There are two words that are entirely missing from this address by Dr. Mark A. Calabria, Director

Federal Housing Finance Agency (FHFA). Those two words? “Manufactured homes.”

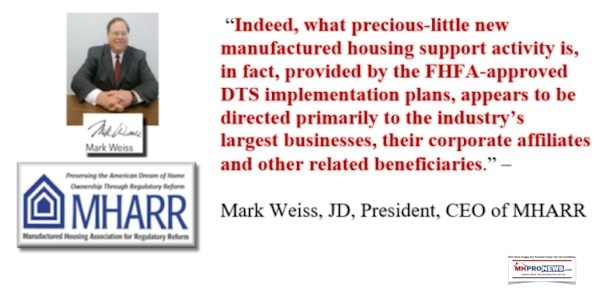

Perhaps it is no surprise? After all, the plan that has been advanced by the GSEs, as reported earlier this week by the Manufactured Housing Association for Regulatory Reform (MHARR) reflects a decrease in support that Fannie Mae and Freddie Mac would like to provide to the manufactured housing market.

There are several interesting possible pull quotes in what follows, which may be examined another time. Let’s dive into the remarks as prepared by Dr. Calabria to the Mortgage Bankers Association (MBA) 2019 annual convention.

Prepared Remarks of Dr. Mark A Calabria, Director of FHFA at MBA 2019 Annual Convention & Expo

10/28/2019

Remarks as Prepared for Delivery

Dr. Mark A. Calabria, Director

Federal Housing Finance Agency

MORTGAGE BANKERS ASSOCIATION

2019 ANNUAL CONVENTION & EXPO

MONDAY, OCTOBER 28, 2019

11:00 AM – 11:45 AM

AUSTIN CONVENTION CENTER – AUSTIN, TX

“REAL CHANGE HAS BEGUN:

BUILDING MOMENTUM FOR LASTING HOUSING FINANCE REFORM”

Thank you, Brian, for that kind introduction and for inviting me to speak here today.

It is great to be back with the Mortgage Bankers Association. And it is great to be back in the state of Texas.

Like many of you, I came here today from a city with housing laws that are a little different from what you find in Texas. I think it is fair to say that if the rest of the country looked more like Texas we might have less of a housing affordability problem in America.

I know housing affordability is an issue that MBA cares about – and so is fostering a competitive market.

I like to say that competition in the mortgage market – and any market – is the best way to serve families and communities. And mortgage bankers are proof of that.

You are also a leading voice in public policy debates. MBA has long been a key source of input for discussions on mortgage finance policy. As we endeavor to build a stronger and more stable mortgage finance system, we will need your ideas more than ever.

I have lost track of the number of MBA events I have attended over the years. But I do know that this is the second one I have attended since becoming FHFA Director.

The first was MBA Secondary in May, about 1 month after I had been sworn in as Director. I traveled to New York City to lay out my vision and agenda for mortgage finance reform.

Today’s status quo poses significant risk to taxpayers, homeowners, renters, and the entire financial system. Yet, since 2008, reforming our mortgage finance system has received a fair amount of discussion but very little action. Or, as they like to say here in Texas, it has been all hat and no cattle.

Five months ago, I said the status quo is no longer an option and change is on the way. Today, I am back at MBA to say: Real change has begun, and we are finally building momentum for lasting mortgage finance reform.

We have come a long way the past 5 months, and today marks another critical milestone in our progress. I am pleased to announce that FHFA just released a new Strategic Plan and Scorecard for Fannie Mae and Freddie Mac.

I came here to the MBA Annual Convention to discuss what is in the new Strategic Plan and Scorecard, and how these two documents will guide Fannie and Freddie through this important period of change and reform.

But first, let me take a step back to clarify why exactly our mortgage finance system is in such urgent need of reform.

Urgent Need for Reform

I recognize that business is probably pretty good for most of you – especially now that we are in a refi market. And it does not hurt that the economy has been booming the past few years and house prices have been rising at a steady clip.

Some see these positive economic trends as evidence that reform should wait for a crisis. I disagree. To quote President John F. Kennedy, “The time to repair the roof is when the sun is shining.” Now is the time to reform our mortgage finance system because our economy and housing market are strong.

Also, I imagine many of you would like to see a real estate and mortgage market that is not so “boom and bust.”

A more stable and predictable mortgage market would be better for everyone’s business. It may also be more boring. But boring looks pretty good from the wrong side of a boom and bust cycle.

We should also never lose sight of the human cost of these booms and busts. The old adage is right: “The worst loans are made in the best of times.” But when those good times turn bad, families’ lives are upended.

As a safety and soundness regulator, it is my job to hope for the best but prepare for the worst. And that is why we must act now to repair the roof before it starts raining.

