Recent reports about the broader housing market set the context for manufactured housing potential. That, in turn, is relevant to the formal, on-the-record responses provided by the Department of Housing and Urban Affairs (HUD) to MHProNews relative to FHA lending. HUD also provided significant replies on the Manufactured Housing Improvement Act of 2000 (MHIA or 2000 Act), including that law’s “enhanced preemption” theme.

This report will begin with the broader real estate picture, and then pivot to those exclusive items provided by HUD to MHProNews on FHA lending, the MHIA and federal “enhanced preemption.”

“The real estate market is seeing strong signs of a rebound after being hammered by the COVID-19 pandemic and related lockdowns across the United States,” said a July 12 2020 report by the right-of-center Epoch Times, under the headline “Home Prices Surge Despite Pandemic, Unemployment Crisis.”

It stated that “buyers are trying to take advantage of the record low mortgage rates, although the pandemic may result in a weakening market later this year.”

Journalist Emel Akan cited as evidence, “National home prices increased by 4.8 percent year-on-year in May, as the pent-up buyer demand was delayed, according to CoreLogic, a data provider for the real estate and mortgage industries. In addition, home prices increased 0.7 percent in May compared to the previous month.” He went on to say that record low level interest rates have occurred because the Federal Reserve cut its benchmark rates to near zero.

The report, in several ways, echoes data provided by the American Enterprise Institute in their “Nowcasts.”

“Despite unprecedented job losses in a wide swath of industries across the country since the COVID‐19 pandemic arrived in the United States, home price growth has unexpectedly accelerated,” Scott Anderson, chief economist at Bank of the West wrote in a report.

“The housing market today is not characterized by loose lending standards, low or no down payment mortgages, a preponderance of subprime loans, and highly‐leveraged homeowners like it was in 2008,” Anderson said.

Among of the key points that Akan made are these quoted items.

- And unlike the pre‐Great Recession era, the housing market entered this downturn undersupplied rather than oversupplied.

- Another factor pushing home prices higher is the federal government stimulus program. The income support for small business owners and the enhanced unemployment insurance benefit have boosted the demand for home purchases, according to Lawrence Yun, chief economist at the National Association of Realtors (NAR).

- The association reported that pending home sales surged 44 percent in May after two months of decline.

- “The demand is exceptionally strong, far higher than what I anticipated,” Yun told the show “NTD Business.”

- “2019 was considered a very good, respectable year. But here we are in the midst of the pandemic; sales activity appears to be stronger than last year’s figures.”

- According to Yun, home prices are being pushed up across the board with the exception of the New York City area and San Francisco, where the prices were already high.

The Epoch Times has been rated by AllSides media as accurate in their reports, while acknowledging that they are right-of-center in their coverage. They also have ties in Asia, sources in mainland China, the Falun Gong movement, and are strongly anti-communist. That is a useful framework for what comes next in their real estate report.

“The CCP virus outbreak has also altered buyers’ preferences about locations and features.” The Epoch Times describes COVID19 or the novel coronavirus that originated in Wuhan, China as the Chinese Communist Party (CCP) virus as a means of pinning the origins of the virus on the responsible party. For more on that, see the report linked here, which includes a documentary video on the origins of the virus.

- “We are definitely seeing some shift away from the city and toward larger-size homes,” Yun said.

- According to a survey conducted by the NAR, 24 percent of realtors said their clients wanted to move away from cities to suburbs, rural areas, and smaller towns. Thirty-five percent of NAR members also indicated that buyers preferred larger homes to accommodate more family members and have a dedicated office space.

- Experts say, however, that continued high unemployment could be a drag on purchase activity and home prices after the summer.

- “If somehow the job creation pace is slow and the stimulus package is pulled out, then we could run into some complications,” Yun said.

- A rise in foreclosures at the end of this year could also increase the number of homes for sale and put downward pressure on home prices next year.

