According to a brief in S&P Global Market Intelligence, the Securities and Exchange Commission (SEC) plans to take an enforcement action against Dan Urness, Cavco Industries’ Principle Accounting Officer.

“Rather than have this be a distraction to the company, Mr. Urness has decided to go on leave to focus on his response to the Wells Notice,” their brief said was Cavco’s response to the SEC enforcement report.

“A Wells notice is a letter that the U.S. Securities and Exchange Commission sends to people or firms when it is planning to bring an enforcement action against them,” says Wikipedia.

The source said that Cavco Chief Accounting Officer Paul Bigbee will be in charge of the company’s principal financial officer in completing its upcoming quarterly filing for the period ending Sept. 26, 2020.

Cavco and SEC Approaching Settlement on Joe Stegmayer Related Controversies?

Additionally, “Cavco Industries Inc. said it expects to reach an “agreeable settlement” with the SEC staff in the coming months regarding an ongoing investigation involving trading in the securities of other public companies.” That’s also according to the same S&P Global Market Intelligence short.

The manufactured and modular housing homebuilder added that the SEC staff recently issued a Wells Notice to CFO and Principal Accounting Officer Dan Urness in connection with its investigation, saying it plans to recommend an enforcement action against him.

“Rather than have this be a distraction to the company, Mr. Urness has decided to go on leave to focus on his response to the Wells Notice,” Cavco said.

