UMH Properties (NYSE:UMH) is a publicly traded firm which Wikipedia says was

- “founded in 1968 by Eugene W. Landy.[2] ”

- “In 2006, the company changed its name from United Mobile Homes, Inc. to UMH Properties, Inc.”

On December 17 and 18th, UMH announced 3 promotions through various media releases. Elements of those three UMH releases are quoted as follows.

Samuel A. Landy, President and Chief Executive Officer, commented, “Shaya has worked with many insurance partners to provide our renters with affordable liability insurance policies. He will also continually analyze UMH’s insurance needs to ascertain that we are adequately covered. We look forward to him continuing these efforts and growing this area of our business.”

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 124 manufactured home communities with approximately 23,400 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland and Michigan.””

Also, among those announced management changes was this release.

Samuel A. Landy, President and Chief Executive Officer, commented, “T.C. has done an excellent job working with our community managers and customers to obtain financing and ultimately close home sales. Our sales and finance operation has grown over the years and T.C. has played a key role in that accomplishment. Financing homes in our communities has been an excellent business that produces reliable income streams. We look forward to expanding upon this already successful venture.””

Preceding those two announcements was this one from UMH. Because the announcement doesn’t define ESG, this definition from Investopedia will prove useful to some readers “Environmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments.” With that backdrop, was this UMH announcement.

Eugene W. Landy founded UMH in 1968 with a social mission to provide quality affordable housing. Today UMH continues executing on that vision with modern and energy efficient, three-bedroom homes with rents starting at only $750 per month. The promotion of Aaron Potter and the creation of this role will ensure that the company maintains and continues to work towards this mission. He will work with the entire company to promote sustainability, social responsibility, and diversity.

Samuel A. Landy, President and Chief Executive Officer, commented, “Aaron has been involved in our growth over the past few years. He has effectively worked with our Executive Officers, Vice Presidents, Regional Managers and Community Managers to ensure that our goals are being met. From the inception of this company, management has focused on being socially mindful, environmentally beneficial and well-governed. Aaron will further our commitment to these important priorities.”

As detailed in the ESG Report posted on the Company’s investor website (www.umh.reit), UMH believes that environmental and socially desirable initiatives result in strong shareholder returns and enrich the lives of our employees, residents and society as a whole through beneficial products and the creation of meaningful careers. We are an environmentally friendly company. Our homes are produced in a factory which results in less material waste. We have also separately metered most of our homes which has resulted in a reduction in water consumption of approximately 30%. We believe that investors should view UMH as an ESG investment because of its 52 year history of providing quality affordable housing and the implementation of its environmental initiatives.

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 124 manufactured home communities with approximately 23,400 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland and Michigan.”

##

It should be noted that upper management at UMH Properties has previously told MHProNews that following certain news coverage by this platform, that they noticed stock moves. MHProNews holds no position in that firm or others that we track in our evening market report. Our news and views are independent.

Our most recent featured report on UMH prior to today’s is linked here. It was published on December 17, 2020.

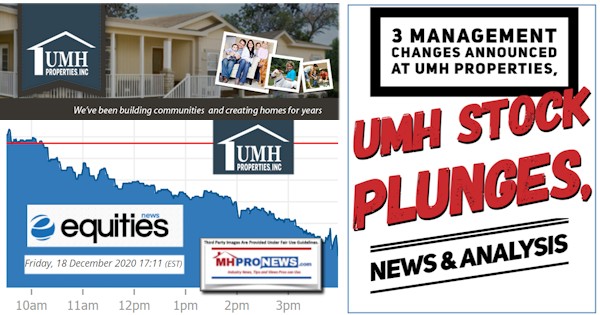

That noted, at 17:11 EST on December 18, 2020 Equities reported that “UMH Properties Inc. (UMH) Plunges 6.71% on December 18.”

Per Equities, the following.

As a result of the decline, UMH Properties Inc. now has a market cap of $643.58 million. In the last year, shares of UMH Properties Inc. have traded between a range of $16.64 and $8.64…

…UMH Properties Inc together with its subsidiaries is a real estate investment trust. It is engaged in the business of ownership and operation of manufactured home communities – leasing manufactured homesites to private manufactured home owners. It also leases homes to residents. The company also owns the land, utility connections, streets, lighting, driveways, common area amenities, and other capital improvements. It earns income from leasing, brokerage, and appreciation. It is located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Michigan, and Maryland.

