You don’t take flak unless you are over the target. That’s a piece of military folklore.

Flak, diversionary strategies and tactical retreats by those involved in allegations of the corruption of the U.S. affordable manufactured home market has increased.

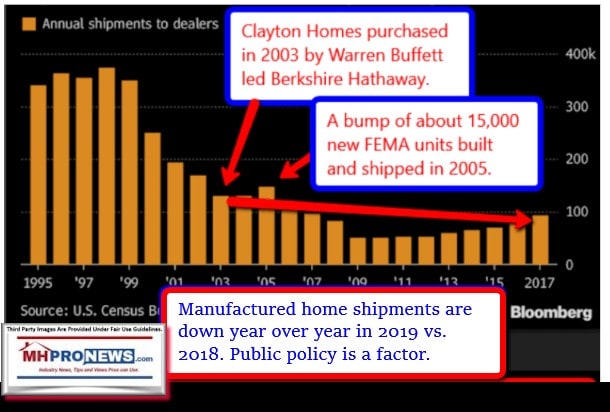

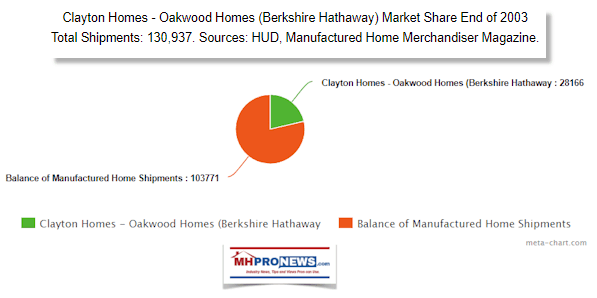

As MHProNews has sharpened our focus on the causes and potential cures to the manufactured housing industry’s historic underperformance since Berkshire Hathaway entrance into the industry. That entry was authorized by Warren Buffet, chairman of that Omaha-based conglomerate’s acquisition of Clayton Homes in 2003.

New readers, increased interest and new sources of insider tips have statistically been noted here. That surge is in the wake of our refocus on fact-checks, following-the-money trails, analysis and commentary on the various claims and ‘news’ from those involved in the so-called “Omaha-Knoxville-Arlington axis,” their surrogates and allies.

Last week and this, we’ve begun a new test. Less is more. Fewer articles, with increased readership of each article.

Perhaps it is coincidental. But numbers of new documents have been obtained revealing with increasing detail evidence of the corrupt collusion between corporate, organizational – and in certain cases – public officials. While not all collusion may be illegal, when it occurs in a fashion harmful to thousands of independent businesses and tens of millions of Americans, including current manufactured home owners, at a minimum it merits increased attention.

Frankly, the documents to date are confirming prior findings. We don’t question the motives of a tip source, but perhaps that’s why some of our sources have sent them.

As we ask various federal agencies, the Government Sponsored Enterprises of Fannie Mae and Freddie Mac and others to respond to various matters, some of the feedback is revealing too, as upcoming reports will reflect.

A History of Corruption?

Certainly, an argument can be crafted that there long has been and will continue to be corrupted behavior in American politics going back to the early days of the American experiment in ‘self-government.’

Tammany Hall is an example in New York. But one can look at the Oklahoma County Commissioner scandal that was finally broken up by the Federal Bureau of Investigations (FBI) to realize that in states across the left-right divide, illicit practices can be found.

Such cases often featured the intersection of business with public interests. Note the first state is a more Democratic stronghold, the second are more Republican. This isn’t partisan. Human nature is what it is.

While various administrations want to portray themselves as being pristine, there was ineptitude or corrupt behavior to be found with Democratic or Republican administrations at the federal level.

A federal official that served in the Obama and Trump Administrations told MHProNews that much of the federal government’s spending must be viewed through the lens of tax dollars ending up in the hands of private enterprises. That, said the official, creates temptations for corruption.

Let’s further note that mainstream or trade media plays a critical role in how soft or hard corruption is revealed. Or media may play a role in how its concealed. The corruption being examined by MHProNews and MHLivingNews spans decades, which means it covers both Democratic and Republican administrations.

In manufactured housing reports, we as trade media pressed from the outset for ethically sound best practices. From early on at MHProNews, we reported those periodic instances of black hat behavior that often resulted in charges or litigation by public officials and/or private attorneys. It was a practice then new to our industry, as typically trade media in manufactured housing for years was described as mostly thinly veiled marketing.

