BlackRock (BLK) reportedly has significant manufactured housing industry investments, some of which are noted herein below. That noted, the opening paragraph of a 73-page complaint against private equity giant BlackRock, stated the following. “As one of the world’s largest investment-management firms, defendant BlackRock, Inc. has been at the forefront of using aggressive strategies to push controversial Environmental, Social, and Governance (“ESG”) goals across the assets it manages. BlackRock marketed many of its funds as devoid of ESG considerations and has admitted that ESG aims-in particular, radically reducing portfolio companies’ carbon output-“do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund.” Regardless, BlackRock committed to global organizations that it would pursue these aims across all assets under management. And it did. For years, however, BlackRock has misled consumers about the scope and effects of its widespread ESG activity. BlackRock’s conduct concerning the marketing or sale of its investment products and services constitutes deceptive acts and practices under the Tennessee Consumer Protection Act (“TCPA”), including Tenn. Code Ann. $ 47-18- 104(a) and (b)(27). The State of Tennessee, by and through its Attorney General and Reporter Jonathan Skrmetti (the “State”), now brings this civil law enforcement proceeding to stop BlackRock’s rampant ESG evasion and protect consumers.”

That same suit’s pleadings also says: “BlackRock is the world’s largest investment management firm, with a staggering $8.6 trillion of assets under management (“AUM”) as of December 31,2022. Its holdings are more than the gross domestic product of nearly every country in the world except for the United States and China. It employs approximately 19,800 employees in more than 30 countries and serves clients in over 100 countries across the globe.1”

Those remarks from the pleadings of Tennessee Attorney General Jonathan Skrmetti help frame the report shared in Part I herein.

- Part I of today’s report is provided by the Daily Signal to MHProNews.

- Part II will provide additional information with more MHProNews analysis and commentary about some insights on BlackRock’s holdings in manufactured housing. It will also provide additional information in the light of Skrmetti’s complaint, which will include some of the potential ripples from this newly announced litigation for the manufactured home industry and beyond.

