Manufactured housing performance needs to be contrasted with mainstream housing or other U.S. economic sectors in order to obtain a reasonably objective understanding of how HUD Code manufactured home production and shipment levels year-to-date performance in 2020 should be viewed. In a report published this week on JD Supra, a legal information website, was an overview of the conventional U.S. housing market in 2020. That JD Supra report included this pull quote: “recently released housing start data from the U.S. Census Bureau shows that year-over-year single-family housing starts increased in July by 15.5%, while multifamily starts for the same period fell by .5%. Home sales nationally have remained strong, with home purchase activity in July 2020 up 22% over the same month in 2019. In the Denver metro area, single-family home prices and sales increases for July far outstripped those for condos.”

That same source said that the trend has been toward more personal space, not necessarily larger space. That and other factors they cited reflect positive potential for single-family HUD Code manufactured homes.

“Downsizing had been the story of the decade in housing. The homebuilding industry took notice of empty nesters’ and millennials’ preferences for smaller dwelling spaces, and willingness to exchange square footage and yards for public spaces and proximity to amenities. Condos and other multifamily housing became increasingly popular. However, likely due to health concerns surrounding the COVID pandemic, consumers’ priorities have recently swung away from amenities and towards separation.”

Co-authors of that report, Rick J. Rubin and Will Soper, said that “Average mortgage rates have fallen from 3.65% on March 19, 2020 to 2.99% on July 30, 2020. Cheap money, coupled with a demand for more personal space, has taken a significant bite out of the rental market. First-time home buyers in April 2020 made up 36% of the all home sales compared with 32% in April 2019.”

Rubin and Soper added that “However, some rental products are poised to capitalize on consumer demand for more personal space, especially in higher-priced markets where entry-level home prices are still out of reach for many. For example, townhouses can be built, managed and rented like an apartment community, without many of the shared-space issues common in apartments.

Some large companies have even begun building rental communities of one-, two- and three-bedroom single-family detached houses. Toll Brothers, a publicly traded homebuilding company with a national footprint, recently announced a $400 million joint venture with a private partner to build single-family home rental communities, targeting Phoenix, Denver, Las Vegas and other fast-growing metro areas. Eliminating the need to save for a down payment or qualify for a mortgage may make more single-family homes available as rental units.”

It should be noted that the co-authors from the Fox Rothschild LLP law firm which boasts “950 Attorneys | 27 Offices | 70 Practice Areas” touched on prefab housing, including manufactured and modular homes too. Some of that data is problematic in terminology and they lack the same data that they provided with much of the balance of their otherwise useful report. More on that will be forthcoming later.

‘Trailers for Sale or Rent’ – Build to Rent Trend, Manufactured Homes and Communities

But that backdrop from Rubin and Soper via JD Supra is a largely useful and insightful summation of the state of the overall housing market. With that backdrop, MHProNews will now segue to the latest data gathered on behalf of the U.S. Department of Housing and Urban Development (HUD) as reported by the Manufactured Housing Association for Regulatory Reform (MHARR).

FOR IMMEDIATE RELEASE Contact: MHARR

(202) 783-4087

MANUFACTURED HOME INDUSTRY PRODUCTION INCREASES IN JULY 2020

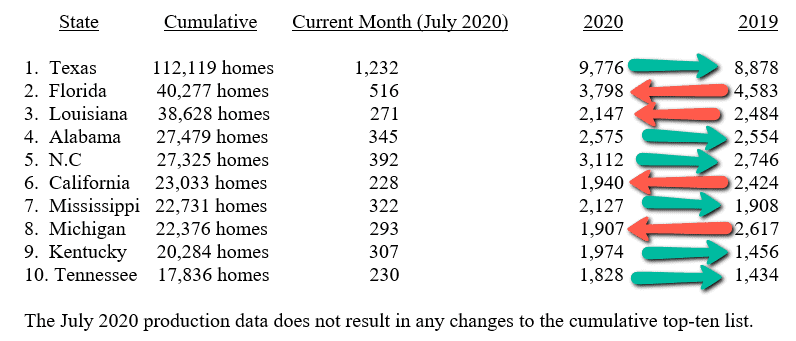

Washington, D.C., September 3, 2020 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production showed a moderate increase in July 2020. Just-released statistics indicate that HUD Code manufacturers produced 7,485 homes in July 2020, a 4.9% increase from the 7,135 new HUD Code homes produced during July 2019. Cumulative 2020 production at the end of July 2020, stands at 53,650 homes as compared with 53,817 homes produced over the same period in 2019, a decrease of .3%.

