“So there’s enough here for probably a decade of ‘Law & Order’ episodes,” said Jeff Heuer, Sun Communities’ (SUI) CEO Gary Shiffman’s lawyer. The Detroit News report by Francis X. Donnelly said that attorney Heuer expressed that during a January 2023 hearing involving Shiffman, who is described online by Sun as “our Chairman, Chief Executive Officer [CEO] and President, and has been a director and an executive officer since our inception in 1993.” Shiffman’s attorney Heuer was described as “shaking his head during” that hearing. Donnelly’s narrative for The Detroit News describes a “high roller” named Brian Benderoff and Dr. William “Billy” Gonte. Benderoff and Gonte found themselves on the receiving end of a federal indictment. Donnelly’s Detroit News article stated that “Benderoff said he and Gonte had been involved in an insurance scam” that included Shiffman. Allegations involving Shiffman are mentioned in a federal case as well as in an Oakland County Circuit Court lawsuit “scheduled to go to trial on June 12.” The various legal actions had generated thousands of pages which The Detroit News said they had reviewed in crafting their report, which follows below. Nevertheless, approaching two weeks after Donnelly’s report, a check of the generally pro-Manufactured Housing Institute (MHI) bloggers and trade media revealed that none of those ‘news’ sources mentions the case. Sun Communities is an MHI National Communities Council (NCC) member which happens to be represented on the MHI board of directors. It will be interesting to see if MHI will mention Sun’s Shiffman connected report by The Detroit News in their headline round up of manufactured housing industry related headline news to their members.

In this evidence packed article are the following elements.

- Part I of this article will be a flashback to 2016, with a report on the local Detroit Patch article that doesn’t mention Shiffman by name, but alludes to an “unnamed” person and two “associates” of Benderoff and Gonte involved in a federal legal controversy. There are similarities and differences between the facts mentioned in the Patch and what’s cited in The Detroit News.

- Part II of this article will feature the roughly 2376-word text of The Detroit News article by Donnelly involving Gary A. Shiffman. Shiffman is mentioned by name dozens of times in that report. So too are actors Ben Affleck, Kevin Costner, and basketball player Kevin Durant. Note that MHProNews reached out to Shiffman for comment on Tuesday, May 30. As of 6.1.2023 at 2:20 AM ET, no apparent reply has been received from Shiffman or an attorney acting on his behalf.

- Part III will be additional information which includes court filings and pages of various documents, plus MHProNews analysis and commentary in brief.

- Part IV is our Daily Business News on MHProNews manufactured housing connected stocks, REITs and equities market recap.

Note that third party content is provided under fair use guidelines for media. The highlighting below in Part I and II are added by MHProNews. Photos and images in the following are omitted from their local Patch and The Detroit Times.

Part I – Posted Fri, Dec 30, 2016 at 9:03 am ET on the Detroit’s “Patch.com”

Politics & Government

Feds Seize $2.5M from Metro Detroit Gambler

Brian Benderoff represented himself as a high roller, the federal government alleges in a civil forfeiture lawsuit in U.S. District Court.

Beth Dalbey, Patch Staff

DETROIT, MI — Brian Benderoff, a professional gambler from Southfield who racked up six-figure gambling debts, was part of a scheme with two others to scam investors out of hundreds to thousands of dollars to finance gambling trips to Las Vegas, the federal government alleges in a civil forfeiture court case unfolding in U.S. District Court in Detroit. Brian Benderoff, 50, of Southfield, doesn’t face criminal charges

The scheme worked until Benderoff, 50, and his associates arrived at the Detroit Metro Airport in June with a suitcase full of money — about $2.5 million, about $1.6 million of it in cash, according to court documents in the suit filed Dec. 23. The feds say the money was illegally obtained.

Federal authorities were alerted after Transportation Security Administration agents at McCarren Airport in Las Vegas spotted a large amount of cash in the carry-on luggage of one of Benderoff’s associates as they about to board a flight bound for Detroit. Two federal agents were waiting at the arrival gate when the flight arrived, then escorted them to the luggage carousel, where six bags belonging to Benderoff and his associates were searched, according to court documents.

Inside the luggage, agents found $886,372 in cash in Benderoff’s luggage; a cashier’s check for $850,000 drawn from Benderoff’s account at Caesars Palace Casino in Las Vegas; a $150,000 cashier’s check in Benderoff’s luggage; and $699,00 in cash in the unnamed associate’s luggage.

“Benderoff told agents that a majority of these funds were the ‘cashed out’ proceeds of recent gambling activity in Las Vegas,” according to the court filing.

Benderoff told the agents that he was a professional gambler and that he and two associates had been in Las Vegas for several weeks, according to the filing.

The associates cooperated with the feds and said the money was from unwitting investors for bogus business deals, but instead it was used for gambling, according to the filing.

One of Benderoff’s attorneys, Gerald (Gerry) Gleeson, told the Detroit Free Press, said the legal team is “looking forward to sorting it out in the next couple of months,” but declined additional comment. Another top-shelf attorney, Thomas Cranmer, is also part of Benderoff’s legal team.

Among the alleged victims is a Bloomfield Hills physician, Dr. Sheldon Gonte, who alleged in a lawsuit filed in Oakland County Circuit Court that Benderoff stiffed him on a $2.6 million loan, the Free Press reported.

According to the filing, Gonte loaned the money because his brother was Benderoff’s business partner. He had borrowed $2 million from the brothers’ parents, but never paid it back, the lawsuit claims, so Gonte loaned Benderoff $2.6 million to satisfy the debt. But neither Gonte nor his parents were repaid, according to the Oakland County filing.

Benderoff’s is a familiar face in courtrooms. The Free Press reported that he filed for bankruptcy in 2001, has been a defendant in several Oakland County lawsuits and a 2008 federal lawsuit in New Jersey for allegedly scamming a travel agent out of more than $600,000 in loans. ##

MHProNews Note: compare the above to the recent report that follows from The Detroit News. Photos and other images from each article have been omitted, but the text is as published in the original articles.