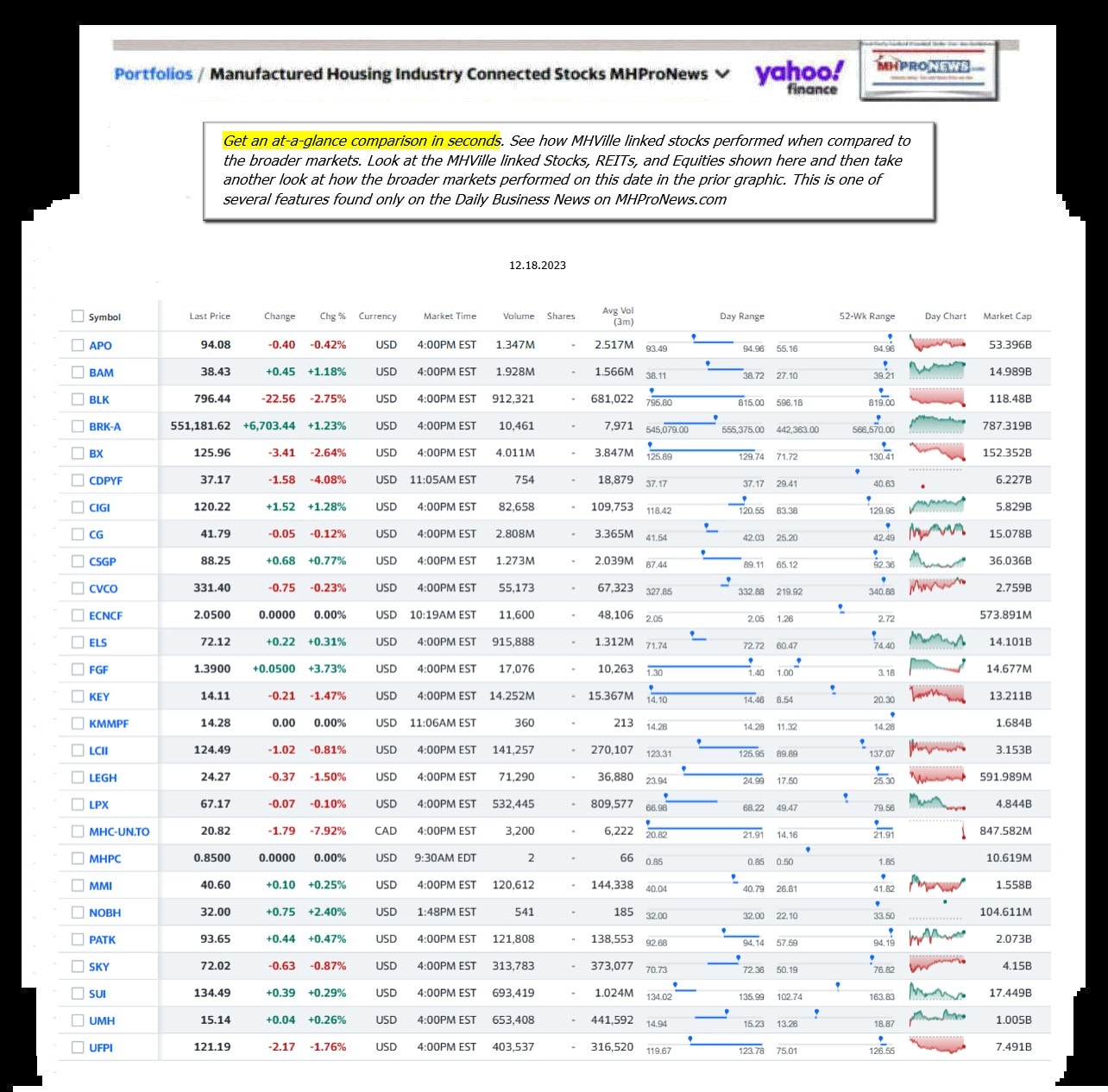

- Part III is our Daily Business News on MHProNews left (CNN) right (Newsmax) market-moving headlines recap, which includes a graphical day-by-day snapshot of dozens of manufactured home industry connected equities, including BlackRock, producers, communities, lending, suppliers, retailers among the dozens of others captured in our reports. Performance and trends of macro-markets can be compared ‘at a glance’ to that of those manufactured housing industry connected equities.

Part I

LAW | NEWS

BlackRock CEO Larry Fink in a suit with a blue tie looks left

EXCLUSIVE: Conservative State Files First-in-the-Nation Lawsuit Against BlackRock Over Deceptive Climate Policies

Tyler O’Neil / @Tyler2ONeil / December 18, 2023

FIRST ON THE DAILY SIGNAL—Tennessee Attorney General Jonathan Skrmetti on Monday sued the investment company BlackRock for deceptive practices.

“BlackRock has said two things that can’t both be true,” Skrmetti, a Republican, told The Daily Signal in an interview Monday. “The first is that they’re taking investors’ money and investing it purely for the purpose of maximizing the return on investment. But they’ve also put out statements saying that they’re committed to net-zero [carbon emissions to combat] climate change by certain dates.”

“They’ve made lots of statements about working to use all of the assets under their management to further the goal of reducing greenhouse gas emissions, and both of those can’t be true,” he added.

In the suit filed in Williamson County Circuit Court, Skrmetti alleges that BlackRock violates the Tennessee Consumer Protection Act by engaging in deceptive practices regarding its so-called environmental, social, and governance goals. BlackRock has helped lead the movement to force climate alarmism goals on companies in the name of ESG. These goals often involve pledging to alter business practices to decrease or offset carbon emissions in the name of helping the environment, even though science on carbon emissions destroying the climate is far from settled.

In 2020 and 2021, BlackRock joined the climate alarmism groups Climate Action 100+ and the Net Zero Asset Managers Initiative, committing to use the weight of all assets under management to advance many environmental, social, and governance goals and achieve net-zero carbon emissions by 2050.

Yet BlackRock operates many non-ESG funds, claiming that such funds “do not seek to follow a sustainable, impact, or ESG investment strategy.” The company further claims that there is “no indication” that non-ESG funds will adopt an ESG investment strategy.

Although BlackRock claims these funds don’t advance its ESG goals, it has adopted a companywide commitment to ESG goals and aggressively urged climate goals on other enterprises it invests in. As a shareholder in many other companies, BlackRock carries considerable weight and has pushed them to make climate-related commitments.

“BlackRock’s pledge as a member of [the climate groups] is to force companies to disclose targets for net-zero emissions for environmental and political reasons (limiting warming to well below 2°C), without regard to materiality to the particular company’s financial performance,” the lawsuit argues. “BlackRock makes no mention of this commitment to non-material factors when explaining its portfolio company disclosure expectations to fund investors.”

The lawsuit cites many instances where BlackRock used its influence over companies it invests in—including Chevron, United Airlines, and Walmart—to push climate-related shareholder proposals. Yet BlackRock claimed in a December 2022 statement responding to state attorneys general that the company doesn’t “dictate to companies what specific emission targets they should meet or what type of political lobbying they should pursue.”

BlackRock also claimed that its role “is to help [clients] navigate investment risks and opportunities, not to engineer a specific decarbonization outcome in the real economy.”

As for ESG funds, Skrmetti’s lawsuit cites this claim by BlackRock: “The global aspiration to achieve a net-zero global economy by 2050 is reflective of aggregated efforts; governments representing over 90% of GDP have committed to move to net-zero over the coming decades.”

