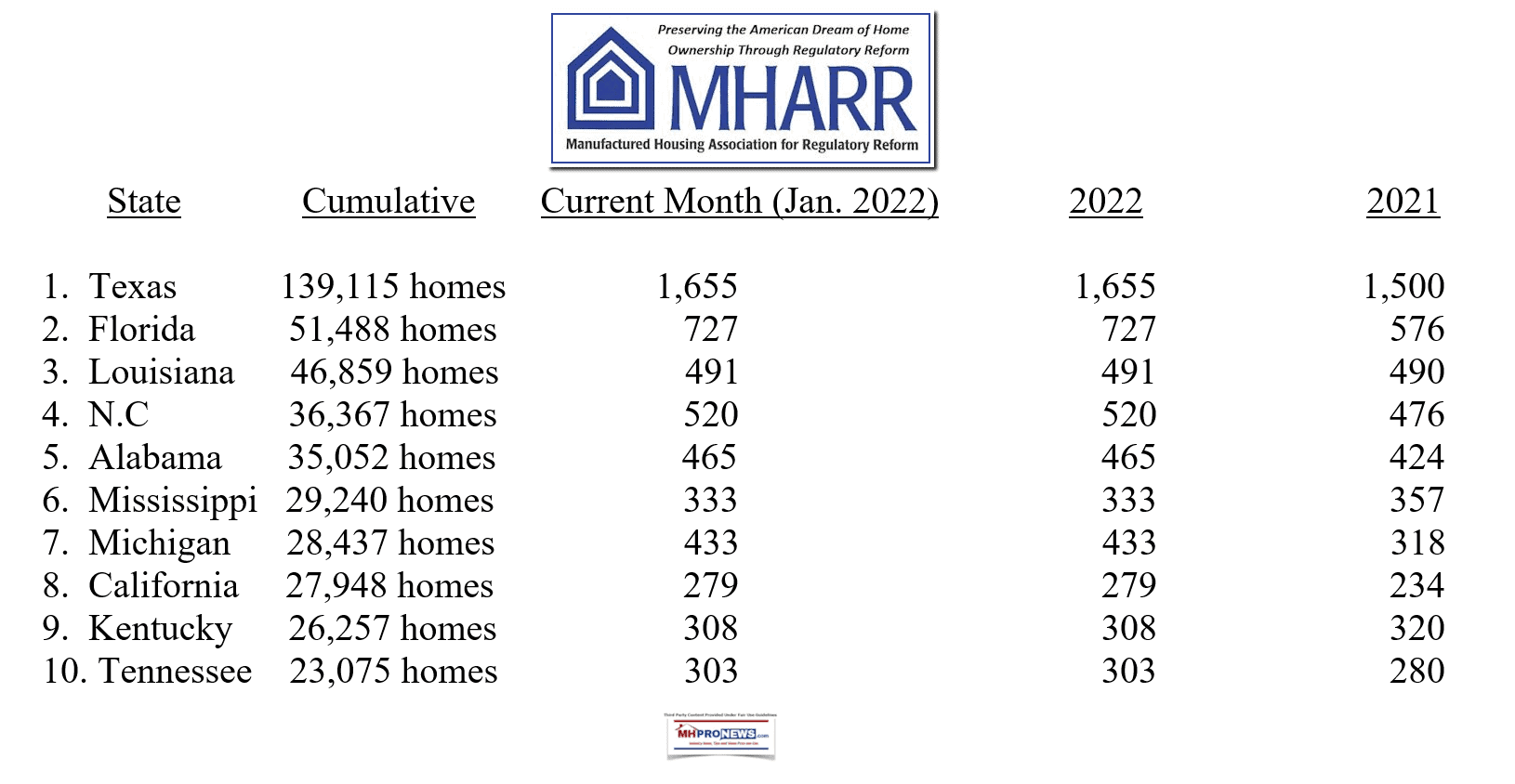

Manufactured housing production data for January 2022 will precede what WFTV News, among others in the mainstream media, reported on “Congress exploring new solutions for affordable housing shortage.” While the data and discussion from the Congressional hearing on 3.1.2022 is relevant, interesting, and offers more evidence why manufactured housing should be soaring, objectively, it is also an example of why manufactured housing growth is relatively muted. The manufactured housing data below is provided by the Manufactured Housing Association for Regulatory Reform (MHARR), which in turn relies upon official data collected on behalf of the industry’s primary federal regulator – which is the U.S. Department of Housing and Urban Development, or HUD.