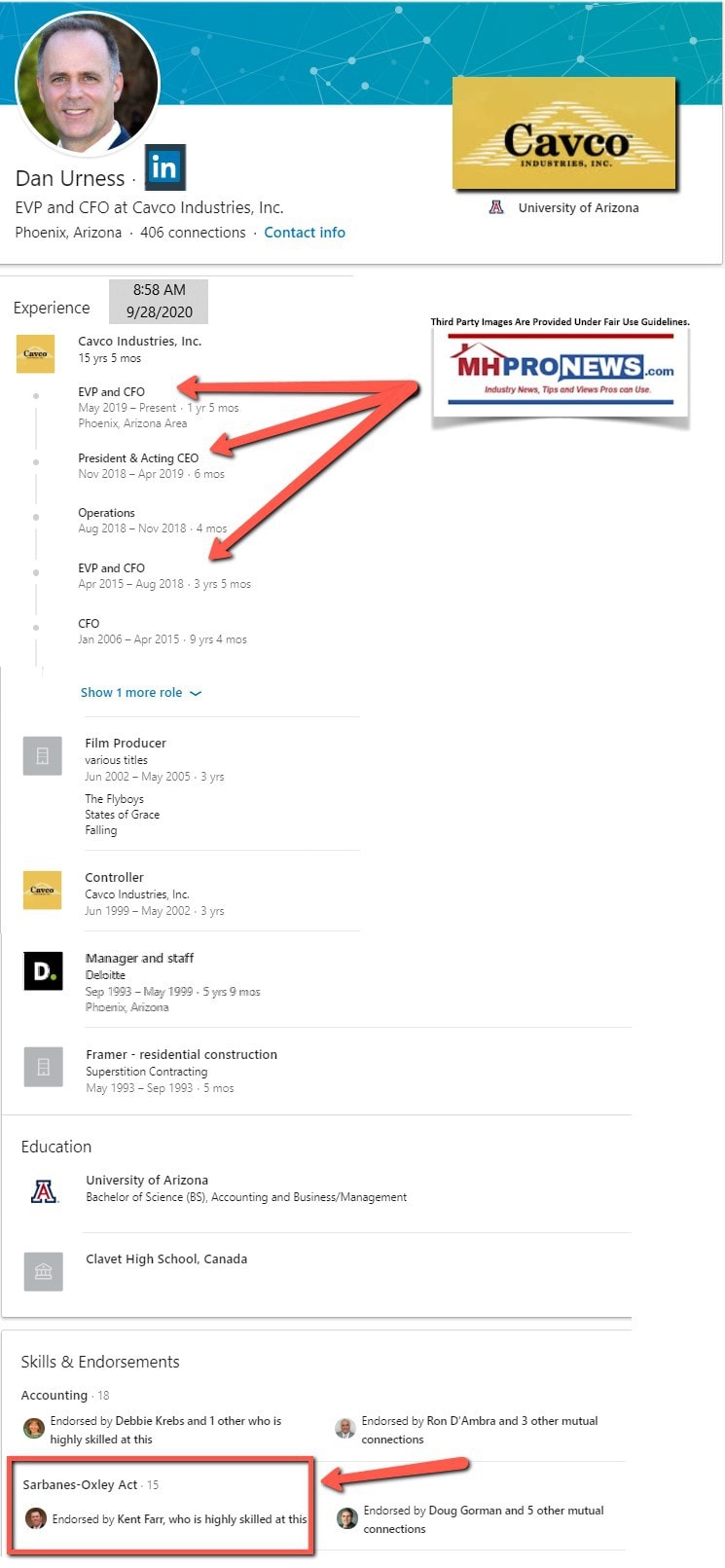

LinkedIn shows Urness’ title as being executive vice president (EVP) and chief financial officer (CFO). It also reflects his claimed expertise in the Sarbanes-Oxley Act. The act was supposed to protect investors, and the Balance described it as “cracks down on corporate fraud. It created the Public Company Accounting Oversight Board to oversee the accounting industry. It banned company loans to executives and gave job protection to whistleblowers.”

Cavco Chief Accounting Officer Paul Bigbee will be in charge of the company’s work as principal financial officer in completing its upcoming quarterly filing for the period ending Sept. 26.

A copy of a letter that is part of a more details statement involving Stegmayer, Cavco and the SEC was obtained from a federal source as shown is linked here.

Additional Information, Stegmayer Trading History, SEC, Legally Related Documents, with MHProNews Analysis and Commentary

Newcomers to MHProNews may need an FYI that it was in November, 2018 that Cavco’s stock dropped sharply as a result of the news that prior Chairman, President, and CEO Joe Stegmayer – as well as Cavco – were issued a subpoena over securities related controversies that allegedly violated SEC regulations.

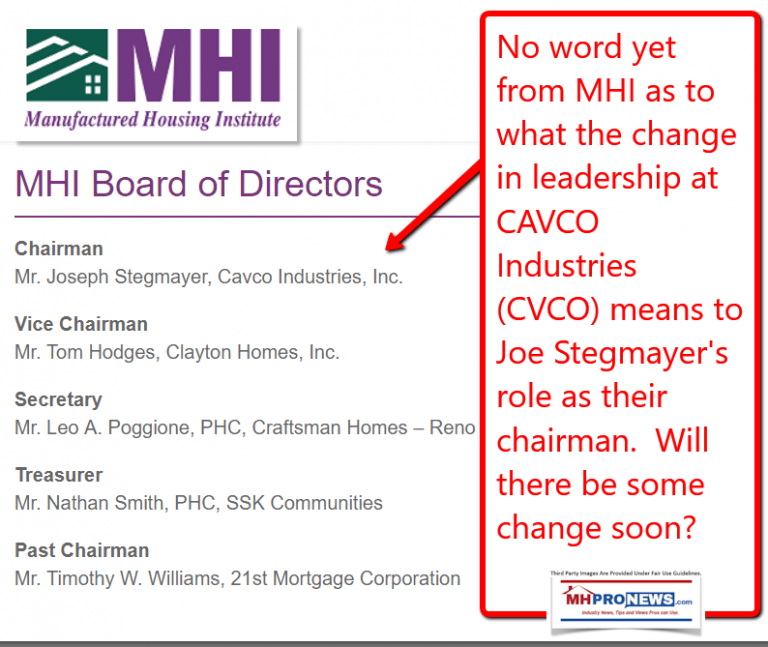

Manufactured Housing Institute on Cavco Industries, ex-Chairman Joe Stegmayer SEC “Debacle”

In the wake of what an insider told MHProNews about that Cavco “Debacle,” a raft of Shareholders investigations and legal probes were launched by plaintiffs attorneys. One of several reports on that are linked below.