To spotlight black hat or illegal behavior was a kind of morality tale, showcasing what to do, but also what not to do.

But it wasn’t until more recent years that we as trade media began to grasp the Manufactured Housing Institute (MHI) methods could not be adequately explained as a mere style or procedural difference from the smaller Manufactured Housing Association for Regulatory Reform (MHARR) tactics.

For new readers, it must be emphasized that MHARR’s stated mission is to represent the interests of independent producers. MHARR is a ‘production’ association. By contrast, MHI’s own website and literature make it plain that they claim to represent the interests of ‘all segments of manufactured homes and factory-built housing.’ It’s a post-production as well as producers trade group. MHI claims to be an umbrella trade association that covers all interests.

Those self-descriptions are thus part of the standards by which a trade group should be viewed.

The acid test for an umbrella trade group that claims to be promoting the industry is the acceptance and performance of manufactured housing in the marketplace.

Certainly, since the Berkshire era, MHI seems unable or unwilling to admit the obvious. In 2019 the manufactured housing industry is performing at a lower level in terms of total shipments – and thus production – of new HUD Code manufactured homes than it did in 2003. A rationale clear thinking mind might wonder: how is that possible, given the needs of affordable homes has only grown?

When decades of research that praises manufactured housing quality, durability, safety and value, how is it possible that MHI fails to point to that kind of research? Why does MHI use instead ‘studies’ they’ve commissioned, which are then hidden behind a firewall so the methodology can’t be fact-checked?

But the issues go deeper.

How is it possible that with good aspects to federal laws such as:

- the Manufactured Housing Improvement Act (MHIA) of 2000,

- or the Duty to Serve (DTS) rural, affordable housing preservation and manufactured housing by Fannie Mae and Freddie Mac

- that those useful federal provisions are under-enforced, misdirected or outrageously perverted?

- Why is it that routinely MHARR pushing for full enforcement of the law, while MHI postures, prances, does photo or video ops and manages to accomplish little or nothing?

Hold those thoughts. Because only through that lens can the current state of the manufactured housing industry be clearly understood. That condition has a far greater ripple effect on the U.S. economy, taxpayers, and government programs than initially meets the eye. The third-party report published on Value Penguin outlines that issue.

While MHARR has been challenging MHI for decades to do more, they were not alone.

The still newly formed National Association of Manufactured Housing Community Owners (NAMHCO) publicly explained why they broke away from the Manufactured Housing Institute (MHI). We reported that, but our reports on MHProNews also foreshadowed that break.

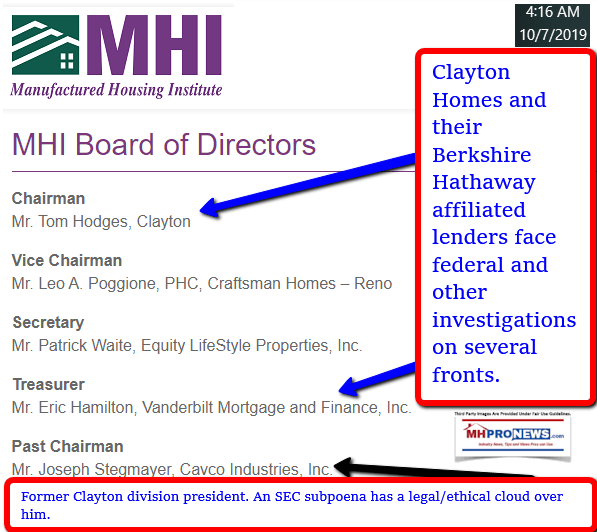

MHI has been dominated for some time by Clayton Homes, 21st Mortgage Corporation (21st), Vanderbilt Mortgage and Finance (VMF) and other Berkshire Hathaway connected interests. Let it not be forgotten that Buffett wanted manufactured home land-lease communities spun off from Clayton. That divestiture occurred. Buffett’s rationale reportedly was that he ‘didn’t want to be seen as raising the site rents on grandma.’

But that shouldn’t be construed to mean that Buffett didn’t have any interest in land-lease communities per se. Through commercial, wholesale and retail lending, brokerage, the sales of products and services, Berkshire’s ties to manufactured home communities has remained. Indeed, the case can be made that it has grown.

