Representative Cindy Axne’s office has provided MHProNews with the following media release on the hot-button topic of manufactured home communities (MHCs) and resident rights. It will be followed by additional information, MHProNews analysis in brief, and our Daily Business News on MHProNews market recaps.

In the release and letter below, the yellow highlighting is added by MHProNews. The text of their statements are otherwise unchanged.

Axne, Hickenlooper Lead Letter to Protect Manufactured Housing Community Residents

August 4, 2022

Letter to the Federal Housing Finance Agency Calls for Stronger Protections In Federally Backed Purchases

Today, Rep. Cindy Axne (IA-03) and Sen John Hickenlooper (D-CO) led 17 Members of Congress in writing to Federal Housing Finance Agency (FHFA) Director Sandra Thompson urging strong protections for residents at manufactured housing communities (MHCs) such as mobile home parks purchased with federal backing.

The letter calls for the FHFA to take several steps to better protect residents living in MHCs backed by Fannie Mae and Freddie Mac, which the FHFA oversees. Those include requiring public disclosure of MHCs covered by existing tenant site lease protections (TSLPs), long-term leases to protect against rent increases, giving residents an opportunity to purchase the MHC they live in, and eviction protections.

“ Across the country, outside investors are purchasing MHCs using GSE financing, and proceeding to significantly increase rents, add fees, or push residents out to replace existing units with new higher-cost homes,” the Members wrote. “We ask that you better support MHC residents, and ensure the Enterprises are not simply financing investment firms’ efforts to buy properties and extract maximum profit from those who have less.”

Fannie Mae and Freddie Mac are required to serve underserved markets, including manufactured housing, and submit regular plans to do so, which are subject to FHFA approval. They must then work towards those goals to receive credit toward their Duty to Serve obligations.

“ FHFA should work to protect our constituents by requiring that residents have the opportunity to buy their MHC for any property that receives Duty to Serve credit. Resident ownership and control over the land under their homes will give them long term security and ensure any rent increases go towards benefits they want,” they continued. “ DTS credit should also be reserved for loans which actually protect residents from eviction and major cost increases. We urge you to strengthen existing protections like TSLPs, to better protect residents from eviction and major price increases. These protections should include efforts to ensure long term affordability for tenants, and protect MHC residents from predatory landlords.”

The letter is signed by Reps. Earl Blumenauer (OR-03), Suzanne Bonamici (OR-01), Madeleine Dean (PA-04), Raúl Grijalva (AZ-03), Daniel T. Kildee (MI-05), Jimmy Panetta (CA-20), and Jennifer Wexton (VA-10) and Sens. Michael Bennet (D-CO), Richard Blumenthal (D-CT), Timothy Kaine (D-VA), Amy Klobuchar (D-MN), Bernie Sanders (I-VT), Tina Smith (D-MN), Ron Wyden (D-OR), and Sherrod Brown (D-OH, Chairman of the Senate Banking, Housing, and Urban Affairs Committee).

Background

The FHFA regulates Fannie Mae and Freddie Mac, which have played a significant role in recent years in financing the purchase of MHCs, often by outside investors who proceed to raise rents and add fees.

Fannie Mae and Freddie Mac have offered a set of Tenant Site Lease Protections, first outlined by the FHFA in 2016, but these do not protect residents from rent increases or eviction, and have not slowed the trend of extreme rent increases by new MHC buyers who are using federally backed financing.

Last year, Rep. Axne introduced the Manufactured Housing Tenant’s Bill of Rights to establish minimum standards to protect residents living in manufactured housing communities, in response to rent spikes at several Iowa MHCs that were purchased by outside investors.

She also secured passage of the Manufactured Housing Community Preservation Act, legislation to create a new grant program to help nonprofits, resident-owned cooperatives and other local entities purchase and maintain an MHC through awards of up to $2 million out of the House Financial Services Committee.

Support

The letter is supported by MH Action, National Neighborworks Association, and ROC USA.

“Residents in manufactured home communities, as well as affordable housing providers, will significantly benefit from the proposals outlined in Representative Axne and Senator Hickenlooper’s letter to FHFA,” said Lou Tisler, Executive Director of the National NeighborWorks Association. “Many organizations within the NeighborWorks America network are proficient in manufactured housing and are eager to see these recommendations implemented to protect families living in manufactured housing.”

“The GSEs have provided inexpensive financing to deep-pocketed firms that purchase manufactured home communities whose sole interest is generating lucrative returns for investors,” said Paul Bradley, President of ROC USA. “But homeowners, whose duty it is for the GSEs to better serve, are unable to tap that same financing when they’re given the chance to buy their communities or make critical health and safety improvements. We appreciate Congressional leaders’ interest in this often-overlooked affordable housing stock and the current threats homeowners there face.”

The text of the letter is available here and below:

Dear Director Thompson,

As you know, when Congress originally chartered Fannie Mae and Freddie Mac (the Enterprises or GSEs) they designed them to facilitate access to housing by providing increased liquidity to the secondary mortgage market. Manufactured housing communities are one of the last bastions of naturally-occurring affordable housing[1], but the GSEs are failing them. As we all work to ensure every American has a safe and affordable roof over their head, we urge the Federal Housing Finance Agency (FHFA) to improve protections for residents in manufactured housing communities (MHCs) financed by the Enterprises.

