There is a well-publicized and undisputed affordable housing crisis in America. Federal data reveals that over 500,000 Americans are homeless, despite a generally strong economy. Millions of others in the U.S. are in marginal scenarios that point to the need for literally millions of additional affordable housing units. “NLIHC released The Gap: A Shortage of Affordable Homes 2019 on March 14. The report finds a shortage of 7 million affordable and available rental homes for households with extremely low incomes at or below the poverty guideline or 30% of the area median income (AMI), whichever is higher,” said the National Low Income Housing Coalition (NLIHC) nonprofit.

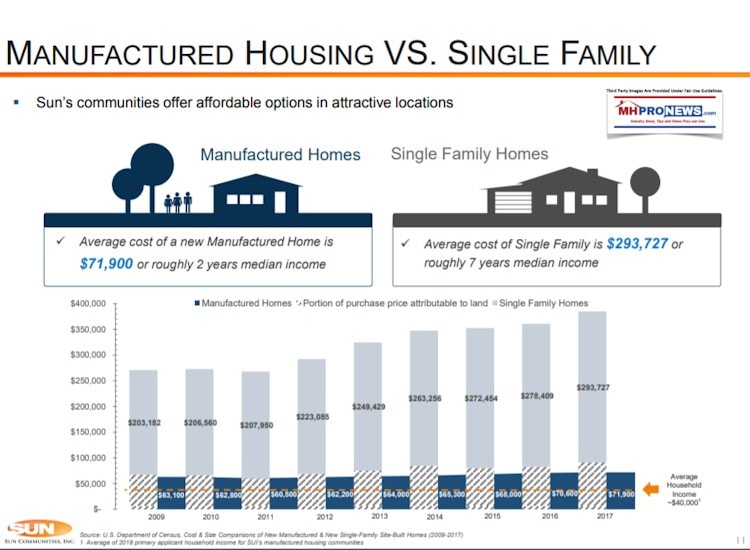

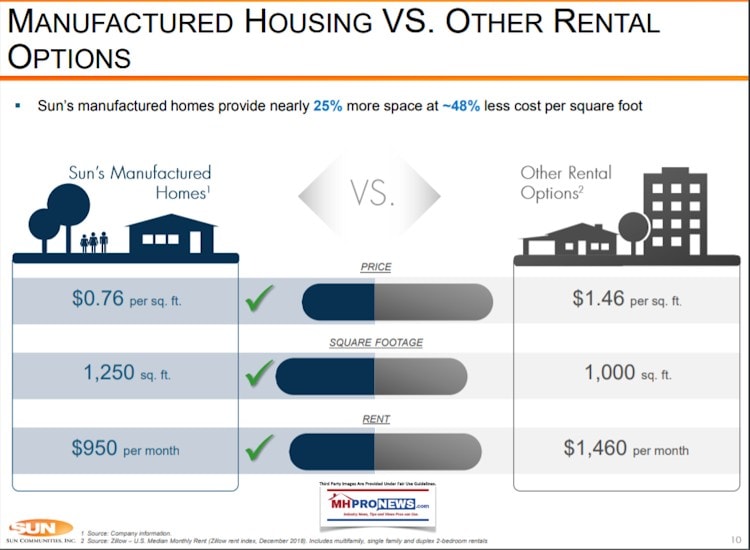

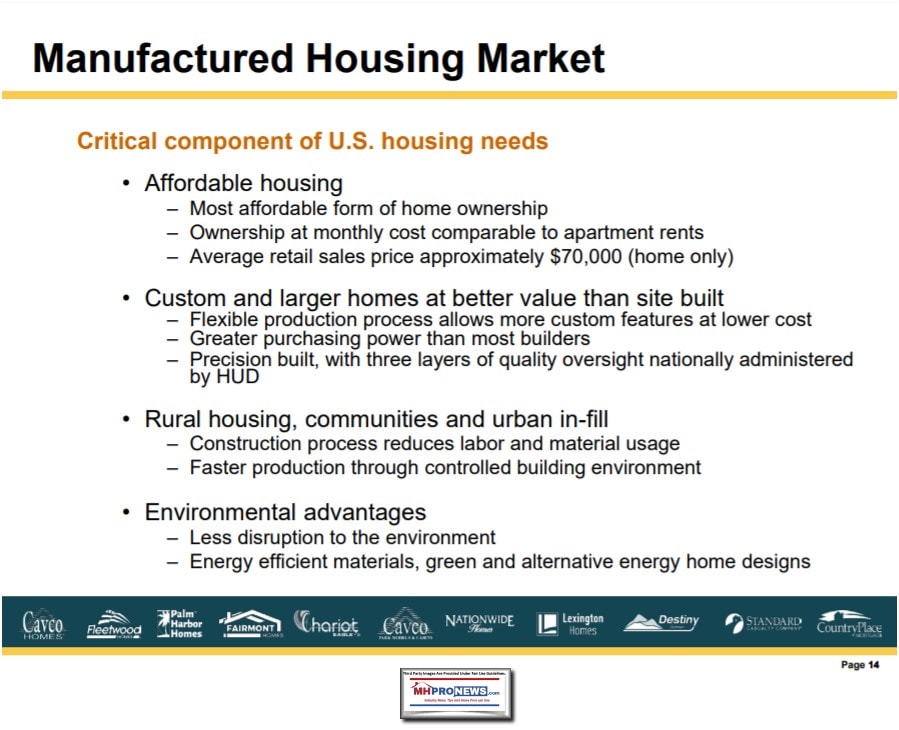

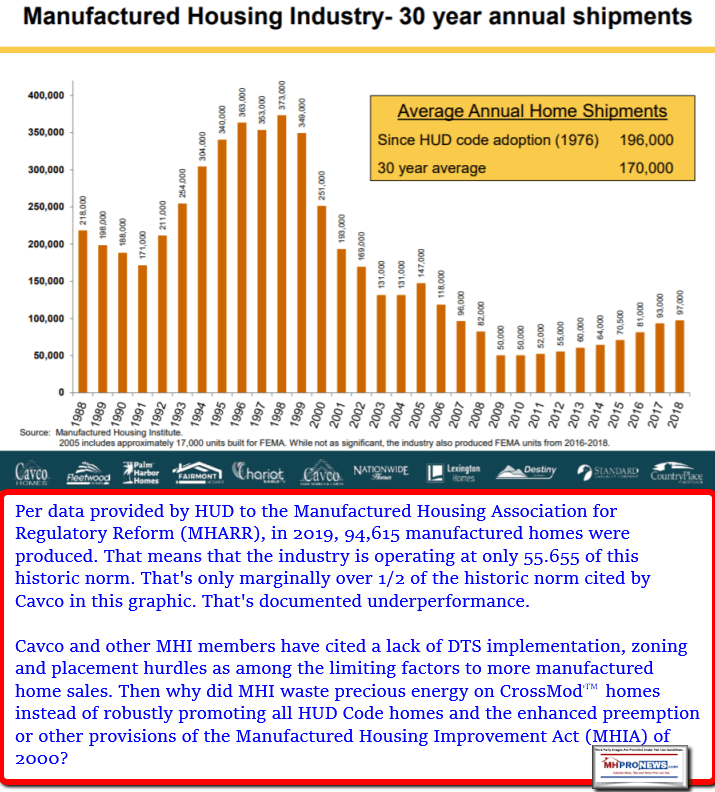

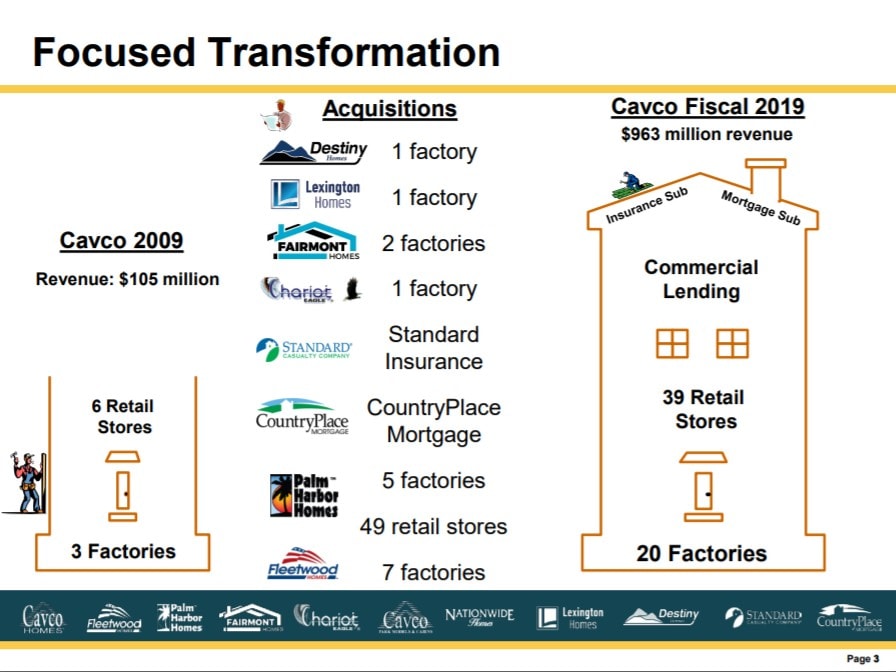

Against even that brief backdrop, it is clear that the most affordable kind of permanent housing in the U.S.A. ought to be booming. That construction type would be manufactured housing, as Cavco Industries’ investor relations (IR) presentation below will reflect. But the HUD Code regulated manufactured home industry is demonstrably underperforming, as Cavco’s data reflects. Why is that so? What insights can be found, or what lessons can be learned that might benefit investors, public officials, affordable housing advocates and other professionals involved in the industry?

What follows are insights largely sourced from Cavco Industries (NASDAQ:CVCO) IR presentation dated November 2019 but published in January 2020. That will be supplemented with illustrations from their current “showcase of homes” photos and images. Additional sources will be referenced too in order to create a more complete picture.

The sequence used for this report may not always be the same as that used by Cavco’s IR pitchbook. That switch-up is done deliberately to illustrate certain points that will be made during this report, fact-check and analysis.

We will note that over a week ago, specific issues were raised by MHProNews with Mark Fusler regarding Cavco’s corporate disclosures and related risk profile. Mr. Fusler is listed as the primary contact at Cavco for investor relations. Fusler declined to comment about the issues raised in that inquiry. Keep that point in mind as discerning minds sift through the various facts, figures, points of appeal and yet seemingly odd underperformance of this firm and the industry.

The sequence in this report will follow a generally systematic plan.

