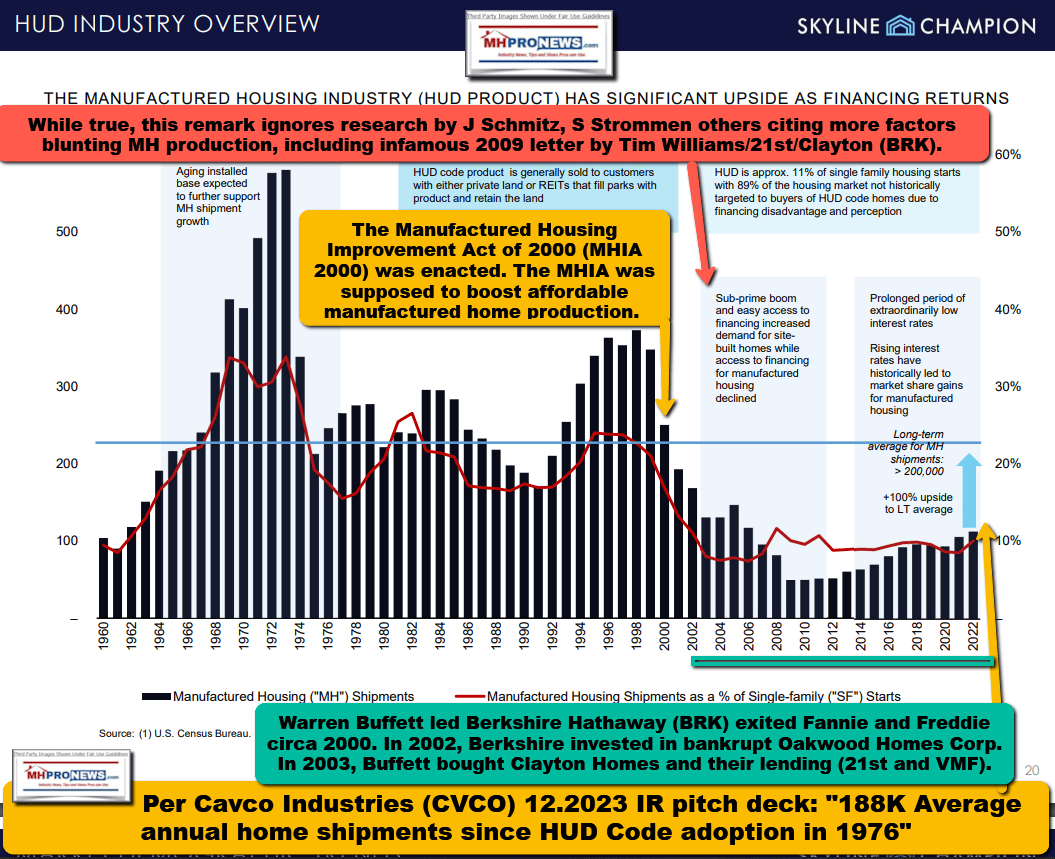

Starting on Sunday 3.24.2024 and again on Wednesday 3.27.2024, MHProNews identified two distinct Manufactured Housing Institute (MHI) member firms that per a reasonable application of financial news reports have had their valuations and operations arguably harmed by the apparent policies, actions/inactions advanced by key people in that trade group. Intentional or not, when UMH Properties President and CEO Sam Landy said in his remarks below that: “if we had received these homes in early 2022, our year-end revenue would have been $6.3 million higher” to some extent could join that club, despite UMH’s apparent years of support of MHI beyond their basic MHI membership dues. For numbers of firms in MHVille, $6.3 million dollars in more revenue is a big deal. Landy also said: “Our results for 2022 and the first half of 2023 were negatively impacted by our inventory issues.” That’s also apparently to the point of harm caused by ‘fellow’ MHI members that in many cases were potentially avoidable, per known information previously reported by MHProNews (see linked items herein below). As or perhaps more significantly, Sam Landy said about expansions and greenfield developing: “With the right time horizon, these investments significantly outperformed the acquisition of stabilized assets.” “We anticipate further improvements in our sales division as the demand for affordable housing continues, and the carrying costs of our inventory decrease.” Boom. Landy-led UMH, another MHI member firm, directly or indirectly reveals just how problematic stated or de facto policies (see Part II) of key MHI member firms are for many of their members, not to mention untold thousands of independents (past and present), hundreds of thousands of employees (past and present), along with millions of potential consumers of affordable manufactured housing, taxpayers, investors, and others.

Landy’s remarks on interest rates are noteworthy. They also broadly confirm observations reported by MHProNews about a year ago.

But UMH’s Chairman of the Board Eugene Landy’s remarks may merit a red-letter, gold lined quote-illustration. Eugene said as part of his remarks from their most recent earnings call transcript: “The parks [i.e.: manufactured home land-lease communities] are filling up. Our parks are filling up… And if you’re going to sell 100,000 homes in the nation, at that point, you’re going to have to build 100,000 more communities.”

For a variety of reasons, MHProNews has held off publishing this report longer than we normally would have. There is more to be unpacked in the often revealing remarks that follow. Several of these key points will be unpacked in Part II in our MHProNews analysis and commentary.

As MHProNews often does, certain remarks in what follows have been highlighted, but those yellow or aqua highlighted items should not distract the reader from digesting the entire contents of the statements that follow. Some of those highlighted items were cited above and/or will be cited further below in Part II.

Part I

UMH Properties, Inc. NYSE:UMH FQ4 2023 Earnings Call Transcripts

Thursday, February 29, 2024 3:00 PM GMT

S&P Global Market Intelligence Estimates

Call Participants

EXECUTIVES

Anna T. Chew

EVP, CFO, Treasurer & Director

Brett Taft

Executive VP & COO

Craig Koster

Executive VP, General Counsel & Secretary

Eugene W. Landy

Founder & Chairman of the Board

Samuel A. Landy

President, CEO & Director

ANALYSTS

Jeffrey Alan Walkenhorst

Copeland Capital Management, LLC

John James Massocca

B. Riley Securities, Inc., Research Division

Robert Chapman Stevenson

Janney Montgomery Scott LLC, Research Division

ATTENDEES

Unknown Attendee

Presentation

Operator

Good morning, and welcome to UMH Properties Fourth Quarter and Year-End 2023 Earnings Conference Call. [Operator Instructions] Please note, this event is being recorded.

It is now my pleasure to introduce your host, Mr. Craig Koster, Executive Vice President and General Counsel. Thank you. Mr. Koster, you may begin.

Craig Koster

Executive VP, General Counsel & Secretary Thank you very much, operator.

In addition to the 10-K that we filed with the SEC yesterday, we have filed an unaudited fourth quarter and year-end supplemental information presentation. This supplemental information presentation, along with our 10-K, are available on the company’s website at umh.reit.

We would like to remind everyone that certain statements made during this conference call, which are not historical facts, may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements that we make on this call are based on our current expectations and involve various risks and uncertainties.

Although the company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the company can provide no assurance that its expectations will be achieved.

The risks and uncertainties that could cause actual results to differ materially from expectations are detailed in the company’s fourth quarter and year-end 2023 earnings release and filings with the Securities and Exchange Commission. The company disclaims any obligation to update its forward-looking statements.

In addition, during today’s call, we will be discussing non-GAAP financial metrics. Reconciliations of these non-GAAP financial metrics to the comparable GAAP financial metrics as well as the explanatory and cautioning language are included in our earnings release, our supplemental information and our historical SEC filings.

Having said that, I would like to introduce management with us today: Eugene Landy, Founder and Chairman; Samuel Landy, President and Chief Executive Officer; Anna Chew, Executive Vice President and Chief Financial Officer; Brett Taft, Executive Vice President and Chief Operating Officer; Jim Lykins, Vice President of Capital Markets; and Daniel Landy, Executive Vice President.

It is now my pleasure to turn the call over to UMH’s President and Chief Executive Officer, Samuel Landy.

Samuel A. Landy

President, CEO & Director

Thank you very much, Craig. At this time in 2022, we were running out of homes to sell or rent, and we were hoping that our manufacturers could shorten the backlog, so that we could meet our occupancy and sales goals.

At this time in 2023, we suddenly had 1,300 new homes in inventory and had to set up those homes before they could be sold or rented. Now we are proud to report we rented or sold those homes. And obtaining homes for sale or rent has normalized, so we can again carry just-in-time inventory of approximately 400 homes.