Across the country, outside investors are purchasing MHCs using GSE financing, and proceeding to significantly increase rents, add fees, or push residents out to replace existing units with new higher-cost homes.[2] This is happening to Americans up and down the income ladder. [3][4] Since manufactured housing residents tend to be older and have lower incomes, these are often the people who are least able to afford these increases. Those that own their home, but rent the land underneath, often cannot afford the $10-15,000 it costs to relocate.[5]

Not only are some investors benefiting from federal backing while taking advantage of our constituents, these purchases are actually getting credit towards obligations that Fannie Mae and Freddie Mac have to serve underserved communities.[6] We ask that you better support MHC residents, and ensure the Enterprises are not simply financing investment firms’ efforts to buy properties and extract maximum profit from those who have less.

Current Protections

As you know, both Fannie and Freddie offer a financial incentive for MHC purchasers willing to offer a set of Tenant Site Lease Protections (TSLPs). We appreciate recent steps taken by both Enterprises to require that all MHC loans they purchase finance MHCs that will be covered by these TSLPs. Those loan purchases currently count for credit towards the Enterprises’ Duty to Serve (DTS) obligations, as do loans to resident-, government-, or nonprofit-owned MHCs. While the TSLP program has made progress in some ways, we feel the FHFA and the GSEs, both through this program and DTS obligations generally, could do far more to protect people living in MHCs.

The FHFA defined the current set of minimum pad lease protections in the 2016 Duty to Serve Rule.[7] These have since been implemented by both Fannie and Freddie, with loan purchases of MHCs protected by the TSLPs beginning in 2019, and more than 20,000 pad leases now covered. While we’re encouraged that more residents currently have some basic level of protections, we believe the existing TSLP offerings are just that – basic – and that the Enterprises should do a better job of protecting the residents in covered MHCs.

Public disclosure of MHCs backed by the Enterprises

First, we are concerned by a lack of public information about which MHCs are covered. This can leave some residents unsure if they are covered or not, a problem that is exacerbated by MHCs where TSLPs only cover some of the tenants. We appreciate the recent changes made at both Enterprises to ensure that all residents in newly purchased parks covered by TSLPs will have those protections, but prior purchases of MHC loans that received TSLP financing benefits did not require that all residents had these protections. Prior TSLPs from Freddie did not clearly include residents who rented both the pad and home in those parks, and, prior to 2022, Fannie Mae only required some of the homes in an MHC to be covered by the TSLPs in order for the owner to receive a pricing benefit for the entire community. In addition to creating confusion and doing less to protect residents in MHCs backed by the Enterprises, disparate treatment for neighbors within a community makes oversight of the program by either Congress or the FHFA far more difficult.

Requiring a full public list of the covered MHCs, including the date at which those TSLPs went into effect and the units covered, would greatly improve our ability to assess the effectiveness of the TSLPs in protecting renters. Service to the manufactured housing market could also be enhanced by earlier disclosure when a community is being purchased by an owner using GSE financing. This will have three primary impacts. First, it can improve resident awareness of a change in ownership of the park, where all too often they first find out when they’re notified of a rent increase.[8] Second, it could increase the chances for a resident-owned group or nonprofit to work to purchase the park. And finally, it will increase public information about what can be an opaque market.

We have heard disturbing reports of MHC owners in parks that should be covered by the TSLPs that have not offered lease renewals or may have otherwise violated the TSLPs. However, it can be difficult for the public or a member of Congress to easily ascertain whether a given MHC or tenant is covered by the protections. This hurts our ability to protect our constituents or evaluate whether more needs to be done to ensure compliance with the existing TSLPs. Further, the current penalties for violating the TSLPs may not be sufficient to incentivize the park owner to comply, and we would urge you to evaluate those penalties in that light.

Improvements to the existing tenant protections

Second, while the current TSLPs provide some basic rights, we believe these protections could do more to protect tenants. For example, the current TSLPs do not include protection from eviction. Eviction has long lasting impacts on renters because the cost of moving their home may be prohibitively high. In addition, a 60-day notice of the closure of a park can significantly impact the many residents that have put tens or hundreds of thousands of dollars into their homes. Further, and perhaps most importantly, there are no protections from increases in rent or fees, which can have the effect of pricing tenants out of an MHC.

Investors buying MHCs have raised rents and added fees in order to maximize profit from a captive audience. Those increases can be extreme; in Iowa we have seen the total cost at one park financed by Fannie Mae increase by 60% in just two years.[9] These types of extreme increases can mean a resident may be forced to sell their home, or lose it entirely (often allowing the MHC owner to sell that home, or sell a newer replacement home). In addition, in the event the tenant is able to sell the home, they will often get less for it, as the new buyer knows their ongoing costs of renting the pad site will be higher. That leaves these communities in a difficult situation where a rent increase actually decreases the value of homes in the MHC – which can have the effect of transferring value from the homeowner to the park owner.

