To set the legal context for the newest controversy involving Cavco Industries (NASDAQ:CVCO), a brief background of a top antitrust official’s statement is useful.

In one of several previously reported speeches, the June 11, 2019 “…And Justice for All…” address on Antitrust Enforcement by Assistant Attorney General Makan Delrahim indicated that the Antitrust Division of the Department of Justice (DOJ) is looking for “the potential for mischief” of acquisitions that have “the purpose and effect . . . to block potential competitors, protect a monopoly, or otherwise harm competition by reducing consumer choice, increasing prices, diminishing or slowing innovation, or reducing quality.”

True to Delrahim’s words, the DOJ and the Federal Trade Commission (FTC) challenged “actual and promised enforcement against [merger and acquisition] transactions that might fit the killer acquisition archetype, [but] critics argue that U.S. enforcement is not rigorous enough,” said a legal review posted by the Latham & Watkins (LW) firm, which includes as its specialties antitrust and competition law.

The article that LW cited was published by the American Bar Association (ABA), Antitrust, Volume 34, No. 2, Spring 2020 and was co-authored by Kelly Fayne and Kate Foreman. The duos brief bio in that article states, “Kelly Fayne is an associate in the San Francisco office of Latham & Watkins LLP, where she advises clients on government reviews of mergers and acquisitions, antitrust compliance and counseling, and government conduct investigations. Dr. Kate Foreman is a Senior Consultant in the San Francisco office of NERA Economic Consulting, where she consults on mergers and acquisitions in life sciences, tech, and energy.”

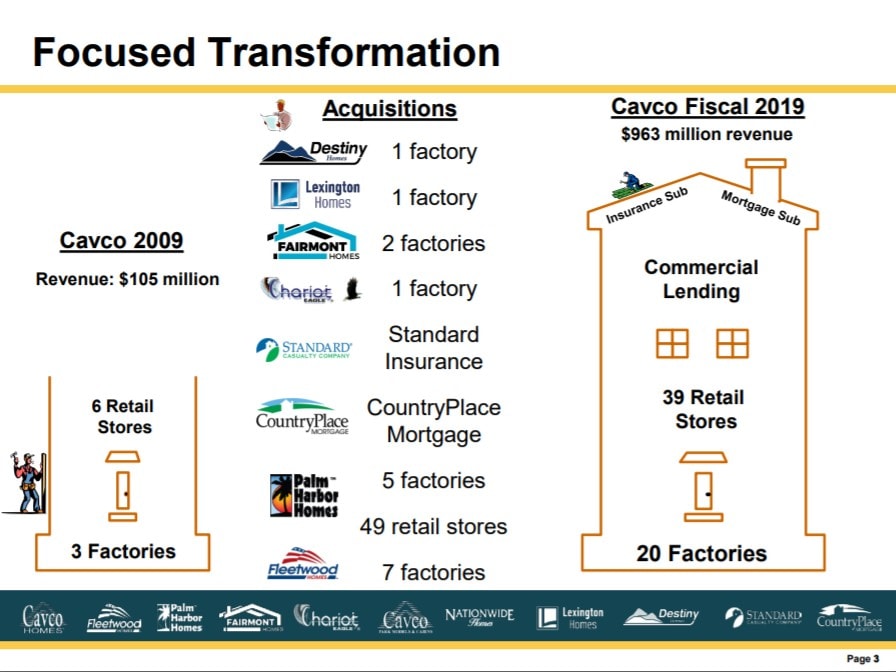

With that backdrop, in Cavco Industries most recent earnings call, corporate officials revealed the rather surprising announcement that Phoenix, AZ base Cavco was planning to close one of its more recent acquisitions, namely Lexington Homes.

The ‘read hot’ linked report above provided the full context. But these statements bear additional reflection in the light of the killer acquisition allegation.

In a formal media statement on April 4, 2017 Cavco said that “Cavco Industries Inc. (NASDAQ: CVCO) today announced its closing of the acquisition of Lexington Homes, Inc. (“Lexington”), which became effective on April 3, 2017.”