However, only 15% of countries that have made a net-zero commitment have enshrined such commitments in law, and only 10% of global emissions would be covered by legally binding pledges, according to Tennessee’s lawsuit. The lawsuit lists 14 statements that BlackRock could have added as disclosures to make that statement less deceptive, such as noting that no country in the world has implemented policies that will prevent the world climate from increasing 1.5 degrees Celsius, according to the Climate Action Tracker.

BlackRock also has presented contradictory claims about whether ESG goals align with positive financial outcomes.

BlackRock has said that its “focus on climate risk and energy is about driving financial outcomes for clients,” but the company also has admitted that sustainability metrics “do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund.”

Contrary to BlackRock’s claims, ESG-guided funds don’t yield higher returns on investment, according to the lawsuit. It cites a 2019 study finding a “statistically significant negative relation between ESG investing and investor returns.”

“BlackRock’s acts and practices concerning the marketing or sale of products and services, as alleged herein, are deceptive to consumers and other persons in Tennessee,” the lawsuit states.

Skrmetti asks the circuit court to find that BlackRock violated the Tennessee Consumer Protection Act, that the court order BlackRock to cease making misrepresentations, that it order BlackRock to “restore the money or property lost as a result of the alleged violations of law,” and that it order BlackRock to give up its “ill-gotten gains.”

Skrmetti asks the court to fine BlackRock a civil penalty of $1,000 to Tennessee for each violation of the law, and that “all costs, including discretionary costs, in this case be taxed against BlackRock.”

BlackRock is the leading exchange-traded fund provider in the world, with $9.4 trillion in assets under management.

Although some states have passed laws to restrict the use of ESG goals in making investment decisions, Skrmetti’s lawsuit represents the first civil enforcement action against BlackRock for ESG deception.

“Ultimately, this is a case about the truth, and the biggest takeaway for me at the end of the day is we can get clarity for consumers,” Skrmetti told The Daily Signal in the interview. “If you’re going to make decisions about how companies should have to behave to do business, those are decisions that ultimately have to flow from the people, and this is part of, I think, a broader effort on the part of some elites to make sure that the American people don’t have that kind of oversight over their economy.” ##

Part II – Additional Information with More MHProNews Analysis and Commentary

Besides investments made in the manufactured home community sector, BlackRock (BLK) has investments in Berkshire Hathaway (BRK), per FinTel.io. FinTel.io’s “heat map” at that link on this date shows BLK has Berkshire in their top 100 holdings. According to the Private Equity Stakeholder Project (PESP) report linked here, “Large investment managers including The Vanguard Group, Fidelity, Blackrock, and Cohen & Steers are Equity Lifestyle Properties’ largest investors.132” That’s on page 22 of the report.

BlackRock’s website has this statement (bold emphasis added): “During the quarter, the fund maintained its concentration in MBS pools, with the core allocation held in downpayment assistance, foreclosure prevention, and manufacturing housing pools.”

Having initially missed the manufactured housing connection, with some prompting, Bing AI confirmed the above: “according to a FinIntel report, Berkshire Hathaway is one of BlackRock’s top 100 holdings 1.” “Regarding your second question, BlackRock’s website states that it invests in MBS (Mortgage-Backed Securities), which are pools of mortgages that are securitized and sold to investors. These pools can include mortgages for manufactured homes…” and “Finally, according to the Private Equity Stakeholder Project, BlackRock is one of the investors in Equity LifeStyle Properties stock 3.”

So, does this lawsuit by TN AG Skrmetti have potential implications for manufactured housing? On several levels, the obvious answer should be “yes.” That noted, let’s look deeper.

The Daily Signal observed that TN AG “Skrmetti’s lawsuit represents the first civil enforcement action against BlackRock for ESG deception.” The Daily Signal’s Tyler O’Neil also wrote that: “BlackRock’s pledge as a member of [the climate groups] is to force companies to disclose targets for net-zero emissions for environmental and political reasons (limiting warming to well below 2°C), without regard to materiality to the particular company’s financial performance…” MHProNews has periodically raised the issue of materiality under SEC and other legal requirements.

With that brief preface in mind, in no particular order of importance are the following items to consider.

1. The Daily Signal’s O’Neil may have indeed raised several issues with respect to this new case against BlackRock that could have rippled effects in the U.S. generally and manufactured housing specifically. Recall prior reports on legal concerns with respect to BlackRock, including those linked below.

2. So, unlike any other known publisher or blogger in the arguably artificially smaller world of HUD Code manufactured housing trade media, readers here at MHProNews have been previously advised about legal issues involving BlackRock that make this suit by TN AG Skrmetti seem quite common sense.

