Every evening our headlines that follow provide snapshots from two major media outlets on each side of the left-right news spectrum that reflect topics that influence or move investor sentiment. In moments on this business evening report, you can get ‘insights-at-a-glance.’

This report also sets the broader context for manufactured housing markets, in keeping with our mantra, “News through the lens of manufactured homes and factory-built housing” ©.

We begin with headlines left-of-center CNN followed by right-of-center Fox Business. We share closing tickers and other related data courtesy of Yahoo Finance, and more. 5 to 10 minutes reading this MHProNews market report every business night could save you 30 minutes to an hour of similar reading or fact-gathering elsewhere.

Perhaps more important, you will get insights about the industry from experts that care, but also dare to challenge the routine narrative that arguably keeps manufactured housing underperforming during an affordable housing crisis.

Newsy, Peeling Back Media Bias, Manufactured Housing Sales, Investing, Politics, and You

Headlines from left-of-center CNN Business

- Dow lands in a bear market

- The building of the New York Stock Exchange (NYSE) is pictured on January 9, 2019 in New York.

- LIVE UPDATES Stocks sold off sharply, and the index closed 20% below its most recent high

- US stocks are nearing a bear market. Here’s what caused the last 12 bears

- Here’s why you should worry about the turbulent stock market… and why you shouldn’t

- The longest bull market … and longest expansion in history are in danger

- Saudi Arabia doubles down on threat to flood the oil market

- 5 things to know about the payroll tax

- The coronavirus economic ‘disaster’ scenario: Stagflation

- America’s biggest video game conference canceled because of coronavirus

- Walmart confirms coronavirus case in one of its stores

- Verizon launches Yahoo Mobile, a $40-per-month phone service

- Computers still aren’t fluent in human speech. IBM is changing that

- The best ways to get yourself hired

- Your city may be in the running to build Elon Musk’s new Cybertruck

- Opinion: It’s time for us to go back to the moon — and stay there

- People walk past the New York Stock Exchange building after the ringing of the opening bell to celebrate New York Stock Exchange’s 225th Anniversary, at the NYSE in New York on May 17, 2017.

- Trump’s stock market gains have been cut in half by the coronavirus sell-off

- Consumers snap up PhoneSoap to sanitize cell phones as coronavirus outbreak spreads

- A customer walks out of a bagel shop after picking up coffee and a breakfast sandwich early Wednesday, March 11, 2020, in New Rochelle, N.Y. State officials are shuttering several schools and houses of worship for two weeks in the New York City suburb and sending in the National Guard to help with what appears to be the nation's biggest cluster of coronavirus cases.

- Inside an American coronavirus containment zone, business anxiety is spreading

- Chick-fil-A will start selling bottles of its signature sauce

- McDonald’s is selling a Big Mac with four patties

- Dunkin’ will give out free donuts this month

- These McDonald’s scented candles smell like food

- Dunkin’ has a plan for better coffee

- BANKING

- A pedestrian passes in front of a Fifth Third Bancorp automatic teller machine (ATM) location in Chicago, Illinois, U.S., on Thursday, July 13, 2017. Fifth Third Bancorp is scheduled to release earnings figures on July 21.

- Fifth Third employees opened fake accounts to meet sales goals, US says

- Could the coronavirus shut down Wall Street?

- Wells Fargo chairwoman quits abruptly

- One of India’s biggest banks has been bailed out

- Banks in Europe will delay mortgage payments for coronavirus victims

Headlines from right-of-center Fox Business

- Dow closes in bear market amid volatile session

- S. equity markets are lower amid skepticism over proposed stimulus.

- Coronavirus outbreak a pandemic, World Health Organization declares

- Oil crash poised to siphon bank profits

- Coronavirus pushes New York Fed to increase liquidity

- Virus creates another layer of woes for Boeing

- Doctor makes frightening reveal about younger coronavirus patients

- Coronavirus puts paid sick leave benefits under scrutiny

- Oil tycoon Hamm: Russia, Saudi Arabia launching ‘direct attack’ on US producers

- Trump mulls permanent 0% payroll tax rate

- Pelosi to unveil coronavirus aid as Republicans signal possible support

- Opinion: Virus threatens global economy, but US will contain outbreak and thrive

- Dos and don’ts of stockpiling: 5 must-have items for quarantine

- Sporting goods retailer Modell’s files for bankruptcy after 131 years

- Coronavirus forces NBA’s Warriors to play home game without fans

- April filing deadline likely to be delayed

- Katherine Schwarzenegger Pratt’s new book teaches forgivness

- Sanders vows to stay in 2020 race as Biden closes in on nomination

- Former Patriots star nearing WWE deal

- Harvey Weinstein sentenced to decades in prison

- Private jet service booms amid coronavirus fears

- Coronavirus pushes Ben & Jerry’s to postpone ‘Free Cone Day’ for first time in 41 years

- Coronavirus raises concerns in jails and prisons

- California AG drops challenge to T-Mobile-Sprint merger

- Who is Harvey Weinstein’s brother, Bob?

