Imagine for the next several minutes being in the position of one of the remaining manufactured home producing (building) independents in the manufactured housing industry. Many of those independents are not publicly traded. But Nobility Homes is a public company. That means that Nobility is traded ‘over the counter’ (OTCQX) under the NOBH symbol. Being publicly traded means that periodic financial statements are made. Those legal filings and remarks allow actual or potential investors – others too – to review the information that they share. In the press release that follows from Nobility Homes (NOBH), which includes comments from their President Terry Trexler, disclosures are made that are arguably best understood from the vantagepoint of a survivor in manufactured housing who has navigated the industry’s several challenges of the 21st century. As a survivor who can report ‘record sales’ in any respect with ‘no debt’ and tens of millions of dollars in liquid assets, that is quite an accomplishment, as will be briefly explored in Part II of this report and analysis.

Part I

Nobility Homes, Inc. Announces Record Sales for Its Fiscal Year 2023

Nobility Homes, Inc.

February 2, 2024

OCALA, FL / ACCESSWIRE / February 2, 2024 / Today Nobility Homes, Inc. (OTCQX:NOBH) announced record sales for its fiscal year ended November 4, 2023. Sales for fiscal year 2023 increased 23% to $63.3 million as compared to $51.5 million recorded in fiscal year 2022. For the fourth quarter of fiscal 2023, sales were $14.7 million as compared to $16.2 million in the fourth quarter of last fiscal year.

Nobility’s financial position during fiscal year 2023 remained very strong with cash and cash equivalents, certificates of deposit and short-term investments of $24.6 million and no outstanding debt. Working capital is $37.9 million and our ratio of current assets to current liabilities is 3.9:1. Nobility’s Annual Report on Form 10-K will be delayed because of the ongoing financial audit, whereby most of the remaining in-process audit procedures relate to the capitalization of costs in finished goods inventory.

Terry Trexler, President, stated, “The primary reason that sales increased in fiscal 2023 over fiscal 2022 was due to the severe supply chain challenges experienced during the first nine months of fiscal 2022 that negatively impacted our ability to complete and deliver homes to customers. During fiscal year 2023, the supply chain challenges eased compared to the prior year and we were able to complete and deliver more retail customers’ homes, which included us selling sixty-four new homes during fiscal year 2023 purchased for $10,871,250 from other manufacturers, to help reduce our backlog. We continue to experience limitations being placed on certain key production materials from suppliers, the delay or lack of key components from vendors as well as back orders, delayed shipments, price increases and labor shortages. These issues continue to cause delays in the completion of the homes at the Company’s manufacturing facility and the set-up process of retail homes in the field, resulting in decreased net sales due to our inability to timely deliver and set up homes to customers. We expect that these challenges will continue throughout fiscal 2024 and potentially beyond. The Company also continues to experience inflation in some building products resulting in increases to our material and labor costs which may increase the wholesale and retail selling prices of our homes.

The current demand for affordable manufactured housing in Florida and the U.S. is slowing, which we believe is because of the interest rate environment. According to the Florida Manufactured Housing Association, shipments for the industry in Florida for the period from November 2022 through October 2023 declined by approximately 16% from the same period last year.

Maintaining our strong financial position is vital for future growth and success. Our many years of experience in the Florida market, combined with home buyers’ increased need for more affordable housing, should serve the Company well in the coming years. Management remains convinced that our specific geographic market is one of the best long-term growth areas in the country.”

On June 5, 2023, the Company celebrated its 56th anniversary in business specializing in the design and production of quality, affordable manufactured and modular homes. With multiple retail sales centers in Florida for over 33 years and an insurance agency subsidiary, we are the only vertically integrated manufactured home company headquartered in Florida.