A further analysis of the official industry statistics shows that the top ten shipment states from the beginning of the industry production rebound in August 2011 through July 2020 — with cumulative, monthly, current year (2020) and prior year (2019) shipments per category as indicated — are:

The July 2020 production data does not result in any changes to the cumulative top-ten list.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 –

Additional Facts, MHProNews Analysis, and Commentary

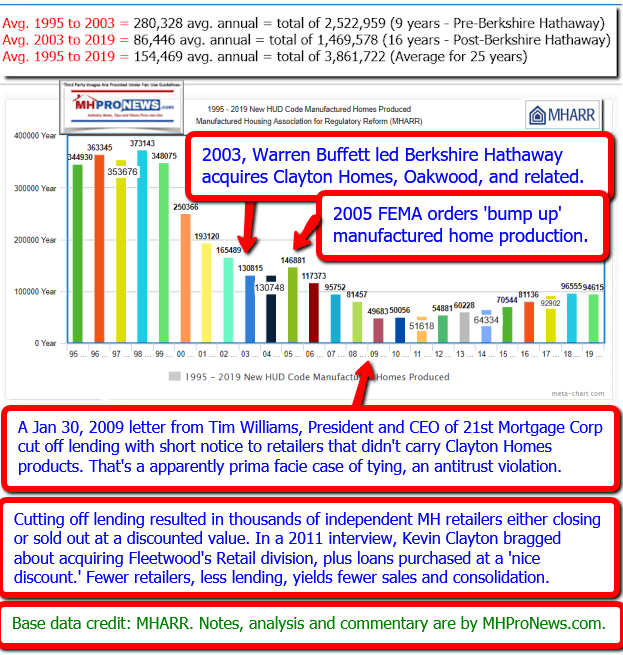

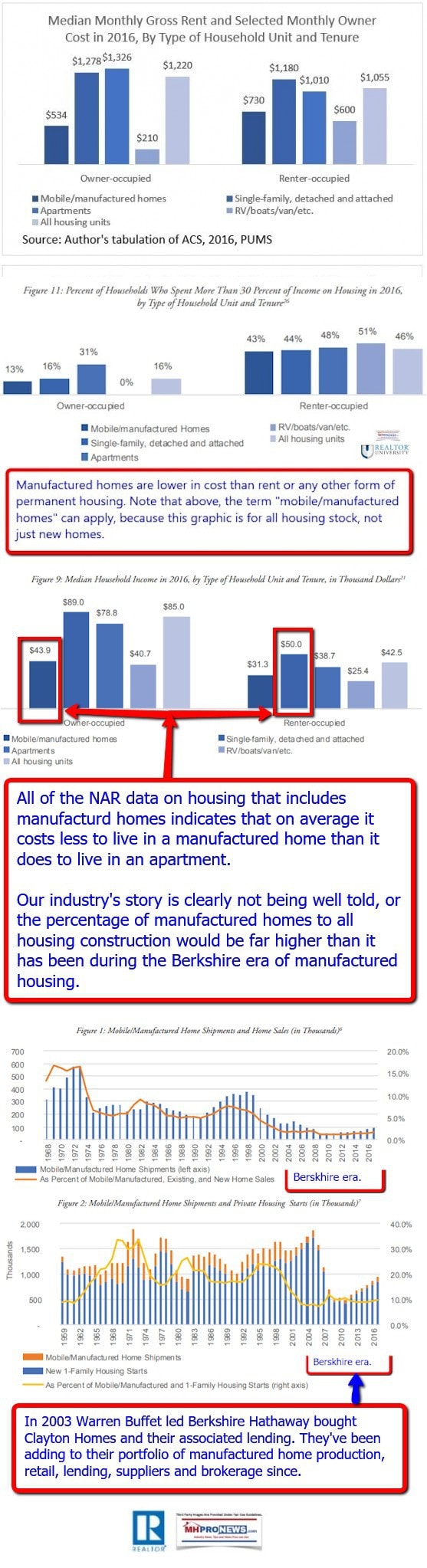

While they used the outdated and inaccurate term “mobile home,” Rubin and Soper noted something that too few in our industry’s trade media or in many associations readily admit. Citing U.S. Census Bureau data, the co-authors made this point: “Traditional mobile homes [sic] continue to lose popularity as a viable housing product. Shipments of new mobile homes [sic] has decreased by half since 2000.”

Rubin and Soper have framed that issue of the decline in manufactured home production and shipment levels in a fashion that would likely cause some in our industry to cringe. But the statement – their ‘mobile home’ vs. ‘manufactured home’ terminology error aside – has evidence-based merit.

Census Bureau based data reflects the point that manufactured housing is operating at roughly 25 percent of the last high achieved in 1998.

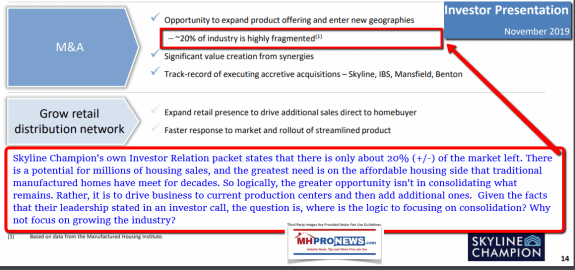

