As was previously announced a few days ago, Samuel Strommen of the Knudson School of Law (a.k.a. USD Law) provided MHProNews with an exclusive copy of his research paper that focused on Warren Buffett-led Berkshire Hathaway, Clayton Homes, their related lending, other Manufactured Housing Institute (MHI) members, MHI itself, and the industry’s Real Estate Investment Trust (REITs) sector.

Strommen said that “The aim of this paper is thus: to expose a number of antitrust violations—both blatant and subtle—in the form of the increasing monopolization of the manufacturing, financing, and the increasingly consolidating landlords, and to call for reforms within this industry.”

Strommen precise title as submitted read as follows. “The Monopolization of the American Manufactured Home Industry and the Formation of REITs: a Rube Goldberg Machine of Human Suffering.”

As the reference to Rube Goldberg is a prominently featured colorful metaphor, it will be briefly defined as follows.

“A Rube Goldberg machine, named after American cartoonist Rube Goldberg, is a machine intentionally designed to perform a simple task in an indirect and overly complicated way,” says Wikipedia. The cartoonist’s namesake website says, “Rube Goldberg (1883-1970) was a Pulitzer Prize winning cartoonist best known for his zany invention cartoons.” That website noted “Rube Goldberg is the only person ever to be listed in the Merriam Webster Dictionary as an adjective. It’s estimated that he did a staggering 50,000 cartoons in his lifetime.” Their website includes this video.

That reference to “a Rube Goldberg Machine of Human Suffering” defined, Strommen’s significant research paper is presented below. Note that the version as published below includes some edits (…) and typos addressed by MHProNews with Strommen and acknowledged in his replies. Titles of publications like the Financial Times have been italicized. Spacing has been added in the dense opening and some subsequent paragraphs, but his content and context remain the same.

Among the interesting uses of terminology is Strommen’s description of Warren Buffett-led Berkshire Hathaway-owned Clayton Homes as “…malevolent…” which choice of wording has as some possible synonyms “evil” “wicked” “malignant” “vindictive” and “spiteful.”

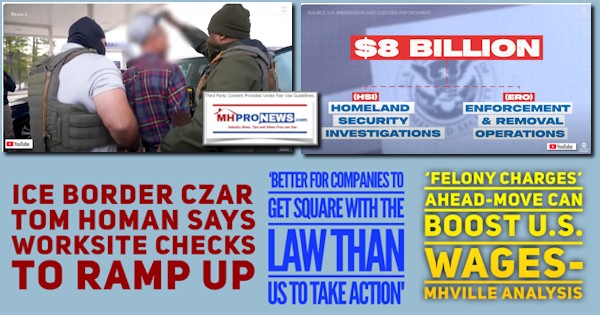

The term “felony” in the headline is a reference by Strommen to a specific pull-quote he used from federal antitrust law. It is part of his presentation and legal contentions below.

Strommen also takes aim and rips HUD and FHFA, as will be noted in his evidence-based narrative, as de facto working to foster the interests of Clayton Homes and MHI’s “Big Three.” His look at the application of the Noerr-Pennington legal doctrine as it applies to these issues may be a first in the manufactured housing sector.

Strommen’s research paper is to be understood as a serious set of evidence-based allegations that have contributed to the historically low levels of manufactured home sales in America. His extensively-footnoted paper will be followed by additional linked information, MHProNews analysis and commentary.

The Monopolization of the American Manufactured Home Industry and the Formation of REITs:

a Rube Goldberg Machine of Human Suffering

Samuel Strommen

Antitrust & Consumer Protection

Research Paper

- Introduction

The American manufactured home, known colloquially as a mobile home, a prefab, or, most commonly, a trailer, stands alone as the most widely looked over and denigrated form of residence offered in this country today. In fact, it is the only form of residence in the United States that carries its own pejorative connotation, “trailer trash.” An apartment, on the other hand, carries no such connotation, and the utterance of the word allows the reader to envisage a full gamut of possibilities, from rundown urban projects to a posh Fifth Avenue penthouse. Likewise, a house, without context, likely inspires images of the average single-family home, with contextual connotations ranging from a squalid shanty to an opulent mansion.

The manufactured home…for tens of millions of Americans today—a great many of whom hail from the lowest socioeconomic stratum, it is a way of life, the only affordable living situation available, and the only means of achieving home ownership.

Here, in the midst of what could be declared without the merest hint of shame or irony one of the most comprehensive affordable housing gluts in American history, pernicious forces are skulking in the (backdrop): consolidating power, subsuming an industry rife with lack of oversight, and preying upon the vulnerability of the impoverished in a gross, incestuous symbiosis.

Manufacturers and financiers (oftentimes a single streamlined, vertically integrated entity) have taken advantage of, if not sold outright to their customers, a conflation of home ownership and owning a manufactured home. There is, however, a striking distinction between the two: home ownership, in the traditional sense, is to possess real property, along with all of the rights and privileges that are afforded with it. Manufactured homes, on the other hand (for reasons that will be explored later), are by and large personal property—chattels—and come with few of those same rights and protections one would find in a traditional home.

The aim of this paper is thus: to expose a number of antitrust violations—both blatant and subtle—in the form of the increasing monopolization of the manufacturing, financing, and the increasingly consolidating landlords, and to call for reforms within this industry.

Data on the manufactured home industry is scarce—very few studies that would pass any sort of academic muster have been published, and to make matters worse, much of the data appears to be obfuscated, both by the alleged bad actors as well as their critics.

Part of the problem is that manufactured homes go by a number of different aliases: colloquially, they are known as trailers or mobile homes. This is a misnomer. In 1976, the United States Department of Housing and Urban Development (HUD) released the Manufactured Home Construction and Safety Standards Code.[1] As a result, a “mobile home” is any home of the same variety manufactured before the codes were released, and a “manufactured home” is any home manufactured after.

It is unclear if modern publications, when referring to “manufactured homes” and “mobile homes” (oftentimes synonymously) are proffering data applicable to both types of homes, or just the former.

Furthermore, search results for each of the two terms tends to produce radically different results, with searches for “manufactured homes” tending to reveal more accurate, less biased data. To complicate matters, the last rigorous study of the industry by the federal government comes from a 2014 report published by the Consumer Financial Protection Bureau (hereafter CFPB),[2] an independent agency of the United States Federal Government that endeavored to gather as much information as possible about the industry: the geography, demographics, and financial data of the typical manufactured home owner and resident; and the market-share and business practices of the manufacturers. To illustrate the previous point, this report is only available by searching specifically for manufactured housing information; searching for mobile home data does not include this among its higher-ranking search results. While this CFPB report promised in its introduction to continue monitoring the industry, unfortunately, either no new report has been produced, or, if it has, is exceedingly difficult to locate. The data compiled herein is the most readily accessible and up-to-date as is available.