Longer-term leases for pad rentals could also help protect residents from predatory increases in cost,and serve an additional benefit. Multi-year leases will give more certainty for homeowners, which will in turn make it easier for the Enterprises and others to support more traditional mortgages for people buying manufactured homes, a long-term goal to provide better protections and lower costs for homebuyers that is consistent with Fannie Mae’s most recent Duty to Serve plan.[10]

Right of First Refusal

Finally, FHFA should work to protect our constituents by requiring that residents have the opportunity to buy their MHC for any property that receives Duty to Serve credit. Resident ownership and control over the land under their homes will give them long term security and ensure any rent increases go towards benefits they want. For example, a MHC in Durango, Colorado was recently bought by its residents, who were able to avoid a projected $350 rent increase from the corporate offer in favor of one for less than $100.[11] Other groups of resident ownership could be supported in one of two ways – first, requiring evidence that the residents were offered the chance to purchase the property for any MHC that would receive DTS credit, or, second, including this protection going forward in the loan agreement for any property covered by the TSLPs (and thus receiving DTS credit).

Properly aligning Duty to Serve credit with the protections for residents

We also ask that you work to focus more of the Enterprises’ support for MHCs on those properties that do protect tenants, and to align the level of DTS credit with the level of protections for the residents. For example, additional credit for sales to resident groups could encourage the Enterprises to do more to support those purchases. DTS credit should also be reserved for loans which actually protect residents from eviction and major cost increases.

We urge you to strengthen existing protections like TSLPs, to better protect residents from eviction and major price increases. These protections should include efforts to ensure long term affordability for tenants,and protect MHC residents from predatory landlords. Some additional possible protections can also be found in legislation like the Manufactured Housing Tenants’ Bill of Rights.[12] Over the long run, FHFA should be working to ensure that all homeowners, regardless of the type of home they purchase or where they site it, have the protections and stability that homeowners with site-built homes enjoy today.

We thank you for your work to ensure all Americans will be stably housed and for your attention to the steps FHFA and the GSEs can take to better protect the people living in manufactured housing communities. We hope to work with you further to ensure the Enterprises are fulfilling their intended purpose, and that MHCs they finance are benefiting the residents.

###

[1] https://www.manufacturedhousing.org/wp-content/uploads/2017/10/Understanding-Manuactured-Housing.pdf

[2] https://www.nytimes.com/2022/03/27/us/mobile-home-park-ownership-costs.html

[3] https://www.washingtonpost.com/business/2022/06/06/mobile-manufactured-home-rents-rising/

[4] https://www.newyorker.com/magazine/2021/03/15/what-happens-when-investment-firms-acquire-trailer-parks

[5] https://www.npr.org/2021/12/18/1034784494/how-the-government-helps-investors-buy-mobile-home-parks-raise-rent-and-evict-pe

[6] https://docs.house.gov/meetings/AP/AP20/20220526/114841/HHRG-117-AP20-Wstate-McCarthyG-20220526.pdf

[7]https://www.fhfa.gov/SupervisionRegulation/Rules/RuleDocuments/2016%20Duty%20to%20Serve%20Final%20Rule_For%20Web.pdf

[8] https://www.desmoinesregister.com/story/news/local/waukee/2019/03/27/waukee-midwest-country-estates-mobile-home-park-havenpark-capital-utah-rent-increase-rates-iowa/3267410002/

[9] https://www.desmoinesregister.com/story/news/local/waukee/2019/03/27/waukee-midwest-country-estates-mobile-home-park-havenpark-capital-utah-rent-increase-rates-iowa/3267410002/

[10] https://www.fhfa.gov/PolicyProgramsResearch/Programs/Documents/FannieMae2022-24DTSPlan-April2022.pdf

[11] https://www.durangoherald.com/articles/renters-become-owners-of-durango-mobile-home-park/

[12] https://www.congress.gov/bill/117th-congress/house-bill/3333/text?r=12&s=2#idF7247B5F531841EFA2BB5733C36B57EB

Additional Information with more MHProNews Analysis and Commentary in Brief

A few facts and links to prior and related reports with analysis are useful in setting the context for the above.

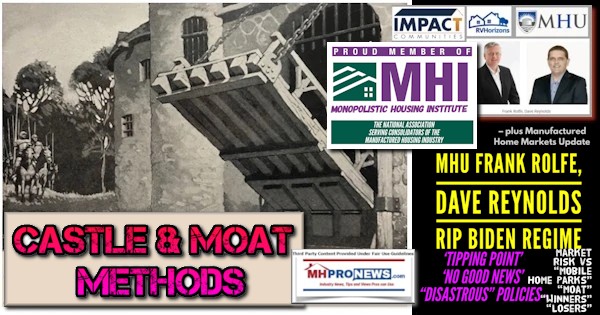

- The Manufactured Housing Institute (MHI) stands in opposition to much of this regulatory and legislative maneuvering that the lawmakers and organization above have announced on behalf of manufactured home community residents.

- As factual evidence for the bullet above, the following was emailed by MHI to the ‘Federated States’ (MHI state affiliates) and some of their members on August 8.2022.