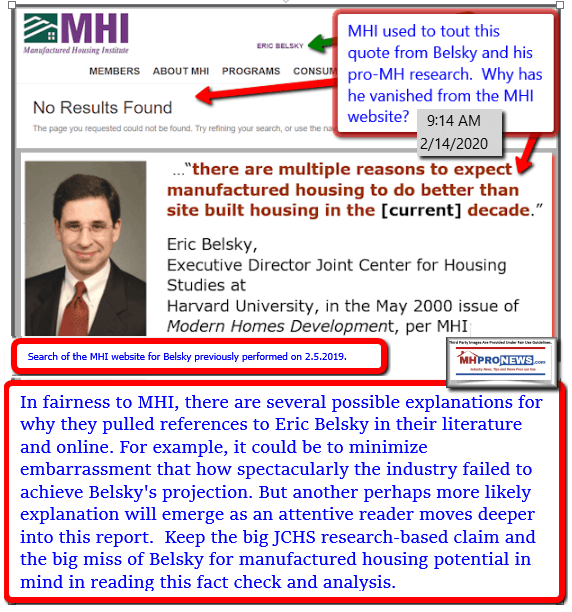

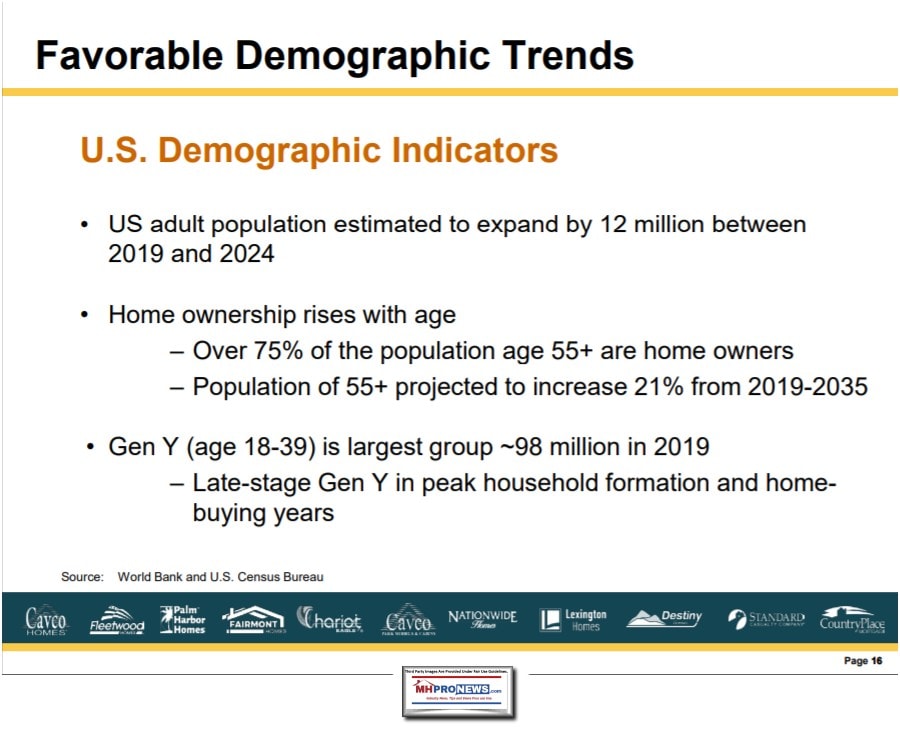

- Part 1. Reasons why manufactured housing ought to be performing at a higher levels than has occurred in recent years. That notion that there should be far higher levels of sales is supported by the logic of Cavco’s investor relations packets as well that of other publicly traded firms that are Manufactured Housing Institute (MHI) members. They correctly point to the higher historic trends vs. the current low levels of production. As Cavco’s IR references flash back to 2009, it is worth noting that Eric Belsky, then with the Harvard Joint Center of Housing Studies (JCHS) had projected that the industry would overtake conventional housing by 2010. That obviously didn’t occur, which will also be scrutinized below.

- MHProNews will weave into the narrative snippets of information from other publicly traded firms and sources that often happen to be MHI members too. Those quotes, claims and data points will be useful to compare and contrast with what Cavco said. That will yield a richer picture in the process.

- Part 2. Certain legal and investing questions will be raised herein. That will include, but not be limited to, Cavco’s own forward looking statements.

- Among those issues will be the logic, prudence – or the lack thereof – of the HUD Code manufactured homes that Cavco often identifies as MH Advantage ® and CHOICEHomeSM – the designations used by Fannie Mae and Freddie Mac respectively of what MHI has trademarked the name “CrossModTM home” – or what was pitched by MHI in recent years as a ‘new class’ of manufactured housing.

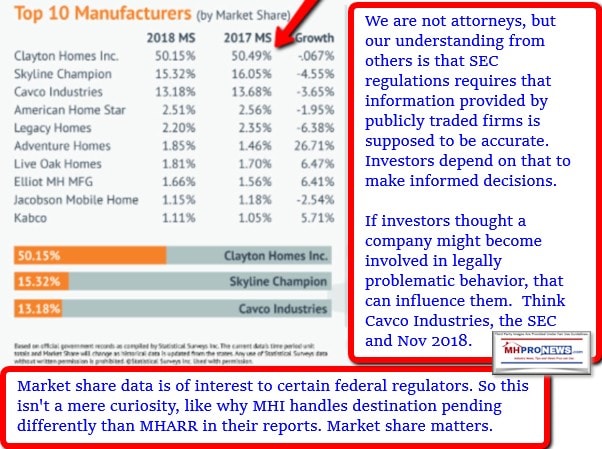

- Newer readers at MHProNews, as well as those who have been readers for years, are reminded that Cavco and a now former key management official were issued SEC subpoenas. When that was disclosed in late 2018, the stock dropped sharply, various shareholder investigations were announced as being opened by an array of law firms, and per their most recent statements, those legal issues remain ongoing. That noted, the stock recovered over time and has surpassed the share value at the point the SEC subpoenas were made public.

- Let’s note that per informed sources, management at Cavco has for years been among the thousands of routine readers of MHProNews and that articles published here that may or may not mention them specifically, but may address MHI or other industry related issues are ‘shared’ within the corporation as well as beyond.

- As a disclosure, let’s further note that MHProNews holds no position in this company, nor its publicly traded rivals. We have stressed for some time the principle of separating the wheat from the chaff; meaning, good information should be retained, while problematic or inaccurate claims should be discounted, scrutinized, possibly merit legal examination or could otherwise be tossed aside.

- Part 3. As pro-growth, pro-free enterprise and pro-consumer manufactured housing trade media, an MHProNews analysis and commentary will be woven in, and there will be some concluding thoughts. They will be related to recent and ongoing controversies regarding the nature of the causes of the manufactured housing industry’s underperformance, what that may imply to shareholders, investors in certain – not all – other publicly traded firms operating in this industry, and potential legal issues that may arise from the evidence and allegations that are developed and/or linked.

With that outline for this report, let’s proceed, with the images above, plus third-party data points below. New readers should keep in mind that our research and analysis is third-party evidence and reason based.

Part 1 Reasons why manufactured housing ought to be performing at a higher level.