Part II

Detroit feds’ discovery of luggage with $1.6M leads to legal saga

The Detroit News

Published 11:01 p.m. ET May 18, 2023 Updated 3:44 a.m. ET May 19, 2023

Farmington Hills — When Brian Benderoff and Dr. Billy Gonte returned from a trip to Las Vegas in 2016, they were stopped by federal agents who discovered $1.6 million in cash in their luggage.

Gonte told the Homeland Security investigators that their gambling trip was partly financed by people who thought they were making business investments, according to federal court records.

But Benderoff, sitting all day in a federal detention facility near Detroit Metro Airport, had an even more riveting story, one unrelated to the Vegas trip.

Benderoff said he and Gonte had been involved in an insurance scam with one of the highest-paid business executives in Michigan, Gary Shiffman, chief executive of Sun Communities, a Southfield firm that develops manufactured home communities, according to Benderoff and a motion filed last year in a federal criminal case against him.

Shiffman and the insurance deal also are mentioned in an ongoing lawsuit filed in 2021 in Oakland County Circuit Court.

The lawsuit, filed by Benderoff’s wife, Amy Mosher, said Shiffman worked with Gonte to fraudulently sell life insurance policies covering Shiffman’s mother. Shiffman, who was the beneficiary, received higher payments after Gonte made his mother seem unhealthy. Mosher is suing Shiffman for ownership of an unrelated life insurance policy. The case is scheduled to go to trial on June 12.

A lawyer for Shiffman, Jeff Heuer, declined to speak to The Detroit News for this story. In a court motion in April, he said the allegation of insurance fraud is false and scandalous.

“(Mosher) has made this litigation as annoying, evasive, expensive and unpleasant as possible to extort a large settlement payment,” Heuer wrote.

Shiffman, 68, was interviewed by prosecutors and turned over personal information during a five-year federal investigation that didn’t lead to charges against him, Heuer said in the motion. He and Shiffman declined to answer questions about the insurance deals.

While no charges were filed against Shiffman, the investigation led to the indictment of Gonte, 62, and Benderoff, 56, in 2020. Those charges were dismissed in September when a judge ruled the statute of limitations had expired. Gonte, who doesn’t have a lawyer, declined to comment.

The seizure of cash at the airport sparked two federal investigations whose only conviction was a single minor figure, but the repercussions continue today with a legal squabble that might cost a West Bloomfield Township woman her home.

The saga includes alleged blackmail, a private handwritten agreement, $40,000-a-night villas, a doctor charged with switching a patient’s blood, a lawyer convicted of swindling clients, a high roller gambler amassing seven-figure debts and cameo appearances by actor Ben Affleck and basketball star Kevin Durant.

Details of the alleged activities were gathered through interviews and the review of thousands of pages of depositions, affidavits, court transcripts, financial documents, medical reports and investigative reports in federal and state court files.

“I worked 23 years as a federal prosecutor, and this, by far, is one of the most crazy cases I’ve ever been in,” said Michael Bullotta, a Detroit attorney who represented Benderoff.

A business executive’s struggles

Shiffman, who made $14 million in 2021, is worth $237 million, according to Benzinga financial news. In 2008, however, he was hurting. So were other business executives as a global financial crisis decimated the housing market, caused the stock market to plummet and led to the failure of major companies.

The calamity left Shiffman with an adjusted gross income of negative $4.9 million, according to his 2009 federal tax return. He owed $30 million to various creditors, including his mother, according to the federal indictment of Gonte and Benderoff.

A financial statement prepared by Shiffman’s assistant in 2009 showed that, while he owned considerable assets, he had just $120,000 in cash, said the indictment. He was facing $2 million a year in premiums for life insurance policies he had on his mother.

He tried to unload the six policies worth $63 million but failed several times. He then sought help from Gonte, an internist from West Bloomfield who worked with close friend Benderoff on those types of sales.

In the kitchen of Shiffman’s home in West Bloomfield, he wrote a one-page, handwritten agreement in 2009 that gave Gonte up to 30% of the proceeds of the sales, according to the indictment.

“I hereby grant Bill Gonte an unassignable interest in the proceeds of a sale of life insurance policies on Lois Shiffman,” reads a copy of the agreement, which is an exhibit in the Mosher lawsuit.

Shiffman said in a deposition in the lawsuit that the agreement wasn’t secret but that he didn’t use an attorney to draft it because Gonte wanted it done quickly. He said 30% was a high payment but represented a net benefit.

The reason the insurance policies were hard to sell was his mother’s good health, financial experts said.

Potential buyers would have to make premium payments, so the longer Lois Shiffman lived, the more it would cost them. A person with a short life expectancy is more lucrative.

Gonte used blood from a diabetic patient to create a false lab test in 2010 that said Lois Shiffman had diabetes, according to the indictment. She also visited a psychiatrist in Birmingham who falsely diagnosed her with severe dementia.

Gonte was asked during a deposition in March about another diagnosis by him that Lois Shiffman might have cancer.

“It was highly unlikely,” he said. “It was almost — it was almost an absurdity, like all the other diagnoses.”

Benderoff, a Farmington Hills resident who worked for an insurance broker, facilitated communications and meetings for the sales, said the indictment.

The false medical reports lowered Lois Shiffman’s life expectancy from 14 years to 7.5 years, according to the indictment.

Gary Shiffman promptly sold five of the six policies for $6.9 million in 2010 and 2011, according to a spreadsheet prepared by federal prosecutors.

Payments lead to big bets

Benderoff enjoyed gambling big money, six-figures big, he told The News during several interviews. He played blackjack during monthly treks to casinos in Las Vegas, Florida and Connecticut.

Benderoff, who is excitable and garrulous, said he has a genius-level IQ and a photographic memory.

All gamblers experience swings in their winnings, and for Benderoff, the changes were huge.

That’s what happens when one bets up to $50,000 per hand.

In 2006, he was charged with failing to repay $300,000 in loans in Atlantic City, New Jersey, according to New Jersey court records. He pleaded guilty to failure to make a lawful disposition and was sentenced to 18 months of probation.

