In a press release to MHProNews and others in media, Nobility Homes provided the following information for their third quarter 2021 results. There are insights on several issues that remain hot topics in manufactured housing. They include production, labor and supply challenges – several of which appear to be linked to COVID19 and public policies.

Among the items Nobility’s management team raised in their quarterly report includes the lack of lending as a factor hampering manufactured housing. Per Terry Trexler, President of Nobility (NOBH): ”The lack of lenders in our industry, still adversely affects our results by limiting many affordable manufactured housing buyers from purchasing homes.” That was a one of the subjects that the Washington Post’s recent report on manufactured housing raised, and will be tied into their corporate statements and the broader industry picture in our added information, analysis and commentary following their release.

Nobility Homes, Inc. Announces Sales and Earnings for its Third Quarter 2021

September 8, 2021

In this article:

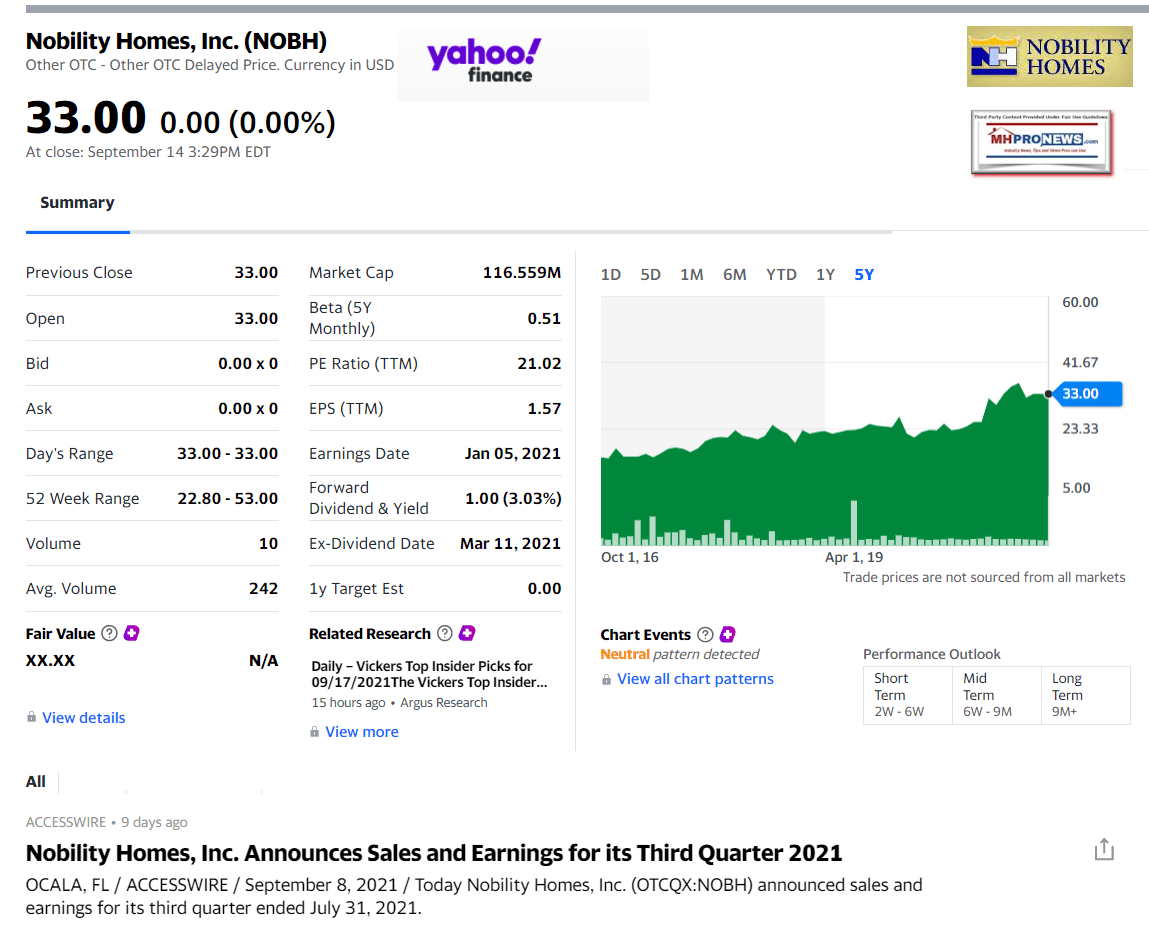

For the first nine months of fiscal 2021, sales increased 25% to $35,592,531 as compared to $28,446,764 for the first nine months of 2020. Income from operations was $4,478,526 versus $4,879,632 last year. Net income after taxes was $3,841,449 compared to $4,110,283 last year. Diluted earnings per share were $1.06 per share compared to $1.13 per share last year.