Publicly traded firms, such Skyline Champion (NYSE:SKY), de facto admit to that but point to it as the potential upside for the industry. Meaning, because the manufactured home industry is underperforming now, it has the opportunity to rise up toward its historic trend levels. The base graphic above is from a Skyline Champion investor relations presentation, with the dashed line showing their view of the historic averages.

MHProNews has generated its own historic averages in the chart below, once more using government or public data.

The Takeaways?

Manufactured housing is underperforming. The data makes that statement difficult if not impossible to dispute. That should beg the question, what is the cause of that underperformance?

The accurate answer is that there are several causes. They would include, but not be limited to:

- Financing related issues.

- Zoning placement related issues.

- Public perception related issues.

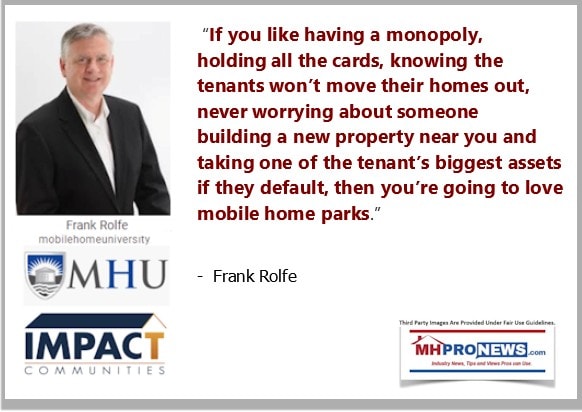

In an industry that is dominated by three major producers that are all Manufactured Housing Institute (MHI) members, one must certainly scrutinize those operations and ‘their’ trade association.

But underperformance means there is significant upside opportunity. The very factors that make factory-home building potentially well suited for rapid and sustainable growth are also the ones that should make manufactured homes poised for strong growth.

Additionally, favorable legislation was passed in 2000 and 2008 – explored in our Q&A series with former MHI VP and MHARR founding president and CEO Danny Ghorbani – that ought to be supporting that growth. At least on paper legally, two of the three major issues are ‘handled’ at the federal level – save for their proper implementation.