To fully understand the industry, it would be wise to first look towards the demographic data provided in the CFPB report. As of the time that report was published, manufactured housing accounted for some six percent of all occupied housing in the United States,[3] with some 22 million American residing in manufactured homes as their principal place of residence.4

Contrary to what major credible publications such as the Guardian5 or the Financial Times 6 state in think-pieces about the industry, the majority of manufactured home owners own both the home and the land, with about 62% of all manufactured home owners owning both the house and the land. This accounts for 48% of all manufactured home residents,7 with 30% owning just the home but not the underlying land, and another 18% renting both.8 Somewhere between 25-30% of all manufactured homes are situated in manufactured home communities9 (commonly referred to…as “trailer parks”). Manufactured homes are concentrated largely in Western and Southern States,10 and residents skew older,11 less wealthy,12 and generally less educated when compared to site-built homeowners.13

It is prudent to note, however, that simply because one owns both the home and the underlying land, that does not make the majority of manufactured homes real property, as is the case with site-built homes.14 The distinction comes from how the home itself is titled, which affects every aspect of the transaction, from the interest rates on the financing, the availability and types of financing, and the eventual appreciation and resale value.15

Even if the home owner owns both the land and the home, the likelihood that the home itself is titled as real property and not personal property is relatively slim: in 2013, the most recent year from which data is readily available, only 14% of new homes of this variety were titled as real property.16 In fact, the treatment of manufactured homes as personal—and not real—property is the default rule, with the encumbrance of additional documentation being required for it to be considered otherwise.17

The differences between real and personal property are myriad, but for the purposes of this paper, we will restrict the difference to that which is most relevant: the type of financing available. Real property, like a traditional home, qualifies for a more traditional form of financing, like a home mortgage. When a manufactured home sits on property owned by purchaser, generally both the land and the home qualify for a traditional mortgage.18 The average interest rate on a 30-year fixed-rate mortgage usually hovers around 3%, although this number can fluctuate.19

However, if the consumer wishes to place their manufactured home in a land-lease community, other land they do not own, or wish to title the home separately from the land as personal property or a “chattel,” they are only eligible for a chattel loan, the average interest rate for which is between 50 and 500 basis-points higher (around .5%-5%), depending on factors that usually affect interest rates.20 Moreover, many consumer protection laws such as the Real Estate Settlement Procedures Act (RESPA) apply only to traditional real property home loans, and not to chattel loans.21 The same is true for many state foreclosure and repossession protection laws.22 This becomes particularly injurious when it is taken into account that, despite some 48% of all manufactured home owners feasibly qualify for a traditional mortgage, only about 14% of new manufactured homes are titled accordingly.23

The United States today faces one of its greatest affordable housing crises in decades. Consumers looking for lower cost alternatives to site-built housing, particularly the thousands of retirees that are selling their site-built homes, have found, at face, manufactured housing to be an attractive, lower-cost alternative.24

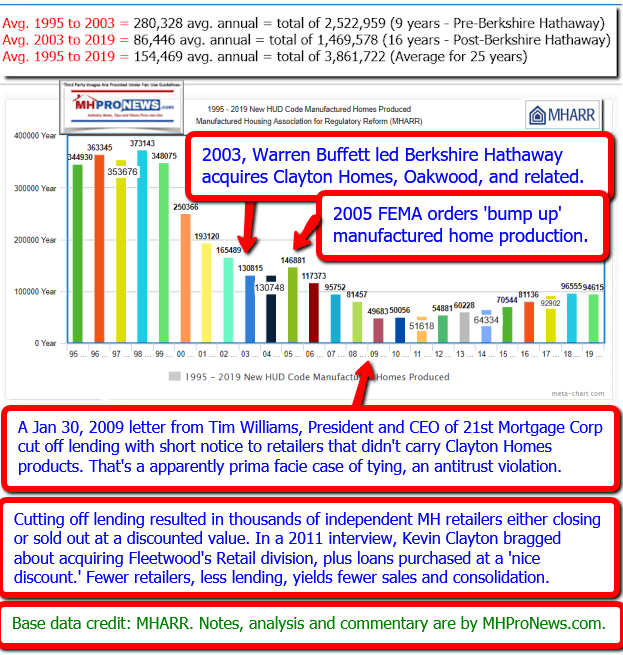

However, production of manufactured homes hit its apex over twenty years ago, with a maximum production of some 375,000 units in 1998.25 For much of the past two decades, the average production has dwindled to less than 100,000 new units produced annually, in the midst of an affordable housing crisis.26 This is directly correlated to how manufactured homes are financed and securitized: in the 1990s, standards for lending in the industry were tempered, and, as a result, the quality of the loans decreased.27 As sales of manufactured homes spiked, so did their value, with financiers over-appraising the values of homes and doing whatever they could—including filing fraudulent (or at the very least misrepresentative) credit applications on behalf of consumers.28

Housing giants Freddie Mac and Fannie Mae, two Government Sponsored Entities (GSEs), were once actively involved in securitizing these loans, with Fannie Mae securitizing some 24% of all manufactured home loans in order to meet its Duty-to-Serve mandate.29 With relaxed standards, however, these loans were far from investment grade and would, by today’s standards, be considered subprime.30 And despite a once Pollyannaish outlook towards the sector, today, the GSEs today maintain minimal involvement, securitizing few loans for manufactured homes and are arguably more involved in land-lease communities. They have a very limited number of home only or chattel loans, while more are classified as real property.31

By the early 2000s, lending in the industry had gone well-beyond its event horizon, with GSEs promptly exiting after losing billions in what could in no uncertain terms be described as a subprime lending crisis.32 If the aforementioned events sound familiar, it was an almost foreshadowing of sorts to the mid-to-late 2000s subprime mortgage lending crisis, precipitated by the same factors, and reaching a similar conclusion, albeit on a significantly smaller scale. Suffice it to say, that which fails the lowest cantons of society does not augur well for America as a whole.

- Antitrust Allegations

In the American manufactured housing industry, a single company stands alone at the apogee of manufacturing, retail, and finance. Warren Buffett’s Berkshire Hathaway maintains a commanding position over its competitors, the symbol of triumphant capital: arching, malevolent, resplendent. While there is competition in both the manufacturing and financing sectors, such competition is nominal, as through its principal subsidiary Clayton Homes, Berkshire Hathaway maintains an impressive filigree of smaller, subordinate institutions that account for exorbitantly high market share percentages of both sectors.

While the stories of how exactly Berkshire Hathaway came to acquire Clayton Homes vary depending on source, a few things remain certain: in 2003, Berkshire Hathaway purchased Clayton homes for $1.7 billion in cash.33 Today, there is perhaps no company more vertically integrated than Berkshire Hathaway and Clayton: Clayton uses almost exclusively materials that have been purchased from other Berkshire Hathaway subsidiaries.34 The paint is supplied by Benjamin Moore, the insulation is supplied by Johns Manville.35 The two predominant lenders in the industry, 21st Mortgage Corporation and Vanderbilt Mortgage and Finance are themselves both wholly-owned subsidiaries of Berkshire Hathaway as well. So, when a consumer purchases a manufactured home from Clayton Homes, Berkshire Hathaway routinely profits in some form or another at several stages.36

While claims that Berkshire Hathaway vis-à-vis Clayton Homes have violated American antitrust law have not been litigated in court, ample evidence that violations are taking place are myriad.

