It is precisely the bizarre or dubious that merits added professionals’, advocates’, and policy makers’ attention.

Whatever is weird or out of the ordinary should be studied with careful consideration and a sincere search for an objective understanding. Because for intelligent minds, in an industry that Skyline Champion (SKY) and other publicly traded companies indicate are underperforming by historic standards during an affordable housing crisis, whatever is abnormal needs a reasonable explanation.

Specifically, for publicly traded firms, the case can be made that they have a legal and fiduciary duty to their shareholders to dive deeply and seek reality, given the industry’s underperformance. That’s necessary and required for their investors’ sake. That will be a separate theme explored in upcoming reports.

There are some undisputed facts that one must be return to, over and over. First, because repetition is necessary in order to go beyond mere familiarity and grasp the deeper and sometimes obscure picture that explains why manufactured housing is underperforming on at least two levels.

· One level is HUD Code manufactured housing underperformance as measured by historic trend lines.

· The second is underperformance as measured by the opportunity potential. Let’s briefly look at two examples that support that claim.

1) When the National Association of Realtor’s Chief Economist Lawrence Yun said that there is a need for some 8.3 million housing units, that reflects an immediate opportunity. Normally that kind of opportunity would attract serious investor interest, because needs are what private enterprise seeks to meet in order to generate ethical profits.

2) Or when the National Low Income Housing Coalition (NLIHC) in their April 30, 2019 annual “Gap” report said that there is a need for about 7.2 million affordable housing units, that should be a magnet for factory-housing builders. Given that no form of permeant construction today is more affordable on a cost per square foot basis than HUD Code manufactured homes, to be under 100,000 new units shipped annually is problematic. Then, to be sliding for nine straight months year-over-year is professionally embarrassing.

Once pros, investors, and others are exposed to the reality of modern manufactured homes, reasonable questions arise in their minds.

For example, why is the industry underperforming, given the opportunities, product quality, proven value, and enormous needs?

Such inquiries are what mature industry leaders must grapple with and offer reasonable, hopefully fact-based explanations. Those explanations should intelligibly spell out why the industry is underperforming given, the significant shortfall between historic and opportunity potential.

With that prologue, let’s examine a recent news tip and related.

Manufactured Housing Institute and Community-Investor Business Deal?

News tips come in to MHProNews from a variety of sources. The Manufactured Housing Institute (MHI), elected and staff leaders, as well as their outside counsel that informed this publication that they were ‘assigned’ to MHProNews were asked about this specific tip for their reaction.

So too was the part-time MHI critic who pivoted in recent months and turned into a MHI supporter and cheerleader. It is the (former) “community-investor,” George F. Allen. Notice to Allen-ites, SECO, and others in the community sector, as well as other independents in manufactured housing: this concern has several practical implications that will be unpacked after the tip and related evidence are reviewed.

Based on the tip, here was the emailed inquiry posed by MHProNews to Allen on July 8, 2019, to obtain his comments and reaction.

“George [F. Allen],

A normally reliable source tells us that you entered into an arrangement with MHI and the NCC. It involved, but was not limited to, their annual top 50 community list. It also involved COBA7.

There are other tidbits claimed, but we’d value your reaction to the above. You are also encouraged to react to other [industry] news…

…You know the drill, email your comments for our mutual accuracy in handling. Thank you.”

That and related items were sent to Allen. As was previously noted, it was also separately emailed to MHI leaders, their inside and outside attorneys, on the same date.

Allen, MHI leaders, and their attorneys all declined comment. Allen normally responds one or more times, even if it is only to make a denial while throwing out an inflammatory and unsupported claim. But in this case, his reply was silence.

A legal source, as well as MHI connected sources, tell MHPoNews that MHI routinely uses non-disclosure agreements (NDAs) in items that they want to keep hush-hush. If indeed MHI has and/or is compensating Allen for being an surrogate for the Arlington, VA based trade group, it may not be a surprise if they strive to keep that arrangement quiet and as ‘arm’s length’ in appearance to outsiders as possible.

But is there any evidence beyond the tip? Let’s explore that query.

Evidence from Allen Himself?

MHProNews has noted for some time that MHI and some of their ‘big boy’ brands are purportedly attempting to deflect criticism and fact-checks by launching their oblique smoke-screen attacks.

With that in mind, let’s start from Allen’s blog a seemingly innocent and routine statement he’s published for some time.