MANAGEMENT WILL NOT HOLD A CONFERENCE CALL. IF YOU HAVE ANY QUESTIONS, PLEASE CALL TERRY OR TOM TREXLER @ 800-476-6624 EXT 121 OR TERRY@NOBILITYHOMES.COM OR TOM@NOBILITYHOMES.COM

All sales numbers for the fourth quarter and fiscal year ended November 4, 2023, in this report are unaudited and subject to change because of the completion of Nobility’s audit. In addition, certain statements in this report constitute forward-looking statements within the meaning of the federal securities laws. Although Nobility believes that the amounts and expectations reflected in such forward-looking statements are based on reasonable assumptions, there are risks and uncertainties that may cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to, the potential adverse impact on our business caused by competitive pricing pressures at both the wholesale and retail levels, inflation, increasing material costs (including forest based products) or availability of materials due to supply chain interruptions (such as current inflation with forest products and supply issues with vinyl siding and PVC piping), changes in market demand, increase in interest rates, availability of financing for retail and wholesale purchasers, consumer confidence, adverse weather conditions that reduce sales at retail centers, the risk of manufacturing plant shutdowns due to storms or other factors, the impact of marketing and cost-management programs, reliance on the Florida economy, impact of labor shortage, impact of materials shortage, increasing labor cost, cyclical nature of the manufactured housing industry, impact of rising fuel costs, catastrophic events impacting insurance costs, availability of insurance coverage for various risks to Nobility, market demographics, management’s ability to attract and retain executive officers and key personnel, increased global tensions, market disruptions resulting from terrorist attacks or other events such as a pandemic, any armed conflict involving the United States and the impact of inflation.

SOURCE: Nobility Homes, Inc. ##

Part II – Additional Information from Nobility’s 2022 Annual Report and Other Information with Analysis in Brief

Given the delay in certain facts being reported, as explained by Nobility’s media release posted above, a reasonable way to explore their press release is through the lens laid out in the preface for this report and analysis. Namely, what does the world of U.S. housing in general, and manufactured housing in particular, look like to someone sitting at Terry Trexler’s and his key colleagues’ desks?

