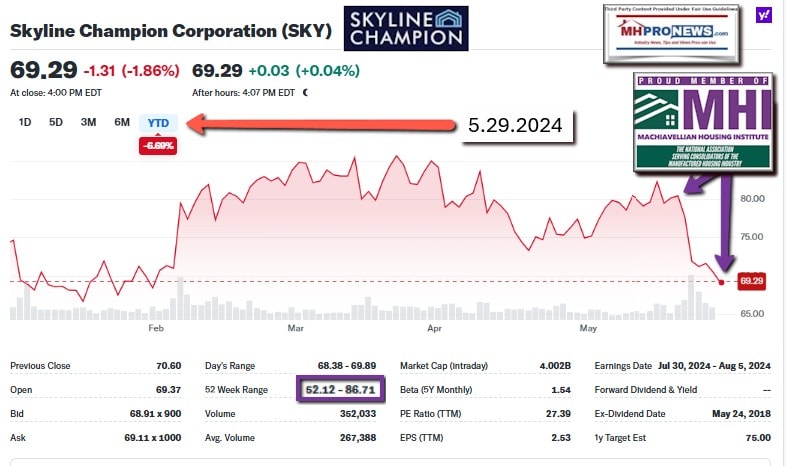

“Despite facing some significant market headwinds, including the prolonged destocking by our channel partners and considerable regional variability, we made substantial progress,” said Mark Yost, Skyline Champion’s President and Chief Executive Officer (CEO). Despite those comments, it may not appear so to numbers of investors, as the stock has fallen sharply in recent days following the publication of Skyline Champion’s quarterly and annually results. Since the Manufactured Housing Institute (MHI) member firm issued their latest quarterly and annual report via Berkshire Hathaway owned BusinessWire (see Part I below for details), Yahoo Finance indicates that the value of shares of manufactured home producer Skyline Champion (SKY) has steadily fallen (see screen capture above in featured image and further below in Part II). According to MarketBeat: “Barclays Lowers Skyline Champion (NYSE:SKY) Price Target to $68.00.” “StockNews.com downgraded Skyline Champion from a “hold” rating to a “sell” rating in a research report on Thursday, May 23rd. Craig Hallum dropped their price target on shares of Skyline Champion from $88.00 to $84.00 and set a “buy” rating for the company in a research report on Thursday, May 23rd. Royal Bank of Canada lowered their price objective on shares of Skyline Champion from $73.00 to $68.00 and set a “sector perform” rating for the company in a research note on Thursday, May 23rd. Finally, Wedbush reissued a “neutral” rating and issued a $72.00 target price on shares of Skyline Champion in a research note on Wednesday, May 22nd. One research analyst has rated the stock with a sell rating, four have assigned a hold rating and one has assigned a buy rating to the company.”

“Skyline Champion had a return on equity of 13.50% and a net margin of 7.24%.” See how that compares to some rivals in Part II.

Per Skyline Champion’s press release, while some quarterly information improved over the prior year, the full fiscal 2024 vs. 2023 showed a decrease.

Full Year Fiscal 2024 Highlights (compared to Full Year Fiscal 2023)

- Net sales decreased 22.3% to $2.0 billion

- Gross profit margin contracted [i.e.: dropped, fell] by 740 basis points to 24.0%

- Average selling price (“ASP”) per U.S. home sold decreased 3.1% to $89,800

- Adjusted gross profit margin contracted [i.e.: dropped, fell] by 390 basis points to 24.8%

As seasoned industry pros know, and MarketBeat also said: “Skyline Champion Corporation produces and sells factory-built housing in North America. The company offers manufactured and modular homes, park models RVs, accessory dwelling units, and modular buildings for the multi-family and hospitality sectors. It builds homes under the Skyline Homes, Champion Home Builders, Genesis Homes, Athens Park Models, Dutch Housing, Atlantic Homes, Excel Homes, Homes of Merit, New Era, Redman Homes, ScotBilt Homes, Shore Park, Silvercrest, and Titan Homes brands in the United States; and Moduline and SRI Homes brand names in western Canada.”

