A high-level executive with a publicly traded manufactured housing firm told MHProNews that there are certainly advantages for privately owned companies. His statement was a reference to the significant levels of disclosures that must legally occur for a public company. In one sense, that comment mirrors a previous statement by Randy Rowe with Green Courte Partners.

Speaking of Rowe and not unrelated to our recent report on the new Manufactured Housing Association for Regulatory Reform statement on the FHFA manufactured housing “Duty to Serve” lending on manufactured homes, it worth looking at both Rowe’s words on that topic to see what was said before and what has occurred since.

That noted, publicly traded firms are a useful source for information on several manufactured home industry topics. For instance, privately owned firms may not be so anxious to admit the impacts of COVID19 on their enterprise. By contrast, like it or not, Mark Yost President and CEO at Skyline Champion (SKY) has little choice but to acknowledge the harm down by “intermittent COVID plant shut downs” – as Yost phrased it – caused by the coronavirus. See that and more in his comments further below.

With the run-up to the 2020 election and the post-election drama, MHProNews made the decision to hold this Skyline Champion (NYSE:SKY) report until later in November (i.e. now). In some ways that may prove to have been useful, given that it might have been lost in the intense pre- and post-election media, professional, and public focus. Nevertheless, we teed up what was coming from these insights via reports like the one below.

Note that a delay for similar reasons was also implemented on Legacy Housing [NASDAQ:LEGH] or some other publicly-traded related reporting in the pre- and post November 3 timeframe.

It is important to consider what follows below about Skyline Champion in the light of the retailer tip-based controversy broken by MHProNews that is linked above. While neither Yost nor his Skyline Champion team members specifically mentions the incident related in that report above, one can’t help but note comments that are related to lumber and the drama around serving their retail network.

With the backdrop of the two reports linked above, as with MHProNews’ recent report and analysis on publicly-traded Legacy Housing [NASDAQ:LEGH], minor edits of typographic type errors has been made in the transcript below. That noted, there are no substantive changes in the meaning or text, which remains faithful to what the Motley Fool reported at this link here. At the end of this report, a few pull quotes will be spotlighted for possible future insights.

Skyline Champion Corp (SKY) Q2 2021 Earnings Call Transcript

(MFTranscribers)

Oct 28, 2020 at 5:30PM

Skyline Champion Corp (NYSE:SKY)

Q2 2021 Earnings Call

Oct 28, 2020, 8:00 a.m. ET

Contents:

- Prepared Remarks

- Questions and Answers

- Call Participants

Prepared Remarks:

Operator

Good morning, and welcome to Skyline Champion Corporation’s Second Quarter Fiscal Year 2021 Earnings Call. The Company issued an earnings press release yesterday after the close.

I would now like to introduce your host for today’s call, Sarah Janowicz, the Company’s Director of Investor Relations and External Reporting. Sarah, you may begin.

Sarah Janowicz — Director of Investor Relations and External Reporting

Good morning, and thank you for participating in our earnings call to discuss our second quarter results. Joining me on today’s call is Mark Yost, President and CEO; and Laurie Hough, EVP and CFO.

I would like to remind everyone that yesterday’s press release and statements made during this call include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties that could cause actual results to differ materially from our expectations and projections. Such risks and uncertainties include the factors set forth in the earnings release and in our filings with the Securities and Exchange Commission.

Additionally, during today’s call, we will discuss non-GAAP measures, which we believe can be useful in evaluating our performance. A reconciliation of these measures can be found in the earnings release.

I would now like to turn the call over to Mark.

Mark Yost — President and Chief Executive Officer

Thank you, Sarah, and good morning, everyone. Today, I will provide an update on the second quarter, as well as the balance of the fiscal year and beyond. I will discuss the overall favorable housing environment, which continues to recover in the very strong long-term dynamics.

Let me begin by saying that I am very encouraged about the strength of the broader industry. We have seen a significant inflection point in the homebuilding industry as demand at the macro level is being driven by low interest rates, millennial home ownership and people adapting to lifestyles centered around the home. With homes now serving as a home, office, school, gym, entertainment center and a place of safety and solitude, we believe demand, especially for high-quality and affordable homes will remain strong. We are fortunate that we are very well positioned to benefit from these dynamics. True to these dynamics, we are seeing strong demand in order rates. During the quarter, our consolidated orders were up 70% sequentially from our first quarter, and up 53% from the second quarter of last year. We delivered 4,991 homes during the quarter, an 18% improvement from a sequential first quarter, but down 7% from prior year due to our production ramp.

During the quarter, our US manufacturing facilities improved capacity utilization by 5%, reaching 63% during the quarter, despite being hampered by intermittent COVID plant shut downs, supplier disruptions and short-term hurricane-related outages. By the end of September, we reached production levels that are similar to those achieved at the same time last year.