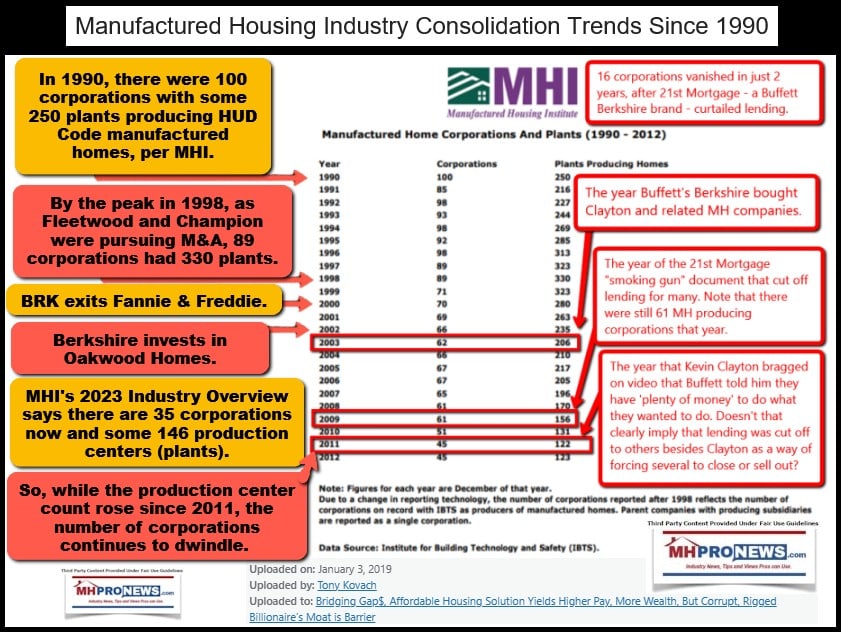

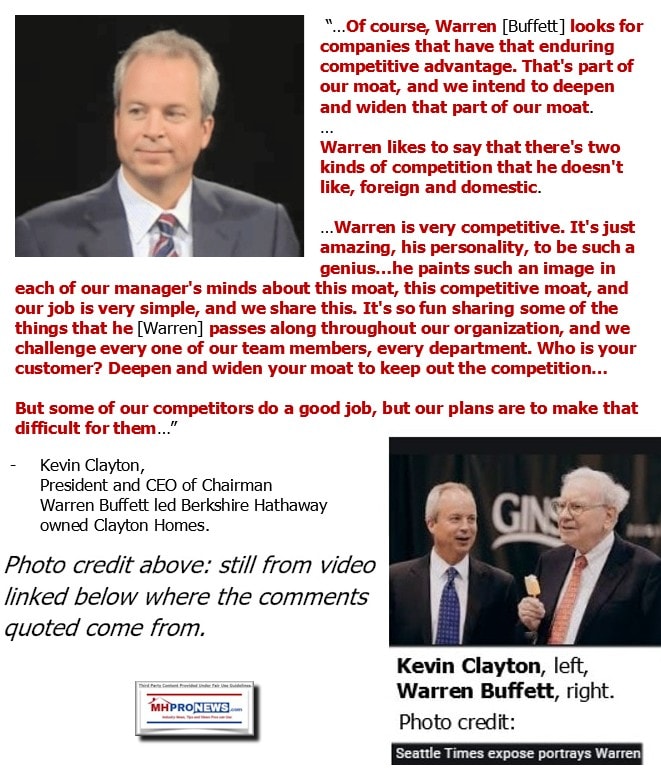

Manufactured housing is statistically an industry in decline compared to its last high in 1998. It is in decline since its last high of 2022. Kevin Clayton’s remarks in a video with pro-Warren Buffett interviewer Robert Miles is likely not lost on Trexler, nor for that matter, any other remaining producer of HUD Code manufactured homes. Look for a moment at the landscape painted by this document obtained from the Manufactured Housing Institute (MHI) website, of which to our knowledge Nobility Homes is not a member of that trade group.

The base document is from MHI. The call outs, arrows and other illustrations and remarks are by MHProNews.

In 1990, there were 100 corporations in the U.S. which represented 250 producing HUD Code manufactured housing building centers or “plants.”

By 1998, there were only 89 corporations, but there were 330 producing plants.

In 2000, the Manufactured Housing Improvement Act of 2000 is enacted. But it is also the year that Warren Buffett led Berkshire Hathaway largely exited their position in Fannie Mae and Freddie Mac, two stocks which Buffett had bragged over the years had made Berkshire a nice profit. The boom-bust of the conventional housing market had not yet occurred. But the early signs of the meltdown of HUD Code manufactured homes was already underway.

In 2002, Berkshire invested in then publicly traded but also bankrupt Oakwood’s vertically integrated manufactured home operation.

In 2003, Buffett led Berkshire bought out Clayton Homes, their affiliated lending became Berkshire owned, and they acquired the Clayton Homes portfolio of land-lease manufactured home communities (later spun off and which emerged in time as Yes! Communities, which Yes! still has strong ties to Clayton-21st Mortgage Corporation, etc.).

By 2003, with Fannie and Freddie’s pull-back from manufactured home chattel lending, there were 62 corporations and only 206 producing HUD Code manufactured home plants.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

By 2009, the year of the “infamous” Tim Williams/21st Mortgage Corporation letter to manufactured housing retailers, loan brokers, etc. there were only 61 plants and 156 manufactured home building centers or plants. One should recall, or know, that Warren Buffett’s annual letter apparently contradicted some of the claims made by Williams, see that report linked here.

During all of that time, Trexler at Nobility, along with dozens of other manufactured home industry independents were not only running their own operations. Those independents had to have one eye on this steady erosion of their once greater industry.

Fast forward to the MHI 2023 Industry overview. It says that there are now 35 corporations and 146 producing plants. In 2022, MHI reported in their document that there were 112,882 new HUD Code manufactured homes built.

As the Manufactured Housing Association for Regulatory Reform reported earlier this week on 2.5.2024: “Just-released statistics indicate that HUD Code manufacturers produced 6,360 new homes in December 2023, a .7% decrease from the 6,406 new HUD Code homes produced in December 2022. Cumulative production for 2023 thus totals 89,169 homes, a 21% decrease from the 112,882 HUD Code homes produced during 2022.