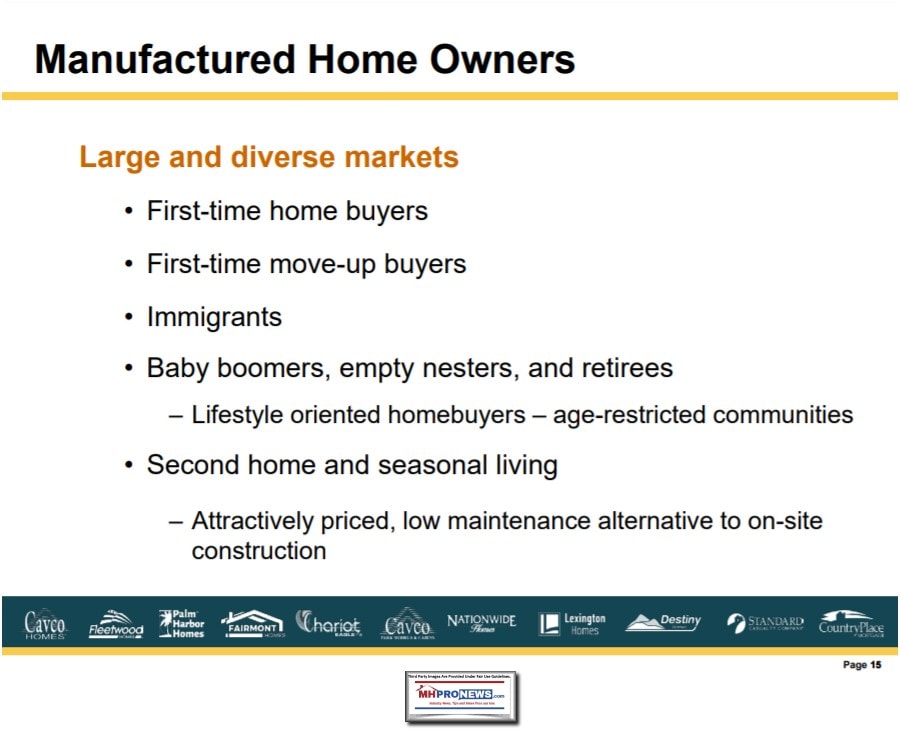

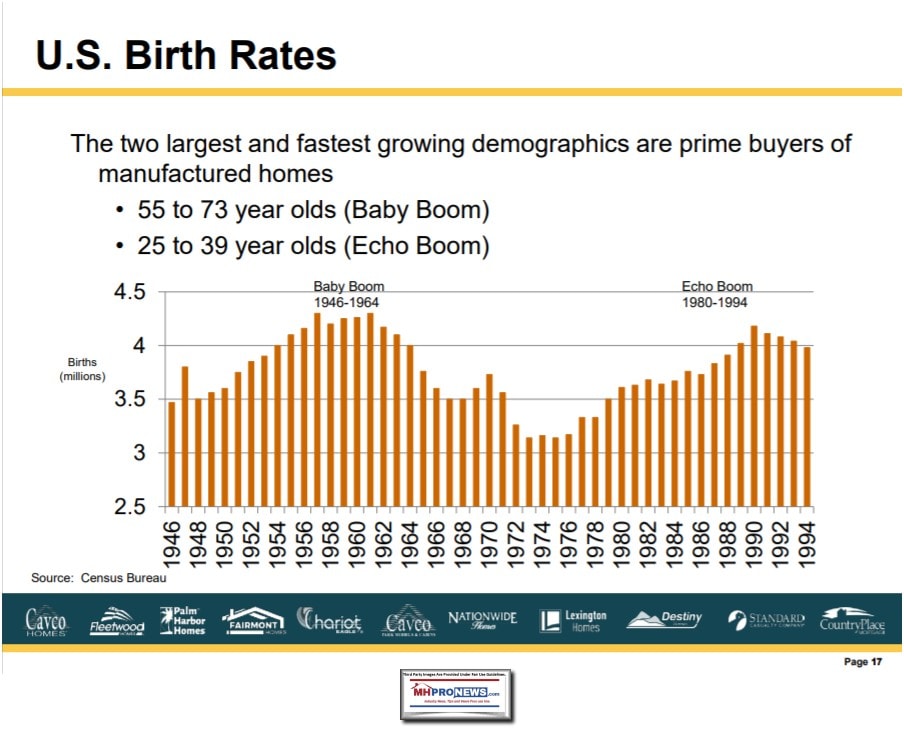

Each of the screen captures from Cavco’s IR presentations herein often reflect useful data-points on demographic or historic trends or other relevant information that should point to far higher levels of manufactured housing sales. Consider the following.

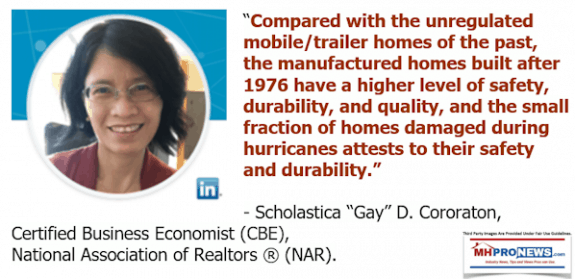

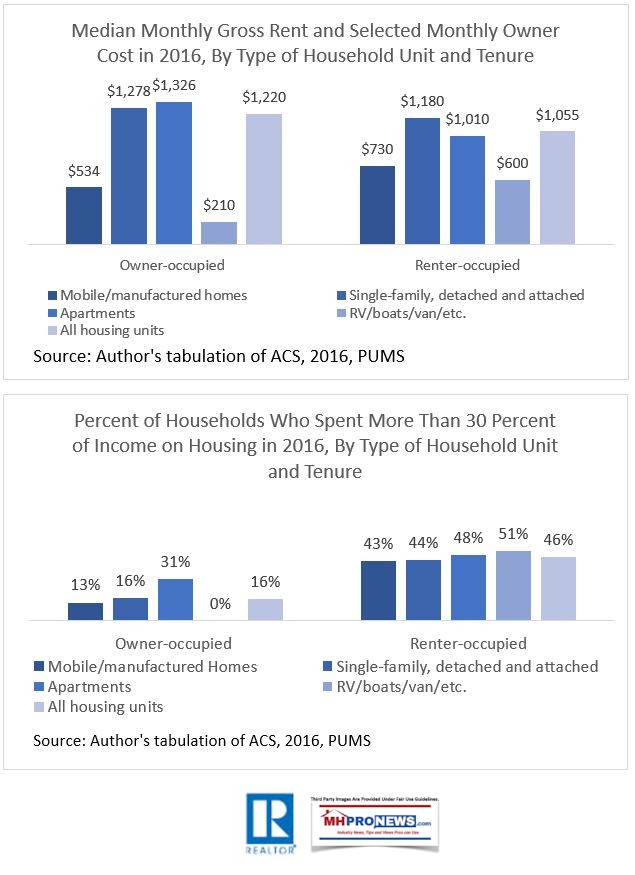

With that array of impressive data, the next two data points – one from the NAR, the other from Cavco – illustrates why there should be serious questions about the true cause of the manufactured housing industry’s underperformance.