Members of Congress Call for More Requirements for Community Loans by Fannie Mae and Freddie Mac

Senator John Hickenlooper (CO) and Representative Cindy Axne (IA-03) sent a letter, along with 15 of their House and Senate Democratic colleagues, calling for FHFA Director Thompson to increase tenant protection requirements and transparency about those owners and operators receiving financing from Fannie Mae and Freddie Mac. The letter was supported by MH Action, National Neighborworks Association and ROC USA. The current Fannie Mae and Freddie Mac tenant lease requirements have been in place since last Fall and no evidence has been cited demonstrating that these protections have not worked since they were put into place. In the letter MHI sent to the Hill in opposition to the recommendations made by Senator Hickenlooper and Representative Axne, MHI cautioned lawmakers that adding more restrictions will only hurt the very homeowners they seek to protect. Rather, federal policies should encourage capital investment into land-lease communities to increase the supply of quality affordable homeownership options, to preserve these communities and protect them from closure. Click here to read MHI’s letter and here to read MHI’s communities research. Click here to read the Sen. Hickenlooper/ Rep. Axne letter. ##

Note the MHI letter linked above in the last sentence was posted on the MHProNews website server to preserve the document, but the letter is the same as MHI provided. That noted, the second and third links above are unchanged. Note that MHI hides behind their member login their ‘communities research.’ What does that mean in practice? Unlike other national trade associations that are attempting to Protect Educate or Promote (P.E.P.), MHI’s ‘research’ is unavailable to the vast majority of the public. Meaning, their ’response’ to the allegations is hidden. It is either ‘association malpractice,’ as a Manufactured Housing Executives Committee (MHEC) member told MHProNews, or mere posturing for effect to make MHI look good when they are in fact failing at their PEP job.

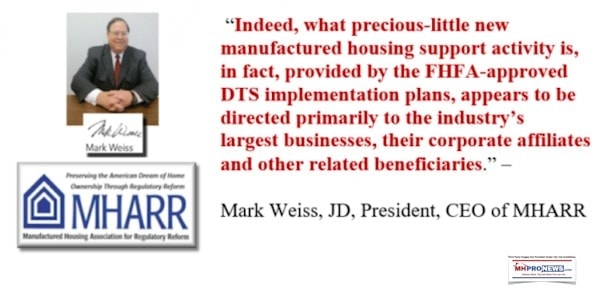

While MHI has helped protect DTS (Duty to Serve) credits for the GSEs on manufactured home community lending by firms charged with predatory behavior that are often MHI member firms, MHI has also secured DTS credits for their “CrossModTM homes” initiative that is backed by Clayton Homes. Oddly, MHI claims to be working to ‘get’ FHFA and the GSEs to provide chattel lending (personal property, home only loans) support for all manufactured homes that are not CrossMods. Why are they unable to do what benefits the majority of consumers and all producers? That leads to the insights from periodic MHI critics, like those cited below.

MHProNews has been saying for over 2 years, business as usual is dead or dying. That’s true in manufactured housing, but also with respect to the pressures being placed on smaller firms in general throughout the U.S. economy.

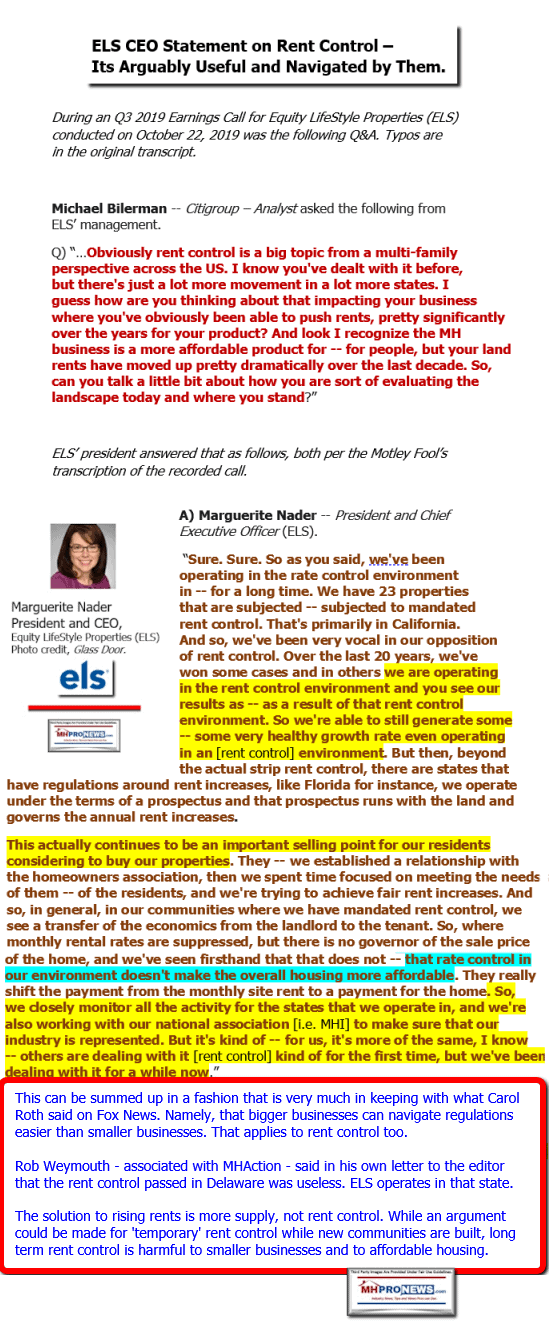

As if to prove the general or specific points raised by Carol Roth et al above, consider what prominent MHI member Equity LifeStyle Properties (ELS) President and CEO, Margerite Nader said during one of that firm’s quarterly earnings calls.