By contrast to 2023 totals, in 1998, the report linked here reveals that 373,143 were built by 89 corporations and 330 plants.

That outlines the facts and linked-evidence that Trexler and his team led-Nobility Homes, and several dozen remaining independents have to consider. Besides the need for disclosures to their shareholders, is it now clearer why their press release said: “Nobility’s financial position during fiscal year 2023 remained very strong with cash and cash equivalents, certificates of deposit and short-term investments of $24.6 million and no outstanding debt.”

If you had witnessed the demise and/or absorption of some 6o plus corporations and over 200 plants since their respective prior industry peaks in the 1990s, wouldn’t you be stressing “no debt” and “very strong with cash and cash equivalents, certificates of deposit and short-term investments of $24.6 million” too?

Of course.

Every single independent manufactured housing industry survivor merits a measure of acclaim.

Even numbers of independents who shuttered their doors rather than sell out to one of what today is called the Big Three merits a serious measure of respect. Not many can appreciate what they had to go through.

The day may come when the tables are turned. When being one of those independents who said “no” to Clayton Homes (BRK), Skyline Champion (SKY), or Cavco Industries (CVCO) are viewed as heroic and courageous figures. With the number of antitrust suits involving members of MHI and/or an MHI linked state association are growing,

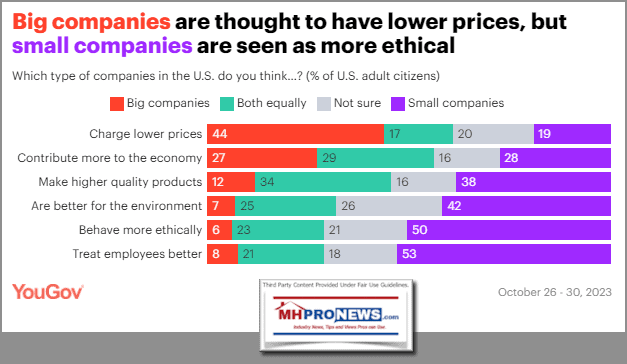

The mood in the country against corporate giants and the realization that oligopoly style monopolization is harming the nation is reportedly shifting.

There was a time when Bernie Madoff, Enron, WorldCom, or more recently, Sam Bankman-Fried (SBF) were thought to be untouchable.

MHProNews doesn’t claim to know what is actually going through the minds of Trexler, or others like him.

But that brief romp through some facts reflects reasons why they have done or do and why they merit a serious measure of earned respect. If not for those fighting in the trenches, while still serving their customer base, manufactured housing might be down to a half dozen firms or less. The treacherous waters in MHVille were aptly described by Warren Buffett himself.

So, here to those who have stood up to those moat-builders who have arguably decimated manufactured housing for their own reasons.

With those brief thoughts, given that more reporting and from Nobility are pending, let’s provide their 2022 letter to shareholders, which helps round out more corporate information.

Sales for fiscal year 2022 increased 14% to $51.5 million as compared to $45.1 million recorded in fiscal year 2021. Income from operations for fiscal year 2022 increased 37% to $8.4 million versus $6.1 million in the same period a year ago. Net income after taxes increased 34% to $7.2 million as compared to $5.4 million for the same period last year. Diluted earnings per share for fiscal year 2022 were $2.10 per share compared to $1.50 per share last year.

The demand for affordable manufactured housing in Florida and the U.S. is starting to reflect the increased interest rate environment by the Federal Reserve. Although net sales increased during the twelve months ended November 5, 2022, as compared to the same period last year, we continued to experience the negative impact of limitations being placed on certain key production materials from suppliers, the delay or lack of key components from vendors as well as back orders, delayed shipments, price increases and labor shortages. These supply chain issues have caused delays in the completion of the homes at the manufacturing facility and the setup process of retail homes in the field, resulting in decreased net sales due to our inability to timely deliver and setup homes to customers. We expect that these challenges will continue for the first six months of fiscal year 2023 or until the industry supply chain

normalizes. According to the Florida Manufactured Housing Association, shipments for the industry in Florida for the period from November 2021 through October 2022 were up approximately 23% from the same period last year.