Our results for 2022 and the first half of 2023 were negatively impacted by our inventory issues. With those problems behind us, we are back in a position to generate growth in revenues from new rental homes, home sales and rent increases. We made considerable progress executing our long-term business plan, which resulted in improved operating and financial results. We filled over 1,000 new rental homes and had a net increase in occupancy of 704 units or 210 basis points. This is the equivalent of building a 1,000-unit apartment complex in 1 year.

Additionally, sales increased by 23%. These newly occupied rental and sales units resulted in a 9% same-property income growth and 13% same-property NOI growth. The improved operating results are generating a meaningful increase in community value, which is being realized through our financing and refinancing efforts.

We are pleased to report another quarter of normalized FFO growth. Normalized FFO per share was $0.23 in the fourth quarter of 2023 as compared to $0.20 in the fourth quarter of 2022, representing an increase of 15%. This is the third consecutive quarter of sequential FFO growth. We believe that the company is well positioned for additional FFO growth, as we continue to improve our operating results.

Additionally, normalized FFO for the year was $0.86 as compared to $0.85 in the prior year. Our past work generates our current income, and FFO does not fully reflect the tremendous effort we are putting into our future results. Our 2,100 acres of vacant land, 3,400 vacant lots and 400 homes in inventory are all part of our efforts to generate future income.

Investing in value-add communities, expansions and greenfield development requires patient capital, as these investments take 3 years or more to produce accretive returns. With the right time horizon, these investments significantly outperformed the acquisition of stabilized assets.

UMH is carefully balancing the investment in new projects with earnings accretion, so that we can generate long-term shareholder value, while increasing short-term per share earnings. We have invested to date approximately $27 million with our partner, Nuveen, in developed and undeveloped lots that will not reach full occupancy for approximately 3 years.

We have approximately $40 million invested in 500 vacant expansion lots that will not be fully occupied for 3 years. We are working on 7 turnaround properties purchased in the last 2 years that will become accretive within the next 2 years. At any given time, UMH has $100 million or more invested that is not yet producing accretive returns. Our results are strong, but we continue to work to achieve even better results.

Our team did an exceptional job installing, renting and selling over 1,200 new homes this year. 1,040 of these homes are new rental homes, and 164 were new home sales. Net rental homes increased by 871 units, with the difference being rental home sales and home removals at recent acquisitions.

Our successful sales and rental programs generated a net increase in occupancy of 704 units, an increase of 210 basis points over last year. As we have discussed throughout the year, our financial results were impacted by the carrying costs associated with our unusually high inventory levels during the first half of the year. Moving forward, we anticipate our inventory being between 300 and 500 units as compared to 1,300 at the beginning of 2023.

Manufactured backlogs have been reduced to 4 to 8 weeks, so we believe we will be able to achieve similar, if not better, occupancy gains with just-in-time inventory.

Our same-property operating results demonstrate the success of our value-added business plan. We generally acquire well-located communities in need of repair with existing vacancies. As we improve the communities and make them desirable places to live, demand for sales and rentals increases.

In the fourth quarter, same-property income increased by 11% and same-property NOI increased by 19%. Same-property income for the year increased by 9% and same-property NOI increased by 13% or $12.2 million. These increases were driven by an increase in occupancy of 632 units or 310 basis points and are rent increases.

Our occupancy gains occurred throughout the year, but predominantly in the second and third quarters. Therefore, the annualized run rate effect of the revenue generated by these occupancy gains is not fully reflected on our financial results.

Our same-property revenue reported for the year was $182.9 million and $47.3 million for the fourth quarter, which annualizes to $189.2 million. Therefore, our annualized fourth quarter revenue is $6.3 million higher than our actual results for the year, meaning if we had received these homes in early 2022, our year-end revenue would have been $6.3 million higher. The gains made on the occupancy and revenue fronts position us for an even stronger 2024.

Our sales operation continues to profitably sell and finance homes. Gross home sales were $31.2 million as compared to $25.3 million last year, representing an increase of 23%. We sold 341 homes, of which 164 were new home sales averaging $138,000 per home sale, and 177 were used home sales averaging $48,000 per home sale.

We were able to achieve a 32% gross profit as compared to a 31% last year. We are proud to announce that with our $31.2 million in sales this year, we broke our previous all-time sales record of $28.1 million and exceeded our sales goal of $30 million. We anticipate further improvements in our sales division as the demand for affordable housing continues, and the carrying costs of our inventory decrease.

Our rental home portfolio continues to perform exceptionally well. We now own 10,000 rental units, of which 94% are occupied. We continue to experience 30% or less turnover per year, and our expenses are only approximately $400 per unit per year.

We anticipate adding another 800 to 900 homes next year. Backlogs from our manufacturers have returned to normal levels of 4 to 8 weeks, allowing us to no longer have to carry large amounts of inventory. This should help to reduce our interest expense and carrying costs, while allowing us to generate similar overall occupancy and revenue gains next year.

COVID caused manufacturing backlogs that increased the cost of each home, increased the amount of inventory we carried and increased many costs associated with carrying high inventory, but that is all behind us now.

We completed the construction of 216 expansion sites. These expansions are located in good markets in Maryland, Pennsylvania, Tennessee and Indiana and should generate profitable sales. Next year, we anticipate approvals to develop 800 sites and plan on developing approximately 300 or more sites.

2023 was a quiet year on the acquisition front. We acquired one newly developed community in Georgia through our opportunity zone fund. The spread between buyers and sellers resulted in a relatively muted transaction year in the MH space. We anticipate that a prolonged high interest rate environment may result in communities being available at more reasonable prices than the past few years. We are well positioned to execute on these opportunities when they arise.

We have 2 communities in Maryland under contract and anticipate closing on both in 2024. We are also evaluating several other acquisition opportunities and hope to grow our acquisition pipeline.

UMH owns a portfolio of 25,800 developed homesites situated in 135 manufactured home communities across 11 states. Additionally, we are a 40% partner with Nuveen Real Estate, which owns 2 communities containing 363 sites in Florida and 1 community that is under construction in Pennsylvania.

We have over 3,400 vacant sites to fill, plus 2,100 vacant acres of land that can potentially be developed into an additional 8,500 home sales. We can project that our $190 million rental revenue will grow 5% due to our rent increases. That amounts to $9.5 million in new revenue.

Additionally, we plan on installing and renting 800 homes in 2024, resulting in an increase in revenue of approximately $10 million. Also every 100 new homes sold should generate $10 million in additional gross revenue and $2 million in additional net income. We expect that in 2024, rental and sales revenue should be approximately $20 million higher than our 2023. Our accomplishments in 2023 and previous years laid the groundwork to make this possible.

And now Anna will provide you with greater detail on our results for the quarter.

Anna T. Chew

EVP, CFO, Treasurer & Director Thank you, Sam.

Normalized FFO, which excludes amortization and nonrecurring items, was $15.4 million or $0.23 per diluted share for the fourth quarter of 2023 compared to $11.3 million or $0.20 per diluted share for 2022, resulting in a 15% per share increase. Sequentially, normalized FFO increased from $0.22 for the third quarter to $0.23 in the fourth quarter, resulting in a 4.5% per share increase.

For the full year 2023, normalized FFO was $54.5 million or $0.86 per diluted share compared to $46.8 million or $0.85 per diluted share for 2022. We were able to obtain this increase in normalized FFO, despite our operating results being largely impacted by our investments to grow the company through value-add acquisitions and developments, inflation and rising interest rates on our short-term borrowings.

Rental and related income for the quarter was $49.2 million compared to $43.7 million a year ago, representing an increase of 13%. For the full year, rental and related income increased from $170.4 million in 2022 to $189.7 million in 2023, an increase of 11%. This increase was primarily due to recent community acquisitions, the addition of rental homes and an increase in rental rates.

Community operating expenses increased 5% during the quarter and 8% for the year. This increase was mainly due to our recent acquisitions as well as an increase in payroll, rental home expenses, real estate taxes, insurance, waste removal, water and sewer expenses.

Despite the increase in community operating expenses, community NOI increased by 18% for the quarter from $24.3 million in 2022 to $28.7 million in 2023 and increased by 14% for the full year from $94.8 million in 2022 to $108.4 million in 2023.

