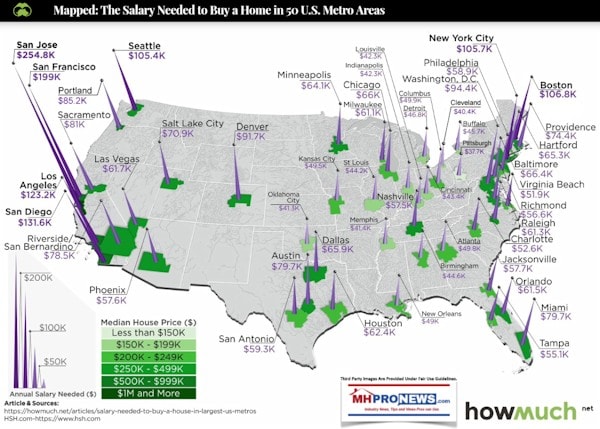

HSH, HowMuch, and Visual Capitalist have pulled together data that yielded the following information presented. It’s arguably useful data for those savvy manufactured home industry professionals who happen to be near the various markets that are spotlighted.

Before diving into the data, let’s note the tragically obvious.

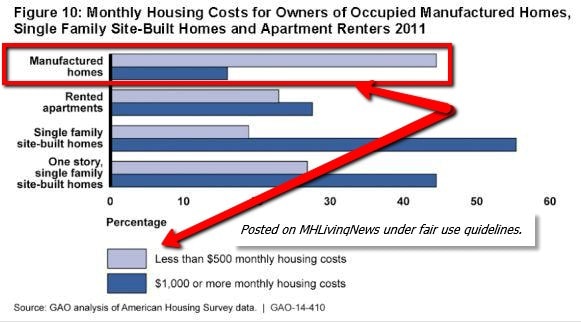

There is no hint of manufactured housing in this information. Let’s use that factoid to make the point that if the Manufactured Housing Institute (MHI) was serious about industry growth at this vexing point in time, there are several common-sense steps that they as the industry’s post-production trade association ought to be taking.

So why aren’t they?

The fact that MHI and manufactured homes are routinely missing from reports like this ought to make the Arlington, VA based trade association’s believers pause. After all, recall that MHI – pre-Berkshire Hathaway’s entry into the manufactured housing market – used to promote people like Harvard’s Eric Belksy, who touted that the industry would overtake conventional building. Conventional housing and manufactured homes were both discussed, not so many years ago. What happened?

That was MHI back then. More recently, we learned today that they had to be dragged by a pair of members into doing an event that was utterly obvious. The report below speaks volumes, and it is a book-end in a sense to this report. ICYMI, you can access the earlier report by clicking the linked text-image box below

https://www.manufacturedhomepronews.com/hud-secretary-carson-to-host-innovative-housing-showcase-featuring-affordable-housing-solutions/

That noted, here’s the data from the trio noted at the top in this evening’s report, which includes insights from the National Association of Realtors ® (NAR).

The bullets that follow are pull-quotes from HSH.

- “How much salary do you need to earn in order to afford the principal, interest, tax and insurance payments on a median-priced home in your metro area?

- For our calculations, HSH.com uses the National Association of Realtors’ 2018 fourth-quarter data for median-home prices, national mortgage rate data derived from weekly surveys by Freddie Mac and the Mortgage Bankers Association of America for 30-year fixed rate mortgages and available property tax and homeowners insurance costs to determine the annual salary it takes to afford the base cost of owning a home (principal, interest, property tax and homeowner’s insurance, or PITI) in the nation’s 50 largest metropolitan areas.

- We used standard 28 percent “front-end” debt ratios and a 20 percent down payment subtracted from the NAR’s median-home-price data to arrive at our figures. We’ve incorporated available information on property taxes and homeowner’s insurance costs to more accurately reflect the income needed in a given market.”

Visual Capitalist (VC) noted that “Over the last year, home prices have risen in 49 of the biggest 50 metro areas in the United States. At the same time, mortgage rates have hit seven-year highs, making things more expensive for any prospective home buyer.”

As multi-decade industry veterans recall, the type of dynamics that VC cited in prior decades used to cause an increase in manufactured home sales.

Once more, when one considers the favorable facts and the problematic performance of MHI, that begs the question, what changed?

The Map and Metro Details

The first graphic reflects the formula used described by VC as follows. “With a 20% down payment and a 4.90% mortgage rate, and taking into account what’s needed to pay principal, interest, taxes, and insurance (PITI) on the home, it would mean a prospective buyer would need to have $61,453.51 in salary to afford such a purchase.”

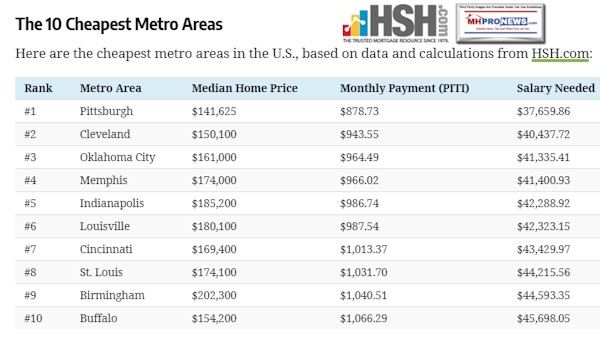

The 10 Cheapest Metro Areas

Per HSH and using the same down payment and other formula factors noted above, here are the lease expensive metropolitan areas to buy a house.

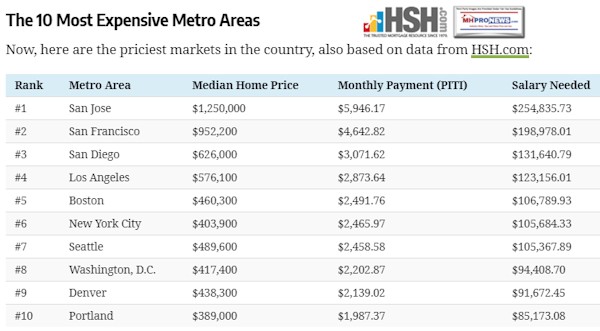

The 10 Most Expensive Metro Areas

Using that same formula, here’s the ten most costly areas to buy a home. These are areas that manufactured housing ought to be soaring, not snoring.

Manufactured Housing Professionals and Two Good Laws

Finally, we’ll close tonight’s report with this reminder.

The manufactured home industry already has enviable laws on the books. The challenge is getting existing laws enforced. Given that this current federal administration has repeatedly said that they are in ‘the law enforcement business,’ why isn’t MHI pushing their vaunted contacts to get existing laws fully enforced?

It should be noted that based upon a growing pile of evidence that MHI may arguably be falling down on the job, that doesn’t mean that individual companies can’t make some of these arguments in their local market, such as enhanced preemption. Duty to Serve? That’s likely a tougher nut to crack for an independent firm, unless they are a giant.

See the related reports, further below the byline and notices.

That’s tonight’s edition of manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, analysis and commentary.)

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

“Lead, Follow … Or Get Out of The Way” | Manufactured Housing Association Regulatory Reform

The last decade-plus has not been especially kind to the manufactured housing industry and consumers of affordable housing. The 21 stCentury began with a great deal of promise for the industry and consumers alike.