Apparently similar information to what BusinessWire offered is also on Skyline Champion’s Investor Relations page, and some was also available via Yahoo Finance.

Part I

Skyline Champion Announces Fourth Quarter and Full Year Fiscal 2024 Results; Announces New $100 Million Share Repurchase Program

Business Wire

Tue, May 21, 2024 |

In This Article:

TROY, Mich., May 21, 2024–(BUSINESS WIRE)–Skyline Champion Corporation (NYSE: SKY) (“Skyline Champion”) today announced financial results for its fourth quarter and full year ended March 30, 2024 (“fiscal 2024”).

Fourth Quarter Fiscal 2024 Highlights (compared to Fourth Quarter Fiscal 2023)1

- Net sales increased 9.1% to $536.4 million

- U.S. homes sold increased 15.3% to 5,652

- Total backlog increased 8.7% to $315.8 million from the sequential third quarter

- Average selling price (“ASP”) per U.S. home sold decreased 3.1% to $89,800

- Gross profit margin contracted by 1,040 basis points to 18.3%

- Recorded $34.5 million of estimated remediation costs for water intrusion issues

- Adjusted gross profit margin contracted by 390 basis points to 24.8%

- Net income of $2.8 million

- Adjusted net income decreased 37.7% to $36.0 million

- Adjusted Earnings per share (“Adjusted EPS”) decreased 38.6% to $0.62

- Adjusted EBITDA decreased 30.2% to $53.1 million

- Adjusted EBITDA margin contracted by 560 basis points to 9.9%

1 . This release includes references to non-GAAP financial measures. Refer to “Non-GAAP Financial Measures” later in this release for the definitions of the non-GAAP financial measures presented and a reconciliation of these measures to their closest comparable GAAP measures.

Full Year Fiscal 2024 Highlights (compared to Full Year Fiscal 2023)

- Net sales decreased 22.3% to $2.0 billion

- Gross profit margin contracted by 740 basis points to 24.0%

- Earnings per share (“EPS”) decreased 63.9% to $2.53

- Adjusted EBITDA decreased 55.0% to $245.3 million

- Adjusted EBITDA margin contracted by 880 basis points to 12.1%

- Net cash generated by operating activities of $222.7 million during the year

“Fiscal 2024 was a transformative year for our organization, marked by strategic investments and expanding our market presence,” said Mark Yost, Skyline Champion’s President and Chief Executive Officer. “Despite facing some significant market headwinds, including the prolonged destocking by our channel partners and considerable regional variability, we made substantial progress. We initiated the integration of our strategic investments, which broaden our retail and financing capabilities. We also took decisive actions to address production efficiencies while serving the expanding builder developer demand. As we move into fiscal 2025, we are better equipped with enhanced capabilities to capitalize on growth opportunities and deliver increased value to our customers and shareholders.”

Fourth Quarter Fiscal 2024 Results

Net sales for the fourth quarter fiscal 2024 increased 9.1% to $536.4 million compared to the prior-year period. The number of U.S. homes sold in the fourth quarter fiscal 2024 increased 15.3% to 5,652 driven by net sales of $108.1 million from the Regional Homes acquisition. The ASP per U.S. home sold decreased 3.1% to $89,800 due to changes in product mix and the decrease in material surcharges compared to the prior year. The number of Canadian factory-built homes sold in the quarter decreased to 189 homes compared to 246 homes in the prior-year period due to softer demand given the higher interest rate environment. Total backlog for Skyline Champion was $315.8 million as of March 30, 2024, compared to $290.4 million at the end of the third quarter, reflecting increased order volume.

