This report will involve two broad aspects. First the essence of two new press releases from UMH Properties which will be followed by a related MHProNews analysis.

Contact, links or other standard disclosure information are omitted in what follows from UMH, but the words are otherwise as provided in their releases.

UMH PROPERTIES, INC. ANNOUNCES PROMOTION OF BRETT TAFT

FREEHOLD, NJ, Dec. 12, 2019 (GLOBE NEWSWIRE) — UMH Properties, Inc. (UMH) today announced that it has promoted Brett Taft from Vice President to Chief Operating Officer, effective January 1, 2020.

Samuel A. Landy, President and Chief Executive Officer, commented, “Brett has been with the Company for over eight years. During that time, he has done an outstanding job on all matters with UMH. Throughout the years, he has played a key role in growing our portfolio, integrating our communities, and upgrading our operating procedures. As Chief Operating Officer, Brett will be responsible for the day-to-day operations of the Company. Brett fully understands our business plan and will work to continue to improve our operating results and ultimately help us to accomplish our long-term goals.”

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 122 manufactured home communities with approximately 23,000 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland and Michigan. In addition, the Company owns a portfolio of REIT securities.

##

UMH PROPERTIES, INC. ANNOUNCES ADDITION OF VICE PRESIDENT OF CAPITAL MARKETS

FREEHOLD, NJ, Dec. 11, 2019 (GLOBE NEWSWIRE) — UMH Properties, Inc. (NYSE: UMH) today announced that it welcomes James O. Lykins as a Vice President of Capital Markets, effective January 15, 2020. Previously, Jim was an analyst at D.A. Davidson & Co. from 2015-2019 where he covered the REIT sector. Prior to that beginning in 2014, he was the Acquisitions Manager at Whitestone REIT. He was at Hilliard Lyons from 2000-2014, including 12 years in Equity Research and two years in Investment Banking. Jim graduated from the University of Kentucky with a B.B.A. in Finance and received his MBA from Bellarmine University. His experience will add tremendous value to the overall operations of the Company.

Samuel A. Landy, President and Chief Executive Officer, commented, “UMH is proud that Jim will join UMH Properties as Vice President of Capital Markets. He is very familiar with our Company, our investor base and our investment bankers. We look forward to working with Jim to communicate with our investors, analysts and bankers, the value that UMH is adding to our Company each year by upgrading acquisition properties, adding over 800 new rental homes per year and selling over 100 new homes into our communities.”

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 122 manufactured home communities with approximately 23,000 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland and Michigan. In addition, the Company owns a portfolio of REIT securities.

##

MHProNews Analysis in Brief

Publisher L. A. ‘Tony’ Kovach said, “I know Brett Taft personally and he is a very capable professional.”

As a disclosure, MHProNews and MHLivingNews have performed some contract services for UMH Properties (UMH). We’ve also done several interviews and reports over the years involving Sam Landy, J.D. and Eugene Landy, J.D.

UMH is an interesting and worthwhile case study in what has occurred in manufactured housing in the past 15 years.

During the timeframe – we provided some professional services to UMH – they were more focused on the sales of manufactured homes, but were beginning their move into rental housing. They are clearly executing on their business plan in recent years, which is a testament to their leadership, management and team.

Their stock performance is one possible measure of those points. Note that UMH Properties are among the number of publicly traded firms involved in manufactured housing that are included in our evening market snapshot and focus report. Last night’s report is linked here.

Let’s next focus on three possible bullets from their twin releases above.

- 800 new rental homes per year

- selling over 100 new homes

- operates 122 manufactured home communities with approximately 23,000 developed homesites

Using only the information from the above at face value, ponder these thoughts and observations.

Sam Landy and UMH was not so long ago focused on the sale of new manufactured homes. See the interview with Sam Landy linked here, but also the video in the report below. UMH had a finance arm that assisted in that sales function. That finance arm was profitable, as Landy said. Their loans were performing. That raises several possible points of their own, for example, with respect to the arguable stall tactics that FHFA – for whatever reason(s) – has accepted from Fannie Mae and Freddie Mac.

Dodd-Frank and Consumer Financial Protection Bureau (CFPB) regulations deflected much of that sales and financing plan. A small sense of that is found in the quote by Sam below, but a greater sense is from a now historically interesting vantagepoint are found in the interviews linked above.

From the standpoint of an investor, it is worth noting that when CFPB and other regulations frustrated their plans, they pivoted more toward rentals. Over time, their enthusiasm at UMH for the rental market has grown, as their own press and other statements reveal. Once more, objectively, that business model is performing.

That said, how many of those renters might now be owners instead, had circumstances been different? That is just one of many possible ideas that ought be explored.

That said, several possible lessons for manufactured housing as well as researchers and public officials can be learned from the UMH saga.

In no specific order of importance, ponder these evidence based points.

- UMH says they are selling roughly 1 new home for every 8 units being rented.

- The average new home sale is less than 1 per year for every community that they own.