Our Western Canadian plants have followed a pattern like the US plants. Sales were down about 7% in the quarter of fiscal ’21 as compared to the same period last year, but we’re up 62% from the fiscal first quarter. Canada also saw a steady increase in orders during the quarter. The strong order demand for our homes has continued to outpace production, which has resulted in increases in backlog. Our backlog grew $198 million during the second quarter to $390 million and stands on average in the US at 19 weeks. As a basis of comparison, our backlog grew $19 million during the second quarter of last year and was out in average of seven weeks in the US. As our supply chain partners increased their production levels, we will be able to deliver more products to our customers.

While recruitment of new applicants is not at pre-COVID levels, it has improved in most regions of the US over the last few months. We are in the process of training and onboarding new employees and are working to increase our labor force to accommodate the increased demand for housing. Maintaining a safe and healthy environment for our employees remains a top priority, and we continue to follow the enhanced safety and sanitation protocols at our facilities and are adhering to CDC guidelines for social distancing and other measures to reduce the spread of COVID-19.

Walk-in traffic at retail stores is still below pre-COVID levels, but has also improved over the last few months. Customers come in to look for homes are ready and able to buy. We hear that many buyers are moving from multi-family apartment buildings and need more space as they spend more time at home due to the financing environment, many first time buyers are entering the market.

In talking with our dealers, financing availability is still strong and inventory levels are lean as customers are purchasing spec homes instead of waiting for custom-ordered homes to arrive from the manufacturing facilities. We continue to gain traction in our builder developer channel with our Genesis brand. Our penetration into small and mid-sized subdivision builders continues to gain momentum. Builders like the turnkey nature of the product. More of our channel partners are asking for full turnkey solutions. In the Northeast, where we’ve launched our set crew and finishing services last year, we are utilizing our turnkey approach on a Genesis exclusive subdivision currently under way. Likewise, the ADU market is starting to pick up out West.

Given the backdrop of low interest rates, favorable demographic and geographic trends, combined with limited housing supply, we believe that the demand for our housing solutions will grow. What is important to note is that, the demand is being driven by every channel we serve and across multiple geographies, which has deeper roots in sustainable demands in past years.

Given the dichotomy between housing inflationary factors and a recovering economy with millions out of work and behind in payments wanting to expand, we believe that our attainable housing solutions will outpace the overall market. With our labor force we can scale more effectively over the long-term, especially as we expand our automation and digital capabilities, which we intend to invest more heavily in for our customers.

I will now turn the call over to Laurie to discuss our quarterly financials in more detail.

Laurie Hough — Executive Vice President and Chief Financial Officer

Thanks, Mark, and good morning, everyone. I will begin by reviewing our financial results for the quarter, followed by a discussion of our balance sheet and cash flows. I will also briefly discuss the margin headwinds we are expecting in our fiscal third quarter.

Net sales decreased by 9% to $322 million in the second quarter versus the same quarter last year. We saw revenue declines of $29.5 million in the US factory-built housing segment, as well as declines in our Canadian factory-built housing segment of $1.8 million. The decline in US factory-built revenue was primarily driven by a decline in the number of homes sold and a reduction in average selling price. The decrease in the number of homes sold was 6.7% or 337 units, compared to the same quarter last year.

The average selling price per US home sold decreased by 2.9% to $60,400 due to a shift in product mix to more single section homes and customers selecting less expensive upgrades versus the same period last year. While results remained below a year ago levels, we are particularly encouraged by the strong sequential performance as conditions have improved significantly, compared to the beginning of the pandemic. Net sales revenue and the number of homes sold for our US factory-built segment increased 14% and 16%, respectively, in the second quarter, compared to the first quarter of fiscal 2021.

Canadian revenue decreased 7% to $24.6 million, compared to last year, driven by a 4% decline in the average home selling price to $81,300, as well as a 3% decline in the number of homes sold to 302 units. The decrease in the average selling price was due to a shift in product mix.

Consolidated gross profit decreased to $62.8 million, down 15.2% versus the prior year quarter due to reduced sales volume. Our US housing segment gross margins were 19.2% of segment net sales, down 170 basis points from the second quarter last year due to increased material costs as a percent of sales caused by market volatility in certain commodities, including forest products.

SG&A in the second quarter decreased to $41.4 million versus $48.4 million in the same period last year. The decrease was primarily due to a reduction in variable incentive compensation and reduced travel and marketing costs. We also experienced favorability in SG&A costs due to a reduction in non-cash equity compensation expense of $1.4 million.

We recorded other income of $2.6 million during the quarter related to the — to Canada’s Emergency Wage Subsidy program enacted in response to the pandemic. We continue to monitor our eligibility to apply for financial assistance with this or any other government program.

Net income for the second quarter was $17.5 million, or $0.31 per share, compared to net income of $17.7 million or earnings of $0.31 per share during the same period in the prior year. On an adjusted basis, we generated $0.31 of net income per diluted share, compared to $0.34 in the year ago quarter driven by a combination of lower gross profit, which was partially offset by a reduction in SG&A, the benefit of the Canadian Wage Subsidy program and a reduction in income tax expense.

The Company’s effective tax rate for the three months ended September 26, 2020 was 24.4% versus an effective tax rate of 29.8% for the fiscal 2020 second quarter. The Company’s effective tax rate decreased primarily due to increased federal tax credits related to R&D and the ENERGY STAR program.

