In recent years, once monthly the Texas Real Estate Research Center (TRERC) collaborates with the Texas Manufactured Housing Association (TMHA) to issue a report that when pressed by MHProNews, their publishers admitted was a ‘sentiment’ survey. Sentiments are moods or opinions, which may or may not be grounded in facts. The reasons why someone issues a sentiment that may not comport with reality can be simple. Someone or some organization may have an apparent or unstated agenda. A sentiment survey may be one of several possible vehicles for sharing an agenda-driven message. If that sounds skeptical of TRERC and TMHA’s sentiment report, new and longer-term readers should know that examples of reports that proved to be factually incorrect, misleading, a distraction or whatever similar phrase might seem appropriate have been published. Before diving into the TRERC report for January 2024, consider the following example to illustrate the point.

11 months ago, TRERC-TMHA proclaimed that the manufactured home industry in Texas, the number 1 state in the U.S. for production and shipments of new manufactured homes was ‘ready for a rebound.’ As longtime and detail minded readers know, the industry has been in a now 13-month downturn as measured in year-over-year drops in the monthly production of new HUD Code manufactured housing. That pattern has largely held in Texas and most other states. But as the facts since their ‘Ready for a Rebound’ report (see Part II below) reflected, manufactured housing in Texas and nationally didn’t rebound. That downturn in Texas – and nationally – continued.

With that focused 255-word preface, Part I is the monthly TRERC January 2024 report. Additional facts and analysis will follow in Part II.

Part I

Texas housing manufacturers bullish heading into 2024

COLLEGE STATION, Tex. (Texas Real Estate Research Center) – Texas manufactured housing activity ended the year on a positive note with nine consecutive months of production increases, according to the December Texas Manufactured Housing Survey (TMHS). Backlogs decreased for the second straight month, and the industry is well positioned for a springtime surge in activity.

“The fourth quarter marked the first time that Texas’ aggregate inventory appears to have risen since the end of 2022, indicating that the seasonal pattern of inventory buildup by retailers from the fall through February could be normalizing,” said Rob Ripperda, vice president of operations for the Texas Manufactured Housing Association. “Nobody would call 2023 a good year for manufactured home production when looking at total shipments, but manufacturers weathered the storm brought on by interest-rate hikes and are entering 2024 with backlogs of around six to seven weeks.”

Although the TMHS new-orders index fell for the second straight month, the six-month sales expectations measure reached a record high heading into 2024.

“Retail sales have reliably jumped higher in March for the past decade, and a rise in production has coincided with that seasonal increase in demand,” said Ripperda.

In addition to stimulating sales volume, lower interest rates will result in upward price pressure.

“Prices received for finished homes have declined rather steadily over the past 18 months,” according to Wes Miller, senior research associate at the Texas Real Estate Research Center (TRERC). “Lower rates will loosen budget constraints and spur demand for housing. On the supply side, housing manufacturers are confident that the cost of raw materials and labor will increase during the first half of 2024, applying additional upward pressure on prices.”

The health of supply chains could play an important role in determining production and prices.

“Last month, supply chain costs were low and relatively stable, and the primary concern was drought-related constraints at the Panama Canal,” according to Harold Hunt, Ph.D., TRERC research economist. “In the last 30 days, however, attacks on shipping in the Red Sea have sent spot container rates soaring. The Shanghai Containerized Freight Index (SCFI), a key spot rate indicator for the shipping industry, rose 40 percent in the last week alone.”

Manufactured-housing supply chains have exhibited signs of volatility over the past eight months after recovering from COVID-19-related disruptions, but TMHS respondents expect disruptions to dissipate despite geopolitical strife.

“Although costs are currently climbing, total imports to Houston rose almost 30 percent in December from the November level based on data from logistics provider Descartes,” said Hunt.

Geopolitical headwinds and domestic election-year concerns weighed on the TMHS uncertainty index but failed to curb respondents’ optimistic outlook for the first half of 2024.