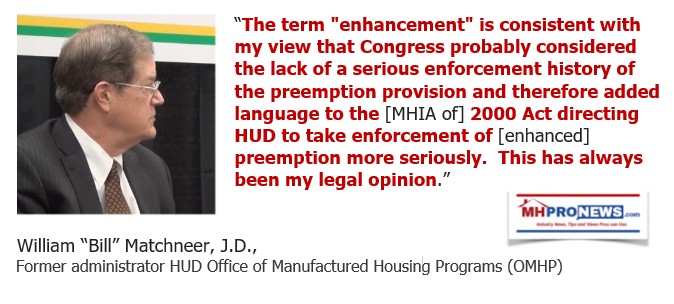

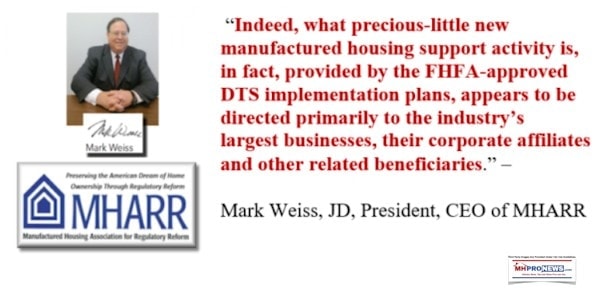

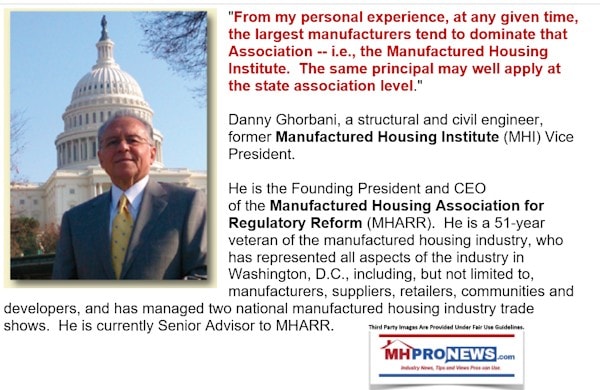

The report below the quotes from former MHI consultant and prior HUD Office of Manufactured Housing Programs administrator – Bill Matchneer, J.D. – reflects why zoning and placement should not be the hurdles that are currently being experienced. The similar and more detailed statement by Mark Weiss, J.D., President and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR) outlines why “enhanced preemption” of local zoning and regulatory issues under the Manufactured Housing Improvement Act (MHIA) of 2000 matters so much.

Lawmakers involved in the process of passing the MHIA are quoted at length in the report linked below that underscore what Weiss and Matchneer said. So this isn’t wishful thinking, this is federal law.

Also relevant to the discussion of sales volumes and what the roadblocks are include zoning, placement, regulatory hurdles and financing challenges. Who says? Cavco’s IR pitch and related disclosures. More on that below, but with that in mind, the details in the report linked below are critical for investors, professionals, advocates, researchers and public officials to fully grasp.

No Title

No Description

Part 2. Certain legal and investing questions will be raised herein.

Corporate officers and board members have a fiduciary responsibility to their shareholders. Here’s how the legal site Nolo phrased it, “Officers, directors, and sometime even stockholders, have fiduciary duties, or obligations of trust.”

Note that Nolo says that applies to nonprofits too: “Structuring your business or nonprofit as a corporation creates fiduciary responsibilities, or obligations of trust.” That may result in liability: “A breach of a fiduciary duty may result in personal legal liability for the director, officer, or controlling shareholder,” but in certain conditions could involve statutory or ‘criminal’ risks too. As the Lawyer website states, even promoters of publicly traded firms have certain responsibilities that could lead to civil or criminal liability. “Breach of a fiduciary duty by a promoter is a fraud upon any person or entity to whom the duty extends and the promoter can be held liable for any losses suffered as a result of the fraud.”