“To input this blog &/or affiliate with Community Owners (7 Part) Business Alliance, a.k.a. COBA7…” (December 17th, 2018)

That phrasing, or something similar was common for Allen for years. But one week after the one above, here is what one sees not. MHProNews routinely turns direct pull-quotes bold and brown to make them pop, but below to emphasize the word ‘formerly’ we’ve turned it red. But the quotes are from his blog on the dates shown.

“To input this blog, &/or affiliate with EducateMHC, formerly Community Owners (7 Part) Business Alliance, or COBA7...” (23 December 2018)

So, between those two dates, per Allen’s blog, the COBA7 brand he spent years establishing was no more. Why? He didn’t explain publicly.

Or did he? Allen’s blog provides a possible answer. In his public musing about his desire to sell or do something with COBA7, Allen listed the following among other several options he had.

“3. Partner COBA7 with MHI, broadening the focus of its’ NCC division, to better serve information and statistical reporting needs of land lease communities nationwide! A second conversation has occurred, but no firm plans to date. There is a way to make this happen, but only if in the best interests of the asset class!” (24 January 2018)

So, per Allen, MHI and he entered into formal talks to do some sort of business arrangement.

Given the likelihood that MHI would have required an NDA, it’s no surprise that none of the parties or their legal representatives answered our inquiries. To do so could presumably violate their NDA. To be transparent would also foil their mutual goals to make Allen seem to be independent of MHI.

Based on specifics, it may or may not be illicit to do make such an arrangement, that would depend on several elements not known with certainty or worthy of mention at this time.

But for those who have followed the industry’s and MHI’s politics for years, it will be recalled that George Allen and Spencer Roane became ‘persona non grata’ several years ago. Roane, after a rather public dust-up in a National Communities Council (NCC) session led at the time by David Lentz, quit the association not long after. Allen hung in for some time, but eventually dropped out too. But Allen was also sidelined by the powers-that-be. Conversations were had by MHI leaders, per sources, that sought to change association bylaws, in order to deal with ‘troublemakers’ like Allen. When one considers the following, does that help explain why?

So with that background, why would MHI re-embrace someone who has publicly blasted them and some of their big boy companies periodically for years?

