Possible sources of liability and current litigation in manufactured housing will be explored further below. But first, exploring some data will shed light on the issues that follow. According to the National Association of Home Builders (NAHB): “Homebuilder sentiment is now declining rapidly in the US after a 1H23 bounce, manufactured by historically low existing home inventory.”

National Association of Home Builders Housing Market Index fell more than expected in September to 45 (Exp. 50, Prev. 50).

Homebuilder sentiment is now declining rapidly in the US after a 1H23 bounce, manufactured by historically low existing home inventory.

A reading below… pic.twitter.com/jLr4fsdkNx

— Macro Dose (@macro_dose) September 18, 2023

In a case that could have significant repercussions for the housing industry, the U.S. Supreme Court on Oct. 3 heard oral arguments in Consumer Financial Protection Bureau (CFPB) v. Community Financial Services Association of America. https://t.co/7ECof4onZh

— NAHB 🏠 (@NAHBhome) October 4, 2023

The Department of Energy has opened applications for $400 million in grants to states to adopt the 2021 International Energy Conservation Code (IECC) for new homes, as appropriated in the Inflation Reduction Act. https://t.co/IU5QQscdpL

— NAHB 🏠 (@NAHBhome) September 29, 2023

The cost of land lots for building single-family homes continued to rise in 2022, albeit at a slower pace than in inflation over the course of last year. Lot values also varied widely from region to region in the U.S. https://t.co/pipA8ekzC4

— NAHB 🏠 (@NAHBhome) September 28, 2023

Sales of new single‐family homes dropped 8.7% in August to an annual rate of 675,000, 5.8% higher than in August 2022. The median sales price of new homes sold in August 2023 was $430,300, down from $440,300 a year ago. #realestate #economy pic.twitter.com/3ftrUsl42U

— NAHB 🏠 (@NAHBhome) September 26, 2023

Meanwhile the National Association of Realtors (NAR) had the following shares via “X” – formerly known as Twitter.

NAR Chief Economist Lawrence Yun reacts to the latest jobs report. pic.twitter.com/8j06iedmHQ

— National Association of REALTORS® (@nardotrealtor) October 6, 2023

Pending home sales slid 7.1% in August.

“Mortgage rates have been rising above 7% since August, which has diminished the pool of home buyers,” Lawrence Yun, NAR chief economist. https://t.co/n6ln5kjnHo

— National Association of REALTORS® (@nardotrealtor) September 28, 2023

The median existing-home price for all housing types in August was $407,100, an increase of 3.9% from August 2022. Learn more: https://t.co/PPTSO73YnN pic.twitter.com/0AkVDhi8v2

— National Association of REALTORS® (@nardotrealtor) September 24, 2023

Existing-home sales retreated 0.7% in August. Among the four major U.S. regions, sales improved in the Midwest, were unchanged in the Northeast, and slipped in the South and West. https://t.co/Pfc90fncug

— National Association of REALTORS® (@nardotrealtor) September 21, 2023

What about the word from the Manufactured Housing Institute (MHI)? Beyond pitches for their next meetings, not much as the folks who office in Arlington, VA are on a self-declared information hiatus following their recent meeting.

Per MHI: “There will be no Federated States Newsletter on October 2 due to MHI’s Annual Meeting in Palm Springs.” Must be nice to have days of hobnobbing at a resort without having to produce the kind of ongoing reports and updates. Meanwhile, as evidenced by the X-posts above, the NAHB and NAR routinely crank out data and information year-round. NAR and NAHB do so not only their members, but also for the broader public. Comparisons to other associations helps shed light on what little, if anything useful to the growth (instead of shrinkage) of manufactured home sales and production is occurring. But don’t forget to make those dues payments on time to MHI! That’s what keeps their profitable meetings, cushy trips, their pensions, bonuses, healthy pay, and other fringe benefits for supporting consolidators coming! For more on that see the item below plus the reports from the week in review on MHLivingNews and MHProNews.

Fortunately for manufactured housing pros, the national Manufactured Housing Association for Regulatory Reform (MHARR), while significantly smaller in staff and budget than MHI, continues to publish information that is timely and relevant.

