Others include MHI itself.

However, new tips from whistleblowers have been coming in about other MHI member firms in the community sector. There are issues from a variety of sources developing. Stay tuned as information on those allegations about MHI/NCC members are developed.

Legacy

There are also additional tips from multiple sources inside and outside of Legacy Housing. Comments from a senior Legacy executive received today deny any wrongdoing on the SBA plan and said they have no intention to return the money. That source was advised via email of the nature of developing evidence from Legacy accusers plus new allegations beyond the SBA Paycheck Protection Program (PPP) controversy. As of press time there are no additional replies from Legacy leadership on those mounting controversies.

The Carlyle Group

Another MHI member firm has been specifically named by celebrity Taylor Swift against The Carlyle Group (CG) private equity firm. Swift’s public complaint isn’t about manufactured housing, but it does underscore the troubling pattern of smoke that seems to routinely be coming from organizations associated with MHI. CG has invested in some land-lease communities that have at various times sparked their own controversies with residents, others.

A look at some of those developing issues tied to the headline and this tee up will be our featured focus tonight. As usual, that will follow our left-right media headline summary, graphic snapshots and standard business nightly fare.

Headlines from left-of-center CNN Business

- Stimulus lawsuit

- A cut of the Tomahawk ribeye being placed on two separate plates at Ruth’s Chris Steak House in Irvine, CA, August 17, 2016

- FIRST ON CNN BUSINESS

- JPMorgan, Ruth’s Chris accused of cheating small businesses out of emergency loans

- Automakers plan to restart factories in early May. UAW says not so fast

- Facebook is taking on Zoom with new video features

- Limits on savings withdrawals have been lifted

- Americans are adopting more puppies and Chewy is cashing in

- LIVE UPDATES Stocks snap a two-week winning steak

- AT&T CEO Randall Stephenson to retire. COO John Stankey will succeed him

- Lysol maker: Please don’t drink our cleaning products

- DraftKings goes public without many live sports to bet on

- ‘Welcome to the house of horror’: The awful economic data for April is here

- Opinion: The US oil boom is over

- The Gap is running out of money and stopped paying rent

- In this still image from video provided by the NFL, NFL Commissioner Roger Goodell speaks from his home in Bronxville, New York during the first round of the 2020 NFL Draft on April 23, 2020.

- Virtual NFL Draft nabs record viewership

- Surgical face masks are photographed for illustration photo during the spread of coronavirus. Krakow, Poland on April 24, 2020. The rule of covering the nose and mouth in public places with face masks, carves or handkerchiefs came into force from April 16th.

- OPINION As a doctor in the US, I shouldn’t have to buy masks and gloves on the black market

- View of an empty 9th Avenue where a large sign reads, "Restaurant for Lease" amid the coronavirus pandemic on April 21, 2020 in New York City, United States. COVID-19 has spread to most countries around the world, claiming over 176,000 lives with over 2.5 million cases.

- This app lets New York tenants sue their landlord

- STATE OF OUR WORKFORCE

- SPECIAL REPORT

- Workers everywhere are suffering. 16 of them share how they try to hold on

- Fear and a firing inside an Amazon warehouse

- Garment workers face ruin as big brands ditch contracts

- These folks are always all remote. Here are their tips

- ‘We did everything right.’ Small businesses left in limbo waiting for government loans

Headlines from right-of-center Fox Business

- MARKETS

- Stocks rally as Trump signs $484B small-business relief bill

- Despite Friday’s rally stocks end the week lower.

- Rubio: When small businesses can expect to see second wave of loans

- MONEY

- Wall Street fat cats, boutique equity firms shut out of coronavirus loans for small biz, SBA says

- Trump signs $484 stimulus package, sending more relief to employers and hospitals

- MARKETS

- Two more American meat processing plants shuttered due to coronavirus

- Coronavirus drives french fry demand as suppliers try to keep up

- LIFESTYLE

- Coronavirus leaves some calling on Trump to close NYC subways

- MONEY

- IRS ‘Get My Payment’ tool to shut down, retool, come back with update

- BLEACH BATHS?