In understanding the relationship between Buffett and the manufactured home industry, too many overlook the point that Wells Fargo is the number three lender on manufactured homes. Wells Fargo is a serious player in the complex relationship with Fannie Mae and Freddie Mac and the manufactured home industry.

Who is the largest stockholder in Wells Fargo? Berkshire Hathaway.

When Berkshire became more involved in community brokerage, by coincidence or not, the number of instances of problematic behavior by firms such as Havenpark Capital – an MHI member company – or others involved in MHI grew.

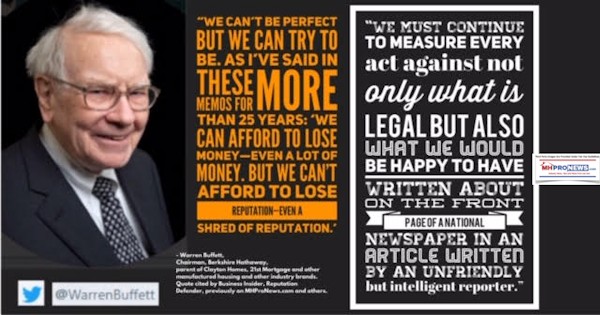

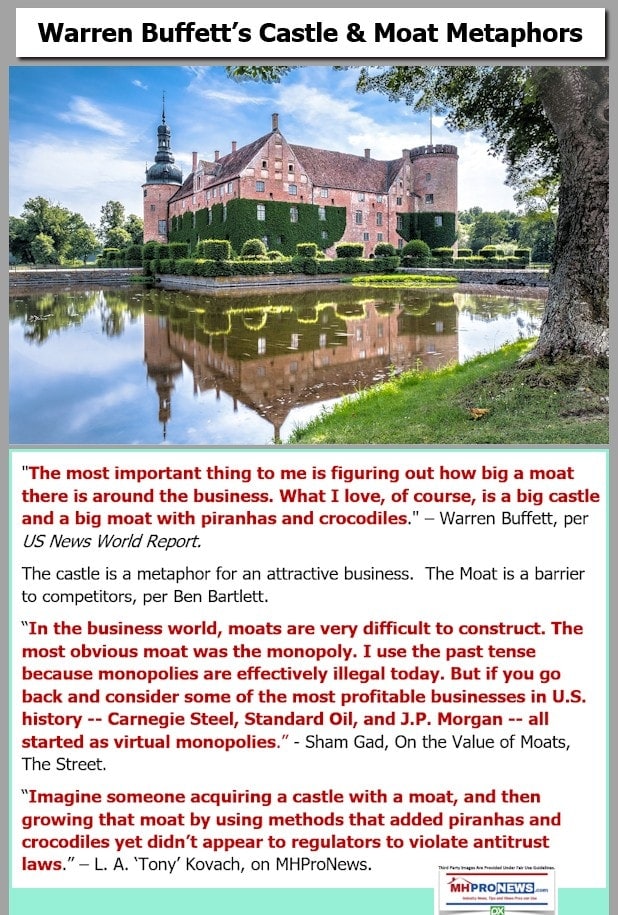

Buffett is well known for his statements about business ethics and not losing money. Ponder the quotes that follow, but look at them with new eyes.

Because Buffett has also said that they can afford to lose money so long as they don’t harm their reputation. Is that candor or a clever lie?

Consider the scandals at Wells Fargo. Buffett stood by the giant bank. Per CNN, “But, the billionaire Wells Fargo (WFC) shareholder defended the scandal-ridden lender, arguing its misdeeds aren’t much worse than what other big banks have done.”

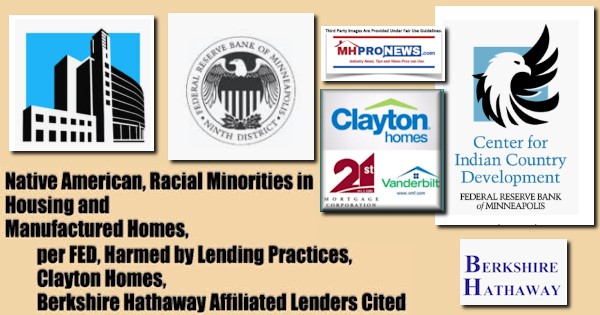

Ponder the scandals involving Clayton Homes, 21st or VMF. They include, but are not limited to, allegations of racism, predatory or biased behavior against minorities and the working lower economic classes.