When asked to comment on such evidence and issues, MHI and their apologists routinely decline, duck, dodge, evade, or distract from the concerns raised.

Meanwhile, numbers of MHI and/or their state affiliate members are stirring up problems through aggressive behavior which makes smaller ‘white hat’ firms look bad by mere association with the industry. It is a vicious cycle that honest public officials and plaintiffs’ attorneys should probe and act upon.

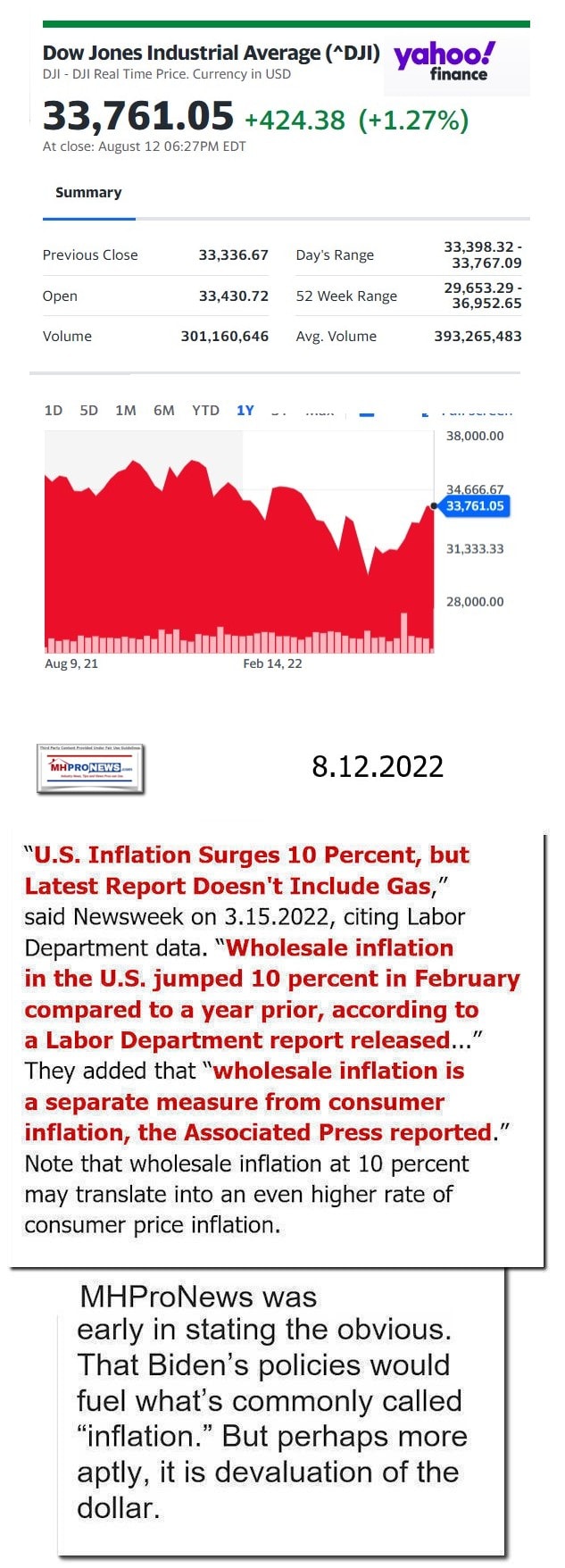

Next up is our daily business news recap of yesterday evening’s market report, related left-right headlines, and manufactured housing connected equities.

The Business Daily Manufactured Home Industry Connected Stock Market Updates. Plus, Market Moving Left leaning CNN and Right-leaning (Newsmax) Headlines Snapshot. While the layout of this daily business report has been evolving over time, several elements of the basic concepts used previously are still the same. For instance. The headlines that follow below can be reviewed at a glance to save time while providing insights across the left-right media divide. Additionally, those headlines often provide clues as to possible ‘market-moving’ news items.

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Headlines from left-of-center CNN Business – from the evening of 8.12.2022

- Uphill climb

- A woman walks in front of a Peloton store in Manhattan on May 05, 2021 in New York. Peloton company has recalled both of its treadmill models after the death of a 6-year-old child and been received 72 reports of adults, children, pets injured, the company and the US Consumer Product Safety Commission announced.

- Peloton is cutting jobs, closing stores and hiking prices as it makes changes under its new CEO

- Judge denies Trump Org and former CFO’s motion to dismiss tax fraud indictment

- The Rhine river is drying up, making it hard for cargo ships to travel

- South Korea pardons Samsung’s Jay Y Lee in bid to revive the economy

- Consumers still don’t feel great about the economy, despite lower gas prices

- Inflation cools, new electric car tax credits explained, and Elon Musk’s promises

- Walgreens is paying signing bonuses up to $75,000 to pharmacists

- Johnson & Johnson is abandoning its talc-based baby powder

- The streaming wars are over

- This tried-and-true investing strategy isn’t working

- Analysis: We thought Murdoch’s news outlets were abandoning Trump. Then the FBI searched Mar-a-Lago

- Italians react to Domino’s leaving the country

- A Rivian electric pickup truck sits in a parking lot at a Rivian service center on May 09, 2022 in South San Francisco, California. Shares of Rivian stock fell 13 percent after Ford, which currently owns as 11.4 percent stake in the electric car maker, is planning to sell 8 million of its 102 million shares.

