“We don’t want the small business people who own most of the apartment buildings and single-family rentals in the country to go out of business.” – said David Dworkin, President and CEO of the National Housing Conference (NHC), per CBN News.

In spotlighting several sobering points of concern impacting thousands of smaller businesses and millions of renters, National Housing Conference (NHC) President and CEO David Dworkin, the Manufactured Housing Institute (MHI), and a coalition of other housing connected groups have apparently failed to mention other no less concerning issues that also harm renters as well as independents in and out of our segment of the affordable housing industry.

A quick review of pull-quotes by Dworkin will serve to illustrate the issue.

“For property owners, [the CDC’s eviction order] is a crushing unfunded mandate that will bankrupt many small businesses.” – said David M. Dworkin, per the DCist.

In another article published by The Hill entitled “Trump eviction ban tests limits of CDC authority,” NHC’s Dworkin is quoted saying “Whether it’s three months from now, or six months from now, or a year from now, having millions of people be evicted because they can’t pay a year’s worth of rent is not a solution.”

In the left-of-center Slate, Dworkin warned that “As many tenant advocates have warned, the administration’s plan is a temporary solution to the country’s bubbling housing challenges, one that won’t necessarily save every family in distress, even during the short term. “It is a stopgap measure. It will not be totally effective. People will definitely fall through the cracks.”

Right-of-center Forbes noted a contrasting quote from Dworkin, that should be viewed later by those involving in affordable manufactured housing with greater care. “The money homeowners save on their mortgage through refinancing is going to go somewhere. Plus, they’re strengthening their bottom line, which is important when you’re in a recession.”

In Affordable Housing Finance, NHC’s Dworkin is cited as saying “There is broad agreement across the housing industry that the only real solution to this crisis is federal rental assistance. For property owners, it is a crushing unfunded mandate that will bankrupt many small businesses. For 43 million renter households, it creates a complicated and opaque maze that those most in need cannot possibly navigate. Congress and the White House must reconvene negotiations on a comprehensive solution immediately. Treasury secretary Steven Mnuchin has said, ‘Our first choice is to have bipartisan legislation that allocates specific rental assistance to people hardest hit.’ If there’s that much agreement, then there is no reason to delay any further.” Since each of these quotes are proudly cited on the NHC website, they are presumably accurate reflections of that nonprofit organization and Dworkin.

In the wake of these comments in early September, 2020, Dworkin’s letter below, sent on a Sunday afternoon around 4 PM ET on 9.13.2020, completely ignores the obviously partisan political divide underway in what voices from the left and right – Democrats and Republicans alike – say is the most consequential election of modern times.

By citing Urban Institute research, while failing to mention the behind-the-scenes influences of billionaires and their business interests – for example, Warren Buffett’s “lifetime trustee” status at the Urban Institute, and Berkshire Hathaway’s influences at MHI, NHC, and other coalition members – by accident or design CEOs Dworkin and Lesli Gooch have failed in the test of transparency. While commenting on how this political impasse in Washington, D.C. hurts small businesses and millions of renters, and by not commenting on the political and economic benefits this emerging scenario is fostering, that arguably marks and thereby tends to benefit Democrats who are routinely backed by those same ‘profitable pandemic’ billionaires like Warren Buffett.

In this report, two emailed pleas by Dworkin/NHC and MHI are provided herein. Those emailed statements will be followed by additional information, MHProNews Analysis and Commentary. The one from NHC dated September 13, 2020 to L. A. “Tony” Kovach, a managing member of MHProNews, is shown immediately below.

by David M. Dworkin, NHC President and CEO

Dear L. A.,

As Congress and the administration continue to bicker over a much-needed COVID-19 economic stimulus bill, landlords and tenants are suffering. Rent payments cannot be made by people who have been unemployed for months, and building owners struggle to pay their own bills as a result. Tragically, prospects for a resolution of this crisis before the election are highly unlikely.