Nobility’s financial position during the third quarter 2021 remains very strong with cash and cash equivalents, certificates of deposit and short term investments of $36,373,258 and no outstanding debt. Working capital is $34,059,497 and our ratio of current assets to current liabilities is 3.3:1. Stockholders’ equity is $47,740,536 and the book value per share of common stock increased to $13.52.

Terry Trexler, President, stated, “The Company’s third quarter sales were strong and continue to reflect a robust housing market. According to the Florida Manufactured Housing Association, shipments for the industry in Florida for the period from November 2020 through July 2021 were up approximately 11% from the same period last year. The lack of lenders in our industry, still adversely affects our results by limiting many affordable manufactured housing buyers from purchasing homes.

During third quarter of 2021 our production of homes was impacted due to the challenges in hiring additional factory workers and the unpredictable absenteeism of the COVID-19 quarantine. These factors have continued in the fourth quarter of 2021. Also, production has incurred shortages in certain building products delaying the completion of the homes and has continued to experience inflation in most building products resulting in significant increases to our material costs and a corresponding decrease in gross profits. We have continued to focus on increasing production of homes due to the above challenges.

Maintaining our strong financial position is vital for future growth and success. Because of very challenging business conditions during economic recessions in our market area, management will continue to evaluate all expenses and react in a manner consistent with maintaining our strong financial position, while exploring opportunities to expand our distribution and manufacturing operations.

Our many years of experience in the Florida market, combined with home buyers’ increased need for more affordable housing, should serve the Company well in the coming years. Management remains convinced that our specific geographic market is one of the best long-term growth areas in the country.”

On June 5, 2021 the Company celebrated its 54th anniversary in business specializing in the design and production of quality, affordable manufactured homes. With multiple retail sales centers in Florida for over 30 years and an insurance agency subsidiary, we are the only vertically integrated manufactured home company headquartered in Florida.

MANAGEMENT WILL NOT HOLD A CONFERENCE CALL. IF YOU HAVE ANY QUESTIONS, PLEASE CALL TERRY OR TOM TREXLER @ 800-476-6624 EXT 121 OR TERRY@NOBILITYHOMES.COM OR TOM@NOBILITYHOMES.COM

Certain statements in this report are unaudited or forward-looking statements within the meaning of the federal securities laws. Although Nobility believes that the amounts and expectations reflected in such forward-looking statements are based on reasonable assumptions, there are risks and uncertainties that may cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to, the potential adverse impact on our business caused by the COVID-19 pandemic or other health pandemic, competitive pricing pressures at both the wholesale and retail levels, inflation, increasing material costs (including forest based products) or availability of materials due to potential supply chain interruptions (such as current inflation with forest products and supply issues with vinyl siding and PVC piping), changes in market demand, changes in interest rates, availability of financing for retail and wholesale purchasers, consumer confidence, adverse weather conditions that reduce sales at retail centers, the risk of manufacturing plant shutdowns due to storms or other factors, the impact of marketing and cost-management programs, reliance on the Florida economy, impact of labor shortage, impact of materials shortage, increasing labor cost, cyclical nature of the manufactured housing industry, impact of rising fuel costs, catastrophic events impacting insurance costs, availability of insurance coverage for various risks to Nobility, market demographics, management’s ability to attract and retain executive officers and key personnel, increased global tensions, market disruptions resulting from terrorist or other attack, any armed conflict involving the United States and the impact of inflation.

| Condensed Consolidated Balance Sheets | ||||||||||||||||||

| July 31, | October 31, | |||||||||||||||||

| 2021 | 2020 | |||||||||||||||||

| (Unaudited) | ||||||||||||||||||

| Assets | ||||||||||||||||||

| Current assets: | ||||||||||||||||||

| Cash and cash equivalents | $ | 33,720,078 | $ | 30,305,902 | ||||||||||||||

| Certificates of deposit | 2,090,910 | 4,602,307 | ||||||||||||||||

| Short-term investments | 562,270 | 358,960 | ||||||||||||||||

| Accounts receivable – trade | 1,134,675 | 790,046 | ||||||||||||||||

| Note receivable | 41,636 | 35,997 | ||||||||||||||||

| Mortgage notes receivable | 22,217 | 20,162 | ||||||||||||||||

| Income taxes receivable | 81,262 | 105,676 | ||||||||||||||||

| Inventories | 9,428,923 | 9,294,677 | ||||||||||||||||

| Pre-owned homes, net | 678,303 | 441,937 | ||||||||||||||||

| Prepaid expenses and other current assets | 1,370,339 | 1,014,849 | ||||||||||||||||

| Total current assets | 49,130,613 | 46,970,513 | ||||||||||||||||

| Property, plant and equipment, net | 6,916,778 | 5,142,714 | ||||||||||||||||

| Pre-owned homes, net | 716,582 | 1,077,240 | ||||||||||||||||

| Note receivable, less current portion | 44,595 | 6,573 | ||||||||||||||||

| Mortgage notes receivable, less current portion | 223,762 | 227,509 | ||||||||||||||||