- The CARES Act, passed to provide financial relief to those affected by the pandemic, provided stressed homeowners the option to request up to 180 days of forbearance, meaning they can either reduce or pause payments on a federally backed mortgage loan.

- According to Black Knight, more than 4.1 million homeowners were in mortgage forbearance plans as of July 7. These mortgages represent nearly $900 billion in unpaid principal, or 7.8 percent of all active mortgages.

- “The home price weakness is expected to accelerate once the forbearance window closes later this year,” Anderson stated.

That last statement is an echo of what the AEI report published by MHProNews at the link below likewise sounded a sobering cautionary note on, when they said that the housing market could become destabilized by “unsustainable growth.”

Anderson said that “By early next year, home prices should be on a widespread decline from a year ago, though our baseline forecast is we will not see the magnitude of home declines we saw in 2008 and 2009. We are forecasting, national home price declines of around 4.2 percent year‐on‐year by the second quarter of 2021.”

That expected decline could be pushed further into the future if the government provides further support or extends mortgage forbearance, Anderson stated.

##

On May 20, 2020 HUD responded to questions posed earlier that month from MHProNews. Those questions and ‘on the record’ responses are as follows. It will be followed by a brief MHProNews analysis and commentary that will also shed light on why MHProNews has held these responses until now.

MHProNews Question: There are over 30 million already unemployed and that number will likely rise. Lenders don’t make loans to those who are unemployed. But what will happen post-pandemic return to more employment? Will there be a provision for FHA and other federally backed lending programs to allow for those who had pre-COVID19 employment disruption to be approved despite a forced period of unemployment?

FHA’s existing guidance provides for provisions that address temporary employment and income loss that may be occurring due to COVID-19.

- (B) Addressing Gaps in Employment For Borrowers with gaps in employment of six months or more (an extended absence), the Mortgagee may consider the Borrower’s current income as Effective Income if it can verify and document that:

- the Borrower has been employed in the current job for at least six months at the time of case number assignment; and

- a two year work history prior to the absence from employment using standard or alternative employment verification.

- (C) Addressing Temporary Reduction in Income For Borrowers with a temporary reduction of income due to a short-term disability or similar temporary leave, the Mortgagee may consider the Borrower’s current income as Effective Income, if it can verify and document that:

- the Borrower intends to return to work;

- the Borrower has the right to return to work; and

- the Borrower qualifies for the Mortgage taking into account any reduction of income due to the circumstance.

- For Borrowers returning to work before or at the time of the first Mortgage Payment due date, the Mortgagee may use the Borrower’s pre-leave income.

- For Borrowers returning to work after the first Mortgage Payment due date, the Mortgagee may use the Borrower’s current income plus available surplus liquid asset Reserves, above and beyond any required Reserves, as an income supplement up to the amount of the Borrower’s pre-leave income.

- The amount of the monthly income supplement is the total amount of surplus Reserves divided by the number of months between the first payment due date and the Borrower’s intended date of return to work.”

MHProNews Question:

For Commissioner Montgomery. Lower cost “affordable housing” will be more important than ever after lockdowns are eased. For approaching two decades after the passage of the Manufactured Housing Improvement Act (MHIA) of 2000, the “enhanced preemption” provision has been woefully underenforced. Given the inevitable surge in the need for more affordable homes, and HUD Secretary Carson’s repeatedly stated support for the use of more manufactured housing, will “Enhanced Preemption” of manufactured housing become a focus for HUD? If not, why not?