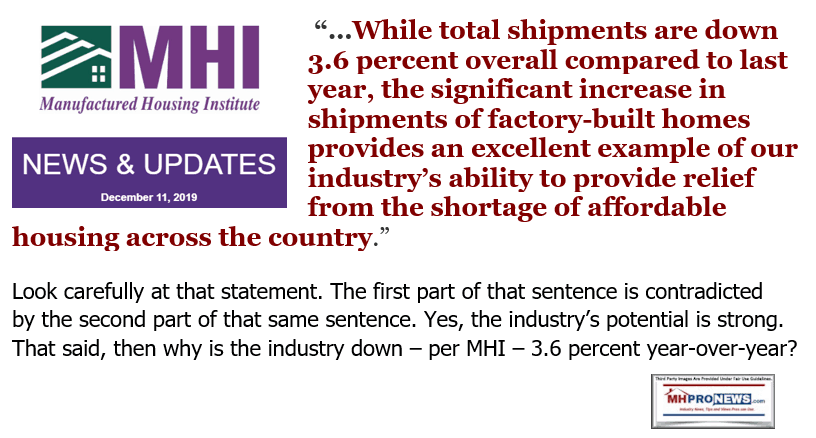

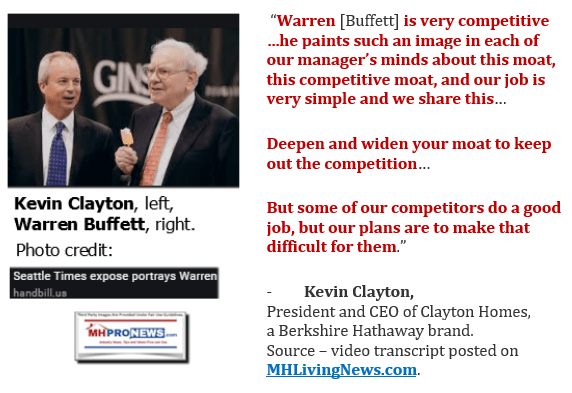

It is MHI that claims to be the post-production representatives of the manufactured housing industry. They say they represent “all segments” of manufactured housing. Here is how they phrase it: “The Manufactured Housing Institute (MHI) is the only national trade organization representing all segments of the factory-built housing industry.” There are times they use the phrase “manufactured housing” instead of factory-built housing.

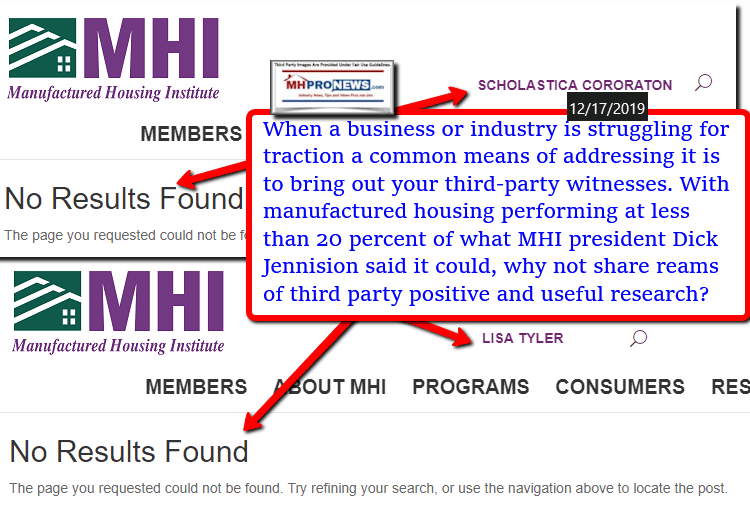

MHI – and their dominating members – have said that they are working to promote manufactured home acceptance. If so, where is the statistical evidence?

The numbers don’t lie.

MHI and the industry’s ‘big boys’ can’t have it both ways.

See the related reports above and below for more.

