Legal Preface. The leadership of publicly traded companies are not supposed to provide false or misleading information. Who says?

The Securities Exchange Act is the basis for the U.S. Securities and Exchange Commission (SEC). From that act is the following legal reference that bars “false or misleading” statements, according to the Legal Information Institute. The LII is an independently-funded project of the Cornell Law School.

Ҥ 240.14c-6 False or misleading statements.

(a) No information statement shall contain any statement which, at the time and in the light of the circumstances under which it is made, is false or misleading with respect to any material fact, or which omits to state any material fact necessary in order to make the statements therein not false or misleading or necessary to correct any statement in any earlier communication with respect to the same meeting or subject matter which has become false or misleading.

(b) The fact that an information statement has been filed with or examined by the Commission shall not be deemed a finding by the Commission that such material is accurate or complete or not false or misleading, or that the Commission has passed upon the merits of or approved any statement contained therein or any matter to be acted upon by security holders. No representation contrary to the foregoing shall be made.

Related is this. “Every director of a corporation owes fiduciary duties to the corporation for which he or she serves and to its stockholders. Directors can be subject to personal liability for breaches of these duties; as such, it is important for directors to understand what is required with respect to their fiduciary duties.” So says Buchanan Labs, which describes itself as “a cross-practice group of seasoned attorneys who provide efficient legal solutions to emerging companies.”

Additionally, “corporate directors and officers are said to be “fiduciaries.” Basically, fiduciary duties in a corporate setting require directors to apply their best business judgment, to act in good faith, and to promote the best interests of the corporation.”

Summing up the above could be done like this. The leadership of publicly traded firms by law have a responsibility to provided information that is not misleading or false. They must also behave in the best interests of their stockholders, described as acting in the “best interests of the corporation and its stockholders collectively.” That last quote is according to the Skadden legal team, which is an international law firm based in New York City.

That preface is a firm legal foundation for the concerns that will be raised from recent and prior public statements from Cavco Industries.

Unpacking the Latest Official Insights From Cavco…

Cavco Industries (NASDAQ:CVCO) made several surprising revelations in their recent Quarter 4 2020 investor call transcript.

There were actually multiple types of closures that occurred, including temporary ones that were reportedly tied to incidences of COVID19 cases at various production facilities. There are also arguably several legal/regulatory issues that these and prior statements raise, but this report will be focused on Lexington Homes and related legal/regulatory/controversial issues.

In this report, the entire transcript of the most recent investor call will be included for context and comparison purposes. But additional public statements by Cavco regarding Lexington will also be included to shed light on why MHProNews is zeroing in on the announced Lexington Homes closure as a topic that merits possible investor, legal and regulatory attention.

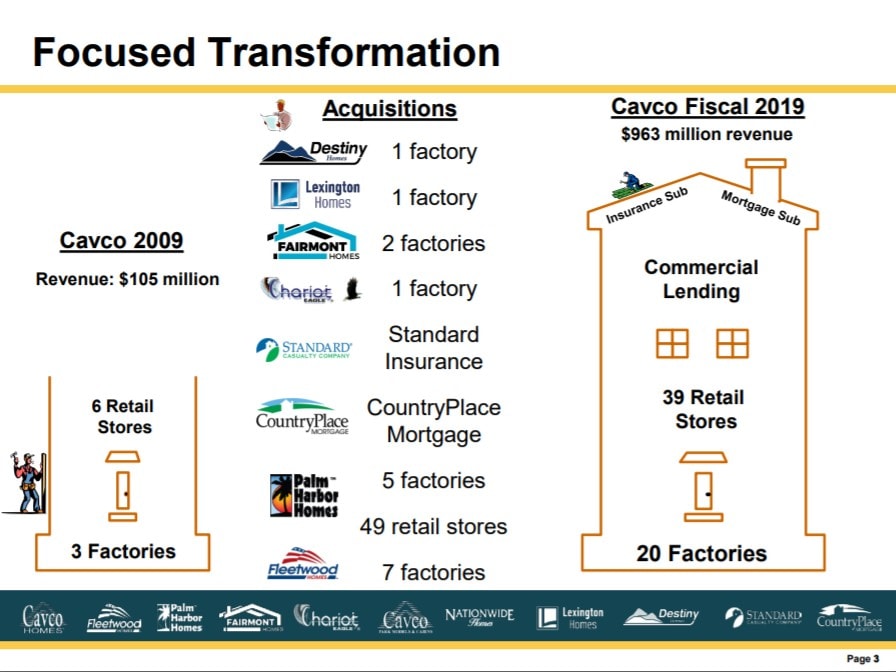

With that backdrop, let’s begin with a media release from Cavco on April 4, 2017 that said “Cavco Industries Inc. (NASDAQ: CVCO) today announced its closing of the acquisition of Lexington Homes, Inc. (“Lexington”), which became effective on April 3, 2017.”

That same release said that “Lexington provides affordable manufactured housing from its manufacturing plant in Lexington, Mississippi to its retail distributors in the Southeastern United States.”

“We are pleased to welcome the Lexington business and employees as they join the Cavco group of companies,” said [then] Cavco Chairman, President and Chief Executive Officer, Joe Stegmayer. “Our combined operations will allow us to more fully serve Cavco’s existing customers in the Southeast and provide added resources to support Lexington’s customer base. The historically strong manufactured housing markets in Mississippi, Louisiana, Alabama and nearby states are generally improving and this acquisition enables Cavco to better participate in future growth potential.”

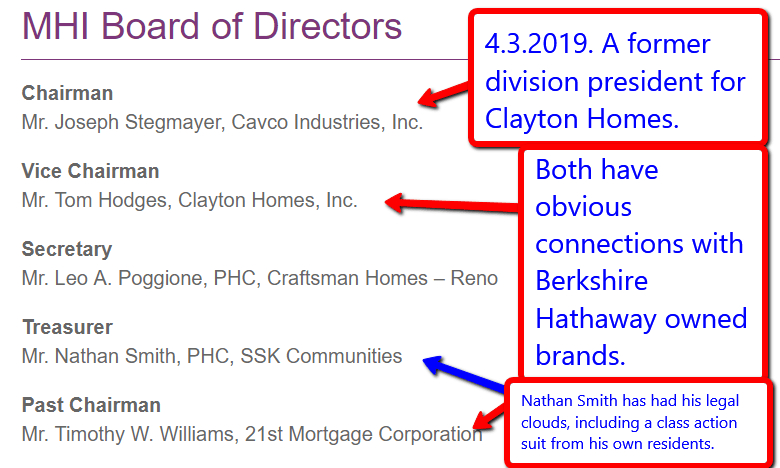

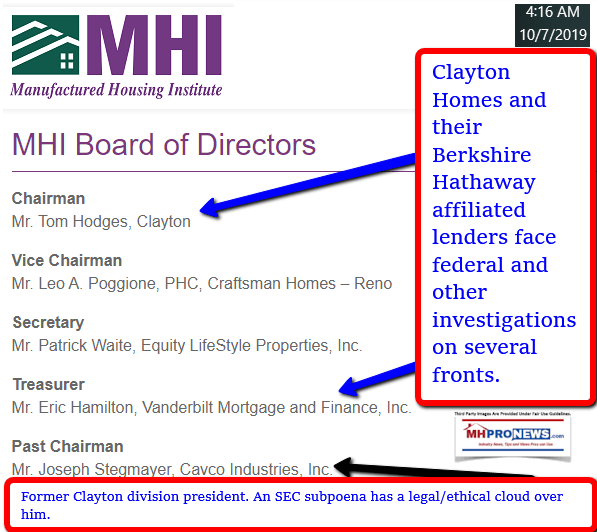

Since that time, Stegmayer stepped down from leadership at Cavco under the cloud of an SEC subpoena that was announced by the company on November 8, 2018. That release sent their stock plummeting and sparked a series of investigations by plaintiff’s attorneys on behalf of shareholders. ICYMI, or as a reminder, one of the prior reports by MHProNews on that topic are linked below.

As transcript of their May 27, 2020 quarterly call revealed, that SEC investigation is still ongoing. So too are the legal and other costs associated with that matter.

Returning to Cavco’s 4.4.2017 statement, it continued with the following.