- LIFESTYLE

- Cuomo’s blog reveals eccentric, intense coronavirus home treatment routine

- FORE YOUR HEALTH?

- SPORTS

- Is golf an essential activity during coronavirus?

- STATE OF PAY

- PERSONAL FINANCE

- These states have received the most coronavirus checks

- KNOW YOUR RIGHTS

- LIFESTYLE

- Going back to work: Tips on what your boss can – and can’t – make you do

- NEW ENEMY LURKS

- HEALTH

- Buildings closed by virus now at risk of breeding another dangerous threat

- PERFECT STORM

- MONEY

- These workers expected to be worst hurt by the coronavirus pandemic

- THE SWEDE LIFE

- ECONOMY

- Sweden keeping open during coronaviru protects its economy

- WHEN THE CHIPS ARE DOWN

- SPORTS

- 2020 NFL Draft betting on DraftKings exceeded expectations, CEO says

- REESE PEACES

- REAL ESTATE

- Reese Witherspoon sells $17M California mansion

- NOT TO BE TOYED WITH

- LIFESTYLE

- American Girl sued by astronomer

- SUMMER BUMMER

- LIFESTYLE

- Beach town won’t turn on water for seasonal homes in bid to stop virus

- ‘CHAOTIC’

- HEALTH

- Bill Gates: Why coronavirus testing at national level ‘might not happen’

- KIM UNFILTERED

- LIFESTYLE

- Kim Kardashian asks Zoom to make the cameras fun again with Snapchat

- FREE ACCESS

- ECONOMY

- Fed eliminates banking restriction, making it easier for you to get cash

- TRUST FALL

- OPINION

- Puzder: Latest round of PPP shows hard-working Americans not forgotten

- TECHNOLOGY

- France upholds ruling limiting Amazon deliveries during COVID-19 crisis

- MARKETS

- Workers behind “Disney on Ice” laid off

- LIFESTYLE

- Ikea: Visitors returning fast in China, Germany

- MONEY

- Luxury hotel owner is biggest beneficiary of coronavirus small business program with nearly $60M in aid

- TECHNOLOGY

- Apple, Google update coronavirus contact-tracing software plans

- ECONOMY

- Most losing jobs to coronavirus think they’ll return: Poll

- LIFESTYLE

- Coronavirus-hit retailers begin curbside pickup in Texas

- LIFESTYLE

- Coronavirus lockdown turns seafood into boat-to-table service

- MONEY

- How many businesses have seen coronavirus relief so far

- S.

- US coronavirus death toll surpasses sobering benchmark

- MARKETS

- Harold Hamm’s Continental Resources shutting production in key oil field

- HEALTHCARE

- Doctor reveals how much rich patients are willing to spend for virus tests

- BUSINESS LEADERS

- AT&T CEO Randall Stephenson to step down, John Stankey to take over on July 1

- MARKETS

- Grocers hunt meat as coronavirus hobbles beef and pork plants

- HEALTH

- Lysol-maker issues warning about disinfectants

- MARKETS

- Freeport-McMoRan plans cost cuts after coronavirus loss

- MARKETS

- American Express profit sinks 76%

- MONEY

- China to host online shopping festival to boost economy impacted by coronavirus

- MARKETS

- UAW says restarting US auto plants next month ‘too risky’

- REAL ESTATE

- SEE PICS: Prince’s former mansion hits market for $30M

- OPINION

- Varney: Media not interested in coronavirus back-to-work movement

10 Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus – Where Business, Politics and Investing Can Meet

Let’s get artist and left-wing activist Taylor Swift’s Instagram rant that cites the Soros family and The Carlyle Group (CG) out of the way.

Next from the Chicago-based Levenfeld Pearlstein, LLC lawfirm is this.