Gross profit decreased by 30.3% to $98.4 million in the fourth quarter fiscal 2024 compared to the prior-year period. Gross profit margin was 18.3% of net sales, a 1,040-basis point contraction compared to 28.7% in the fourth quarter fiscal 2023. The change in gross profit and gross profit margin reflects the impact of an estimated liability of $34.5 million recorded in the fourth quarter of fiscal 2024 related to remediation costs for water intrusion issues in homes sold from one of our plants prior to fiscal 2022. Adjusted gross profit decreased by 5.9% to $132.9 million and was 24.8% of net sales, a 390-basis point contraction compared to 28.7% in the prior year period. Adjusted gross profit margin compared to the prior year period reflects lower ASPs, a shift in product mix, the ramping of previously idled facilities, and the impact of the Regional Homes acquisition.

Selling, general, and administrative expenses (“SG&A”) in the fourth quarter fiscal 2024 increased to $90.6 million from $72.4 million in the same period last year. SG&A as a percentage of net sales was 16.9%, a 220-basis point increase from prior year levels. The higher SG&A expense during the quarter was primarily due to the Regional Homes acquisition.

Net income decreased by 95.2% to $2.8 million for the fourth quarter fiscal 2024 compared to the prior-year period. The decrease in net income was primarily driven by the impact of the $34.5 million water intrusion accrual, lower gross profit margins, an equity in net loss of affiliate of $7.0 million and increased SG&A spend.

Adjusted EBITDA for the fourth quarter fiscal 2024 decreased by 30.2% to $53.1 million compared to the fourth quarter fiscal 2023. Adjusted EBITDA margin contracted by 560 basis points to 9.9%.

Full Year Fiscal 2024 Financial Highlights

For fiscal 2024, net sales were $2.0 billion which represents a decrease of 22.3%, or $581.7 million, compared to fiscal 2023. The decrease in net sales was primarily driven by lower home sales and the absence of $200 million in FEMA-related sales that was recorded in the first half of fiscal 2023, partially offset by net sales from the acquisition of Regional Homes.

Gross profit decreased $332.9 million or 40.7% to $485.8 million in fiscal 2024, compared to $818.7 million in the prior year period. Gross profit margin contracted by 740 basis points to 24.0% of net sales for fiscal 2024, compared to fiscal 2023, reflecting the impact of the $34.5 million water intrusion accrual, lower home sales, the absence of FEMA-related sales, ramping of new plant operations and the acquisition of Regional Homes.

SG&A increased 3.4% to $310.6 million for fiscal 2024, compared to $300.4 million in the prior year period primarily due investments in new capacity and the Regional Homes acquisition. As a percentage of sales, SG&A increased 380 basis points to 15.3% compared to the prior year period.

Net income for fiscal 2024 was $146.7 million compared to net income of $401.8 million for fiscal 2023, a decrease of $255.1 million or 63.5% due to lower gross profit, an equity in net loss of affiliate of $7.0 million and increased SG&A spend.

Adjusted EBITDA for fiscal 2024 decreased 55.0% to $245.3 million, compared to $545.0 million for fiscal 2023. Adjusted EBITDA margin contracted 880 basis points to 12.1% in fiscal 2024.

As of March 30, 2024, Skyline Champion had $495.1 million of cash and cash equivalents, a decrease of $252.4 million as compared to prior fiscal year end, primarily the result of the acquisition of Regional Homes in fiscal 2024.

Share Repurchase Program

On May 16, 2024, Skyline Champion’s Board of Directors approved a new share repurchase program for up to $100 million of the Company’s common stock. Under this share repurchase program, the number of shares ultimately purchased, and the timing of purchases are at the discretion of management and subject to compliance with applicable laws and regulations. This share repurchase program may be amended, suspended or terminated by the Board of Directors at any time. The Company expects to fund the program from existing cash and future cash generation.

“We are excited to launch our inaugural share repurchase program, underscoring our dedication to enhancing shareholder value through our robust financial position,” said Mark Yost. “This initiative allows us to distribute capital to our shareholders, while continuing to prioritize the financial health of the organization and supporting ongoing investments and strategic growth opportunities. This balanced capital allocation strategy affirms our commitment to both returning capital to shareholders and fueling our future expansion.”