The adrenaline rush was just part of the allure. Casinos spend lavishly on high rollers knowing the cost is usually offset by their gaming losses.

So Benderoff traveled by private jet, drank Cristal, smoked Cuban cigars, swam in a private pool and received free tickets to the Super Bowl.

He played poker with Affleck, basketball with Durant and took selfies with Kevin Costner.

He received so many Rolex, Cartier and Patek Philippe watches that he started a collection.

A lawyer pleads to wire fraud

The odds caught up with Benderoff as his gambling losses outweighed the wins.

A friend, Rob Gross, a lawyer from Clawson, sought short-term, high-interest loans from his clients, said a criminal complaint against him.

Gross, 54, told them it was for various investments: the selling of life insurance policies, a business obtaining a license to sell medical marijuana in Colorado, paying a lien on equipment that would allow a business to be sold.

“It’s about time you and I made some money,” he wrote in an email to one client in 2016.

Instead of investing the money, Gross sent it to a bank account owned by Benderoff and Gonte and used by Benderoff to pay his gambling debts, according to the complaint.

Gross was charged with fraud in securing $3.6 million in loans from six people from 2013 to 2016. He pled guilty to one count of wire fraud in 2017 and was sentenced to three years in prison. His law license was suspended for four years.

Gonte and Benderoff, who cooperated in the federal investigation, weren’t charged.

Gambler pleads for more loans

Benderoff and Gonte also sought money from Shiffman.

The business executive had paid them $1.9 million for their help in the sale of his mother’s life insurance policies, but they said he owed them more.

When Shiffman balked, they threatened to tell authorities about his alleged role in the sale, Benderoff told The News.

Shiffman eventually gave them an additional $1.5 million from 2013 to 2015, according to depositions and exhibits in the Mosher lawsuit.

Shiffman said during a deposition that they were loans. But Benderoff and Gonte said they were payments dressed up as loans to hide the fact Shiffman was paying them so much money. The money was never repaid.

In 2015, Shiffman filed a lawsuit against Gonte for failing to repay a $700,000 loan from 2013. Gonte and Benderoff then dropped off an envelope at Shiffman’s office that contained a copy of their agreement and the medical records where he switched his mother’s blood with another patient’s, Benderoff said.

Shiffman dropped the lawsuit three weeks later.

Benderoff, who has kept records of his dealings with Shiffman for 13 years, was asked by The News if he was strong-arming the business executive.

“We did have to pressure him in terms of reminding him,” he said. “He put everyone in harm’s way, so he needs to honor his agreement (to pay them).”

During his deposition in the Mosher lawsuit, Shiffman repeatedly denied being pressured to make the loans, saying there was nothing to pressure him about.

Asked why he continued to make the loans after earlier ones weren’t repaid, Shiffman said he appreciated how Benderoff and Gonte had helped him with his mother’s policies.

‘I’m in trouble’

In June 2016, Gross joined Benderoff and Gonte on a trip to Las Vegas. They were there for three weeks while Benderoff, starting with $1 million, won another $1 million on the blackjack tables, he said.

Benderoff and Gonte caught a red-eye flight back to Detroit on June 23. (Gross had returned two days earlier for work.)

The two men carried $1.6 million in cash, two checks worth $1 million and a Rolex watch, according to a Homeland Security investigative report. The stacks of $10,000 in $100 bills were wrapped in Caesar Palace casino bands.

Besides the $1 million stake and $1 million in winnings, the other $600,000 was additional money Benderoff had brought for the trip, he said.

Asked why he took the winnings in cash, Benderoff said the loans from Gross’ clients had to be repaid quickly, and he didn’t want to wait for a check to clear.

A Transportation Security Administration screener spotted the cash at the airport in Las Vegas and alerted Homeland Security officials in Detroit. When Benderoff and Gonte got off the plane in Detroit, they were greeted by four law enforcement officials and a police dog.

Benderoff asked to use the airport bathroom, and sitting in a stall with a federal agent on the other side of the door, he sent an email to his attorney.

“I’m in trouble,” he wrote.

Homeland Security agents brought the two men to their facility and interrogated them the entire day about where they got the money to gamble with.

The agents told Benderoff that Gonte was giving them incriminating evidence against him.

Benderoff then told them about the life insurance deals involving Shiffman’s mother.

In 2020, Benderoff and Gonte were charged with conspiracy and six counts of wire fraud affecting a financial institution, which has a statute of limitations of 10 years.

They argued in federal court that Wells Fargo, the bank involved in the insurance sales, wasn’t financially hurt by the alleged fraud because it merely facilitated the exchange of paperwork and held the sale proceeds in escrow before disbursing them.

A simple charge of conspiracy to commit wire fraud has a statute of limitations of five years, which expired, they said. Detroit U.S. District Judge Nancy Edmunds agreed with their argument, dismissing the case in September.

Fighting about death benefits

In her lawsuit against Shiffman, Mosher is fighting for the death benefits of a New York woman named Coula Johnides. Mosher said she received the woman’s life insurance policy from Gonte in 2016.

But Shiffman said Gonte gave the policy to him in 2014 as compensation for extending a $700,000 loan he made to Gonte the year before.

Gonte said in a deposition in the lawsuit that he never gave the policy to Shiffman. He said the loan was a sham that was never meant to be repaid, that it was payment to him and Benderoff for their roles in the sale of Shiffman’s life insurance policies.

“There was no loan. There was nothing,” Gonte said during the deposition last month. “It was just another papier-mache, window-dressing sham loan.”

When Johnides died in 2018, Shiffman and a friend pocketed $800,000 in death benefits, Mosher said.

Mosher said she was confused by Shiffman’s action in taking something that she believes belongs to her.

“It angers me that some people in this world seem to be able to get away with anything. You can quote that,” she said.

In November, Shiffman tried to foreclose on the West Bloomfield home of Lori Selonke, who is close friends with Benderoff. Selonke then filed her own lawsuit against Shiffman, saying the foreclosure was being done in retaliation for Mosher’s accusations.

Selonke’s condo in West Bloomfield was collateral for a $550,000 loan from Shiffman to Gonte and Benderoff in 2015.