That same release said that “Lexington provides affordable manufactured housing from its manufacturing plant in Lexington, Mississippi to its retail distributors in the Southeastern United States.”

“We are pleased to welcome the Lexington business and employees as they join the Cavco group of companies,” said [then] Cavco Chairman, President and Chief Executive Officer, Joe Stegmayer. “Our combined operations will allow us to more fully serve Cavco’s existing customers in the Southeast and provide added resources to support Lexington’s customer base. The historically strong manufactured housing markets in Mississippi, Louisiana, Alabama and nearby states are generally improving and this acquisition enables Cavco to better participate in future growth potential.”

Since that time, Stegmayer stepped down from leadership at Cavco under the cloud of an SEC subpoena announced by the company on November 8, 2018. That release sent their stock plummeting and sparked a series of investigations by plaintiff’s attorneys on behalf of shareholders. ICYMI or as a reminder, one of the prior reports by MHProNews on that topic is linked below.

As transcript of their May 27, 2020 quarterly call revealed, that SEC investigation is still ongoing. So too are the legal and other costs associated with that matter. At a minimum, the matter raises concerns as to Cavco leadership willingness to ignore federal law. While they have brought on board new people designed to mollify concerns, issues such as this one arguably calls into question the sincerity of steps which mollify certain investors.

The point of Joe Stegmayer’s role as a prior chairman of the Manufactured Housing Institute (MHI) must not be ignored, for reasons that will become more evident below.

Returning to Cavco’s 4.4.2017 statement, it continued with the following.

“The purchase price, which was paid in cash at closing and funded with Cavco’s internal capital, was not disclosed. Lexington home products will continue to be marketed under the Lexington brand name and the current management team will remain with the company.”

More Details and Insights

Several messages and discussions about that report follows. Certain sources with clear ties to Cavco in managerial roles indicated that the firm brings financial benefits, along with greater buying power and other advantages to a new acquisition. That inside insight mirrors what the company itself has said.

Which begs the question? What went wrong in the case of Lexington Homes?

Before probing that, at least two more company statements ought to be examined. Note that statements by a publicly traded company are supposed to be true and accurate or they may be subject to various federal sanctions.

On March 28, 2017 Cavco Industries Inc. said that “The purchase of Lexington is expected to improve Cavco’s ability to participate in the growing Southeastern housing market, as well as better serve the needs of Lexington customers.” Statistically, that is sound. The Southeastern U.S. market is consistently strong for manufactured housing.

Fast forward to Cavco’s May 27, 2020 call transcript, per the Motley Fool.

William C. “Bill” Boor, President and Chief Executive Officer (CEO) said the following. “I’m going to take a minute and comment about Lexington [Homes]. Unfortunately, we had to make the very difficult decision to cease the operations at our Lexington, Mississippi plant. Cavco purchased this operation in 2017. Since the acquisition, we’ve struggled to get the operation up to the expected level of performance. In particular, we’ve not been able to establish the product positioning in that region that’s needed to improve the plant’s distribution network as planned.

These challenges were compounded by the drop-off in orders due to COVID-19, and ultimately, the uncertainty about the timing of recovery. We’re currently operating the plant to deliver on pre-existing orders in support of our independent dealers. The plant will be closed by the end of June.”