- Los Angeles must provide homeless with beds, services: Lawsuit

- Pepsi deal will make Rockstar ‘powerhouse brand,’ founder says

- Mortgage size hurts your ability to save money, most Americans believe

- Lori Loughlin’s attorney in cheating scandal led Enron prosecution team

- Critical system at Dept. of Health crashes as officials scramble to contain virus

- Will coronavirus really cause a recession? What telltale signs to watch

- Biden, Sanders to debate without live audience as coronavirus spreads

- Bank of England slashes interest rates

- Saudi Aramco boosts oil production capacity amid price war with Russia

- Weinstein reportedly asked Bezos, Bloomberg for help as accusations mounted

- The Democratic primary race just took a big turn

- El-Erian: Central bank coronavirus response ‘pushing on a string’

- Sex harassment claims made about opera legend deemed ‘credible’

- Study makes frightening find about how vulnerable US is to cyberattacks

- WATCH: Hedge fund founder on why virus could lead to ‘slight’ global recession

- New York cancels major race amid coronavirus concerns

- What are coronavirus-free states doing?

- Coronavirus and the elderly: This is the age at which you’re considered ‘at risk’

- Stock swoon has Mnuchin, Powell talking daily

- Former Home Depot CEO: 50% of fracking companies will go bankrupt

- Amazon, Apple, Google lead tech coronavirus White House meeting

- Lawyers reveal whether Robert Durst will testify at trial

- What a payroll tax cut could mean for your wallet

10 Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus – Where Business, Politics and Investing Can Meet

To set the stage for the report that follows, here are some headlines pulled from ubiquitous Drudge Report that are coronavirus related:

- German officials that: ‘70% WILL BE INFECTED’

- FED PUMPS $175 BILLION IN DAY

- SEATTLE SCHOOLS CLOSE

- TRUMP TO ADDRESS NATION

- TOP DOC: Virus 10 TIMES more lethal than flu… [bottom line, 1 percent mortality rate versus .1]

- Political Leaders at Risk…

- FAUCI: Infections and deaths ‘totally dependent upon how we respond’…

- Most Americans Will Likely Be Exposed…

- X-rays show terrifying damage in lungs of victims…

- Clusters swell on both sides of USA…

- White House told federal health agency to classify deliberations…

- ‘Emergency meeting’…

- Fight enters new phase as containment falters…

- Response could test limits of govt powers…

- Georgia to isolate patients at Hard Labor Creek State Park…

- No Escape From Threat for 2 Million Crammed in Prisons…

- GOODWIN: Trump needs to step up…

- POLL: PRESIDENT’S APPROVAL HOLDS AT 40%…

- Military Struggles to Respond…

- New Italian lifestyle upends most basic routines and joys…

- WHO Blasts ‘Alarming’ Inaction…

- USA weighs limits on travelers from Europe…

- JETBLUE CEO: Impact On Airline ‘Probably Worse’ Than 9/11…

- Young capitalize on cheap flights: ‘If I die, I die’…

- Casino To Take Temperatures Of Guests, Employees…

- AP PHOTOS OF OUTBREAK…

- STOCK SELL-OFF ACCELERATES: DOW -1464…

- BEAR MARKET…

- 11-Year Bull Run Ends…

- TREASURIES TURN RISKY…

There are certainly plenty of voices that are pushing the panic button. There are numbers of headlines and reports that are fueling the market selloff.

What are others saying?

“But in the heat of the moment, difficult questions have been raised that will persist beyond the current crisis,” said award-winning independent investigative reporter Sharyl Attkisson in an op-ed via The Hill.

From that same column, Attkisson said the following.

“How can taxpayers be protected from a money grab?”

During health emergencies such as this one, enormous sums of taxpayer money exit the public coffers at the speed of light. Nobody wants to be blamed for appearing to hold back on money needed to save lives. Politicians in both parties risk getting blamed if they ask too many questions about exactly how all those emergency billions will be spent and how much is really needed. Sometimes, accountability goes out the window.

Unless you believe that politicians and agencies are above a money grab, especially if it can be justified under the auspices of a public health emergency, then you should favor prudent, careful allocation of resources with accountability on the front end and follow-up after the fact.”