“The purchase price, which was paid in cash at closing and funded with Cavco’s internal capital, was not disclosed. Lexington home products will continue to be marketed under the Lexington brand name and the current management team will remain with the company.”

That same release included the following.

About Cavco Industries, Inc.

Cavco Industries, Inc., headquartered in Phoenix, Arizona, designs and produces factory-built housing products primarily distributed through a network of independent and Company-owned retailers. The Company is one of the largest producers of manufactured homes in the United States, based on reported wholesale shipments, marketed under a variety of brand names including Cavco Homes, Fleetwood Homes, Palm Harbor Homes, Fairmont Homes and Chariot Eagle. The Company is also a leading producer of park model RVs, vacation cabins, and systems-built commercial structures, as well as modular homes built primarily under the Nationwide Custom Homes brand. Including Lexington, the Company will employ approximately 4,200 people and operate twenty manufacturing plants along with retail home centers, housing finance and homeowner insurance businesses in the United States. Additional information about Cavco can be found at www.cavco.com.

About Lexington Homes, Inc.

Lexington Homes, Inc. was founded in 2004 by individuals with combined experience of over 100 years in the manufactured housing industry. Lexington operates one manufacturing plant in Lexington, Mississippi and distributes homes through a network of independent retail businesses in the Southeastern United States. More information about Lexington can be found at www.lexington-homes.com.”

In another prior release on that same Lexington Homes acquisition topic, Cavco said the following.

“March 28, 2017 (GLOBE NEWSWIRE) — Cavco Industries Inc. (NASDAQ:CVCO) today announced that it has signed a Letter of Intent and has reached an understanding on the principal terms to acquire Lexington Homes, Inc. (“Lexington”). Lexington provides affordable manufactured housing from its manufacturing plant in Lexington, Mississippi to its retail distributors in the Southeastern United States.

The purchase of Lexington is expected to improve Cavco’s ability to participate in the growing Southeastern housing market, as well as better serve the needs of Lexington customers.”

Rephrased, Cavco’s statements made it clear that the firm expected good things to occur in a market that was primed for growth.

Then, there’s these pull-quotes from their May 27, 2020 call transcript, per the Motley Fool. Highlighting added by MHProNews for emphasis. Note to new readers: MHProNews often turns direct quotes bold and brown to emphasize it or make it ‘pop’ visually for more rapid follow up reference.

These challenges were compounded by the drop-off in orders due to COVID-19, and ultimately, the uncertainty about the timing of recovery. We’re currently operating the plant to deliver on pre-existing orders in support of our independent dealers. The plant will be closed by the end of June.” So said William C. “Bill” Boor, President and Chief Executive Officer (CEO).

With that, step back to Cavco’s June 3, 2019 annual report to shareholders document. Their report included this map below. #15 is the location of Lexington Homes.

For those who understand the manufactured housing industry and the notion of vertical integration, the Lexington acquisition on paper made good sense from their investment perspective. Lexington’s location was clearly not close to other Cavco-owned production centers. At least hypothetically, Cavco stood to gain an advantage in market penetration due to shorter shipping distances and thus lower total cost.

Additionally, ‘going vertical’ should have resulted in operating savings too. Sources in companies acquired by Cavco have told MHProNews that operating efficiencies were notable. That is supported by various public statements from the firm too. Which once more begs serious evidence and logic based questions about this shutdown of Lexington.

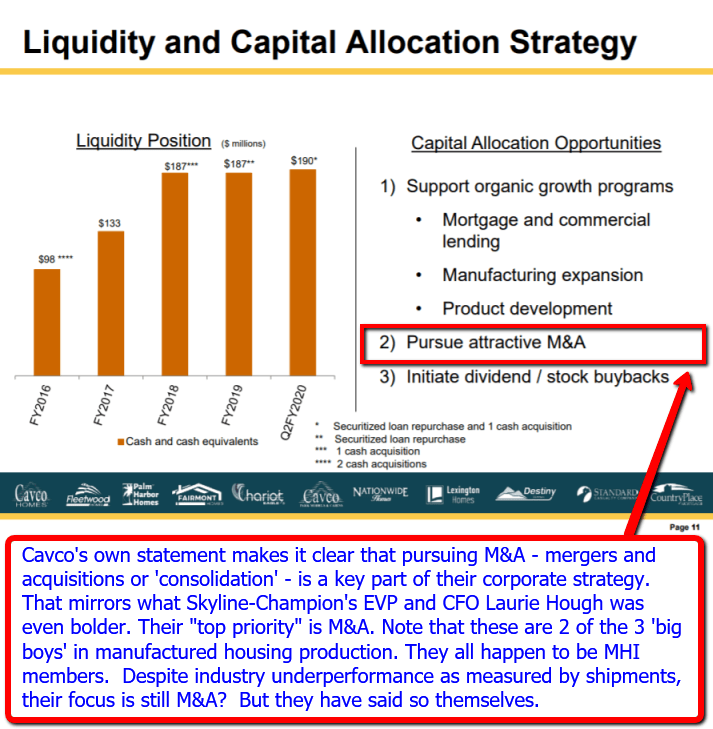

That June 3, 2019 annual report signed by President and CEO Bill Boor also said the following. Note that the highlighted portion stands in contrast to a more recent statement that underscores their arguably inordinate thirst for M&A – mergers and acquisitions, which he mentions following the highlighted item. More on that further below.

“I would be remiss if I didn’t acknowledge that fiscal year 2019 had its challenges as well. It is impossible to predict the outcome or timing for resolution of the subpoenas received from the Securities and Exchange Commission (the “SEC”) regarding the company’s trading activities. You can have confidence in the response of your Board of Directors and senior management team. We responded quickly with an independent investigation, which has now been completed, and we are fully supporting the SEC’s process. Moreover, we are taking this opportunity to review and improve overall governance and compliance processes. We have added 3 highly qualified directors that expanded the Board to 7 members. We have also separated the Chief Executive Officer and Chairman of the Board positions. Under the leadership of a newly created Legal and Compliance Committee of the Board and a new General Counsel, we are undertaking a comprehensive review of policies and procedures to ensure that we come out of this experience stronger and with improved risk management approaches.

Strategically, we will remain focused on prudent investment in our operations to improve efficiency and grow capacity. Additionally, the company has an outstanding record of value-enhancing acquisitions and we will continue seeking and developing acquisition opportunities. Our manufactured housing division remains debt-free and our strong cash position (approximately $187 million at fiscal year-end) provides the financial strength and flexibility we need to invest wisely in continued growth.”

That financial prowess once more points to the pressing question, why is it that Cavco – either as an independent corporation and/or as an MHI member – failed to more robustly penetrate the mainstream housing market during an affordable housing crisis? Hold that thought for further below.

In the annual report on form 10k in their June 3, 2019 annual report are the following points.

“The purchase of Chariot Eagle, LLC (“Chariot Eagle”), Fairmont Homes, LLC (“Fairmont Homes”) and Lexington Homes, Inc. (“Lexington Homes”), in March 2015, May 2015 and April 2017, respectively, provided for further operating capacity, increased home production capabilities and further strengthened our market position in the Midwest, the western Great Plains states, the Northeast, the Southeast and several provinces in Canada.”

“Manufactured housing is a regional business and the primary geographic market for a typical manufacturing facility is within a cost effective shipping radius of 350 miles. Each of our manufacturing facilities serves multiple distributors and a number of one-time purchasers. Because homes are produced to fill existing wholesale orders, our factories generally do not carry finished goods inventories, except for homes awaiting delivery.”

- “Revenue and Distribution. The Company sold 14,389, 14,537 and 13,820 homes in fiscal years 2019, 2018 and 2017, respectively, through Company-owned and independent distribution channels.” Rephrased, Cavco’s sales dipped in 2019 vs. 2018, which also occurred for the industry at large.

More from that 2019 annual report.

As of March 30, 2019, the Company had a network of independent distribution points, of which 13% were in Arizona, 10% in Texas, 9% in California, 7% in Florida, and 7% in Oregon, based on the quantity of wholesale shipments during fiscal 2019. The remaining 54% were in 39 other states and Canada. As is common in the industry, our independent distributors typically sell homes produced by other manufacturers in addition to those produced by the Company. Some independent distributors operate multiple sales outlets. No independent distributor accounted for 10% or more of our factory-built housing revenue during any fiscal year within the three-year period ended March 30, 2019.