Note that those groups are one way that the Housing and Economic Recovery Act (HERA) of 2008 in establishing for the Federal Housing Finance Agency (FHFA) the guidance to the activities of Fannie Mae and Freddie Mac. Here’s how the FHFA’s website describes the Duty to Serve (DTS) mission:

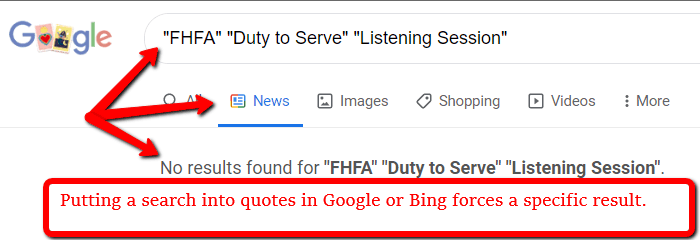

As comments during the 12.2.2019 Washington, D.C. ‘listening session’ at FHFA headquarters reflected, numerous voices present that presented made it plain that they don’t believe that DTS is being used that way at all. In listening to the plight of residents, the final presenter – Maurice Jourdain-Earl of ComplianceTech – said it literally made him cry.

Jourdain-Earl and Antoine Maurice Thompson – Executive Director of the National Association of Real Estate Brokers (NAREB) – each had their own tale of woe tied to DTS.

We hear much of late of the notion that no one is above the law. That ought to be true. But if so, why is FHFA, Fannie and Freddie aloud to ignore, deflect or misdirect lending away from the stated purpose of the law with impunity? Is that a signal – as in the historic examples noted above – of collusion with an illicit element to them?

Calls for formal Congressional inquiries into such issues are growing. Editorially, we concur.

But there is more to this purported charade than what’s already been outlined.

Nonprofits, Buffett and Berkshire Hathaway

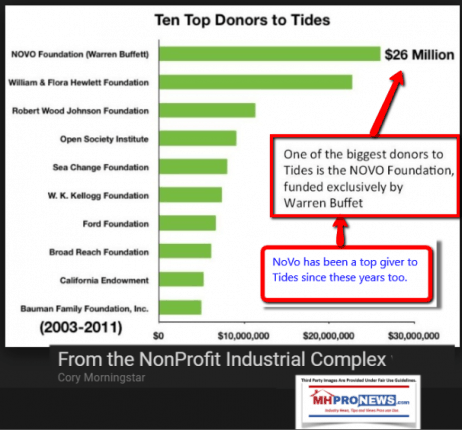

Then ponder how Buffett has used donations to a nonprofit operated by family members which in turn is the largest source of contributions to the Tides nonprofit. After the Golden State Manufactured-Home Owners League (GSMOL) brought it to MHLivingNews and MHProNews attention that MHAction was funded by the Tides, we gave that nonprofit closer scrutiny.

GSMOL proved correct, but there was more to see between the nexus of Buffett, money flowing to nonprofits and how that influences the manufactured home industry.

It is MHAction – de facto funded in good measure by Buffett and like-minded donors – that has arguably jumped over the National Manufactured Home Owners Association (NMHOA) in prominence as measured by the number of media reports.

Prosperity Now, Nonprofits Sustain John Oliver’s “Mobile Homes” Video in Their Reports

What does MHAction do? They organize resident-activists to protest problematic behavior and have produced a co-branded white paper with two other nonprofits. That white paper is the “The Private Equity Stakeholder Project.” It documents numerous instances of stiff hikes in site fees and other problematic practices in manufactured home land-lease communities, naming specific companies. What ought to be emphasized is that those ‘black hat’ actors MHAction and others have identified are routinely tied to members of the Berkshire Hathaway dominated MHI.

Rephrased, Buffett and Berkshire money is on both sides of several battles within manufactured housing. That is done in part through dark money channels. That might be legal, but it begs the question; why are they engaged in such chicanery?

- What’s the goal of stirring up bad news through MHAction et al while claiming on the other hand to be advancing the interests of manufactured housing industry companies via MHI?