A root cause of the 2008 financial crisis was imprudent mortgage credit risk backed by insufficient capital. This fundamental problem remains unresolved today.

A case in point is that Fannie and Freddie are undercapitalized for their size, risk, and systemic importance.

Together, they own or guarantee $5.6 trillion in single and multifamily mortgages – nearly half the market. And until very recently they were limited to just $6 billion in allowable capital reserves. When I first walked in the door at FHFA, the combined leverage ratio at Fannie and Freddie was nearly a thousand to one.

Last month, Treasury Secretary Mnuchin and I signed a letter agreement modifying the terms of the Preferred Stock Purchase Agreements. Under that agreement, Fannie and Freddie can retain capital of up to $45 billion combined. This is a significant step forward.

Retaining just one quarter’s net worth has cut their combined leverage ratio by nearly half. I am proud to say that in my first 6 months at FHFA, we doubled the capital at Fannie and Freddie.

But their combined leverage ratio still stands at nearly five hundred to one. To put this in perspective, our nation’s largest banks have an average leverage ratio of around ten to one.

While capital levels are low at the Enterprises, we have also seen mortgage credit risk rising across the market for several years.

Average borrower credit scores tend to be better today than pre-crisis. But low down payment and high debt-to-income mortgages have been on the rise in recent years.

Today, market-wide serious delinquency rates are low. But they were low before the last crisis, too. Low delinquency rates today are a function of a strong labor market and rising house prices. But the underlying risks in the system are still there.

Regardless of loan quality, when the tide turns, there will be defaults and we know that Fannie and Freddie do not have the capital today to withstand a downturn.

Fannie and Freddie are not the only ones responsible for today’s broken status quo. For more than 11 years, they have been operating under government control through the conservatorships. This means their performance has been determined in part by government policies.

That is why, last month, the Departments of Treasury and Housing and Urban Development released plans to reform those policies.

These plans represent a fundamental shift from past policies. The Administration’s plans aim to enable Fannie and Freddie to build sufficient capital to withstand a downturn and operate safely and soundly outside of conservatorship.

I share this goal – and aim to achieve it through the new Strategic Plan and Scorecard.

FHFA’s New Strategic Plan and Scorecard

The Strategic Plan outlines FHFA’s priorities that will guide Fannie and Freddie’s operations. And the Scorecard is FHFA’s primary tool to hold Fannie and Freddie accountable for achieving those priorities.

The three objectives of the new Strategic Plan and Scorecard are to ensure that Fannie and Freddie…

Number 1: Focus on their mission of fostering competitive, liquid, efficient, and resilient housing finance markets.

Number 2: Operate in a safe and sound manner appropriate for entities in conservatorship.

And Number 3: Prepare for their eventual exits from the conservatorships.

Together, the Strategic Plan and Scorecard represent a new approach to operating the conservatorships of Fannie and Freddie. FHFA has already started to put this new approach into action. Like I said, real change has begun – and we are quickly building momentum for lasting reform.

Objective 1: Foster CLEAR Markets

To focus Fannie and Freddie on their core mission, our guide will always be: “What does the statute say?”

Under the Housing and Economic Recovery Act of 2008, the FHFA Director is responsible for ensuring our national housing finance markets are competitive, liquid, effective, and resilient. This is wholly consistent with the 5 purposes laid out in both Fannie and Freddie’s charters.

To achieve this objective, FHFA is focusing the Enterprises on providing access to smaller market participants and community lending institutions.

Ensuring that access is critical to sustainable homeownership and affordable rental housing.

Revised Multi-Family Caps

In September, FHFA released new multi-family loan purchase caps for Fannie and Freddie. They ensure a strong focus on their statutory mission without crowding out private capital.

The new caps provide ample support to the multi-family market with a combined $200 billion in purchase capacity through 2020.

They also close loopholes that had enabled the Enterprises to unnecessarily displace private capital.

A key aspect of the new caps is that they increase the levels of Fannie and Freddie’s multi-family business that is mission-driven, affordable housing to at least 37.5 percent.

Protected Equitable Access for Small Lenders

Also in September, FHFA issued formal policy guidance prohibiting the Enterprises from volume-based guaranty fee discounts. This is a key element to leveling the playing field for small lenders.

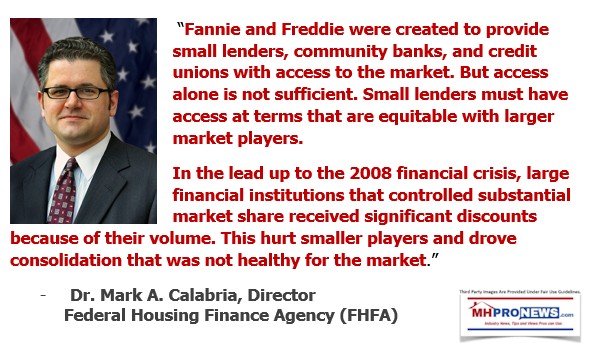

Fannie and Freddie were created to provide small lenders, community banks, and credit unions with access to the market. But access alone is not sufficient. Small lenders must have access at terms that are equitable with larger market players.