The Company continually seeks to increase wholesale shipments by growing sales at existing independent distributors and by identifying new independent distributors to sell our homes. The Company provides comprehensive sales and product training to independent retail sales associates, including providing opportunities to visit our manufacturing facilities to discuss and view new product designs as they are developed. These training seminars facilitate the sale of our homes by increasing the skill and knowledge of the retail sales consultants. In addition, we display our products at trade shows and support our distributors through the distribution of floor plan literature, brochures, decor selection displays, point of sale promotional material and internet-based marketing assistance.”

The bullets that follow are also quotes form that 2019 annual document.

- Consumer Financing. Sales of factory-built homes are significantly affected by the availability and cost of consumer financing. There are three basic types of consumer financing in the factory-built housing industry: conforming mortgage loans which comply with the requirements of FHA, VA, USDA or GSE loans; non- conforming mortgages for purchasers of the home and the land on which the home is placed; and personal property loans (often referred to as home-only or chattel loans) for consumers where the home is the sole collateral for the loan (generally HUD code homes).

- Restrictive underwriting guidelines, higher interest rates compared to mortgages for site-built homes, a limited number of institutions lending to manufactured home buyers and limited secondary market availability for manufactured home loans continue to constrain industry growth. The Company is working directly with industry participants to develop manufactured home consumer financing loan portfolios to attract industry financiers interested in furthering or expanding lending opportunities in the industry. Additionally, the Company continues to invest in community-based lending initiatives that provide home-only financing to new residents of certain manufactured home communities. Our mortgage subsidiary also develops and invests in home-only lending programs to grow sales of homes through traditional distribution points. The Company believes that growing our participation in home-only lending may provide additional sales growth opportunities for our factory-built housing operations.”

MHProNews Analysis and Commentary

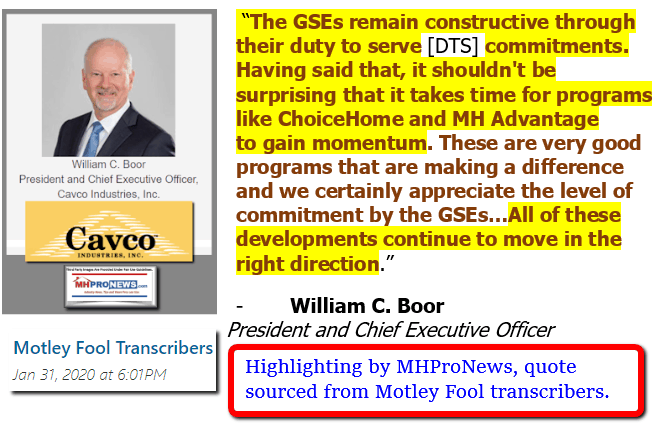

In addition to points already made in this report, those statements above arguably should be red flags when it comes to the Duty to Serve (DTS) manufactured housing provisions mandated for the Government Sponsored Enterprises (GSEs) as established by law under the Housing and Economic Recovery Act (HERA) of 2008. But that won’t be the focus of this report.

Sufficient for now is to consider what Danny Ghorbani said in interviews linked here and here, plus Cavco’s following and the link to the Related Report about the MHI, Clayton Homes and Skyline Champion backed “CrossModTM” homes initiative.

There are opinions, but there are facts based upon evidence. The points of concern raised herein and in linked items are ironically in good measure supported by Cavco’s own statements.

For instance, also from the June 2019 CVCO annual report.

- “The Company is also working through industry trade associations to encourage favorable legislative and GSE action to address the mortgage financing needs of buyers of affordable homes. Federal law requires the GSEs to implement the “Duty to Serve” requirements specified in the Federal Housing Enterprises Financial Safety and Soundness Act of 1992, as amended by the Housing and Economic Recovery Act of 2008. In December 2017, Fannie Mae and Freddie Mac released their final Underserved Markets Plan that describes, with specificity, the actions they will take over a three-year period to fulfill the “Duty to Serve” obligation. These plans became effective on January 1, 2018. Each of the three-year plans offers an enhanced mortgage loan product through their “MH Advantage” and “ChoiceHome” programs, respectively, that began in the latter part of calendar 2018. Small-scale pilot programs for the purchase of home-only loans are expected to commence towards the end of calendar year 2019. Expansion of the secondary market for lending through the GSEs could support further demand for housing, as lending options would likely become more available to home buyers. Although some progress has been made in this area, meaningful positive impact in the form of increased home orders has yet to be realized.”

With that in mind, examine the report below.

As previously noted, there are any number of items that jump off the page for those who may scrutinize Cavco’s public statements in what follows and previous related commentary by corporate leaders. The following is from the investor-focused Motley Fool website. MHProNews will provide some related reports and closing commentary following their investor call trasncript.

Cavco Industries Inc (CVCO) Q4 2020 Earnings Call Transcript

Motley Fool Transcribers (MFTranscribers)

May 27, 2020 at 12:30PM.

Cavco Industries Inc (NASDAQ:CVCO)

Q4 2020 Earnings Call

May 27, 2020, 8:00 a.m. ET

Contents:

Prepared Remarks

Questions and Answers

Call Participants

Prepared Remarks:

Operator

Ladies and gentlemen, thank you for standing by, and welcome to the Fourth Quarter Fiscal Year 2020 Cavco Industries Earnings Call Webcast. [Operator Instructions] Please be advised that today’s conference is being recorded.

[Operator Instructions] I would now like to hand the conference over to your host for today Mr. Mark Fusler, Director of Financial Reporting and Investor Relations. Sir, please go ahead.

Mark Fusler — Director of Financial Reporting and Investor Relations

Good morning, and thank you for joining us for Cavco Industries Fourth Quarter and Fiscal Year 2020 earnings conference call. During the call, you will be hearing from Bill Boor, President and Chief Executive Officer and Dan Urness, Executive Vice President and Chief Financial Officer.

Before we begin, we’d like to remind you that the comments made during this conference call by management may contain forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995 including statements of expectations or assumptions about Cavco’s financial and operational performance, revenues, earnings per share, cash flow or used, cost savings, operational efficiencies, current or future volatility in the credit markets or future market conditions.

All forward-looking statements involve risks and uncertainties, which could affect Cavco’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of Cavco. I encourage you to review Cavco’s filings with the Securities and Exchange Commission including, without limitation, the Company’s most recent Forms 10-K and 10-Q which identify specific factors that may cause actual results or events to differ materially from those described in the forward-looking statements.

Some factors that may affect the Company’s results include, but are not limited to, the impact of local or national emergencies including the COVID-19 pandemic and such impacts from state and federal regulatory action that results from our ability to operate our business in ordinary course and impacts on; one, customer demand and availability of financing for our products; two, our supply chain and availability of raw materials for the manufacture of our products; three, availability of labor and the health and safety of our workforce; and four, the liquidity and access to the capital markets.

And also, the risk of litigation or regulatory action; potential reputational damage that Cavco may suffer as a result of matters under inquiry; adverse industry conditions; our involvement in vertically integrated lines of business, including manufactured housing consumer finance, commercial finance and insurance; market forces and housing demand fluctuations; our business and operations being concentrated in certain geographic regions; loss of any of our executive officers; additional federal government shutdowns; and the regulations affecting manufactured housing.

This conference call also contains time-sensitive information that is only accurate as of the date of this live broadcast, Wednesday, May 27th, 2020. Cavco undertakes no obligation to revise or update any forward-looking statements, whether written or oral, to reflect events or circumstances after the date of this conference call, except as required by law.

Now I’d like to turn the call over to Bill Boor, President and Chief Executive Officer, Bill?

William C. Boor — President and Chief Executive Officer

Thank you, Mark, and welcome everyone. Our fiscal year, obviously, came to a close during a time of incredible disruption and uncertainty, but I think it’s important to start the call by reviewing a few of the accomplishments of what was a very strong year. Net revenue grew by over 10% and exceeded $1 billion for the first time in our history. We passed the 15,000 homes sold milestone. Factory-built housing gross margin as a percentage of net revenue expanded by over 0.5% contributing to record segment operating income.