Manufactured Housing Industry Production Increases to Begin 2022

FOR IMMEDIATE RELEASE Contact: MHARR: (202) 783-4087

Washington, D.C., March 3, 2022 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production increased in January 2022. Just-released statistics indicate that HUD Code manufacturers produced 9,110 homes in January 2022, a 7.5% increase over the 8,476 new HUD Code homes produced during January 2021.

A further analysis of the official industry statistics shows that the top ten shipment states from the beginning of the industry production rebound in August 2011 through January 2022 — with cumulative, monthly, current year (2022) and prior year (2021) shipments per category as indicated — are:

The January 2022 data results in no changes to the cumulative top-ten shipment list.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 –

The information above should be considered in the light of the data and recent testimony to Congress that follows.

The House Select Committee on Economic Disparity and Fairness in Growth held hearings on March 1, 2022 on the affordable housing crisis. Their 8-page overview document mentions “affordable” housing 9 times, per the WORD search tool. Manufactured homes, manufactured housing, modular homes, prefab or factory-built housing are not mentioned at all.

Five witnesses gave written testimony, no one in manufactured housing was apparently invited. Or if anyone from manufactured housing was invited, no one in the manufactured home arena testified. Given that one of those who testified was a former HUD Secretary, Shaun Donovan, that should be a reality check for the happy talk that comes from self-promoters in MHVille who posture, preen, but have apparently failed to produce measurable results throughout the 21st century.

Two of those five who testified to the House Select Committee, per the WORD search tool of the testimony of witnesses, mentioned manufactured homes/manufactured housing.

- One mention of manufactured housing was a negative comparison, see below.

- Another reference to manufactured homes was framed in the context of protecting residents in manufactured home communities by providing more ROC-style conversion support.

- These pieces of evidence from a hearing that is seeking solutions to the affordable housing crisis are reality checks. They speak volumes on the why manufactured housing is underperforming during an affordable housing crisis.

Here are the two mentions, before this report and analysis pivots toward the meat of the hearing overview, which is useful to all forward thinkers.

In the “Testimony of Nikitra Bailey Senior Vice President of Public Policy, National Fair Housing Alliance Before the U.S. House Select Committee on Economic Disparity and Fairness in Growth Tuesday, March 1, 2022,” Bailey’s mention of manufactured housing was as follows. Highlighting is added in both of these pull-quotes below.

- “Nine percent of renters reported the likelihood of evictions, and 28 percent of residents in manufactured housing reported an inability to pay rent, compared to 12 percent of single-family home residents and 18 percent of residents in small multi-family units.55”

Then, there was the Testimony of Jacqueline Waggoner, President, Solutions Division, Enterprise Community Partners, Inc. March 1, 2022.” Waggoner said the following.

- One such approach would create a pilot program and interagency task force to support the longterm affordability of manufactured home communities through preservation efforts, tenant ownership and community land trust models. These efforts would incentivize proper maintenance practices and other tenant protections, prevent predatory acquisitions and ensure the long-term preservation of this critical supply of affordable housing. As Fannie Mae and Freddie Mac have instituted requirement that all new manufactured housing community transactions include tenant site lease protections, a pilot program would support those efforts and ensure similar protections in private market transactions.

While Waggoner’s point wasn’t necessarily negative per se, it nevertheless points to a problem that has existed for some years. Namely, so-called predatory community operators who are creating such a negative pushback that stirs up the need for such “preservation” and “protections” efforts.

Against that backdrop, here was the information provided by the Congressional website with respect to this affordable housing hearing.

WHO:

- Chairman Jim Himes (CT-04)

- Ranking Member Bryan Steil (WI-01)

- Select Committee Members

- Secretary Shaun Donovan, Former U.S. Secretary of Housing and Urban Development

- Ms. Nikitra Bailey, Senior Vice President of Public Policy, National Fair Housing Alliance

- Ms. Jacqueline Waggoner, President of Solutions Division, Enterprise Community Partners

- Mr. Kevin J. Nowak, Executive Director, CHN Housing Partners

- Dr. Salim Furth, Senior Research Fellow, Mercatus Center at George Mason University

From that hearing document was this interesting overview. It will be followed by our weekly recap, with additional information on this specific topic found in this week’s postscript.