| Mobile home park note receivable | 72,731 | – | ||||||||||||||||

| Other investments | 1,775,323 | 1,729,364 | ||||||||||||||||

| Deferred income taxes | – | 3,598 | ||||||||||||||||

| Operating lease right of use assets | 684,142 | 715,368 | ||||||||||||||||

| Cash surrender value of life insurance | 3,929,552 | 3,795,902 | ||||||||||||||||

| Other assets | 156,287 | 156,287 | ||||||||||||||||

| Total assets | $ | 63,650,365 | $ | 59,825,068 | ||||||||||||||

| Liabilities and Stockholders’ Equity | ||||||||||||||||||

| Current liabilities: | ||||||||||||||||||

| Accounts payable | $ | 818,230 | $ | 928,095 | ||||||||||||||

| Accrued compensation | 441,760 | 670,520 | ||||||||||||||||

| Accrued expenses and other current liabilities | 1,427,862 | 1,383,833 | ||||||||||||||||

| Income taxes payable | – | – | ||||||||||||||||

| Operating lease obligation | 33,039 | 24,192 | ||||||||||||||||

| Customer deposits | 12,350,225 | 5,098,633 | ||||||||||||||||

| Total current liabilities | 15,071,116 | 8,105,273 | ||||||||||||||||

| Deferred income taxes | 86,413 | – | ||||||||||||||||

| Operating lease obligation, less current portion | 752,300 | 778,519 | ||||||||||||||||

| Total liabilities | 15,909,829 | 8,883,792 | ||||||||||||||||

| Commitments and contingencies | ||||||||||||||||||

| Stockholders’ equity: | ||||||||||||||||||

| Preferred stock, $.10 par value, 500,000 shares | ||||||||||||||||||

| authorized; none issued and outstanding | – | – | ||||||||||||||||

| Common stock, $.10 par value, 10,000,000 | ||||||||||||||||||

| shares authorized; 5,364,907 shares issued; | ||||||||||||||||||

| 3,532,100 and 3,631,196 outstanding, respectively | 536,491 | 536,491 | ||||||||||||||||

| Additional paid in capital | 10,749,843 | 10,694,554 | ||||||||||||||||

| Retained earnings | 58,185,400 | 57,976,051 | ||||||||||||||||

| Less treasury stock at cost, 1,832,807 shares in 2021 and | ||||||||||||||||||

| 1,733,711 shares in 2020 | (21,731,198 | ) | (18,265,820 | ) | ||||||||||||||

| Total stockholders’ equity | 47,740,536 | 50,941,276 | ||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 63,650,365 | $ | 59,825,068 | ||||||||||||||

| Condensed Consolidated Statements of Income | ||||||||||||||||||

| (Unaudited) | ||||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||||

| July 31, | August 1, | July 31, | August 1, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||

| Net sales | $ | 11,778,120 | $ | 8,800,410 | $ | 35,592,531 | $ | 28,446,764 | ||||||||||

| Cost of sales | (9,265,376 | ) | (6,361,500 | ) | (26,969,655 | ) | (19,980,510 | ) | ||||||||||

| Gross profit | 2,512,744 | 2,438,910 | 8,622,876 | 8,466,254 | ||||||||||||||

| Selling, general and administrative expenses | (1,320,456 | ) | (1,107,850 | ) | (4,144,350 | ) | (3,586,622 | ) | ||||||||||

| Operating income | 1,192,288 | 1,331,060 | 4,478,526 | 4,879,632 | ||||||||||||||

| Other income (loss): | ||||||||||||||||||

| Interest income | 62,491 | 53,209 | 145,621 | 239,365 | ||||||||||||||

| Undistributed earnings in joint venture – Majestic 21 | 20,202 | 20,855 | 45,959 | 61,125 | ||||||||||||||

| Proceeds received under escrow arrangement | 75,156 | 64,053 | 121,024 | 336,447 | ||||||||||||||

| Increase (decrease) in fair value of equity investment | (449 | ) | 21,475 | 203,310 | (159,051 | ) | ||||||||||||

| Gain on sale of assets | – | 32,041 | – | 32,041 | ||||||||||||||

| Miscellaneous | 48,169 | 12,910 | 73,434 | 32,504 | ||||||||||||||

| Total other income | 205,569 | 204,543 | 589,348 | 542,431 | ||||||||||||||

| Income before provision for income taxes | 1,397,857 | 1,535,603 | 5,067,874 | 5,422,063 | ||||||||||||||

| Income tax expense | (347,111 | ) | (375,465 | ) | (1,226,425 | ) | (1,311,780 | ) | ||||||||||