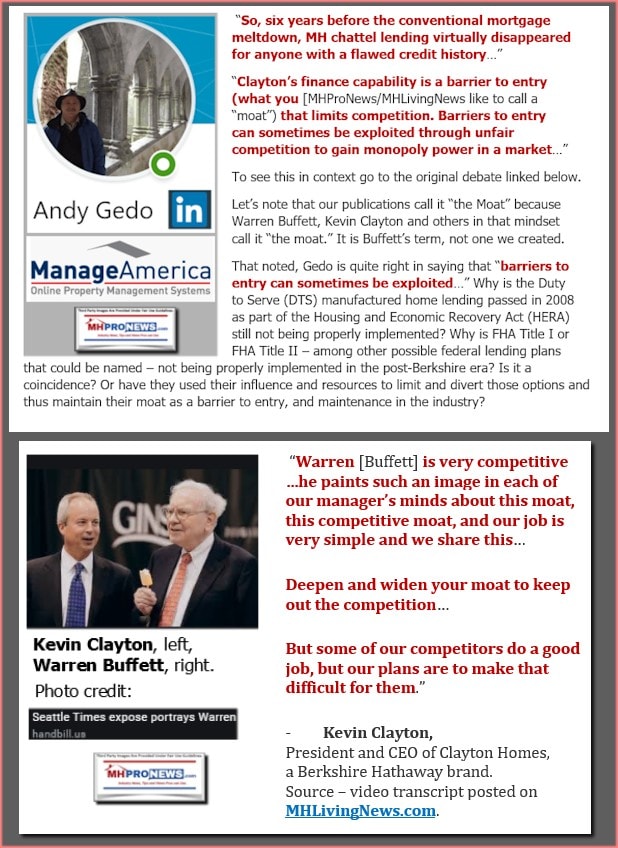

Buffett’s own words on his business strategy provide valuable insight into Clayton Homes’ strategy in this sector: “A good business is like a strong castle with a deep moat around it,” Buffett said on a CNBC broadcast, “I want sharks in the moat. I want it to be untouchable.”37 In this analogy, the castle would be the business he has invested in, fortified and standing safe from outside attack. The shark-filled moat is representative of the litany of additional deterrents Buffett-led Berkshire Hathaway has at its disposal to ward off nascent competitors as well as regulators.

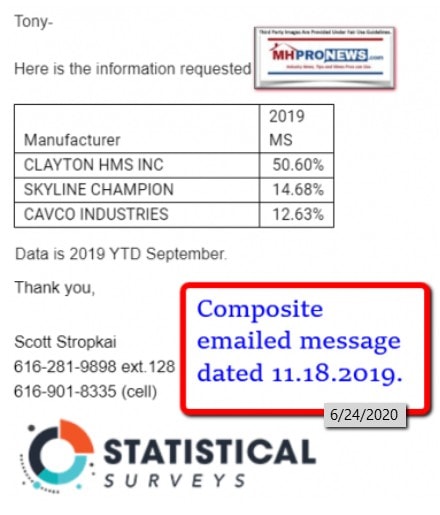

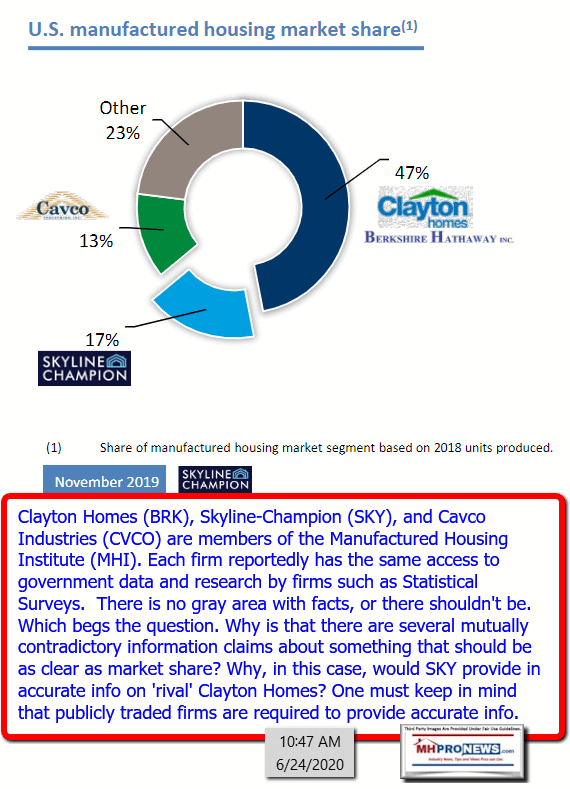

In 2002, prior to Berkshire Hathaway’s acquisition of Clayton Homes, there were 88 manufacturers scattered across the United States.38 Today, the number has fallen to less than half that.39 A report from the now-defunct Manufactured Home Merchandiser publication indicates that in 2003, Clayton was the third largest manufactured home fabricator40 in the United States, and at that time, the top twenty-five manufacturers accounted for 78% of all home production and sales.41 Today, Clayton, Skyline-Champion, and Cavco, the top three, account for some 80% market share combined.42 Clayton alone comprises about 51% of manufactured home production.43 A series of mergers and acquisitions has made this industry increasingly consolidated.

There was a brief increase in production and shipment numbers, apparently due largely to FEMA purchases in 2005 post-Katrina, but the numbers declined following that blip [ibid]. Those numbers nonetheless correlate with that acquisition.44 The United States, again, is undoubtedly in the midst of an affordable housing crisis, and manufactured homes account for 75% of all homes sold in the United States for less than $125,000.45 Puzzlingly, while profits for the three largest players in the industry have continued to grow, the industry has yet to come close to producing as many homes as it did before Berkshire Hathaway’s acquisition.46 To make matters more troubling, intentions, both stated and inferred-by-conduct, of the industry leaders is to increase profitability not by selling more homes, but by eliminating competition.

Lori Hough, one of the vice presidents of Clayton “competitor” Skyline Champion, stated in a shareholder conference call that her company was focused principally on mergers and acquisitions as its primary method of growth.47 Moreover, since 2009, a pivotal year in the industry, Clayton itself has gone on to acquire the following companies: Schult, Crest, Karsten, Golden West, Norris, Giles, Marlette, SE, Buccaneer, A and Cavalier Homes.48 Cavco, a third member of the industry’s “Big 3” has, over the same time span, acquired Destiny, Lexington, Fairmont, Chariot Eagle, Palm Harbor, A and Fleetwood Homes.49

Clayton’s conduct here could be construed as a potential violation of Section 2 of the Sherman Antitrust Act, which states in part: “Every person who shall monopolize, or attempt to monopolize, or combine or conspire with any other person or persons, to monopolize any part of the trade or commerce among the several States, or with foreign nations, shall be deemed guilty of a felony[.]” While monopoly status has yet to be attained, Clayton’s growth over the past 17 years has been meteoric: Clayton’s market share has gone from a paltry 13.9%51 to a commanding estimated 51%.52 The number of firms they and the two other industry leaders have either acquired, merged with, or squeezed out has pushed down the total number of competitors in production-sector of the industry virtually since its inception.

In addition to potentially constituting a violation of Section 2 of the Sherman Act, this may also constitute a separate violation of Section 18 of the Clayton act, which states:

“No person engaged in commerce or in any activity affecting commerce shall acquire, directly or indirectly, the whole or any part of the stock or other share capital and no person subject to the jurisdiction of the Federal Trade Commission shall acquire the whole or any part of the assets of another person engaged also in commerce or in any activity affecting commerce, where in any line of commerce or in any activity affecting commerce in any section of the country, the effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly.”53

Here, it would appear that Clayton Homes, Cavco Industries, and Skyline Champion are doing just that: In 2003, when Berkshire Hathaway purchased Clayton Homes, Champion was the largest manufactured home builder.54 Skyline was the fifth largest, and the two companies have now merged.55 Of the top twenty-five largest manufactured home builders in 2003, Clayton itself purchased or merged with Oakwood, the fourth largest,56 Cavalier, the seventh largest,57 Southern Energy, the ninth largest,58 and Golden West, the fifteenth largest.59 Cavco at the time was the twelfth largest,60 has since merged with or acquired Fleetwood Homes, which was previously the second largest,61 Palm Harbor, the sixth largest,62 and Fairmont, the tenth largest.63 What was previously a top ten has amalgamated into a top three. What the industry has presented as apotheosis is closer to apoptosis.