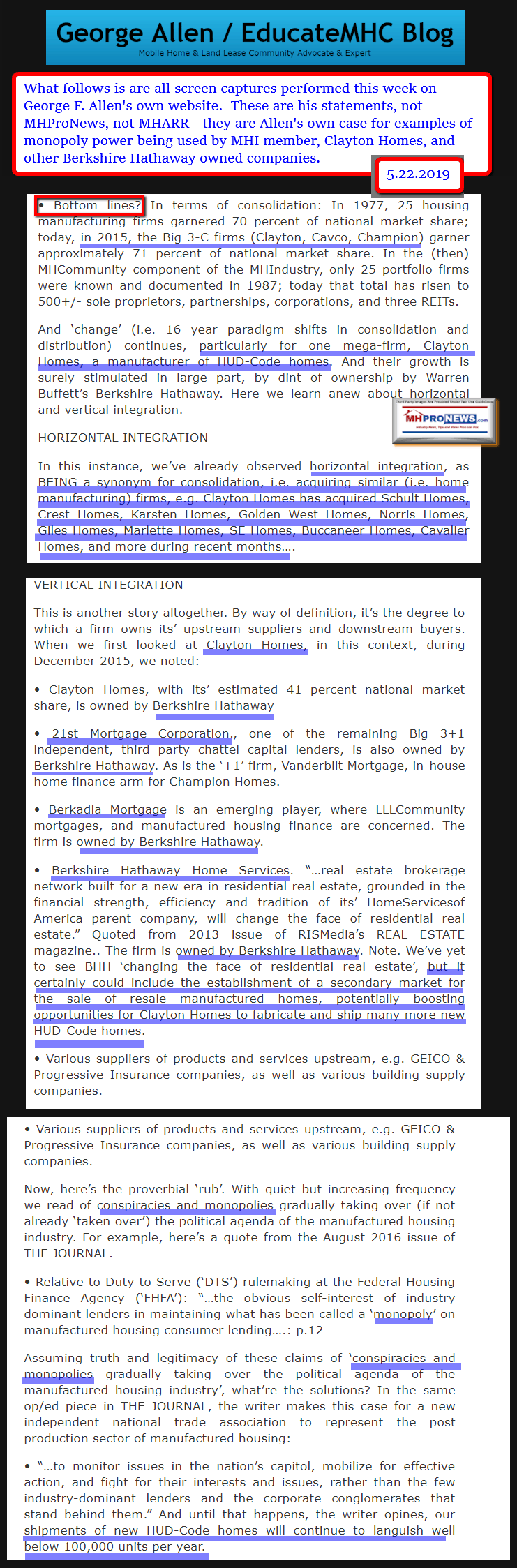

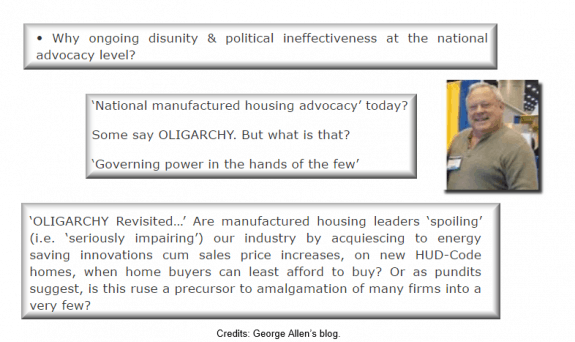

Note the examples above and below, all from Allen’s blog.

So part of what makes this news tip and related noteworthy are shifts from Allen. The tips plus the evidence suggest plausible explanations for Allen’s flip-flop with respect to MHI and some larger industry companies. But imagine the distaste that this brings, given Allen’s, Spencer Roane and Tom Lackey’s connection to reports out of Georgia and elsewhere, such as the one reflected below.

George Allen Blasts MHI, NCC Ignoring Own, Spencer Roane, SECO, COBA7, Tom Lackey Controversies

But why does this matter to MHVille? Why should especially community and other sectors, not to mention independent producers, suppliers, or public officials care one whit about this?

Joe Stegmayer, George F. Allen, Manufactured Housing Institute Slogans, Slump, Slurs, Solutions

Let’s unpack those queries.

Why Such a Stealth Deal Could Matter to Independents, Actual Investors, and Others

As noted, Allen was a multi-year critic of MHI, or of anyone/anything else he decided for whatever reason was problematic to him, and/or communities, or the industry. As a prominent, former Allen client and MHI member told MHProNews, the key to understanding “George” is summed up like this. “With George, it is AAA – All About Allen.” The statement was tongue-in-cheek, and was not meant as a compliment to the self-proclaimed ‘community-investor.’

But beyond that, the Allen-MHI ‘deal’ puzzle piece must be set in a larger context with other puzzling tid-bits. Consider the following items.

- Other sources with longtime ties to MHI have already told MHProNews that independents were often being given discounted deals in order to get them into meetings and networking with ‘big boy’ members who want to acquire such business.

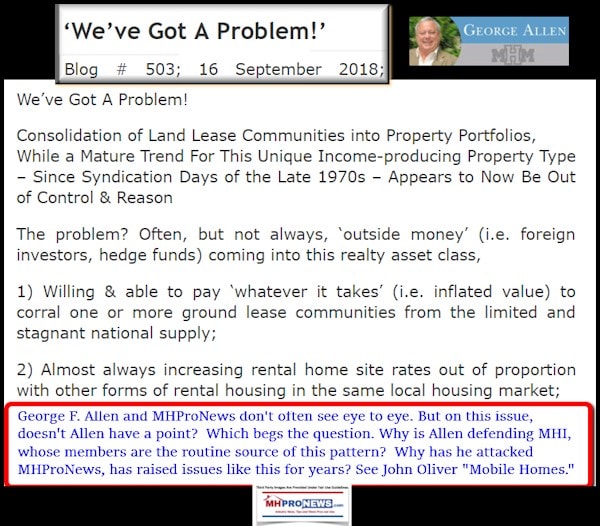

- Allen, who himself blasted MHI, Clayton Homes, or predatory ‘oligarchs’ that were or are harmful to the interests of industry independents, is now quite openly giving cover to the same people who he once excoriated.

- Since the dates noted from his blog in the quotes above when COBA7 was no more, and without cleaning up or explaining his 180 degree changes in MHI related concerns, Allen – who once had a large following, some respect, and still has a body of supporters – publicly embraced MHI, Clayton, et al.

- Further, as previously noted, there is evidence that Allen is purportedly actively attacking via his blog, emails, or verbally those who are fact-checking, exposing holes in the MHI narrative or those of their ‘big boy’ bosses. Allen’s published attacks, however illogical, evidence-free, or easily debunked have been aimed specifically at MHARR and/or MHProNews. It just so happens that MHARR – the Manufactured Housing Association for Regulatory Reform – and MHProNews are two organizations that the ‘big boys’ don’t control. Is it a coincidence that Allen has retrained his more serious ire, away from MHI to others that routinely contradict the Omaha-Knoxville-Arlington axis narrative?