HUD understands that effective implementation of preemption is critical to the success of the manufactured housing industry and the availability of unsubsidized affordable housing nationwide. Revised language in Section 604(d) of the National Manufactured Housing Construction and Safety Standards Act of 1974, as amended by the Manufactured Housing Improvement Act of 2000, does require that the original preemption provision be “broadly and liberally construed.” HUD currently does in fact take a broad and liberal, enhanced, view with regard to preemption of state and local standards when a state or local standard actually conflicts with HUD’s Manufactured Home Construction and Safety Standards (construction and safety standards). Whenever the HUD program office receives information that suggests that a local jurisdiction is trying to enforce its own construction or safety standard against an element of performance that is addressed by HUD’s construction and safety standards, HUD’s office of Manufactured Housing Programs works with its Office of General Counsel to provide correspondence to that jurisdiction informing them that such local laws are subject to federal preemption under the Act.

- Section 604(d) provides that if a home is built to the HUD code, state and local building authorities may not apply their own codes that are “applicable to the same element of performance.” HUD has always understood that Federal preemption of state and local codes is one of the biggest competitive advantages the HUD-code manufactured housing industry has over-site built and modular housing. Maintaining the viability of federal preemption is therefore critical to the entire HUD-code business model. For preemption to work, however, the Act requires that HUD’s construction and safety standards address the same elements of performance as the International Residential Code (IRC) and other state and local codes. Otherwise local code authorities are free to enforce their own code provisions. The Department and the MHCC therefore concentrate on maintaining preemption by updating the elements of performance addressed by the construction and safety standards.”

MHProNews Analysis and Commentary

Volumes could be written about these replies from HUD. While the FHA lending statements are significant and potentially useful, this analysis will focus on HUD’s statement about MHIA and the “enhanced preemption” topic.

In no specific order of importance are the following bullets.

- For whatever reason, HUD’s reply to the enhanced preemption issue uses phrasing other than “enhanced preemption.”

- For instance, it says that the original law “as amended by the Manufactured Housing Improvement Act of 2000, does require that the original preemption provision be “broadly and liberally construed.”

- HUD’s reply also says: “Whenever the HUD program office receives information that suggests that a local jurisdiction is trying to enforce its own construction or safety standard against an element of performance that is addressed by HUD’s construction and safety standards, HUD’s office of Manufactured Housing Programs works with its Office of General Counsel to provide correspondence to that jurisdiction informing them that such local laws are subject to federal preemption under the Act.”

That last statement is demonstrably inaccurate. MHProNews directly contacted Teresa Payne at the Office of Manufactured Housing Programs (OMHP) about the ban against new manufactured homes that went into effect in Bryan, Texas.

Not only did Payne and HUD not act, according to local officials contacted by MHProNews, the Manufactured Housing Institute didn’t act either. More on that in the report linked above.

Summing up, HUD has agreed that the MHIA law and federal “enhanced preemption” – the language used in the law – applies.