Conference Call and Webcast Information:

Skyline Champion management will host a conference call tomorrow, May 22, 2024, at 9:00 a.m. Eastern Time, to discuss Skyline Champion’s financial results and an update on current operations.

Interested investors and other parties can listen to a webcast of the live conference call by logging onto the Investor Relations section of Skyline Champion’s website at skylinechampion.com. The online replay will be available on the same website immediately following the call.

The conference call can also be accessed by dialing (877) 407-4018 (domestic) or (201) 689-8471 (international). A telephonic replay will be available approximately two hours after the call by dialing (844) 512-2921, or for international callers, (412) 317-6671. The passcode for the live call and the replay is 13745547. The replay will be available until 11:59 P.M. Eastern Time on June 5, 2024.

About Skyline Champion Corporation:

Skyline Champion Corporation (NYSE: SKY) is a leading producer of factory-built housing in North America and employs approximately 8,600 people. With more than 70 years of homebuilding experience and 48 manufacturing facilities throughout the United States and western Canada, Skyline Champion is well positioned with an innovative portfolio of manufactured and modular homes, ADUs, park-models and modular buildings for the single and multi-family housing markets.

In addition to its core home building business, Skyline Champion provides construction services to install and set-up factory-built homes, operates a factory-direct retail business with 74 retail locations across the United States, and operates Star Fleet Trucking, providing transportation services to the manufactured housing and other industries from several dispatch locations across the United States.

Skyline Champion builds homes under some of the most well-known brand names in the factory-built housing industry including Skyline Homes, Champion Homes, Genesis Homes, Regional Homes, Athens Park, Dutch Housing, Atlantic Homes, Excel Homes, Homes of Merit, All American Homes, New Era, Redman Homes, ScotBilt Homes, Shore Park, Silvercrest, and Titan Homes in the U.S., and Moduline and SRI Homes in western Canada.

Presentation of Non-GAAP Financial Measures

In addition to the results provided in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) throughout this press release, Skyline Champion has provided non-GAAP financial measures, Adjusted Gross Profit, Adjusted Gross Profit Margin, Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted EPS, which present operating results on a basis adjusted for certain items. Skyline Champion uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. Skyline Champion believes that these non-GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that Skyline Champion believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of Skyline Champion’s financial results in accordance with U.S. GAAP.

Skyline Champion defines Adjusted Gross Profit as gross profit or loss plus expenses or minus income for charges related to the remediation of the water intrusion product liability. Adjusted Gross Profit Margin is calculated as Adjusted Gross Profit as a percentage of net sales. Adjusted Gross Profit and Adjusted Gross Profit Margin are not a measure of earnings calculated in accordance with U.S. GAAP, and should not be considered an alternative to, or more meaningful than, gross profit, net income or loss, net sales or operating income prepared on a U.S. GAAP basis. Adjusted Gross Profit and Adjusted Gross Profit Margin do not purport to represent cash flow provided by, or used in, operating activities as defined by U.S. GAAP. Adjusted Gross Profit and Adjusted Gross Profit Margin is reconciled from the respective measure under U.S. GAAP in the tables below.

Skyline Champion defines Adjusted EBITDA as net income or loss plus expenses or minus income, (a) the provision for income taxes, (b) interest income or expense, net, (c) depreciation and amortization, (d) gain or loss from discontinued operations, (e) non-cash restructuring charges and impairment of assets, (f) equity in net earnings or losses of affiliates, (g) charges related to the remediation of the water intrusion product liability, and (h) other non-operating income or expense including but not limited to those costs for the acquisition and integration or disposition of businesses and idle facilities. Adjusted EBITDA is not a measure of earnings calculated in accordance with U.S. GAAP, and should not be considered an alternative to, or more meaningful than, net income or loss, net sales, operating income or earnings per share prepared on a U.S. GAAP basis. Adjusted EBITDA does not purport to represent cash flow provided by, or used in, operating activities as defined by U.S. GAAP. Skyline Champion believes that Adjusted EBITDA is commonly used by investors to evaluate its performance and that of its competitors. However, Skyline Champion’s use of Adjusted EBITDA may vary from that of others in its industry. Adjusted EBITDA is reconciled from the respective measure under U.S. GAAP in the tables below. Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided by net sales reported in the income statements.