| Net income | 1,050,746 | 1,160,138 | 3,841,449 | 4,110,283 | ||||||||||||||

| Weighted average number of shares outstanding: | ||||||||||||||||||

| Basic | 3,599,133 | 3,631,089 | 3,621,084 | 3,641,048 | ||||||||||||||

| Diluted | 3,613,187 | 3,632,420 | 3,630,216 | 3,642,397 | ||||||||||||||

| Net income per share: | ||||||||||||||||||

| Basic | $ | 0.29 | $ | 0.32 | $ | 1.06 | $ | 1.13 | ||||||||||

| Diluted | $ | 0.29 | $ | 0.32 | $ | 1.06 | $ | 1.13 | ||||||||||

SOURCE: Nobility Homes, Inc.

Additional Information, more MHProNews Analysis and Commentary

According to Beth DeCarbo for the Washington Post in her recent article on manufactured housing: “Moreover, only 27 percent of 420,000 manufactured home loan applications in 2019 resulted in the loan being financed, compared with 74 percent of applications for site-built homes, according to a CFPB analysis of loan-disclosure data. These differences remain even after controlling for credit score.”

That is just one of the key issues that is holding manufactured housing at historically low levels. Yes, the industry has ‘recovered’ from the arguably manmade crash caused in 2009 when Tim Williams, President and CEO of 21st Mortgage Corporation pulled lending from thousands of non-Clayton selling independent retailers and others. Per Samuel Strommen at Knudson Law, it is an apparent antitrust violation – citing tying – but including other potential causes for federal action too.

The industry’s under-performance have both internal and external causes. Some of those external causes have been explored by James A “Jim” Schmitz Jr with the Minneapolis Federal Reserve and other colleagues. Internal industry causes have been probed by the Manufactured Housing Association for Regulatory Reform, the Modular Home Builders Association (MHBA), Strommen, and others that have been reportedly primarily by MHProNews and our MHLivingNews sister site. Meanwhile, others have downplayed, defended, or ignored these themes that are an apparent embarrassment for the Berkshire brands and their consolidator allies national association of choice, the Manufactured Housing Institute (MHI).

The silence from MHI leaders and their attorneys have dodge the questions about their years of lack of performance at attaining their own goals and various claims lodged against them speaks volumes. If they had a good defense, they would do so. Who says? Their own outside attorney.

Silence speaks. Facts speaks. Evidence matters, to borrow HUD’s PD&R term. Manufactured housing is underperforming for a variety of reasons. But many of them can be traced back to the brands that hide behind three letters. M.H.I. On the push-back side in the manufactured housing association world, that comes down to 5 letters – MHARR – the Manufactured Housing Association for Regulatory Reform. ##