Shiffman never took action on the loan, which has been unpaid for seven years, until Mosher filed a lawsuit against him, Selonke said.

In December, Selonke received a temporary restraining order that prevented the sale of her home one hour before a public auction.

All the legal wrangling in the various cases had Heuer, Shiffman’s lawyer, shaking his head during a January hearing.

“So there’s enough here for probably a decade of ‘Law & Order’ episodes,” he said. ##

Part III Additional Information with More MHProNews Commentary and Analysis in Brief.

An MS Word search of the attached article – shown above – reveals that Gary Shiffman and his mother Lois Shiffman are mentioned some 44 times. The allegations include mention of several different legal actions. In a filling reported on the Justia website is this reference requesting a redaction of a court filing by Petitioner Gary A. Shiffman and Brian Helmerson vs. Defendant Brian W. Benderoff, who is frequently named in the report above. The highlighting that follows is by MHProNews, but the text is as shown on the Justia legal website.

United States of America v. Benderoff

| Plaintiff: | United States of America |

| Defendant: | Brian W. Benderoff |

| Petitioner: | Brian Helmerson and Gary A. Shiffman |

| Case Number: | 2:2022mc51404 |

| Filed: | September 1, 2022 |

| Court: | US District Court for the Eastern District of Michigan |

| Presiding Judge: | David R. Grand |

| Referring Judge: | Nancy G Edmunds |

| Nature of Suit: | Other Statutory Actions |

| Jury Demanded By: | None |

Docket Report

This docket was last retrieved on September 12, 2022. A more recent docket listing may be available from PACER.

| Date Filed | Document Text |

| September 12, 2022 | Filing 6 ATTORNEY APPEARANCE: Milan Reside appearing on behalf of Gary A. Shiffman (Reside, Milan) |

| September 9, 2022 | Filing 5 TRANSCRIPT of Motion held on 9/8/2022. (Court Reporter: Carol Harrison) (Number of Pages: 24) The parties have 21 days to file with the court and Court Reporter a Redaction Request of this transcript. If no request is filed, the transcript may be made remotely electronically available to the public without redaction after 90 days. Redaction Request due 9/30/2022. Redacted Transcript Deadline set for 10/11/2022. Release of Transcript Restriction set for 12/8/2022. Transcript may be viewed at the court public terminal or purchased through the Court Reporter before the deadline for Release of Transcript Restriction. After that date, the transcript is publicly available. (CHar) |

Another court document in the case cited by The Detroit News is linked here. The federal indictment makes reference to an unnamed person described as “Owner A” and life insurance policies for “Owner A’s Mother.” Based on the account by Donnelly in The Detroit News, shown above, those references to Owner A and Owner A’s Mother appear to mean Gary A. Shiffman and his mother Lois Shiffman. Owner A is described in the indictment as a business executive living in the Eastern District of Michigan, which is where the headquarters of Sun Communities (SUI) happens to be. Similar to how Donnelley’s report stated, the federal indictment says that Owner A (apparently, Shiffman) had “liquidity issues” and several references to insurance related transactions are described in the 26-page indictment. The screen capture below is from that federal indictment.

The federal indictment attached here of Gonte and Benderoff is described as a purported “scheme to defraud.” The federal allegations mention “Owner A” and “Owner A’s mother,” which based on the information from The Detroit News report dated 5.18.2023 and updated 5.19.2023 appear to be references to Gary A. Shiffman and his mother, Lois Shiffman. It is unclear why Shiffman wasn’t indicted. An attorney that was asked about this case told MHProNews that there were several possibilities, and that speculation may be moot on an issue that has apparently lapsed due to the statute of limitations having expired. That too raises questions: how and why did prosecutors let this case lapse due to the statute of limitations expiring? Note again that neither Shiffman nor an attorney for Shiffman have replied as of the time noted above, more than a day after Sun’s Shiffman was contacted by email.

Note: in several devices and browsers, the image

below can be expanded and or downloaded to reveal a larger size.

See the instructions below the image and/or click the image and

follow your device’s prompts.

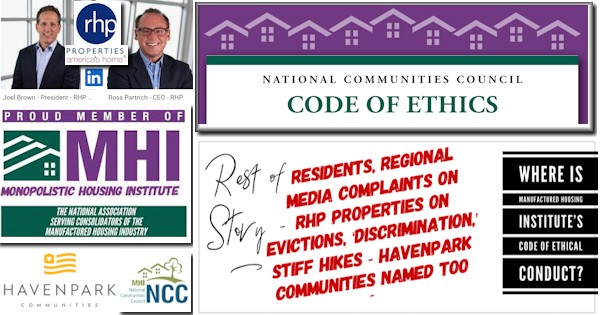

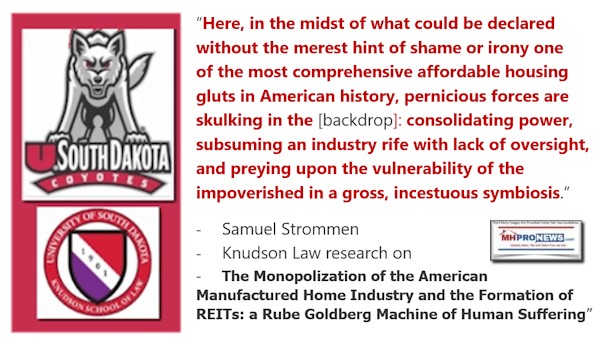

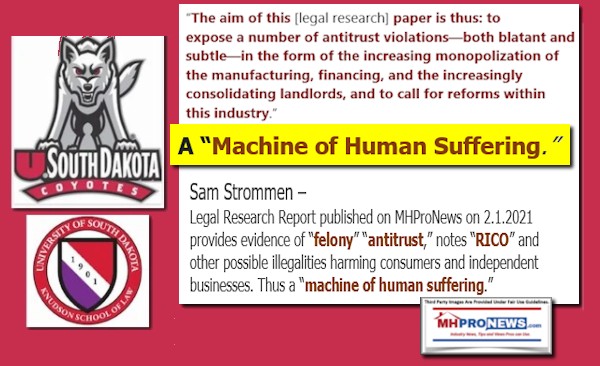

The Detroit News article above indicates that there are several legal issues underway, including a case involving Shiffman that is scheduled to go to trial on June 12. If these allegations involving Shiffman are true, it may have possible consequences for investors in Sun Communities and possibly others involved with MHI-NCC. While the two cases are obviously different, recall the bruhaha that occurred during the legal issues involving Joseph “Joe” Stegmayer at Cavco Industries (CVCO). See the links below to learn more about those issues, and to see how they might shed light on possible outcomes for Shiffman, the company that he leads, shareholders and others involved.

