In a news release to MHProNews and others in media, Bedford, Texas based Legacy Housing Corporation provided a snapshot of their third quarter 2020 results.

That report follows below. It will be followed by additional information, MHProNews analysis and commentary.

November 16, 2020 19:15 ET | Source: Legacy Housing Corporation

BEDFORD, Texas, Nov. 16, 2020 (GLOBE NEWSWIRE) — Legacy Housing Corporation (NASDAQ: LEGH) today announced its financial results for the third quarter ended September 30, 2020.

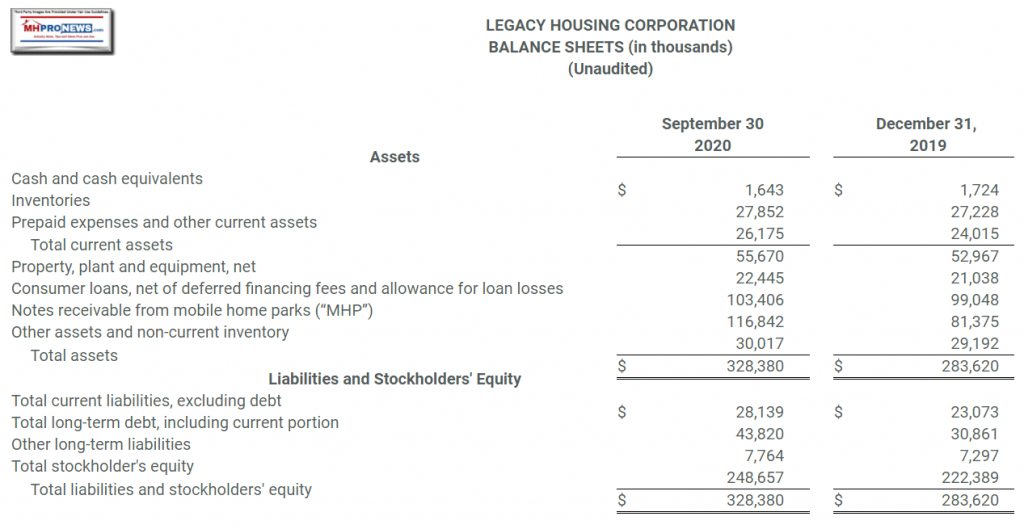

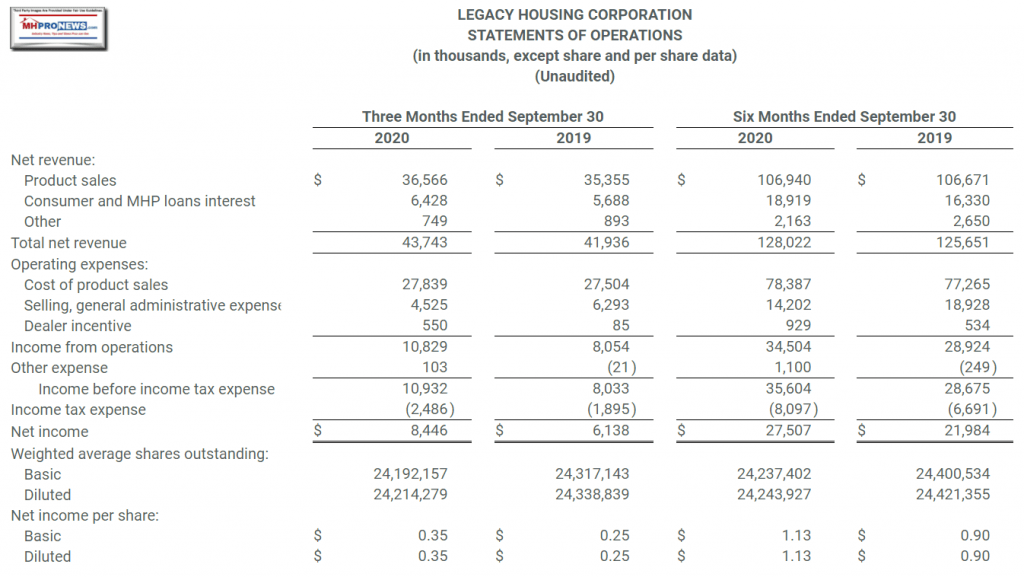

Financial Highlights:

- Revenue for the third quarter of 2020 was $43.7 million, which was an increase of $1.8 million and a 4.3% improvement from the net revenue of $41.9 million in the third quarter of 2019.