Adjusted EBITDA for the quarter was $28.9 million, a decrease of 10.9% over the same period a year ago. The adjusted EBITDA margin compressed by 20 basis points to 9% due to an increase in material costs that were partially offset by lower SG&A expenses and the Canadian Wage Subsidy program. Without the benefit of the Wage Subsidy, our adjusted EBITDA margin would have been 8.2%.

Shifting to our outlook for the third quarter, we believe our financial results will continue to be impacted by increased material costs, especially forest products, labor constraints, including higher than normal absenteeism due to COVID and intermittent material shortages. There has been considerable market volatility for lumber and OSB over the last few months. While pricing seems to have peaked and it’s starting to decrease, we expect to see compression in our margins in our fiscal third quarter as more of the impact of the spike in lumber pricing will be realized in our results due to the length of our backlog and the structure of our lumber and OSB contracts.

We have instituted price increases to help offset a portion of the increased material costs. But in some cases, we are constrained by competitive pressures and other market dynamics that don’t permit a full recovery of the increased costs in the short-term. Over the medium- and long-term, we believe the demand for single family homes is strong and the increase in input costs can be passed on to the end consumer as they seek affordable and attainable housing solutions.

Turning to our labor force, voluntary attrition is lower this quarter compared to this time last year. We value our direct labor team members and are committed to retaining our people and growing our team to meet increased demand. We continue to recruit, onboard and train new team members to support the expected growth in the business. However, our production capability may continue to be limited in the short-term by additional instances of high absenteeism or intermittent plant shutdowns related to COVID-19. We mentioned last quarter that labor constraints contributed to our idling of two plants that are situated in a campus-style layout. By the end of our second quarter, we restarted operations at one of the two idle plants and expect to restart our operations at the other plant later this fiscal year as recruiting initiative allow.

As we progress through the second half of our fiscal year, we expect to continue to experience intermittent shortages or delays of certain raw materials used in our homes. We believe our supply chain partners are experiencing similar challenges with labor constraints, including COVID outbreaks and higher than normal absenteeism. We believe that we will be able to work with our vendors to effectively manage through these situations by using alternate sources or products to obtain the supplies needed for the homebuilding process.

As of September 26, 2020, we had $264 million of cash and cash equivalents, and long-term borrowings of $77 million with no maturities until June 2023. We generated $32 million of operating cash flow during the second quarter, compared to $25 million during the same period last year. The increase in operating cash flow is primarily due to cash flow benefits from government programs.

Under the CARES Act, employers are eligible to defer the employer portion of payroll taxes in part until as late as December 2022. During the first half of the fiscal year, we’ve deferred just over $7 million of US payroll taxes and have received almost $6 million from the Canadian Wage Subsidy program. We remain focused on executing on our growth and operational initiatives and plan to utilize our cash to reinvest in the business and to support strategic growth.

I’ll now turn the call back to Mark for some closing remarks.

Mark Yost — President and Chief Executive Officer

Thanks, Laurie. While we remain mindful of the uncertain conditions that the pandemic has introduced, we believe we are well positioned to support growth in revenues and expanded returns over the longer term as we work through labor constraints and pricing dynamics over the short-term. I continue to be impressed with the way our entire team has rallied together in the current environment. Our employees are amazing and dedicated. They continue to work hard, providing the market with attainable housing options that are so very desperately needed today.

And with that, operator, you may now open the lines for Q&A.

Questions and Answers:

Operator

Thank you. [Operator Instructions] Our first question comes from the line of Daniel Moore with CJS Securities. Please proceed with your question.

Daniel Moore — CJS Securities — Analyst

Good morning, Mark and Laurie. Thank you for taking the questions.

Mark Yost — President and Chief Executive Officer

Good morning, Dan.

Daniel Moore — CJS Securities — Analyst

I wanted to start with maybe just describe the monthly cadence of homes shipped through the quarter and thus far into October? I think Mark you said you were back at the similar rates of production to this time last year at the end of September. I’m wondering if we have been able to exceed that at this point.

Mark Yost — President and Chief Executive Officer

Yeah, Dan, thanks. I think steadily through July, August, and September, we saw pickups in production. So, it was pretty good pickups month after month. We had a 21% increase in production in the second quarter versus the first quarter. Thus far into October, we’re running about 10% to 15% in the first few weeks of October, higher production levels than we were during the average of the second quarter. So, we’ve seen steady improvement even into October and it’s progressing. The concern going forward, I think is with the increase in COVID cases and potential for enhanced supplier disruption, maybe later in the quarter. We’re kind of moderating the production levels or potential production levels to think that we’re going to be relatively flat for the quarter in terms of shipments versus last year.

Daniel Moore — CJS Securities — Analyst

Got it. That’s helpful. And you gave very good color, obviously, in the prepared remarks, but maybe just talk about whether it’s rank ordering, but the most significant bottlenecks to expanding production, is it labor? Is it the supply chain concerns? If so, what items and just kind of what’s in your control and what’s a little bit less than your control in terms of how long it might take to ramp up?