—30—

Part II – Additional Information with More MHProNews Facts and Analysis in Brief

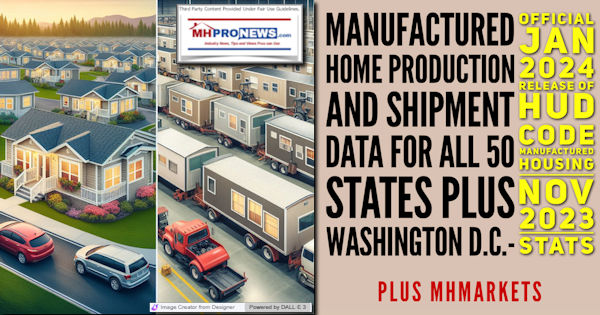

Per the official data gathered on behalf of the U.S. Department of Housing and Urban Development (HUD) by the Institute for Building Technologies (IBTS) are the following data points for the various months in question in Texas in 2023. National and other state data are found linked further below in Part III among our headlines for the week in review.

2023 Shipments by month then Production by month.

(SW = Single Section or a.k.a. “Single Wide”) (MW = Multiwide or a.k.a. ‘double wide.) Total of SW and MW.

Month | State SW MW Total | Production SW MW Total

11.2023 Texas 636 752 1,388 Texas 867 874 1,741

10.2023 Texas 638 755 1,393 Texas 966 885 1,851

9.2023 Texas 607 678 1,285 Texas 990 763 1,753

8.2023 Texas 691 706 1,397 Texas 1,086 800 1,886

7.2023 Texas 510 539 1,049 Texas 704 636 1,340

6.2023 Texas 646 776 1,422 Texas 916 865 1,781

5.2023 Texas 607 741 1,348 Texas 897 838 1,735

4.2023 Texas 477 643 1,120 Texas 772 689 1,461

3.2023 Texas 595 712 1,307 Texas 856 761 1,617

2.2023 Texas 507 560 1,067 Texas 666 594 1,260

1.2023 Texas 521 560 1,081 Texas 719 605 1,324

In no particular order of importance are the following insights from our analysis.

- TRERC said there was “nine consecutive months of production increases.” Perhaps they phrased that incorrectly, but taken literally, the data above proves otherwise. Production rose and fell several times over the course of 9 months. The same is true over the course of the first 11 months of 2023.

- Quoting TRERC: “The fourth quarter marked the first time that Texas’ aggregate inventory appears to have risen since the end of 2022, indicating that the seasonal pattern of inventory buildup by retailers from the fall through February could be normalizing” said Rob Ripperda, vice president of operations for the Texas Manufactured Housing Association. Those remarks may also suggest the oddity of the claims by TRERC and the point made in Part II Point 1 above. But the TRERC observation should be viewed through the lens of insights from retailers and other sources found in the 2023 retail related reports linked below.

3. TRERC said: “Although the TMHS new-orders index fell for the second straight month, the six-month sales expectations measure reached a record high heading into 2024.” That “new-orders index fell for the second straight month” also seems to contradict the facts shown above and underscored Part II Point 1 and the Texas 2023 data as shown.

When production orders fall, how can they have 9 consecutive months of increases?

Curious or perhaps technically true in terms of some sort of ‘sentiment’ (at best), but factually that seems to be a logically self-contradictory set of remarks in their January 2024 report.

4. In fairness to TRERC, in the “About the Survey” blurb that they send along with their monthly report has the following disclaimer. This disclaimer is posted after –30– which in media parlance (along with ## or ### ) usually means the end of a report or the end of a section of a report.

Per TRERC:

This monthly sentiment survey gauges current conditions and expectations surrounding Texas’ manufactured housing industry.”

That disclaimer this month, which may have appeared in some prior months since our raising this concern with them, is apparently the result of an exchange previously mentioned by MHProNews and TREREC.

TRERC, in response to our concerns that their sentiments seemed at times to contradict known facts said that they would begin to disclose that their report is in fact a sentiment survey. They have technically done so with their “About the Survey” statement. Unfortunately, their disclosure, because it follows their –30– is in a part of their monthly email that statistically many or perhaps most will never read or see.

5. Those points (Part II 1-4) noted, TRERC has begun to push their report back later in the month.

That gives them a potential opportunity to clarify and potentially improve the value and quality of their reports. Here is how.

The Manufactured Housing Association for Regulatory Reform (MHARR) gives publishers – which presumably would include TRERC – the okay to publish most of their news items so long as their contents are not changed, and proper link backs and credits to MHARR are provided. That reality means that there is no reason why TRERC doesn’t include MHARR’s data as part of their ‘sentiment’ survey. They are normally relatively short reports, perhaps 300 or so words (+/-). Should TRERC and TMHA do so, and MHARR agrees, their report team writers could compare FACTS – the hard data – with the ‘sentiments’ of firms that are often Manufactured Housing Institute (MHI) members.