Allen-ites, independents, investors, and other interested parties take note.

MHInsider has published ‘a report’ on selling manufactured home community(ies). So long as the industry is underperforming, those sales are logically at a discounted rate. MHInsider has Allen among the flatterers that contribute articles to their pro-MHI publication. MHInsider are blindly supporting whatever the Omaha-Knoxville-Arlington axis promote. It may be why MHInsider reader engagement rates are so poor.

But what that and some other related point to is this. Manufactured home companies and communities that are underperforming have slowly but steadily been sold and/or closed. Meanwhile, the market share of Clayton Homes, and some larger community and other operations that are MHI members are growing. Coincidence, or is that the plan?

Warren Buffett has preached the value of patience and persistence in investing. By establishing an industry environment that seems to face a variety of headwinds, and some firms sell or close, Berkshire Hathaway and a few other larger brands are growing in a manner that might normally escape regulatory scrutiny. How many regulators would be closely tracking how some larger consolidating community operators are accomplishing their acquisitions of arguably underpriced properties? Or would the Securities and Exchange Commission (SEC) or the Federal Trade Commission (FTC) pay as much attention to Berkshire or other more prominent MHI members, if the industry is small and underperforming?

The pattern the puzzle pieces when aligned suggest the following emerging picture.

Ø The industry’s largest trade association, MHI, postures efforts with little or no measurable results. Indeed, in the last 9 months, shipments have been sliding year over year. That’s outrageous during an affordable housing crisis, but there is hardly a whimper from MHI or their toady surrogates.

Ø MHI engages in what MHARR President and CEO Mark Weiss, JD, aptly called the “Illusion of Motion.” There are MHI meetings, there are legislative and lobbying goals, there are promotional items ongoing. But what is there to actually reflect growth and performance from all of those busy-work activities?

Ø Further, those meetings and feckless activities are profit centers to MHI, per their own IRS form 990. MHI salaried leaders are getting paid sizable bonuses for their work, it is almost unbelievable, but per their own 990s, it is true.

Ø Not to be overlooked, those networking opportunities provide numerous chances for big boys to develop a relationship with smaller firm. When the smaller companies finally weary of the struggle against regulatory or other hurdles, who do they often turn to? Isn’t it obvious that they could and do turn to those who’ve they networked with at MHI meetings?

The above is logical. It is documented. But that isn’t legal proof that MHI and Allen have a deal, any more than MHI or MHInsider have a deal. Kurt Kelley, publisher of MHR a monthly turned quarterly on the almighty Allen’s approved reading list recently said this.

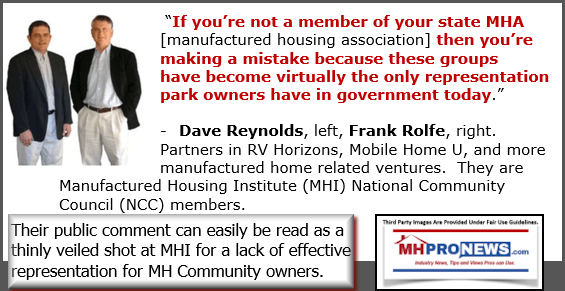

MHI members Frank and Dave wrote this in June 2019.

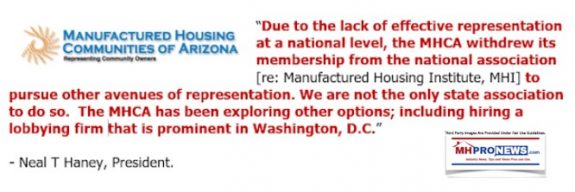

Previously, Neal Haney politely called MHI ineffective in his reasoning for breaking ranks from MHI.

Allen was cheer leading just weeks ago for MHARR to give up its autonomy. Isn’t it plausible that it is statements like these from Allen that are part of the MHI agreement with their former foe?

That’s evidence, but not proof. But it is insightful and worth pondering in the absence of any denials by Allen, MHI, top MHI members, or the outside MHI attorney.

The net result of all this is that MHInsider, Allen, and MHI are purportedly behaving in ways that suggest they are all actively and/or passively working to support the consolidation of the industry. It contradicts Allen’s own strenuous concerns about claimed abuses he lodge against MHI, the NCC, Clayton, and aggressive community operators.