In the lead up to the 2008 financial crisis, large financial institutions that controlled substantial market share received significant discounts because of their volume. This hurt smaller players and drove consolidation that was not healthy for the market.

FHFA’s recent guidance enshrines the principle of “same rate of the return for the same risks, regardless of size.” It also allows guaranty fees to reflect differences in the risk profiles between lenders of different size.

New QM Standard Equally Applicable to All Market Participants

There is much more work to be done to level the playing field and foster fair competition.

A key example is the Qualified Mortgage standard. The responsibility to change QM lies with the Consumer Financial Protection Bureau. But Fannie and Freddie have a role to play, too.

The Strategic Plan and Scorecard direct them to support the development of a QM standard that applies equally to all players originating responsible loans, with no special advantages for anyone.

Objective 2: Ensure Safe and Sound Operation

This should be obvious, but it is worth emphasizing: No policy change will matter unless Fannie and Freddie are financially viable and strong enough to withstand a downturn in the economy.

That is why the second objective of the new Strategic Plan and Scorecard is to ensure Fannie and Freddie operate in a safe and sound manner.

Meeting FHFA’s standards of safety and soundness is paramount while Fannie and Freddie remain in conservatorship. It is also a prerequisite for each Enterprise to exit conservatorship.

One way to think about FHFA’s standards for safety and soundness is: Are Fannie and Freddie equipped to withstand a downturn on the scale of what we saw in 2007 and 2008?

We know they cannot meet that standard right now. But I believe they are capable of and committed to getting there. In fact, today I think we see the strongest board and management teams in the history of these companies. I will measure progress by looking at whether they are moving in the right direction and as quickly as possible without jeopardizing their mission.

Meeting this objective and implementing the Strategic Plan and Scorecard will not be calendar driven. It will be driven by meeting key mile markers between today’s unsustainable status quo and a reformed and resilient housing finance system.

Fannie and Freddie cannot change their risk profiles overnight. But the Strategic Plan and Scorecard direct them to begin the process of calibrating their risk to their capital levels.

Here again, real change has already begun.

In response to some of the risk trends I mentioned earlier, Fannie and Freddie have taken measured steps to address loans with layered risk.

When tailoring risk, we will proceed thoughtfully. But this does not mean moving slowly. Small adjustments to the footprint can pay significant dividends in trimming the tails of risk.

Matching Fannie and Freddie’s risk profiles to their capital levels is also part of addressing overlaps between the Enterprises and the Federal Housing Administration (FHA).

Objective 3: Prepare for Responsible Exit From Conservatorships

Reducing these overlaps is one of the recommendations in the Administration’s housing finance reform plans. It is also part of the third and final objective of the new Strategic Plan and Scorecard, which is to ensure Fannie and Freddie are preparing to responsibly exit conservatorship.

Addressing Overlaps with FHA

Thoughtfully addressing these overlaps makes sense for both the Enterprises and FHA because they were created to perform different roles in our housing finance system.

FHA exists to support borrowers that would be served poorly – or not at all – by private capital.

Of course, the Enterprises will continue to support access to credit through low down payment lending. Also, they have a Duty to Serve and Affordable Housing Goals to meet – and FHFA expects them to continue meeting those goals. Borrowers and lenders will continue to have choice in the market.

But Fannie and Freddie have a different model than the fully taxpayer-backed FHA.

Fannie and Freddie’s risk must be supported by private capital. Their activities are expected to earn “a reasonable economic return.” They must be able to withstand an economic downturn and their loans must be sustainable through the cycle.

Reducing irresponsible and needless competition between the Enterprises and FHA also strengthens and stabilizes the FHA fund.

When the Enterprises stretch credit guidelines to “skim the cream” from FHA, they not only put themselves at risk, but they also undermine the pooling of risks across a broad range of credit necessary for FHA to function.

Therefore, the new Strategic Plan and Scorecard direct Fannie and Freddie to support FHFA’s effort to address areas of overlap. We will also ensure that the secondary market continues to provide liquidity and access to credit.

Change has already begun. FHFA is in the early stages of consulting with HUD and FHA. Our approach is to ensure that each program is properly focused so that it can fulfill its mission.

In order to prepare to responsibly exit conservatorship, Fannie and Freddie must not repeat the mistakes of the crisis by stretching to serve borrowers who are better served by FHA.