Our same-property results continue to meet our expectations. Same-property income increased by 11% for the quarter and 9% for the year, generating same-property NOI growth of 19% for the quarter and 13% for the year.

As we turn to our capital structure, at year-end, we had approximately $690 million in debt, of which $497 million was community level mortgage debt, $93 million was loans payable, and $100 million was our 4.72% Series A bonds. 90% of our total debt is fixed rate. The weighted average interest rate on our mortgage debt was 4.17% at year-end compared to 3.93% at year-end last year.

The weighted average maturity on our mortgage debt was 5.3 years at year-end and 5.1 years at year-end last year. The weighted average interest rates on our short-term borrowings was 6.98% as compared to 6.76% last year. In total, the weighted average interest rate on our total debt was 4.63% at year-end compared to 4.60% at year-end last year.

We completed the addition to our Fannie Mae credit facility of a pool of 8 communities totaling 1,280 sites for total proceeds of approximately $58 million. The addition is interest-only at a fixed rate of 5.97%.

These communities were acquired in 2012 and 2013. Our total investment in these communities, including capital improvements, is $52.2 million or approximately $41,000 per site. The community is appraised for approximately $108 million or $84,000 per site, reflecting an increase in value of $55.9 million or 107%. We utilize this capital to pay down our short-term borrowings, which resulted in increased earnings.

At year-end, UMH had a total of $290 million in perpetual preferred equity. Our preferred stock, combined with an equity market capitalization of over $1 billion and our $690 million in debt, results in a total market capitalization of approximately $2 billion at year-end as compared to $1.9 billion last year, generating an increase of 6%.

During the year, we issued and sold 9.4 million shares of common stock through our common ATM programs, generating net proceeds of approximately $145.8 million. The company also received $9 million, including dividends reinvested through the DRIP.

In addition, we issued and sold 2.6 million shares of our Series D preferred stock during 2023 through the preferred ATM programs, generating net proceeds of approximately $55.7 million.

Subsequent to year-end, we issued 1.2 million shares of common stock through our common ATM program, generating net proceeds of approximately $18.9 million. In addition, we issued 121,000 shares of our Series D preferred stock through our ATM program, generating net proceeds of approximately $2.7 million.

From a credit standpoint, we ended the year with net debt to total market capitalization of 31.3%, net debt less securities to total market capitalization of 29.6%, net debt to adjusted EBITDA of 6.2x and net debt less securities to adjusted EBITDA of 5.9x. Interest coverage was 2.7x, and fixed charge coverage was 1.9x.

From a liquidity standpoint, we ended the year with $57.3 million in cash and cash equivalents and $110 million available on our unsecured revolving credit facility, with an additional $400 million potentially available pursuant to an accordion feature. We also had $198.5 million available on our other lines of credit for the financing of home sales and the purchase of inventory and rental homes.

Additionally, we had $34.5 million in our REIT securities portfolio, all of which is unencumbered. The portfolio represents only approximately 1.9% of our undepreciated assets. We are committed to not increasing our investments in our REIT securities portfolio and have, in fact, continued to sell certain positions. We are well positioned to continue to grow the company internally and externally.

And now let me turn it over to Gene before we open it up for questions.

Eugene W. Landy

Founder & Chairman of the Board

UMH begins 2024 by reflecting on everything we accomplished in 2023 and setting our goals higher for 2024. We are proud that we installed and rented or sold over 1,200 homes in 2023. These new homes generated a 230 basis point increase in same-property occupancy, a 23% increase in gross sales of manufactured homes and a 13% increase in same-property NOI.

The occupancy and revenue gains position UMH to outperform the market in 2024. We plan on installing and renting 800 to 900 new homes, achieving our 5% rent increases, growing our gross sales and our sales margins.

We also intend to be active in the acquisition market, assuming attractive asset pricing and to develop 300 or more expansion sites. These items will help us to generate additional occupancy and revenue gains, thereby increasing earnings and property values.

We have a mission to provide the nation with high-quality affordable housing. We have made strides in executing this mission through the acquisition and rehabilitation of older communities, the development of expansion sites and new communities and our financing of home sales.

We have the best quality affordable housing at a price point that can’t be matched. The affordable housing crisis is only going to intensify, from single-family homebuilders pulling back resulting in fewer housing starts, mass migration to the United States and the obsolescence of the existing housing stock.

Our new manufactured homes sell for as little as $90,000 and rent for as low as $1,000 per month. These are prices that are unmatched by any quality competition in the market. Families with a household income of $40,000 can afford to either buy or rent a home in a UMH-managed community.

UMH operates our communities with a long-term business plan. We complete the necessary improvements, which results in a high-quality community with happy tenants. We treat our tenants fairly by limiting their rent increases to 5%, 6%, even though we may be able to achieve larger rent increases. These policies generate good relationships with our tenants, which results in lower turnover and turnover-related expenses.

UMH had a solid year on the financial and operating fronts. We believe that we have positioned the company to outperform in the coming years. As site and home rental income should continue to grow through our rent increases and improvements in occupancy, we should continue to increase the profitability of our sales operation.

We intend to acquire communities as they become available and develop new expansion sites in new communities. Our business plan has positioned the company with 3,400 vacant sites and 2,100 acres of vacant land that can be developed into additional sites.

Our vacant sites and land holdings have significant potential. As we fill the existing vacant sites and build more sites on our vacant land, these values can be realized.

We are pleased with the progress to date and look forward to furthering our mission and accomplishing our goals again in 2024. Congratulations to all our staff who have executed so well on our mission statement to provide quality affordable housing for the nation.

Question and Answer

Operator

[Operator Instructions] And our first question comes from Rob Stevenson of Janney.

Robert Chapman Stevenson

Janney Montgomery Scott LLC, Research Division

Are you seeing any uptick in bad debt on the rental units? The apartment guys have been getting a hit harder by various fraud schemes. Anything like that going on in your business these days?

Samuel A. Landy

President, CEO & Director

No. We keep a close eye on our receivables, and it’s in line with where it typically is, and it’s above 98%, I believe, in the 98.8% range.

Anna T. Chew

EVP, CFO, Treasurer & Director

Our bad debt and our write-offs are still at around the 1%. I mean, yes, the dollar value has gone up, but that’s because our rent roll has gone up. But again, it’s around the 1% range.

Robert Chapman Stevenson

Janney Montgomery Scott LLC, Research Division

And how does that differ between the rental units and the — and just the pad rentals? I would assume if somebody’s got a $50,000 or $75,000 house sitting on a pad, that they’re going to be much more inclined to pay the monthly rents and if they don’t have any skin in the game on a rental.

Samuel A. Landy

President, CEO & Director

No. The great discovery through COVID was that people appreciate the house we provide them at the price we provided. So to such an extent that even when they lost jobs during COVID, we maintained 95% rental occupancy and 98% rent collection. Because they’re only paying about $1000 per month for this great 3-bedroom, 2-bath house on a 5000-square-foot lot, they know if they lose this they go into a place that’s not as desirable that costs more. Therefore they do everything in their power to pay the rent. And so the great tests in our history, right?

So 2011, we began doing rental homes staring at just $100 per year and we proved to ourselves, our bankers and our investors that the income stream from rental homes is just as good as the income stream from resident-owned homes. Sam Zell said back in 1994 that there is nothing more stable than the revenue from a resident-owned home in a community. Well, after COVID, we proved that the rents on rental homes are just as stable as that revenue which is why we then went into acquisition mode in the South where there’s other forms of inexpensive housing. But because nobody on the rental front can compete with a factory-built home on a lot, we did more of those because we know, we’ll maintain 95% occupancy and 98% rent collection.

Robert Chapman Stevenson

Janney Montgomery Scott LLC, Research Division

Okay. That’s helpful. And can you talk about where you’re financing home sales today and how much of an impact 25 or 50 basis point change in rates is likely to have on incremental demand there?

Samuel A. Landy

President, CEO & Director

Well, so, first, the affordability gap widens as interest rates increase. So a $400,000 house becomes further out of reach to a significant part of the population as interest rates rise. And on a $100,000 house, even though you feel that increase in interest rates, it’s just not as great.

The size of the market that needs our product increases as interest rates rise. And the history of that goes all the way back to the 1970s when interest rates got to 18% in manufactured home, shipments got to about 400,000 units in a year. So the interest rates are a positive for us. We source our own financing. We provide the money to the company that approves the loans. And then we gauge what interest rate to charge our retail customer based on interest rates, and we’re currently —

Brett Taft

Executive VP & COO

New home sales, we’re currently at 7.5%.