- Interest income from both the consumer loan and mobile home park loan portfolios in the third quarter of 2020 was $6.4 million, a 13.0% increase from the $5.7 million recorded in the third quarter of 2019.

- Income from operations in the third quarter of 2020 was $10.8 million, which was a $2.8 million increase and a 34.5% improvement from the $8.1 million reported in the third quarter of 2019. On a trailing twelve month basis, income from operations has increased by $10.4 million or 31.4%.

- Selling, general and administrative expense in the third quarter of 2020 was $4.5 million, a 28.1% decrease of $1.8 million from the $6.3 million in the third quarter of 2019. This was due to a reduction in payroll costs, bad debt expense and loan loss provision, warranty service costs, and consulting and professional expenses.

- Total inventory was reduced by $2.3 million or 5.7% to $38.0 million in the third quarter of 2020 compared to $40.3 million in the third quarter of 2019.

- Net income in the third quarter of 2020 increased by $2.3 million to $8.4 million or 37.6% compared to $6.1 million in third quarter 2019.

- Earnings per share for the third quarter of 2020, based on diluted weighted average shares outstanding, was $0.35 on 24,214,279 diluted outstanding shares versus $0.25 on 24,338,839 diluted outstanding shares for the comparable quarter in 2019.

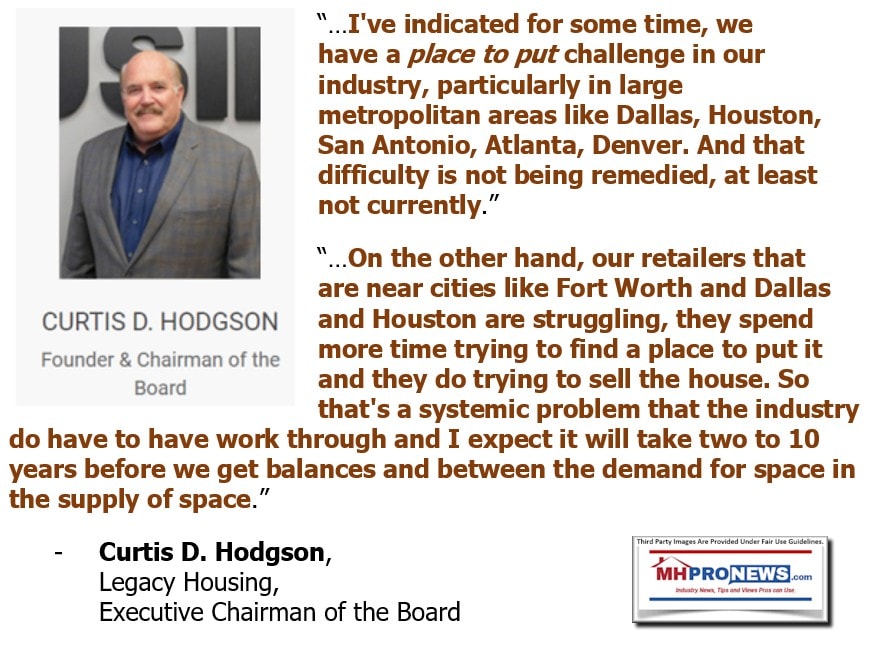

- Curtis D. Hodgson, Executive Chairman of the Board, commented, “We are pleased with the results of the third quarter of 2020, especially in our ability to outperform 2019 earnings results despite the challenges of 2020. Demand for mobile housing remains strong as we look to finishing out the remainder of the year. Over the last twelve months, we have increased tangible book value by $1.42 per share.”

This shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the Company’s securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Management Conference Call – November 17 at 10 AM (Central Time)

Senior management will discuss the results of the third quarter of 2020 in a live webcast and conference call on Tuesday, November 17, 2020 at 10:00 AM Central Time. To register and participate in the webcast, please go to https://edge.media-server.com/mmc/p/zc7af25t which will also be accessible via www.legacyhousingUSA.com under the Investors link. In order to dial in, please call in at (866) 952-6347 and enter Conference ID 8382528 when prompted. Please try to join the webcast or call at least ten minutes prior to the scheduled start time.