In an attempt to prevent an impending wave of evictions following the expiration of the CARES Act eviction moratorium in July, the Centers for Disease Control (CDC) last week announced a moratorium to prevent evictions through the end of the year for certain eligible renters. In a range of press interviews, NHC made clear that the order merely kicks the problem down the road to January, when the weather will be colder, and more people will be experiencing even greater crisis. Several housing organizations also recently sent a letter to congressional leaders cautioning that the new eviction moratorium, in the absence of “a robust emergency rental assistance plan, places the stability of the entire rental housing sector in danger.”

The order has already caused enormous confusion among landlords and tenants alike. Much has been written about the devastating impact on tenants facing eviction. Avail, an organization that helps small landlords manage units and collect rent for 53,000 properties, partnered with the Urban Institute to focus its periodic member survey on the impact of COVID-19.

According to Avail, small landlords look a lot like America. Of the 2,225 landlords who responded, the largest group of respondents were age 60 or over (45.1%), with 67.8% being Non-Hispanic White, 14.6% identifying as Non-Hispanic Black or African American, 8.5% identifying as Hispanic, and 8.4% identifying as Asian. Notably, 2019 total household income before taxes was largely modest, with the majority falling between $24,000 and $150,000. Only 16.5% reported earning more than $200,000 per year. Nearly one third made less than $75,000 per year. To cover missed rents, 35% of the landlords surveyed reported withdrawing money from their savings accounts or emergency funds for help covering expenses related to their rental properties during the pandemic.

In a recent blog post published by the Urban Institute, two of the best analysts in housing research today, Laurie Goodman and Jung Hyun Choi, concluded that “the inability to pay rent will affect mom-and-pop landlords with fewer than 10 rental units, who own slightly more than half of all rental units.” Minority landlords were disproportionately impacted. “Without government support for rental payments, by direct payment to either the tenant or the landlord, these small operators may not be able to continue making their mortgage payments and keep their tenants housed,” Goodman and Choi said.

This is why 31 of the most influential housing groups, representing both industry associations and advocates, wrote to the White House and congressional negotiators, imploring them “to immediately return to the negotiating table and reach agreement on rental assistance and broader relief legislation that keeps people in their homes.” We noted that renters impacted by the COVID-19 pandemic already owe an estimated $25 billion in back rent and could owe up to $70 billion by the end of the year. “Without federal rental assistance,” the letter said, “these debts will be unsustainable and financially ruinous for renter households across the nation. Failure to act will put tens of millions of renters at risk of being evicted, undermine the stability of our rental housing system, and needlessly prolong our nation’s ability to fully recover from the economic damage that has been wrought by this pandemic.”

If representatives of both landlords and tenants can agree on how to move forward, why can’t Congress and the White House? Emergency rental assistance should be part of any legislation that goes to the president before the end of the month.”

##

Ahead of the above, on Friday, September 11, 2020 at about 6:10 PM ET, under the Manufactured Housing Institute (MHI) logo was this email to their members and some others.

“MHI Continues Push for Targeted Rental Assistance

Last week, the Centers for Disease Control and Prevention (CDC) issued an order temporarily halting residential evictions for failure to pay rent until December 31, 2020.”

Under the subheading of eligibility was this from MHI.

Eligibility

According to the [CDC] order, renters must file sworn declarations stating they are eligible for the relief because:

- The individual has used best efforts to obtain all available government assistance for rent or housing;

- The individual either (i) expects to earn no more than $99,000 in annual income for Calendar Year 2020 (or no more than $198,000 if filing a joint tax return), (ii) was not required to report any income in 2019 to the U.S. Internal Revenue Service, or (iii) received a stimulus check pursuant to Section 2201 of the CARES Act;

- The individual is unable to pay the full rent or make a full housing payment due to substantial loss of household income, loss of compensable hours of work or wages, a lay-off, or extraordinary out-of-pocket medical expenses;

- The individual is using best efforts to make timely partial payments that are as close to the full payment as the individual’s circumstances may permit, taking into account other nondiscretionary expenses; and

- Eviction would likely render the individual homeless— or force the individual to move into and live in close quarters in a new congregate or shared living setting— because the individual has no other available housing options.”

That CDC order that NHC and MHI refer to is linked here.

Under the heading, MHI Advocacy, was the following.