Robert Chapman Stevenson

Janney Montgomery Scott LLC, Research Division

Okay. That’s helpful. And then last one for me. Can you talk a little bit about some of your larger ’22 acquisitions that had a bunch of upside potential from vacancy now that you’ve owned them for more than 18 months?

And specifically, I think Hidden Creek in Michigan and Fohl Village in Ohio, they were both sort of larger $20 million-ish acquisitions that were sub-80% occupied a year ago. Just trying to get a sense of how much upside has already been realized there on the revenue run rate and how much is left to come over the next, call it, 18 months.

Brett Taft

Executive VP & COO

Yes. Sure. Happy to address those communities specifically. So Hidden Creek in Erie, Michigan, has 351 sites. It was purchased with 220 occupied sites. Last year, we rented 54 new homes, which resulted in an overall increase in occupancy of 40 units.

So we still have plenty of runway to go, and we’ve proven that demand is very strong. So we anticipate a similar increase in occupancy here this year, with just-in-time inventory to limit the impact that interest expenses on floor plan had on overall operations.

And Fohl Village has been a very strong location, and we’re very pleased with the numbers. We haven’t implemented our rental home program the way we typically would because sales have been so strong. I believe we sold about 8 new homes last year and have very strong demand to continue to sell homes, and those are all very profitable sales.

So we’re closely looking at demand. Assuming sales traffic remains strong, we’ll probably continue to go in that route, while putting some rental homes in, but I wouldn’t expect an increase in occupancy of 40 units there this year.

The other acquisition from 2022, I’m sorry, we’re completing our initial improvements. That might be water or sewer line replacements, and we’re starting to get rental homes in. So that pool of assets still has quite a bit of upside.

Robert Chapman Stevenson

Janney Montgomery Scott LLC, Research Division

Okay. That’s helpful. I mean, just a follow-up on that, though. How are you guys thinking about, if you have the opportunity to sell a home and not have to buy the rental unit yourself and deal with that versus the upside from the rental unit?

I mean, what does the returns look like to you guys when you pencil out between selling a typical home on a site and just collecting the pad rentals in perpetuity versus having to outlay the cash for the rental unit, but then collecting a higher rent over that time period? How does that look to you guys when you think about that trade-off?

Samuel A. Landy

President, CEO & Director

Warren Buffett bought Clayton Homes to obtain the finance business. Rental homes are really the finance business. We own the home, and we rent it out year after year, increasing the rents 5%. It starts out earning about 9%, and that’s unlevered. And then it goes up from there as the rent increases occur. And these homes are going to last as long as any other home, so 50 years.

We sell homes because banks, investors like resident-owned homes and communities, but we’re building Memphis Blues as an all rental community. And we think we’re going to obtain a mortgage on both the land and the home from a government-sponsored entity.

And so we’re going to prove that horizontal apartments, communities with manufactured homes are the best way to build affordable rental housing. And we should be entitled to the lowest interest rates on what we pay the banks.

But comparing a sale to a rental, I can make the argument, we don’t even want to sell homes. But on the other hand, it benefits the resident. If a resident knows they’re staying 3 years or more, it benefits them to own a house because, then, they only receive the rent increase on the lot rent.

So if the lot rent is $500, they’re receiving a 5% increase on the $500 versus if they were renting the home for $1,000 a month, they receive 5% on the $1,000. So over a 5- to 10-year period, the person in a resident-owned home builds equity in the house. The house could be appreciating. It benefits them.

On the other hand, the rental home benefits us. That 30% turnover on the rental home allows us to mark the rent to market wherever we are, whereas when the resident owns the home, we’re probably only going to receive a 5% rent increase per year. So we receive better rent increases on the rentals, and I believe the rental homes are more profitable than selling the house and renting a lot.

But it’s still nice to gross $30 million. And on each additional $10 million in sales, we’ll have approximately 20% profit hitting the bottom line. So growing sales from $30 million to $40 million will be beneficial. I think it would be even more beneficial if we rented the homes, but because it benefits the resident, we continue to sell homes.

Operator

The next question comes from Jeff Walkenhorst of Copeland Capital Management.

Jeffrey Alan Walkenhorst

Copeland Capital Management, LLC

So great progress on — the underlying property fundamentals are among the best of any REIT that I’ve seen report recently, and the double-digit growth in same-store NOI is very, very compelling. I’m wondering, on the per share FFO growth, which also was strong in the fourth quarter, if that sort of operating leverage in growth might be expected for 2024.

And related to that, a big part of your business has been — the challenge has been the higher cost of funding because you do have significant growth opportunities that you’re investing in. So I was wondering if you can walk us through your sources and uses in the spreads, the expected returns on the large uses of capital that you expect and, again, how that might impact that per share growth for ’24.

Samuel A. Landy

President, CEO & Director

So it’s really remarkable, if you look back at our 2020 annual report, how similar the results are but how more of it hit on a per share level. But to the extent it didn’t hit on a per share level today, it’s strictly because of the problems we spoke about the first half of the year, carrying such inventory and needing to pay down the cost of that inventory through issuing equity.

But as you project forward, the purpose of that equity is to make more money. And these rental homes generate 9%. Additional lots generate additional income. Sales generate additional income. So you had a lag in 2023 caused by not having inventory in ’22 and too much inventory in early ’23.

But all of that’s behind us, so that’s why I look back at that 2020 annual report. Our cost of capital was high this year because of the low stock price. But despite it being high, it’s accretive and going to make money.

Eugene W. Landy

Founder & Chairman of the Board

If I could add the government-sponsored entities are a wonderful thing, for the housing industry. It enables people to buy houses and rent apartments for much less than they would otherwise. And it’s unique to the United States.

And we recently borrowed, I think it was $56 million, under 6% in a market where other companies are paying 9% for money. So our hats are off to the GSEs. And long term, we feel that we can get 60% of the value of our properties from the government-sponsored entities long term at low interest rates, and that will be the source of growth in the returns on our equity.

Anna T. Chew

EVP, CFO, Treasurer & Director

Having said that, I also want to mention that it is still a balancing act. The GSEs are lending to us because we’re a strong company. And so therefore, we always have to have that balancing act, whether it be 50% capital, 50% debt or whatever.

Right now, we’ve always been a conservative company. Our net debt to total market cap is approximately 30%, 34% right as of this moment.

So we are a strong company. We do need additional sources of capital because every year, we will need approximately $100 million to $130 million in new capital for our expansion programs, for our rental homes, for any — for the loans on the sales since we finance approximately 70% of them. So again, we will always need between $100 million and $130 million in additional capital.

Samuel A. Landy

President, CEO & Director

I just wanted to point out, we talked about the properties we refinanced this year. And so that $52 million in properties doubled in value over 10 years to $108 million, which is a 7.2% per year compounded return.

Additionally, those properties throw off about 7%, so you’re talking about 14% unlevered returns. So the capital we raised through the common ATM is invested in properties that you’re earning 14% on, so it has to be accretive.

Brett Taft

Executive VP & COO

And just to add to what everybody else said and going back to Sam’s initial comment about the same-property NOI returns from 2020, in 2020 and 2021, we had 8 consecutive quarters in a row where we had double-digit same-property NOI increases. We’re very pleased that this year, we were also able to achieve a double-digit same-property NOI increase.

And we look at our inventory and the locations and the demand, the rent increases we obtained last year with the increase in occupancy we obtained, we think that we’re on track to continue achieving similar returns going forward, maybe not quite double digit, but certainly high single digits.

Every quarter that goes by, we anticipate more of that getting down to the bottom line, as shown through our 3 sequential quarters of normalized FFO growth.

Jeffrey Alan Walkenhorst

Copeland Capital Management, LLC

So to summarize — that’s really helpful. To summarize, that operating leverage, I think you just pointed out, as you move through the year, should continue to be visible on a per share basis. And we would expect to see FFO per share growth in ’24 over ’23.

Samuel A. Landy

President, CEO & Director

Yes, exactly. You saw it in the fourth quarter. And so the first quarter should even be better, and that lines us up for our March Board meeting to discuss dividend increases.