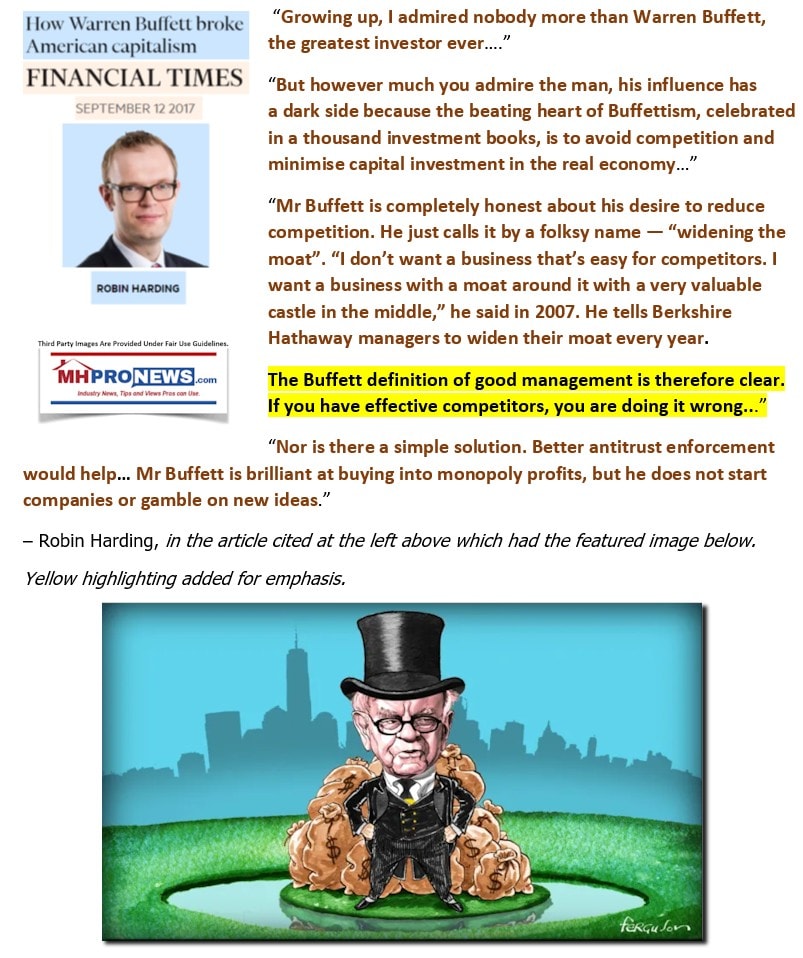

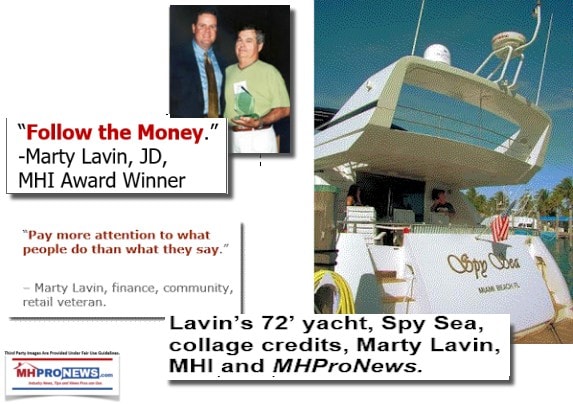

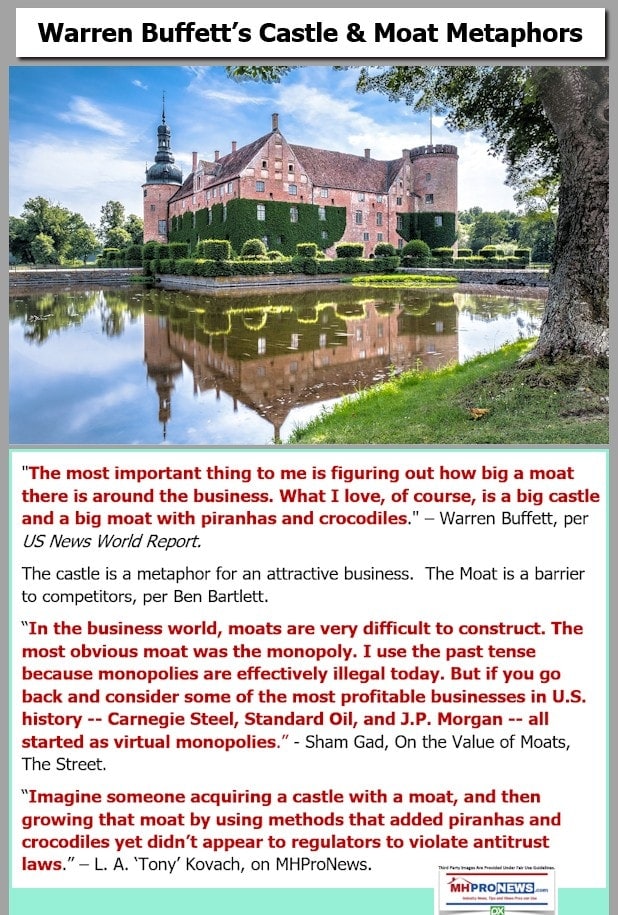

Joe Stegmayer reportedly learned lessons akin to the Buffett way from Clayton and through connections at the Manufactured Housing Institute. As Robin Harding at the Financial Times said about his analysis of the Warren Buffett “Castle and Moat” monopolistic scheme, if you have effective competition you are doing it wrong. See the highlighted portion of the extended quote, below.

It is also worth noting that it was Third Avenue Value Fund (TAVFX) that provided the capital and related financial clout need to make the early acquisitions of Cavco Industries possible. Third Avenue is a ‘value fund,’ that publicly states how their method is similar to that of Warren Buffett. Not only before the SEC subpoena was made public, Third Avenue sold off all of their shares in Cavco Industries. Specifically, Yahoo Finance reported on October 4, 2018 that “Third Avenue Value Fund Exits Cavco Industries…” With that backdrop, ponder some additional noteable points, per Cavco’s IR package.

The bookend to the above is the graphic below.

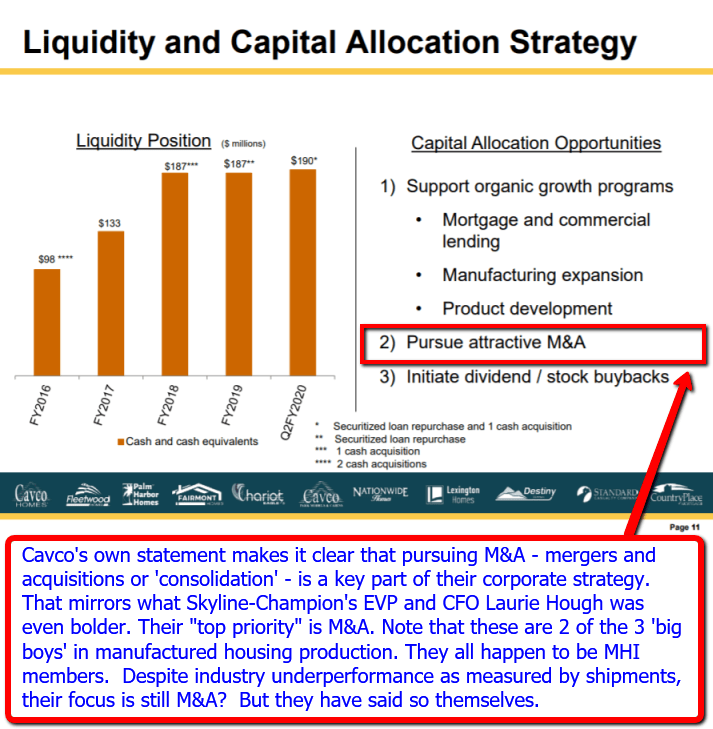

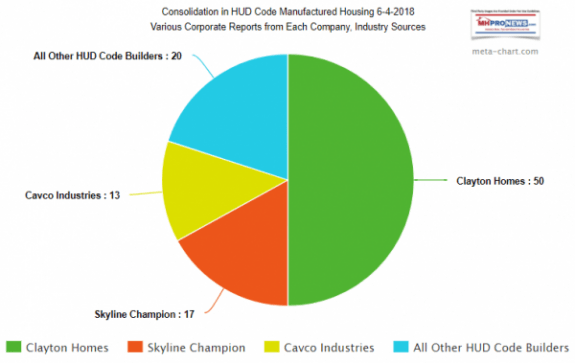

The Cavco bragging point is clearly focused on consolidation or ‘merger and acquisitions.’ It is similar to what fellow MHI member Skyline Champion’s EVP and CFO Laurie Hough said recently.