Skyline Champion defines Adjusted EPS as net income or loss plus expenses or minus income (net of tax), (a) gain or loss from discontinued operations, (b) non-cash restructuring charges and impairment of assets, (c) equity in net earnings or losses of affiliates, (d) charges related to the remediation of estimated water intrusion product liability, and (e) other non-operating income or expense including but not limited to those costs for the acquisition and integration or disposition of businesses and idle facilities. Adjusted EPS is not a measure of earnings calculated in accordance with U.S. GAAP, and should not be considered an alternative to, or more meaningful than, net income or loss, net sales, operating income or earnings per share prepared on a U.S. GAAP basis. Adjusted EPS does not purport to represent cash flow provided by, or used in, operating activities as defined by U.S. GAAP. Skyline Champion believes that Adjusted EPS is commonly used by investors to evaluate its performance and that of its competitors. However, Skyline Champion’s use of Adjusted EPS may vary from that of others in its industry. Adjusted EPS is reconciled from the respective measure under U.S. GAAP in the tables below.

Forward-Looking Statements

Statements in this press release, including certain statements regarding Skyline Champion’s strategic initiatives, and future market demand are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by use of words such as “believe,” “expect,” “future,” “anticipate,” “intend,” “plan,” “foresee,” “may,” “could,” “should,” “will,” “potential,” “continue,” or other similar words or phrases. Similarly, statements that describe objectives, plans, or goals also are forward-looking statements. Such forward-looking statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of Skyline Champion. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, implied, or projected by such forward-looking statements. Risks and uncertainties include regional, national and international economic, financial, public health and labor conditions, and the following: supply-related issues, including prices and availability of materials; labor-related issues; inflationary pressures in the North American economy; the cyclicality and seasonality of the housing industry and its sensitivity to changes in general economic or other business conditions; demand fluctuations in the housing industry, including as a result of actual or anticipated increases in homeowner borrowing rates; the possible unavailability of additional capital when needed; competition and competitive pressures; changes in consumer preferences for our products or our failure to gauge those preferences; quality problems, including the quality of parts sourced from suppliers and related liability and reputational issues; data security breaches, cybersecurity attacks, and other information technology disruptions; the potential disruption of operations caused by the conversion to new information systems; the extensive regulation affecting the production and sale of factory-built housing and the effects of possible changes in laws with which we must comply; the potential impact of natural disasters on sales and raw material costs; the risks associated with mergers and acquisitions, including integration of operations and information systems; periodic inventory adjustments by, and changes to relationships with, independent retailers; changes in interest and foreign exchange rates; insurance coverage and cost issues; the possibility that all or part of our intangible assets, including goodwill, might become impaired; the possibility that all or part of our investment in ECN Capital Corp. (“ECN”) might become impaired; the possibility that our risk management practices may leave us exposed to unidentified or unanticipated risks; the potential disruption to our business caused by public health issues, such as an epidemic or pandemic, and resulting government actions; and other risks set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section, and other sections, as applicable, in our Annual Reports on Form 10-K, including our Annual Report on Form 10-K for the fiscal year ended April 1, 2023 previously filed with the Securities and Exchange Commission (“SEC”), as well as in our Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, filed with or furnished to the SEC.

If any of these risks or uncertainties materializes or if any of the assumptions underlying such forward-looking statements proves to be incorrect, then the developments and future events concerning Skyline Champion set forth in this press release may differ materially from those expressed or implied by these forward-looking statements. You are cautioned not to place undue reliance on these statements, which speak only as of the date of this release. We anticipate that subsequent events and developments will cause our expectations and beliefs to change. Skyline Champion assumes no obligation to update such forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, unless obligated to do so under the federal securities laws.