Additionally, MHProNews has linked a copy of an insight-rich legal document from one of those law firms further below.

While Cavco’s stock slowly recovered pre-pandemic, the publicly traded firm has acknowledged in filings that they have spent “millions” dealing with the legal issues.

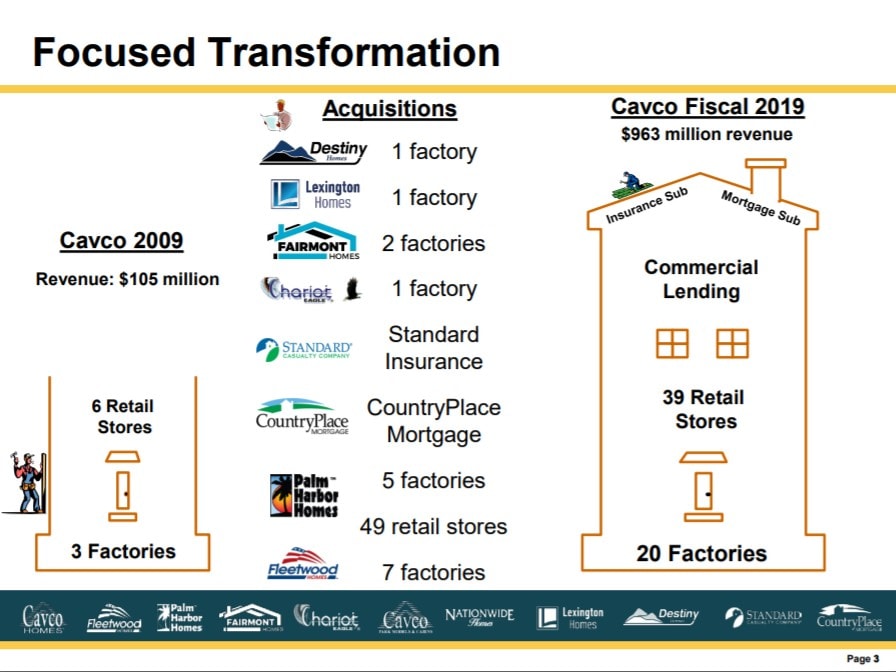

More recently, a new allegation has emerged. Namely, that Cavco bought Lexington Homes as part of a ploy to close the prior competitor, which if true, could result in antitrust and other possible legal risks.

Cavco Industries “Killer Acquisition,” CVCO’s New Controversy Tests Antitrust Resolve

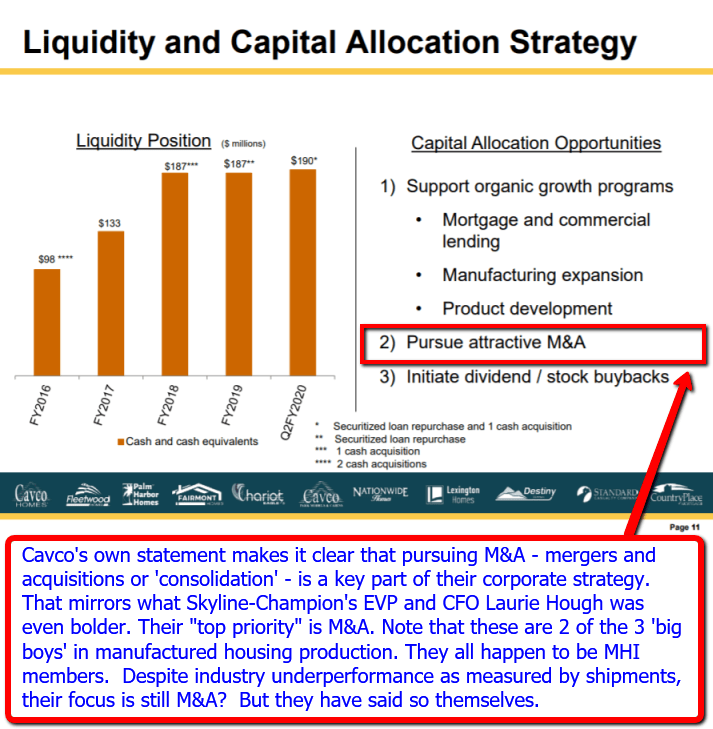

See the related reports for more. But note that CVCO’s own investor relations package makes clear that ‘mergers and acquisitions’ are a focus for the firm.