“Overview of the Affordable Housing Crisis

Housing has become more expensive since the turn of the century relative to earnings. In 2021 dollars, the median asking price for a rental unit in the United States increased from $780 in 2000 to $1,250 in 2021—a jump of 61%.2 The real median price of houses sold in the US increased from $271,000 to

$404,000, or by 49%, over the same period.3 Yet between 2000 and 2021, real median weekly earnings rose by just 10%.4 Affordability is especially a problem for Americans in their prime home-buying years; over the same period, real median weekly earnings for those aged between 25 and 34 rose by just 8%.5

The increase in housing prices relative to incomes partially reflects the relatively low rate of new home construction in the US. In the 2010s, construction started on an average of 21,000 new homes annually for every 100,000 residents—just 50% of the 42,000 constructed on average annually in the 2000s, 1990s, and 1980s.6 The Federal Home Loan Mortgage Corporation estimates that as of 2020, the US had a housing supply deficit of 3.8 million units, with much of this shortfall concentrated in entry-level home construction.7 The increase also partially reflects high regulatory costs associated with exclusionary zoning, or the exclusion of certain types of land use in a given community or locality. Measures of zoning strictness—including restrictions related to minimum lot sizes, minimum square footage requirements, prohibitions on multi-family homes, and height limits—are highly positively correlated with home prices.[1]

As a result, lower- and middle-income workers are bearing the brunt of the rental affordability crisis. A

“rent-burdened” household spends 30% or more of income on rent, and the share of renter households that are rent-burdened has been increasing over the past two decades. In 2001, 41% of all renters were rent-burdened, but by 2017, that figure had increased to 47%.[2] In 2020, the average minimum-wage worker had to work 79 hours per week—nearly two full-time jobs—to afford a one-bedroom rental home without being rent-burdened.[3]

More recently, the affordability crisis has contributed to increased rates of homelessness, which in turn contribute to decreased levels of upward economic mobility through worse health, lower academic achievement, and less stable employment.11 2020 marked the fourth consecutive year in which homelessness increased nationwide, with roughly 580,000 people experiencing homelessness on any given night.[4]

Historically, homeownership has been an important method of wealth accumulation in the United States. Yet with home prices and rents significantly outpacing wages, those without financial assistance or sufficient savings for a down payment are increasingly locked out of buying. Between 2001 and 2015, the national share of prime buying-age renters that successfully transitioned to owning within four years declined from 26% to 16%, a trend that reflects higher rents, stagnant wages, and ballooning student loan obligations, in addition to some generational shifts in preferences surrounding geography.15, [5], [6]

The economic fallout from the onset of the COVID-19 pandemic, which disproportionately harmed lower-income workers, has likewise negatively affected the ability of many households to save. While just 16% of upper-income Americans drew on savings or retirement funds to pay bills in 2020, 33% of middle-income and 44% of lower-income Americans did.[7] Moreover, just 3% of upper-income Americans had problems paying rent or mortgages, compared to 11% and 32% of middle- and lowerincome Americans, respectively.[8] Black and Hispanic Americans were far more likely than their white counterparts to experience economic hardship.20

Relatedly, homeownership rates also vary drastically by race and ethnicity. 73% of white families own homes, compared to just 40% of Black families and 47% of Hispanic families.[9] Further, in 2020, Blackowned homes were worth on average 16% less than white-owned ones, while Hispanic-owned homes were worth 10% less.[10] These differences can partially be attributed to the legacies of redlining, discrimination in the mortgage loan underwriting process, racially influenced home value appraisals, racial and ethnic pay gaps, and legal housing and occupational segregation.23” …##

Again, unpacking that information will take place in today’s postscript; that follows the headlines for the week.

With no further adieu, here are the headlines in reports for the week that was from 2.27.2022 to 3.6.2022.

What’s New on MHLivingNews

What’s New from Washington, D.C. from MHARR

What’s New on the Words of Wisdom

What’s New on the Masthead

What’s New on the Daily Business News on MHProNews

Saturday 3.5.2022

Friday 3.4.2022

Thursday 3.3.2022

Wednesday 3.2.2022

Tuesday 3.1.2022

Monday 2.28.2022

Sunday 2.27.2022

What’s New in our 2022 Mainstream Media Campaign

{This is one of several images plus a video in that report}

Postscript

In no specific order of importance, some of the takeaways from the Congressional hearing referenced above are the following.

- Stating the obvious, there is a large and growing need for affordable housing.