Nobility’s financial position during fiscal year 2022 remained very strong with cash and cash equivalents, certificates of deposit and short-term investments of $21.1 million and no outstanding debt. Working capital is $33.7 million and our ratio of current assets to current liabilities is 3.3:1. Stockholders’ equity is $47.9 million and the book value per share of common stock increased to $14.22. Maintaining our strong financial position is vital for future growth and success. Because of very challenging business conditions during economic recessions in our market area, management will continue to evaluate all expenses and react in a manner consistent with maintaining our strong financial position, while exploring

opportunities to expand our distribution and manufacturing operations.

On June 5, 2022, we celebrated our 55th anniversary in business specializing in the design and production of quality, affordable manufactured and modular homes. With multiple retail sales centers in Florida for over 30 years and an insurance agency subsidiary, we are the only vertically integrated manufactured home company headquartered in Florida.

We gratefully acknowledge the Board of Directors, officers, employees and friends of the Company and express our appreciation for their dedication. Our appreciation is also extended

to our retail distribution network, customers and suppliers for their support and loyalty. We sincerely thank our stockholders for their continued investment confidence in Nobility and pledge our efforts to maintain and guard that trust. With this confidence and support, we enter fiscal year 2023 with full awareness of the challenging opportunities that lie ahead and with renewed enthusiasm and determination to achieve the goals for higher sales and operating results that have been set for your Company. ##

Some Prior Reports on Nobility Homes are linked below.