3. Indeed, while Skrmetti and his aligned associates merit a measure of public kudos for this bold step, because it is no small thing to file suit against “one of the world’s largest investment-management firms…” it could well hold several implications that will be explored in this focused segment.

4. One should ponder that remark with respect to the allegations of deception, fraud, and various antitrust violations that the Manufactured Housing Institute (MHI) is accused of in the deep dive report linked below.

5. While two antitrust suits pending against several MHI members has been requested to be merged into one, at least one more national class action complaint has been filed. MHProNews and/or MHLivingNews plan to report. While some in MHVille have attempted to downplay or explain away the legal actions occurring in manufactured housing, MHProNews – in reports like the one below – provides the links to several complaints, and considers the weaknesses in the arguments made by Dr. Cody Dees or others that seem to operate in the MHI orbit.

6. Pivoting back more specifically to the TN AG’s suit, the pleadings by Skrmetti linked above said in part: “BlackRock may point to its various recent disclosures where it purports to exercise independence as it relates to its fiduciary duties. Such claims are not only misleading but are contradicted by other public statements.” That begs the question. How often has MHI issued such contradictory remarks?

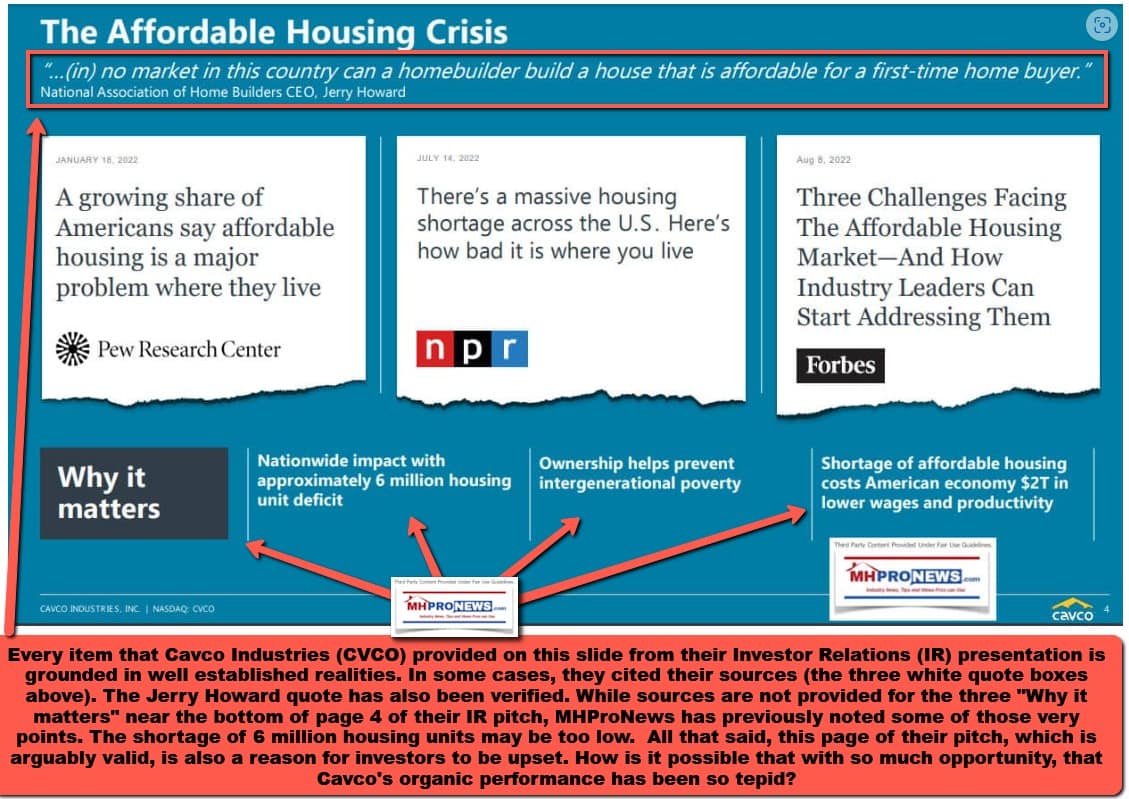

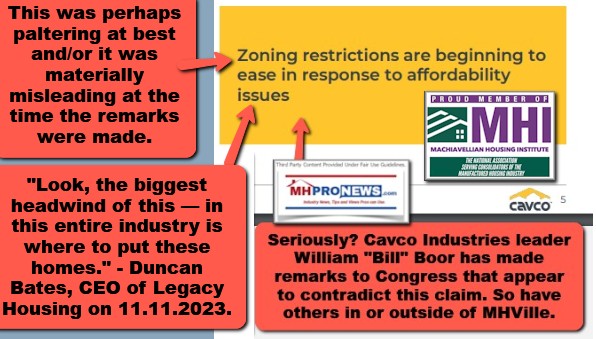

7. Or how often have MHI member firms, such as Cavco Industries, made similarly contradictory remarks and moves? For example.