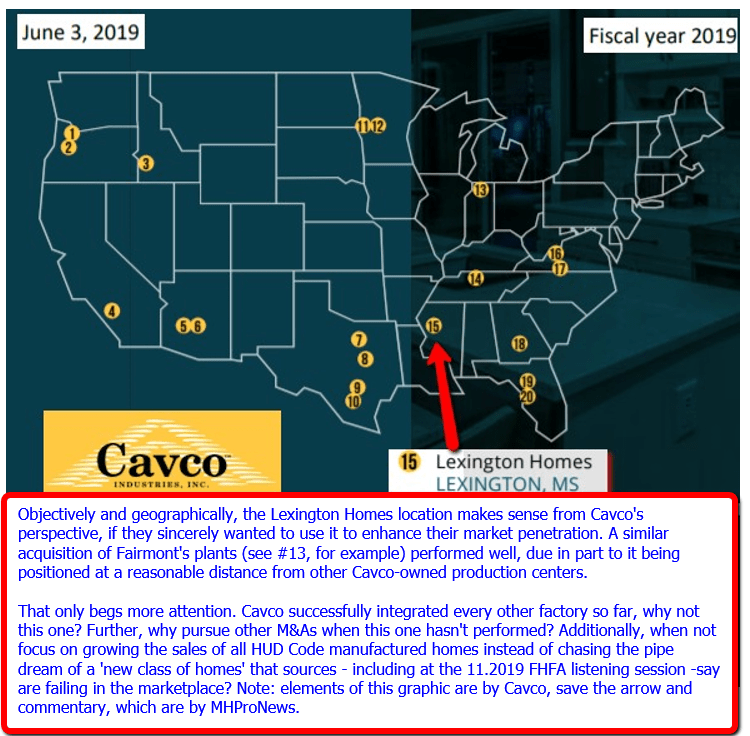

With that, step back to Cavco’s June 3, 2019 annual report to shareholders document. Their report included this map below. #15 is the location of Lexington Homes.

As MHProNews has previously reported, for those who understand the manufactured housing industry and the notion of vertical integration, the Lexington acquisition on paper made good sense from their investment perspective. Lexington’s location was clearly not close to other Cavco-owned production centers. So, hypothetically, Cavco stood to gain an advantage in market penetration due to shorter shipping distances, lower supply costs, lower total costs, and other possible marketing advantages.

“Killer Acquisition” – Cavco ‘Bought It to Close It’ Alleged

Certain industry sources have raised the allegation that Cavco bought Lexington Homes with an eye to close it. But why would they do so? One argument is that it would tend to undermine the Manufactured Housing Association for Regulatory Reform (MHARR), which is the chief rival of the Manufactured Housing Institute (MHI). When asked, MHARR has been mute on this topic. It should be noted that the Washington, D.C. based independent producer’s trade organization often doesn’t comment on members by name, past or present. So not too much should be read into that silence.

But the point is that MHARR has routinely taken very different stances than MHI, precisely to foster more competition that protects independent producers. Rephrased, MHI insiders arguably have a motivation to see MHARR neutered, if consolidation is their goal.

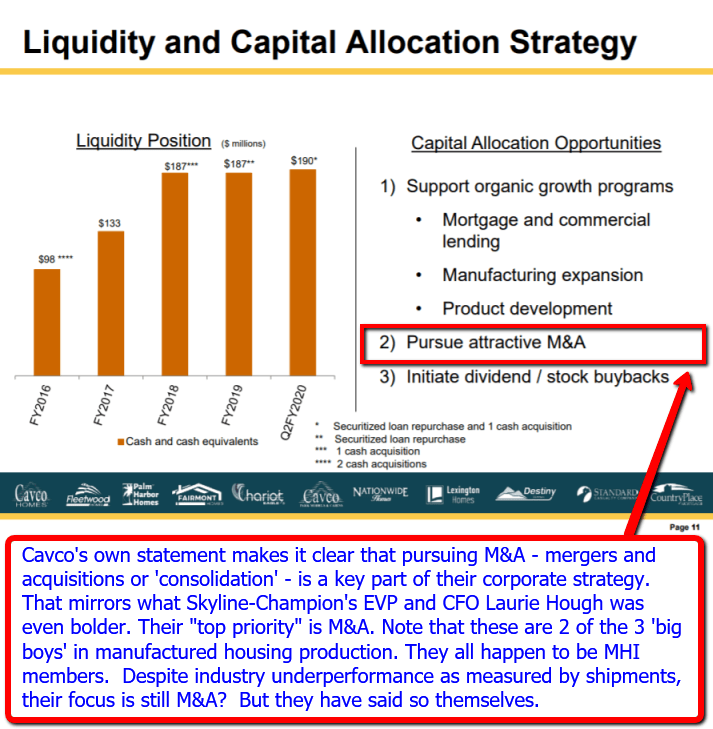

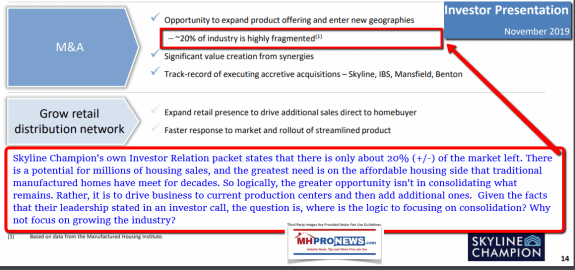

That noted, consolidation IS the stated goal of Cavco and others in manufactured housing that are MHI members.