Jeffrey Alan Walkenhorst

Copeland Capital Management, LLC

Okay. That was also my next question. So I know that you have been a consistent dividend grower. Is the objective to be consistent with your peers, Sun and ELS, where they do grow the dividend on a regular annual basis?

Samuel A. Landy

President, CEO & Director

Well, whether you’re running track or whatever you’re doing, you shouldn’t look back at the competition. So it has nothing to do with considering them, but it does have to do with considering our increase in property values, our increase in income, our increase in FFO and our projections for the future growth. And since all of those are positive, I tend to believe we will be able to seriously discuss dividend increases.

Good time to mention. I’ve mentioned it on the previous calls, but that land next to Fairview Manor where Tiger Woods and Mike Trout are building a golf course is becoming very valuable, and we’re working on that and hope to eventually have some kind of agreement to sell that land, which could potentially further increase income.

Jeffrey Alan Walkenhorst

Copeland Capital Management, LLC

Okay. That’s a potential source of capital to fund your growth initiatives.

Samuel A. Landy

President, CEO & Director

Yes. All those things take — that — those things don’t happen all at once. But over time, the answer is yes.

Jeffrey Alan Walkenhorst

Copeland Capital Management, LLC

Okay. Sam, can I go back to the fundamental question? Looking across the 11 states, you’re talking about continued occupancy gains in the same-store portfolio, where, last year, occupancy was up a couple of hundred basis points.

And the rental occupancy as well on the rental units was up 70 basis points year-over-year, whereas most apartments, I think, are seeing flat to down occupancy trends. Are you seeing any differences in demand across the different states when it comes to whether it’s the purchases or the rentals?

Samuel A. Landy

President, CEO & Director

No. Demand is incredibly strong on the sales and the rental front. I have no question we’ll receive our 5% rent increase during the year 2024. Last year, we added an incredible number of homes. And so the challenge there is can you add that many homes with just-intime inventory.

But even to the extent that you’re not able to, you’re going to have significant savings on interest costs. But if you’re able to achieve the same number of homes coming in, but on a just-in-time basis, the results will be even better than they are today.

Operator

The next question is from Joel Goodman, a private investor.

Unknown Attendee [MHProNews i.e.: Joel Goodman]

This is Joel Goodman in Colorado, one of your investors, and I want to commend UMH on your mission to provide affordable housing. I also want to thank you for your efforts on my behalf as an individual investor.

My question has to do with analyst coverage. There are some very sharp analysts from small firms who cover your stock, and I’d like to know if there have been recent efforts to attract analysts from the big firms to take an interest in UMH.

Samuel A. Landy

President, CEO & Director

Yes, absolutely. And one of the issues out there to obtain coverage from the major firm is we have to provide guidance. And so we’re giving a lot of thought to providing guidance and hope to provide guidance shortly, so that the major firms will pick up coverage.

Unidentified Analyst [MHProNews i.e.: Joel Goodman]

Thank you.

Samuel Landy

Thank you. And good to hear from you.

Operator

The next question comes from John Massocca of B. Riley. Please go ahead.

John James Massocca

B. Riley Securities, Inc., Research Division

Good morning.

Samuel A. Landy

President, CEO & Director

Good morning.

John James Massocca

B. Riley Securities, Inc., Research Division

So you kind of talked about it a little bit in some of your prior answers, but if you look at kind of the same-store occupancy sitting at over 80%, kind of historically relatively flat. And I know in this coming year, things are going to change as some new properties move into the same-store bucket.

But what do you kind of see as maybe the ceiling for occupancy in a steady-state portfolio? Is there opportunity for more uplift in occupancy maybe in some of the properties that were considered same-store in 2023? Just any kind of color there. It’s been a pretty big driver of some of the same-store NOI growth.

Samuel A. Landy

President, CEO & Director

If you take each of our annual reports, they show you the occupancy at each community at the end of every year. And if you compare them, you’ll find out how much occupancy grows at each community, and it’s substantial.

But what happens is we acquire communities 30% occupied, 50% occupied, 60% occupied, which they get moved into the samestore bucket, so that same-store occupancy is in that 86% area. But we consider that 86% area ideal because that’s what allows us to continue to add 1,000 rental homes per year.

If we run out of vacant sites, there goes that whole world of growth. So at this moment, if you look forward 3 years, can we raise the rents 5% a year for 3 years? The answer is yes, and that’s $10 million a year. For 3 years, that’s $30 million.

Can we add 3,000 rental homes without building a single another lot or doing an acquisition? And the answer is yes because we have 3,000 vacant sites today, and that’s $36 million in new revenue.

And then what you got to consider, because those 3,000 lots already exist, the only capital investment you need is the homes. So 3,000 new homes times approximately $70,000 per house, and with that investment, we’re going to be grossing an additional $66 million per year.

And these communities are going to be closer to 90% occupied, so they’re going to be closer to that 30% expense ratio, with more of that money making it to the bottom line.

Now we’ll continue to do acquisitions of communities with vacancies, so we continue to grow from the future for that. And we continue to take that valuable vacant land we have and seek approval, so we can continue to expand that way. So there will be some costs involved in future growth and actions for future growth. But 3 years from today, you will have increased the rents $30 million on rent increases and $36 million from new rentals.

Eugene W. Landy

Founder & Chairman of the Board

The nation must build new manufactured housing. The parks are filling up. Our parks are filling up, and we will go to 95%, 96% occupancy at some point. And if you’re going to sell 100,000 homes in the nation, at that point, you’re going to have to build 100,000 more communities.

And at 200 spaces, that’s 500 parks that we have to build each year for the next decade. And that’s something which we must do as part of our mission statement, and we must do it because the demand is there. The shortage of housing is there, and it’s not so easy to get the approvals and to build those communities. And it takes long-term patient money, but that’s part of our mission statement.

And UMH is going to continue what we call greenfield development. And we’re doing that with a joint venture with Nuveen, and that’s in our long-term plan.

Samuel A. Landy

President, CEO & Director

And those numbers you use, that’s for the industry.

Eugene W. Landy

Founder & Chairman of the Board

The industry.

Brett Taft

Executive VP & COO For UMH.

For UMH

Eugene W. Landy

Founder & Chairman of the Board

We do 1,000 homes a year, both — of everything, rental homes and filling up vacant sites in the community board and expansions and greenfield development, 1,000 homes a year. And the cost of that is probably $250 million on a replacement cost.

Brett Taft

Executive VP & COO

And just to add to that, almost all of our communities will be in our same-property pool this year. And we always analyze the progress we made last year, looking at overall gains in occupancy through both sales and rentals, analyze our vacant sites, make sure we’re ordering homes for the right communities at the right price.

And in working with our Vice President of Rentals and our other Vice Presidents, we feel very confident that we can achieve a similar amount of homes as last year. I mean, 1,040 was quite a bit, but we’re very confident in that 800 new rental home number.

Anna T. Chew

EVP, CFO, Treasurer & Director

And as Brett had said, in 2024, our same-property pool will include the 2022 acquisitions. And that was — they were big acquisitions then. It was 1,500 sites almost, with a vacancy factor at — or occupancy factor at the time of purchase of 66%. So we will have room to grow, and that’s what we need, room to grow, and we are doing it.

John James Massocca

B. Riley Securities, Inc., Research Division

Okay. Just understanding that, right? So the occupancy goes closer — the same-store occupancy for next year goes probably closer to that 86-and-change percent level. I mean, is there the opportunity set then in 2024 to have another 200 basis points of occupancy growth? Or is — either [indiscernible] individual?

Samuel A. Landy

President, CEO & Director

My giant point is don’t worry about that same-store occupancy number. Worry about whether or not the occupancy is increasing at each community, and you could see that by looking at each year’s annual report. And we look at that constantly, and it is growing. And the fact that our expense ratio has now dropped from about 42% to 40%.

Brett Taft

Executive VP & COO

Same-property, yes. Overall, it was 44.4% to 42.9%.

Samuel A. Landy

President, CEO & Director

Okay. And that indicates that we’re filling the communities because the higher the individual communities occupancy goes, the lower the expense ratio goes at each individual community. And the fact that that’s declining means we’re filling sites in communities.

John James Massocca

B. Riley Securities, Inc., Research Division

And maybe in that same vein, same-store community operating expense was basically kind of flat on a year-over-year basis in 4Q ’23. Is that kind of seasonal or an anomaly? Or is that something that’s maybe sustainable as you look out into ’24?