An argument can be made that if the evidence-based allegations indicated in the federal indictment, Detroit News, and other sources are true, then at a minimum, there ought to be questions and concerns about the ethics of Shiffman and how those ethics play out in his role at Sun Communities. For example. One should keep in mind that Sun has been involved in several legal issues involving residents.

The New York Attorney General’s Office announced a “major” settlement in a case that involved Sun Communities and others. “Attorney General Barbara D. Underwood announced that – following her office’s industry-wide investigation into rent-to-own practices of the manufactured home park industry – eight major corporate owners have agreed to major reforms of their practices.” One of those firms included Shiffman led Sun Communities.

That NY AG release in 2018 included the following.

“New Yorkers across the state are already struggling to afford a home – and these companies took advantage of that struggle, promising home ownership and instead leaving families with default, eviction, and financial devastation,” said Attorney General Underwood. “This settlement holds these manufactured home park owners to account and provides rent-to-own tenants with much needed protections and relief. We’ll continue to work to further reform the industry and ensure all New Yorkers have the protections they deserve, no matter where they live.”

- Optionees usually make a significant upfront, non-refundable payment. If the optionee defaults before the end of the option period, they are subject to eviction and forfeit their deposit.

- Title to the subject manufactured home does not transfer to the optionee until the end of the option period and then only transfers if the optionee has made timely rental, insurance, and property tax payments and performed all repairs and maintenance throughout the option period.

- In almost every case, rent-to-own contracts include indemnification provisions that hold manufactured home park owners harmless against all damages, claims, and penalties arising from injury anywhere in the manufactured home park.

- Optionees agree to take the manufactured home “as is” and are responsible for all repairs, restoration, extermination, and maintenance to the home throughout the option period.

- Contracts do not require that “clear” title, free of superior interests, liens, or encumbrances be transferred to the optionee at the end of the lease term. The optionee takes title “as is.”

- Contracts prevent optionees from protecting their interest by recording the Option Agreement.

The Attorney General’s investigation found that these park owners were violation ofReal Property Law §§ 233(m), 235-b, 235-c, General Obligations Law § 5-321, and established tenant protections.

As part of today’s settlement, eight manufactured home park owners, which together own over 100 manufactured home parks in New York State, agreed to the implement the following reforms…

The following manufactured home park owners have agreed to discontinue rent-to-own practices found to be unlawful by the Attorney General and to sign the assurance of discontinuance:

- Garden Homes Management, Inc., Stamford, Connecticut

- Harper Homes, Inc., Avon, New York

- Hoffman Homes, Inc., Ballston Spa, New York

- Horizon Land Company, Crofton, Maryland

- JKLM Communities, Inc., Oneonta, New York

- Kingsley Management Corporation, Inc., Provo, Utah

- Sun Communities, Inc., Southfield, Michigan

- UMH Properties, Inc., Freehold, New Jersey

In the coming months, the Attorney General’s office will continue to work with the New York Housing Association and its members toward further reforming industry practices for the benefit of manufactured home park tenants throughout the state.”

MHProNews noted that the Department of Justice (DoJ) has a policy against collusive schemes. Depending on the type of case, witnesses, testimony, and other circumstances, such items may or may not be introduced into evidence. That said, it is possible that such history could prove relevant, at least to ethically minded investors who recall the numerous legal probes and shareholder lawsuits the emerged from the Cavco Industries fiasco. Given that some believe that various and prominent MHI corporate leaders are accused of sabotaging their own industry for the apparent benefit that it may bring to consolidators, such as Sun Communities, questionable ethics is certainly a factor that prudent professionals should consider.

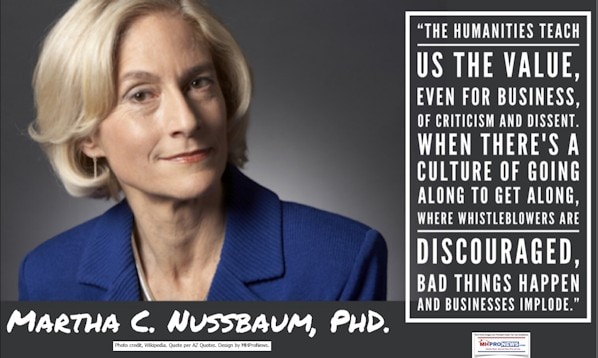

The fact that MHI leaders seem to turn a blind eye to such issues, and even give ‘awards’ for “excellence” to firms that have troubling reputations with consumers ought to be of concern to public officials, investors in MHI linked companies, evidence- and commonsense-minded researchers, and others.

This report on Shiffman came as a result of a news tip to MHProNews. There are those in the industry, including those involved at MHI, who are troubled by the kind of business and ethical practices that are reported by mainstream media, in statements by public officials, in research documents, and more. While thousands of manufactured home professionals have never known the robust era of manufactured housing firsthand, some have keen memories and experiences that are important for grasping why the industry could be performing better. An argument can be made that good, bad, and ugly business ethics each are a factor in a company and the collective industry’s performance.

That MHI repeatedly fails to publicly address, or at times even acknowledge, these issues ought to be cause for alarm. After all, one of their own members that MHI has ‘endorsed’ pointed out the obvious connection between industry underperformance and a steady stream of bad news involving not only industry players, but MHI connected industry firms.