While a precise history of the industry’s mergers, acquisitions, and outright failure of competition is less than perfectly discernible, it is quite clear that the year 2009 had a devastating impact on competition. It was in this year that 21st Mortgage Corporation Century Mortgage, a Clayton Homes sister-brand and Berkshire Hathaway subsidiary that provides financing within the industry to independent retailers, sent out a letter to its retailers indicating that it was no longer capable of finding sufficient sources to sustain their then-current levels of reliable financing. As a result, financing through 21st Mortgage was no longer going to be offered to mortgage brokers.64 Furthermore, outside of FHA-insured loans, only 21st Century [Mortgage] repossessions and homes built by Clayton or one of its subsidiaries would be eligible [for 21st lending]—retailers also had to be approved.65 Prior to this letter being sent, there were still 61 total manufactured housing corporations in the United States.66 Within two years, twenty-one competitors either failed, or were acquired.67 The true content of the message was made manifest not by what it said, but rather the implied consequences: capitulate to Berkshire Hathaway, or fail.68

In public, Buffett boasted through a rictus that Clayton and its financing arm were performing a good deed, saying:

“Lenders other than Clayton have come and gone. With Berkshire’s backing, however, Clayton steadfastly financed home buyers throughout the panic days of 2008-2009. Indeed, during that period, Clayton used precious capital to finance dealers who did not sell our homes. The funds we supplied to Goldman Sachs and General Electric at that time produced headlines; the funds Berkshire quietly delivered to Clayton both made home ownership possible for thousands of families and kept many non-Clayton dealers alive.”69

As has become thematic throughout the course of this paper, however, it was what was left unsaid that was more telling: shortly after this, in the midst of the subprime lending crisis, Clayton and 21st switched course. While its Vanderbilt subsidiary always appears to have been a captive lender to Clayton, this was not the case for 21st.70

The [Tim Williams/21st] letter itself appears to be another clear violation of Section One of the Sherman Act, as well as Section Three of the Clayton Act, which prohibit what is colloquially called “tying.” This section of the Clayton Act states in relevant part:

“It shall be unlawful for any person engaged in commerce, in the course of such commerce, to lease or make a sale or contract for the sale of goods…on the agreement, or understanding that the lessee or purchaser thereof shall not use or deal in the goods…of a competitor or competitors of the lessor or seller, where the effect of such lease, sale, or contract for sale or such condition, agreement, or understanding may be to substantially lessen competition or tend to create a monopoly in the line of commerce.”71

Here, Clayton [Homes and their affiliated lending] have done exactly that: from 2009 going forward, outside of loans insured by the FHA, if a retailer was going to offer 21st Mortgage financing, that financing was only going to be available for homes built by its parent company. To elaborate, in Jefferson Parish Hospital District No. 2 v. Hyde,72 and Eastman Kodak Co. v. Image Technical Serves., Inc.,73 The Supreme Court has established four elements for identifying unlawful tying arrangements:

- Whether the seller is selling two separate products that may be tied together;7[4]

- The sale or lease of an item on the condition that the buyer make all his purchases of a separate tied product from the seller;7[5]

- The seller has the market power to tie the products, i.e. “the power to force the purchaser to do something he would not do in a competitive market”;7[6] and

- A “not insubstantial amount of interstate commerce in the tied market is affected.”[7]7

Let us examine each of these elements in a vacuum, and then as an aggregate. For element one: through 21st, Clayton is selling homes and mortgages for those home, which are two separate products (in traditional home buying, these are rarely, if ever, tied together). For element two: in the letter, 21st stated and followed through by choking off credit to retailer that did not sell Clayton homes, or for any homes the retailer sold that were not Clayton homes. For element three: the seller has inordinate market power to force retailers to accept the tying arrangement, whether they liked it or not. Finally, and most clearly, a not insubstantial amount of interstate commerce has been affected: Clayton, its subsidiaries, and its two chief competitors have functionally eradicated any serious, cognizable competitor from the industry. If the last element is met, that alone may be sufficient to constitute a per se violation of the Sherman and Clayton Acts.78

The record makes it clear: Clayton Homes and its subsidiaries, Vanderbilt and 21st, backed by Berkshire Hathaway capital, are the runaway giants in the chattel mortgage sector that dominates financing in the manufactured housing sector. Some reports indicate that they provide more financing in the manufactured housing industry by a factor of seven.79 In fact, the third largest financier in the industry is Wells Fargo.80 As it stands, 21st and Vanderbilt’s ultimate parent company, Berkshire Hathaway, is the fifth largest stakeholder in Wells Fargo.81 Prior to Berkshire Hathaway’s divestment of some 46% of its Wells Fargo shares, it was the single largest stakeholder.82 As recently as 2017, it held some 13% of Wells Fargo shares, far and away more than the next largest shareholder.83 There is even some indication that the loans Wells Fargo is making in this industry are themselves backed by Berkshire Hathaway.84 With such a suffocating control over the financial side of the industry, Berkshire Hathaway has enabled Clayton Homes to go from one of many in an industry with stiff competition to dominant force in a market it has not only vertically integrated, but is in the midst of horizontally integrating as well.

The expungement of competition has borne a demonstrably negative effect on consumers as well. Most Americans derive the majority of their net worth from the equity in their homes.85 As noted above, however, titling one’s manufactured home as a chattel not only restricts the availability of financing to usurious Berkshire Hathaway-backed loan, but chattel depreciation has a tendency to counteract the appreciation of the real property it sits on, if the consumer in fact owns both.86 In what is potentially another claim for tying under the Sherman and Clayton Acts, much like retailers, consumers are pushed to only finance through Clayton lenders.87 Other options, including traditional mortgages, may be obfuscated altogether.88 Former independent retailers have indicated they received kickbacks or discounts on their own financing for pressuring customers to take chattel mortgages through Clayton.89 Customers are [purportedly] often made to believe that it was either the best option available, or the only option available.90 This is despite the fact that some 93% of these loans have such high interest that Federal law requires additional disclosure.91 Industry consultants and experts believe that about 28% of these loans are in default.92 While courts have held that traditionally anticompetitive behavior may justify skirting antitrust law if there is an economic efficiency available to consumers,93 here, there is not.

Berkshire Hathaway and its subsidiaries’ anticompetitive behavior is quite clearly injurious to consumer, but in this matter, they are not alone. It would appear that Cavco Industries and Skyline Champion are willing [de facto allies]. An additional [possible] antitrust violation, in the form of a conspiracy under Section 1 of the Sherman Act, would at this point seem [like a] fait accompli. This section declares: “Every contract, combination in the form of trust or otherwise, or conspiracy, in restraint of trade or commerce among the several States, or with foreign nations, is declared to be illegal.”94 However, this begs the question not of the method but the mode by which the three industry leaders are using to accomplish this. The answer to that would appear to be the industry trade association, the Manufactured Housing Institute. The Manufactured Housing Institute [MHI] acts not only as the public mouthpiece of the Big 3 manufacturers (in the name of the industry) but also appears to act directly on its behalf in its various lobbying endeavors.95

In the year 2000, Congress passed the Manufactured Housing Improvement Act.96 This act authorized “enhanced preemption,” which superseded all state and municipal standards, allowing manufacturers to deliver and install manufactured homes in separate jurisdictions provided they meet HUD standards.97 In 2008, the Federal Housing Financing Authority [FHFA], under the authority of the Housing and Economic Recovery Act of 2008, implemented an expanded Duty to Serve regulation, requiring Fannie Mae and Freddie Mac to facilitate home financing for very low-, low-, and moderate-income families.98 It should follow logically, then, that it should be cheaper and easier for residents of any state to finance and acquire a manufactured home. Unfortunately, this is not the case.