Samuel A. Landy

President, CEO & Director

Well, what happens is as the community is 80% occupied and goes to 100%, we don’t have to cut the grass on vacant rental homes. You don’t need an additional manager. Most of your expenses are fixed. And so filling those vacant lots reduces the expense ratio. Go ahead.

Brett Taft

Executive VP & COO

Yes, absolutely right on the expense ratio. As per the exact dollar amount and the percentage increase, I do not expect expenses to be flat next year. I would expect an increase in the 4% to 7% range, depending on exactly what the cost of materials and labor does. We were very happy with 4.2% this year. We think it’s possible that it’s in that 4% range, but it could be slightly higher than that.

John James Massocca

B. Riley Securities, Inc., Research Division

No. Continue.

Brett Taft

Executive VP & COO

Yes, I was going to say, but, regardless, with approximately 9% income growth with expenses in that 4% to 7% range, that does get you to the high single digit, low double-digit NOI — same-property NOI growth, which we’re aiming for next year.

Operator

This concludes our question-and-answer session. I would like to turn the conference back over to Samuel Landy for any closing remarks.

Samuel A. Landy

President, CEO & Director

Thank you, operator. I would like to thank the participants on this call for their continued support and interest in our company. As always, Gene, Anna, Brett and I are available for any follow-up questions. We look forward to reporting back to you in May with our first quarter 2024 results. Thank you.

Operator

The conference has now concluded. Thank you for attending today’s presentation. The teleconference replay will be available in approximately 1 hour. To access this replay, please dial U.S. toll-free 1 (877) 344-7529 or international (412) 317-0088. The conference access code is 5824602. Thank you, and please disconnect your lines. ##

Part II – Additional Information with More MHProNews Analysis and Commentary

MHProNews begins by editorially observing that in several respects, this may be one of the most important earnings calls in the industry in some time due to several potent insights about not only UMH, but also of important to the manufactured home industry. While even experts may differ on some details of the above, several highly significant statements made should have been big news. Oddly, they were not. In no particular order of importance, MHProNews makes the following observations.

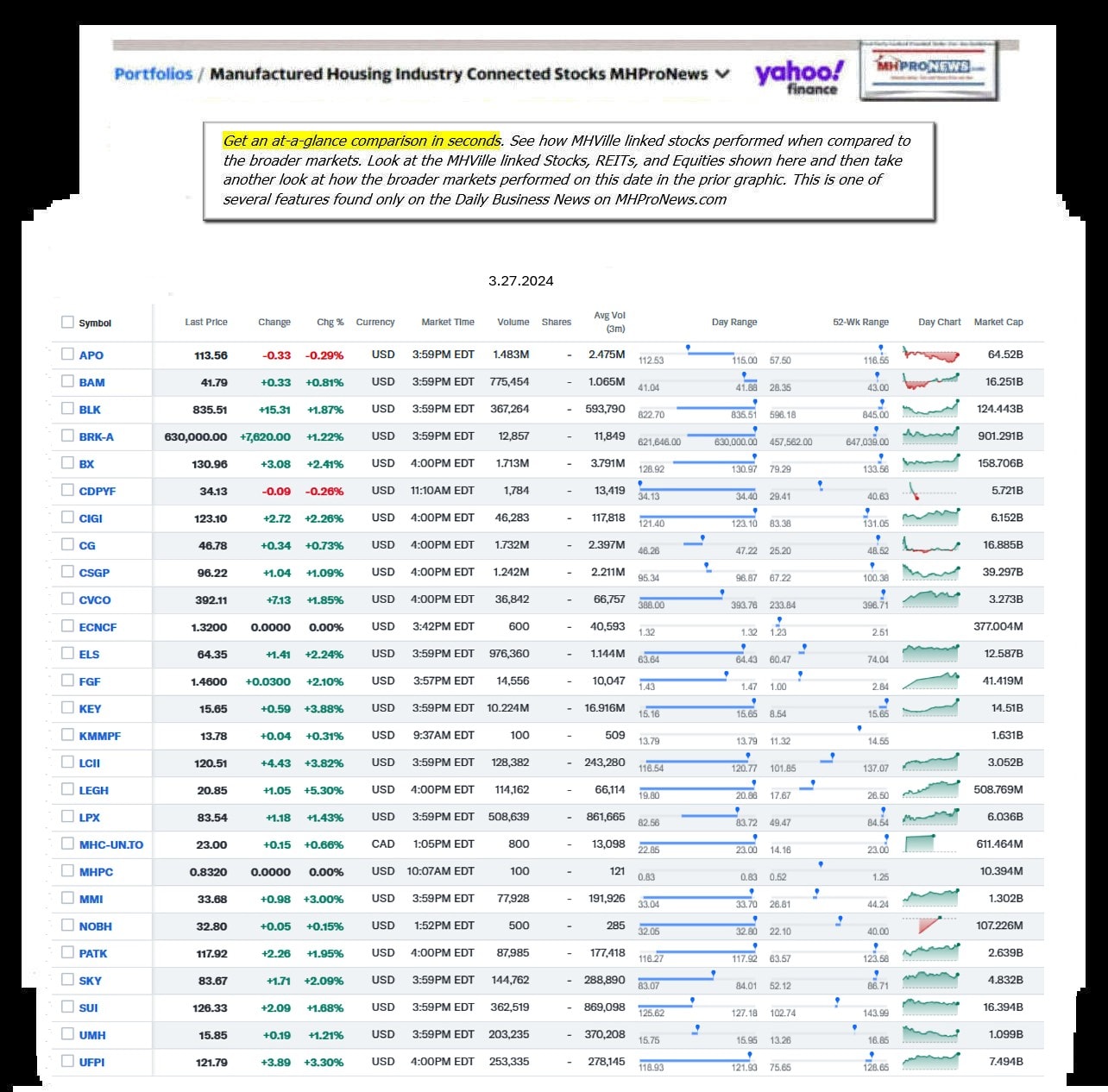

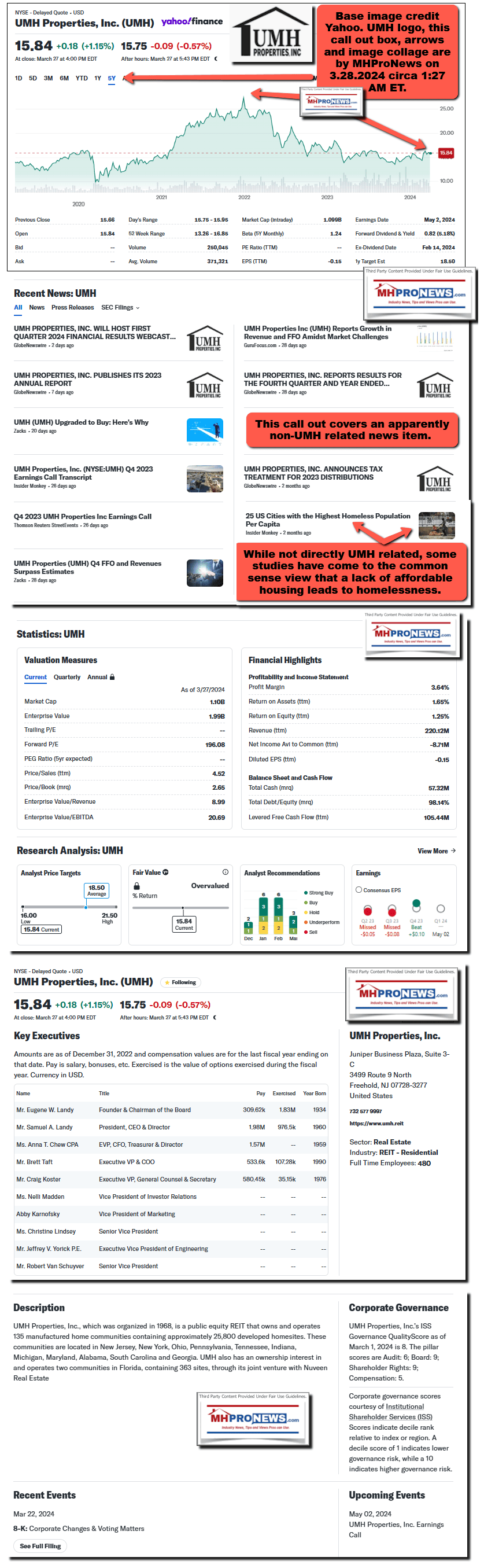

1) The Yahoo Finance generated insights and recaps presented as an image collage arranged by MHProNews are as follows.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

2) The following is a fresh Q&A with Bing’s AI powered Copilot using the blue or balanced setting. The Q&A occurred on 3.28.2024 starting at about 2:30 AM ET.