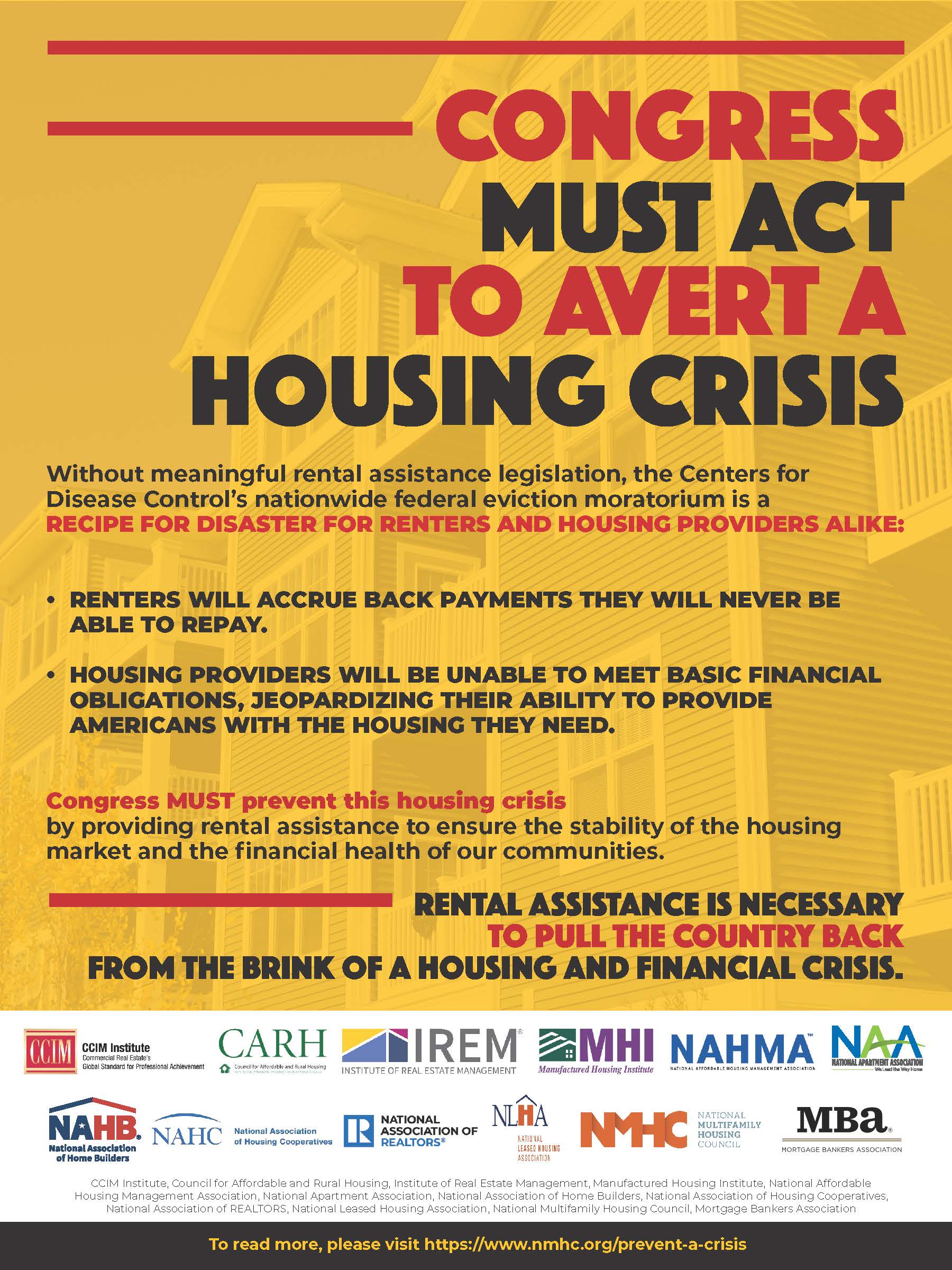

“DC BASED MEDIA CAMPAIGN

The rental housing coalition launched its second advertising campaign in publications frequented by policymakers and staff to push for federal funding for rental assistance.” It included thumbnails of the following ads that they boast were paid as part of their coalition effort.