“Double-check your PPP loan application certifications. The SBA has issued new guidance on the certification that has to be made with any PPP application that, “the current economic uncertainty makes the loan request necessary.” The new guidance gives an example of a public company that could have accessed the funds elsewhere and provides that a company like that probably could not make the certification. The guidance also provides an opportunity for any borrowers who have already received proceeds to look back at their own certification and determine if they can still make the certification given the new guidance. If a borrower has already received proceeds and now believes the certification to be untrue given the new guidance, the borrower can return the loan proceeds by May 7, essentially without any recourse to the borrower for making a false certification. As this new guidance is only hours old, LP is still considering the effects of this regulation and will advise further as we better understand the implications of this guidance.”

According to CNBC on that same topic is this today.

Government’s threat

“…the Treasury Department and SBA on Thursday issued new guidance on which companies qualify for the loans. The SBA warned Thursday that large public companies who tapped the PPP before the rule change can avoid government scrutiny by returning the relief loans in two weeks.

“Borrowers still must certify in good faith that their PPP loan request is necessary,” the SBA said. “It is unlikely that a public company with substantial market value and access to capital markets will be able to make the required certification in good faith, and such a company should be prepared to demonstrate to SBA, upon request, the basis for its certification.”

“Any borrower that applied for a PPP loan prior to the issuance of this guidance and repays the loan in full by May 7, 2020 will be deemed by SBA to have made the required certification in good faith,” the SBA added.

Pandemic Profiteers

Fast Company reported on the left-leaning Institute for Policy Studies latest report on what they call “pandemic profiteers.”

“In the same month that 22 million Americans lost their jobs, the American billionaire class’s total wealth increased about 10%—or $282 billion more than it was at the beginning of March. They now have a combined net worth of $3.229 trillion.”

In a prior Fast Company report regarding a 2018 research by the same organization said this: “The U.S., the “Billionaire Bonanza” report reminds readers, has a strong tradition of breaking up concentrated wealth. Theodore Roosevelt famously said: “Of all forms of tyranny, the least attractive and the most vulgar is the tyranny of mere wealth, the tyranny of a plutocracy,” following the first Gilded Age. Now that we’re well into the second, we need bold policy solutions to redistribute the country’s vast economic resources in a way that benefits everyone from the bottom up, not just those already sitting at the top.”

The research by Institute for Policy Studies is linked here. While some of their facts are difficult to argue with, their policy prescriptions would often have quite the opposite result than what they think. Thus the need for routinely sifting fact-from-feel good bumper sticker phrases that are mere fiction, or put differently, separating the wheat from the chaff.

The need is to break up big operations under antitrust laws. Merely ‘taxing the rich’ simply won’t work, as they can move capital or make sure that loopholes exist that escapes the taxes sought. That’s been demonstrated in the US and places in Europe which dropped wealth tax efforts.

Enforcing the law, equally and honestly ought to be the goal.

As whistleblowers push back against ‘pandemic profiteers’ and others who purportedly are acting in problematic ways toward their own employees, customers and others there is plenty to ponder and reasons to pivot while that is still possible.

Related Reports:

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

-

-

-

-

-

Spring 2020…

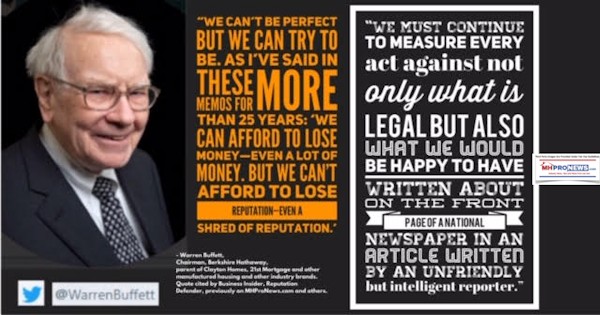

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our tenth anniversary and is in year 11 of publishing.

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.https://www.manufacturedhomepronews.com/celebrating-10-years-of-goal-and-solution-oriented-manufactured-home-industry-innovation-information-and-inspiration-for-industry-professionals/· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

http://latonykovach.com Connect on LinkedIn: http://www.linkedin.com/in/latonykovach