Ed Pinto and Tobias Peter with the American Enterprise Institute (AEI) Housing Center were by asked by MHProNews for their expert insights on concerns over a ‘housing bubble’ and their organization’s recent data and related U.S. housing market forecast. To tee up the reply below from Peter, Ast. Director of Research with the AEI Housing Center, the backdrop and inquiry provided. MHProNews’ inquiry noted that “some have said there is a [housing] bubble and it will pop. Others say this is different than 2008 and its liar loans, etc. That distinction granted, with some saying we are already in recession, what do you anticipate? Are housing prices in the next 12-24 months likely to dip? Will they continue to soar, in your view?

In an emailed reply to MHProNews in which Peter copied Pinto, AEI provided the following remarks.

In our latest Housing Finance Watch (please see attached), we wrote:

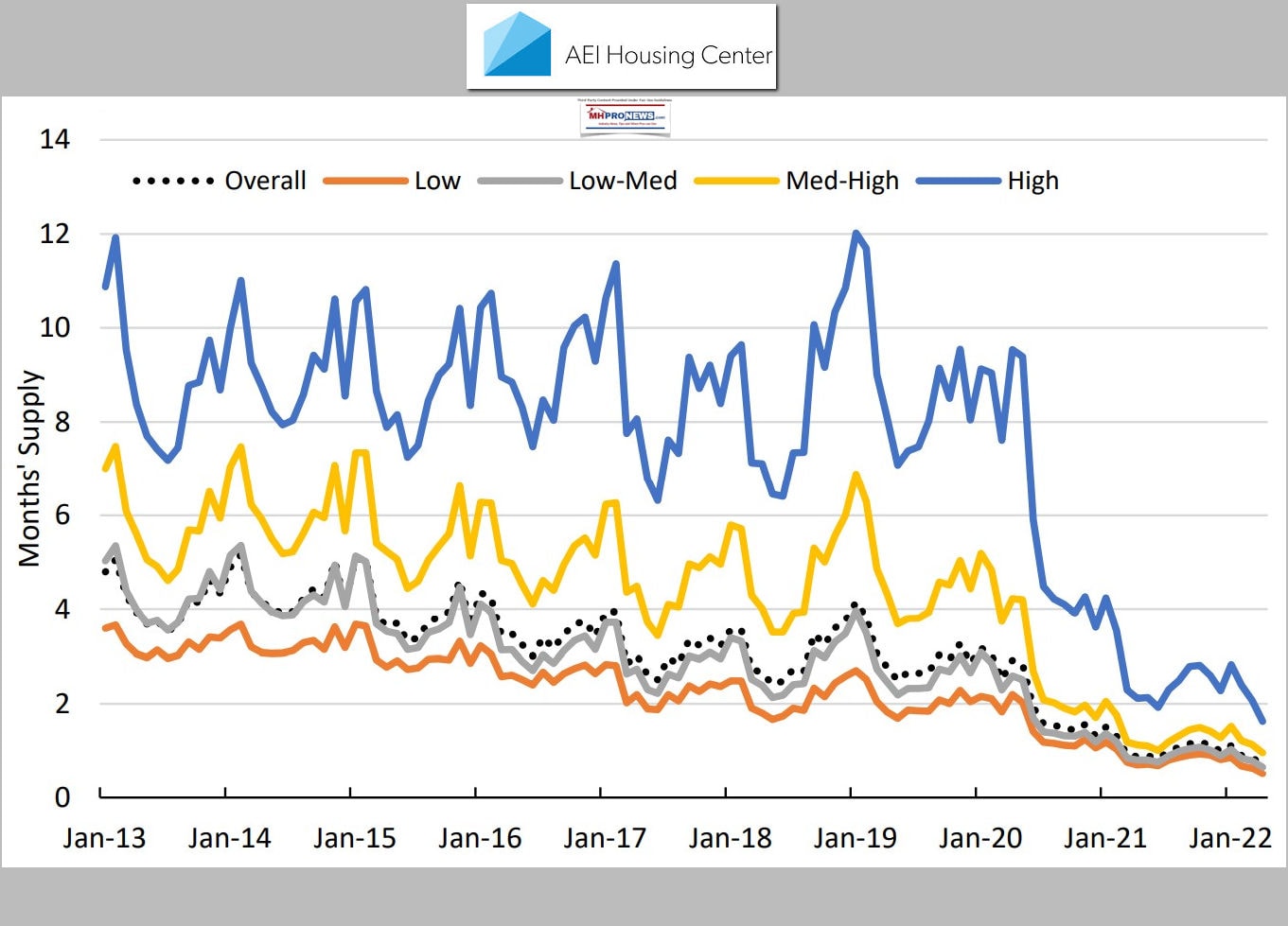

Purchase volume for week 20 is down 16% and 1% over 2021 and 2019, respectively, and home price appreciation (HPA) is projected to moderate in June. However, unless supply increases, we expect y-o-y HPA to remain high until mortgage rates are at 6% or more. At that point, demand should drop, and supply should grow, with the greatest HPA slowdown felt at the high end of expensive markets and low end of some FHA markets.