About Legacy Housing Corporation

Legacy Housing Corporation builds, sells and finances manufactured homes and “tiny houses” that are distributed through a network of independent retailers and company-owned stores and are sold directly to manufactured housing communities. We are the fourth largest producer of manufactured homes in the United States as ranked by number of homes manufactured based on the information available from the Manufactured Housing Institute. With current operations focused primarily in the southern United States, we offer our customers an array of quality homes ranging in size from approximately 390 to 2,667 square feet consisting of 1 to 5 bedrooms, with 1 to 3 1/2 bathrooms. Our homes range in price, at retail, from approximately $22,000 to $120,000.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Securities and Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. As a result, our actual results or performance may differ materially from anticipated results or performance. Legacy Housing undertakes no obligation to update any such forward-looking statements after the date hereof, except as required by law. Investors should not place any reliance on any such forward-looking statements.

Investor Inquiries:

Shane Allred, Director of Financial Reporting, (817) 799-4903

investors@legacyhousingcorp.com

or

Media Inquiries:

Casey Mack, (817) 799-4904

pr@legacyhousingcorp.com

##

Additional Legacy Housing Related Information, and MHProNews Commentary

From Legacy’s latest 10Q are the following pull-quotes, which reflects their distribution network information.

“Our homes are marketed under our premier “Legacy” brand name and currently are sold primarily across 15 states through a network of 84 independent retail locations, 13 company-owned retail locations and through direct sales to owners of manufactured home communities. Our 13 company-owned retail locations, including 11 Heritage Housing stores and two Tiny House Outlet stores exclusively sell our homes. For the nine months ended September 30, 2020, approximately 45% of our manufactured homes were sold in Texas, followed by 11% in Michigan, 7% in Georgia, 5% in Kansas, 5% in North Carolina, and 5% in Kentucky. For the nine months ended September 30, 2019, approximately 43% of our manufactured homes were sold in Texas, followed by 12% in Oklahoma, 7% in Alabama, 7% in Georgia, and 5% in Tennessee. We plan to deepen our distribution channel by using cash from operations and borrowings from our lines of credit to expand our company-owned retail locations in new and existing markets.

We offer three types of financing solutions to our customers. We provide floor plan financing for our independent retailers, which takes the form of a consignment arrangement between the retailer and us. We also provide consumer financing for our products which are sold to end-users through both independent and company-owned retail locations, and we provide financing solutions to manufactured housing community owners that buy our products for use in their manufactured housing communities. Our ability to offer competitive financing options at our retail locations provides us with several competitive advantages and allows us to capture sales which may not have otherwise occurred without our ability to offer consumer financing.”

That 10Q, which is data and corporate insight rich, is located at this link here.

As the quotes from Legacy’s Chairman, Curt Hodgson, indicate, the firm takes a longer term view and strategy. From an investment standpoint, they have been successfully executing on their business model.

There is more to know about Legacy, which will be covered in an upcoming report. But until then, what follows will give some added insights.

Postscript

Legacy had its controveries in the spring of 2020, which were reported by MHProNews. But based upon the what has happened since, and the dearth of similar issues since, that seems to be in the rear view mirror. By contrast, several other companies that are Manufactured Housing Institute (MHI) members have continued in a pattern of moving from one controversy to another and/or have never mended the fences they broke, to use a West Texas expression. That troubling statement of reality is one of several reasons why the manufactured housing industry are among the reasons why the industry is underperforming.