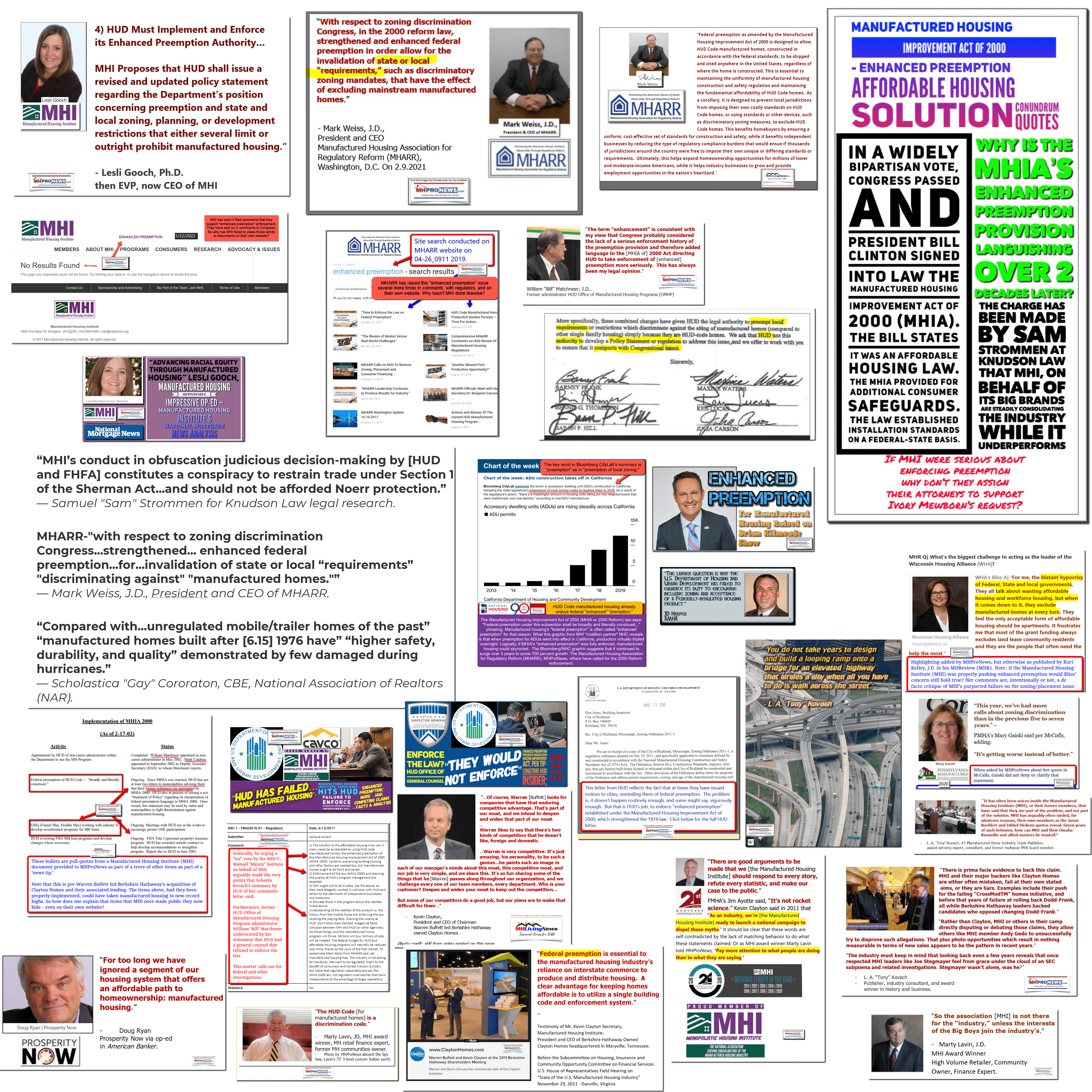

- Among those testifying were experts who believe that local barriers are an issue. That fits naturally into the case for enforcing the Manufactured Housing Improvement Act (MHIA) of 2000, and its so-called “enhanced preemption” provision.

- Clearly, that committee gave essentially no attention, and those who gave testimony, barely mentioned manufactured homes.

- What was mentioned about manufactured housing was more negative than positive.

- In fairness, the above is hardly a bellwether. But it is indicative of what happens when MHI doesn’t get someone to make some token mention of manufactured housing.

- Among the oddities in the housing units need is a point that MHProNews has raised for our readers several times. Namely, the disconnect between the once higher numbers of housing units needed just a few years ago than is occurring recently. What explains that? After all, as the hearing claims pointed out, there has been insufficient production for years. That should mean that the number of housing units needed ought to have grown from an estimated 7 to 8.3+ million units. Instead, we are seeing claims more in the 4 to 5 million units range.

- Rephrased, even with trillions of dollars flowing through the federal government, some of which returns to businesses and researchers, the ‘data’ is at best inconsistent.