We acquired and integrated Destiny Homes, which is a strong contributor to our results. Financial services gross profit grew by over 5% despite significant allowances in non-cash charges at the end of the year due to the crisis. And at $75 million, our net income grew 9.4%.

Again, these are just a few of the milestones and accomplishments in a year that until March it was marked by growing demand and positive trends in all of our market. The fourth quarter did become defined by the COVID-19 developments. We reacted quickly by focusing on our employees and our customer. Homebuilding was designated as an essential service in all of the geographies we operate within, which provided us the opportunity to continue operations.

We committed to finding ways to operate safely with the goal of providing continued employment and benefits for our people and to meet our commitments to our customers. We developed leave policies to support employees that faced hardship due to the virus and we resolved to implement the CDC guidelines to manage the possibility of transmission within our facilities.

Our Financial Services operations quickly transitioned to working from home, and they did a remarkable job continuing to support customers. Our plants experienced episodic downtime due to a variety of COVID related causes. The vast majority of that downtime occurred in April after the year-end. While it fluctuated on a daily basis for a period of time, we peaked at six of our 20 plants down. The most days down for a week occurred in early April when we did not run 25% of the possible plant operating days.

However, for the second half of April, the typical downtime was closer to 5%, or said a different way, about one out of our 20 plants at any given point in time. Over the last couple of weeks, all of our plants have been operating for the most part.

In addition to the plant downtime, we experienced elevated absenteeism late — from late March through early May that contributed to reduced production efficiency. For the most part, absenteeism is back to pre-COVID levels and our plants are quickly returning to full run rates.

“I’m going to take a minute and comment about Lexington. Unfortunately, we had to make the very difficult decision to cease the operations at our Lexington, Mississippi plant. Cavco purchased this operation in 2017. Since the acquisition, we’ve struggled to get the operation up to the expected level of performance. In particular, we’ve not been able to establish the product positioning in that region that’s needed to improve the plant’s distribution network as planned.

These challenges were compounded by the drop-off in orders due to COVID-19, and ultimately, the uncertainty about the timing of recovery. We’re currently operating the plant to deliver on pre-existing orders in support of our independent dealers. The plant will be closed by the end of June.”

Shifting back to the total manufactured housing business, reduced production roughly matched the decline in orders, resulting in relatively unchanged backlogs. Those backlogs remain at healthy levels. There were few order cancellations. However some orders were put on hold, mostly by large community operators. Communities, which had been driving much of the manufactured housing industry demand growth in recent periods, slowed orders starting in March.

Street dealer business has remained surprisingly robust during the period-to-date. In our retail operation, traffic, which includes e-leads and phone inquiries as well as walk-ins initially dropped by over 50%. However, traffic has improved to near pre-COVID levels. As has been reported elsewhere, conversion rates in the sales process have been high, resulting in retail sales recently exceeding pre-COVID and year-over-year levels despite the reduced traffic.

In line with these retail results, plant orders have been trending up since the second half of April and they’ve currently surpassed February levels. Clearly, there was a lot of momentum going into the pandemic, after an initial shock, the reduced activity from mid-March through mid-April, it’s been really encouraging to observe that people who were actively seeking a home before have largely continued on with the process and are placing orders.

What is less clear is the extent to which the pipeline is reselling with new buyers entering the process. Each week, we’re more convinced that the demand is replenishing. Time will tell whether the positive order trends we’re seeing now will be sustained. That will depend largely on macroeconomic drivers such as employment and consumer confidence as well as the supportive lending environment.

Given the lack of visibility in these drivers, we’re spending less time and attention on specific forecasts and predictions and more on remaining flexible and ready to react to various scenarios. I’m extremely proud of the way the people who are at Cavco delivered a year of growth and record-breaking results and then responded so positively to the disruption as our fiscal year came to a close.

Through the COVID-19 challenges, people throughout the company has stayed focused and flexible and have demonstrated a tremendous amount of commitment for our important work of providing affordable homes. The virus did not wipe away the country’s deficit of affordable housing and associated pent-up demand. Sitting where we are today, we can’t reliably predict when that demand will translate into orders, but indications at the moment are positive.

From a business perspective, we’re responding to the uncertainty by focusing on costs and cash flow, and remaining ready regardless of the market scenario. Our balance sheet and demonstrated ability to flex our cost structure to market conditions affords us the ability to continue making decisions for the long term, while managing the urgency demanded by the COVID-19 crisis.

With that, I’ll turn it over to Dan Urness to review the financial results.

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Thank you, Bill. Net revenue for the fourth fiscal quarter of 2020 was $255 million, up 5.9% compared to $241 million during the prior year’s fourth fiscal quarter. Within the factory-built housing segment, net revenue increased approximately 7% to $241 million from $226 million in the prior year quarter.

Improvement in the factory-built housing segment was from a 4% increase in units sold largely from the addition of the Destiny Homes factory earlier in the fiscal year and a 3% increase in average revenue per home sold, primarily from changes in product mix toward more multi-section homes. Home shipments and related net revenue slowed in the latter part of the quarter from operational challenges presented by COVID-19.

Financial Services segment net revenue decreased nearly 7%, mainly the result of a $2 million unrealized loss on equity investments in the insurance subsidiaries portfolio versus the prior year period which included $600,000 in unrealized gains. Excluding those unrealized gains and losses, revenue for the fourth quarter increased from higher home sales — home loan sales volume and more insurance policies in force compared to the prior year.

Consolidated gross profit in the fourth fiscal quarter, as a percentage of net revenue was 20.3% down from 23.1% in the same period last year. This decline is mainly the result of challenges in both of the Company’s operating segments related to COVID-19 and changes in financial markets. The largest impact was in the Financial Services segment as the Company increased its loan loss reserves, primarily from adverse effects the pandemic is expected to have on borrower loan payments, and recorded negative accounting impacts of interest rate locked and forward loan sale commitments used as part of our lending operations.

In addition, there is a high — there was higher insurance claim volume than the same quarter last year. And, as discussed above, unrealized losses were incurred in the Financial Services Equity portfolio.

In the factory-built housing segment, adverse impacts included idle days at some factories, while payroll and certain other costs continued and substantial home assembly inefficiency in the final part of the quarter related to implementing COVID-19 working guidelines in our factory setting and general disruption of the construction material supply chain.

Selling, general and administrative expenses in the fiscal 2020 fourth quarter, as a percentage of net revenue, was 14.7% compared to 13.1% during the same quarter last year. The increase was primarily from additional employee-related costs, including stock compensation as well as higher general and administrative expenses.

Income before income taxes this quarter also included an unrealized loss of $2.1 million on corporate equity investments versus $700,000 in unrealized gains in the prior year quarter. The current year period also has lower interest income earned on cash resulting from reduced interest rates.

The effective income tax rate was 12% for the fourth fiscal quarter compared to 23.4% in the same period last year. The current quarter included a $1.7 million benefit related to tax benefits from stock option exercises versus a $200,000 benefit in the prior year quarter.

Net income was $12 million, down 40% compared to net income of $20 million in the same quarter of the prior year. Net income per diluted share this quarter was $1.29 versus $2.17 in last year’s fourth quarter. Comparing the March 28th, 2020 balance sheet to March 30th, 2019 last year, the cash balance was nearly $242 million, up from $187 million a year earlier. The increases from net income and changes in working capital, partially offset by the repurchase of securitization bonds and cash paid for the Destiny Homes acquisition.

Inventories were lower from a reduction in the number of homes at our company-owned retail locations compared to last year. Property, plant and equipment, goodwill, and other intangible balances increased from the Destiny Homes’ purchase. Property, plant and equipment also increased from the completion of a like-kind exchange whereby the company obtained commercial real estate in Phoenix for potential future plant site.

Certain balance sheet line items were affected by the new lease accounting standard, which was implemented at the beginning of this fiscal year. As a reminder, this accounting standard requires that all leases be recorded on the balance sheet. The current portion of the securitized financings and other declined from the repurchase of securitization debt in August of 2019.