UMH Properties Inc. is based out of Freehold, NJ and has some 420 employees. Its CEO is Samuel A. Landy.

UMH Properties Inc. is a component of the Russell 2000. The Russell 2000 is one of the leading indices tracking small-cap companies in the United States. It’s maintained by Russell Investments, an industry leader in creating and maintaining indices, and consists of the smallest 2000 stocks from the broader Russell 3000 index.

Russell’s indices differ from traditional indices like the Dow Jones Industrial Average (DJIA) or S&P 500, whose members are selected by committee, because they base membership entirely on an objective, rules based methodology. The 3,000 largest companies by market cap make up the Russell 3000, with the 2,000 smaller companies making up the Russell 2000. It’s a simple approach that gives a broad, unbiased look at the small-cap market as a whole…All data provided by QuoteMedia and was accurate as of 4:30PM ET.”

###

Additional Information, MHProNews Analysis and Commentary

It is not often a given or obvious as to what causes a stock ‘to move’ up or down sharply on a certain day. Per Yahoo Finance, the following ‘recent headlines’ about UMH are as follows. Note that they include the three linked above and another one that was reported by MHProNews last week.

Additionally, it is worth noting that Yahoo Finance’s one day stock movement graph concurred with that reported by Equities News. That is as it should be. But perhaps of more significance to long term thinkers, investors, and professionals is the juxtaposition of the 1 day vs. the 5 year chart, shown below.

MHProNews has long monitored UMH, as part of the basket of manufactured home industry connected stocks that have been the core of our business evening/nightly report. Friday’s report is linked here and shown below.

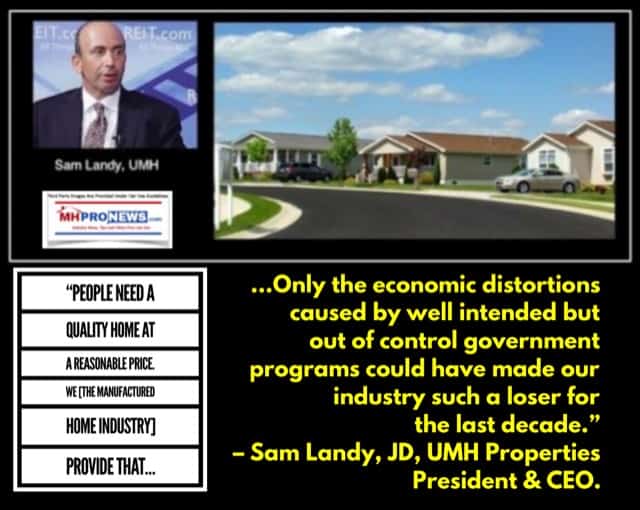

MHProNews has routinely reported on the controversies, announcements, and acquisitions by UMH or others in our industry. As a disclosure, UMH has been a client of the consulting side of our firm some years ago. But UMH pivoted more towards leasing than sales. Be it a coincidence or not, while leasing has been ‘profitable’ for UMH, it is not the traditional business model for many land-lease community operators for decades. It was not until the Dodd-Frank era and onerous regulations by the Consumer Financial Protection Bureau (CFPB) during the Obama-Biden Administration that UMH, along with other larger land-lease community operators, began to make the move away from a focus on in community sales to ‘safer’ in community rentals. UMH CEO Sam Landy himself to MHLivingNews that regulatory risk is what caused them to make serious changes away from financing sales of manufactured homes, which has previously been a good business model that also yielded home ownership opportunities for numbers of residents.

Renting has long been considered ‘easier’ on the front end than selling, because a renter is not making the same level of commitment to a home and location as someone who is buying.

But buying an affordable home is a key part of the decades of post-HUD Code manufactured housing history. Affordable housing under accessible terms fueled the sales of a large swatch of pre-HUD mobile home sales too.

The article above was also published on 12.17.2020. Controversies and various industry accolades from the arguably tainted Manufactured Housing Institute (MHI) aside, a case can be made that UMH has been more resident friendly than some of its larger ‘competitors.’ Though at a seemingly lesser level, there have been legal and other issues that UMH has faced. One of those is linked below.