How many references can you find to this quote: “The nation must build new manufactured housing. The parks are filling up. Our parks are filling up, and we will go to 95%, 96% occupancy at some point. And if you’re going to sell 100,000 homes in the nation, at that point, you’re going to have to build 100,000 more communities. And at 200 spaces, that’s 500 parks that we have to build each year for the next decade.” MHProNews will use that quotation by Eugene Landy from an earnings call in a report to be published on 3.28.2024, but other than MHProNews has anyone in manufactured housing trade media or the Manufactured Housing Institute made reference to that remark by Landy?

3)

It is no secret that in various editorials, fact checks, and expert commentaries that Manufactured Home Pro News (MHProNews) has been a critic of the Manufactured Housing Institute (MHI) for several years. In various articles and reports MHProNews and/or their sister trade publication, Manufactured Home Living News (MHLIvingNews) has noted that some companies associated with the Manufactured Housing Institute and/or a Manufactured Housing Institute state association affiliate have been cited by regulators, in law suits, or in mainstream news articles as being predatory or other less than flattering terms due to a given MHI-member company’s treatment of their own customers, is that a fair statement? At the same time, MHProNews/MHLivingNews have created a bright line distinction on the point that not all MHI member firms appear to fall into that predatory or proverbial black hat category. Is that accurate?

Learn more

> MHProNews and MHLivingNews have both been pro-manufactured home industry growth platforms, starting from their founding, is that a fair statement? And in their various critiques of certain firms, is it fair to say that the relationship between those trade publications and the Manufactured Housing Institute’s leaders soured as MHProNews/MHLivingNews increasingly focused on arguably avoidable problems connected to so-called predatory or “black hat” brands?

However, as they delved into critiques of specific firms, their relationship with the Manufactured Housing Institute (MHI) experienced some strain. The focus on issues related to so-called “predatory” or “black hat” brands led to heightened scrutiny. While MHProNews and MHLivingNews maintained their commitment to industry growth, their critical analysis sometimes clashed with MHI’s leadership.

In essence, their dedication to transparency and accountability prompted them to address avoidable problems head-on, even if it meant challenging certain practices within the industry. As a result, the dynamics between these trade publications and MHI evolved, reflecting the complexities and tensions inherent in advocating for responsible business practices while supporting overall growth .

5)

While several MHI member brands have been criticized for their practices with respect to residents or customers, UMH Properties appears to have avoided such critiques, is that accurate? For example, in the numbers of national class action lawsuits filed on behalf of residents in 2023 against members of the Manufactured Housing Institute and/or MHI member state associations, UMH Properties has not been named in such suits. is that correct? Are you aware of any similar suits against UMH as those which have been filed against Datacomp, Equity LifeStyle Properties, Sun Communities, and others that MHProNews/MHLivingNews or others have reported?

> Even while the parent company of MHProNews was a member of the Manufactured Housing Institute (MHI), they reported on periodic efforts to organize a new post-production sector trade association, one that would be focused on accomplishing the claimed objectives such as the full and proper enforcement of the Manufactured Housing Improvement Act of 2000, including its so-called “enhanced preemption” provision. Is that accurate? MHProNews and MHLivingNews have also editorially advocated that such a new post-production trade group should work in close collaboration with the Manufactured Housing Association for Regulatory Reform (MHARR), which unlike MHI, appears to have stayed true to its mission of getting enhanced preemption and other good aspects of federal law fully enforced while working to stop potentially harmful regulations. Confirm or clarify that and then address this issue. Given that Eugene Landy has said that there is going to be a need to develop some 500 new manufactured home communities a year in the U.S., and given that MHI doesn’t even have the words “enhanced preemption” listed on their website, wouldn’t enhanced preemption enforcement offer a simplified means for new developments and expansions when it comes to dealing with local officials? Elaborate on the importance of the potential for enhanced preemption enforcement and the apparent disconnects between some formal MHI remarks, and their actual behavior due to some MHI members apparently stating in their investor relations packages that the constraint of new developing is a benefit to their business models.

Learn more

7)

Good stuff, Copilot. Okay, from time to time, MHProNews cites the maxim attributed to the late President Ronald Reagan that my eighty percent friend is not my twenty percent enemy, correct? It isn’t easy to find any two people, much less two organizations, that agree on everything, is that accurate? Even within an organization, there can be differences, right? So that 80 – 20 maxim is pragmatic, correct? That noted, MHProNews recently reported on two Manufactured Housing Institute member firms – Legacy Housing and ECN, the later is the parent company to Triad Financial Services, that appear to have been negatively impacted due to perceptions in financial news sites and by others that the manufactured housing industry is performing in a “soft” or “weak” manner. Given that perception, and the very real data that MHARR, MHProNews and MHLivingNews have published to points to historically low industry performance in the 21st century, is there a reasonable argument to be made that some post-production focused firms ought to work to collaboratively to establish the kind of new trade organization that MHARR and MHProNews have long advocated should be established? Couldn’t such a new post-production trade group help get good existing federal laws enforced so that the industry could grow in a robust manner again, while still providing good service to customers and those who need or want affordable housing?

Learn more

> Copilot, it seems to me that one of the problems with so-called mainstream news is that it often seems to be agenda driven, and that agenda may be connected at times to who advertises and to what extent. Obviously, news needs revenue. It might be a difficult balancing act for media, trade or mainstream, to put some operation, person, party or group in a favorable light when their behavior has not merited it. But for media to be credible, it should report facts, figures, and do tips, analysis, or commentary in an authentic fashion based on evidence, is that a reasonable remark in keeping in with principles of the American Press Institute and the Society for Professional Journalism’s Code of Ethical Conduct? Give some guidance and feedback on those notions.

- Agenda-Driven News:

- It is true that some mainstream news outlets may have agendas influenced by various factors, including advertisers, political affiliations, or corporate interests.

- The challenge lies in maintaining a balance between revenue generation and unbiased reporting. When financial considerations overshadow journalistic integrity, it can lead to skewed narratives.

- Credibility and Authenticity:

- Credibility is the cornerstone of journalism. For media to be trusted, it must adhere to rigorous standards of accuracy, fairness, and transparency.

- The American Press Institute and the Society for Professional Journalism’s Code of Ethical Conduct emphasize principles such as:

- Accuracy: Reporting facts and figures with precision, verifying information, and correcting errors promptly.

- Independence: Avoiding conflicts of interest and undue influence.

- Transparency: Disclosing sources, affiliations, and potential biases.

- Accountability: Taking responsibility for the impact of reporting.

- Authenticity is crucial. Journalists should present information honestly, even if it challenges prevailing narratives.

- Balancing Act:

- Balancing revenue needs with ethical reporting is indeed complex. However, media outlets can prioritize both by:

- Diversifying revenue sources beyond advertising.

- Maintaining editorial independence.

- Prioritizing public interest over commercial interests.

- Clearly distinguishing between news and opinion pieces.

- Fact-checking and providing evidence-based analysis.

- Balancing revenue needs with ethical reporting is indeed complex. However, media outlets can prioritize both by:

- Role of Journalists:

- Journalists play a vital role in shaping public discourse. Their commitment to truth, accuracy, and accountability is essential.

- By adhering to ethical guidelines, journalists can maintain credibility and serve as watchdogs for democracy.

In summary, media credibility hinges on adhering to ethical principles, reporting facts objectively, and fostering public trust. As consumers of news, we should critically evaluate sources and demand authentic, evidence-based reporting . …”

9)

Note that MHProNews has edited parts of the reply to the following, because at times Copilot seems to confuse the Manufactured Housing Institute (MHI) abbreviation with the organization MHI.org, which are not in the manufactured housing industry (MHI.org is material handling). Those non-manufactured housing items have been edited out for accuracy, noting that Bing itself gives a disclosure that Copilot’s response should be checked for accuracy. That said, in a Google search for the quote above from Eugene Landy, Google gave no response, while Bing’s AI powered Copilot gave a far more accurate and complete one.