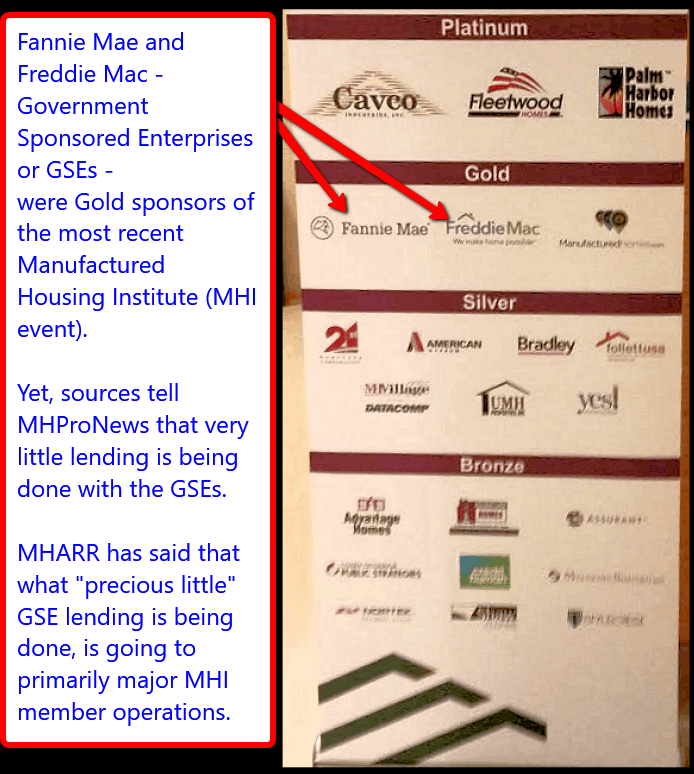

There may be no greater indicator of collusion by the industry Big 3 through the MHI than HUD’s ongoing failure to implement enhanced preemption and for the [FHFA to compel the] GSEs to follow through on the Duty to Serve mandate. To call this ongoing failure a coincidence is a risible proposition: promotion of these runs contrary to the Big 3—and Clayton’s—interests in particular. The stated purpose of the GSEs is to securitize mortgages by purchasing them from lenders, packaging them together, and selling them as mortgage backed securities to investors. By alleviating lenders of the burden of having their capital tied up in loans that tend to amortize over periods of decades, liquidity—and thus allocable credit—is freed up, making credit cheap and lending competitive.

Clayton Homes [and their affiliated lenders] would suffer a detriment if [the] GSEs were to re-enter the chattel mortgage industry: it [apparently] does not need nor want capital from a large pool of investors, it accesses the capital through its parent company, Berkshire Hathaway.100 If GSEs undertook their Duty to Serve, it is hardly speculative to assert that Clayton—and Berkshire Hathaway’s—bottom lines would suffer, both from a new volume of competitors entering the market, as well as lower interest rates from more competitive lending. Accordingly, there is evidence to suggest that MHI has lobbied against any efforts that would threaten to disrupt the profitable and vertically integrated complex Clayton has developed.101 In fact, as recently as 2012, when major reforms were last announced, objections by the MHI led to manufactured housing being exempted.102

After exiting the manufactured housing market in the early 2000s, the two GSEs have yet to return in any meaningful sense.103 There are indications that the GSEs have securitized [only a limited number of manufactured home loans] in the industry since their departure after the aforementioned subprime lending crisis that occurred in the late 1990s.104 The MHVillage’s [MHInsider], which serves as an unofficial trade publication for the Manufactured Housing Institute, has heralded in several of its recent issues that the MHI has made great inroads with the GSEs, particularly in their implementation of the MHAdvantage and Choice Home programs. However, for the two GSEs to securitize these loans, the price range must be between $200,000-$250,000, and they must be titled as real property, [nor are] and they available to homes that will be placed in land lease communities. With a broader view of the industry in mind, these programs essentially serve no one, and certainly do not fall within the scope of the GSEs’ Duty to Serve mandate. In the same issue, Tim Williams, the same gentlemen from 21st Mortgage [and former MHI Chairman] who authored the letter that may be a violation of tying mentioned above, stated that they (Manufactured Housing Institute members) “are better suited to serve communities than GSEs.”109

Furthermore, while MHI claims to represent the industry as a whole, a look at the incestuous nature of the Big 3 and MHI make it clear whose interests are actually being represented: currently, half of the MHI executive [committee board members] are former employees of Clayton Homes.110 As mentioned above, MHI (and MHInsider) has touted programs such as MHAdvantage and ChoiceHomes.111 However, these programs benefit a single new, trademarked class of manufactured housing: CrossMod™ homes.112 A cross-reference on the U.S. Patent Office’s website indicates that MHI is the holder of the CrossMod trademark.113 The only manufacturers (in principal) able to produce—and thus take advantage of programs such as MHAdvantage and ChoiceHomes are [essentially] MHI members.114 It would appear that MHI’s lobbying efforts are done less to serve the industry as a whole, but rather to keep competitors—and consumers—from accessing competitive rates on lending if the Duty to Serve were properly implemented.

MHI’s relationship with HUD and the GSEs is no secret: most recent issues of MHVillage[’s MHInsider] touts some form of progress.115 And yet, only a few loans for this new class of home have been securitized by GSEs.116 MHIs lobbying of the FHFA, or for that matter HUD, seems to invariably result in in policies that either benefit the Big 3, or at the very least, mitigate detriment. The outcome of these lobbying efforts is stultifying at best, and an abject failure at worst.

For as heavily as MHI has promoted CrossMod™ homes, sales appear to be stagnant, particularly when demand in the sector remains focused on traditional manufactured housing.117 This begs the question: when lobbying [FHFA on the Duty to Serve], was MHI acting in good-faith? The U.S. Supreme Court has held in Eastern Railroad Presidents’ Conference v. Noerr Motor Freight Inc.,118 and United Mineworkers v. Pennington119 that the use of governmental processes such as lobbying or litigating by private [enterprise] is covered by the First Amendment right to free expression and the right to petition. That right extends even if the use of said processes is done to achieve an anti-competitive purpose that would otherwise be unlawful under antitrust law. The famous Noerr-Pennington doctrine is not without exceptions, however. In California Motor Transport Co. v. Trucking Unlimited, the Court identified that there is a “sham” exception to the doctrine’s protections.112 While the Court has never elucidated what exactly constitutes a sham, it is essentially an attempt to disguise the anticompetitive, purely business-related behavior as political—antitrust legislation is designed, after all, to regulate the sphere of business alone.

The Federal Trade Commission published a guide for regulators in 2006 that serves to elaborate on what is—and is not—protected by the Noerr-Pennington doctrine.123 The document outlines three activities that constitute a sham within the Noerr-Pennington context: filings that seek only a ministerial response,124 misrepresentations,125 and repetitive petitioning.126 Of these, MHI’s behavior, if indeed done to mislead or defraud the government, most closely resembles the misrepresentation exception. The deciding factor as to whether misrepresentations are afforded Noerr protection is if they are done to achieve a specific political outcome, even if that outcome is anticompetitive, or if there is an abuse of the process itself to hinder competition.127 In its Union Oil Co. of Cal. (Unocal) opinion, the FTC identified three elements for a petitioning or lobbying effort to lose Noerr protection: the representation must be (1) deliberate,128 (2) subject to factual verification,129 and (3) central to the legitimacy of the affected governmental proceeding.130

The author of this paper submits that the MHI’s conduct in obfuscation judicious decision-making by the [FHFA and HUD] constitutes a conspiracy to restrain trade under Section 1 of the Sherman Act, and by virtue of the misrepresentative nature of the conduct, should not be afforded Noerr protection. The intent of the MHI to influence [FHFA and] HUD to act in a particular way, or omit to act in a certain way, would be protected—however, the chief misrepresentation is that lobbying efforts are representative of an industry and not a select few companies. The data supplied to governmental officials is likely erroneous,131 and the attempts by the MHI to obtain governmental intercession on the industry’s behalf is likely a ruse.