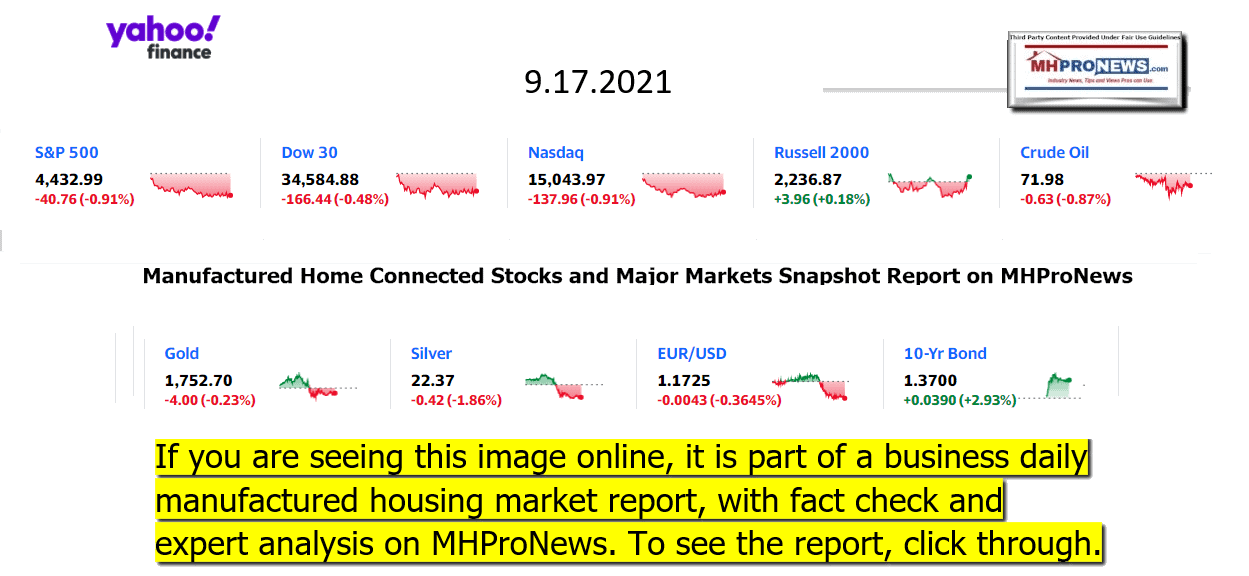

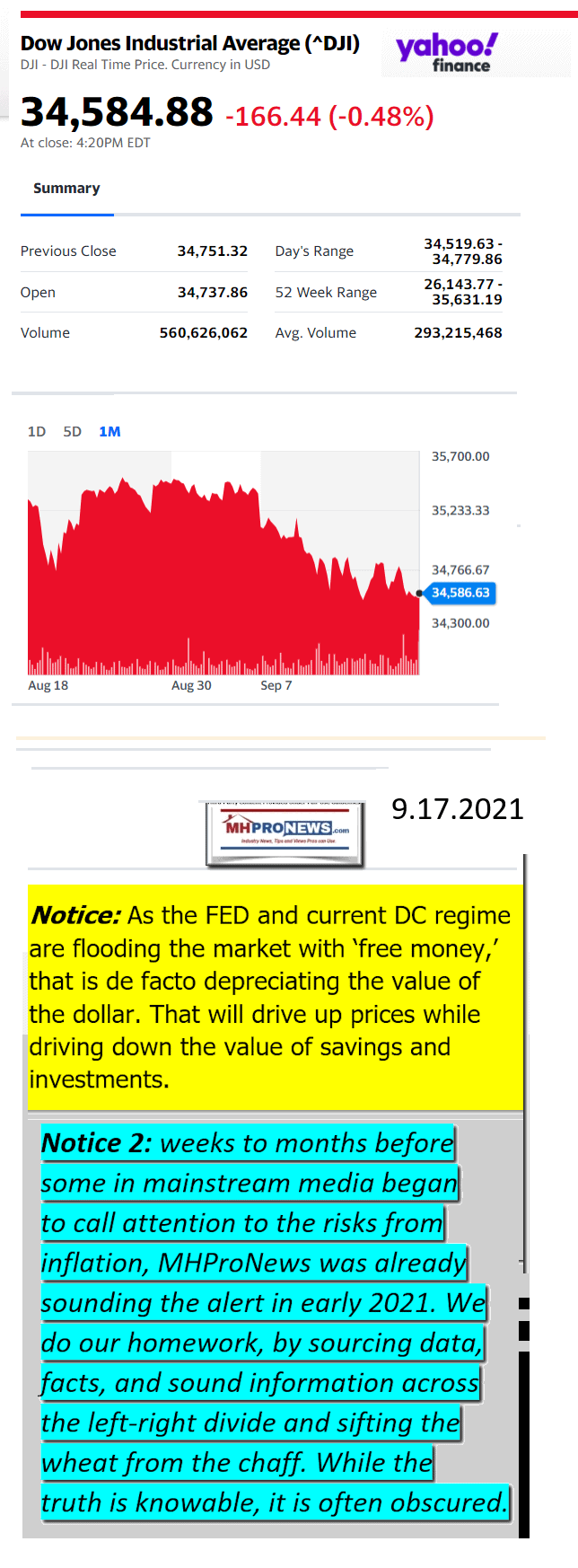

Next up is our business daily recap of yesterday evening’s market report, related left-right headlines, and manufactured housing connected equities.

The Business Daily Manufactured Home Industry Connected Stock Market Updates. Plus, Market Moving Left (CNN) – Right (Newsmax) Headlines Snapshot. While the layout of this daily business report has been evolving over time, several elements of the basic concepts used previously are still the same. For instance. The headlines that follow below can be reviewed at a glance to save time while providing insights across the left-right media divide. Additionally, those headlines often provide clues as to possible ‘market-moving’ news items.

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Headlines from left-of-center CNN Business – evening of 9.17.2021

- Taliban takeover

- Cars wait in traffic as Afghans shop in a local market in Kabul, Afghanistan, Saturday, Sept. 11, 2021.

- This mobile app is helping Afgans navigate safely around Kabul by sharing real-time information

- The stock market is afraid again. Here’s what that means for your investments

- Are you a working parent concerned about Delta, fresh quarantines or lockdowns? Share your story

- Forget inflation. This billionaire investor worries about democracy

- Workers in these five industries will be affected the most by Biden’s vaccine mandate

- Extreme weather keeps knocking out America’s power. We must act

- Investigation finds World Bank leaders pushed staffers to boost rankings for China and Saudi Arabia in high-profile reports

- China faces a potential Lehman moment. Wall Street is unfazed

- 5 things to know about Evergrande, the Chinese empire on the brink

- Google and Apple said to have removed Navalny voting app as Russian elections begin