Building Capital

In addition to tailoring risk to match capital, the Enterprises must build capital to match their risk. This is a precondition for exiting conservatorship.

Here again, change has already begun – and it is building momentum for lasting reform.

As I mentioned, last month, Secretary Mnuchin and I modified the PSPAs, allowing Fannie and Freddie to effectively double their capital.

FHFA is also working on a capital rule that balances the imperative of protecting taxpayers, the mission of supporting liquidity, and the economic incentives of raising private capital.

This may be the most important rule of my tenure. It is a prerequisite for the Enterprises to be able to raise additional private capital.

FHFA is in the process of reviewing potential financial advisors that can provide needed expertise to evaluate different capital raising options and help chart a roadmap to responsibly end the conservatorships.

I will continue to work with Secretary Mnuchin on further revisions to the PSPAs necessary to end the conservatorships.

The objectives of the new Strategic Plan and Scorecard – and the changes we have made the past 6 months – lay the foundation for Fannie and Freddie to ultimately raise private capital.

But again, the path out of conservatorship will not be driven by the calendar. It will be driven by Fannie and Freddie meeting the mile markers set out for them.

Setting the Conditions for Success: Enacting Changes to Build Momentum for Lasting Reform

FHFA’s job is to establish the conditions necessary for Fannie and Freddie to operate outside of conservatorship in a safe and sound condition, to meet their mission, and to protect taxpayers.

The Strategic Plan and Scorecard are focused on putting those conditions in place within the Enterprises themselves. When implemented, Fannie and Freddie will operate appropriately while in conservatorship, avoid the imprudent practices of the past, and serve a more counter-cyclical role in the market.

But we need to change more than the Enterprises to build a reformed, resilient, and sustainable housing finance system.

That is why we are working to set the right conditions to support lasting reform both within FHFA and across the mortgage finance system.

We have begun to implement changes to ensure our Enterprise supervision is strong, well-executed, and focused on safety and soundness.

And in June, I asked Congress for the authority to charter new market participants, the power to examine Enterprise third parties, and the discretion to appropriately tailor capital requirements.

These authorities would give FHFA important tools to ensure the Enterprises remain well-regulated and well-capitalized outside of conservatorship. I will not end the conservatorships unless I am confident that once Fannie and Freddie leave, they never have to return.

I will also continue advocating for reforms that inject competition and equality under the law into our mortgage finance system. You need to have both elements to have fair and effective markets.

I do not need to tell a room full of mortgage bankers about the benefits competition brings to consumers, product innovation, and industry efficiency. But it is important to remember that competition’s benefits materialize only when the laws and regulations apply equally to everyone.

I am the first to recognize the size and scope of the agenda that I just outlined. We certainly have our work cut out for us.

And as the Mortgage Bankers Association proves every day, the only way to accomplish an agenda like this is to work together.

I thank you for that work. And I invite you to be partners in today’s effort to ensure we have the best mortgage finance system in the world.

Since we are in the Lonestar State, let me close with words of wisdom from one of the great sons of Texas, President Lyndon Baines Johnson. In his first Thanksgiving address from the White House, LBJ told the American people: “Yesterday is not ours to recover, but tomorrow is ours to win or lose. I am resolved to win the tomorrows before us.”

I hope you share that resolve.

And when you put in the hard work to enact the changes you believe in, you start to build momentum for lasting reform.

Thank you.

##

MHProNews Analysis in Brief

In fairness, there are several noteworthy statements in the above. FHFA Director Calabria was addressing the MBA, not manufactured housing professionals.

But perhaps it is precisely when he isn’t speaking to a manufactured home audience that the industry should be focused on what is and isn’t said.

Some of the points Dr. Calabria outlined above could – in principle – be useful to manufactured housing, if it is applied.

For example:

That statement is an apt one. Notice how often the issue of consolidation – the monopolization of a market by larger players that dominate smaller ones – arises in practical terms? Note too how failure to enforce good existing laws has adverse consequences on the marketplace too?

But based on those words and others spoken by Director Calabria, why isn’t the law with respect the Duty to Serve manufactured housing being fully and properly enforced?

Perhaps top officials at FHFA need to dig into the report below, because doing so would benefit the U.S. economy, renters, manufactured and conventional homeowners. Most of the country, save perhaps a few monopolistic minded players, would benefit.

Day by day, when events are viewed based on the evidence developed here and on MHLivingNews, through direct and indirect measures, it becomes more apparent that manufactured housing is struggling due to a lack of enforcement of good, existing federal laws. DTS – the Duty to Serve – manufactured housing, rural and underserved markets could slip through our industry’s fingers if action isn’t taken. That’s your first installment of the reality check for today of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and and here.

Related Reports:

Click the image/text box below to access relevant, related information.