- Are such facts mere coincidence?

- Or is there a clear pattern that MHI seems incapable of advancing the acceptance of the industry, while much smaller MHAction manages to get the Washington Post, Los Angeles Times or HBO’s Last Week Tonight with John Oliver to do reports that reflect poorly on the industry at large?

Ironically, Buffett and Clayton are prominently attacked in Oliver’s video.

- What happened to that notable Buffett claim about reputation?

- Or has the Tide gone out (pun intended) and now those with the eyes to see what’s hiding in plain sight can witness how Buffett and his tentacles are manipulating manufactured housing in a manner that keeps the industry smaller, while his market share and that of industry allies is growing?

There is no need for guess work. The entire pattern in explained step-by-step by Berkshire brand CEO Kevin Clayton of Clayton Homes in his own words in the softball video interview with a Berkshire sycophant.

In the annotated version of this video posted below, Kevin Clayton says much in just under an hour. Some of it – following the model of Buffett that Kevin says he admires? – is accurate, but some of it is arguably misdirection or paltering.

1) Kevin exudes enthusiasm for nonprofits.

2) Kevin speaks about an industry image campaign that has yet to materialize in a manner that has benefited the industry in terms of new home shipments or acceptance.

3) He praises independents, but also preaches Buffett’s mantra about being a tough competitor and to always deepen and widen your Moat.

4) Kevin clearly says it would be okay with Warren if Clayton lost money for 5 years, so long as they were deepening and widening the Moat.

Between that video, the facts outlined and linked from reports herein, one can begin to see how manufactured housing was weaponized from within.

Note that MHAction has protested:

- HUD Secretary Ben Carson’s address to MHI in 2018.

- They’ve protested ‘Frank and Dave’ led RV Horizons, now known as Impact Communities, along with Frank and Dave’s Mobile Home University.

The later is so notorious that CBS’ popular program NCIS did an episode with a character arguably modeled after Frank Rolfe and Mobile Home U.

Did any of those problematic behaviors which stand in stark contrast with MHI’s National Communities Council (NCC) so-called new ‘Code of Ethical Conduct’ result in any ejection of Frank and Dave, Havenpark Capital, or Berkshire brands from the Arlington, VA based MHI? Not that we’ve seen, have you?

It’s a seemingly clever game of truth mixed with paltering and spin, the claimed ‘good’ of which is amplified by their toadies. Those Buffett-Berkshire toadies in MHVille seem to include:

- MHI,

- several state associations,

- MHInsider/MHVillage

- blogger George Allen and his buddies,

- MHReview,

- plus others that will be the focus of planned future reports.

DTS is a mirage in terms of manufactured home lending on new single-family manufactured housing.

As protester/activists – who may well be pure of intention, regardless of what one thinks of MHAction – indicated during the Washington, D.C. FHFA “listening session” on December 2nd, DTS is being used to benefit consolidating community operators. Jourdain-Earl and Thompson both pointed to the huge disparity in lending that exists in DTS, harming minorities.

Those listening session speakers’ points could be boiled down to this. DTS isn’t just going under-enforced. It has demonstrably been turned on its head. Those of greater means are benefiting while those of lesser means are being harmed. How could that happen without insider help at FHFA?

MHProNews believes that one or more of those involved at FHFA need to be investigated. But this is far from the only investigation of federal corruption that needs to be opened. There are several others.

So-called predatory MHI member community operators acquire a manufactured home community from independent owners, and then routinely jack up site fees in a manner that makes living in those communities less affordable. Those loans are often coming from Fannie and Freddie.

Residents protested that they had no protection. But the GSEs claim they have safeguards built in. Really?

Per Wells Fargo, when Fannie and Freddie say they have resident protections, what do they cite?

Wells Fargo lists the following about so-called consumer safeguards provided by the Government Sponsored Enterprises (GSEs or Enterprises) of Fannie Mae and Freddie Mac.

As one ponders that list, consider the common complaints of manufactured home community residents who one day woke up to their property having new owners, who soon thereafter jacked up their site fees. Ask those residents if they feel protected? They’ve clearly said no in a variety of public settings.

Then, ponder this question.

What if anything has FHFA done to draw mainstream media attention to these listening sessions? What has Fannie and Freddie done to draw mainstream media coverage to it?