That was followed with this from MHI.

“CONGRESSIONAL ADVOCACY

MHI and its coalition partners continue to send letters and hold calls with Congressional leadership, the White House, and HUD strongly arguing that targeted funding is needed to accompany the CDC’s eviction moratorium.”

Then, stunningly, MHI states they are in discussions with the rental housing coalition, pondering if they should join in a legal action on this issue. Which begs the question, why haven’t MHI taken legal action to enforce laws that might have turned millions of these renters into manufactured homeowners? That question noted, here is their statement.

“POTENTIAL LEGAL ACTION

MHI is in discussions with the rental housing coalition about whether legal action can successfully stop the CDC’s eviction moratorium.

One complaint has been filed against the CDC by the non-profit civil rights group New Civil Liberties Alliance (NCLA) in the U.S. District Court for the Northern District of Georgia. The complaint challenges that the CDC’s order “violates the rights of housing providers to access the courts, exceeds limits on the Supremacy Clause, raises serious non-delegation doctrine concerns and implicates anti-commandeering principles and precedents.” To read more about the NCLA’s complaint, Rick Brown v. Secretary Alex Azar, et al.”

Then, MHI asks members and their affiliates to do the following.

“ACT NOW

Tell Congress to Pass Targeted Rental Assistance Funding

Simply click the button below to send a letter to your Members of Congress letting them know that federal assistance for rental payments is absolutely necessary to support the nation’s residents, housing providers and the rental housing market.

SEND YOUR LETTER

What We Are Asking

Ask Congress to provide rental assistance funding to stabilize the rental housing sector.

Justification

The halt on evictions imposed by the CDC without funding for rental assistance puts the stability of the rental housing sector in danger.”

##

Additional Information, MHProNews Analysis and Commentary

As already noted, this is among the boldest revelations about MHI – directly from their offices, and clearly sanctioned by their leadership, of how they are arguing for conventional housing supported initiatives rather than staying laser-focused on manufactured housing advocacy which should focus on the full implementation of good federal laws that already exist that benefit manufactured housing.

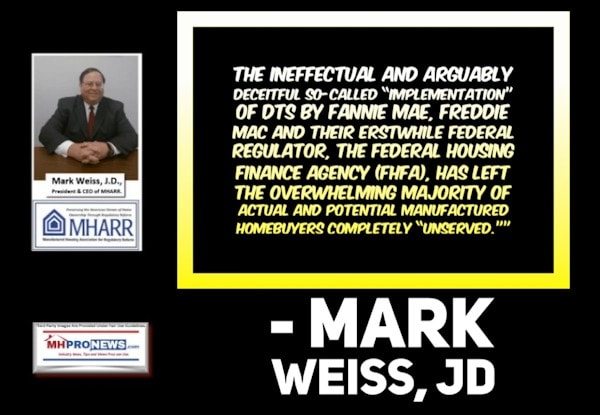

As the rival national trade group, Manufactured Housing Association for Regulatory Reform (MHARR) reform has noted several times, where is there a similar push by MHI to get the full and proper implementation of the Manufactured Housing Improvement Act (MHIA) of 2000? Or its “enhanced preemption” provision?

Or where is there a similar push by MHI to get the federal government to fully and properly implement the Duty to Serve Manufactured Housing, underserved and rural markets mandated by Congress in the Housing and Economic Recovery Act (HERA) of 2008 on Fannie Mae, Freddie Mac, and supposedly regulated by the FHFA?

Setting aside the merits, or lack thereof, of the general claims of this broad housing coalition that includes NHC and MHI, what this illustrates is how MHI is openly and proudly partnering with rival housing trade groups. Why aren’t they partnering with a pro-manufactured housing trade association MHARR, as they previously pledged to do in writing?

Is it any wonder that MHI’s leaders have tolerated Lesli Gooch’s documented conflicts of interest in working-for-pay with non-manufactured housing trade organization, as an MHI whistleblower told MHProNews?