- That pattern is not dissimilar from the experience of some other manufactured home community operators.

- UMH is a member of the Manufactured Housing Institute (MHI) and their National Communities Council (NCC). They are active in the association.

- Based on their Better Business Bureau (BBB) rating, they are A+. While not without some road-bumps, certainly, an objective case could be made that UMH are a ‘white hat’ operation at MHI, among some other firms that have a darker reputation.

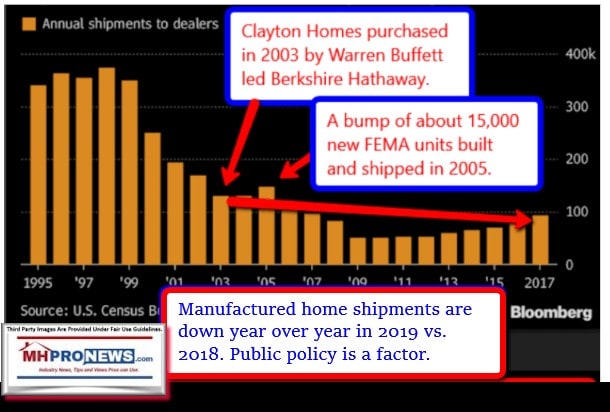

Manufactured housing is underperforming as measured via new manufactured home shipments by historic standards and metrics. The base graphic below was created by Skyline-Champion (SKY), which has a dashed line that shows the historic average for the industry.

That underperformance didn’t ‘start’ with the entry of Berkshire Hathaway into the marketplace in 2003. But oddly, while many thought at that time that Warren Buffett led Berkshire’s entry would ‘save’ manufactured housing’s from its slide production and shipment slide, that is arguably and demonstrably not what has occurred.

Intellectually curious people should ask, why has manufactured housing not recovered?

To the point made by SKY in the graphic above from their IR package – or that of other publicly traded firms that also point to similar data that shows the industry’s ‘upside potential’ based upon historic norms and the need for more affordable housing – the industry is in a sustained 2 decade plus downturn.

The manufactured home industry is shipping only about 25 percent of what it did in its last peak of 1998.

One newly recruited manager at an MHI member firm and his supervisor were having a meal with our publisher, Tony Kovach. That new recruit – an educated person – expressed the view during that meal that the manufactured home industry was dying and was not coming to grips with its own slide. Not too long after, word was heard that he was not longer with that MHI member firm.

Numbers of individuals enter manufactured housing every year only to later leave. How many have similar views to what that ex-management professional did? That would be interesting research.

Is the future of manufactured housing going to be more housing sold as rental units? If so, why and what does that say about the industry?

The new manufactured home shipment data is arguably skewed in this sense. Manufactured housing acceptance in the market is down. Who says? Dispassionate information from Zillow, see the two year snapshot below.

It is further reflected in the latest review of the most current manufactured housing shipment information shown below. The arrows are by MHProNews.

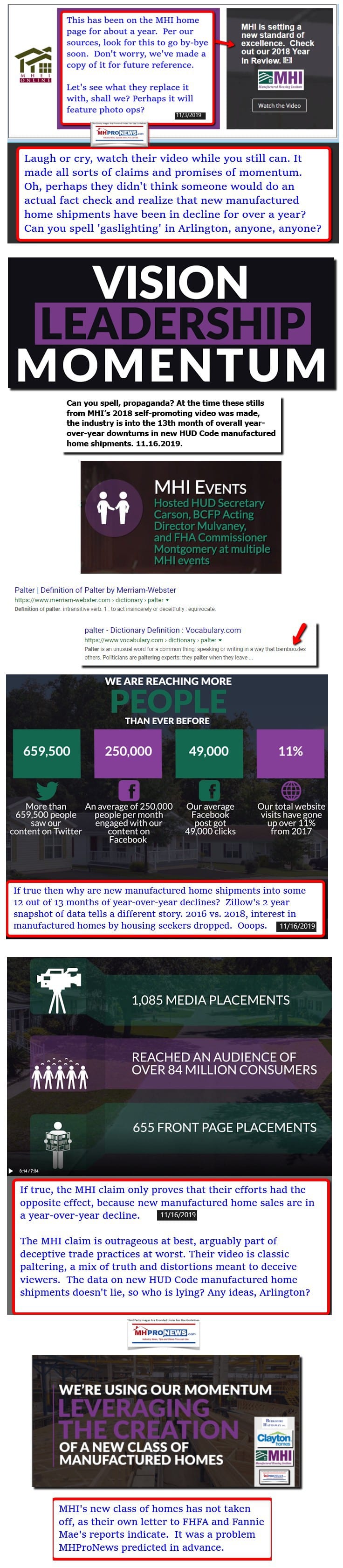

So, while MHI claims to be ‘promoting’ the industry, and is touting with photo ops and videos with federal or other officials their own importance, the acid test of new home sales is down year-over-year.