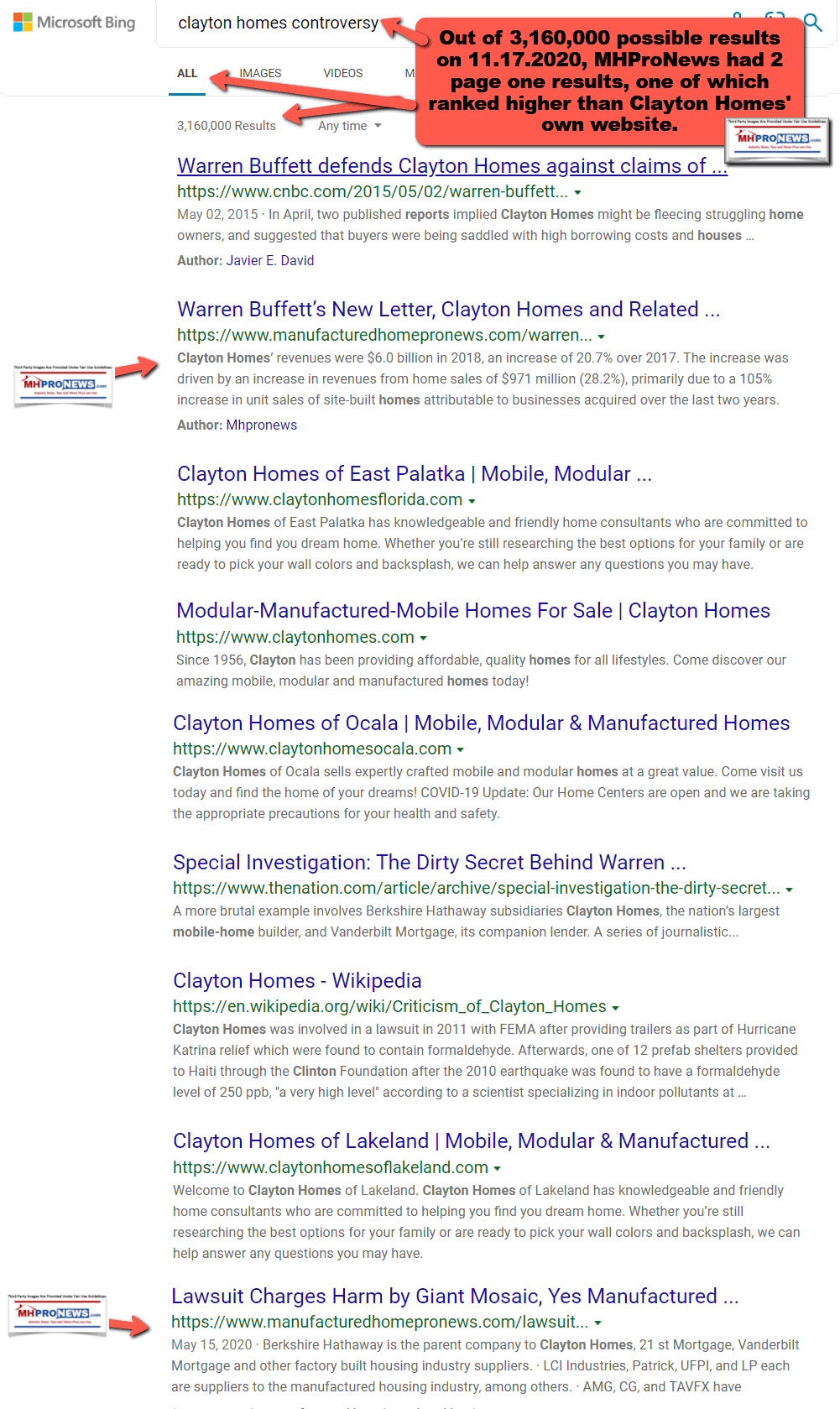

MHProNews is the only trade media that makes the effort to hold the industry’s powers that be accountable. Perhaps as a result, we continue to rank high in coverage, even against mainstream media, on topics we’ve reported on and explored.

Those reports are among the reasons why MHProNews is the runaway largest and #1 most read in our profession.