Mark Yost — President and Chief Executive Officer

Yeah. I think labor has steadily improved during the quarter. We’ve brought on more than about a hundred people, I think, we’ve hired during the quarter. And they’ve been onboarding and ramping up. So, we’ve seen good traction in getting new hires brought in. So, I think with the CARES Act, subsidies kind of waning, I think that’s improved steadily since then.

Labor still comes to market, but I would say, it popped up early in the quarter, second quarter, it was probably labor-related. Later in the second quarter, it was probably supply disruption that was primary, especially in certain cases forest products were very scarce. So we had to travel and go around just to find lumber products in some cases. In many cases, trying to find appliances or other things to make sure we get a complete home for the customer. So, those were challenges probably late in the second quarter. Those in — thus far in October have I think mitigated somewhat. So, we’re seeing improvement in supply chain and improvement in the labor pretty consistently, which is encouraging. Just it really comes down to, will the ramping COVID cases cause a week outage at a certain plant or another week outage or will governors and other people take action to pull back certain limitations.

Daniel Moore — CJS Securities — Analyst

Okay. And maybe one more, and I’ll jump back in queue. But if you could put a little bit more specificity on — around — I know it’s early in the quarter, but around the commentary for margins if we are able to, at least ramp production sequentially — should we think about margins being — gross margin being relatively flat versus this quarter and not expanding, or do you expect it to be actually down sequentially based on what you see today from all those factors? Thanks.

Laurie Hough — Executive Vice President and Chief Financial Officer

Hi, Dan. I can take that one. We expect margins to go down sequentially from the second quarter, primarily due to the length of our backlogs and the structure of our lumber and OSB contracts. So, still expecting to see some decreases, especially in the US.

Daniel Moore — CJS Securities — Analyst

Okay. I’ll jump back with follow-ups. Thanks.

Mark Yost — President and Chief Executive Officer

Thanks, Dan.

Operator

Thank you. Our next question comes from the line of Matthew Bouley with Barclays. Please proceed with your question.

Ashley Kim — Barclays — Analyst

Hi. This is actually Ashley Kim on for Matt this morning. So I just wanted to ask on the increased backlogs. Are you worried about any increased exposure to input cost volatility just given these? And then on that, how are you kind of managing pricing in light of the increased materials cost?

Mark Yost — President and Chief Executive Officer

Yeah. Ashley, thanks. I think — no — I think really the pricing environment is good, and I think overall, with the demand levels and pricing, I know most site-built homes have gone up significantly in price. I think for us with our backlogs, we have price adjusted most of our products into the future here. But — and we’re able to pass along those increases generally depending on competitive pressures by region. But overall, I would say, we’re generally able to pass on those price increases. The only dynamic that I think Laurie was referring to a moment ago is the fact that we had quite a bit of set prices in our backlog in lumber and OSB moved outside of our forecast window quickly. It was somewhat unprecedented, and then on top of that, certain supply contracts that we had were disrupted. And so, we weren’t able to get lumber even on those contracts. So we had to go to the spot market to buy in some cases, because our current obligations were not being able to be met. So, I think, overall pricing environment is a good one. I think the third quarter is where we should see some of that compression. Once we’re out of the third quarter, I don’t expect much compression after that, if any.

Ashley Kim — Barclays — Analyst

Okay. Thank you for that. That’s helpful. And then on the ramping capacity, do you have to make any changes to compensation in order to get those labors that you needed in order to meet demand? Or was that mainly just kind of a result of uncertainty around the CARES Act and that was kind of bringing more labor your way?

Mark Yost — President and Chief Executive Officer

Yeah. I think primarily, it was the competition for labor due to the CARES Act that was driving the challenges earlier in the year. I think labor availability is becoming more available definitely and I would expect as — depending on certain government stimulus packages or other things that they might enact, it could play a role in the labor availability. But overall, I’d say labor is available, there is high levels of unemployment. So, people are looking for work and we’re a great Company to work for and good product to build. People need homes today. So, I think it’s not really a pricing environment for labor as much as it is just getting the labor trained and developed and ramped up, which takes a few months.

Ashley Kim — Barclays — Analyst

Okay. I’ll leave it at that. Thank you.

Mark Yost — President and Chief Executive Officer

Thank you.

Operator

Thank you. Our next question comes from the line of Greg Palm with Craig-Hallum Capital Group. Please proceed with your question.

Greg Palm — Craig-Hallum Capital Group — Analyst

Yeah. Thanks. Good results in light of everything going on. I mean, Mark, I hate to put you on the spot, but from a demand standpoint, I guess, thinking that to last quarter, you sounded a little bit more cautious or maybe cautiously optimistic, is the right way to describe it, you sounded a lot more bullish this quarter, obviously, given the backlog in the order rates that’s, I guess, not all that surprising. But what gives maybe some added confidence that what we’re seeing now in terms of the demand environment had some legs behind it?

