MHProNews asked an economics professor the following hypothetical scenario. Note that this was framed in terms of housing in general, but we will return to how this applies to manufactured homes and communities following this initial review addressed to economics professor Daniel Zarycki.

Imagine for the next for moments the following scenario.

1) Depending on the market, no or few new houses are being built. But the population continues to grow.

2) Depending on the market, no or few apartments and multifamily housing is being developed. But the population continues to grow.

3) What would occur in the above two instances? First, housing costs would steadily climb, as a result of the law of supply and demand.

4) If wage growth failed to keep pace with the rise of housing costs, a point would be reached where increasing numbers could not afford housing.

5) Not unlike 2008, at some point due to the combination of the factors outlined, housing values would not be sustainable, so loan defaults would rise.

6) While the dynamics would differ in some ways from the 2008 credit-crisis that was fueled by so-called ‘liar loans,’ the final outcome would be similar.

7) Those with deeper pockets that have liquidity could then pick up deprecated real estate at discounted values.

Now, let’s pause that imagined scenario. While not enough housing is being built, what construction is occurring is insufficient to meet the needs.

So, without sufficient new supply, destabilizing impacts are inevitable.

Professor Zarycki responded to the question that framed the above as follows.

“Tony [Kovach – MHProNews]

Your observations are well taken. Observations from my historical perspective. 1960 U.S population: 180 million, average income male 35-44 $5500 per year. New housing starts average 1,200,000. Now contrast with today stats. 330,000,000 population, $50,000 average income worker 35-44 (adjusted CPI), housing starts 2019 1,300,000. (Data: U.S. Census, NAHB, St. Louis Fed).

Real estate has typically followed boom/bust cycles in the ’70s 2.5 million unit starts followed by high interest rates resulting in housing start decline in ’81. Now as you are well aware we are importing poverty (immigration) resulting in significant population increase, wage stagnation, land costs, permit fees ($20,000 on a $200,000 home), construction materials and labor costs (the latter not increasing as fast due to moderate inflation.) Now that mortgage companies and banks are tightening their lending practices [since pre-2008 crisis with] no more NINJA lending (no income, no job!) I don’t see any significant near-term increase in housing starts unless wages improve.

Regards, Dan

Daniel Zarycki

Professor of Business & Economics (retired),

Florida Southern College and Hillsborough Community College

How the Above Scenario Applies to Manufactured Housing

Professor Zarycki isn’t a self-proclaimed expert on manufactured homes, although he has some familiarity with factory-built housing. So, the question to him was framed in terms of housing in general, with any kind of housing capable of being plugged in. That includes manufactured homes, more specifically, land lease communities for manufactured homes.

Go back to point 1, but this time, let’s plug in the phrase manufactured homes communities.

- 1) Depending on the market, no or few new manufactured home communities are being built. But the population continues to grow.

- 2) Depending on the market, no or few manufactured home communities are being developed. But the population continues to grow.

- 3) What would occur in the above two instances? First, manufactured home community costs would steadily climb, as a result of the law of supply and demand.

- 4) If wage growth failed to keep pace with the rise of housing costs, a point would be reached where increasing numbers could not afford manufactured home community living.

- 5) Not unlike 2008, at some point due to the combination of the factors outlined, housing values would not be sustainable, so loan defaults would rise.

- 6) While the dynamics would differ in some ways from the 2008 credit-crisis that was fueled by so-called ‘liar loans,’ the final outcome would be similar.

- 7) Those with deeper pockets that have liquidity could then pick up deprecated real estate at discounted values.

The Vexing Facts

As numbers of industry professionals know,

- there are fewer new manufactured home communities being developed than older ones that are closing.

- Because of land-use barriers and NIMBY thinking (Not in My Back Yard attitude toward development), new manufactured home communities are routinely turned down, few are approved.

- Fannie Mae and Freddie Mac have, per Business Insider, financed or refinanced some $15 billion dollars of loans on manufactured home communities. The Federal Housing Finance Agency (FHFA) inexplicably – under both Democratic and Republican administrations – has given Fannie and Freddie (Government Sponsored Enterprises, GSEs or Enterprises) the authorization to get credit for those community loans toward the Duty to Serve (DTS) manufactured housing mandate. DTS became law in the Housing and Economic Recovery Act (HERA) of 2008.

