The data that follows is from the American Enterprise Institute (AEI) nonprofit. While the core of this report is going to focus on housing data, it is useful to frame it in the context of broader ‘retail’ indicators. Retail activity is an important facet of overall Gross Domestic Product or GDP.

Barring the unforeseen, this evening’s MHProNews market report may include the balance of the data that follows. With so much ‘weaponized’ and agenda driven news, it is useful to look at reports that cite hard numbers from which professionals can draw their own conclusions. This retail data compares foot traffic from pre-Wuhan Virus/COVID19 pandemic impact in mid-January 2020.

Note that depending on the city, retail foot traffic dropped as much as nearly 80 percent on the lower end of the scale, while the less ‘locked down’ cities still witnessing a drop of about 60 percent. In terms of recovery from the lows, Kansas City leads with about a 75 percent foot traffic rate compared to pre-pandemic levels. San Francisco is only at about 40 percent of pre-contagion foot traffic.

That data might normally be sobering in terms of what it should suggest for the housing market. However, as several sources have indicated, mainstream housing has rebounded in a not only strong but a surprising way.

That said, the following pull-quotes are also from AEI.

“Metros less affected by the pandemic and that reopen more rapidly will benefit from favorable economic tailwinds. These are largely in the South and Southwest and were already doing well pre-pandemic. While this will likely have a favorable impact on housing demand, home prices may experience unsustainable growth, unless matched by additional supply. Fortunately, these areas tend to benefit additional supply due to looser land use controls.” – from page 11 of the power point (slide deck) presented by American Enterprise Institute (AEI) Housing Center Director Ed Pinto and Director of Research Tobias Peter on June 3, 2020.

That same quote was emphasized in the AEI executive summary. So, it clearly is significant even from their vantagepoint.

AEI provides weekly updates on housing data via what they call a “Nowcast” which MHProNews has been providing weekly, such as the one linked here below on June 23, 2020. Additionally, these reports – as is the case in the report below – includes an additional source of data as a cross reference.

The overall trend lines point to a good recovery for the housing sector. But that quote at the top from their June 3 PowerPoint ‘slide deck” linked here is cited for a manufactured housing specific reason that will be explained following the snapshot of their research.

What follows is the bulk of their emailed update to MHProNews but edits out certain items deemed extraneous for this report.

AEI Housing Center June HMI Briefing Call Recap

For access to the slide deck from the briefing, please click here.

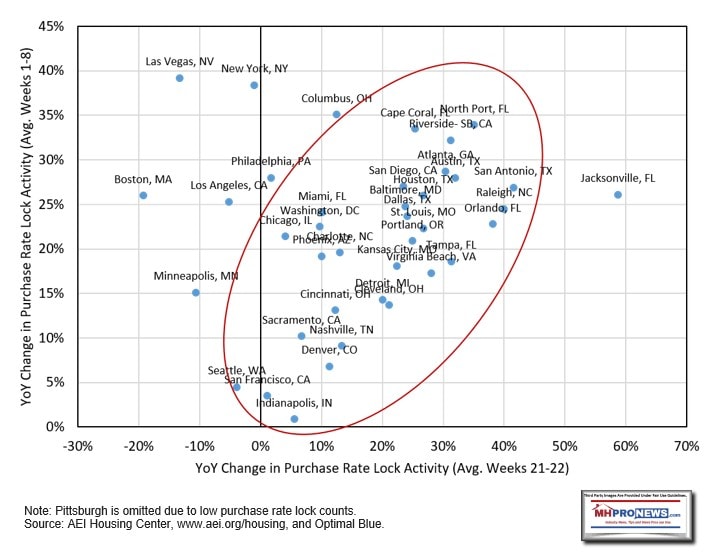

Among the briefing’s key takeaways is the correlation between pre- and post-crisis year-over-year change in purchase rate lock activity for 2020 (largest 40 metros). As shown in the chart below, the metros that experienced strong tailwinds before the pandemic are generally the ones experiencing the same strong tailwinds again. On the other hand, metros with rather subdued demand before the crisis are lagging behind again.

Another key takeaway discussed in the briefing is the pattern that emerges from plotting the year-over-year change in purchase loan rate locks for weeks 21-22 against a Foot Traffic Index for large metros. As seen in the chart below, metros with a high Foot Traffic Index tended to experience larger surges in rate lock volume relative to weeks 21-22 of 2019.

In general, metros less affected by the pandemic and that reopen more rapidly will benefit from favorable economic tailwinds. These are largely in the South and Southwest and were already doing well pre-pandemic. While this will likely have a favorable impact on housing demand, home prices may experience unsustainable growth, unless matched by additional supply. Fortunately, these areas tend to benefit additional supply due to looser land use controls.

On the other hand, metros in the West, Northeast, and Midwest that take longer to safely reopen will face economic headwinds. This will likely lead to reduced housing demand and, in some areas, more supply as jobs disappear or move elsewhere. Ultimately, this will result in minimal home price appreciation, or even price declines.

Edward J. Pinto

Director, AEI Housing Center

American Enterprise Institute

1789 Massachusetts Ave, NW

Washington, DC 20036

##

Prior to pivoting to a brief analysis of what this means for affordable manufactured housing, let’s note that AEI’s retail and other COVID19 related data provides significant insights as to what is occurring in various parts of the U.S., as measured by the top 40 metro areas. Again, barring the unforeseen, that report may be in this evening’s manufactured housing market report.

Additional Information, plus MHProNews Analysis and Commentary

Left-of-center Shelterforce said in March 24, 2020 that “COVID-19 will hurt the low-income and housing insecure the most.”