| SKYLINE CHAMPION CORPORATION

CONSOLIDATED BALANCE SHEETS (Unaudited, dollars and shares in thousands) |

||||||||

| March 30,

2024 |

April 1,

2023 |

|||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 495,063 | $ | 747,453 | ||||

| Trade accounts receivable, net | 64,632 | 67,296 | ||||||

| Inventories, net | 318,737 | 202,238 | ||||||

| Other current assets | 39,870 | 26,479 | ||||||

| Total current assets | 918,302 | 1,043,466 | ||||||

| Long-term assets: | ||||||||

| Property, plant, and equipment, net | 290,930 | 177,125 | ||||||

| Goodwill | 357,973 | 196,574 | ||||||

| Amortizable intangible assets, net | 76,369 | 45,343 | ||||||

| Deferred tax assets | 26,878 | 17,422 | ||||||

| Other noncurrent assets | 252,889 | 82,794 | ||||||

| Total assets | $ | 1,923,341 | $ | 1,562,724 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Floor plan payable | $ | 91,286 | $ | – | ||||

| Accounts payable | 50,820 | 44,702 | ||||||

| Other current liabilities | 247,495 | 204,215 | ||||||

| Total current liabilities | 389,601 | 248,917 | ||||||

| Long-term liabilities: | ||||||||

| Long-term debt | 24,669 | 12,430 | ||||||

| Deferred tax liabilities | 6,905 | 5,964 | ||||||

| Other liabilities | 79,796 | 62,412 | ||||||

| Total long-term liabilities | 111,370 | 80,806 | ||||||

| Stockholders’ Equity: | ||||||||

| Common stock | 1,605 | 1,585 | ||||||

| Additional paid-in capital | 568,203 | 519,479 | ||||||

| Retained earnings | 866,485 | 725,672 | ||||||

| Accumulated other comprehensive loss | (13,923 | ) | (13,735 | ) | ||||

| Total stockholders’ equity | 1,422,370 | 1,233,001 | ||||||

| Total liabilities and stockholders’ equity | $ | 1,923,341 | $ | 1,562,724 | ||||

| SKYLINE CHAMPION CORPORATION

CONSOLIDATED INCOME STATEMENTS (Unaudited, dollars and shares in thousands, except per share amounts) |

||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||

| March 30,

2024 |

April 1,

2023 |

March 30,

2024 |

April 1,

2023 |

|||||||||||||

| Net sales | $ | 536,363 | $ | 491,532 | $ | 2,024,823 | $ | 2,606,560 | ||||||||

| Cost of sales | 438,003 | 350,381 | 1,539,029 | 1,787,879 | ||||||||||||

| Gross profit | 98,360 | 141,151 | 485,794 | 818,681 | ||||||||||||

| Selling, general, and administrative expenses | 90,605 | 72,380 | 310,589 | 300,396 | ||||||||||||

| Operating income | 7,755 | 68,771 | 175,205 | 518,285 | ||||||||||||

| Interest (income), net | (4,164 | ) | (7,684 | ) | (28,254 | ) | (14,977 | ) | ||||||||

| Other (income) expense | (217 | ) | — | 2,604 | (634 | ) | ||||||||||

| Income before income taxes | 12,136 | 76,455 | 200,855 | 533,896 | ||||||||||||

| Income tax expense | 2,325 | 18,709 | 47,136 | 132,094 | ||||||||||||

| Net income before equity in net loss of affiliate | 9,811 | 57,746 | 153,719 | 401,802 | ||||||||||||

| Equity in net loss of affiliate | 7,023 | — | 7,023 | — | ||||||||||||

| Net income | $ | 2,788 | $ | 57,746 | $ | 146,696 | $ | 401,802 | ||||||||

| Net income per share: | ||||||||||||||||

| Basic | $ | 0.05 | $ | 1.01 | $ | 2.55 | $ | 7.05 | ||||||||

| Diluted | $ | 0.05 | $ | 1.00 | $ | 2.53 | $ | 7.00 | ||||||||

| SKYLINE CHAMPION CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited, dollars in thousand) |