- While the land-lease community sector performed quite well during the 2008 housing/finance crunch, there is an open question on how the scenario above might play out if the number of new communities and steadily increasing site fees aren’t successfully addressed. Meaning, if sufficient numbers of residents can no longer afford to pay ever-higher site fees that rise faster than their incomes do, would enough defaults by residents and buyers occur to tip communities from sustainability into unsustainable negative cash-flow?

Manufactured Double Talk? Analyzing New Land-Lease Manufactured Home Community Developments

At a minimum, the risk exists. Yet the FHFA, Fannie and Freddie – who have economists advising them or on staff – have touted their support for land-lease communities while virtually ignoring support for manufactured home single family ‘home only’ lending.

Even the numbers of land-home deals that the GSEs are doing are relatively small in number. Smaller still are the reported totals on the ‘new class of homes’ that the GSEs have named Freddie’s ChoiceHomesSM and Fannie’s MHAdvantage ® which MHI has dubbed “CrossModTM homes.” The dizzying array of additional terms is enough to cause issues for numbers of buyers, who want their housing choices to be as simple and clear as possible. Add complexity, and you’ll lose customers. The shipment data has born that historical pattern out. Per the FHFA Listen Session in St. Louis in November 19, 2019 only ten – 10 – total ‘new class of homes’ loans had closed in all of 2018 and then year to date 2019. 10 for both Fannie and Freddie combined in almost 2 years.

That might be a worse outcome than Clayton Homes’ iHouse had.

For those that don’t know or forget, Clayton’s iHouse and iHouse 2.0 were both cancelled. Yet, the powers that be said at the time that Clayton Homes “iHouse has been insanely popular“, per TreeHugger. Other mainstream media outlets were told and reported similarly. There was a flurry of claims, great fan-fare, the good old “razzle dazzle” is deployed and then — nothing.

Once one grasps such prior patterns then the current ones come into sharper focus. As but one more example, industry veterans should not forget that the Clayton Homes Duck Dynasty connected promotions were supposed to bring a wave of buyers. Can you spell ‘thud?’

There are years of such bold claims with fizzled outcomes that objective facts would reveal with Clayton Homes and other similar projects. Despite that vexing historic snapshot, MHI has proverbially screamed from the rooftops how revolutionary this would be and how this fuels the momentum for so-called MHI 2.0.

MHI and their big boy backers seem to be dependent on an Orwellian memory hole. Never mind what we said last week or month, a year or a few years ago. The ploy is to get others to focus instead on what we tell you now. Trust them, they say. But why ftrust such a problematic pattern of negative leadership?

To be fair, something similar often happens in politics too.

The industry is arguably being destabilized on any number of fronts. Retail has slowed, as shipment data reflects. Communities are buying thousands of manufactured homes. But significant numbers of them – per publicly traded firms – are being purchased for rental housing. In the pre-Berkshire era that would have been anathema to thousands of communities nationally, which wanted owner-occupied housing.

At the 2017 Winter Meeting, this writer asked MHI elected and corporate leaders several questions. Among them:

- What would be done about Pam Danner, now that the Trump Administration was in place?

- Because once vacant homesites were being steadily filled, how would new home production be impacted in 3 to 5 years? Would the industry face another downturn when it had not yet recovered?

- Was it a concern that when rentals were factored out, manufactured home sales were essentially flat since 2009?

The common answers were ‘good question, I don’t know’ to the first bullet above. To the second and third queries, ‘That is something we need to think about.’

Look anew at the Pamela Beck Danner, J.D. topic in the light of the new Dana Wade report headline found further below.

Next, fast forward to Legacy Housing’s Curt Hodgson who said that manufactured home leaders in general thought short term.