We’ve asked all three organizations. We’ll let readers know what answers they give, if any. So far, crickets.

What’s Next?

As FHFA is moving to spin off the GSEs out of conservatorship, who is likely to be involved? Is it possible that given Berkshire’s deep ties to the GSEs before Buffett dumped those stocks that they may hope that some of that $128 billion in liquidity that CNBC or others in media reports that Berkshire has might go to them?

Would it be any surprise if Fannie or Freddie at a minimum behave in a fashion that benefits Berkshire? Perhaps with the realization that Berkshire may once more become a stakeholder in the Enterprises?

It is individual manufactured homeowners – often living in communities that are owned by MHI/NCC members, which in turn are often the source of purported black hat behavior – that are among those suffering under the failure of DTS.

They are not alone, as Jourdain-Earl and Thompson have said that clear evidence based on hard data reveals that systemic racial bias exists.

With that noted, does anyone think about how often Buffett-led Berkshire brands are accused of racial bias? Is that accidental, coincidental, or is there something more sinister afoot? A recent Minneapolis Federal Reserve report points to some of the same data that House and Senate Democrats have in calling out Clayton Homes and their affiliated lenders.

As former NMHOA president Tim Sheahan and manufactured home community leader Robert ‘Bob’ Van Cleef have both noted, the law of supply and demand is working against residents.

It is the lack of construction or development of new manufactured home communities that’s keeping residents trapped in properties that are seeing often dizzying site fee hikes. Yet those same properties, when they were owned by mom-and-pop independents, were living with their residents in harmony.

Since Buffett led Berkshire has entered the industry, much has been turned on its head. Is that all a matter of coincidences? Or are those and other possible examples part of Buffett and Kevin Clayton’s notion of deepening and widening the Moat?

Enforcing Antitrust and Other Laws

Is this why MHI is inept in performance, but brilliant in providing a steady stream of photo or video opportunities? Who do those photos or videos benefit, besides MHI promoting themselves and by extension, those who pull their puppets strings?

As Lesli Gooch and Mark Bowersox seek to take the reins at MHI, one must not forget that they do the bidding of the MHI Executive Committee board of directors. Who are those board members?

It’s a tangled web. We report on it. MHARR in several ways led the charge years ago, urging the industry for years to get a good post-production trade group.

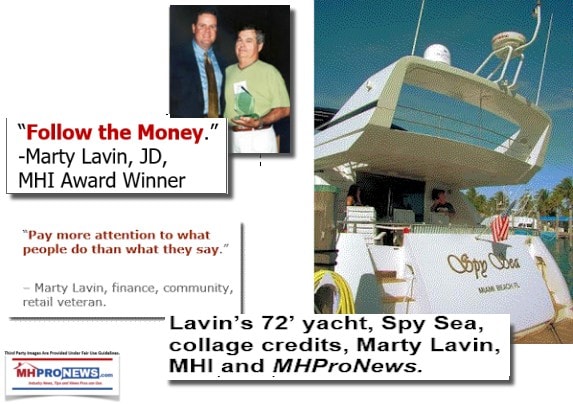

MHI award-winner Marty Lavin, J.D., in a coy fashion played an arguably cautionary note for years as well.