There are a couple of important differences this time vs last time. These items are also summarized in our latest HMI slide deck (see attached slides 14-20).:

1) Supply is as tight as it ever has been.

2) Inflation adjusted mortgage rates are still negative.

3) Leverage is much lower (see Ed’s quotes in the American Banker below).

4) Rents are also rising (which they did not do last time).

5) With work from home and arbitrage opportunities, higher income people have the choice to move to more affordable areas and bid up prices there.

Excerpt from American Banker:

Still, even with the FHA’s embrace of riskier borrowers and practices, Pinto said, the market is in much sounder shape than it was leading up to 2008. According to AEI’s stress modeling, if the circumstances that led to the episode were to repeat, the default rate today would be between 12% and 13%, compared to 36% at the height of the last crisis.

“That gives us some level of confidence that we’re not we’re not looking at an event that is going to be the magnitude of that last event, a 25% price decline in a few years,” he [Pinto] said. “Even if we had that price decline, the overall stress mortgage default rate would be a third of what it was in ’06, ’07.”

With unemployment near an all-time low and job openings outpacing job seekers, a mere technical recession — two consecutive quarters of shrinking GDP — might not be enough to force the housing market into a correction, Pinto said.

“It’s going to take a fair amount for the unemployment rate to … start having significant impacts on home prices,” he said. “Back in the financial crisis, it went up to 10%, in the early ’80s it went up to 10% and we had some serious price declines. We are very far away from 10% unemployment. It’s not to say it couldn’t happen, but we’re very far away.”

Please let us know if you have any questions.

Best,

Tobias

Tobias Peter

Assistant Director | Housing Center

Research Fellow | American Enterprise Institute ##

The Housing Price Appreciation Data infographic Peter provided to MHProNews can be access by clicking the link below.

Peter and his colleague Pinto have routinely been responsive to our inquiries, and have been again as the above response indicates. He also provided the following download of more current housing market related data. Click the link to open the document.

A prior report by AEI on a related topic is linked below, dated June 30, 2020. The current press on accelerated housing price growth was already well underway at that point in time. When AEI projected accelerating costs then, they proved to be right.

Among the articles for this week in review below is May 2022 data from the National Association of Realtors (NAR) Chief Economist Lawrence Yun. AEI and Yun have similar data points on the slowing of housing sales. Both sets of facts merit examination for housing professionals seeking an objective sense of the direction of the housing market.

Historically, what was bad for mainstream housing for decades was ‘good news’ for manufactured housing in the sense that it routinely drove more new HUD Code manufactured home sales. The tragedy of our era is the lack of a post-production trade group that keeps the industry from tapping into sales that could be several times higher than the current levels, as the facts from AEI and NAR both demonstrate.

Don’t miss today’s postscript.

With no further adieu, lets pivot toward the headlines for the reports, analysis, and commentaries for the week that was from 5.22 to 5.29.2022.

What’s New on MHLivingNews

What’s New from Washington, D.C. from MHARR

What’s New on the Masthead

What’s New on the Daily Business News on MHProNews

Saturday 5.28.2022

Friday 5.27.2022

Thursday 5.26.2022

Wednesday 5.25.2022

Tuesday 5.24.2022

Monday 5.23.2022

Sunday 5.22.2022

What’s the Latest on Words of Wisdom by Tim Connor, CSP

Postscript – Sneak Peaks

MHProNews has several reports percolating that include an exclusive insight from a former Trump White House insider, insider, facts, figures, and analysis on one of the Big 3 in manufactured housing, the rising heat on the Manufactured Housing Institute for what critics are saying are years of posturing, photo, and video ops without measurable performance, and more.