MHProNews plans to monitor and report on possible developments in the allegations involved in the Shiffman saga or other concerns of a legal, ethical, and ‘predatory’ business practices that may be in some sense like it. Because Shiffman’s attorney, per The Detroit News, made an interesting and relevant remark. “So there’s enough here for probably a decade of ‘Law & Order’ episodes,” said Jeff Heuer, Sun Communities’ (SUI) CEO Gary Shiffman’s lawyer. Manufactured housing is demonstrably underperforming. That means that individual firms within it, such as Sun and others, are also underperforming on one or more levels. More insights ahead that others in MHVille can’t, won’t, or don’t report, so stay tuned right here. ##

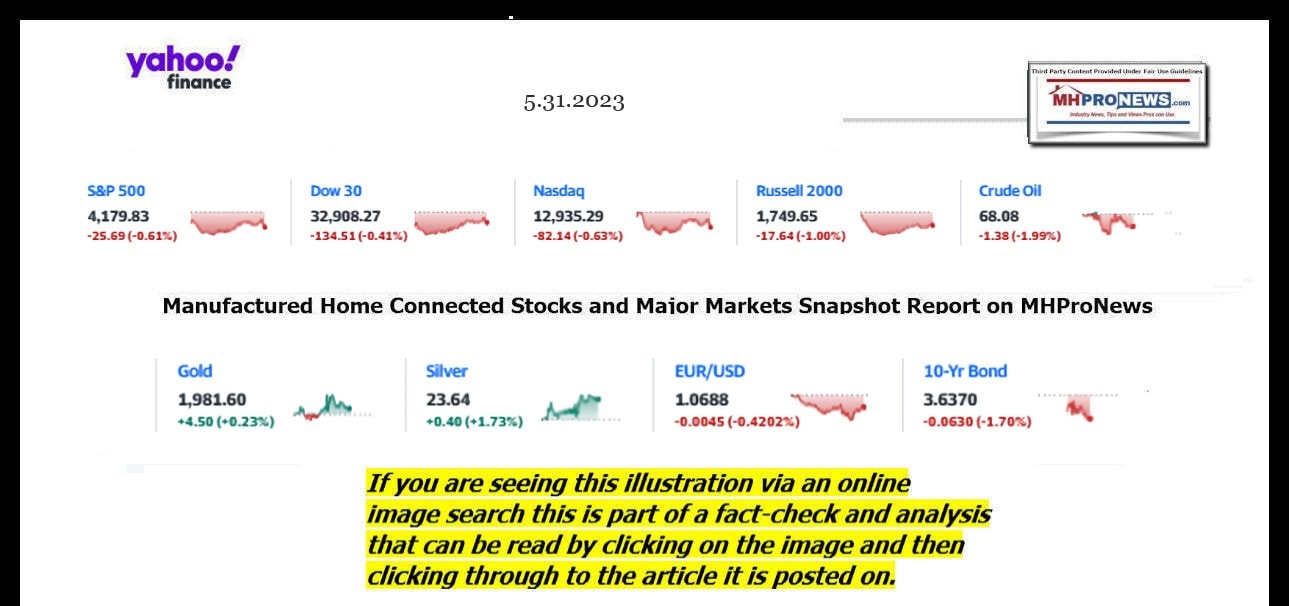

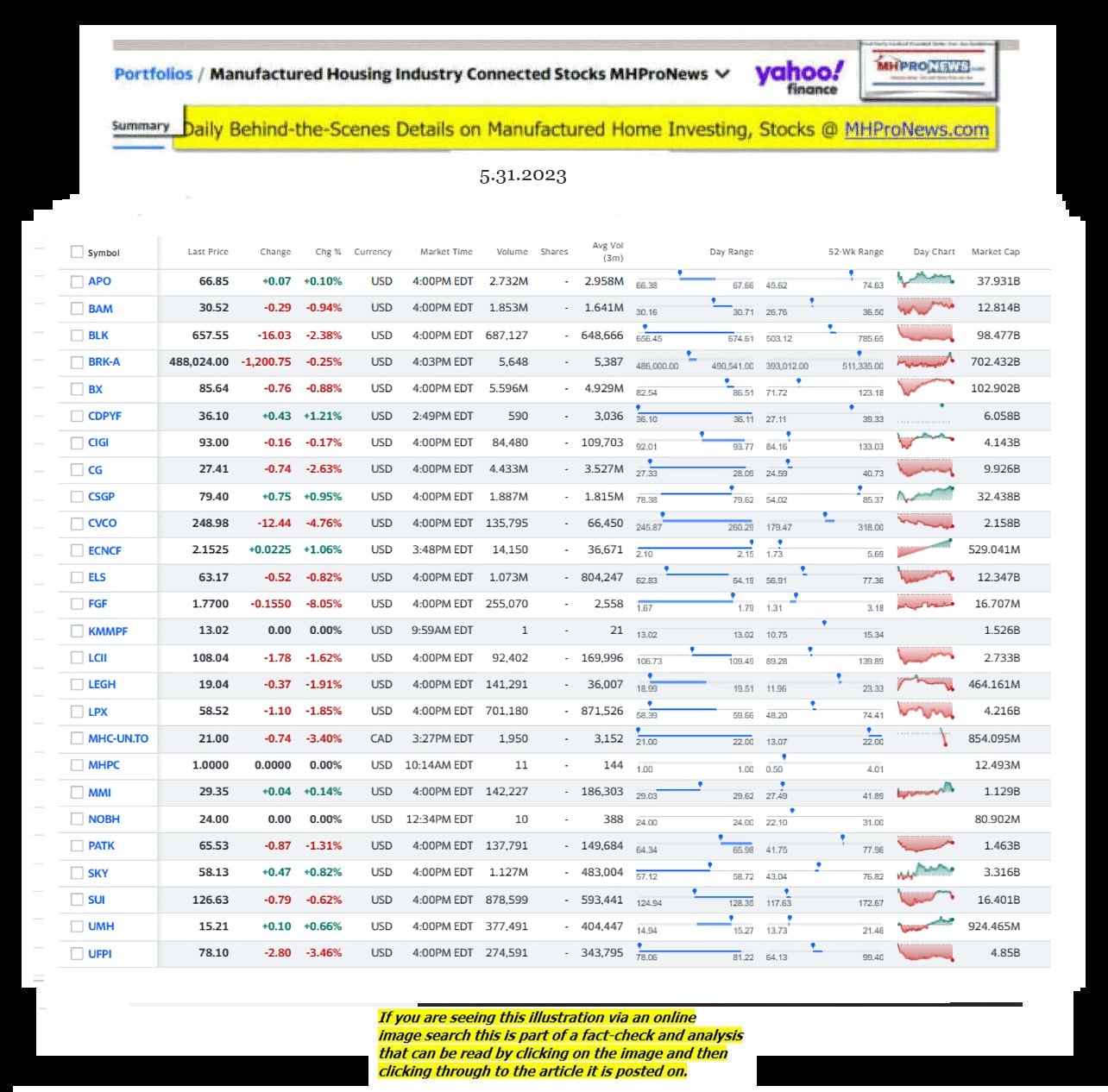

Part IV – Daily Business News on MHProNews Markets and Headline News Segment

The modifications of our prior Daily Business News on MHProNews format of the recap of yesterday evening’s market report are provided below. It still includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines. The macro market moves graphics will provide context and comparisons for those invested in or tracking manufactured housing connected equities.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 5.31.2023

- A future in politics?

- Jamie Dimon, chairman and chief executive officer of JPMorgan Chase & Co., during a Bloomberg Television interview on the sidelines of the JPMorgan Global China Summit in Shanghai, China, on Wednesday, May 31, 2023. Dimon said JPMorgan Chase & Co. will be in China in both good and bad times, remaining committed to doing business in the Communist Party-ruled nation as political tensions grow.

- Jamie Dimon signals an openness to at least explore an eventual second act in public office

- The average wedding just hit $29,000

- Amazon corporate workers stage walkout, citing ‘lack of trust’ in leadership

- Amazon to pay more than $30 million to settle FTC privacy complaints over Alexa and Ring

- Debt ceiling deal won’t have much impact on the US economy, analysts say

- Marlboro as an ESG investment? CEO tells FT that’s his goal

- The Ford Bronco is being recalled because people may get ‘discouraged’ trying to use the seatbelts

- Twitter may be worth only a third of its pre-Musk value, Fidelity says

- 49 people have been killed at Dollar General stores since 2014. Workers are protesting for safer conditions

- The number of available US jobs surged in April, complicating the Fed’s strategy

- The debt ceiling drama may feel like it’s over, but it may have only just begun

- From Elon Musk to Jamie Dimon, CEOs flock to China as risks to trade and investment rise

- The banking crisis has gone quiet but it isn’t over

- Fueled by AI, Nvidia joins the $1 trillion club

- Experts are warning AI could lead to human extinction. Are we taking it seriously enough?