- Rivian lost $1.7 billion in three months. Here’s why that may not be a problem

- A customer shops in a Kroger grocery store on July 15, 2022 in Houston, Texas. U.S. retail sales rose 1.0% in June according to the Commerce Department, with consumers spending more across a range of goods including gasoline, groceries, and furniture.

- Everyone is confused about the economy. Here’s what analysts have to say

- A young salesman weighs buns in a store on August 10, 2022, Argentina, Buenos Aires.

- Argentina hikes interest rates to 69.5% as inflation hits 20-year high

- Uphill climb

- Peloton is cutting jobs, closing stores and hiking prices as it makes changes under its new CEO

- Judge denies Trump Org and former CFO’s motion to dismiss tax fraud indictment

- The Rhine river is drying up, making it hard for cargo ships to travel

- South Korea pardons Samsung’s Jay Y Lee in bid to revive the economy

- Consumers still don’t feel great about the economy, despite lower gas prices

- Inflation cools, new electric car tax credits explained, and Elon Musk’s promises

- Walgreens is paying signing bonuses up to $75,000 to pharmacists

- Johnson & Johnson is abandoning its talc-based baby powder

- The streaming wars are over

- This tried-and-true investing strategy isn’t working

- Analysis: We thought Murdoch’s news outlets were abandoning Trump. Then the FBI searched Mar-a-Lago

- Italians react to Domino’s leaving the country

- Content by The AscentIt’s official: now avoid credit card interest into 2024

- Rivian lost $1.7 billion in three months. Here’s why that may not be a problem

- Everyone is confused about the economy. Here’s what analysts have to say

- Argentina hikes interest rates to 69.5% as inflation hits 20-year high

Headlines from right-of-center Newsmax 8.12.2022

- FBI Seized ‘Top Secret’ Docs From Trump Home: Unsealed Court Papers

- The receipt for property that was seized during the execution of a search warrant by the FBI at former President Donald Trump’s Mar-a-Lago estate in Palm Beach, Fla., is photographed Friday. (AP)

- In a statement earlier Friday, Trump claimed that the documents seized by agents were “all declassified,” and argued that he would have turned over the documents to the Justice Department if asked. [Full Story]

- Raid on Trump’s Mar-a-Lago

- US Archive Disputes Trump Claim That Obama Kept Classified Docs

- Trump: FBI Playing Politics With Raid, Didn’t Need to ‘Seize’ Anything

- Report: FBI Removed Top Secret Docs From Trump’s Home

- Trump Had Declassified Mar-a-Lago Documents: Allies

- Trump Calls ‘Hoax’ on Nuclear Documents Report,

- WashPost: FBI Searched Trump’s Home for Nuke Documents

- Mar-a-Lago Raid Judge Donated to Obama, Recused From Trump Lawsuit platinum

- Ex-CIA Chief Hayden Appears to Promote Execution for Leaking Nuclear Secrets

- Trump Lawyer: Garland’s Depiction of Raid Inaccurate

- Graham: US ‘In Trouble’ After Trump Raid | video

- Newsmax TV

- Candidate Tshibaka: Alaskans ‘Very Concerned’ Over NORAD Report | video

- Burgess: Solve Inflation by Restoring Energy | video

- Candidate Kent: Impeach Merrick Garland | video

- Meuser: Inflation Bill ‘Throws Fuel to Fire’ | video

- John Bolton: Glad for Incompetent Iranian Plot

- John Bolton: Weakness on Iran Endangering US Lives | video

- Antonio Sabato Jr.: If FBI Can Raid Trump, ‘It Can Happen to Anybody’ | video

- Cloud: We Base Economics on Personal Experience | video

- Tenney: Biden’s ‘Zero Inflation’ Claim ‘Ridiculous’ | video

- Newsfront

- Trump Blasts Inflation Reduction Act, Urges Dems to Vote Against It

- Former President Donald Trump on Friday released a statement slamming the Inflation Reduction Act and calling for Democrats to vote against it…. [Full Story]

- Trump Doesn’t Object as Raid Warrant Is Unsealed

- A federal judge opted Friday to grant the Department of Justice’s [Full Story]

- S&P 500, Nasdaq Mark 4th Straight Week of Gains

- Wall Street closed higher on Friday as signs that inflation may have [Full Story]

- Russian ex-president Dmitry Medvedev issued a veiled threat on Friday [Full Story]

- Related

- Navrozov: Revolt of Moscow’s Satraps

- UN Watchdog Warns of ‘grave’ Crisis amid Violence near Ukraine Nuclear Plant

- Strikes at Ukraine Nuclear Plant Prompt UN Call for Demilitarized Zone

- Zelenskyy Tells Officials to Stop Talking About Ukraine’s Tactics

- NORAD: Russian Aircraft Entered Alaska Defense Zone

- Satellite Pictures Show Devastation at Russian Air Base in Crimea

- Arizona to Construct Border Wall Without White House

- Arizona officials revealed on Friday that the state has begun [Full Story]