And lastly, stockholders’ equity was approximately $608 million as of March 28th, 2020, up approximately $78 million from the March 30th, 2019 balance.

So that completes the financial report.

Thank you, Dan. Dimitris, let’s turn it over for questions.

Questions and Answers:

Operator

[Operator Instructions] And our first question comes from Daniel Moore with CJS Securities. You may proceed.

Daniel Moore — CJS Securities, Inc. — Analyst

Bill, Dan, good morning. Thanks for taking the questions. Wanted to start with sales orders down about 40% for April now trending, I guess down 20%-ish. Are those seasonally adjusted? In other words are those — what does the orders look like on a year-over-year basis thus far quarter-to-date? And, I think you gave us some detail, Bill, in terms of shipments, but similar question for shipments, where are we sort of quarter-to-date at this point?

William C. Boor — President and Chief Executive Officer

So, let me just, I guess, start with one part of that where — you’re talking about the fiscal quarter or since the fiscal quarter Dan?

Daniel Moore — CJS Securities, Inc. — Analyst

The description of sales orders was essentially since pre COVID levels, I’m just trying to get a sense on a year-over-year basis for fiscal Q1, kind of where — how we are trending year-over-year for sales orders as well as shipments quarter-to date?

William C. Boor — President and Chief Executive Officer

Okay, got it. Yeah, year-over-year for the quarter both up and I’m not sure if there is any specific component you’re looking for in there, but certainly both higher.

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Dan, I might be — I might be lost. You quoted some numbers there at the beginning of your question, could you repeat that because…

Daniel Moore — CJS Securities, Inc. — Analyst

Sales orders, you told us what they were quarter-to-date so far on a sequential — essentially since pre-COVID levels, but I’m just trying to make sure that — understand what they look like year-over-year, that’s all. Sales orders as well as shipments.

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Trying to look back at what we commented on and seeing what you’re picking up. So, yeah you’re saying that we were — we dropped in the middle of, kind of the pandemic, if you will, down 40% and then we are up to — back 20% around mid-May and that’s compared to pre-pandemic levels. It’s not compared to say a year ago, it’s not compared to the end of December sequentially. When we say those numbers, we’re comparing to kind of a shortened period of time that we call pre-pandemic levels and that’s roughly a few weeks leading up to the first week or so in March.

Daniel Moore — CJS Securities, Inc. — Analyst

Understood. So, do you have more detail on a year-over-year basis, how we are trending thus far in the quarter versus say the first half of first quarter last year. If not I’ll move-out?

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Oh, I see what you’re saying. Yeah, OK, so we’re looking at the seasonal impact there as well. We don’t have those numbers in order to compare. We’ve really been able to compare against the — and see kind of where we’re at to give you some sense of how the quarter shaping up on a sequential basis.

You know year-over-year, I would say we’re flat to probably down still because you got to take the seasonal impact into account and we’re not — we should be obviously higher now than where we were pre-pandemic just because of the seasonality that is normally in place this time of year. We get a bump in March, April, May timeframe and we’re not at those levels yet like we were last year.

William C. Boor — President and Chief Executive Officer

One of the challenges Dan, is that it’s difficult because we want to help with the question. One of the challenges we’re facing is literally the weeks are highly variable. So to be just a few weeks into the period and kind of be able to give a really clear answer, even in our own minds is a little bit of a challenge because things are bouncing so much. So we’ve definitely seen an upward trend.

We’ve been focused, as Dan said, more on the late February to mid-March timeframe as a baseline and we’re kind of encouraged by the upward trend. But I think to your point, if you looked at it on a seasonally adjusted basis, we’d still be down.

Daniel Moore — CJS Securities, Inc. — Analyst

Right. I’m assuming April was down somewhere in the, you know 40%, 50% range, just trying to get a sense there, but I’ll move on. In terms of where are you today as far as operating capacity, if you took Lexington out of the mix. Are we — it sounded like you’re almost back, if not fully back to pre-COVID levels, is that correct and what kind of impact does social distancing have on operating capacity at this stage?

William C. Boor — President and Chief Executive Officer

It’s definitely had an impact, I would say. My sense is that it’s — the social distancing and the guidelines we’ve implemented in our plants has been a challenge, but probably less of an impact on productivity during the month of April than just absenteeism. We had elevated levels of absenteeism and we had relax policies in that area, just out of consideration of the situation. So I would — I would personally say the CDC guidelines are a factor, but I don’t think they’re a huge factor in efficiency.

And yeah, my comments — it’s a generalization where every plant kind of has its own story. But I feel like most of our plants are really getting right back to full run rate. We’ve got a couple that are lagging a little bit that happen to be struggling getting back to full absenteeism — or lower absenteeism, kind of more typical. But the general statement would be, we’re kind of right back at, able to run as hard as we could before.

And I don’t think the social distancing is a big enough factor to kind of enter into that discussion too much. [Speech Overlap] Our folks have done really a good job of some meaningful changes to how they operate, but doing it in a way that when they have other folks in the plant, they can run pretty well.

Daniel Moore — CJS Securities, Inc. — Analyst

Got it, OK. And then maybe just some detail on geographies, starting with Texas. How are traffic order and traffic trends currently into mid-May in light of the recent sharp declines in oil prices, are you seeing an impact there? And then other regions Florida, Southeast-Southwest, et cetera. Just kind of walk us through region by region what you’re seeing, if there’s much differentials?

William C. Boor — President and Chief Executive Officer

Yeah, I can comment and maybe Dan can add to it. Texas has been pretty strong. Everyone saw kind of an impact from an initial — kind of the shock factor of what went on late March, early April. So that was just disruptive everywhere. But Texas they’ve — from a production perspective, we’ve been pretty steady there and from a demand perspective, what we’ve seen is pretty strong orders. In fact in recent weeks, they’ve been a little bit of both, that pre-COVID based period that we’ve talked about.

So we’ve been really encouraged by — we’ve wondered about and talked a lot internally about the oil field impact and the truth is that we’re probably a little less exposed to that than kind of the overall industry. In Texas, we probably are skewed a little bit to the upper range of product in manufactured housing and so we haven’t felt like it’s been a huge impact on our results in Texas.

But I think from an industry perspective, you’d have to expect that it will have an impact or has. Other regions, they’re all going to be in between the bookmarks of Texas and Florida. Florida, you might remember, even when we are — even when COVID was ahead of us all and we didn’t really have any idea what we are getting ourselves into as a society, we were already talking in these calls and otherwise that if you had to look at an area and say we got to keep our eye on that, it was Florida. And that’s been true during the — during this experience as well.

Florida has definitely been the geography of most concern. For us — here I’m going to say the opposite of Texas, we probably skew a little bit extra exposure to communities and communities have dropped off more significantly than street dealerships. And I think that’s a general statement, but it’s very true in Florida. So we definitely have felt the impact there and orders have been significantly down.

But when I’ve looked at the trends, we were just looking at it in preparation for the call and some of the trends in Florida on orders are that they are coming back up. So I don’t know where that’s going to settle, but that’s been the most challenging geography for us. And not to kind of plans over it, but I would say all the other regions lie somewhere in between.

That community impact that I mentioned relative to Florida is an important general comment about the market. The community operators, particularly the big community operators reacted very quickly and put a lot of orders on hold. And so we’ve definitely seen a difference between the reaction or impact on community orders compared to street dealerships where street dealers, I think have probably been surprisingly, I wouldn’t say steady, but surprisingly relatively strong.

If you had told me what the industry was going to face as far as just the pandemic, I guess I would have expected street dealers to fall off much more than they did. I guess that’s the way to say it. So there’s really a difference between the impact on community orders and street orders. And I’ll just close off that slide, I mentioned a lot of communities put orders on hold, we saw — we saw pretty few cancellations of orders, but a significant amount that were put on hold, and time will tell whether those folks see clear as things unfold here in the coming weeks and months to release those orders or not.

We take them — Dan, you can confirm this, we take those hold orders out of our backlog when we make comments about backlog.

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

That’s right.

William C. Boor — President and Chief Executive Officer

So, I mean that’s encouraging if those orders do come through here in the next little bit.

Daniel Moore — CJS Securities, Inc. — Analyst

That’s great color, Bill. Just any sense, order of magnitude, how much of — relative to the size of backlog, how big those orders on hold could be?