Consider William “Bill” Boor’s remarks to Congress on 7.14.2023 and juxtapose them with his firm’s stance and published remarks about their ESG investing. Aren’t those similarly contradictory?

Furthermore, to the extent that those remarks by Boor to Congress were made on behalf of MHI, can’t a similar concern be raised about how Flagship Communities (or others…) ESG pitch fit such a seemingly contradictory pattern?

8. MHProNews stated just over a year ago that manufactured housing had apparently become ‘a target-rich environment’ for legal action. That prediction has seemingly been coming to pass as legal events for months has illustrated.

9. There is an evidence-based case to be made that specific activity involving Berkshire Hathaway (BRK) owned brands has violated antitrust and other laws. Those purported antitrust violations, per the legal research by Samuel “Sam” Strommen at Knudson Law, who per his profile on LinkedIn is now an Associate Attorney with Goodsell Oviatt Law Firm in Rapid City, South Dakota 12, involve “felony” antitrust allegations.

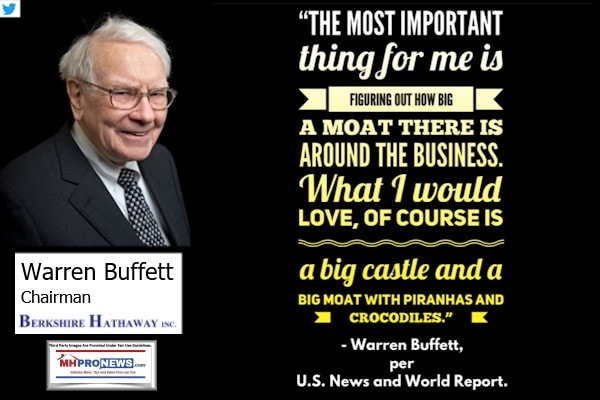

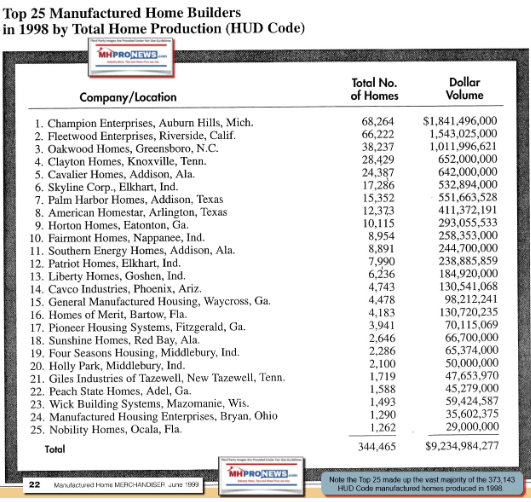

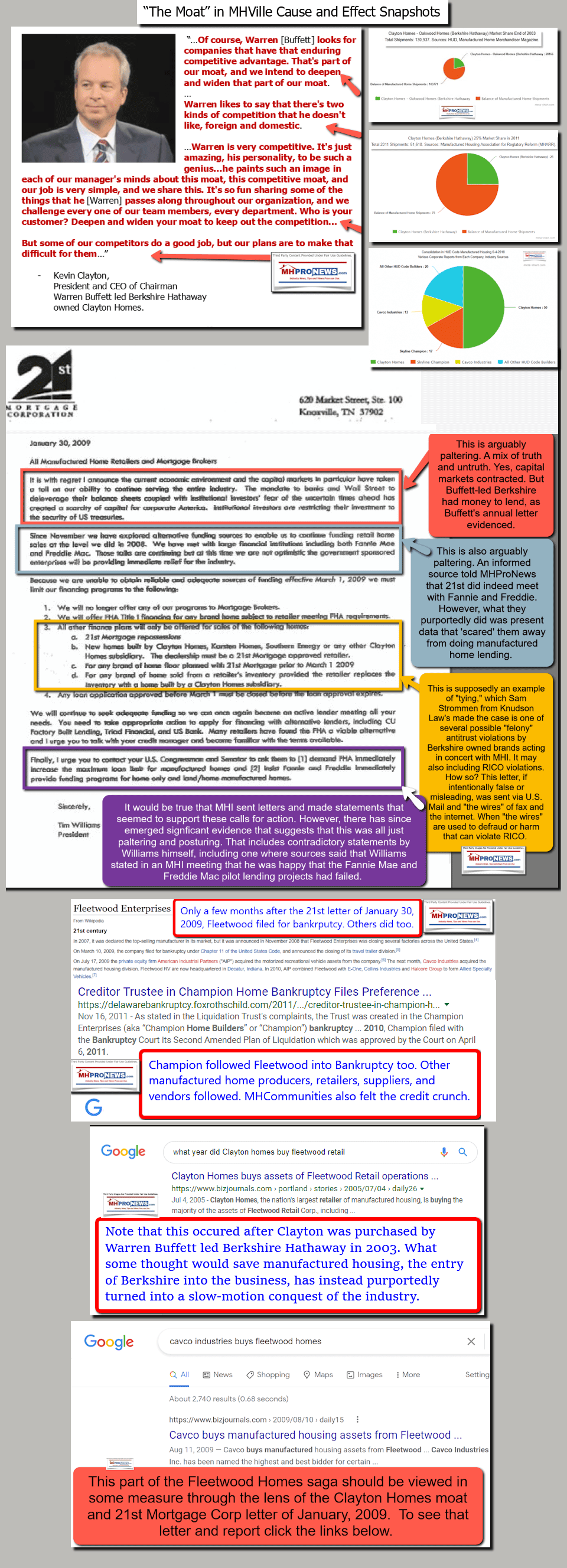

10. Much of the history of manufactured housing in the 21st century should be viewed through the lens of the timing of Warren Buffett’s plunge directly into manufactured housing and what has occurred in the manufactured housing market since that entry of Berkshire into direct manufactured home business ownership.

11. Without claiming or implying any crystal ball or ability to discern the future, it would now seem that part of ‘what’s in store for 2024 in MHVille’ could very well be still more legal action. Let’s not forget what happened with the SEC and Cavco Industries, which was previously led for years by a Clayton Homes (BRK) division president, Joseph “Joe” Stegmayer. Stegmayer also served as a chairman for MHI’s board of directors.

12. Several of the firms that are dressed up by MHI’s arguably deceptive ‘awards program‘ have, per the insights gleaned from Indeed reviews and other sources, apparently large numbers of employees that don’t think well of their respective employer’s business practices. Note that since the report below was produced, Havenpark reported has exited MHI membership.