- The Inspiration 4 crew is in orbit, but they may not get astronaut wings

- Microsoft will now let its users log in without passwords

- ‘Disturbing for democracy’: Americans are divided into two media worlds, survey shows

- From back left, Singapore’s Minister for Trade and Industry Lim Hng Kiang, New Zealand Trade Minister David Parker, General Secretary Ministry of International Trade and Industry of Malaysia Y.bhg. Datuk J. Jayasiri, Canada’s Minister of International Trade Francois-Philippe Champagne, Australian Minister for Trade and Investment Steven Ciobo, Chile’s Foreing Minister Heraldo Munoz, Brunei’s Foreign Minister Haji Erawan bin Pehin Yusof, Japan’s Trans-Pacific Partnership minister Toshimitsu Motegi, Secretary of Economy of Mexico Idelfonso Guajardo, Peru’s Trade Minister Eduardo Ferreyros and Vietnamese Trade Minister Tran Tuan Anh, poses for a pictures after the signing ceremony of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, CP TPP, in Santiago, Chile, Thursday, March 8, 2018.

- Trump abandoned this giant trade deal. Now, China wants in

- Women walk past by a “Now Hiring” sign outside a store on August 16, 2021 in Arlington, Virginia.

- It’s premature to declare economic victory from the Covid crash

- For restaurants, the economic recovery is ‘moving in reverse’

- BOOZY NEWS

- Bud Light hopes this beer is the next big thing

- Pumpkin spiced seltzer is coming soon from Bud Light

- IHOP is adding booze to the menu at some locations

- Boozy Mountain Dew is coming in 3 flavors

- A big craft beer name is moving to cannabis business

- FUTURE OF TRANSPORTATION

- Rivian beats Tesla, GM and Ford to build the first electric pickup truck

- Apple loses a leader of its rumored car group to Ford

- A surprising ally is pumping the brakes on Biden’s EV goal

- Cars have been guzzling leaded gasoline. Not any more

- Futuristic pods could help cities solve traffic problems

Headlines from right-of-center Newsmax – evening of 9.17.2021

- Deadly Gaffe: Pentagon Now Says Kabul Drone Strike Killed 10 Civilians in ‘Tragic Mistake’

- The Ahmadi family prays this week beside the graves of relatives killed by a U.S. drone strike in Kabul, Afghanistan. Zemerai Ahmadi an Afghan man who was killed, was an enthusiastic and beloved longtime employee at an American humanitarian group, his colleagues say, painting a stark contrast to Pentagon claims that he was an ISIS militant planning to attack U.S. troops. (AP)

- Newsmax TV

- Steube: ‘Reckoning’ Coming From House GOP on Afghanistan

- Ronna McDaniel: Vaccine Mandates Result of Biden’s Failures | video

- Meuser: GOP Will Get Answers on Taliban Humanitarian Aid | video

- Roger Stone: ‘Not a Scintilla of Evidence’ in Jan. 6 Lawsuit

- Kevin McCarthy: China ‘Wins in This Tax Bill’ | video

- Stewart: ‘Stunning’ Milley Circumvented Civilian Leaders | video

- Malliotakis: Don’t Believe Blinken on Taliban’s Capabilities | video

- Tenney: Milley Must Face Action If Book’s Claims Proven | video

- More Newsmax TV

- Newsfront

- Defense Sec, OKs 100 Guard Troops If Needed at ‘Justice for J6’ Rally

- Defense Secretary Lloyd Austin has approved a Capitol Police request to provide 100 D.C. National Guard troops for Saturday’s “Justice for J6” rally in Washington, D.C…. [Full Story]

- Related Stories

- Trump: ‘Justice for J6’ Rally a ‘Setup’

- Pompeo, Christie Skeptical About Woodward, Want to Hear From Milley

- Former Secretary of State Mike Pompeo said Friday he’s “always [Full Story]

- Related

- Pompeo, NSA Had No Intel Before Milley’s China Calls

- Hoyer: House to Hold Vote to Avoid Debt Default, Shutdown

- House Majority Leader Steny Hoyer, D-Md., said on Friday that the [Full Story]

- FDA Advisory Panel Rejects Widespread Pfizer Booster Shots

- An influential federal advisory panel has soundly rejected a plan to [Full Story]

- 3 Attack NYC Eatery Host for Requesting Vaccine Proof

- 3 Attack NYC Eatery Host for Requesting Vaccine Proof

- A host at a popular New York City restaurant was assaulted by three [Full Story]

- Related

- Moderna COVID Vaccine Edges Pfizer in New Research

- Tennessee Mayor, A WWE Star, Vows To Fight Biden Mandate

- 6 Detentions Called ‘Cruel and Unusual’ Punishment

- A lawyer representing several defendants arrested in connection with [Full Story] | platinum

- France Recalls Ambassadors to US, Australia Over Sub Deal

- French Foreign Minister Jean-Yves Le Drian said Friday evening that [Full Story]

- North Carolina Court Strikes Down Voter ID Law

- North Carolina Superior Court judges on Friday struck down the [Full Story]

- Will Inflation Spark Major Gold Rush to $5,000 an Ounce?