- Additionally, it is problematic for our industry that manufactured housing, the MHIA and enhanced preemption gain no serious consideration.

That’s a sobering snapshot of our industry’s challenges on this date. That said, it is a potential opportunity in disguise. Those willing to tell the industry’s story in a factual fashion that don’t dodge the problematic headlines and their apparent root causes have tremendous opportunities.

The footnotes for the segment of the Congressional hearing above are shown below. To learn more, check out the reports for the week, and others from prior weekly recaps that follow further below.

[1] Cecilia Rouse, Jared Bernstein, Helen Knudsen, Jeffery Zhang. “Exclusionary Zoning: Its Effect on Racial Discrimination in the Housing Market.” Council of Economic Advisers. June 17, 2021. https://www.whitehouse.gov/cea/writtenmaterials/2021/06/17/exclusionary–zoning–its–effect–on–racial–discrimination–in–the–housingmarket/#:~:text=Exclusionary%20zoning%20laws%20enact%20barriers,and%20fewer%20homes%20being%20built.

[2] Sean Veal, Jonathan Spader. “Nearly a Third of American Households Were Cost-Burdened Last Year.” Joint Center for Housing Studies of Harvard University. December 7, 2018. https://www.jchs.harvard.edu/blog/more–than–a–third–of–americanhouseholds–were–cost–burdened–last–year.

[3] Andrew Aurand, Dan Emmanuel, Dan Threet, Ikra Rafi, Diane Yentel. “Out of Reach 2021: The High Cost of Housing.” National Low Income Housing Coalition. 2020. https://reports.nlihc.org/oor. 11 Kriti Ramakrishnan, Elizabeth Champion, Megan Gallagher, Keith Fudge. “Why Housing Matters for Upward Mobility: Evidence and Indicators for Practitioners and Policymakers.” Urban Institute. January 12, 2021.

https://www.urban.org/research/publication/why–housing–matters–upward–mobility–evidence–and–indicators–practitioners–andpolicymakers.

[4] Meghan Henry, Tanya de Sousa, Caroline Roddey, Swati Gayen, Thomas Joe Bednar. “The 2020 Annual Homeless Assessment Report (AHAR) to Congress.” The U.S. Department of Housing and Urban Development. January 2021. https://www.huduser.gov/portal/datasets/ahar/2020–ahar–part–1–pit–estimates–of–homelessness–in–the–us.html.

[5] Erin Currier, Clinton Key, Joanna Biernacka-Lievestro, Walter Lake, Sheida Elmi, Sowmya Kypa, Abigail Lantz. “American Families Face a Growing Renter Burden.” The Pew Charitable Trusts. April 2018. https://www.pewtrusts.org/en/research–andanalysis/reports/2018/04/american–families–face–a–growing–rent–burden.

[6] Jung Hyun Choi, Jun Zhu, Laurie Goodman, Bhargavi Ganesh, Sarah Strochak. “Millennial Homeownership: Why Is It So Low, and How Can We Increase It?” Urban Institute. July 11, 2018. https://www.urban.org/research/publication/millennialhomeownership.

[7] Kim Parker, Racel Minkin, Jesse Bennett. “Economic Fallout From COVID-19 Continues to Hit Lower-Income Americans the Hardest.” Pew Research Center. September 24,2020. https://www.pewresearch.org/social–trends/2020/09/24/economic–falloutfrom–covid–19–continues–to–hit–lower–income–americans–the–hardest/.

[8] Ibid. 20 Ibid.

[9] Andrew Haughwout, Donghoon Lee, Joelle Scally, Wilbert van der Klaauw. “Inequality in U.S. Homeownership Rates by Race and Ethnicity.” Federal Reserve Bank of New York. July 8, 2020.

https://libertystreeteconomics.newyorkfed.org/2020/07/inequality–in–us–homeownership–rates–by–race–and–ethnicity/.

[10] Treh Manhertz. “Home Value Disparities Between Races Are Shrinking, but Remain Very Wide.” Zillow Research. December 19, 2020. https://www.zillow.com/research/home–values–by–race–2020–28478/. 23 Michela Zonta. “Racial Disparities in Home Appreciation.” Center for American Progress. July 15, 2019. https://www.americanprogress.org/article/racial–disparities–home–appreciation/.

###

Take a few seconds and sign up for our industry leading emailed news updates, further below or linked here. Input your email, press enter and confirm in your inbox. Done!

Again, our thanks to you, our sources, and sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.