Data and sentiments side-by-side could be far more useful to Texans and others who find their report potentially of interest. It would also save us the hassle of having to fact check their remarks for apparent disconnects. It is better for everyone, so long as TRERC, TMHA, and MHARR all agreed to it. This is our observation, not MHARR’s.

6. One might wonder what possible reason TRERC and TMHA might have not to include the MHARR data in their monthly report?

Simply put, it might be because there are some in MHI who may not be motivated to provide hard data and accurate information. MHI avoids it, as reporting in the week in review will reflect.

As TRERC’s report is currently structured in recent years those aggregated sentiments regrettably may allow the devious to slide in window dressing without having to document who reported what.

Once again, sunlight and transparency being good disinfectants means that this suggestion by MHProNews to include MHARR data monthly from TRERC and TMHA has potential upside for all honest providers of information.

7. Coal and diamonds are both made up of carbon. There are times that an uncut gem or two are proverbially hiding among lumps of proverbial coal.

Or to apply the insights from the Idaho National Laboratory: “Coal and diamonds are both composed of carbon. The two materials differ in their microscopic arrangement of atoms, and that leads to quite a difference in appearance, conductivity, hardness and other properties. As this shows, the microstructure of carbon-based materials is important.”

Meaning, details (the microstructure) matter. That’s an analogy for points 5 and 6 that are based upon science.

8. Moving beyond proverbial coal, are some potential diamonds in the rough too from TRERC. Per their January 2024 report are these remarks: “The Shanghai Containerized Freight Index (SCFI), a key spot rate indicator for the shipping industry, rose 40 percent in the last week alone.” MHProNews has noted for years that manufactured housing producers who rely upon imports from China (or numbers of other countries) are asking for trouble. “Manufactured-housing supply chains have exhibited signs of volatility over the past eight months after recovering from COVID-19-related disruptions…” Those pull quotes underscore related points from MHProNews over the course of years. The factual and evidence-based report like the one below illustrates why imports from China (or most other countries) can be problematic. We’d editorially applaud that sort of factual insight from TRERC.

9. Their closing sentence gives no factual color behind their ‘sentiments’, but is apt.

To quote them: “Geopolitical headwinds and domestic election-year concerns weighed on the TMHS uncertainty index but failed to curb respondents’ optimistic outlook for the first half of 2024.” To learn more about those issues, see the reports for the week that was below. And don’t miss our postscript.

Per CNN

10. In a “Perspective” (meaning, an op-ed) published by CNN, it said the following. “The housing crisis will continue if Congress fails to address its root cause.” That specific remark is logically quite apt. While parts of the brief op-ed (Urban Institute) and Mark Zandi (Moody’s Analytics) are debatable and entirely fail to mention manufactured housing, other parts are spot on. Consider these pull quotes.

Parrott and Zandi said: “…it appears the housing solutions that dominate the package [provided by the Biden Administration and Democrats] are more focused on addressing the symptoms of this growing [affordable housing] crisis rather than its root cause.”

“However, Congress appears more focused on the havoc that the supply shortfall is wreaking than the underlying problem.” They cited various programs, including the voucher-subsidies programs.

“There is no doubt that the nation could readily spend all that and more [in increased spending] and still not close the shortfalls in public housing and voucher funding. But if policymakers don’t address the supply shortfall, they won’t deal with the underlying problem: that so many need subsidized housing in the first place.”

To that point in that CNN op-ed, their thinking was arguably a mix of hits and misses. Several interesting and apt points (like those in the pull quotes shown above) and then a few items that in our view might be less than relevant. However, most of their two paragraphs are arguably spot on. Here they are.

It will take years to climb out of a ditch that has long been in the making. And, in the meantime, we will no doubt need additional funding for housing assistance, like vouchers and public housing, to mitigate the ongoing harm. But, if we focus only on the symptoms of the supply shortfall, we will be forever burdened with them no matter how much we spend.”

Those could be drilled down to these points: [by focusing on] “increasing the supply of affordable housing, we would gradually see the growth in rents and home prices slow enough for wages to catch up. That way, fewer families need a subsidy to pay their rent, and more are able to buy their first home.” “But, if we focus only on the symptoms of the supply shortfall, we will be forever burdened with them no matter how much we spend.”