Under Noerr, if obtaining securitization of loans for CrossMod™ homes is in fact MHI’s desired political outcome, its lobbying efforts to support that would be protected under the First Amendment. However, this would appear to be a strategy not dissimilar to the old cup-and-ball trick: a misdirection by MHI at the behest of its principal benefactors—the Big 3—an act of skillful subterfuge to misdirect the government in one area, allowing the Big 3 to engage in anticompetitive in another area unabated. This is supported by more than simple inference: industry leaders have lauded GSEs failure,132 sales of CrossMod™ homes remain far below that of traditional manufactured homes,133 and that seemingly every time reform in the industry or intrusion by GSEs is proposed, in nearly the same breath it vanishes.

The manufactur[ing] and lending sectors of the industry are rife with potential antitrust violations, from the Sherman Act, to the Clayton Act, to potential violations of the Noerr-Pennington Doctrine. It is clear that the Federal Trade Commission and United States Department of Justice should investigate these companies. The American consumer can ill-afford to pretermit manufactured housing as a viable option in the midst of an affordable housing crisis. Traditional site-built homes have continued to increase in price since the mid-2000s subprime mortgage crisis, and industry experts are predicting that the joblessness caused by the COVID-19 pandemic will fuel a second foreclosure crisis in America. Clayton Homes, et al. have gotten demonstrably more profitable. Why has manufacturing yet to cross the 100,000 unit threshold, much less come anywhere close to its most recent 1998 peak?

##

—————————————————————————-

The footnotes by Strommen from the above are as shown below.

[1] 42 U.S.C. §5402

2 U.S. Consumer Financial and Protection Bureau, Manufactured-Housing Consumer Finance in the United States (2014), available at https://files.consumerfinance.gov/f/201409_cfpb_report_manufactured-housing.pdf.

3 Id., at 6.

4 Industry Trends & Statistics, MHInsider (July 2020), at 38, available at https://www.mhvillage.com/pro/print/july-august-2019/.

5 Rupert Neale, America’s Trailer Parks: The Residents May Be Poor but the Owners Are Getting Rich, The Guardian, May 3, 2015, available at https://www.theguardian.com/lifeandstyle/2015/may/03/owning-trailer-parks-mobile-home-university-investment.

6 Rana Foroohar, Why Big Investors Are Buying Up American Trailer Parks, Financial Times, Feb. 7, 2020, available at https://www.ft.com/content/3c87eb24-47a8-11ea-aee2-9ddbdc86190d.

7 CFPB, supra note 2, at 21.

8 Id.

9 Id.

[10]0 Id. see Figure 1: Manufactured Housing Share of Occupied-Housing Units, by State.

[11] Id., see Figure 3: Head-of-Household Age Distribution.

[12] Id., see Table 3: Selected Family Financial Characteristics by Type of Housing.

[13] Id., see Table 2: Highest Level of Educational Attainment by Residents Ages 25 or Older in Owner-Occupied Households.

[14] Id., at 6.

[15] Id. at 23.

[16] Id.

[17] Id. at 10.

[18] Jeff Ostrowski, 30-Year Interest Rates, Nov. 9, 2020, available at https://www.bankrate.com/mortgages/rates/30-year-rates-for-monday-november-9-2020/.

[19] J.B. Maverick, The Most Important Factors that Affect Mortgage Rates, Jun. 25, 2019, available at https://www.investopedia.com/mortgage/mortgage-rates/factors-affect-mortgage-rates/

20 CFPB, supra note 2, at 6.

21 Id. at 24.

22 Id.

23 CFPB, supra note 16.

24 See graphic download linked here: https://www.manufacturedhomepronews.com/wp-content/uploads/2020/11/ManufacturedHousingMarketDataProductionShipmentsComparisonsToConventionalHousingRentalsNationalAssocRealtorsScholasticaGayCororatonMHProNewsInfographic.jpg

25 CFPB, supra note 3, at 26.

26 MHVillage, supra note 4.

27 CFPB, supra note 3, at 26.

28 Id.

29 Id. at 28.

30 Id. at 6.

31 Id. at 37.

32 Id.

33 The prevailing public narrative is that Mr. Buffett sought ought Clayton, but this is subject to dispute. The Berkshire Hathaway acquisition of Clayton Homes for $12.50 a share was met with a shareholder lawsuit. Investors thought the industry had already hit its nadir and was in the process of rebounding, rendering the offer from Berkshire Hathaway too low. It was alleged that a local bank under-valued the company, and that independent advisors pegged the worth between $15.80 and $17.20 a share. It was subsequently alleged that the Claytons’ were “speaking out of both sides of their mouths,” telling Berkshire Hathaway the positive position of both the company and the industry, all-the-while telling investors how bad things were. See Jennifer Reingold, The Ballad of Clayton Homes, Fast Company, Jan 01, 2004, available at https://www.fastcompany.com/48214/ballad-clayton-homes.

34 Financial Times, supra note 6.

35 Id.

36 Id.

37 This quote and variations are found in abundance. It has also been repeated by Clayton CEO and namesake Kevin Clayton on a number of occasions. Mr. Clayton’s reasons for favoring this strategy, and perhaps targeting Berkshire Hathaway (supra note 33) will become clear later in the paper. See Tae Kim, Warren Buffett Believes This Is ‘the Most Important Thing’ to Find in a Business, CNBC, May 7, 2018, available at https://www.cnbc.com/2018/05/07/warren-buffett-believes-this-is-the-most-important-thing-to-find-in-a-business.html.

38 CPFB, supra note 3, at 39.

39 This is taken from the 2014 CFPB report. More recent data is not currently available. Id.

40 A huge debt of gratitude is owed by the author of this paper to the author of the article linked. L. A. “Tony” Kovach, Clayton Homes, Skyline Champion, Cavco Industries, Other Leading HUD Code Manufactured Housing Industry Market Share Data, Jun 24, 2020, MHProNews, available at https://www.manufacturedhomepronews.com/clayton-homes-skyline-champion-cavco-industries-other-leading-hud-code-manufactured-housing-industry-market-share-data/.

41 Id.

42 Id.

43 As Mr. Kovach duly noted, the discrepancies between the market share reported both by Clayton Homes itself, as well as the official figures presented by the Manufactured Housing Institute. This speaks to a level of potential collusion that will be addressed below. [Kovach cited Statistical Surveys, an independent research firm, for the most accurate known market-share data.] Id.

44 See https://www.manufacturedhomepronews.com/manufactured-housing-comparisons-data-sets-vs-existing-and-new-single-family-housing-sales-rvs-auto-facts-potent-insights-for-mh-professionals-investors and https://www.manufacturedhomelivingnews.com/affordable-housing-needed-corporate-corruption-and-manufactured-homes-time-to-get-federal-officials-fully-involved.

45 Jennifer Brown and Kevin Simpson, Mobile Home Parks Move from Mom-and-Pop to Corporate, Sept. 16, 2019, Associated Press, available at https://apnews.com/article/de31aa729f514f48b934bf23ebd3f641.

46 See Figure 1. L. A. “Tony” Kovach, Prima Facie Cases Against Manufactured Housing Institute, Richard A. ‘Dick’ Jennison, Tim Williams, 21st Mortgage, Kevin Clayton, Tom Hodges – Clayton Homes, Et Al, MHProNews, Jan 7, 2020, available at https://www.manufacturedhomepronews.com/masthead/prima-facie-cases-against-manufactured-housing-institute-richard-a-dick-jennison-tim-williams-21st-mortgage-kevin-clayton-tom-hodges-clayton-homes-et-al/.