Several corporate leaders and media contacts were asked today and previously about these matters. One politely stated words that meant ‘no comment.’

Questions Posed to Cavco Leadership

Here was the way the inquiry by MHProNews was framed to a Cavco media relations contact. Others at Cavco received a similar message.

“Some industry sources have raised the concern that this was a “killer acquisition” by Cavco Industries.

Additionally, there has been feedback from sources inside Cavco that tend to support that concern.

Furthermore, it seems hard to imagine that with Cavco’s resources that Lexington not only failed to improve but declined during a well-publicized affordable housing crisis?

We’d like to give Cavco an opportunity to respond to those concerns and allegations. Kindly email your and/or any other corporate official’s reply for our mutual accuracy. Please state clearly what is on or off the record.”

A link to the report found here was also included, to make the matters in question as clear as possible.

Additional MHProNews Analysis and Commentary

June 3, 2019 annual report signed by President and CEO Bill Boor included the following, “Strategically, we will remain focused on prudent investment in our operations to improve efficiency and grow capacity. Additionally, the company has an outstanding record of value-enhancing acquisitions and we will continue seeking and developing acquisition opportunities. Our manufactured housing division remains debt-free and our strong cash position (approximately $187 million at fiscal year-end) provides the financial strength and flexibility we need to invest wisely in continued growth.”

That same annual report on form 10k in their June 3, 2019 annual report are the following points.

“The purchase of Chariot Eagle, LLC (“Chariot Eagle”), Fairmont Homes, LLC (“Fairmont Homes”) and Lexington Homes, Inc. (“Lexington Homes”), in March 2015, May 2015 and April 2017, respectively, provided for further operating capacity, increased home production capabilities and further strengthened our market position in the Midwest, the western Great Plains states, the Northeast, the Southeast and several provinces in Canada.”

“Manufactured housing is a regional business and the primary geographic market for a typical manufacturing facility is within a cost effective shipping radius of 350 miles. Each of our manufacturing facilities serves multiple distributors and a number of one-time purchasers. Because homes are produced to fill existing wholesale orders, our factories generally do not carry finished goods inventories, except for homes awaiting delivery.”

These are valid points. So where was there any hint prior to their May 27, 2020 earnings call that Lexington Homes was in trouble? When other acquisitions performed well, what explains the failure of this M&A to perform?

If there are good explanations for these concerns, then why haven’t corporate officials made them plain by providing a clear written statement?

The steady monopolization of the industry by three dominant players, all of whom are members of the MHI has occurred in plain sight. Stegmayer is a former division president for Clayton Homes. While MHI has an antitrust statement that is referenced before the start of business meetings, there are several items on that MHI statement that call out for antitrust investigation. For years, much of what MHI has done has apparently been window dressing to posture efforts to address industry needs, while routinely failing to do what is necessary.

The recently formed American Economic Liberties Project has this on their home page.

“We stand committed to the proposition that freedom is no half-and-half affair. If the average citizen is guaranteed equal opportunity in the polling place, he must have equal opportunity in the marketplace.” – Franklin D. Roosevelt.

These bullets are from that same nonprofit’s home page.

- All across our society, monopolistic corporations govern much of our economic lives and exert extraordinary influence over our democracy.

- With Wall Street’s help, they extract more and more wealth and power from working people, independent businesses, entrepreneurs, ordinary investors, consumers, and entire communities.

- To protect their power, they use their wealth to manipulate public opinion, influence government policy, and ensure our laws — for them — are mere suggestions.

- Non-profit and non-partisan, the American Economic Liberties Project is part of a growing, cross- ideological movement to combat monopolistic corporations and the systems that entrench their power.