Those notions are spot on. CNN, as we have previously noted by citing independent and award-winning journalist Sharyl Attkisson’s left-right media bias chart, is a left-leaning news outlet. Let’s note that effective today, we are launching two updated graphics of left-center-right media bias that includes insights from AllSides and about Wikipedia and others too.

Returning to that op-ed published by CNN, a commentary carried by two reasonably well-known economic minds focusing on the housing crisis were talking openly to Democratic policy makers.

That CNN perspective was published on “October 27, 2021.” It featured the Build Back Better narrative popularized by World Economic Forum (WEF) leaders in places like the U.K. (United Kingdom of Great Britain and Northern Ireland), in the U.S. by Joe Biden, Canada and elsewhere.

WEF related observations are found in the headlines below. MHProNews and MHLivingNews were perhaps the only manufactured housing trade media in the U.S. that reported on Biden’s Build Back Better plans for housing and related domestic policy controversies. Not to brag, but once more our industry-focused trade publication has provided factually accurate and logically reasonable reports and analysis that may be weeks, months, or even years ahead of mainstream media. That’s not a slam on all mainstream media, as they often have well documented constraints that we don’t.

12. Failure to heed those reports, or the pull quote punchline shared above from Parrott and Zandi, resulted in skyrocketing housing costs. Conventional housing, and manufactured housing, both suffered.

Coincidences? While there are a variety of factors that came together to impact housing and manufactured housing in the U.S. in a downward trajectory, the arguably poor policies of the Biden Administration are among them.

That is a logical conclusion from the thoughts of Parrott and Zandi. Meaning, because the root issues of a lack of affordable housing supply was ignored, the obvious outcome was higher housing costs. But it would be remiss if MHProNews then failed to point out the numerous factors caused by MHI and/or some of their ‘big boy’ members. See the reports for the week in review to learn more.

Part III – MHProNews’ Sunday Weekly MHVille Headlines in Review

As was noted in Part II #9, quoting TRERC: “Geopolitical headwinds and domestic election-year concerns” are business realities.

Some people, including some professionals, may or may not like following political and economic events.

But on that point, TRERC is arguably correct. “Geopolitical headwinds and domestic election-year concerns” clearly impact businesses, including manufactured housing.

That is why MHProNews includes some reporting on topics like the WEF – which promoted the Biden-embraced and deceptively labeled “Build Back Better” agenda – along with other domestic policy, political, and economic policy stances. Big businesses have their own sources for such information. While the so-called ‘big boys’ of MHVille are among our regular readers of MHProNews, so are throngs of smaller independents.

Don’t miss the postscript.

With no further adieu, here are the headlines for the week in review, from 1.14.2024 to 1.21.2024.

What’s New on MHLivingNews

What’s New on the Masthead

Note the topic below is focused on MHI’s new events policy, their tacky happy holidays image is just used because the two appeared about the same timeframe. This is relevant 365 days a year, until their “outrageous” events policy is hopefully repealed or amended.

What’s New in Washington, D.C., from the Manufactured Housing Association for Regulatory Reform (MHARR)

Note: an informed source at MHARR tells MHProNews to expect a new item this week. Stay tuned.

What’s New on the Daily Business News on MHProNews

Saturday 1.20.2024

Friday 1.19.2024

Thursday 1.18.2024

Wednesday 1.17.2024

Tuesday 1.16.2024

Monday 1.15.2024

Sunday 14.2024

Postscript

TRERC mentioned the increase in shipping costs, provided in Part I and was cited as part of our Part II analysis. Imports are a significant factor in manufactured housing costs, because imports account for several items that go into HUD Code manufactured homes.

To TRERC’s point about COVID19, the declared pandemic did indeed contribute to ripple effects in the manufactured housing market. But it should also be recalled that COVID19 sparked an increase in interest by tens of thousands of Americans to leave cities for more suburban or even rural areas. That tees up the reason for this Q&A with Bing Copilot.

> “Shipping in the Red Sea has been disrupted and costs have gone up as a result of reported attacks by the Houthis, is that correct? But isn’t it also true that other brigands, such as Somali Pirates, operating off Africa, have also driven up shipping costs? And what is it that occurred that recently drove up shipping costs through the Panama Canal? Can you add some insights on the increase in shipping costs from various factors in recent months?”