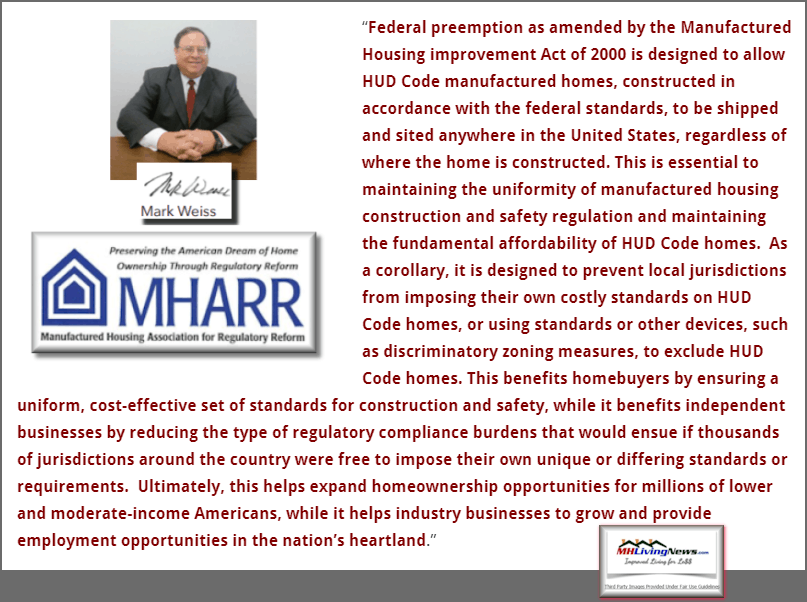

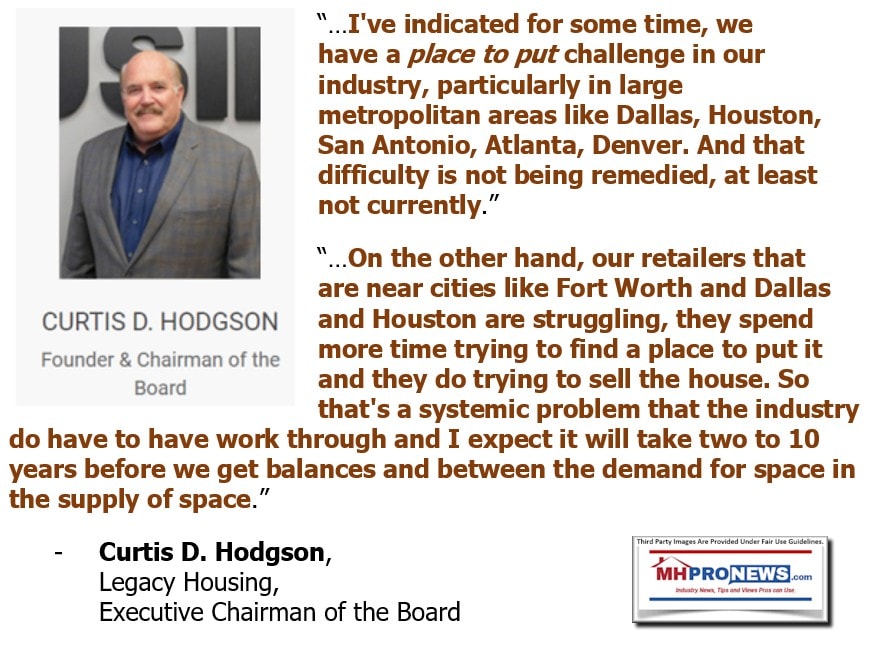

Mark Weiss, J.D., President and CEO of the Manufactured Housing Association for Regulatory Reform, has dealt with this topic repeatedly for years. The screen capture below this quote by Weiss reflects that point.

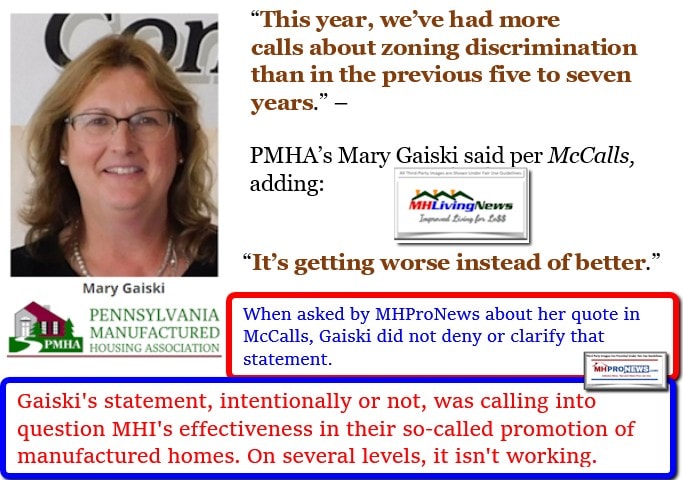

MHI state affiliate quoted leaders below reflect that this issue is not one raised only by MHARR or MHProNews. Rather, it is a broader and ongoing concern. The Pennsylvania Manufactured Housing Association (PMHA) Executive Director Mary Gaiski and others are saying the problem that “enhanced preemption” is supposed to fix is getting worse. That in turn limits manufactured home sales.