47 Motley Fool Transcribers, Skyline Champion Corp (SKY) Q3 2020 Earnings Call Transcript, Jan 29, 2020 available at https://www.fool.com/earnings/call-transcripts/2020/01/29/skyline-champion-corp-sky-q3-2020-earnings-call-tr.aspx.

48 MHProNews, supra note 46.

49 It is also worth noting that Cavco Chairman and CEO Joe Stegmayer and Cavco under under investigation by the securities and exchange commission. Source for data may be found supra note 46, information on the Cavco investigation may be retrieved here https://sec.report/Document/0000278166-20-000066/.

50 15 U.S.C. § 2.

5[1] MHProNews, supra note 40.

52 Id.

[53] Within the ascribed meaning and definition of the Act, “person” includes “corporation.” 15 U.S.C. § 18.

54 It is important to note that it is unclear how the companies in the following footnotes came together, if by merger, acquisition, or some combination of both. MHProNews, supra note 46.

55 Id.

56 Id.

57 Id.

58 Id.

59 Id.

60 Id.

61 Id.

62 Id.

63 Id.

64 MHProNews, supra note 40.

65 This is retrieved from MHProNews, supra note 40, but also corroborated by the CFPB study mentioned, supra note 3 at 14.

66 L. A. “Tony” Kovach, Bridging Gap$, Affordable Housing Solution Yields Higher Pay, More Wealth, But Corrupt, Rigged Billionaire’s Moat is Barrier, MHLivingNews, (article undated), available at https://www.manufacturedhomelivingnews.com/bridging-gap-affordable-housing-solution-yields-higher-pay-more-wealth-but-corrupt-rigged-billionaires-moat-is-barrier/.

67 It would also appear this is a separate violation of 15 U.S.C. § 14 infra note 71. Id.

68 While it is outside the scope of this paper to explore or analyze at length, it has been alleged that this may constitute a predicate offense of the Racketeer Influenced and Corrupt Organizations Act, 18 U.S.C. § 1961.

69 Warrant Buffett, Annual Shareholder Letter, 2015, at 17, Feb. 27, 2016, available at https://www.berkshirehathaway.com/letters/2015ltr.pdf.

70 Moody’s Assesses Vanderbilt Mortgage and Finance, Inc. as ‘Average’ Originator of Residential Conventional Manufactured Home Loans, Feb. 28, 2011, available at https://www.moodys.com/research/Moodys-Assesses-Vanderbilt-Mortgage-and-Finance-Inc-as-Average-Originator–PR_214886.

71 15 U.S.C. § 14.

72 Jefferson Parish Hosp. Dist. No. 2 v. Hyde, 466 U.S. 2.

73 Eastman Kodak Co. v. Image Tech. Servs., 504 U.S. 45.

74 Id. at 462.

75 Id. at 488.

76 Id.

77 Supra note 72, at 8.

78 Id. at 23.

79 Kori Hale, Warren Buffett’s Exploitative Mobile Home Investment, Forbes, Apr. 18, 2019, available at https://www.forbes.com/sites/korihale/2019/04/18/warren-buffets-exploitative-mobile-home-investment/?sh=2c33848b1507.

80 Daniel Wagner & Mike Baker, Warren Buffett’s Mobile Home Empire Preys on the Poor, Center for Public Integrity, Apr. 6, 2015, available at https://publicintegrity.org/inequality-poverty-opportunity/warren-buffetts-mobile-home-empire-preys-on-the-poor/.

81 Wells Fargo & Company (WFC) Top Institutional Holders, Nov. 3, 2020, available at https://finance.yahoo.com/quote/WFC/holders?p=WFC.

82 Theron Mohamed, Warren Buffett’s Berkshire Hathaway Cuts Wells Fargo Stake to 17-year Low, Business Insider, Sep. 7, 2020, available at https://markets.businessinsider.com/news/stocks/warren-buffett-berkshire-hathaway-cuts-wells-fargo-stake-17-years-2020-9-1029566739.

83 Id.

84 Get source.

85 Scott Burns, Americans Love Their Homes – Maybe Too Much, Dallas Morning News, Nov. 13, 2020, available at https://www.dallasnews.com/business/personal-finance/2020/11/13/americans-love-their-homes-maybe-a-little-too-much/.

86 CFPB supra note 3, at 25.

87 CPI, supra note 80.

88 Id.

89 This article cites an interview with Kevin Carroll, a former owner of a Clayton-affiliated dealership who described receiving discounts on his own business loan, which was financed by Clayton Homes, for steering customers to work only with 21st Mortgage. Id.

90 Id.

91 Ninety-nine percent of these loans also had such high interest as to warrant placement in the Federal Government’s “higher-priced mortgage loan” (HPML) status required under 12 U.S.C. § 2801. Id.

92 This figure is highly disputed. Warren Buffett alleged this rate was a mere 3%, but that figure is measuring the total number of failed loans Clayton originated in a single year, not the total number of defaulted loans in the portfolio. See Mike Baker & David Wagner, Buffett’s Mobile-Home Company He Controls Made Record Profits Last Year While Foreclosing on More Than 8,000 Customers, Seattle Times, Feb. 29, 2016, available at https://www.seattletimes.com/seattle-news/times-watchdog/buffetts-mobile-home-empire-makes-record-profits-while-foreclosing-on-8444-homes/.

93 Rothery Storage & Van Co. v. Atlas Van Lines, Inc., 792 F.2d 210.

94 15 U.S.C. § 1.

95 Also note the progressive increase in money spent by the MHI on lobbying efforts after Berkshire Hathaway’s acquisition of Clayton Homes in 2003. Client Profile: Manufactured Housing Institute, Center for Responsive Politics, Nov. 12, 2020, available at https://www.opensecrets.org/federal-lobbying/clients/summary?cycle=2020&id=D000000458.

96 42 U.S.C. § 5401.

97 Id.

98 12 U.S.C. § 4565

99 Gerald Lins, Marie Picard, & Thomas Lemke, Mortgage Backed Securities, 2013.

100 Doug Ryan, Time to End the Monopoly Over Manufactured Housing, American Banker, Feb. 23, 2016, available at https://www.americanbanker.com/opinion/time-to-end-the-monopoly-over-manufactured-housing.

101 Juliet Eilperin, A Once Obscure Office at HUD is the Subject of an Unusually Intense Lobbying Effort, Washington Post, May 1, 2018, available at https://www.washingtonpost.com/politics/a-once-obscure-office-at-hud-is-the-subject-of-unusually-intense-lobbying-effort/2018/04/30/3dfc7ba0-3841-11e8-acd5-35eac230e514_story.html.

102 CPI, supra note 80.

103 CFPB, supra note 28.

105 There is substantial overlap between MHI directors and MHInsider magazine editors. Supra note 4, at 28.

106 Id.

107 Bear in mind that only 14% of loans for manufactured homes are titled as real property, even though a far larger number may be eligible. Id.

108 Id.

109 Id. at 56.

110 Note that, beyond the Chairman and Treasurer, another 5 board seats are held by Big 3 members, with the rest constituted mostly of state-level affiliate directors or REIT representatives. Manufactured Housing Institute, MHI Board of Directors, Nov. 12, 2020, available at https://www.manufacturedhousing.org/board-of-directors/.