Mark Yost — President and Chief Executive Officer

Yeah. Greg, thanks, and good morning. Overall, I think there is a few things. Number one is, there is demand coming from every channel that we serve and in multiple markets. So it’s — if you looked in past years in the MH industry, there was generally large amounts of demand either coming from, let’s say, a large FEMA contract, which was kind of a one-time event, which was coming from a surge in — I’ll call it sudden orders, if you will, that flooded the supply chain. If you remember, like two years ago, we had a large either buildup in the supply chain, which kind of accelerated orders and then a destocking of that supply chain in the retail network that subsequently lowered orders.

I think what we’re seeing here is, generally speaking, retail inventories are in a good position. They’re lean. And also, two, since we see demand coming from multiple channels, it really is more — it’s dispersed and it has deeper roots. I think the financing environment is good. We’re seeing a tremendous amount of millennial traffic from what we’re talking to our dealers on. People are looking to get out of — I think people who have lost their jobs, or maybe lower income are trying to get out of a high payment rent environment apartment, and they can actually save a few hundred dollars a month by going to live in a community, going to purchase one of our homes. So, I think the current economic environment with financing and everything is just driving a lot of it, which I foresee continuing for some time. So, I think the demand is very good. I’m encouraged that our order rates are up 53%, even when we have a significant presence in California, which was affected by wildfires. We have a significant presence in Louisiana, which was affected by hurricanes. Some of the States like Michigan and parts of — when you look at shipments, even in Florida, some of those states that are key states for us were down in terms of shipments, yet our orders were up significantly. So, to me, demand is very good, very strong and it has a lot of deep roots to it to continue.

Greg Palm — Craig-Hallum Capital Group — Analyst

Okay. Good. And in terms of pricing, maybe I missed it. I’m not sure, did you quantify, maybe how much industry pricing has gone up here over the recent months given all of sort of the inflation we’ve been seeing?

Mark Yost — President and Chief Executive Officer

I don’t think we quantified industry pricing, Dan. But I would say, overall, lumber pricing has gone up. I know site builders, I saw a recent report by NAHB, they went up about, I think if I read right, $16,000 per home in that neighborhood. I don’t — our industry has not gone up quite that much, but it’s a meaningful number. It’s definitely in the thousands of dollars per home. But — so, I would say, it’s been significant when lumber doubles and triples in price. Yeah.

Greg Palm — Craig-Hallum Capital Group — Analyst

Yeah. Okay. And, I mean, I guess, just going back to the margin, I think you probably beat our gross margin expectations almost every quarter, since we’ve covered the stock, even though you certainly guide for conservatism. But just help us understand because presumably if pricing is up and shipments are flat, that means revenue is up year-over-year, up sequentially. And, I guess, I would assume if pricing has already gone up, that may be the headwind from lumber and raw materials. It won’t be as bad as the previous quarter, but you’re certainly alluding to the fact that it might be worse. So, just maybe help us understand if there is anything else in there.

Laurie Hough — Executive Vice President and Chief Financial Officer

Hey, Greg. I can take that one. So, the price increases are going to have to trickle in over the December quarter because of the length of our backlogs. And at the same time, we’re going to be hit by higher lumber prices because of the structure of our contract. So, we actually are expecting to see sequentially and versus the third quarter a pretty significant decrease in margins.

Greg Palm — Craig-Hallum Capital Group — Analyst

Okay. I mean, as we get through this, the sort of near-term impact, I mean, you were consistently running 20%-plus pre-COVID. Is that sort of a good baseline when we’re sort of through this near-term impact?

Laurie Hough — Executive Vice President and Chief Financial Officer

Yes, definitely. I think we’ll be able to get back there pretty shortly for this quarter.

Greg Palm — Craig-Hallum Capital Group — Analyst

Okay. Perfect. Okay. That’s it for me. Thanks.

Mark Yost — President and Chief Executive Officer

Thanks, Greg.

Operator

Thank you. Our next question comes from the line of Mike Dahl with RBC Capital Markets. Please proceed with your question.

Christopher Kalata — RBC Capital Markets — Analyst

Hey, guys. This is actually Chris for Mike. Thanks for taking my questions. The first question, just want to dive into the competitive dynamics you’re seeing right now. I mean, given Laurie your comments on potentially [Technical Issues] increased competition. Can you just kind of give us a little more [Technical Issues] driving that increase in competition and whether we should expect that to continue going forward?

Mark Yost — President and Chief Executive Officer

Yeah. Thanks, Chris, and good morning. I think overall — the competitive environment is, obviously, always there. I think right now today demand is outweighing most of the industry’s ability to manufacture and supply. So, I think it’s really on a geographic basis that you might see pockets of competition that are more competitive than others. Generally speaking, I think — overall, I think the Company is able to pass on price increases and manage the business effectively, given the competitive dynamics in the market is obviously a lean market. But, overall, I think the competitive dynamics are good and maybe not more challenging than former times, just it’s the timing and sequencing of people’s reaction to maybe the lumber inflation. That is a dynamic that I think we’ll see over the coming months.