William C. Boor — President and Chief Executive Officer

Do you have a feel for that?

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Yeah, I mean, it’s a — it’s not a very — a real large amount. We don’t have the number, Dan. It’s a little bit fluid but it would be — it would be addition to also the backlog in a meaningful way if we got those orders back in and counted, but they haven’t. It’s not large enough that we called it out separately.

Daniel Moore — CJS Securities, Inc. — Analyst

Not a 2 times or anything. Okay. I’ll jump back in queue. Thank you. That’s very helpful.

William C. Boor — President and Chief Executive Officer

Thanks Dan.

Operator

[Operator Instructions] And our next question comes from Chris Sansone with Sansone Advisors. You may proceed.

Chris Sansone — Sansone Advisors — Analyst

Hi guys, good morning.

William C. Boor — President and Chief Executive Officer

Good morning.

Chris Sansone — Sansone Advisors — Analyst

Couple of general questions from me. I guess the first one is, what should you think the long-term growth rate if we were just to exclude COVID-19, what do you think the long-term growth rate should be for your business and for Cavco? And then separately, to try to understand the SG&A, it was up this year over last year. What do you think the right SG&A level should be? I know there variable costs in the business, so should SG&A as a percentage of revenue look more like it did in the last fiscal year than this fiscal year? Thanks.

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Well, maybe I’ll take the first one and then — sorry, the last one and Bill can take the first one. [Speech Overlap] talk about the last question, which was SG&A. But yes, we had higher SG&A this quarter due to a number of factors, which included higher stock compensation expense and that was a meaningful comparison difference. So we want to make sure we called that out, and then of course other employee-related costs, including commission expense from the higher home sales volume.

So our numbers go up in SG&A with higher volume, given the commission based and variable nature of the sales component there, but we also had higher G&A costs in various categories. And they’ll be higher going forward as the business continues to grow. But I would say that administrative costs can vary quarter to quarter. So we certainly saw some of that this quarter compared to last comparison.

William C. Boor — President and Chief Executive Officer

So the thing, you need to comment on. I hate to be the one to throw this into the discussion, but I think it’s relevant to the SG&A, you might comment on the SEC-type expenses that are driver there, right?

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Yeah, we’ve got that included this quarter as well. And so that’s a very good point because, while we have mainly administrative costs going on with respect to the SEC investigation, at some point those will drop off. We certainly don’t know when that is. But then we have large D&O expenses that you may have seen that are running through that line item as well, $2.1 million per quarter. And that was, again, this quarter and that will continue through the first half of this coming fiscal year. So that’s another drop-off that we would expect to see as the year progresses.

William C. Boor — President and Chief Executive Officer

Yeah, bringing that up because Chris it’s clear you’re trying to think about a long-term run rate, and those would be kind of, I think, extraordinary costs that should be out of there at some point. And to your first question, I think Dan and I were looking at each other like it was, I have to tell you, because it’s hard to pull ourselves out of the current situation and think about long-term growth rates if COVID didn’t exist.

I guess — I feel like I’m going to give you a less satisfactory answer, but if you did put yourself before this thing or remember what it felt like in this industry before COVID-19, the demographics are so compelling and we were seeing that in our growth rates for the year. I mean when we see our revenue grow at the levels it was growing this last fiscal year, we didn’t see that, we saw a lot more runway with those kind of growth rates, because of the demographics. So I don’t have a number for you, I commented very subtly in my opening comments that COVID-19 didn’t wipe away the deficit of affordable housing, we’re just hearing a lot less about it right now.

So I think this industry and certainly Cavco has the opportunity for continuing strong growth and it’s just a matter of how quickly we’ll get back to that. So apologize for not having a specific number for you, but I think there is reason to be pretty optimistic by — driven by those long-term demand drivers.

Chris Sansone — Sansone Advisors — Analyst

Okay, great. And then the last question, I know Cavco has historically had a lot of cash in the balance sheet, what are your thoughts on Dividends, returning some of that capital to shareholders? Thanks.

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Yeah it’s definitely something that we’re doing a lot of thinking about I guess when we — and it’s been an active discussion over time and I think we recognize the perspective that people have about us needing to do a good job in general on capital allocation or managing the balance sheet.

So the point is — I want to assure you, the point is not lost on us. I think as we hit the COVID-19 situation, even though we have a pretty good cash balance and we remain cash positive, which is an important statement as well, we kind of did mentally put those somewhat on hold and say now is not the time to be — now is the time to be focused on cash flow and focused on having a cushion. So I guess this did slow the thinking down a little bit there. But we get the point and have been doing a lot of thinking about capital allocation here.

Chris Sansone — Sansone Advisors — Analyst

Great, thank you.

Operator

And our next question comes from Ian Lapey with Gabelli Funds. You may proceed.

Ian Lapey — Gabelli Global Financial Services Fund — Analyst

Hey Bill and Dan, congrats on a record year. Two questions. First is on the equity unrealized losses, maybe you could differentiate, so the $2 million in the insurance portfolio, I assume that would mostly come back with the market’s recovering. But then on the corporate equity investments, would those also recover or were those more impairments because I believe that relates to community investments and communities.

And then the second question, broader question, what’s happening with pricing and as you obviously are incurring costs for absenteeism and social distancing networks in production. Are you able to recapture some of that with pricing or do you think you will be so that if you look out the next couple of years, margins will be at similar rates to what they have been the last couple of years?

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Okay. Hey Ian, good morning. This is Dan. And yeah, let me just help clarify a little bit on the unrealized losses we experienced this quarter. We had them in two categories, as you mentioned, and both are related to stock market conditions entirely. So there is no impairments that are part of those numbers. And as equity markets recover, we would expect those would recover as well.

The first piece is the unrealized gain on the equity investments in the Financial Services segment and that runs through the revenue line. That was a $2 million unrealized loss this quarter and then the $2.1 million, similar dollar amount was in other income related to corporate equity investments, but none of those are impairment type situations as you mentioned.

Ian Lapey — Gabelli Global Financial Services Fund — Analyst

Okay, good.

William C. Boor — President and Chief Executive Officer

Hi, Ian.

Ian Lapey — Gabelli Global Financial Services Fund — Analyst

Hey Bill.

William C. Boor — President and Chief Executive Officer

You know the pricing question is an interesting one. I think I can say that so far through this experience, we haven’t seen a lot of movement on price, so it hasn’t been heavy pressure to the downside or anything like that. The question about whether we can recover some of the costs that we’ve had, I think it’s really more a question of whether the current positive trend in orders sustains itself, because if — if we really do see orders get back to a level where you’re trying to say, well, they haven’t been that if — we got through the bump and now it’s as if orders are where they would have been were it not for COVID-19, then I don’t think there’ll be any pressure on prices whatsoever.

If we see those orders turned down, it stands to reason that we run a risk of just pricing pressure or pricing competition in the industry. So I certainly think about it more on that side than us being able to push through price increases to recover costs. Our focus hasn’t been on that at this moment.

But the positive is that orders are — for the moment, and I’m going to tell you everything is painted by the week-to-week right now. For the moment, we feel like orders are trending up and it gives us some — some level or room for optimism. If communities come back and release some of those holds and dealer orders continue up, I don’t think there — I wouldn’t expect there to be a lot of price pressure in the industry.

Ian Lapey — Gabelli Global Financial Services Fund — Analyst

Thank you.

Operator

And our next question comes from Greg Palm with Craig-Hallum Capital. You may proceed.

Greg Palm — Craig-Hallum Capital Group — Analyst

Craig-Hallum Capital Group, thanks for taking the questions. Hope you are doing well. Thanks for all the sort of color on intra-quarter type order trends. Bill, I just wanted to sort of go back and start off, just clarify something that you’d said. I think you had mentioned that sales or orders and I don’t know if you had mentioned it was retail or companywide, have already surpassed February levels or the sort of pre-COVID timeframe. Can you just repeat or clarify what you said there? I just wanted to make sure I got it right?