What the JD Supra overview of the housing market reflects is a point that MHProNews and our MHLivingNews sister site have made for years. With single family housing growth surging, or the post-pandemic surge in RVs, those ought to be a sign that manufactured homes should be surging too.

It is logically either incompetence, corruption, some other agenda, or a combination of those factors that arguably are the reason that manufactured housing is snoring instead of soaring. The only one willing to debate that obvious point has been pro-MHI member Andy Gedo. After attempting to do so, Gedo not only ‘threw in the towel,’ but effectively made some of the very points that MHProNews has argued for years.

The MHI and their ‘big boy brands’ response has often been to pretend that MHARR, MHProNews and MHLivingNews don’t exist, after having worked with each of those entities in years gone by. They have made the claim, that a HUD spokesperson categorically denied, that the industry had to completely unite under their aegis in order to advance. It is metaphorically akin to saying that to stop bank robbers one must hire the bank robbers to protect the banks.

MHI has failed in their self-stated mission.

MHI inexplicably fails to provide useful third-party research on their own website. If they claim to be promoting the industry, how is it possible that they won’t use positive research on their website for others to see?

The evidence both indirect and direct is increasingly clear.

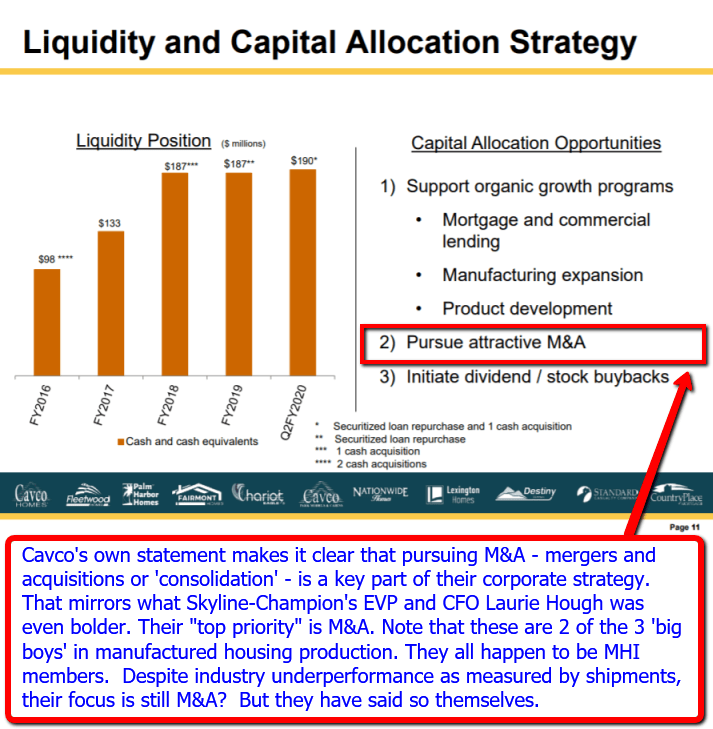

The big boy brands of Clayton Homes, Skyline Champion and Cavco Industries have all admitted that they are focused on consolidation of the remainder of the independents in the manufactured home industry. That desire for consolidation arguably drives their failure to properly promote the industry as well as to take the obvious steps needed to implement the good existing laws that they fail to push to adopt.

It is no wonder they have been unwilling to discuss or debate their performance publicly. How could they possibly win such a debate when their performance is so dismal? It is often MHI insiders that tell MHProNews about their frustrations with the Arlington, VA based trade organization.

So long as underperformance is the norm in manufactured housing, barriers of entry, persistence, and exit are made worse. That’s economics 101. That means that the value of a given business in production and/or retail is less than it otherwise would be. Rephrased, underperformance will tend to keep others out and will steadily cause those inside manufactured housing to quit or sell out at a discounted valuation. Andy Gedo de facto made that argument, and is correct on that point.

To learn more, see the related reports linked herein or from the reports that follow the byline, offers, and notices.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Manufactured Housing Industry Production Dip, Top Shipment States Data – June 2020