13. Then there are the insights from Minneapolis Federal Reserve economic researcher James “Jim” Schmitz Jr. and his collogues into what they call sabotage monopoly’ tactics. Schmitz et al have explained that they don’t mean monopoly in a single dominating firm in an industry, nor in the duopoly sense. But rather, what Schmitz et al have explored is how a limited number of firms and/or trade organizations representing those firms can influence a market in harmful ways to the public interest.

14. No two sources, like no two people, think precisely the same way. One person or source presents information in a different way than another might. It takes a measure of patience to first seek to understand what a person, organization, or entity is presenting. Once understood, does their information or arguments hold to closer scrutiny?

15. On larger, often complex issues, insights from a variety of sources should be gathered together and compared. How do the various sources line up, or not? Where is there overlap or agreement?

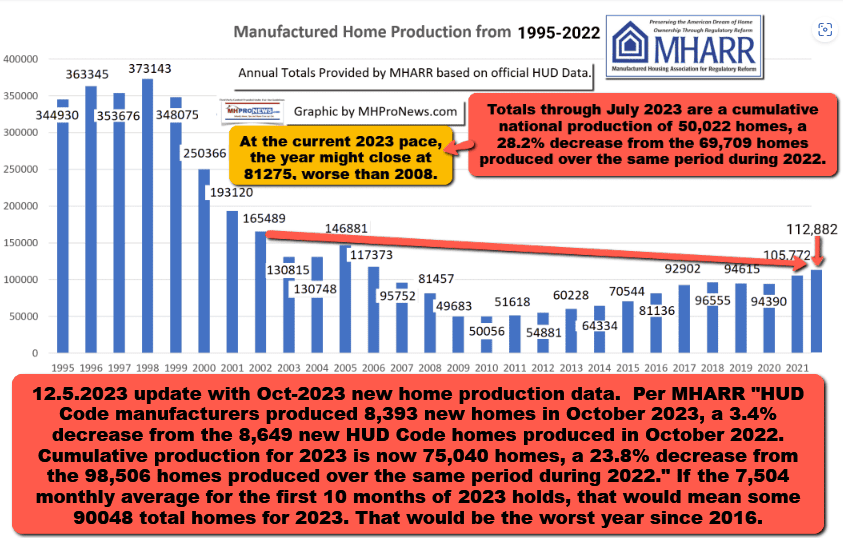

16. It was through such a painstaking process over the years that MHProNews finally pieced together the insights that have resulted in our fact- and evidence-based view of what has gone wrong in HUD Code manufactured housing. What is certain is that the industry has never returned to the production level that it had prior to Warren Buffett led Berkshire Hathaway’s entry into the industry.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

17. It is simply not plausible that manufactured housing would be operating at such a low level unless the ‘giants’ involved in the industry want the industry underperforming for their own purposes. Those purposes include, but are not limited to, consolidation of the industry. Barriers of entry, persistence, and exit are methods that can be utilized to keep competitors out, limit competition from existing firms, and with ‘sabotaging’ tactics of various types, allows firms to often be acquired at a reduced valuation. Anyone seeking to truly understand what has occurred in manufactured housing in the 21st century should carefully ponder the words and implications that follow in the light of a slow motion monopolization that at times yields rather rapid results in terms of consolidation too.