111 Supra note 4.

112 Id.

113 U.S. Trademark Application Serial No. 88/497,913 (filed Feb. 7, 2019).

115 MHVillage, supra note 4. See also: https://www.mhvillage.com/pro/print/ for online sources of print editions.

116 Renan Cunha, Manufactured Housing Securitization, Duke Journal of Economics, Oct. 14, 2016, available at https://sites.duke.edu/djepapers/files/2016/10/renan-cunha-dje.pdf.

117 Id. at 6.

118 Eastern Railroad Presidents Conference v. Noerr Motor Freight, Inc., 365 U.S. 127 (1961).

119 United Mine Workers v. Pennington, 381 U.S. 657.

120 Id.

121 Id.

122 California Motor Transport Co. v. Trucking Unlimited, 1971 U.S. LEXIS 1810

123 FTC, Enforcement Perspective on the Noerr-Pennington Doctrine, 2006, available at https://www.ftc.gov/sites/default/files/documents/reports/ftc-staff-report-concerning-enforcement-perspectives-noerr-pennington-doctrine/p013518enfperspectnoerr-penningtondoctrine.pdf.

124 Id. at 4.

125 Id. at 4.

126 Id. at 4.

127 Id. at 22.

128 Id. at 25.

129 Id. at 25.

130 Id. at 25.

131 L. A. “Tony” Kovach, FHFA, GSEs—High Cost to Minorities, All Americans—Due to Asserted Failures to Follow Duty to Serve Affordable Housing, Existing Federal Laws, Manufactured Home Living News, Dec. 11, 2019, available at https://www.manufacturedhomelivingnews.com/fhfa-gses-high-cost-to-minorities-all-americans-due-to-asserted-failures-to-follow-duty-to-serve-affordable-housing-existing-federal-laws/.

Note: the graphic below is provided by MHProNews and was not in the original report above. Than noted, it illustrates several of Strommen’s points.

Additional Information, MHProNews Analysis and Commentary

Strommen’s characterization of the monopolization of the industry and growing grab of communities as “a Rube Goldberg Machine of Human Suffering” is an immediately compelling image.

“Human suffering” is arguably indeed what has followed this tragic trend Strommen documents since Buffett-led Berkshire bought into the manufactured home industry. Years of MHProNews and MHLivingNews evidenced-based reports and research has similarly contended. The only serious public challenge to debate those claims was by MHI member Andy Gedo. Gedo, after making several useful admissions, finally tossed in the towel, is well supported by Strommen’s compelling thesis.

Among the dozens of classic pull-quotes that should bring cheers from the industry’s independents, consumers, and MHI rivals – the Manufactured Housing Association for Regulatory Reform (MHARR) – is this one: “It would appear that MHI’s lobbying efforts are done less to serve the industry as a whole, but rather to keep competitors—and consumers—from accessing competitive rates on lending if the Duty to Serve were properly implemented.”

While MHARR is not directly referenced, MHARR featured in a significant way in the Washington Post report Strommen cited. See the report linked below for our related report and analysis on that topic.

There are self-evident and other reasons to think that no two writers who approach a similar or the same topic will type the exact same set of words. That noted, while MHProNews would concur with the thrust of Strommen’s thoughts, observations, and allegations, that is not to imply that every nuance or statement published above is agreed upon. There were elements that MHProNews brought to Strommen’s attention, which he acknowledged in writing merited correction.

That noted, given those typos or other corrections, Strommen has broken important ground. His independent look at this ever-important topic to understand why the industry is underperforming during an affordable housing crisis is intelligently addressed in the above.

Strommen is perhaps the first person outside of our profession who peered into these specialized issues in this depth. He did so applying the law to the evidence his research sources pointed toward. He routinely arrived at conclusions that often mirrored years of research that he likely never had time to read on MHProNews or MHLivingNews. It is important to note that as a research paper, there was a deadline that he had to meet. That is noted to underscore an impressive outcome given tight timelines and other time demands on Strommen.

Thus, all things considered, Strommen has done manufactured housing independents, investors, actual and potential manufactured homeowners, public officials, attorneys, nonprofits, and advocates a significant service is presenting his useful thesis.

MHProNews was advised that Strommen reached out to several industry professionals in doing his research on this topic. Only this writer for MHProNews and MHLivingNews responded to Strommen’s requests.

That begs the question – why did the others he contacted in manufactured housing not agree to aid his research?

That subtly implies another point that MHProNews and MHLivingNews have periodically contended.

Namely, that there is an ‘amen corner’ established by the industry’s powers that be that acts as an ‘echo chamber,’ that mouths Clayton-backed MHI talking points.

Whatever Berkshire Hathaway dominated MHI – and what MHI award-winner Marty Lavin, J.D., has called the MHI “big boy” brands – that run the Arlington, VA based trade organization wants said, are often repeated by several sources that tout Clayton/MHI et al talking points uncritically. Their behavior are thus not only a case study in antitrust and monopolization, but also in modern propaganda 101.

While this is the first time Strommen’s research and arguments are presented to a broader audience, a contact at the Knudson School of Law or University of South Dakota Law school told MHProNews that specific publication of his research (beyond MHProNews) is desired.

That has several implications, which may be revealed over time.

Additionally, a law professor felt that beyond typos previously noted and addressed above, that Strommen’s contentions were well presented and reasoned. That can reasonably be construed as additional legal and academic confirmation of the overall value of Strommen’s paper.

Stating the obvious can shed light. It should be noted that much of the research and footnoted references in the paper above were on MHProNews and MHLivingNews, a fact that Strommen flatly stated in a footnote (#40) “A huge debt of gratitude is owed by the author of this paper to the author of the article linked,” and this is the linked article by this author.

Additionally, Strommen says in another footnote (#43), “As Mr. Kovach duly noted, the discrepancies between the market share reported both by Clayton Homes itself, as well as the official figures presented by the Manufactured Housing Institute. This speaks to a level of potential collusion that will be addressed below.”

Strommen noted the possibilities of RICO and other legal violations, which are among other allegations MHProNews has made.

The arguments by Strommen on financing support contentions made by the MHI rival trade group, the Manufactured Housing Association for Regulatory Reform (MHARR).

Two key historic snapshots by former MHI Vice President and MHARR’s founding president Danny Ghorbani are linked above and below. Additionally, MHARR’s website is laced with reams of factual evidence and contentions that merit close scrutiny. Most of that evidence and research were produced by their current President Mark Weiss, J.D. While Strommen did not directly mention MHARR, he made several arguments that buttressed years of their claims and arguments too. As noted, he also cited the Washington Post report linked above that specifically names MHARR in, from the industry’s independent’s perspective, in a favorable way. Thus, much of this research by Strommen may also prove to be important in the days ahead for several pro-growth, anti-corruption forces in the industry.

As several industry voices, past and more recent have said, MHProNews is the preeminent source for independent trade publishing in manufactured housing. The fact that several third parties including Congress – see a partial list on LATonyKovach.com – have referenced this publication and our sister MHLivingNews speaks for itself.

MHProNews has previously reported that the New York Attorney General’s office referred an antitrust complaint against Clayton to the CFPB. It was arguably an odd referral: why did the NY AG’s office send referral to the CFPB? Why not the Department of Justice Antitrust Division?

But others have reportedly used research published on MHProNews and MHLivingNews to do state-based antitrust investigations. Put differently, like Strommen, seasoned antitrust attorneys from several states have deemed the evidence gathered and presented by MHProNews to be sufficiently compelling to warrant serious study. Because study comes first and other balls are being juggled by AGs, in time, their research and our own may lead to actual litigation against the Berkshire brands noted herein, and others involved in MHI.

Typos, style differences, and some nuances in presentation noted, there is much more to unpack from Strommen’s overall fine and important research paper. That will be examined in a planned follow-up to this initial report.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.