- Chinese Exercises Wearing Down Taiwan’s Defenses

- Incursions by Chinese fighters and bombers into Taiwan’s aerial [Full Story] | Platinum Article

- Trump: FBI Playing Politics With Raid, Didn’t Need to ‘Seize’ Anything

- The FBI was “playing politics” when it raided Donald Trump’s [Full Story]

- Mar-a-Lago Raid Judge Donated to Obama, Recused From Trump Lawsuit

- S. Magistrate Judge Bruce Reinhart purportedly greenlighted the [Full Story] | Platinum Article

- Abbott Defends ‘Busing Mission’

- Texas Gov. Greg Abbott hit back at New York City Mayor Eric Adams [Full Story]

- Liberal COVID Policies Shortchanging Landlords

- California’s decision to offer tenants “rent relief” in the form of [Full Story] | Platinum Article

- National Archives Rebuts Trump Claim That Obama Kept Classified Docs

- The National Archives on Friday issued a strong rebuttal to former [Full Story]

- Wanda Sykes to Host Amazon’s Doorbell Video TV Show

- Wanda Sykes to Host Amazon’s Doorbell Video TV Show

- Two Amazon-owned companies – Ring and Hollywood studio MGM – are [Full Story]

- 1952 Mickey Mantle Card Breaks Record on Auction Market

- Mickey Mantle’s first baseball card has already shattered purchasing [Full Story]

- ‘Satanic Verses’ Author Salman Rushdie Attacked at Event in Western New York

- Salman Rushdie, the author whose writing led to death threats from [Full Story]

- Report: Sesame Place ‘Cancels’ Rosita After Black Girls Snubbed

- Sesame Place in Pennsylvania removed most traces of its bilingual [Full Story]

- Report: FBI Removed Top Secret Documents From Trump’s Home

- FBI agents who searched former President Donald Trump’s Mar-a-Lago [Full Story]

- Manafort Book Details ‘Conspiracy That Never Existed’

- Former Trump campaign adviser Paul Manafort says in a new book that [Full Story]

- DeSantis’ Press Secretary Steps Down for New Role in Reelection Campaign

- Florida GOP Gov. Ron DeSantis’ press secretary, Christina Pushaw, [Full Story]

- Teacher Resigns, Claims Posters of Black Leaders Removed

- A Florida teacher quit after he claimed a school district employee [Full Story]

- Poll: Dems Ahead in Generic Ballots in 3 Swing States

- Democrats hold a slight edge in state legislature generic ballots in [Full Story]

- NYC Health Officials Say Polio Detected in City’s Sewage

- New York City health officials say the polio virus has been detected [Full Story]

- Trump: Obama Kept Classified Documents

- Former President Donald Trump said former President Barack Obama kept [Full Story]

- Religious School Student Removed Due to Same-Sex Parents

- A Louisiana kindergarten student was turned away from a religious [Full Story]

- Oz Calls Out Fetterman’s Absence, Challenges Him to Five Debates

- Pennsylvania GOP Senate candidate Dr. Mehmet Oz called out Democrat [Full Story]

- Video Report: FIFA Criticized for Supporting Palestinians Against Israel

- Israelis seeking tickets for the FIFA World Cup in Qatar were forced [Full Story] | video

- New York Judge Rules Criminal Case Against Trump Organization, Ex-CFO Can Proceed

- A New York state judge on Friday ruled that a criminal fraud and tax [Full Story]

- Inflation Outlook Brightens as Import Prices Fall, Consumer Sentiment Rises

- S. import prices fell for the first time in seven months in July, [Full Story]

- Ex-CENTCOM Chief Wanted Troops in Afghanistan ‘Indefinitely’

- Frank McKenzie, former commander of U.S. Central Command, told [Full Story]

- Florida Nixes Medicaid Coverage of Gender-Affirming Care

- The Florida Agency for Health Care Administration reworked the [Full Story]

- C. Mayor Bowser Asks Again for National Guard to Help With Migrants

- Washington, D.C., Mayor Muriel Bowser has renewed her request for the [Full Story]

- Indonesia, US Troops Hold Live-Fire Drill as China Tensions Mount

- Thousands of troops from Indonesia, the United States and allies held [Full Story]

- Inflation Reduction Act May Have Little Impact on Inflation

- With inflation raging near its highest level in four decades, Congress is poised to approve President Joe Biden’s signature Inflation Reduction Act. Its title raises a tantalizing question: Will the measure actually tame inflation?… [Full Story]

- Trevor Gerszt: Gold Stays Strong Despite Rate Hikes, Inflation Pullback

- The Inflation Reduction Act’s Impact on Americans, Explained

- Peloton to Slash 800 Jobs, Hike Prices

- Wall St Week Ahead: Soft-Landing Hopes Brighten Outlook on Stocks

- More Finance

- Health

- CDC Drops COVID Quarantine, Screening Guidelines

- The nation’s top public health agency on Thursday relaxed its COVID-19 guidelines, dropping the recommendation that Americans quarantine themselves if they come into close contact with an infected person…. [Full Story]