Christopher Kalata — RBC Capital Markets — Analyst

Okay. Got it. And then just for my second question, with the pricing that you guys have in place today, is that enough, once you work through this — the backlog, is that enough to kind of cover what the peak lumber inflation is going to look like? Or do you still need incremental pricing from here to make to cover those costs?

Mark Yost — President and Chief Executive Officer

Yeah. I think overall we didn’t really price the product necessarily, I think for full inflation. It’s always a forecast, but generally you try not to price at the peak, you try and price it what you think it’s going to be in the forecast. So, overall, I think with lumber prices coming down on average, our forecasts are probably in line with where we think we should be. So, as lumber is expected to continue to decrease, we are seeing input — other input prices start to increase, maybe offsetting some of the declines that we’re seeing in lumber because other products are lagging to that lumber inflation, but they’re starting to uptick because of those supply chain challenges that I mentioned earlier. So, I think you’re going to see lumber coming down. You’re going to see other materials start to come up and it’ll be kind of be in line with where we think it’s going to be at.

Christopher Kalata — RBC Capital Markets — Analyst

Got it. If I could just sneak one more and just to clarify, is that what’s driving your commentary on 3Q being the low point that as the cost pressures abate that will allow for pricing to catch up?

Mark Yost — President and Chief Executive Officer

Yeah. So, I think with our pricing, we have backlogs that were through the end of the year. At the same time, that our lumber contracts or supply was either affected by outages. So, we weren’t able to buy at our contracted negotiated prices or it wasn’t available, I should say, at those prices. And so, we had to go to the spot market just to continue production and/or in some cases you have a situation where lumber went so quickly up because of those shortages that it will compress some of the margin in the backlog.

Christopher Kalata — RBC Capital Markets — Analyst

Got it. Appreciate all the color.

Mark Yost — President and Chief Executive Officer

Thanks, Chris.

Operator

Thank you. Our next question comes from the line of Phil Ng with Jefferies. Please proceed with your question.

Maggie Grady — Jefferies — Analyst

Hey. Good morning. This is Maggie on for Phil. I guess, first sticking to raw materials. You’ve talked about a lot about the elevated lumber costs, but we’ve also started to hear the manufacturers make price increase now for other categories like insulation and roofing and doors. So, I guess, if you could just talk about on how you’re thinking about the magnitude of some of those other categories into this quarter and into the fourth quarter?

Mark Yost — President and Chief Executive Officer

Yeah. Thanks, Maggie. I think overall the inflationary pressures we see from those other commodities that you just mentioned will start to come into play. I think closer to the end of the third quarter, early fourth quarter is when we’re seeing some of those increases on roofing materials and all those other commodities that you mentioned. So, I believe that with the declines in lumber and because lumber is such a meaningful component within our — the homebuilding process, I think you’ll actually see most of those things net out. So, I don’t think it will be an overall absolute increase inflationary wise. I believe the increase or decreases in lumber will be offset by some of those other commodities that you just mentioned. So, I think we’re priced where we should be.

Maggie Grady — Jefferies — Analyst

Got it. Okay. And then kind of switching gears, can you talk about the rollout of the Genesis product line and the market acceptance, and maybe some color on the revenue opportunities you see with that over the next year or so?

Mark Yost — President and Chief Executive Officer

Yeah. Thank you. I think Genesis is a very exciting product for us. We’re gaining traction with small and mid-tier subdivision builders and that’s going very well. I think the rollout of our — some of our turnkey services that we started to do last year, primarily focused in the Northeast have been received very well by multiple channels, our community partners, our retailers, and now that set and finish crews that we launched last year are able to do subdivision developments and we currently have one under way in the Northeast. So, I think Genesis, especially as builders find out how simple and easy it is to use, the quality and the price point, it’s a very turnkey-oriented solution for builders as they build their subdivision. So, I think the potential is very good and we’re continuing our business case of developing multiple subdivision so that we have proof positive to builder developers that this product really works and sells well.

Maggie Grady — Jefferies — Analyst

Okay. Great. Thank you.

Mark Yost — President and Chief Executive Officer

Thank you.

Operator

Thank you. Our next question is a follow-up from the line of Daniel Moore with CJS Securities. Please proceed with your question.

Daniel Moore — CJS Securities — Analyst

Thank you, again. Though, we’re looking for as much specificity as possible, so production run rate, we’ve got a good sense for October. Is that reasonable? If we think about that as sort of plateauing for the remainder of fiscal Q3? Can we continue to ramp that up a little bit, or is that more challenging given potential COVID outbreaks, lumber availability, etc?

Mark Yost — President and Chief Executive Officer

Thanks, Dan. I think overall, I expect that we’ll continue, obviously, to ramp on the production per day. I think we’re seeing success with that in the number of floors and units we can produce per day. I do expect some COVID disruptions that will take days out of production during the quarter, just given the nature of what we’re seeing in — throughout the US and even in Canada related to the increase in COVID cases. It’s hard to believe that if it continues to spike and elevate that we won’t see maybe higher absentee levels, especially as you get closer to the holidays and people may be more concerned with visiting relatives and other things. So, they may be less likely to come into work, right before and maybe even right after holidays.