Whistleblower’s Documents on Lesli Gooch – Manufactured Housing Institute CEO – New Discoveries

Additionally, what NHC and MHI both ignore or fail to disclose, for whatever reasons, are how this issue is purportedly being used by House Speaker Nancy Pelosi (CA-D) and her key Democratic allies as a kind of hostage negotiation leverage point with the White House and Congressional Republicans.

Furthermore, MHI has claimed for years to have “influence” and “clout” with the federal government. In support of that, they show a steady stream of photo opportunities and videos with federal officials or at White House events. What this plea logically reflects is that when the chips are down, the White House and others have ignored MHI’s call for action to de facto cave into the demands of Democrats. The political logic for that is clear, since Democrats and organizations such as the NHC, Urban Institute, MHI and others are direct beneficiaries of funding from groups such as Warren Buffett nonprofit donations or Buffett led Berkshire Hathaway business units, such as Clayton Homes, 21st Mortgage Corporation, Vanderbilt Mortgage and Finance, and the like. Additionally, Berkshire holds stock in other companies including financial institutions such as Wells Fargo that often are members of groups like NHC and MHI.

One should also note that while NHC’s Dworkin is cited by numerous media outlets in this campaign, MHI – beyond a mention or their logo – is relatively mute. Agree or not with Dworkin, he and the NHC composed a reasonably cogent letter to make their case. Meanwhile, MHI sends out a posturing email that touts their efforts and then begs their members and supporters to pressure Congress in a fashion that would arguably politically benefit Democrats more than President Trump and the GOP.

This is yet another example of how Buffett and his oligarch billionaire allies have established a “heads I win, tails you lose” scenario.

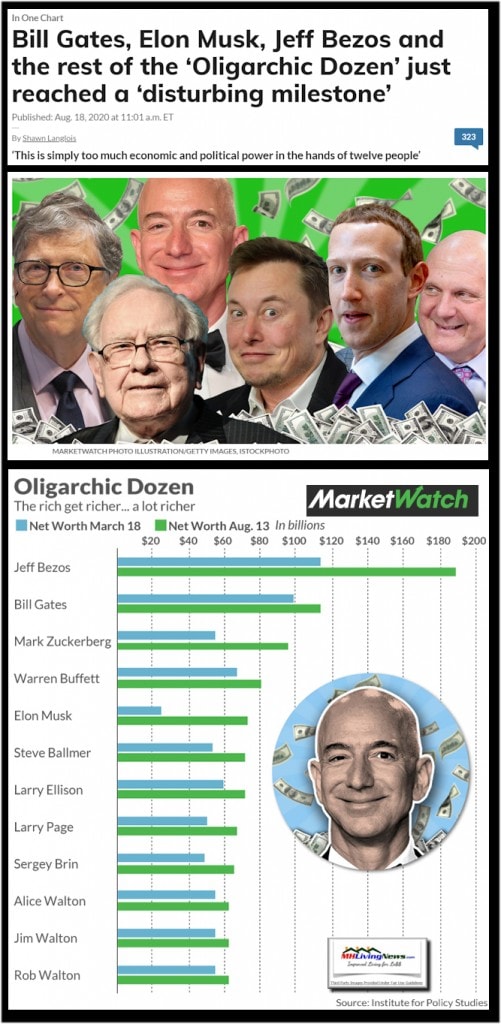

Both action and inaction on this rental housing crisis – either course of action would arguably help what MarketWatch referred to as the “Oligarchic Dozen,” that includes Bill Gates and Warren Buffett.

Summary and Conclusion

“The system is rigged.” That statement has been made by both Democrats and Republicans.

For whatever reason, perhaps timing, perhaps something else, while President Trump has been willing to call out leftist oligarch George Soros, he has not been as vocal about Bill Gates or Warren Buffett recently. Yet, Buffett, Gates, Bezos, Zuckerberg and others from big business, big banking, and big tech are lining up to oppose him, his policies, and political allies. That seems uncharacteristic of the president, who is known as a counterpuncher.