18. When Buffett bought into Oakwood (2002) manufactured homes vertically integrated operation, and then the next year acquired Clayton Homes after what Clayton Homes CEO Kevin Clayton called an “ugly” legal battle, the Clayton-Oakwood combination when from the #3 and #4 producers of HUD Code manufactured homes to become the biggest producer in a steady process that was accelerated during the aftermath of the financial crisis. But it was a purported antitrust violation, per Strommen, that much of that consolidation occurred. Once giant companies in manufactured housing went bankrupt when lending ‘dried up.’ If it had been normal market conditions that caused a failure, well, that’s the risk of free enterprise. But if the financial crisis was used as cover for a clever scheme to pull lending from brands that Berkshire Hathaway owned Clayton and 21st Mortgage Corporation ‘targeted, then Strommen’s concerns make sense in the legal sense for a possible antitrust violation. It shouldn’t require any more than one source with legitimate evidence of the violation of a law to cause public officials to take action. That said, in the case of antitrust concerns, there are several sources from inside and outside manufactured housing that have raised the concerns. Those sources span the left-center-right divide. This isn’t political, it is about evidence and law, though there are doubtlessly political implications.

19. During the Trump Administration, sources deemed reliable advised MHProNews that Makan Delrahim pulled together some antitrust attorneys to consider a probe of Clayton Homes and their lending. If Trump had remained in office, would such a case involving Clayton Homes and others have advanced? Or is such a probe still underway at DOJ? Those are not known at this time.

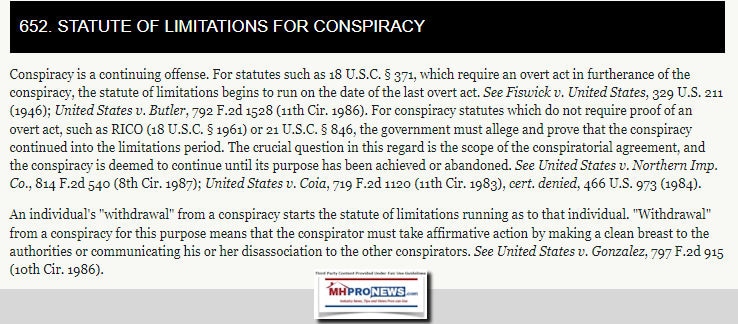

This writer was NOT involved in that asserted meeting with Delrahim and the related antitrust discussion. But if someone probing antitrust concerns had asked this writer were the antitrust violations a one time or ongoing issue, this writer would allege that Clayton’s/21st’s/BRK purported violations it is part of an ongoing pattern. That pattern appears to involve a conspiracy. Those are important details. Why? Because if a conspiracy is involved then the statute of limitations does not begin to run until the final act in that conspiracy occurs. Even then, legal experts have told MHProNews, that there are exceptions to the statues of limitations rules. The bottom line is that purported ‘tying’ and other possible legal violations that appear to have occurred in manufactured housing.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

20. It isn’t just Clayton Homes and 21st Mortage Corporation that are involved in such a case that legal researcher Strommen alleged involves MHI. Equity Lifestyle Properties (ELS) owns Datacomp. Datacomp, ELS, and other MHI members have been hit with national antitrust complaints. There are numerous ‘victims’ to such a purported conspiracy, especially since this involves affordable housing, which is in short supply all over the country. Homelessness is on the rise, despite record spending. The mood of the country in terms of opposition to antitrust violators is growing, per recent polling. The desire for YIMBY policies vs. NIMBYism is also reportedly on the rise.