It is more fun to deliver good news that problematic, but facts are what they are. By accident or design, the Manufactured Housing Institute (MHI) and their leading lights are heading toward a cliff or a wall, pick your metaphor. While shipments have picked up marginally in recent months, they are still well below historic norms. That’s per MHI member data, as reflected by Skyline Champion (SKY) or other companies’ investor relations packages.

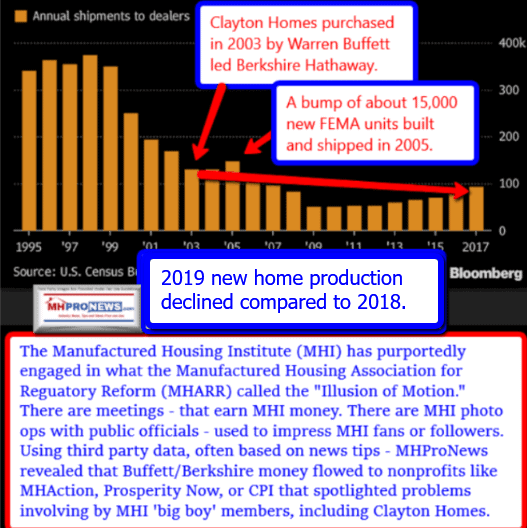

The industry’s scenario in the years since Warren Buffett led Berkshire Hathaway acquired Clayton Homes reveals this stunning factoid. The total production and new home shipment levels are lower in 2019 than they were in 2003. Wasn’t Buffett’s deep

pockets and ability to generate lending and more supposed to ‘save’ the industry?

Instead, what has occurred is that the Buffett moat has been deployed, as Kevin Clayton himself expressed in the video found near the end of the report linked below.

While MHI and their amen corner sing about the glory days ahead, savvy investors say there is much to be learned by past institutional behavior when it comes to predicting future performance. That performance by MHI’s leaders has been problematic at best, when measured by objective standards.

To learn more, see the headlines to the reports that follow.

Tornado season is upon us. You’ll find a helpful new report on that topic among the other headlines linked below. It is also worth mentioning that the latest Masthead report is less about the environment than it is about Michael Bloomberg and Warren Buffett and the recent Sierra Club case that the Manufactured Housing Institute (MHI) and their surrogates have somehow failed to mention. That should be a signal that you should want to read that one and others with appropriate care.

With no further adieu, let’s dive into the headlines for the week that was 2.16 to 2.23.2020.

What’s New on MHLivingNews

What’s New from Washington, D.C. from MHARR

What’s New on the Masthead

What’s New on the Daily Business News on MHProNews

Saturday 2.22.2020

Friday 2.21.2020

Legacy Housing Leadership Comments Undermine Manufactured Housing Institute Claims

Thursday 2.20.2020

Wednesday 2.19.2020

Legacy Housing Corp Reports Dip, Rise – plus Manufactured Home Investing, Stock Updates

Tuesday 2.18.2020

More Surprises – Equity Lifestyle Properties (NYSE:ELS) – Unpacking Official Investor Statements

Monday 2.17.2020

Manufactured Home Communities Targeted by Lawmakers, AG Plans – Manufactured Housing Industry Alert

Comments, input and feedback from an array of sources come routinely to MHProNews. Two last week that were public are shown below, a useful introduction to last Sunday’s important introduction to the weekly headline recap. If you happened to miss it for whatever reason, see what others say and then dive into it.

Sunday 2.16.2020

MailChimp reports that our #4 most clicked link in our latest eblast was the sign up for our x2 weekly emailed headline news. Be in the know. From the mom and pop sized operations to the largest names in the manufactured home industry, you’ll find our readers by the thousands. If you aren’t already on it, you are missing out on the news that thousands of industry professionals, investors, state and federal officials and other pros find a useful way to keep up with the world of manufactured housing.

Detecting destabilization needs a level of expertise. But once someone who understands the industry steps back and looks at historic trends and patterns, the evidence of how that is part of the ‘castle and moat’ ploy becomes more evident.

There is more to come, but that’s it for now on this Sunday installment of “News through the lens of manufactured homes and factory-built housing,” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, week in review, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.)

(See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.