William C. Boor — President and Chief Executive Officer

Yeah, I appreciate you asking for the clarification because it’s important to make sure that people understood what I was referring to. I was referring to our retail organization sales. And people need to keep in mind that we’re largely Texas oriented for our retail business. So it kind of — it dovetails into the discussion with Dan earlier that Texas has been a relative strong area.

But our retail, our company-owned retail operation, again week-to-week information, but they exceeded pre-COVID orders written here in the last couple of weeks. And so that was the comment, it shouldn’t be taken out of light but — or out of context. But that was what I was referring to.

Greg Palm — Craig-Hallum Capital Group — Analyst

Yeah, OK. That’s an interesting data point. And sort of thinking about this call it mid-May timeframe as a reference point, can you talk about how the last sort of 10 days or two weeks have been. I mean, I think a lot of the color you gave was up until mid-May but how have — whether its traffic or order rates, companywide, how have they trended just in the last couple of weeks alone?

William C. Boor — President and Chief Executive Officer

Yeah, I think that’s really the distinction we’ve been trying to and I know it’s not crystal clear, we’ve been trying to make it — these last several weeks from, call it early to mid-May may be, the trend has been upward. So looking at that from both a company-owned retail orders written as well as our plant orders, the trend has been definitely upward and approaching those pre-COVID levels overall.

Greg Palm — Craig-Hallum Capital Group — Analyst

Okay. So it’s continued to trend upward companywide. And then, I may have missed it, but did you give an actual capacity utilization number where we stand today. Was it the 75% that was referenced in the release or was that referencing something else?

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Yeah, it’s — no, it’s referencing the 75% that was in the release. That’s the best estimate. Hard to get too specific on that but we want to kind of give you the range where it had been kind of at the lowest points up toward it’s been running more recently here.

Greg Palm — Craig-Hallum Capital Group — Analyst

Okay, got it.

William C. Boor — President and Chief Executive Officer

And Greg, that kind of dovetails with — we’re giving you kind of the same information in different ways. I guess sometimes. I threw in the point that in the second half of April or early May we were down about 5% of the possible plant operating days. And that’s roughly one out of our 20 plants. And I think that’s pretty much in line with that 70% number.

Greg Palm — Craig-Hallum Capital Group — Analyst

Yeah. So I mean it’s fair to — so production rates today relative to — and I’m talking companywide, but production rates today relative to pre-COVID are maybe only down like mid-single digits. Is that sort of the right way to think about it?

William C. Boor — President and Chief Executive Officer

Yeah, I don’t know if I’ve got the number because like I said, it’s a moving thing. But I think you’re in the right range because we have definitely shifted our focus back to evaluating productivity and trying to get back to those rates. And for the most part our system is really approaching those run rates.

Greg Palm — Craig-Hallum Capital Group — Analyst

Yeah, OK. And then, noticed that capex was unusually high in the quarter. Was that associated with a new plan or something else?

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Yeah, that was associated with that commercial real estate comment I had in my — in my remarks that we did a like kind of exchange and obtained some commercial real estate property for about $6 million of that number. So that is a bit of a stand out in the quarter, yeah.

Greg Palm — Craig-Hallum Capital Group — Analyst

Okay. And then, what are expectations for the next fiscal year for capex?

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

This, I think, would be something that we’ll continue to keep at these levels, around $8 million to $10 million potentially higher as we continue to reinvest, but we’re not slowing down in our initiatives to reinvest and it could be higher depending on what kind of initiatives that we finally engage in. But no slowdown in the maintenance capex or the efficiency improvement capex and probably an increase.

Greg Palm — Craig-Hallum Capital Group — Analyst

Understood. Okay, I’ll leave it there. Thanks for all the color.

William C. Boor — President and Chief Executive Officer

Hey, Greg. I might be — I might be wise just leave it alone. I’m just trying to help everyone tie things together and I may complicate it instead, so Dan can help. That purchase of land, as Dan said, was kind of half of like-kind exchange and the sale of the land that we had earlier in the year kind of offsets that. So if you look at it on a total year basis, it’s kind of neutral from a cash perspective, I would say or maybe — would you say neutral?

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Yeah, relatively neutral from a cash perspective [Speech Overlap].

William C. Boor — President and Chief Executive Officer

Yeah, but it inflated that capital number, particularly for this quarter because you’re just seeing the purchase side of that exchange.

Greg Palm — Craig-Hallum Capital Group — Analyst

Yeah, totally makes sense. Okay, thanks for — thanks again, for the color.

William C. Boor — President and Chief Executive Officer

Thank you.

Operator

Ladies and gentlemen, this concludes the Q&A portion of today’s conference.

William C. Boor — President and Chief Executive Officer

Yeah, let me just make a comment here as we close out. The experience of the last few months has certainly demonstrated the flexibility, the commitment, the can-do attitude of our people. Our Financial Services operations transitioned to work from home without missing a beat while at a time when customer needs peaked. They were dealing with a lot of inbound calls from customers looking for relief on payments, for example, on top of a pretty active market around — due to the low interest rates.

So while their demands were going up, they made a complete operating transition, which I thought was very impressive. As walk in traffic dropped off, our retail organization shifted gears very quickly to a focus on phone and electronic communications and by doing that, they were able to remain available to prospective homeowners who continued to need assistance figuring out the right home to buy. And as we’ve talked, our operations certainly rose to the challenge of adjusting practices, so they could continue safely building desperately needed affordable homes.

Aside from getting homes to deserving families, I think the efforts of our manufacturing people have made a big contribution to keeping small independent dealers in business and that was something we are concerned about going into this experience and we thought it was important to keep the supply of homes, that’s really their life blood flowing. So I feel great about that, our dealers, our partners and they’ve been front of mind for us throughout this.

So while the uncertainty certainly persists, we have every reason to expect continuing challenges, but our employees certainly has given us great confidence and Cavco will be up for it and we’ll continue our important work. So with that, we certainly want to thank everyone for your interest in Cavco and we hope that you and your family stay healthy and safe.

Thanks everyone.

Operator

Pardon me. We have a follow-up question. Can we take this last question?

William C. Boor — President and Chief Executive Officer

Sure.

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Yes, happy to. Yeah.

Operator

Okay. We have a follow-up question from Daniel Moore and you’re free to ask your question sir.

Daniel Moore — CJS Securities, Inc. — Analyst

Sorry to make it bank anticlimactic gentlemen, but I appreciate the extra moment here.

William C. Boor — President and Chief Executive Officer

That was a big finish.

Daniel Moore — CJS Securities, Inc. — Analyst

Exactly, exactly. I guess just looking forward, any comments Dan, gross margin presumably likely to trend a little lower sequentially from fiscal Q4 into Q1 just giving lower absorption to start the quarter, is that the right kind of thought process if — and I’ll start with that.

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Yeah. And thinking about our gross margins there, largely going to be impacted by what we see with material prices as much as what we see with respect to the inefficiencies related to COVID-19. The latter, we continue to get more and more under control, minimizing those impacts on efficiencies, as Bill mentioned earlier in the commentary, and the ongoing planning and logistical efforts with our suppliers certainly helps as well. So that’s been a very good development.

Absenteeism, as you mentioned, has been improving. So all those things are going in the right direction. The variability with the material prices has certainly been relevant. And obviously we can’t predict that, they’ve been increasing more so lately relatively low for the bulk of obviously, fiscal year 2020 which we just reported on. But during this time period, whether — for various reasons, they’ve — they dropped early but then they’ve been spiking again lately.

So I think there is some margin pressure there to be certain but part of it, I think, we’ll be able to control and improve on and then part of it will still be pretty subjective.

Daniel Moore — CJS Securities, Inc. — Analyst

Got it. And then the other one I wanted to — string I wanted to pull on was just mix, pretty impressively favorable given the environment. I guess where geographically — is it Texas where you’re seeing higher ASPs and more multi-floor homes or is that spread across the board. And is that the trend that’s likely to continue?

William C. Boor — President and Chief Executive Officer

Yeah, little hard to pick out a trend right now given that there’s so much movement in the marketplace. We did have our continuation of a trend that we had been seeing this quarter, which was higher multi-section homes as a percentage and proportion of our overall mix. But where that goes going forward, we’ve got initiatives under way really in both areas whether it’d be single section and multi-section.