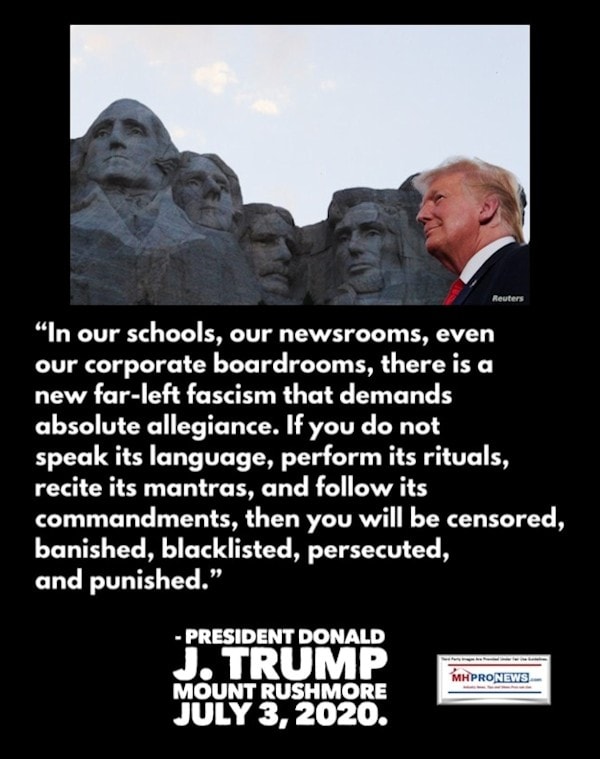

President Trump has made reference to them, but they are oblique, like the one below.

In fairness, here in the U.S., there are indeed numerous constitutional issues at play in this post-Wuhan China Coronavirus era of widespread shutdown and restart epoch in world history. But the selective use of questions of constitutionality by politicos undermines the system, public understanding, and confidence. That happens to routinely play into the hands of the political left and their leftist billionaire backers.

As MHProNews and MHLivingNews have previously illustrated, the powers-that-be that sometimes work behind the scenes, but at other times quite openly, have pummeled the administration for ‘following the science’ as well as for bucking what some ‘experts’ have said is prudent. Those maneuvers dodge the question of the ultimate responsibility lying with Communist China, the World Health Organization (WHO), and those like Gates and his foundation that arguably knew what was occurring well in advance of others here in the U.S.

As the election looms ever closer – now some 7 weeks out from November 3, 2020 – every such issue is viewed through not only a policy lens, but also through the political risks and rewards too. Like the CDC order or not, agree or not with its constitutional legality, it was an effort by the Trump Administration to do what Congressional Democrats declined doing. Namely, sitting down with Administration and Republican leaders and doing a clean deal that focused on targeted aspects of the pandemic, vs. doing nothing at all or caving into the Democrats and their lengthy multi-trillion dollar wish list.

Among the opening quotes above was this from Dworkin: “…Congress and the White House must reconvene negotiations on a comprehensive solution immediately. Treasury secretary Steven Mnuchin has said, ‘Our first choice is to have bipartisan legislation that allocates specific rental assistance to people hardest hit.’ If there’s that much agreement, then there is no reason to delay any further.” That is suspiciously like pro-Democratic paltering.

What Dworkin is quoted as saying in Forbes is perhaps even more relevant to most manufactured home industry professionals and their investors. “The money homeowners save on their mortgage through refinancing is going to go somewhere. Plus, they’re strengthening their bottom line, which is important when you’re in a recession.” Rephrase that through the lens of manufactured housing and the on-paper legal access to lending programs that would or could have turned millions of renters into housing owners. MHI – and by extension, NHC as well – failure to push for the full and proper implementation of the Duty to Serve (DTS) has only served to undermine millions of Americans.

Who benefited from the absence of that, if someone follows the money trail? Arguably, it is those who are consolidating the rental housing market.

This is a scandal of epic proportions that is so extensive that it has to be digested in bits and pieces in order to be properly understood. But it is being woefully misunderstood by far too many in mainstream media.

There is always more to know. Stay tuned with the runaway largest and documented number one most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Who is “Drinking the Kool-Aid” – Sunday Weekly Headline Review