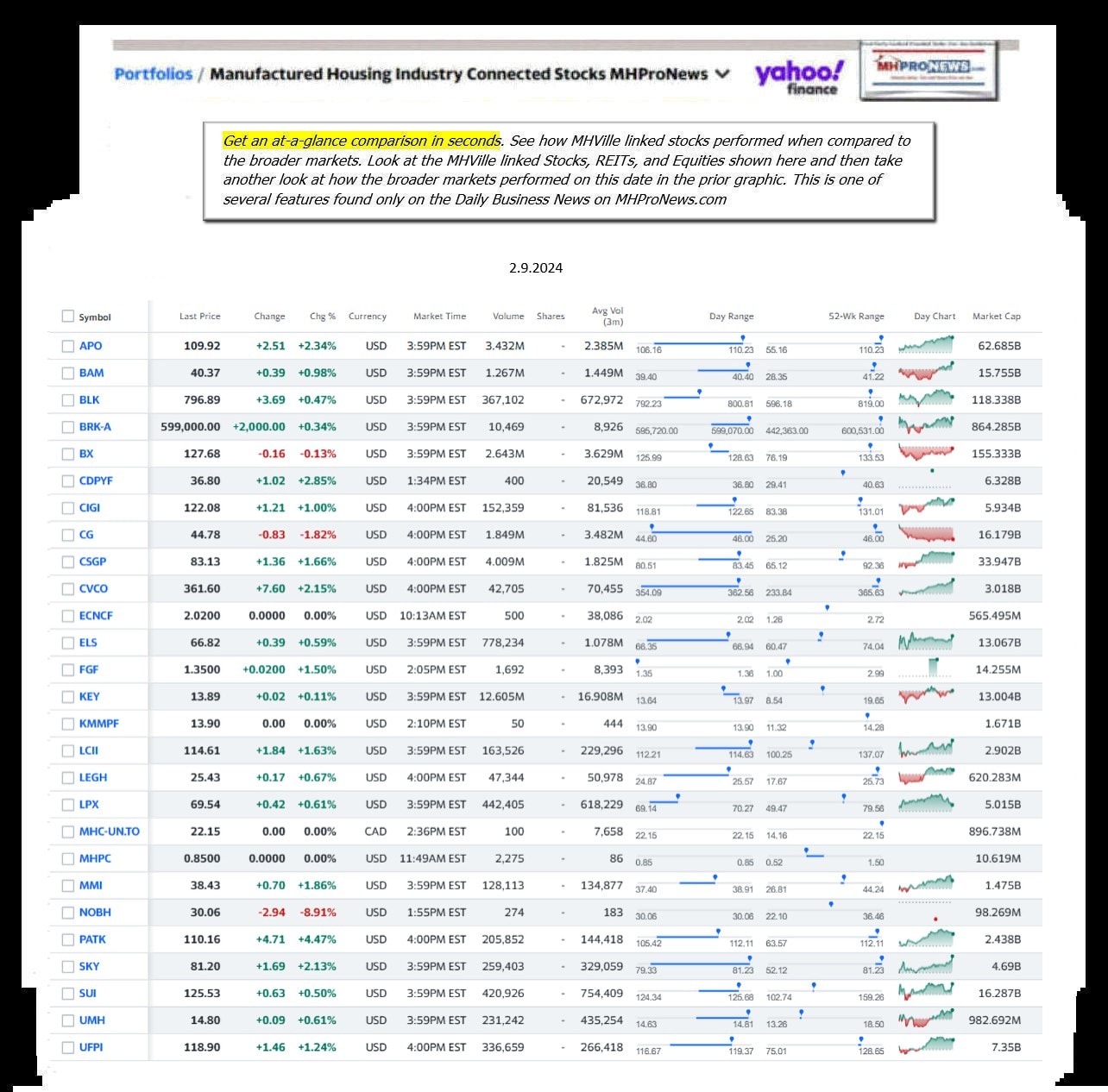

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from 2.9.2024

- S&P 500 closes above key 5,000 level for first time

- Hillary Clinton at a Columbia University panel about sexual violence against women during wars and conflicts on Friday, February 9.

- Hillary Clinton and Sheryl Sandberg decry sexual violence as a war tactic

- FCC votes to ban scam robocalls that use AI-generated voices

- Allegiant Stadium during NFL football Super Bowl 58 opening night Monday, Feb. 5, 2024 in Las Vegas. The San Francisco 49ers face the Kansas City Chiefs in Super Bowl 58 on Sunday.

- It’s not just Taylor Swift: Record number of private jet flights expected for this year’s Super Bowl

- Colin Jost hosts the 2023 PEN America Literary Gala at American Museum of Natural History on May 18, 2023 in New York City.

- ‘Saturday Night Live’ star Colin Jost selected as White House Correspondents Dinner headliner

- Michael E. Mann arrives at the H. Carl Moultrie Courthouse before his defamation case against Rand Simberg and Mark Steyn on February 5, 2024 in Washington, District of Columbia. The case, technically called Mann Vs. National Review et al although National Review and Competitive Enterprise Institute have since been removed as defendants from the case, continues in District of Columbia Superior Court.

- Climate scientist awarded more than $1 million in a lawsuit against conservative writers who defamed his work

- An employee of PT Unilever Indonesia arranges a health care rack at Foodmart Fresh supermarket in Jakarta, Indonesia, October 31, 2016.

- Unilever’s sales decline in Indonesia because of anti-Israel boycotts

- A Ford Mustang Mach-E is charged at a Ford dealership in Colma, California, on July 22, 2022.

- Ford says it has a ‘Skunk Works’ team trying to make lower-cost EVs

- Former TikTok executive sues the company for alleged gender and age discrimination

- $1 million in extra costs and weeks of delays. How the Red Sea crisis is upending global trade

- Prince Harry gets ‘substantial’ payout in phone-hacking case against UK tabloid, lawyer says

- Good news for the Fed: Revised inflation data confirms last year’s progress

- Meta removes Facebook and Instagram accounts of Iran’s Supreme Leader

- Zyn nicotine pouches are flying off shelves. Critics say they’re dangerous for kids

- How empty office space became the new bogeyman on Wall Street

- The dollar is back. It’s not all good news

- Huawei’s offices in France raided by financial prosecutors

- Here’s how to stream the Super Bowl on Paramount+ — even for free

- Celebrities are paid a shocking amount for 30-second Super Bowl ads

- Putin walks away with propaganda victory after Tucker Carlson’s softball interview

- Strong economic growth but high unemployment: a look at Nevada’s economy

- CEOs are feeling more confident about economy — and concerned about the election