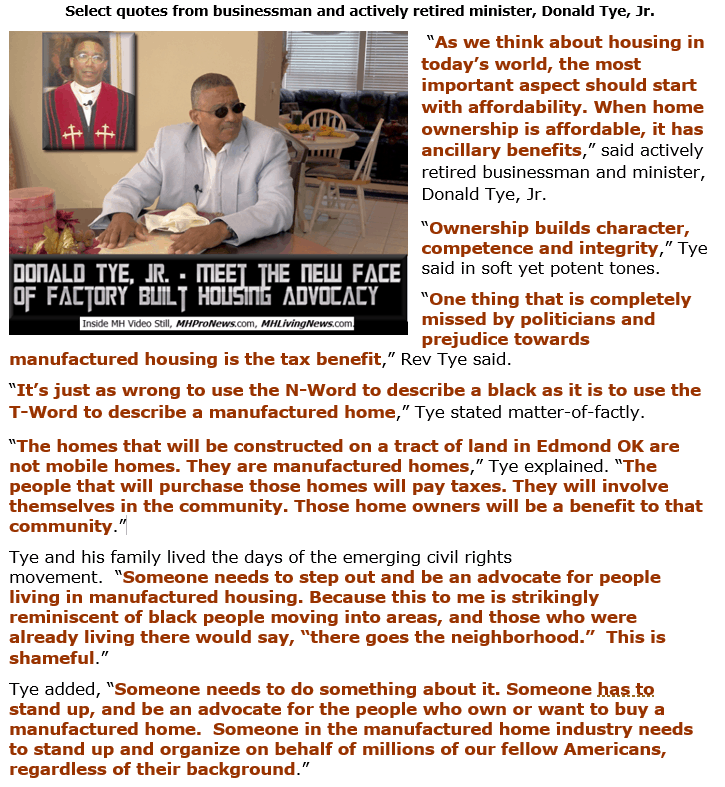

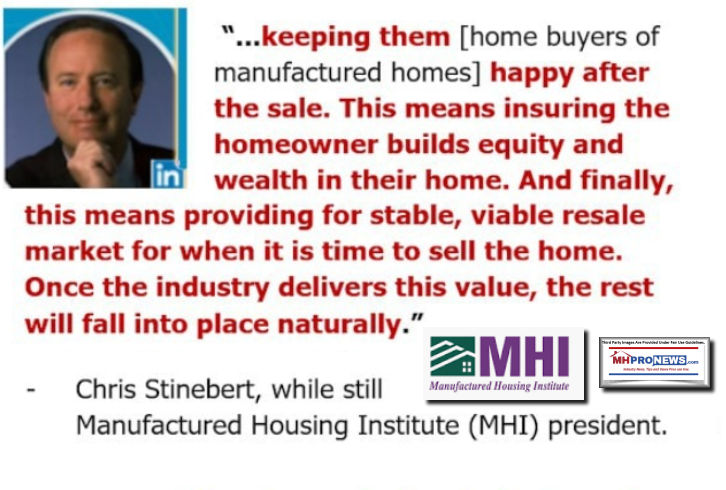

MHProNews will continue to monitor and report on industry issues, controversies, and trends. The ongoing news and analysis here shed a unique light on why the manufactured housing industry is still underperforming over 15 years after Warren Buffett led Berkshire Hathaway bought into the industry, and some 22 years since the last industry peak in 1998. Certainly among the factors that drive that ironically came from a prior MHI President and CEO who left manufactured housing and apparently decided not to come back to the industry.

The former MHI President and CEO Chris Stinebert’s parting message has some debatable portions, but the quote above is arguably near the heart of the issues that plague the industry. The case can be made that the parting message was in some measure a slap in the face of MHI and the ‘big boys’ that dominate the industry.

As a final noted on UMH, it seems rather ironic that the day after an appointment is made for a director of “Environmental, social, and governance (ESG),” that the firm’s stock dropped. While rentals are a profitable business model, as numerous companies in or out of manufactured housing realize, there is arguably a superior benefit to creating a robust path for affordable home ownership.

While the rental housing trend rolls on, perhaps someday more investors and professionals will see the historic and social value to creating and supporting affordable home ownership that works with residents in a positive and sustained manner. There already are numbers of smaller firms in the manufactured home industry who have or continue to do so successfully. Where is the thirst by Wall Street to support that kind of effort?

Another report on UMH is still pending. Watch for it in the near term.

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References or Recent, ‘Read Hot’ Reports:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.