These might all be possible links to additional federal or other regulatory probes in the days ahead. Not yet mentioned publicly in these various allegations and probes are moves by investors in Cavco that might signal inside knowledge prior to the November 8, 2018 public notice.

The continuing controversies eventually caused long-time manufactured housing believers to cut their investments in the firm.

A graphic that covers the insider trading history of Joe Stegmayer, former Manufactured Housing Institute (MHI) Chairman and prior Chairman, President, and CEO of Cavco Industries is shown below.

A copy of a legal draft for a class action lawsuit by Howard Smith Law is attached here. It sheds added light on the various controversies and allegations. Among the notable and related pull quotes from that class action legal document are these claims.

“3. On November 8, 2018, the Company revealed that it had received a subpoena from the SEC’s Division of Enforcement on August 20, 2018, requesting certain documents relating to trading in the stock of a public company, and that then-Chief Executive Officer Joseph Stegmayer had received a subpoena regarding similar issues on October 1, 2018.

4) On this news, the Company’s share price fell $49.48 or over 23%, to close at $165.20 per share on November 9, 2018, on unusually heavy trading volume.

5) Throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors:

- that the Company had agreed to refrain from trading the stock of public companies;

- that, after such agreement, the Company’s CEO had engaged in the trading of the stock of public companies;

- that such trading activities were reasonably likely to subject the Company to regulatory investigations; and

- that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects were materially false and/or misleading and/or lacked a reasonable basis.”

Researchers, serious and attentive professional industry readers, advocates, and public officials should recall that Stegmayer was a division president for Clayton Homes. Clayton is now owned by Chairman Warren Buffett of led Berkshire Hathaway. Berkshire (BRK) is a publicly traded firm. An interview with Stegmayer is linked here. In a stating-the-obvious disclaimer, much has been learned since that interview was published.

It is also worth emphasizing that a prior financial backer for Cavco, Third Avenue, dumped their CVCO stocks in the run up to the SEC investigation. Was that good luck for Third Avenue, or something else?

Last and not least. Sources inside Cavco told MHProNews that despite the notion that Stegmayer ‘stepped down’ as chair and CEO, he continued to carry an oversized role in the firm. Additionally, the Manufactured Housing Institute (MHI) continued to have Stegmayer function as their chairman of the board, despite the public scandal and stock crash following the SEC subpoena. MHProNews contacted Cavco’s outside media relations person. They have not as of press time confirmed or denied the concerns raised in this report.

While we are no fans of Warren Buffett’s business practices, there are times that one or more of his quotable quotes seems to fit.

MHProNews continues to monitor and report on the issue like this one at Cavco that has been largely or completely ignored by other so-called industry trade pubs, bloggers, and the Manufactured Housing Institute (MHI) in their respective messaging. See the linked and related reports above and below to learn more.

Manufactured Housing Lending 2020 Re-Examination – FEDs, Lenders, and Advocates

There is always more to know. Stay tuned with the runaway largest and documented number one most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Manufactured Housing Institute Warns Members – Pondering Legal Action, Insider Insights

Alice Sparks, SSK Communities Partner, Dies Amidst Flagship Communities IPO Controversies

Frank Rolfe, MHU/RV Horizons Protest by MHAction; Nathan Smith/SSK/MHI Flashbacks?

Barriers to Entry, Persistence, and Exiting in Business, Affordable Housing, and Manufactured Homes