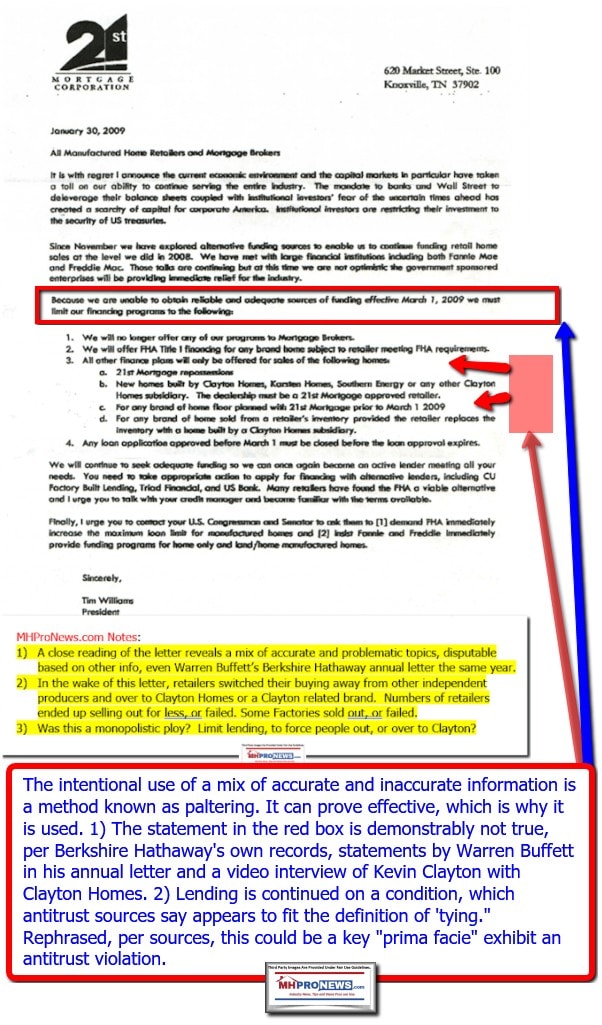

What made this runup of M&A or consolidation possible starting in 2009? A prima facie case can be made that Clayton Homes, another MHI member company, and their affiliated lender 21st Mortgage engaged in a purportedly serious and largely impactful case of antitrust violations. The prima facie evidence is the tying noted in the letter from 21st Mortgage Corporation President and CEO, Tim Williams to independent retailers, shown below.

Note that despite the fact that MHI has an antitrust statement that is routinely presented at their meetings, there is no evidence that this publication is aware of that MHI has taken any steps to report purported antitrust violations. The report linked below the next graphics elaborates on apparent cooperation between MHI members Clayton, Skyline-Champion and Cavco ‘covering’ for each other on arguably inaccurate information presented to potential investors. As that and other points raised in this report should make clear, these are risk factors that corporate officials as well as association – nonprofits – are duty bound to advise others about. Failure to do so, per legal sources cited herein, could raise civil and possible criminal legal concerns.

Routinely mentioned by Cavco, Skyline or other MHI member firms are the issues of financing, placement, zoning and regulatory issues. Illustrating that are the italicized quotes from page 19 – the final one – in their most recently IR presentation package. MHProNews has pulled specific portions of their statements for review of their relevance to our analysis.

This first bullet is pull-quote that frames the following discussion.

- Certain statements contained in this release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities and Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. In general, all statements that are not historical in nature are forward-looking.

The above is pretty-standard language. Some of what follows is fairly routine for manufactured housing, but bears closer attention.

- Factors that could cause such differences to occur include, but are not limited to: our ability to successfully integrate past acquisitions or future acquisitions and the ability to attain the anticipated benefits of such acquisitions; the risk that any past or future acquisition may adversely impact our liquidity; involvement in vertically integrated lines of business, including manufactured housing consumer finance, commercial finance and insurance; information technology failures or cyber incidents; curtailment of available financing from home-only lenders; availability of wholesale financing and limited floor plan lenders; our participation in certain wholesale and retail financing programs for the purchase of our products by industry distributors and consumers, which may expose us to additional risk of credit loss;

- limitations on our ability to raise capital; competition; our ability to maintain relationships with independent distributors;

- unfavorable zoning ordinances;

- governmental and regulatory disruption, including federal government shutdowns; extensive regulation affecting manufactured housing; potential financial impact on the Company from the subpoenas we received from the SEC, including the risk of potential litigation or regulatory action, and costs and expenses arising from the SEC subpoenas and the events described in or covered by the SEC subpoenas, which include the Company’s indemnification obligations and insurance costs regarding such matters, and potential reputational damage that the Company may suffer; and losses not covered by our director and officer insurance may be large, adversely impacting financial performance; together with all of the other risks described in our filings with the Securities and Exchange Commission.

- Readers are specifically referred to the Risk Factors described in Item 1A of the 2019 Form 10-K, as may be amended from time to time, which identify important risks that could cause actual results to differ from those contained in the forward-looking statements. Cavco expressly disclaims any obligation to update any forward-looking statements contained in this release, whether as a result of new information, future events or otherwise. Investors should not place undue reliance on any such forward-looking statements.

Again, before preceding, it is worth noting that corporate officers and board members have a fiduciary duty. The information – including, but not limited to, risk-related matters – is to be disclosed as well as navigated to the best of the ability of those in charge.

Part III. Analysis, Related Information and Commentary

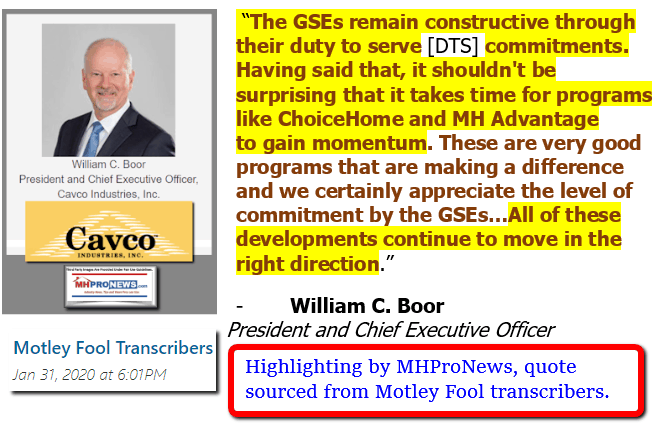

William C. Boor, President and CEO of Cavco, said in a recent investor call the following.

That statement is problematic on several levels. In no specific order of importance:

- Skyline Champion in their recent call, a fellow MHI member – thus their respective statements are based on the same industry and information each relied upon – said this.

That said, why is it that Clayton, Skyline-Champion and Cavco are all pushing this new class of homes dubbed “CrossModTM homes” when there is no evident traction for it? Given what that David Dworkin, President and CEO of the National Housing Conference and a former GSE vice president, said that he was confident that they could meet the requirements, why aren’t they pushing for that instead of this focus on an unproven class of homes that is not taking off in the marketplace? Put differently, why did Dworkin press harder and broader than MHI’s then EVP and now CEO Lesli Gooch did in her written comments?