More recently, on June 1, 2020 the Brookings Institute said that “Housing hardships [have] reach[ed] unprecedented heights…”

The facts reflect the point that the problems for millions in terms of affordable housing have only been increased. The pause on evictions and mortgage foreclosures will likely be ending in the near term. There are indicators that the severity of that isn’t as bad as some might have thought, at least in manufactured housing, based on reporting by publicly traded Equity LifeStyle Properties (ELS), Sun Communities (SUI), and UMH Properties (UMH).

The social, economic, health, legal, political upheavals that are occurring could be turned to good or ill.

If mainstream housing can rebound so rapidly, as AEI and other data reflects, that quote at the top bears a close look by manufactured housing professionals, advocates, and investors. Let’s look at that pull-quote about the conventional housing market: “…home prices may experience unsustainable growth, unless matched by additional supply. Fortunately, these areas tend to benefit additional supply due to looser land use controls.”

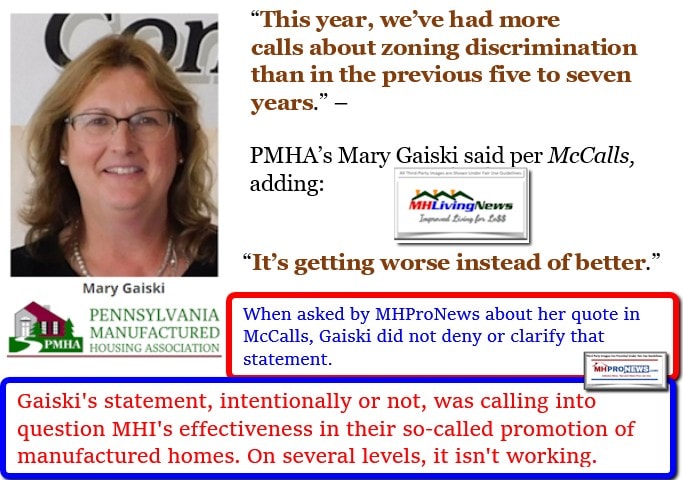

Land controls. As Curt Hodgson has said on several occasions, there is a “place to put” issue. Mary Gaiski, Executive Director of the Pennsylvania Manufactured Housing Association (PMHA) has said matters are worse now. Her association is an MHI affiliate.

So, when MHI members are saying that things are bad on the placement and zoning fronts, the spin and happy talk coming from other MHI-cheerleading sources ought to be viewed skeptically or dismissed outright.

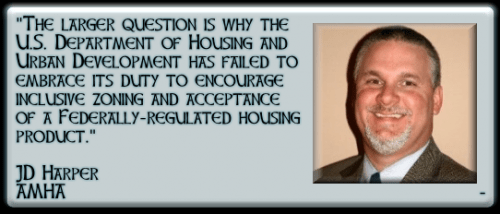

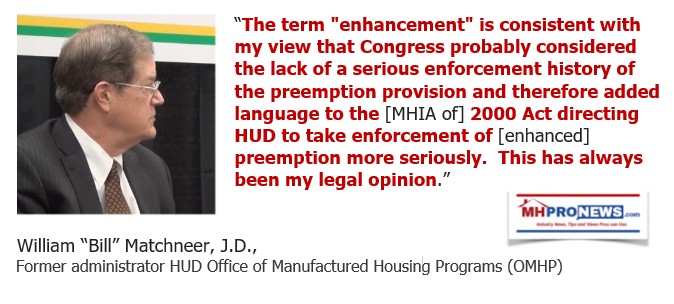

The Manufactured Housing Association for Regulatory Reform (MHARR) has been saying for years that there has to be a focus on placement issues, which includes the full application of the “enhanced preemption” clause of the Manufactured Housing Improvement Act of 2000 (MHIA or 2000 reform law). Leadership on that front is clearly not coming from MHI and the larger firms that dominate that association. They mention “enhanced preemption” from time to time but have obviously not effectively pushed for its full implementation. They mention HUD’s federal “enhanced preemption” without even using those words on their own website.

Rephrased, it is clear that MHI and their key players are posturing vs. doing. While they tried to put a good face on it, even MHI’s statement makes that same point.

The data reflects that demand should be up. Instead, sales in 2019 vs. 2018 where down.

The national upheaval underway has already witnessed the loss of numerous smaller businesses. Even some larger and better-known brands, for example in retail, are in or heading toward bankruptcy.

The solution in good measure is to enforce good existing laws. MHARR’s founding president laid the financing component of that out in detail in the Q&A’s linked below.

AEI is focused on mainstream housing and broader economic data, which facts that manufactured housing professionals need.

Properly understood, that data points to opportunities. MHI, their leaders and surrogates can make whatever claims they wish, but the data speaks louder than their posturing. Their claims don’t stand up to scrutiny.

MHVillage, MHI Present 2020 Manufactured Housing Industry Trends, Statistics – Fact Check Part II

The opportunities for affordable housing are greater today than pre-pandemic.

But they will not be realized unless and until changes are made away from the status-quo leadership of the Omaha-Knoxville-Arlington axis and their allies by the remaining independents in our industry.

Programming note. MHProNews is in the process of revamping our industry-leading x2 weekly emailed headline news updates. The revisions should be completed by early July. Watch for it.

Post Script

The headline pull quote offers one more important data point that even the industry’s forward looking professionals don’t always consider. It is in the interest of mainstream housing owners for their to be more stability in the housing marketplace. Affordable home ownership also creates more tax revenue, instead of creating a drain on tax spending.

That’s a wrap on this installment of manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Recent and Related Reports:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Warren Buffett Declared “Class Warfare,” Buffett Says Fellow Billionaires – “We’re Winning”