There is an old saying, keep your friends close and your enemies closer. While there may be a reasonable reason for a firm that has higher standards than others in the Manufactured Housing Institute to be a member, there is also a case to be made that in the 21st century, MHI has become the tool for corporate consolidators and those companies which may have a rather questionable legal or ethical practices to be involved in MHI where they seem to get cover in the form of awards that have been given to firms that have a poor Better Business Bureau or other perceptions, is that fair? Elaborate on the dynamics that may cause some to be an MHI member even though they are periodically backstabbed by others involved in the Institute. Then, elaborate on the possible reasons that such firms may want to maintain some level of involvement in MHI while working to create a new post-production trade group that will work for sustainable growth that treats customers well, gives a good return on investment to shareholders, and maintains higher standards that can be part of a brighter future for manufactured housing.

- MHI Membership and Complex Dynamics:

- Keep Your Friends Close, Your Enemies Closer: The adage suggests that understanding your adversaries is essential for strategic decision-making.

- MHI’s Role and Challenges: MHI was established to address common industrial challenges for manufacturers in the material handling industry. Over time, its role has evolved, and it now encompasses various stakeholders, including corporate consolidators and firms with differing ethical practices.

- Backstabbing and Awards: Some MHI members may experience periodic backstabbing within the organization. Despite this, they maintain membership for several reasons:

- Networking and Industry Influence: MHI provides a platform for networking, collaboration, and industry influence. Being part of the organization allows firms to engage with peers, policymakers, and industry leaders.

- Visibility and Recognition: MHI’s awards and recognition programs offer visibility and validation. Even if some awards seem questionable, they still provide a level of credibility.

- Trade Shows and Marketing Channels: (omitted by MHProNews see above)

- Positioning as Industry Leaders: Membership positions firms as industry leaders and gives them a voice in shaping the industry’s future.

- Creating a New Post-Production Trade Group:

- Challenges in the 21st Century: The manufactured housing industry faces significant challenges, including supply chain disruptions, workforce shortages, and perceptions of weakness.

- Advocating for Sustainable Growth and Higher Standards:

- Collaborative Efforts: Some firms recognize the need for a new post-production trade group. Collaborating with like-minded peers allows them to collectively address industry issues.

- Enforcement of Existing Laws: A new group could focus on enforcing existing federal laws, including enhanced preemption. This would simplify new developments and expansions.

- Balancing Interests: Firms can maintain involvement in MHI while simultaneously advocating for higher standards. They can work toward a brighter future by:

- Educating Peers: Educating other MHI members about the benefits of responsible practices.

- Leveraging Influence: Using their position within MHI to advocate for transparency, sustainability, and ethical behavior.

- Creating a Unified Voice: A new trade group can amplify their collective voice, emphasizing customer service, shareholder returns, and industry excellence.

In summary, while MHI has its complexities, some firms choose to engage strategically, balancing their interests within the organization while actively working toward a more sustainable and customer-centric future for manufactured housing12 . …”

Learn more

> Useful. Let’s sum up. While I concur that every honest manufactured housing operation should or could benefit from robust, sustainable, ethical industry growth, it seems that some key players in the Manufactured Housing Institute that have been industry consolidation focused have a different view. That said, outline the arguments why honest and growth minded companies should consider partnering with the Manufactured Housing Association for Regulatory Reform (MHARR) if they are manufactured home producers, and why other non-production focused companies should want to work to create an ethical post-production trade group to help the manufactured housing industry recover to its true potential. MHProNews/MHLivingNews have published several reports that indicate that production could sustainably be in the million plus new home per year range in a reasonably short order. Given population growth and the need for an estimated 6 to 10 million new housing units at this time, and obvious more needed in the years ahead, lay out the logic for establishing a new post-production trade group and who should be in involved and why they should arguably ignore or even litigate against the consolidation focused machinations of the Manufactured Housing Institute.

11)

More could be said, but that’s plenty to digest for today. While MHProNews has at times disagreed with some specific stances taken by UMH, this most recent earnings call has produced a lot of information that is arguably worth carefully discerning and digesting. It is worth mentioning from the headline above and the earnings call transcript these points in closing, among others. Sam Landy – ‘Expansions and Greenfield Development’ ‘Significantly Outperform Stabilized Properties.’ Eugene Landy-‘Build 100,000 New Communities’. Keep in mind what Gary Shiffman said that was somewhat similar, shown in the quote-illustration by MHProNews below. A possible follow up to this potentially landmark report on UMH is being considered. Prior reports on UMH are linked below. Recent reports on Legacy and ECN/Triad are linked below as well. The Daily Business News on MHProNews market report follows.

![DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPut[HUDCodeManufactured]HomesMHProNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2023/11/DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPutHUDCodeManufacturedHomesMHProNews.jpg)

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Headlines from left-of-center CNN Business – 3.27.2024

- Disney and DeSantis have settled their years long dispute

- A Fisker Ocean Extreme electric vehicle is displayed during CES 2022 at the Las Vegas Convention Center in Las Vegas, Nevada, U.S. January 5, 2022.

- You can buy this electric luxury SUV for $25,000 right now. But there might be a catch

- A view of the Dali cargo vessel which crashed into the Francis Scott Key Bridge causing it to collapse in Baltimore, Maryland, U.S., March 26, 2024.

- Cars, sugar and cruises: How the Port of Baltimore closure could hurt the economy

- Customers wait in line to order below signage for the Costco Kirkland Signature $1.50 hot dog and soda combo, which has maintained the same price since 1985 despite consumer price increases and inflation, at the food court outside a Costco Wholesale Corp. store on June 14, 2022 in Hawthorne, California.

- Why Costco’s hot dog is still $1.50 when everything has gotten so expensive

- NBC cut ties with Ronna McDaniel after extraordinary pressure, but its problems aren’t over

- In this May 7, 2018 file photo, Berkshire Hathaway Chairman and CEO Warren Buffett speaks during an interview in Omaha, Neb. The world’s most expensive lunch will go on sale again this spring when Buffett auctions off a private meal to raise money for a California homeless charity one last time. Buffett held the online lunch auction once a year for 20 years before the pandemic began to raise money for the Glide Foundation, which helps the homeless in San Francisco.

- Warren Buffett’s favorite market indicator is flashing red

- Chinese leader Xi Jinping met US executives on Wednesday.

- China’s Xi meets American CEOs to boost confidence in world’s second largest economy

- Upward view from below of the I-35W bridge spanning the Mississippi River in Minneapolis, Minnesota, on November 11, 2011. The original 35W bridge collapsed in 2007.

- Lessons for Baltimore: How Minneapolis recovered from its I-35W bridge collapse 17 years ago

- Boeing CEO Dave Calhoun is departing a meeting with Senator Tammy Duckworth (D-IL) in the Hart Senate Office Building, on Capitol Hill in Washington, D.C., on January 25, 2024, as Boeing is dealing with the fallout of multiple recent safety mishaps, including a door blowing out mid-flight. (Photo by Aaron Schwartz/NurPhoto via Getty Images)

- Who can fix Boeing? Here are some potential CEO candidates

- Former FTX Chief Executive Sam Bankman-Fried, who faces fraud charges over the collapse of the bankrupt cryptocurrency exchange, walks outside the Manhattan federal court in New York City, on March 30, 2023.

- Sam Bankman-Fried faces sentencing this week. Here’s what to expect

- Is America at risk of a bond market meltdown? This watchdog thinks so

- An $865 million Powerball jackpot is up for grabs a day after a winning ticket nabbed $1.13 billion Mega Millions prize

- BYD’s profit soared 80% in the year the Chinese EV giant overtook Tesla

- FTC investigating TikTok over privacy and security

- NBC News ousts Ronna McDaniel after network’s anchors launch unprecedented on-air rebellion

- Boeing’s embattled CEO is poised to walk away with millions

- Fisker shares halted as EV company navigates uncertain future

- Trump’s Truth Social is now a public company. Experts warn its multibillion-dollar valuation defies logic

- Krispy Kreme doughnuts are coming to McDonald’s

- Apple announces its annual developers conference is set for June 10

- Visa and Mastercard agree to $30 billion settlement that will lower merchant fees

- Judge’s stern rebuke of Elon Musk’s X gives researchers fresh hope

- There’s more bad news for potential homebuyers: Prices just hit another record