- Bioengineered Pig Skin Is Turned Into Corneas, Restoring Patients’ Sight

- J&J to End Sales of Baby Powder With Talc

- FDA: Take 3 Home Tests If Exposed to COVID to Boost Accuracy

- Experts: Widespread Polio Outbreak Not Expected in US

MHProNews has pioneered in our profession several reporting elements that keep our regular and attentive readers as arguably the best informed in the manufactured housing industry. Among the items shared after ‘every business day’ (when markets are open) is our left-right headline recap summary. At a glance in two to three minutes, key ‘market moving’ news items are covered from left-of-center CNN Business and right-of-center Newsmax. “We Provide, You Decide.” © Additionally, MHProNews provides expert commentary and analysis on the issues that others can’t or won’t cover that help explain why manufactured housing has been underperforming during the Berkshire era while an affordable housing crisis and hundreds of thousands of homeless in America rages on. These are “Industry News, Tips, and Views Pros Can Use” © features and others made and kept us the runaway #1 in manufactured housing trade publisher for a dozen years and counting.

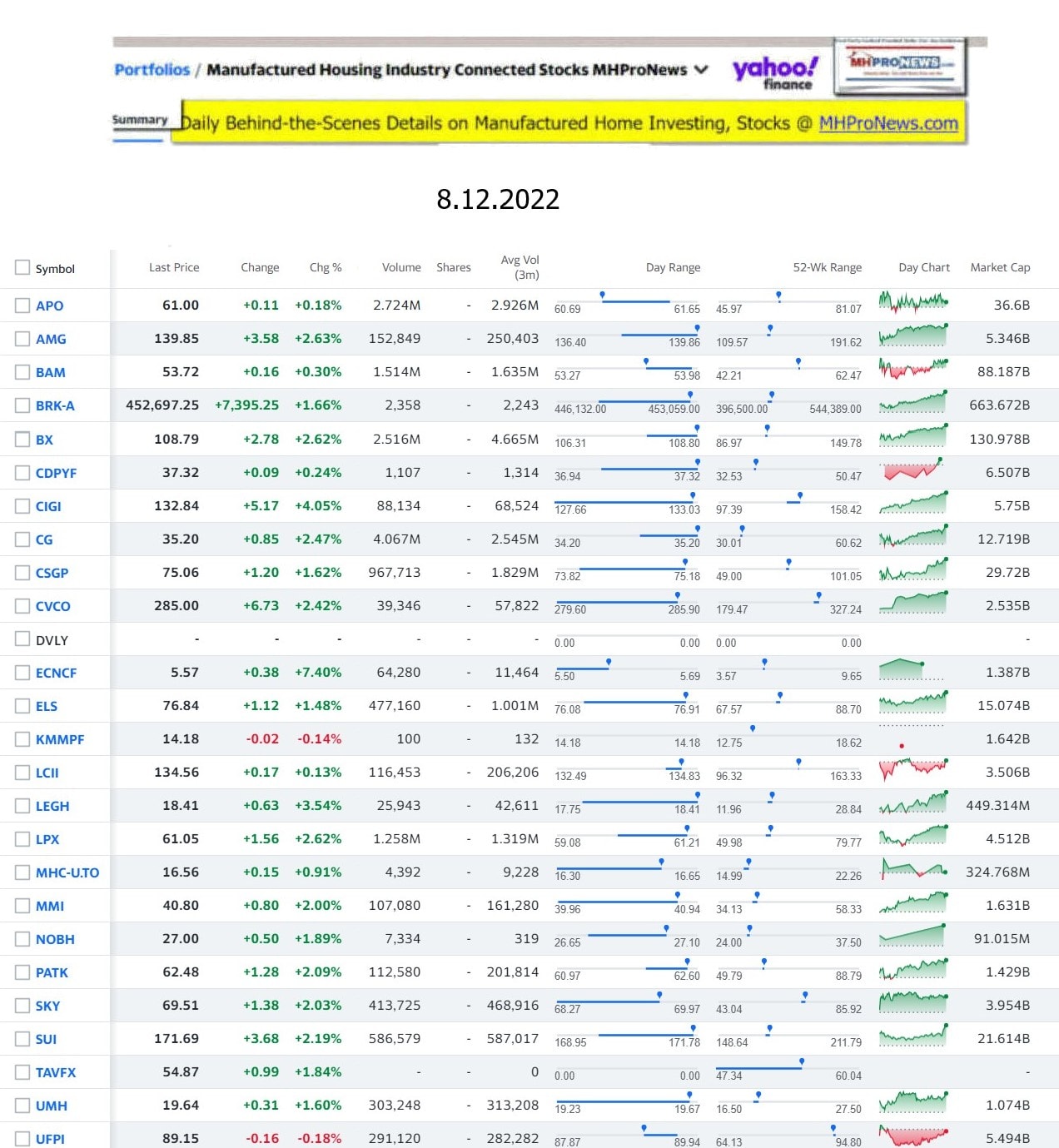

Manufactured Housing Industry Investments Connected Equities Closing Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

-

-

-

-

-

-

-

-

-

-

-

-

-

- 2022 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments. MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing and have completed over a dozen years of serving the industry as the runaway most-read trade media.

- 2022 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

Sample Kudos over the years…

It is now 12+ years and counting…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.