Of course, Allen and his purported puppet masters would want Allen to call for a boycott of MHProNews, and for the dissolution of MHARR. Given the outline above, each of those concerns could be potentially violations of federal laws. How so? If there is evidence of coordination between these players, that could constitute collusion in the minds of antitrust and other officials. If there is evidence of mail and wire fraud, or threats to extort by fear or fraud, each of those could be a RICO violation. Furthermore, such a pattern of activity could put MHI itself in the cross hairs for IRs and other federal bodies.

All of the above could shed light on problematic developments at Cavco Industries, which per sources that firm has reportedly spent millions defending against a range of shareholder plaintiffs’ attorneys. That could be a harbinger of far more to come against other publicly traded firms that are MHI members, unless some of those firms make a break and/or pivot from MHI in some legally acceptable manner.

So, given the apparent legal risks for Allen, and top people associated with MHI, it is unlikely that any of the parties involved will confess to anything, if NDA(s) and/or legal violations are in play.

Allen-ites, investors, public officials, and MHI white hats, take note. The industry is sliding when it should be growing rapidly. Several sources are noting that the powers-that-be are consolidating the industry at a discount.

Investigators Ask, Cui Bono? Who Benefits?

The answer arguably is insiders at MHI. And if sources are correct, then George F. (F?) Allen has ‘sold out’ – literally to MHI. How many pieces of silver did he get for that sellout? 30 – or more?

The related report below now comes into ever clearer focus, and the report below shines additional light on this report too.

MHProNews will once more provide an opportunity for those mentioned in this report to respond to these allegations. If they do, an update can be expected.

Where is the Transparency? MHI’s Outside Attorney

One of MHI’s outside counsel’s is a specialist in – get this – transparency. True, his reported expertise is in governmental transparency, not corporate or organizational transparency.

There are some things so painful, the normal person simply does not want to believe it. For the shrewd, unethical, and dastardly, that tendency of human nature is an opening that can be exploited.

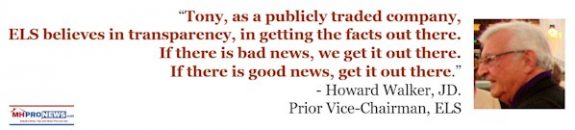

The late Howard Walker, JD, long-time vice chairman of Equity LifeStyle Properties (ELS) spoke about the need for transparency.

At MHI, regular attendees and even minor board members have told MHProNews that MHI operates like a ‘secret society,’ where a few insiders know what is occurring, but the rest are just given the same ‘drivel’ that even non-members are told.

In the search for answers, should litigation and/or public hearings regarding these matters ever occur on Capitol Hill, closed door meetings with the GSEs and unreleased minutes of same are warning signs that investors and other professionals should take note about.

One layer at a time, MHProNews – thanks in good measure to sources and tips – has peeled back the onion. Each layer sheds new light on why the industry is underperforming.

That underperformance and purported market manipulation is arguably fueling the affordable housing crisis. Underperformance means that big boys can acquire smaller firms at a discount. It also means millions are overpaying for loans. The big boys delay some immediate gratification, but they can always cash in big time later, once they in their sole judgment decide what remains of the industry’s independents is not worth consolidating.

Views From Trenches of Manufactured Housing – Factories, Retailers, MHCs, Others Sound Off

That’s why the view from the trenches and other reports about the true state of manufactured housing matters.

There is more to come today on an entirely different issue that likewise reflects on the true state of the industry today. Stay tuned.

That’s a wrap on this installment of manufactured home “Industry News, Tips, and Views, Pros Can Use” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

Related Reports:

Click the image/text box below to access relevant, related information.

MHARR Launches “Fighting Discriminatory Zoning Mandates” Manufactured Housing Project

HUD Secretary Ben Carson, Affordable Housing, Obscuring the Truth, Innovations in Housing, and Manufactured Homes – Masthead L. A. ‘Tony’ Kovach

Hold the headline for 125 words. Poisoning the well. Salting the fields. Those are but two of several ancient methods some enemies used to harm their opponents. The notion behind those vile tactics was if you could kill off their drinkable water or their food supply, someone could effectively destroy their enemy.

Multibillion Dollar Opportunities Knock in Solving Affordable Housing Crisis – Masthead L. A. ‘Tony’ Kovach

In a truly free enterprise system, various needs are identified. Then a means of profitably yet honestly serving those needs are established. Ideally, both the customer and product/service benefit. The happy customer(s) then tell or send their friends. That pattern repeated often enough yields success. For millions, perception is reality.