- As inflation continues to soar, investors nationwide are increasingly [Full Story] | platinum

- Pentagon Reverses Itself, Calls Deadly Kabul Strike an Error

- The Pentagon retreated from its defense of a drone strike that killed [Full Story]

- Apple, Google Remove Opposition App as Russian Voting Begins

- Facing Kremlin pressure, Apple and Google on Friday removed an [Full Story]

- Lawyer Indicted in Durham Probe Enters Not Guilty Plea

- Michael Sussmann, who was charged by special counsel John Durham, [Full Story]

- Florida County Slammed for Using Taco Image to Celebrate Hispanic Heritage Month

- Broward County, Florida, has been criticized after its official [Full Story]

- Biden Weighs Executive Privilege on Trump Jan. 6 Docs

- The investigation into the events surrounding the storming of the [Full Story]

- Roger Stone to Newsmax: ‘Not a Scintilla of Evidence’ in Jan. 6 Lawsuit

- Trump ally Roger Stone, who was served legal papers earlier this week [Full Story]

- Poll: Biden’s Approval Sinks to 44 Percent – His Lowest Yet

- Public approval of President Joe Biden has dropped to the lowest [Full Story]

- TikTok’s ‘Devious Licks’ Challenge Vandalizing Schools

- A TikTok trend running rampant among students involves stealing from [Full Story]

- FAA Places No-Fly Zone Over Texas Bridge

- The Federal Aviation Administration has placed a two-week no-fly zone [Full Story]

- Texas Awards $11M Border Wall Contract

- Texas officials on Thursday awarded a contract to oversee [Full Story]

- Federal Judge Upholds Florida’s Mask Mandates Ban

- A federal judge declined Wednesday to block a ban imposed by [Full Story]

- Rob Finnerty: Bye-Bye, Biden. . .The Future We All Know Is Coming, but Don’t Want To Admit.

- What we are witnessing right now in Washington has never happened [Full Story]

- Texas GOP Rep. Matt Krause to Primary AG Ken Paxton

- Texas State Rep. Matt Krause has announced he is entering the 2022 [Full Story]

- Justice Thomas: Judicial Now ‘Most Dangerous’ Branch

- Justice Clarence Thomas said the Supreme Court might be “the most [Full Story]

- Ohio GOP Rep. Gonzalez Won’t Run for Reelection

- One of the 10 House Republicans who voted to impeach former President [Full Story]

- Experts Rip Mayor Lightfoot’s ‘Sue the Gangs’ Proposal: ‘It’s for Show’

- Amid heavy criticism of violent and often-deadly crime in Chicago, [Full Story]

- Blinken Calls France Vital Partner in Indo-Pacific in Apparent Bid to Calm French Fury

- Secretary of State Antony Blinken on Thursday called France a vital [Full Story]

- Minnesota High Court OKs Ballot Question on Minneapolis PD

- The Minnesota Supreme Court cleared the way Thursday evening for [Full Story]

- House Republicans Seek Probe of Aid to Taliban, Likening It to ‘Ransom’

- The largest GOP caucus in Congress is demanding the Biden [Full Story]

- Roger Stone Served Legal Papers Related to Capitol Riot on Live Radio Show

- Roger Stone was served legal papers related to the Jan. 6 Capitol [Full Story]

- Judge Nixes DOJ Bid to Pause Texas Abortion Law, Sets Oct. 1 Hearing on Matter

- A federal judge on Wednesday scheduled an Oct. 1 hearing to consider [Full Story]

- French Forces Kill Islamic State’s Boss in Sahel

- France said Thursday that its troops deployed in Africa’s Sahel [Full Story]

- Anyone With Tooth Decay Should Watch This (They Hide This From You)

- Anyone With Tooth Decay Should Watch This (They Hide This From You)

- Trendy Discovery

- More Newsfront

- Finance

- Apple Fanfare Over iPhones, Watch, AirPods

- Apple will hold its annual iPhone launch event on Tuesday, according to reports. Analysts expect Apple will unveil new iPhones with 5G connectivity and a more squared-off look; a brand-new Apple Watch with 16I% more pixels and a blood-pressure sensor; and AirPods. [Full Story]