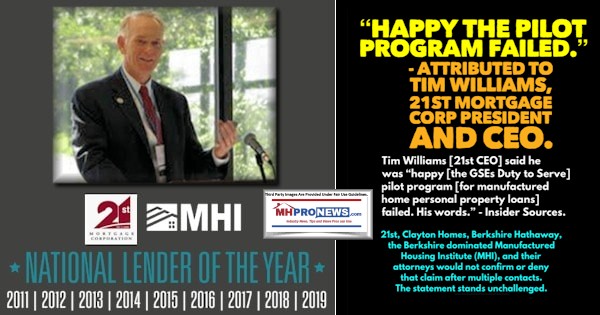

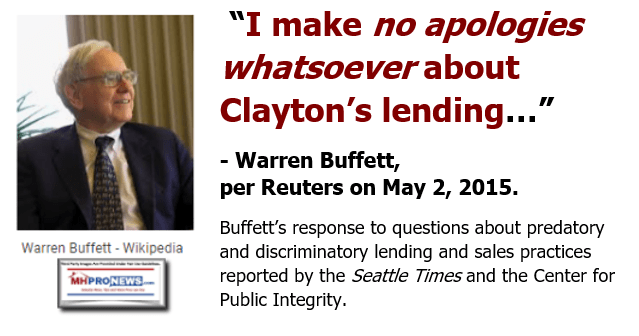

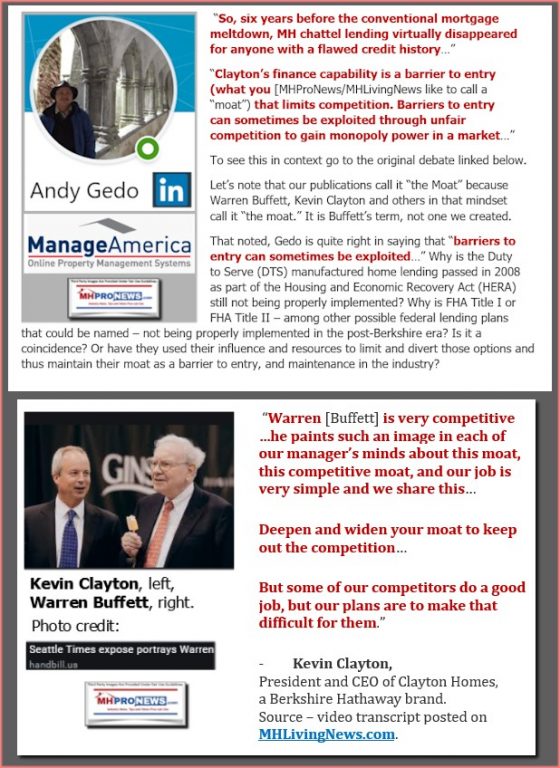

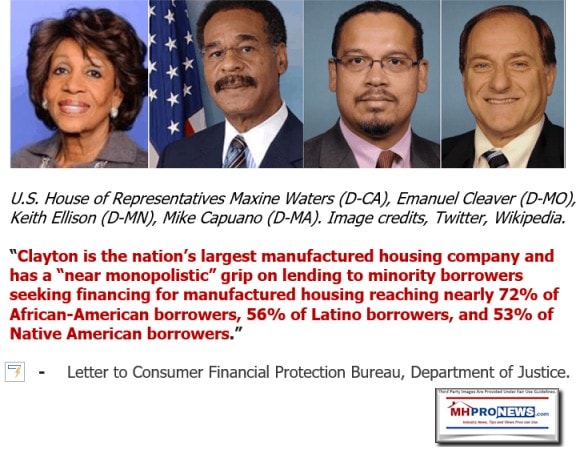

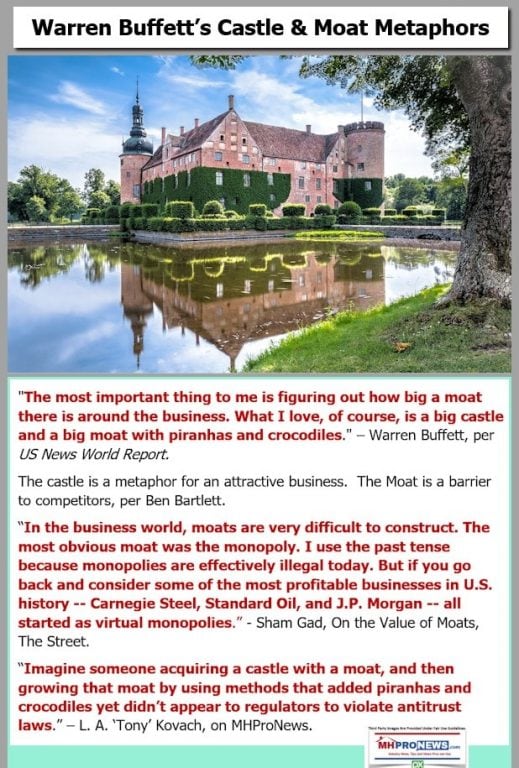

Manufactured housing is poised to do far better than it has been doing since the Warren Buffett led aquistion by Berkshire Hathaway of Clayton Homes and other pieces of the manufactured home industry. The need for affordable housing is growing, not diminishing. But the evidence strongly suggests, and the statments by various Berkshire connected insiders arguably confirms, that the industry in general is underperforming as a stealthy method of slowly creating a monopoly and related oligopolies.

Legacy Housing is relatively unique in our industry as much as they have arguably pushed back against those trends by their own strategic planning and execution. While others in similar capacities have been flaling or failing, Legacy continues to advance their game plan. Their most recent results suggest that game plan is working. Independents can take heart from elements of their example, ever mindful of the principle of separting the wheat from the chaff.

To learn more about connected issues, see the recent or other related reports that are linked herein and below.

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.