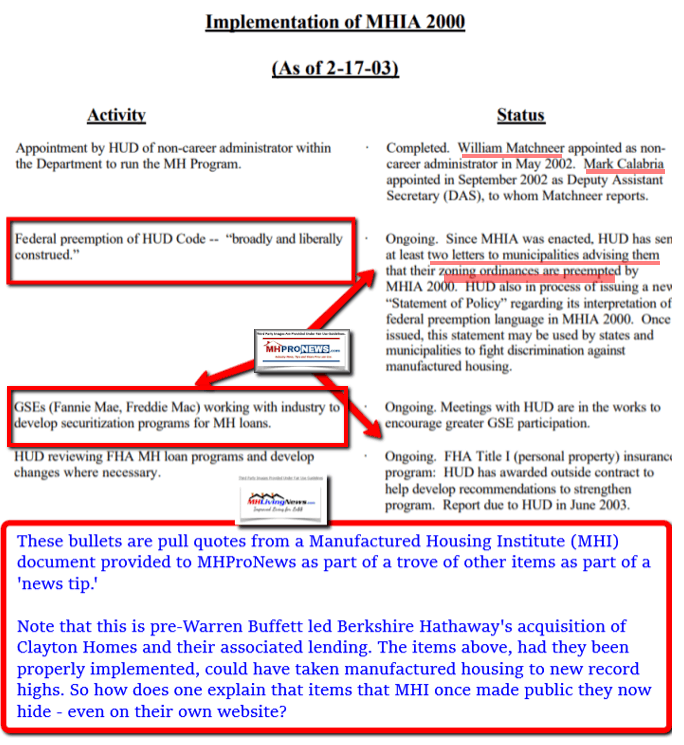

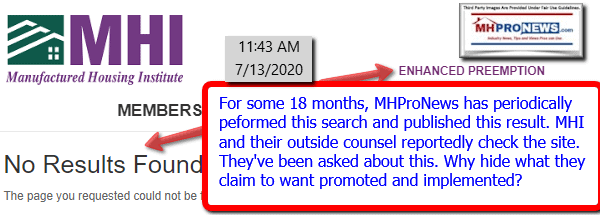

MHI has stated in writing that they want the law “enhanced preemption” provision of the enforced. However, for whatever reason, MHI doesn’t use the words “enhanced preemption” on their own website. In years gone by, they had the document below as an accessible download, as a tip from an informed source revealed.