- China’s economic recovery loses steam as factory production contracts further

- US sanctions Chinese and Mexican firms over fentanyl making equipment

- What Elizabeth Holmes’ life in prison could look like

- Court grants Sackler family immunity in exchange for $6 billion opioid settlement

- Elizabeth Holmes reports to prison

- AI industry and researchers sign statement warning of ‘extinction’ risk

- These companies are winners in the debt ceiling deal

- US oil prices sink below $70 on debt ceiling jitters and Russia-Saudi tensions

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Headlines from right-of-center Newsmax 5.31.2023

- Wray Subpoena Response Leaves Comer Cold; Contempt Charge Looms

- From left: Comer and Wray (AP)

- Newsmax TV

- Gordon Chang: China-US Jet Incident Ordered by Beijing

- Kirk Cameron: Seattle Parents Grateful for ‘Right Kind of Values’ | video

- Matt Whitaker: May Have to Hold Wray in Contempt | video

- Rick Santorum: McCarthy Debt Deal ‘Well-Played’

- Tim Scott: China an ‘Existential Threat’ to US | video

- CatholicVote’s Burch: Dodgers ‘Bud Light of Baseball’ | video

- Mark Morgan: Trump’s Planned Order Will ‘Deter’ Illegals | video

- Rosendale Debt Deal Gives Biden a Blank Check | video

- Meuser to Newsmax: ‘Virtually a Sure Thing’ Debt Bill Passes

- It’s “virtually a sure thing” that the bill for the debt deal reached between President Joe Biden and House Speaker Kevin McCarthy will be approved by the House, as a government default is “something that’s really out of the question,” Rep. Dan Meuser told Newsmax…. [Full Story] | video

- Bob Good to Newsmax: Not Enough ‘Cuts or Reforms’ to Vote for Debt Deal

- Wall Street Falls on Fed Hike Jitters Ahead of Debt Vote

- Biggs to Newsmax: Debt Plan Savings ‘Dubious’

- Paul to Newsmax: Debt Ceiling Deal ‘Absolute Disaster for Conservatives’

- Boebert to Newsmax: McCarthy Negotiated ‘a Gift’ for Biden Admin

- Gaetz to Newsmax: McCarthy Can Be Ousted for Using Dem Votes

- Tim Scott: Raising Limit Gives Biden Open Checkbook

- McCarthy: New Bipartisan Commission on Federal Budget

- Target Takes $12.7B Hit After Pushing DEI

- Since its CEO hailed DEI (diversity, equity, and inclusion) [Full Story] | video

- Conservatives Slam Disney’s Woke Agendas for Young Girls

- Model Who Shot Bud Light Cans Defends MLB Star

- Anheuser-Busch Stock Down 18% Since Trans Fracas

- Bud Light Sales Down 30% as Boycott Grows

- Wall Street Slumps With Markets Worldwide

- Wall Street closed lower as worries rise about the strength of the [Full Story]

- NASA UFO Hearing: ‘Metallic Orbs’ Seen Worldwide

- A top official for the Department of Defense admitted on Wednesday [Full Story]

- Russia Claims Destruction of Ukraine’s ‘Last Warship’

- Russia’s defense ministry said on Wednesday that its forces had [Full Story]