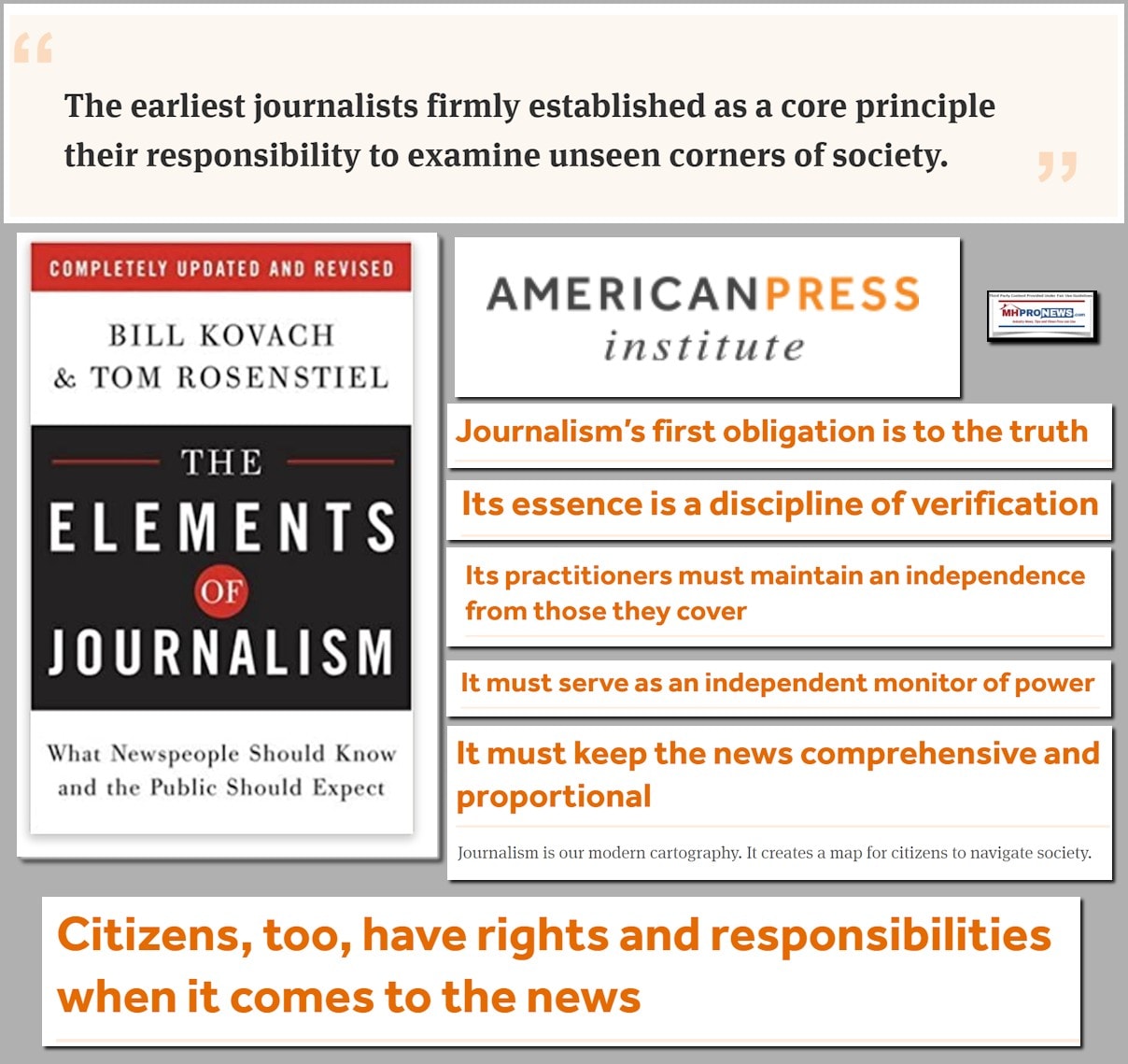

No one else in MHVille provides the level of factual information, evidence – not mere opinion – to support concerns, and analysis that is expert which takes into consideration years of related insights. These are the reasons why readers like you come by the thousands daily, why there are more pages per visit here, and measurably higher engagement than any other known publisher or blogger in MHVille. Competitors may make some uppity sounding claim, but when directly challenged to put their data where their fancy lingo is, none have been willing to compare. Perhaps more important is that while the other trade publishers and bloggers routinely kiss up to the powers that be in MHVille, only MHProNews and our MHLivingNews sister site are willing to hold organizations, public officials, and corporations to account for their behavior by reporting the evidence. “We Provide, You Decide”©, “Industry News, Tips, and Views Pros Can Use,” © and “Intelligence for your MHLife” © are more than just slogans or nice sounding taglines. They are the reality that readers like you have come to count on here. Our thanks to our sponsors and sources/tipsters that make this ongoing effort possible. ##

Again, our thanks to you, our sources, and sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.