So, I do expect that the production per day will increase, but I am concerned about the COVID outages and also that impact on our supply base. And so, I think production levels overall will be closer to what we saw the third quarter of last year. And probably net up mid, high-single digits from this current quarter overall, just because of the — even though we’re producing more per day, there might be a few more outages toward the tail end of the year.

Daniel Moore — CJS Securities — Analyst

Got it. Although it sounds like as the run rate exiting the quarter into fiscal Q4, we should be in better position all else equal and obviously depending on COVID and other factors.

Mark Yost — President and Chief Executive Officer

Yeah, without a doubt.

Daniel Moore — CJS Securities — Analyst

Okay. Thank you.

Mark Yost — President and Chief Executive Officer

Thank you.

Operator

Thank you. Ladies and gentlemen, that concludes our question-and-answer session. I’ll turn the floor back to Mr. Yost for any final comments.

Mark Yost — President and Chief Executive Officer

Thank you very much. I’m very impressed with what our team has done and their ability to, not only survive, but thrive in these challenging conditions and just continue to keep up the good work for everyone listening. And for everyone out there, we’re here to produce great homes for great people. So, thank you very much. Have a great day.

Operator

[Operator Closing Remarks]

Duration: 41 minutes

Call participants:

Sarah Janowicz — Director of Investor Relations and External Reporting

Mark Yost — President and Chief Executive Officer

Laurie Hough — Executive Vice President and Chief Financial Officer

Daniel Moore — CJS Securities — Analyst

Ashley Kim — Barclays — Analyst

Greg Palm — Craig-Hallum Capital Group — Analyst

Christopher Kalata — RBC Capital Markets — Analyst

Maggie Grady — Jefferies — Analyst…”

###

Additional Information and MHProNews Commentary

The graphic below reveals data per Yahoo Finance. It is not part of the Skyline Champion earnings call. To set that in context of the basket of publicly traded manufactured housing firms last night, on the day when the Dow broke 30,000 for the first time in its history, click here.

Some Interesting Pull Quotes from the Earnings Call Above…

A reminder about the recent passage of industry pioneer Art Decio, founder of Skyline Homes.

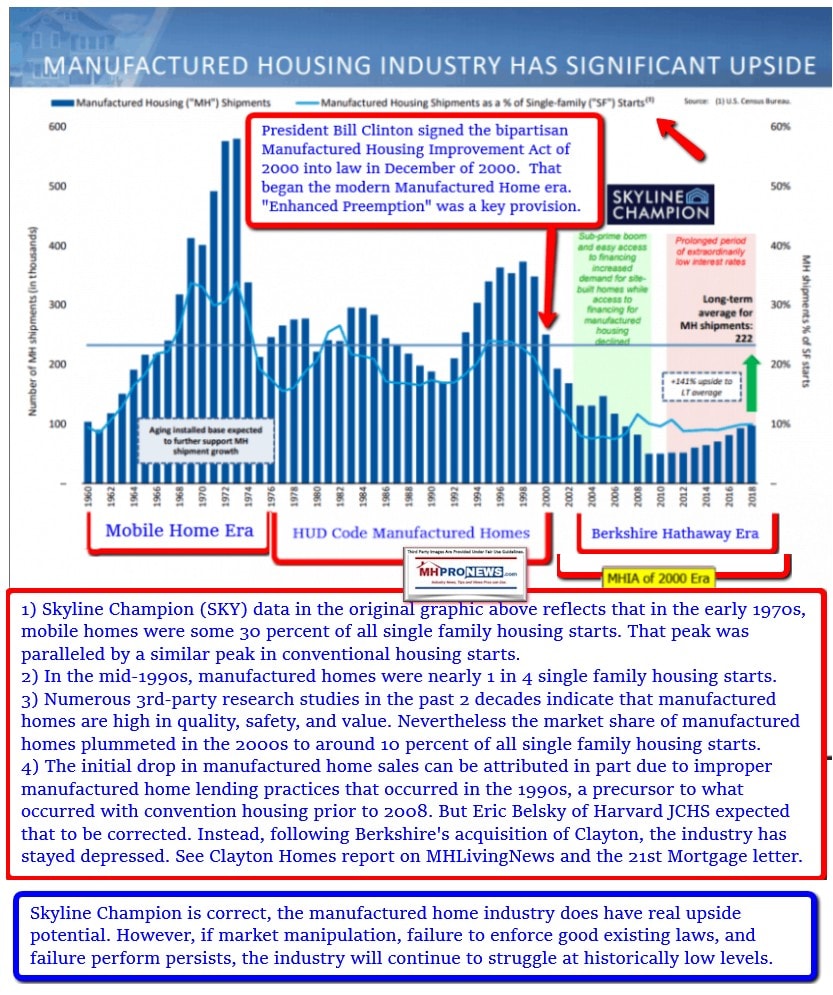

Some recent, relevant, and related reports. Yost and his colleagues have reason to think, as they themselves suggested, that there is plenty of runway to do more.