MHI members such as Cavco or Skyline and MHARR’s president and CEO – at least on paper – seem to agree that there is a requirement by the GSEs to live up to the requirements of the Duty to Serve. NHC President and CEO Dworkin makes a brief but potent case to that effect too, as is evidence above.

But Weiss goes further. He said that the efforts are being diverted to this controversial new class of homes.

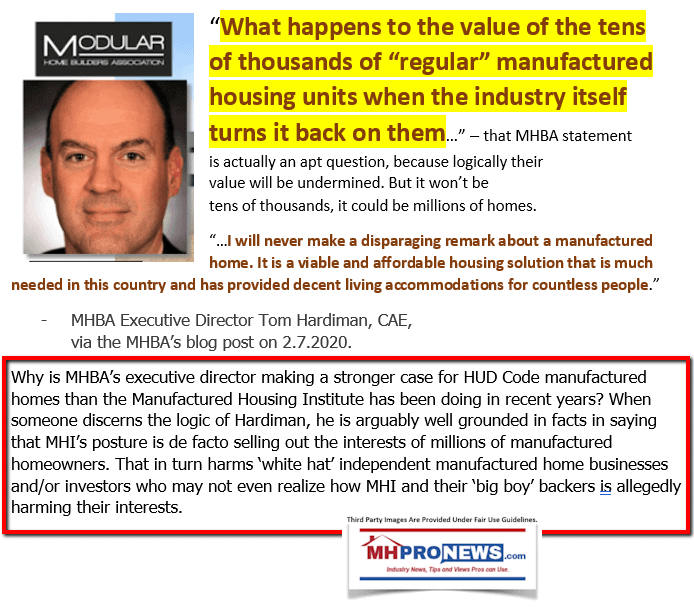

So why does Cavco, Skyline-Champion, Clayton and MHI all push for a program that is arguably harming the industry’s independents, as well as untold numbers of consumers? That’s a point that even the Modular Home Builders Association Executive Director, Tom Hardiman has formally and publicly made.

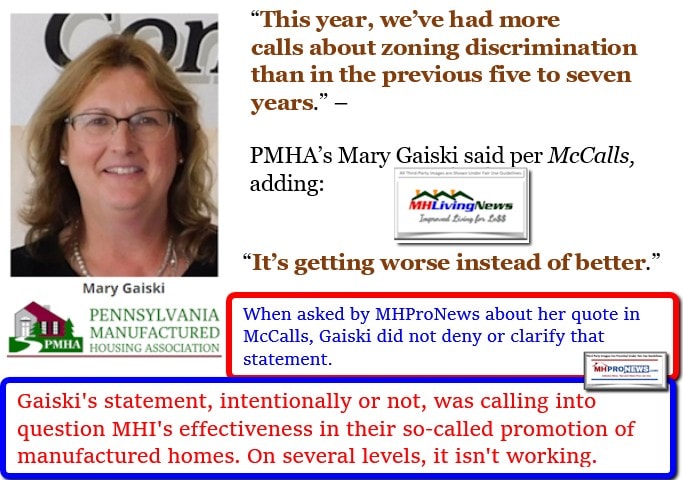

Note that a somewhat related argument about the problems with zoning and placement of the vast majority of manufactured homes has been made to mainstream media by the Pennsylvania Manufactured Housing Association Executive Director Mary Gaiski in these words.

Perhaps in response to a string of concerns published here, including the ones linked above and below, an MHI surrogate reached out to protest our coverage of Lesli Gooch, her apparently well documented conflicts of interest, and how financing and zoning alike are at best being fumbled by MHI. Some of the whistleblower tips and allegations swirling around Gooch and MHI are nothing short of stunning.

At a minimum, MHI has fumbled years of opportunities that Cavco and other evidence makes clear is possible for manufactured housing during an affordable housing crisis.

Even MHI’s past chairman said that “the industry” – code words for MHI – has to be honest with itself that it has often failed.

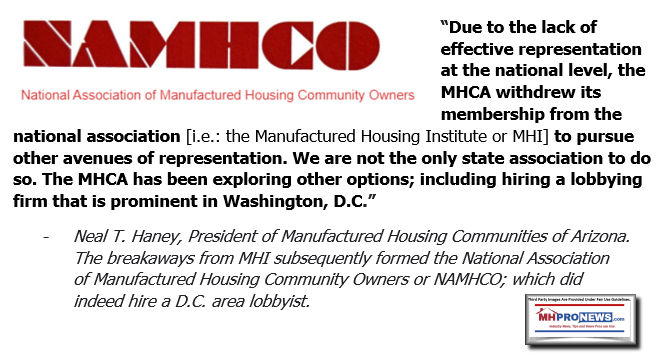

Years of empty promises caused a pair of state associations and their companies to break ranks with MHI.

What these facts and quotes beg are questions about the motivation for the firms that ought to be howling about MHI’s lack of performance. Instead, they are praising it. Why?

The industry’s independents, investors and others must seriously consider the evidence and could come to this conclusion. There is an argument to be made that the larger ‘connected’ firms are consolidating the industry at discounted valuations by keeping the industry underperforming. But if that is the ‘game,’ then it is short-changing investors and others in a variety of ways that are arguably illicit and illegal. The only other reasonable argument is that with all of this useful arguments available for manufactured housing, with good laws on the books that are going under-enforced, are we to believe that all of these educated, successful people can’t score points with all of these advantages?

“Scorched Earth” Reply-Lesli Gooch, Tim Williams, and Manufactured Housing Institute (MHI) Claims

This string of evidence that points to why manufactured housing should be soaring instead of snoring begs for independent investigations. By accident or design, independents, consumers, taxpayers and others are all being harmed by what has been occurring in manufactured housing. It just all happens to fit Buffett’s mantras. Coincidences? Or are these all clues hiding in plain sight?

That’s it for this Friday installment of “News through the lens of manufactured homes and factory-built housing,” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.)

(See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Opportunity Zones, Manufactured Housing, Investors and Public Policy Potential

Clayton Homes, 21st Mortgage, MHVillage, Manufactured Housing Institute Leaders Challenged

Prosperity Now, Nonprofits Sustain John Oliver’s “Mobile Homes” Video in Their Reports