- Drones Target Russia Oil Refineries: Official

- Ukraine Raises Consumer Utility Tariffs to Help Power Grid Repairs

- Wagner Boss to Russia’s Military Leaders: ‘Let Your Houses Burn’

- UN Nuclear Chief Urges Russia and Ukraine to Ban Attacks at Europe’s Largest Nuclear Power Plant

- Ukraine, Allies Plan Peace Summit Without Russia

- Comer Not Satisfied With Wray Call, Contempt Looms

- House Oversight Committee chair James Comer, R-Ky., held a call with [Full Story]

- Papadopoulos Slams Durham for Not Probing ‘Bizarre’ Meeting

- Former Trump campaign aide George Papadopoulos found himself an [Full Story] | Platinum Article

- Alex Murdaugh Pleads Not Guilty to Money Laundering

- Alex Murdaugh was arraigned Wednesday on federal money laundering and [Full Story]

- June Watch: Sports Finals, Fathers, Flags

- Kids are out of school and already enjoying pool parties and [Full Story] | Platinum Article

- Spies: Kim Jong Un a 308-Pound Smoking, Boozing Insomniac

- Spies from South Korea say North Korean leader Kim Jong Un has become [Full Story]

- Mike Pence Will Announce ’24 Campaign Next Week

- The growing 2024 GOP presidential primary field might be adding [Full Story] | video

- Trump Plans ‘Salute to America 250’ Year-Long Party

- Continuing his Agenda 47, former President Donald Trump announced his [Full Story]

- Amazon Left Scrambling As Shoppers Find out About Secret Deals

- Online Shopping Tools

- Bud Light Sales Down 30% as Boycott Grows

- Bud Light sales and revenue continue to plummet following its [Full Story]

- US to Require Automatic Emergency Brakes on New Cars

- The U.S. government’s auto safety agency plans to require that all [Full Story]

- Medvedev: UK Politicians a Legitimate Military Target

- British politicians are a legitimate military target for the Kremlin, [Full Story]

- McCarthy: New Bipartisan Commission on Federal Budget

- A new bipartisan House commission will be formed to tackle the [Full Story]

- Ex-Conn. Rep. Gets 27 Months for Stealing COVID Aid

- A former Connecticut state representative was sentenced to 27 months [Full Story]

- Florida Street Renamed ‘Rush Limbaugh Way’

- The late Rush Limbaugh will be honored with a Florida street in his [Full Story]

- Supreme Court Strikes Down 2 Abortion Bans

- The Oklahoma Supreme Court on Wednesday ruled that two state laws [Full Story]

- Lawmakers: Block Space Command Funding in Colo.

- Alabama’s congressional delegation submitted a bipartisan draft House [Full Story]

- DeSantis Vows to Send Biden ‘Back to His Basement’

- In his first appearance in Iowa since officially declaring his 2024 [Full Story]

- Feds Sue West Virginia Governor’s Coal Empire

- The U.S. Justice Department sued West Virginia Gov. Jim Justice’s [Full Story]

- NASA: Saturn Moon Water Plume Twice the Size of US

- NASA, using the James Webb Space Telescope, detected a vapor plume [Full Story]

- US Economic Outlook Has ‘Deteriorated’: Fed Survey

- S. economic activity was little changed overall in recent weeks, [Full Story]

- Labor Market Still Tight as Job Openings Rise, Layoffs Fall

- S. job openings unexpectedly rose in April and data for the prior [Full Story]

- FDA Warns Against Compounded Wegovy, Ozempic

- Patients taking semaglutide for type 2 diabetes or weight loss should [Full Story]

- US Bank Deposits Fell at Record Pace in Q1: FDIC

- S. banks saw total deposits decline by a record 2.5% in the first [Full Story]

- European Wine Ingredients to Be Seen With QR Code

- European wines are finally being forced to reveal their ingredients [Full Story]

- Chris Christie to Announce White House Bid Tuesday

- Former New Jersey Gov. Chris Christie, who advised Donald Trump’s [Full Story]

- FBI Director to Discuss Biden Doc With Lawmakers

- Leading Republican lawmakers on Wednesday are scheduled to speak with [Full Story]

- Even Mild COVID Can Cause Long-Term Heart Damage

- A new study confirms that lingering effects of a COVID-19 infection, [Full Story]

- CEOs Outearn Typical Worker’s Pay – Over 2 Lifetimes

- After ballooning for years, CEO pay growth is finally slowing…. [Full Story]

- J&J Faces New Trial Over Talc Cancer Claims

- Amazon to Pay $30M for Alexa, Ring Privacy Violations

- Billionaire Calls on Jamie Dimon to Run for President

- Exxon Shareholders Reject All Climate-Related Petitions

- Health

- Morning People Have More Faith, Life Satisfaction

- A study from the University of Warsaw suggests that early risers tend to be more religious than those who stay up until the wee hours. The researchers also found an association between morning people and a higher life satisfaction. According to Study Finds, early risers…… [Full Story]

- Qigong Eases Cancer-Related Fatigue, Improves Mood

- Sick Restaurant Workers Spread Foodborne Illness

- Weight Loss Surgery Rising for Kids and Teens

- Ketamine Nasal Spray Alleviates Severe Migraine

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

2022 was a tough year for many stocks. Unfortunately, that pattern held true for manufactured home industry (MHVille) connected stocks too.

See the facts, linked below.

====================================

Updated

-

-

- NOTE 1: The 3rd chart above of manufactured housing connected equities includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry finance lender.

- NOTE 2: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE 3: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

- Note 4: some recent or related reports to the REITs, stocks, and other equities named above follow in the reports linked below.

-

2023 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

- Manufactured housing, production, factories, retail, dealers, manufactured home, communities, passive mobile home park investing, suppliers, brokers, finance, financial services, macro-markets, manufactured housing stocks, Manufactured Home Communities Real Estate Investment Trusts, MHC REITs.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Department of Energy Publishes ‘Unacceptable’ Manufactured Housing Energy Rule Extension, MHI Remarks, Ex-MHI and MHARR’s Danny Ghorbani Offers Focused Praise – plus MHVille Stocks, REITs Updates