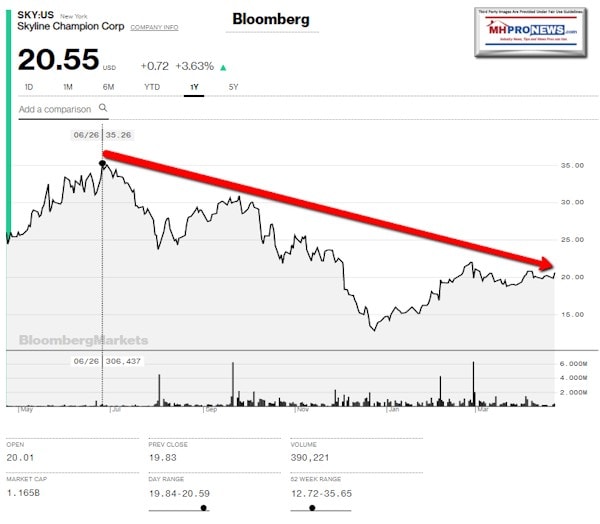

Skyline-Champion has had their own road bumps, not as dramatic as CVCO, but nevertheless it has been somewhat reflected in their 1 year stock ticker history.

By comparison, Legacy has remained far steadier than those two larger firms. Unlike the above, Legacy’s founders have a very large stake in the firm, which should and does give many investors confidence.

Perhaps the biggest issues that face the industry are internal or internally fueled.

HBO’s John Oliver on Last Week Tonight Mobile Homes Video, Manufactured Home Communities Fact Check – manufacturedhomelivingnews.com

” Mobile homes were perfected by humans, but invented by snails,” John Oliver on HBO’s Last Week Tonight, per Time. ” The homes of some the poorest people in America are being snapped up by some of the richest people in America.” Really?

Headlines like the reports above and below – properly understood – could be read in a ways that would increase confidence in Legacy vs. other Manufactured Housing Institute (MHI) publicly-traded member firms. The reasons are more complex than this report allows for, but the linked reports will help set that stage for another time.

https://www.manufacturedhomelivingnews.com/warren-buffett-affordable-manufactured-homes-expert-l-a-tony-kovachs-clayton-homes-counter/

That said, our normal disclaimers stand. We have no position in any stock reported here and have no plan to open a position in any of these stocks soon. That leaves us free to scrutinize a firm based upon insights that the Daily Business News on MHProNews gleans as the industry’s most-read and independent trade media.

Here’s Legacy’s original release.

BEDFORD, Texas, April 12, 2019 (GLOBE NEWSWIRE) — Legacy Housing Corporation (NASDAQ: LEGH) today announced that its Board of Directors has approved a stock repurchase program that will enable the Company to repurchase up to $10,000,000 of its outstanding common stock.

“This share repurchase program is a confirmation of our ongoing belief in our future and our commitment to delivering value to our shareholders,” said Curt Hodgson, Executive Chairman of the Board. “Our strong balance sheet allows us to adopt this stock repurchase program while still having resources to continue to fund our existing operations and future growth.”

The timing and amount of any shares purchased will be determined by the Company’s management based on its evaluation of market conditions and other factors. The repurchase program will be in effect until April 11, 2022.

The repurchase program will be funded using the Company’s credit capacity. As of December 31, 2018, we had a borrowing capacity of $51.3 million under two revolving credit facilities.

About Legacy Housing Corporation

Legacy Housing Corporation builds, sells and finances manufactured homes and “tiny houses” that are distributed through a network of independent retailers and company-owned stores and are sold directly to manufactured housing communities. We are the fourth largest producer of manufactured homes in the United States as ranked by available from the Manufactured Housing Institute. With current operations focused primarily in the southern United States, we offer our customers an array of quality homes ranging in size from approximately 390 to 2,667 square feet consisting of 1 to 5 bedrooms, with 1 to 3 1/2 bathrooms. Our homes range in price, at retail, from approximately $22,000 to $95,000.

Statements in this press release, including Legacy’s statements about its intentions to repurchase shares of its common stock from time to time under this stock repurchase program and the potential source of funding or intended use of any repurchased shares, constitute forward-looking statements as defined in the Private Securities Litigation Reform Act. Forward-looking statements involve substantial risk and uncertainties that may cause actual results to differ materially from expectations. Forward-looking statements represent our beliefs and assumptions only as of the date of this press release. We disclaim any obligation to update forward-looking statements, except as required by applicable law.

Investor Inquiries:

Neal Suit, (817) 799-4906

investors@legacyhousingcorp.com

or

Media Inquiries:

Casey Mack, (817) 799-4904

Related Reports:

Legacy Housing Announces Corporate Role Changes, Plus Manufactured Housing Market Updates

https://www.manufacturedhomepronews.com/deer-valley-homebuilders-release-w-video-underscores-surprising-clayton-homes-berkshire-hathaway-connections/

https://www.manufacturedhomepronews.com/hud-secretary-carson-to-host-innovative-housing-showcase-featuring-affordable-housing-solutions/

https://www.manufacturedhomepronews.com/b2b-statistics-trends-2019-april-2019-snapshot-of-manufactured-home-professional-readers/

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.