Attkisson mentions politicians and agencies, but it must be stressed that money from agencies go to private businesses. Thus, logically any “money grab” involves more than just politicos and bureaucrats, it also involves special interests and their lobbyists.”

As the red in the evening market summary further below reflects, essentially all manufactured home industry connected stocks have been driven down during what some describe as a panic with a resultant historically rapid drop.

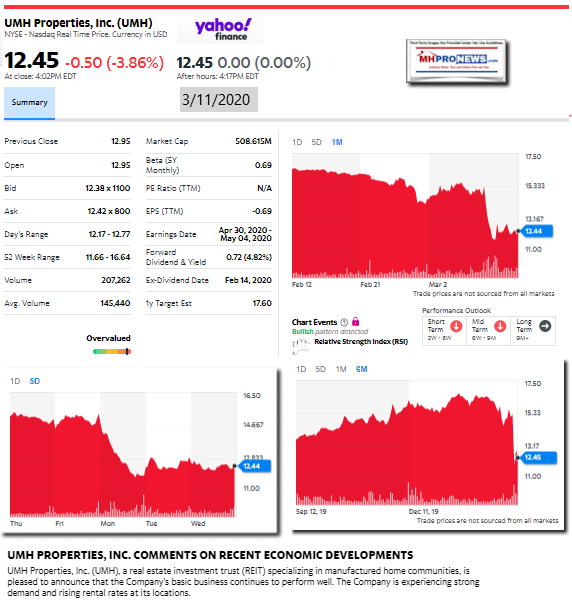

Here is what UMH Properties said yesterday, in a media release. The graphic is based on Yahoo data, and was not provided by UMH.

UMH PROPERTIES, INC. COMMENTS ON RECENT ECONOMIC DEVELOPMENTS

March 10, 2020 16:46 ET | Source: UMH Properties, Inc.

FREEHOLD, NJ, March 10, 2020 (GLOBE NEWSWIRE) — UMH Properties, Inc. (NYSE: UMH), a real estate investment trust (REIT) specializing in manufactured home communities, is pleased to announce that the Company’s basic business continues to perform well. The Company is experiencing strong demand and rising rental rates at its locations.

Samuel A. Landy, President and Chief Executive Officer, commented, “We anticipate that occupancy and rents will not be impacted by the recent decline in oil and gas prices. Our view of the energy industry in Pennsylvania and Ohio was expressed in our 10-K and earnings release and continues to be our current position.”

“Our manufactured home communities are situated on 6,600 acres of valuable land. This includes 3,400 acres in the energy-rich Marcellus and Utica Shale regions. As anticipated, the vast oil and natural gas reserves in these areas have become substantial economic catalysts that are creating significant prosperity and growth. We believe we are still in the early stages of this energy bonanza, and as a result, we look forward to very strong demand for decades to come. The American Petroleum Institute projects employment increases in Ohio and Pennsylvania of 138,000 jobs per year through 2035. If this is actually achieved, it will be a game changer for these states.”

“The recent decline in UMH share price is not related to any fundamentals that we are aware of. Our cost of capital has gone down substantially and is a favorable recent development.”

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 122 manufactured home communities with approximately 23,100 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland and Michigan. In addition, the Company owns a portfolio of REIT securities.

# # # #

MHProNews has an outreach to some researchers to see what, if anything, they may wish to add to this developing drop.

Is the panic warranted? There are voices on both sides of that question. History will have the final word if this was authentic or a “money grab” to borrow the expression used by Attkisson.

That said, a Washington, D.C. contact said in a email that “The SEC [Securities and Exchange Commission] building is basically closed (they had one confirmed case in the building) and everyone is working from home.”

That same source added, “it’s like a ghost town around here [Washington, D.C.]. Much lighter traffic this morning; hardly anybody at the place I normally get lunch (right around 12) which is usually pretty crowded; not many people out on the street…Its almost like it was during the government shutdown, but not quite as extreme.”

“That’s the only agency [SEC] shut-down for now, but wouldn’t be surprised if there were others soon.”

If the Chinese government is to be believed, they have said that the coronavirus spread has slowed. MHProNews will continue to monitor these events from an industry perspective.

See more in the related reports below.

Related Reports:

Sam Zell is Buying, plus Manufactured Home Investing, Stock Updates

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

-

-

-

Winter 2020…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has now celebrated our tenth anniversary.

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach, co-managing member of LifeStyle Factory Homes, LLC and co-founder for MHProNews.com, and MHLivingNews.com.

Connect with us on LinkedIn here and here.