Another objective test is to examine MHI’s own claims from a year ago. The screen capture below are stills from a self-promotional video by MHI that was posted and accessible from the home page of their website.

Clearly, when MHI touted momentum, that claim has proven not to be accurate. Instead of rising, shipments have fallen. One might debate the nuances of how the so-called new class of homes impacted that trend, but it was not only predictable, but our publication warned the industry well in advance that the new class of homes was a mistake and possibly a ‘Trojan Horse.”

The case can be made that toady publications and bloggers in manufactured housing that carry water for MHI, such as the MHInsider, MHReview, George Allen and others that could be mentioned are either singing the praises of the Arlington, VA based trade operation or when critiquing it, do so in muted or diversionary terms. In fairness, the professionals at those 3 competitors in trade media are educated, motivated and often successful professionals in their own right.

That begs more questions. How does one explain the disconnect between what those sycophant publications for MHI have to say versus our analysis on some of the same issues of the day?

The disparate world views are too different to be readily explained.

Not only allegations from sources but also the evidence of their publishing suggests that MHInsider and George Allen have been directly ‘rewarded’ in a variety of ways for being a de facto mouthpiece and/or attack dog for MHI and the powers that be at MHI.

As believers in the constitutionally protected rights of free speech and freedom of the press, we’d defend their right to be demonstrably wrong. That doesn’t mean that they don’t ever have anything of value. But the value that those purported brownnosers bring is debatably precisely that they are so predictably pro-MHI and carry water for firms such as Berkshire Hathaway owned 21st Mortgage Corporation.

MHProNews and our publisher has admitted several times in recent years that we were taken in for a time by the purported ‘razzle dazzle’ that came from MHI, Clayton homes, 21st and other Berkshire owned brands. Nice meetings with pleasant people – including those like professionals at UMH or other firms – at a resort or good hotel has its appeal. It also has sometimes subtle psychological and sociological impacts.

Via fact-checks and analysis of reports like those above, which include contents and quotes from the sources as shown, the true nature of an arguably illegal scheme is being exposed step-by-step. We give those sources an opportunity to respond, before or after a published report. One of several examples is linked below.

Clayton Homes, 21st Mortgage, MHVillage, Manufactured Housing Institute Leaders Challenged

MHProNews now looks at some of the same information provided by the same people in a different light through the lens of experience, facts and reason. Our interview with Tim Williams, seen through the lens of history, is perhaps more potent now than then. Bear in mind that at that time, we ‘believed’ what was being said at face value.

For example, ponder this pull quote from the Williams’ interview linked above.

The Totaro award at MHI was named for “…Dick Totaro, who was a true leader in the industry. He considered us to all be fraternity brothers instead of competitors.”

- A fraternity of brothers vs. competitors. That sounds terrific, doesn’t it?

But compare and contrast that, which to some extent Kevin Clayton echoes in the video interview posted near the bottom of the report linked below, with another statement made by Clayton in that same video. Warren Buffett preaches to his unit managers – that would include Williams and Clayton – that they should be ‘tough competitors’ who should ‘deepen and widen their Moat’ every year.

Understand to that Kevin said that it would be okay with Warren if Clayton Homes lost money for 5 years, so long as they would ‘deepen and widen their moat.’

Those are starkly different images than “a fraternity of brothers instead of competitors,” aren’t they?

Perhaps Marty Lavin, J.D., would agree or disagree. But Lavin – a longtime and successful finance, communities and retail professional in manufactured housing who also was presented the MHI Tataro Award – would periodically say to others verbally or in writing, pay more attention to what people do than what they say.

Lavin’s companion phrase bears attention too. “Follow the money.” That’s not unique to him, Sharyl Attkisson or others in journalism and law enforcement use that same mantra of ‘following the money’ trail to see what evidence and insights it reveals.

Razzle dazzle often falls apart in the face of hard data.

More Mixed News on October 2019 Manufactured Housing Production, Shipment Data

UMH and Lessons Learned?

UMH is performing for their shareholders. Good for them. But would UMH be doing far better for investors and the public if their original business model had been allowed to be executed? After years of advertorials by MHI that MHProNews critiqued at the time, manufactured homes have become demonstrably less appealing to home buyers and housing seekers than even a few years ago. Are these accidents? Or is that part of a scheme that arguably began with Berkshire brands, but later spread to others?

The case could be made that not only UMH, but perhaps every publicly traded firm in manufactured housing could be performing far better, if not for various forms of market manipulation. That requires some effort, and those involved in this ploy are no doubt hoping that most people won’t make that effort.

To learn more, see the linked text-image boxes in related reports further below the byline, or above in the body of this report. That’s your Friday the 13th installment of the manufactured housing trade media’s #1 source for “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” © (Sunday weekly headlines recap, news, fact-checks, analysis, and commentary.)

Soheyla is a co-founder and managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

Related Reports:

Click the image/text box below to access relevant, related information.

California Housing Crisis, HUD Secretary Ben Carson, and Manufactured Housing