I think that we will flex accordingly and then overall be watching to see if there is an overall push toward lower price points, that’s been — for what it’s worth been the experience in past downturns, if we do happen to see a downturn, we’d see a push toward lower average sales prices, that would mean more single section homes, smaller and smaller square footage and lower priced multi-section homes, but a little hard to tell at this point.

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Yeah, I think just to closeout out on that. I think from an industry perspective, it would be a really — may be counterintuitive, it would be, in my opinion a positive sign if we saw single sections kind of increase dramatically. And if we all set back and looked at the past period, and said, geez the mix has shifted to single sections.

If that happens, because of the volume of single sections is up and not that the volume of multi-sections is down that indicates that those entry level buyers are doing well. That’s a good sign about the economy, and I think it would be a positive about the industry, even if we saw a shift to the single sections on a proportionate basis and accommodating ASP drop.

So it’s all how that shift comes about I guess if we see a move toward single cells or single units. And it’s because multi dropped, that’s one thing. But if it’s because single volume came up that would be a great sign in my opinion.

Daniel Moore — CJS Securities, Inc. — Analyst

Got it. Thank you again.

William C. Boor — President and Chief Executive Officer

Okay. Thanks for your last question, Dan?

Daniel Moore — CJS Securities, Inc. — Analyst

Yeah.

William C. Boor — President and Chief Executive Officer

So I’ll say again, I really appreciate everyone’s interest and for your time today, and hope everyone has a great day.

Operator

[Operator Closing Remarks]

Duration: 52 minutes

Call participants:

Mark Fusler — Director of Financial Reporting and Investor Relations

William C. Boor — President and Chief Executive Officer

Daniel L. Urness — Executive Vice President, Chief Financial Officer and Treasurer

Daniel Moore — CJS Securities, Inc. — Analyst

Chris Sansone — Sansone Advisors — Analyst

Ian Lapey — Gabelli Global Financial Services Fund — Analyst

Greg Palm — Craig-Hallum Capital Group – Analyst

##

Disclosures by Motley Fool: “This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript… Motley Fool Transcribers has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

###

MHProNews Summary, Conclusion and Programing Notice

A prima facie argument can be made of problematic behavior by Cavco’s leadership, before or following the SEC supboena to Joe Stegmayer and Cavco Industries. In no particular order of importance are these questions and concerns.

- Stegmayer continued on as MHI’s chairman of the board until his term expired, even following the SEC subpoena. That should be a red flag to regulators, investors and others who ponder how MHI operates in the wake of scandalous or controversial behavior.

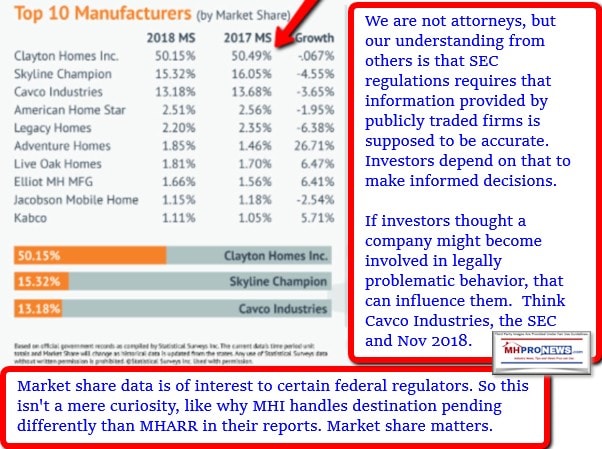

- Cavco’s own leaders and documents have made the point that M&A – mergers and aquistions or ‘consolidation’ – are an important part of their corporate plan. That echoes something that fellow MHI member Skyline Champion has said.

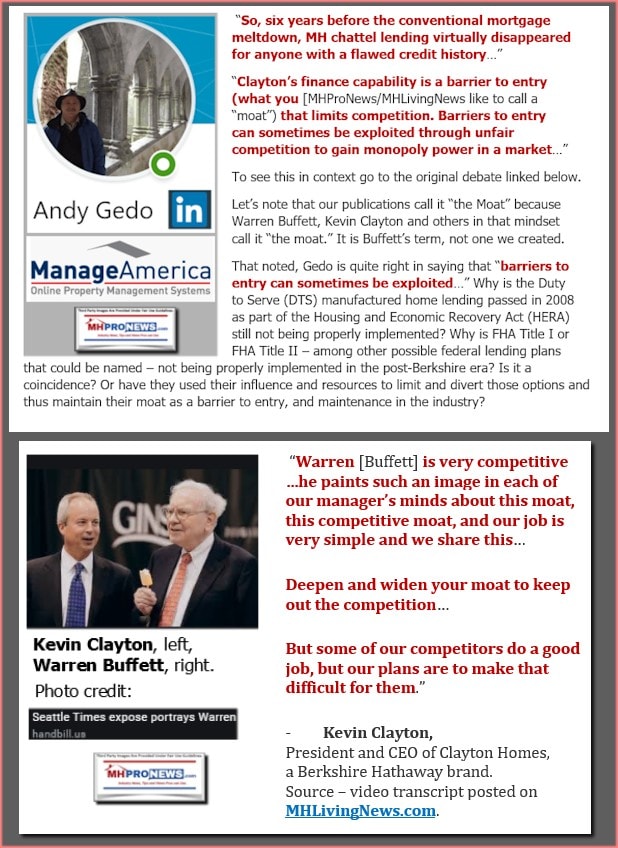

- But that consolidation focus has clearly come at a cost to other things that should have ranked higher, namely, increased penetration of the broader housing market. How are purported misalignments of Cavco resources and focus to be understood? The answer is arguably found in the quotes above and below. They are prima facie examples of a monopolization ploy using an oligarchic methodology. It should be recalled that Stegmayer was a former Clayton division president. Are these coincidences or reasons for former investigation?

- Cavco made clear that financing is critical, a point that is almost universal agreed to in manufatured housing. As a big ticket sales item, not unlike conventional housing, cars, boats or RVs, there are reasons to focus on increasing financing. Cavco’s statements mirror that; which begs the question. Why did Cavco’s leaders join with MHI, Clayton Homes (BRK subsidiary) and Skyline Champion (SKY) in pushing a plan that was arguably flawed CrossModTM plan from the outset instead of promoting DTS for all manufactured homes, which is what the law was established for intially? Even if someone could make a plausible argument for the ‘new class of homes/ Fannie Mae’s MH Advantage®/Freddie Mac’s CHOICEHome℠/or what MHI now controversialy calls CrossModTM There are several proven rules of marketing that have been blatantly violated by Cavco and other MHI members. There are examples of statements that are apparently paltering, misinformation or outright falsehoods. All of these are legally questionable if not actionable.

- The data doesn’t lie. Decisions made by Cavco – among other noteable MHI member firms – have undermined independents. These should be red-flags for the SEC, Federal Trade Commission (FTC), antitrust regulators at the state and federal level, which could include the Department of Justice (DOJ).

Corporate leaders are supposed to act in the best interest of their stockholders. The Lexington Homes, DTS, CrossModTM and other decisions made by CVCO’s leadership should be seen through the prism of the 2018 SEC subpoena and the apparent history of an inordinate prima-facie focus on driving independents out of business. While they don’t say they are driving independents out of business, that is implied by focusing on M&A.

There is a planned follow up on issues raised by the Q4 2020 transcript above. Watch for it.

In conclusion, affordable housing has been a growing crisis for well over a decade. Cavco and other MHI publicly traded firms have agreed that the crisis exists. Yet they have failed to achieve even the historic levels of industry performance. Given the education and experience of these leaders, it is an outrageous data-point on its face. It mitigates for what their own statements have indicated. Namely, that they are focused on M&A. So much so, that eliminating independents – like Lexington Homes ?/! – is more important than addressing the affordable housing crisis, which would arguably make the most sense for investors for the short to midterm, if not the long-term too. It all begs for serious probes into MHI, Cavco, Clayton Homes and others.

Stay tuned for a follow up on Cavco that is planned. That’s a wrap on this installment of manufactured housing industry “News, Tips and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

/

“MHI Lies, Independent Businesses Die” © – True or False? – Berkshire’s Joanne Stevens Strikes Again