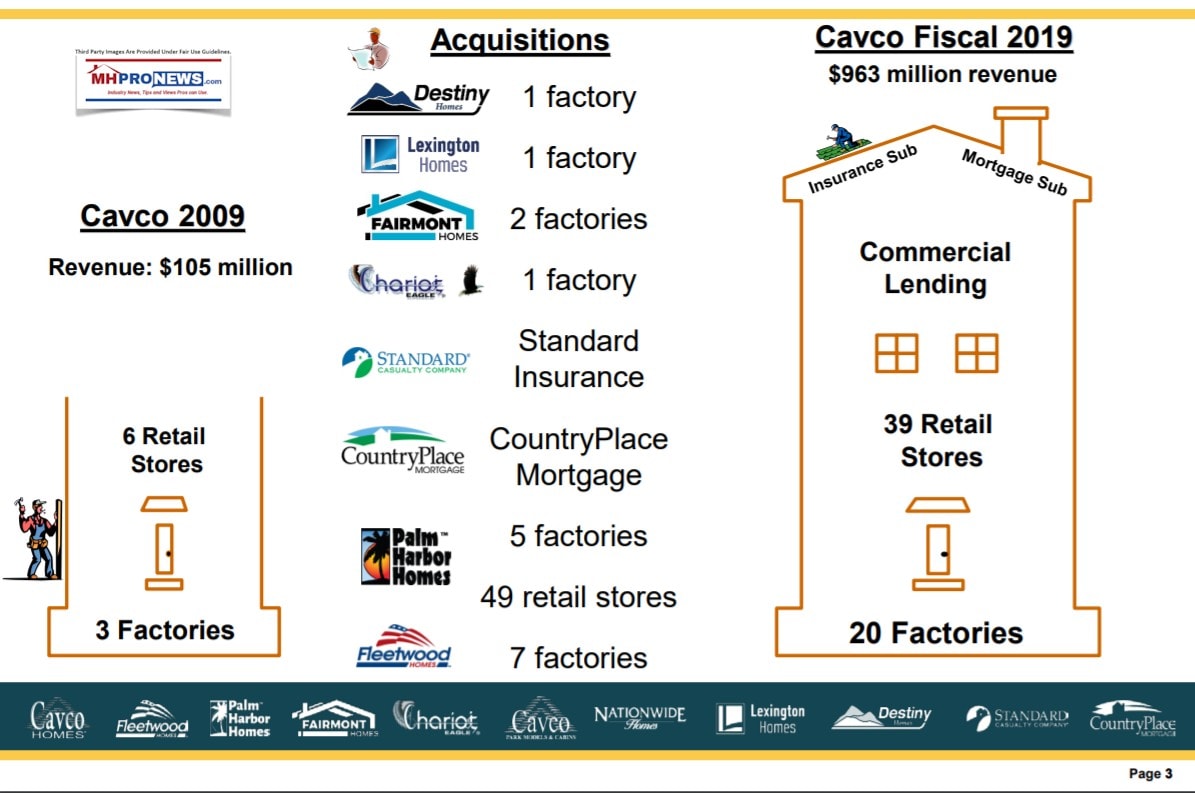

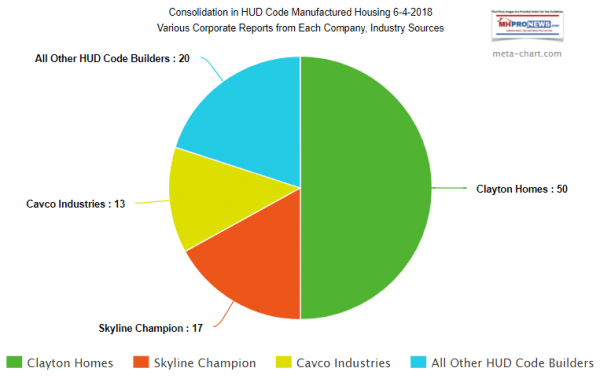

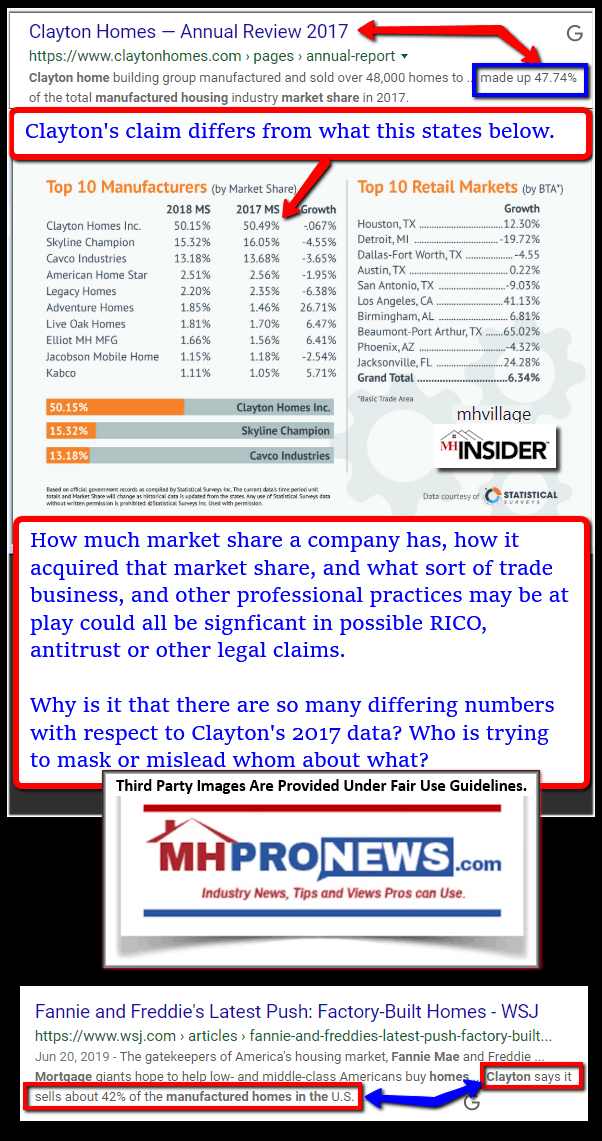

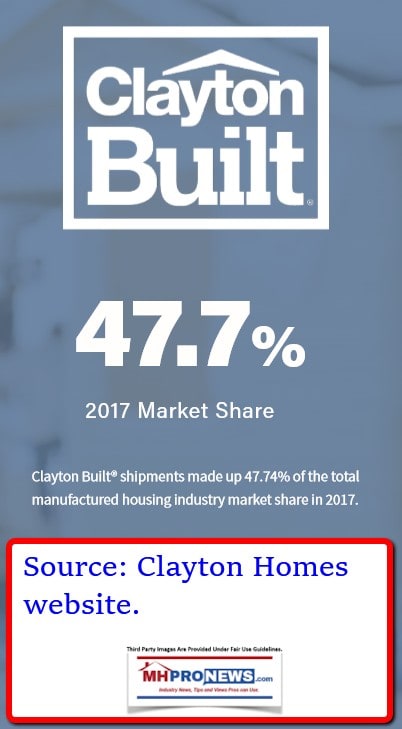

Manufactured housing is a good product when it is offered by white hat brands. The firms in MHARR are routinely white hat brands. The evidence from MHI is that they are frankly a mixed bag. As Clayton Homes was predictably barreling toward 50 percent market share, perhaps in anticipation of that, former Clayton division president Joe Stegmayer left to take over the leadership of Cavco Industries.

Here’s the results, per Cavco.

Coincidences?

No one in MHVille trade media has told this story anything like MHProNews or MHLivingNews has. We’ve caught flak.

Is that flak – which we will update readers about soon – because we are over the targets?

https://www.manufacturedhomepronews.com/masthead/expose-darren-krolewski-datacomp-mhvillage-mhinsider-marketing-claims-fact-check-infographic-and-analysis/

The industry’s independents, residents, affordable housing advocates and others of good will who care about should be pushing for state and federal level investigations. The squeaky wheel will get the grease.

The causes of fear about manufactured homes are sparked in no small measure by bad news often fostered by the failures of MHI and the successes of operations like MHAction. Berkshire owns dozens of newspapers.

If the Berkshire leadership truly wanted the manufactured home industry to be understood, that BH Media Group could easily do an article a week until the misconceptions vaporized. They have not only not done so; the case could be made that BH Media Group papers have done far more negative news reporting than positive news reports.

The argument can be made that a relatively few individuals who lead certain organizations have manipulated the system in their favor. That manipulation has harmed the many to the benefit of the few. It seems to have as a byproduct industry consolidation – which is seemingly a slow-motion play for monopolization.

This couldn’t occur without public officials at a minimum looking the other way, if not actively taking part in such ploys. See the related reports for more details.

Finally, new documents that have been given as news tips are being examined that will likely be the subject of an upcoming report(s). Stay tuned.

There is a plan to expose and oppose what’s alleged herein. Step by step, it has been and will be unveiled. Strategic, long-term thinkers and people of good will across the spectrum are getting involved. How about you?

That’s a wrap on this edition of the manufactured housing trade media’s #1 source for “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” © (Sunday weekly headlines recap, news, fact-checks, analysis, and commentary.)

Soheyla is a co-founder and managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

Related Reports:

Click the image/text box below to access relevant, related information.

Vexing Questions Dogging Manufactured Home Industry Go Unanswered by Key Figures

Fannie Mae Announces 11.26.2019 New Details on Manufactured Home Lending Program