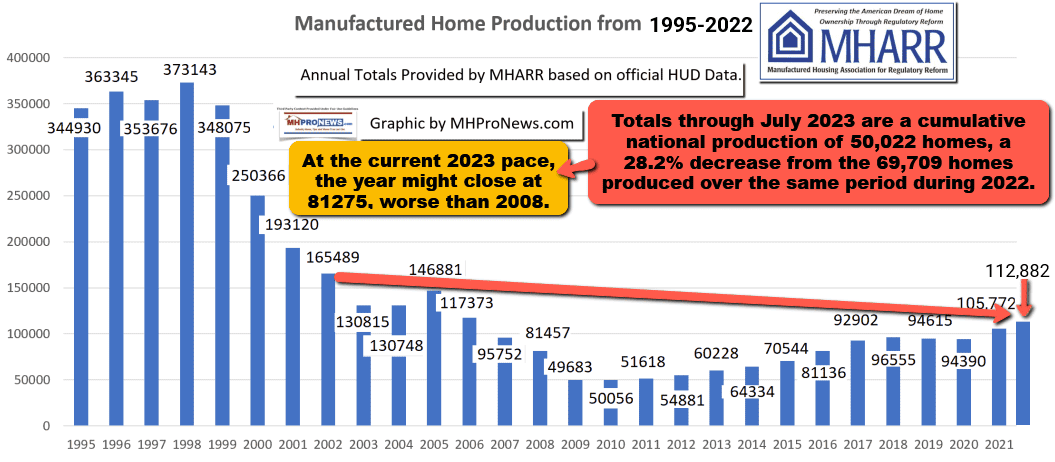

Severe Manufactured Home Production Decline Continues in August 2023

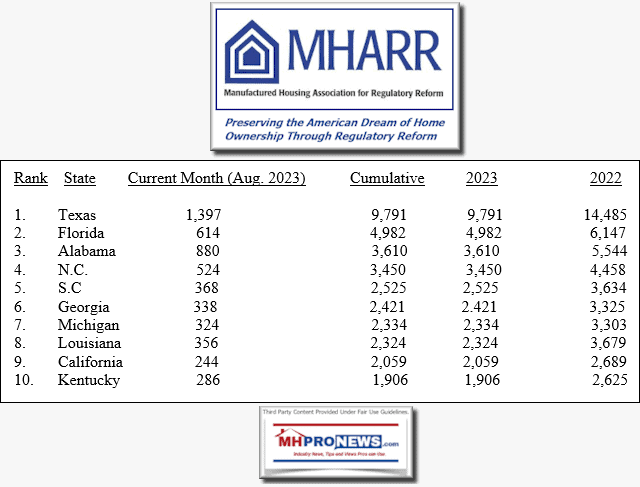

Washington, D.C., October 5, 2023 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production declined again in August 2023. Just-released statistics indicate that HUD Code manufacturers produced 8,670 new homes in August 2023, a 19.1% decrease from the 10,722 new HUD Code homes produced in August 2022. Cumulative production for 2023 is now 58,692 homes, a 27% decrease from the 80,431 homes produced over the same period during 2022.

In the midst of an ongoing affordable housing crisis, with housing costs reaching or nearing all-time highs, inherently affordable manufactured housing continues to significantly underperform, with production levels for 2023 far below the industry’s potential and even the diminished annual production averages of the past decade-plus. As MHARR has explained and documented, this decline continues to be driven by key failures within the industry’s post-production sector including, most significantly, discriminatory zoning exclusion (tolerated by HUD) and the stubborn refusal of Fannie Mae and Freddie Mac to securitize chattel loans for nearly 80% of the industry’s most affordable mainstream manufactured homes. Unless and until someone within the industry can fully explain any and all other possible reasons for this decline, which has left the industry in its current downward spiral, the Manufactured Housing Institute, as the only national association which collects representation dues from the post-production sector of the industry, has a duty and obligation to press HUD as well as Fannie Mae and Freddie Mac to fully comply with the relevant existing laws (i.e., the 2000 reform law and the Duty to Serve law) going forward.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing. ##

Speaking of MHARR, flash back to this remark from former MHI VP and MHARR founding President and CEO Danny Ghorbani.

Ghorbani’s point is one that MHProNews has repeatedly made by pointing out that MHI is oddly ‘teaming up’ in ‘partnerships’ with conventional building associations. MHProNews asked an MHI board member recently: what have MHI’s alliances with conventional housing trade groups yielded in the way of a measurable benefit for manufactured housing? After a short silence, ‘nothing I can think of.’

MHI won’t answer that sort of question from MHProNews. Others in the MHVille trade media and bloggers – who routinely give MHI cover and support – don’t usually ask them questions that may put them in a good light.

This poser to Bing’s AI Chat yielded the response below.

> “What has the Manufactured Housing Institute or MHI linked bloggers and trade media said their alliances with conventional housing trade groups has yielded that benefits manufactured housing?”