- S. Banking Lobby Groups Oppose Proposed Tax Reporting Law

- SpaceX Tourists Speak to Tom Cruise from Orbit

- Wall St Week Ahead-Growth? Value? Some Investors Opt for a Bit of Both

- As California Fire Nears, Crews Protect World’s Largest Tree in Special Wrap

- More Finance

- Health

- Study: Sleep ‘Sweet Spot’ Helps Prevent Alzheimer’s Disease

- Getting too much – or too little – sleep can lead to Alzheimer’s disease. A new study published in the journal JAMA Neurology examined the role of sleep in the accumulation of brain amyloid plaque buildup, cognitive performance, and other factors involved in brain… [Full Story]

- Pfizer Recalls All Lots of Anti-Smoking Drug Chantix

- Moderna COVID Vaccine Edges Pfizer in New Research

- Common Eye Conditions Tied to Higher Dementia Risk

- Flu is Ready for a Comeback, Get Your Shot

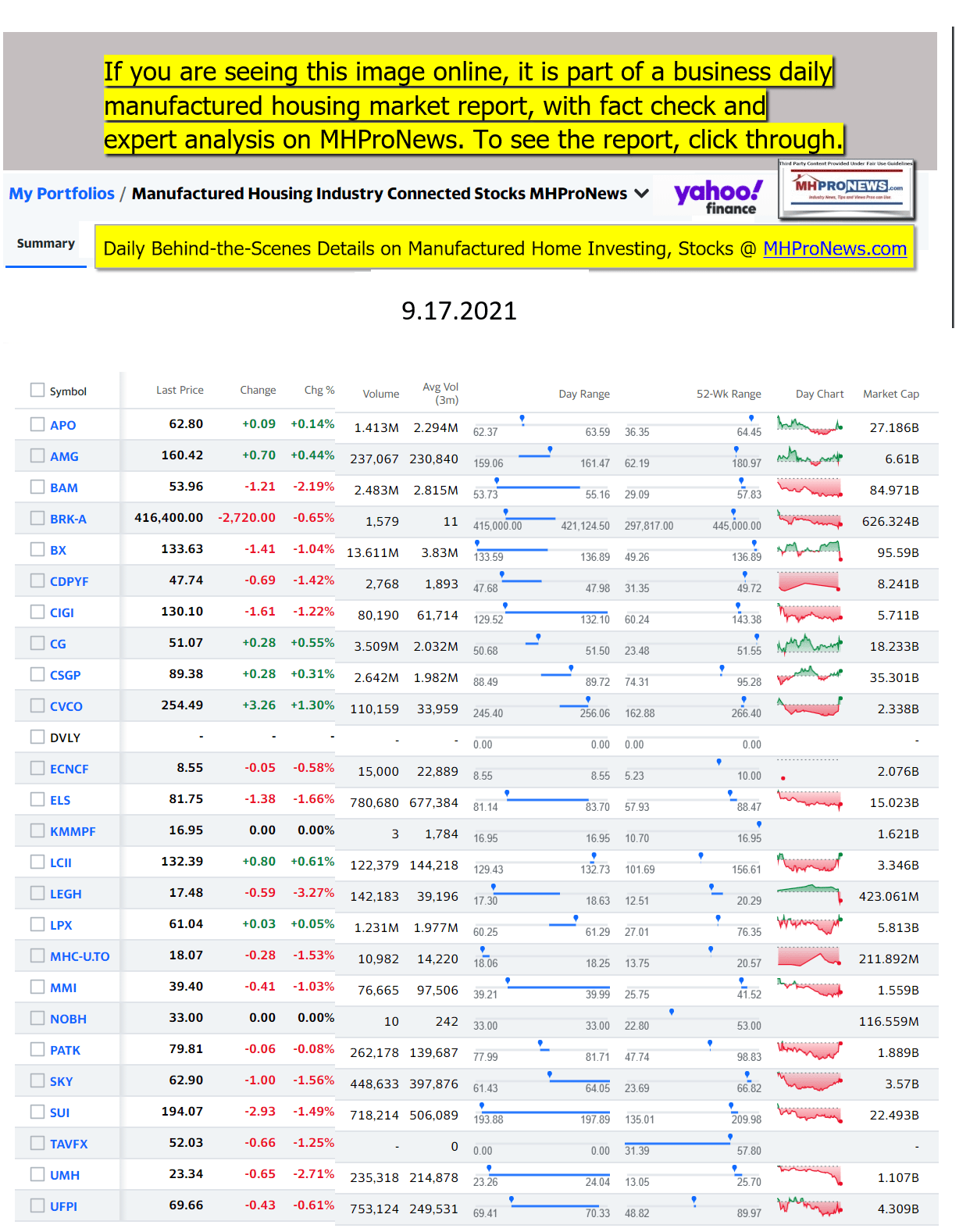

Manufactured Housing Industry Investments Connected Equities Closing Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

-

-

-

-

-

-

-

-

-

-

-

Summer 2021…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12th year of serving the industry as the runaway most-read trade media.

Sample Kudos over the years…

It is now 11+ years and counting…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.