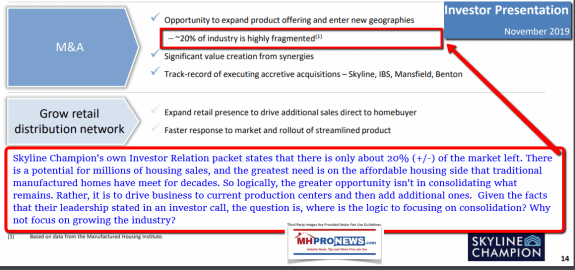

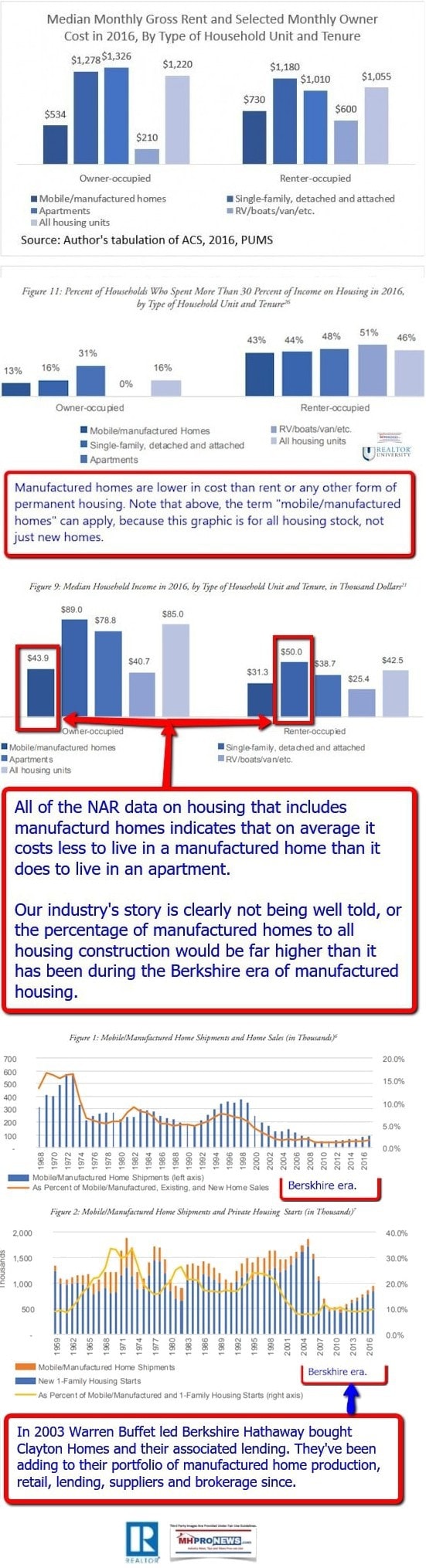

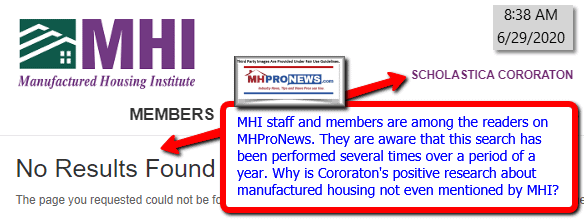

But that begs the question, why is M&A so high on their list, when they could be driving for more penetration by HUD Code manufactured homes into the broader demand for affordable housing? See their previously referenced statements about their corporate focus on mergers and acquisitions. When some 80 percent of the industry is in only 3 corporate hands, isn’t the obvious logic to focus on increased penetration into mainstream housing, seeking to attract clients from rentals as well as from those pondering single-family housing opportunities?

That disconnect and the related opportunities that spells for those who are bottom line-focused can be examined anew in a future planned report.

As a final observation on this topic for now, as of the time of this report, Skyline Champion has not yet updated their November 2019 investor relations presentation. Two of the graphics above are from that 11.2019 Skyline Champion document. Notice that Skyline Champion themselves pointed out the relative low level of industry sales compared to the manufactured housing industry’s historic trends. Then, ponder that in relation to “off the charts” demand for single family housing discussed in our recent report, linked below.

The bottom line could be politely stated like this. The leadership of several of the larger firms in the HUD Code manufactured housing industry has accepted a set of circumstances – the current status quo – which is far below historic trends. As Yost himself said, the opportunities to attract renters – among others – into HUD Code manufactured homes has perhaps never been more obvious. Which begs the question, what are they wait for at this corporation or at their favored Manufactured Housing Institute? Why haven’t they implemented a strategy to get mainstream HUD Code manufactured homes more widely accepted to boost results?

When the opportunities to expand HUD Code manufactured home sales are literally in the millions of units, why would industry leaders and investors tolerate tepid sales at under 100,000 units for over a decade? When some 80 percent of the industry is already consolidated – per Skyline Champion’s own 2019 investor relations report – why focus on more of that instead of growing the industry to its true potential?

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.