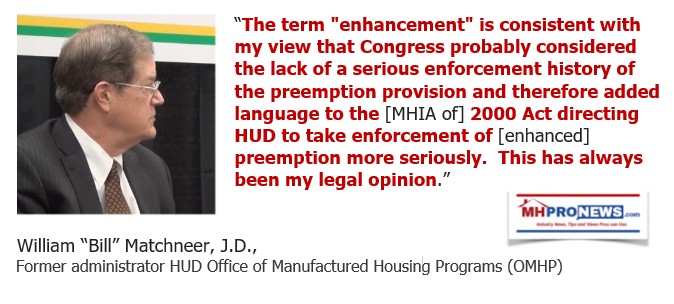

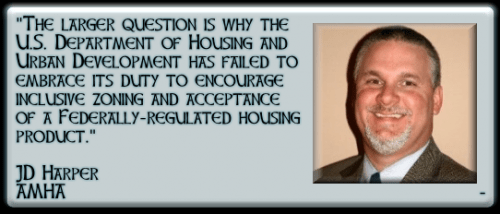

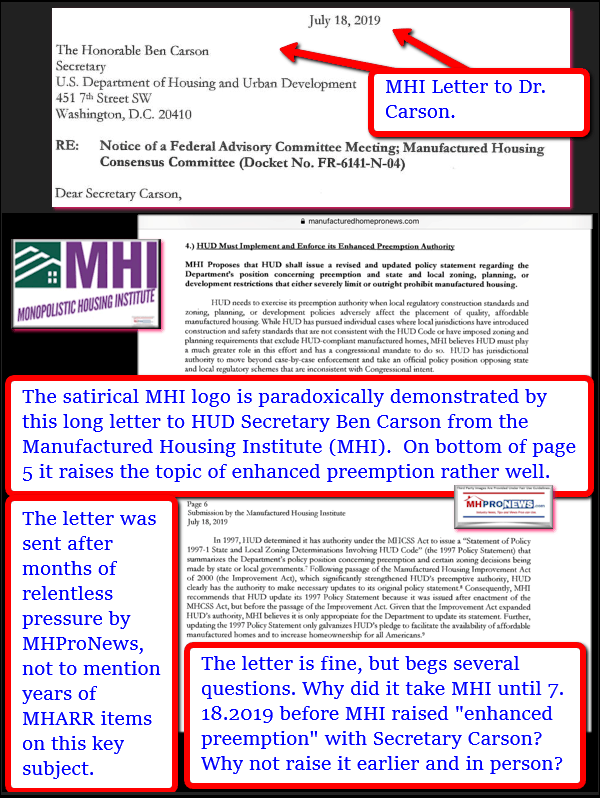

Rephrased, HUD’s claim to be enforcing federal preemption is contradicted by several sources, including a key former HUD staffer, Bill Matchneer. MHI claims they want the law enforced. One example is Lesli Gooch, now MHI’s CEO, in part of her July 18 2019 letter to HUD Secretary Ben Carson regarding HUD’s purported failure to enforce federal preemption.

There are numbers who say federal enhanced preemption is not occurring as it should. Yet HUD claims otherwise?

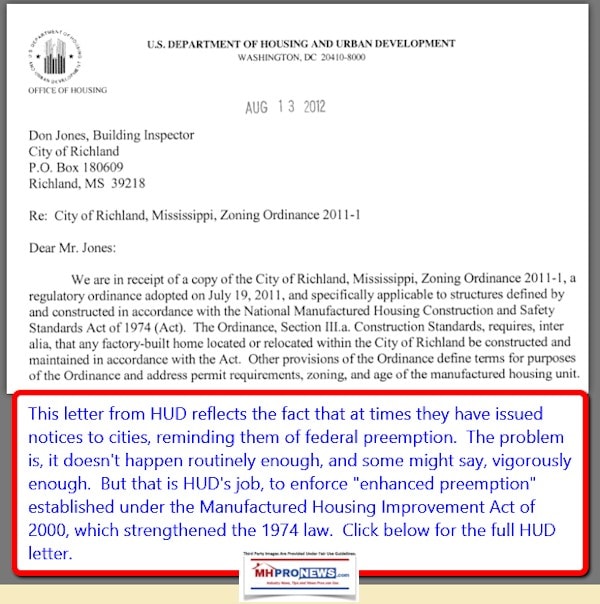

There are known instances when the law was enforced. The letter shown below is an example of one such instance.

Bill Matchneer, in a call with dozens of industry professionals and others on the line, made statements that are at variance with what HUD’s formal May response to MHProNews’ question indicates. The evidence, put differently, supports what Matchneer said below rather than what HUD’s formal statement on preemption makes.

There are more than one known instances when neither MHI nor HUD responded to the very things that HUD’s formal reply says that they are willing to address. When the prior OMHP administrator, Bill Matchneer, contradicted in that report linked above what HUD recently said, these should be a red flag for the industry – for consumers and independents alike. They merit internal, federal, and other investigations.

To learn more, see the reports linked above or others linked below the byline and notices.

There are other report planned for this week which will focus on a different insider look at a report that involves MHI, Warren Buffett connected non-profits, and more. These reports are only found at the runaway number-one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes are often hot-linked to other reports that can be accessed by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

“Never Let a Good Crisis Go To Waste” – COVID19 Pandemic – Problems and Solutions