That rather neatly sums up years of reports by MHProNews and our MHLivingNews sister site. Note the point of “extracting wealth from working people, independent businesses, entrepreneurs, ordinary investors, consumers, and entire communities.”

That said, there must be something beyond mere slogans and catchy phrases. Action is needed, as the nascent organization itself admits. While antitrust law has been underenforced for decades, the framework for strong enforcement exists, as DOJ’s Ast AG Delrahim has said. A prior report and analysis, for those not entirely clear on the subject, can be found at the link below.

Beyond those points are the offshoring of businesses that took with them millions of American jobs that were once the framework of the rising American middle class.

There are several things that Clayton, Cavco Industries, and Skyline-Champion have done in recent years that begs these questions. In what ways have they colluded to increasingly monopolize the manufactured housing industry? What are the specific ways that MHI is involved in those practices? Those are not just empty questions, because evidence exists that contradictory and on its face illogical action has occurred, unless the objective is to have the type of monopoly known as an oligopoly.

See the related reports for more insights and information.

The closing questions should include, will federal investigators leak or announce probes into the self-evident monopolization of manufactured housing, as they have probes into Facebook and Google?

Why wouldn’t Cavco just spin Lexington Homes off? Why did they instead take the financial hit to close it? That too arguably points to their actual motivation – which was to buy it to close it, as some have alleged.

Additionally, there is arguably evidence that the SEC and possibly other federal agencies should also be exploring, in addition to their current SEC subpoena of Stegmayer and the company.

The alleged ‘buy it to close it’ charge against already scandal-ridden Cavco with respect to Lexington Homes on its face has significant evidence to support the kind of formal inquiry that state and/or federal antitrust officials should muster the will to investigate and act upon. The jobs that will vanish when that factory is closed are just the latest casualties in the war against the American middle class.

There are some that fear antitrust because of concerns that it may hurt jobs. But the history of antitrust is the opposite of that concern. It is mergers and acquisitions – consolidation – that historically eliminates jobs.

“First, as the Microsoft case and other enforcement actions…show, we already have in our possession the tools we need to enforce the antitrust laws…U.S. antitrust [i.e. anti-monopoly] law is flexible enough to be applied to markets old and new.”

– Assistant Attorney General Makan Delrahim,

top antitrust official in the Department of Justice,

from a speech on June 11, 2019.

Note that this reference to Microsoft should recall that Bill Gates was directly involved in that case. Gates forged a relationship with Warren Buffett, serving on his Berkshire Hathaway corporate board from 2004 until March of 2020. Buffett is a trustee of the Gates Foundation and a multi-billion dollar donor.

“Good students of history… will remember that Thomas Jefferson was serving as U.S. Ambassador to France…On December 20, 1787, Jefferson wrote to his friend James Madison with his views about the draft Constitution… “I will now add what I do not like. First the omission of a bill of rights providing clearly and without the aid of sophisms for freedom of religion, freedom of the press, protection against standing armies, restriction against monopolies, the eternal & unremitting force of the habeas corpus laws, and trials by jury in all matters of fact triable by the laws of the land & not by the law of Nations.”

– Assistant Attorney General Makan Delrahim,

top antitrust official in the Department of Justice,

from a speech on June 11, 2019.

“Third, clever positioning should not obscure what is otherwise ordinary evidence of an antitrust violation. Where a company has market power, enforcers should be circumspect about conduct that does not plausibly advance a legitimate business objective and transactions that eliminate competition.”

– Assistant Attorney General Makan Delrahim,

top antitrust official in the Department of Justice,

from a speech on June 11, 2019.

Programming note. MHProNews is in the process of revamping our industry-leading x2 weekly emailed headline news updates. The revisions should be completed by late June or early July. Watch for it.

That’s a wrap on this installment of manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Recent and Related Reports:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

State AG Files Suit Against, Manufactured Home Community, Rent to Own, Lease Purchase Option Warning

PissedConsumer.com on Clayton Homes, Growing Section 230 Legal Dispute

“MHI Lies, Independent Businesses Die” © – True or False? – Berkshire’s Joanne Stevens Strikes Again