21. The nation appears to be increasingly aware of the various factors that are undermining our society. That awareness is coming from across the left-center-right spectrum. Given the dire need for affordable manufactured homes, the time for a national case on the production/retail/finance side of the equation is now. The need for public officials, not just private attorneys, to be involved is genuine. Ironically, part of the rationale ought for such a case ought to come for reasons Cavco Industries (CVCO) has pitched to their investors. The flip side of the need and harms from a lack of affordable housing is that those who have undermined the system should be authentically pursued with vigor.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

When the various federal laws that are apparently not being properly enforced that could dramatically boost manufactured housing are understood, then the undermining of manufactured housing by those who are not enforcing those federal laws becomes more apparent. That was in the backdrop of arguments by Strommen, Ryan, and others. This case by TN’s AG against giant BlackRock may bode well to encourage some public officials to get the chutzpah needed to pursue cases involving large firms in manufactured housing. In 1998, Oakwood Homes and Clayton Homes were #3 and #4. In 2002, Berkshire acquired an interest in Oakwood. In 2003, Berkshire acquired Clayton Homes and their lending (see bullets and links above). Champion and Fleetwood went into bankruptcy in 2009.

> “What year did Fleetwood Enterprises and Champion Enterprises go into bankruptcy? Was it 2009? On what date did they file?

Learn more

22. With the bankruptcy filing dates of Champion and Fleetwood in mind, look at the date from the letter issued by Tim Williams, then and now president and CEO of Clayton Homes sister brand and Berkshire Owned 21st Mortgage Corporation. Note that Williams served as MHI chairman for some time.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

23. This Q&A with Bing AI sheds added light on these 21st century trends, and how it all happens to occur after the 21st letter and its apparently harmful impacts above.

> “Sheelah Kolhatkar wrote for the New Yorker that manufactured home communities has become a ‘feudal system.’ The Private Equity Stakeholder Project (PESP) identified several firms that are steadily consolidating the manufactured home industry. The Lincoln Institute said that the GSEs have turned the Duty to Serve Manufactured Housing on its head, turning manufactured home communities from affordable housing to far less affordable housing. Reports on MHProNews and MHLivingNews have identified those reports and others to establish an evidence-based case that manufactured housing consolidation following the financial crisis has made manufactured home community living less affordable, correct? Can you provide summaries of reports by Kolhatkar, PESP, Lincoln Institute, and others that indicate that following the financial crisis that the consolidation of manufactured home communities accelerated?”

Learn more

24. MHLivingNews identified over 4½ years ago the connection between firms named by John Oliver’s satirical slam of Buffett-led Berkshire Hathaway owned Clayton Homes, and several of the other firms named in that report, and membership in the Manufactured Housing Institute (MHI).

25. Once previous and new tipsters involved in manufactured housing helped the leadership of MHProNews better understand the apparent sham of MHI, clarity on why the industry was underperforming began to arise. This writer was a multi-year former MHI member, elected by my peers to sit on the Suppliers Division board of directors at MHI. While I tended to agree more with the Manufactured Housing Association for Regulatory Reform (MHARR) then MHI, even though I was an MHI member. As our critiques of MHI began to grow, MHI leaders began taking steps to apparently marginalize this writer and our firm. Over time, they finally decided the remove our firm from membership, via an unsigned letter that cited an apparently spurious reason to end our membership (‘there is no such membership category at MHI,’ (i.e.: for a trade publication). It didn’t matter that we pointed out that our firm did consulting and marketing, which others involved in similar work as our firm were retained as members, even though they too did blogging or trade publishing). But the 21st Mortgage letter by Tim Williams, the base document in #22 above, was in hand, that is when several of the puzzle pieces began to take shape. Despite being a well-regarded speaker and presenter, despite the praised work done to revive the once defunct Louisville Manufactured Housing Show,

This writer for MHProNews went from being praised and embraced to being marginalized and then ejected from MHI. Later, other industry events barred this writer, without specific written cause. Was it merely a coincidence that those steps against our firm and this writer began after we began to more sharply question and critique what was occurring with certain MHI brands and behaviors that were undermining manufactured housing industry performance? Put differently, there has been an array of costs and harms that could be asserted based on evidence of how this apparently antitrust law violating behaviors have impacted us personally and professionally. That’s not to mention the thousands of once independent businesses that now no longer exist and/or who sold out – in several cases – to the very people that harmed their firm and/or put them under in the first place. Nor does that mention the hundreds of thousands, perhaps a million or more individuals, who live in a land-lease community that have been harmed by “predatory” business practices.

26. MHI leaders, including attorneys, were asked about several of these matters raised in #25 and other parts of this report in an email on 12.7.2023. Almost two weeks have elapsed. Still no response. But we know from informed sources that the messages were received. Indeed, it is examples such as those shown below that may help explain why we were barred in the first place. If so, an array of civil rights violations could apply. But that’s said in part to say we have walked the walk with those who have been harmed by the practices that have become all too common in the manufactured housing industry.

28. There may be more evidence for this problematic and vexing set of concerns than existed for several of the high-profile corporate corruption cases.

Stay tuned for more from behind and in front of the curtains, often only found on MHProNews. ##

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the morning of 12.18.2023