||||||||

| Year Ended | ||||||||

| March 30,

2024 |

April 1,

2023 |

|||||||

| Cash flows from operating activities | ||||||||

| Net income | $ | 146,696 | $ | 401,802 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 34,910 | 26,726 | ||||||

| Equity-based compensation | 19,560 | 14,160 | ||||||

| Deferred taxes | (6,448 | ) | 1,127 | |||||

| Amortization of deferred financing fees | 348 | 357 | ||||||

| Loss (gain) on disposal of property, plant, and equipment | 205 | (129 | ) | |||||

| Foreign currency transaction loss | 297 | 828 | ||||||

| Equity in net loss of affiliate | 7,023 | — | ||||||

| Change in assets and liabilities, net of businesses acquired: | ||||||||

| Accounts receivable | 18,910 | 23,090 | ||||||

| Floor plan receivables | (15,391 | ) | — | |||||

| Inventories | 22,424 | 49,196 | ||||||

| Other assets | (14,579 | ) | (11,930 | ) | ||||

| Accounts payable | (7,950 | ) | (49,082 | ) | ||||

| Accrued expenses and other current liabilities | 16,699 | (39,920 | ) | |||||

| Net cash provided by operating activities | 222,704 | 416,225 | ||||||

| Cash flows from investing activities | ||||||||

| Additions to property, plant, and equipment | (52,915 | ) | (52,244 | ) | ||||

| Cash paid for acquisitions, net of cash acquired | (283,189 | ) | (6,810 | ) | ||||

| Cash paid for equity method investment | (4,100 | ) | (2,500 | ) | ||||

| Cash paid for investment in ECN common stock | (78,858 | ) | — | |||||

| Cash paid for investment in ECN preferred stock | (64,520 | ) | — | |||||

| Investment in floor plan loans | (18,466 | ) | — | |||||

| Proceeds from floor plan loans | 15,721 | — | ||||||

| Proceeds from disposal of property, plant, and equipment | 649 | 375 | ||||||

| Net cash used in investing activities | (485,678 | ) | (61,179 | ) | ||||

| Cash flows from financing activities | ||||||||

| Changes in floor plan financing, net | 15,368 | (35,460 | ) | |||||

| Payments on long term debt | (77 | ) | — | |||||

| Stock option exercises | 1,456 | 2,473 | ||||||

| Tax payments for equity-based compensation | (5,883 | ) | (4,032 | ) | ||||

| Net cash provided by (used in) financing activities | 10,864 | (37,019 | ) | |||||

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (280 | ) | (5,987 | ) | ||||

| Net (decrease) increase in cash, cash equivalents, and restricted cash | (252,390 | ) | 312,040 | |||||

| Cash, cash equivalents, and restricted cash at beginning of period | 747,453 | 435,413 | ||||||

| Cash, cash equivalents, and restricted cash at end of period | $ | 495,063 | $ | 747,453 | ||||

| SKYLINE CHAMPION CORPORATION

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA (Unaudited, dollars in thousand) |

||||||||||||||||

| Three months ended | Twelve Months Ended | |||||||||||||||

| March 30,

2024 |

April 1,

2023 |

March 30,

2024 |

April 1,

2023 |

|||||||||||||

| Reconciliation of Adjusted EBITDA: | ||||||||||||||||

| Net income | $ | 2,788 | $ | 57,746 | $ | 146,696 | $ | 401,802 | ||||||||

| Income tax expense | 2,325 | 18,709 | 47,136 | 132,094 | ||||||||||||

| Interest (income), net | (4,164 | ) | (7,684 | ) | (28,254 | ) | (14,977 | ) | ||||||||

| Depreciation and amortization | 10,893 | 7,386 | 34,910 | 26,726 | ||||||||||||

| EBITDA | 11,842 | 76,157 | 200,488 | 545,645 | ||||||||||||

| Transaction costs | — | — | 3,253 | 338 | ||||||||||||

| Equity in net loss of affiliate | 7,023 | — | 7,023 | — | ||||||||||||

| Product liability – water intrusion | 34,500 | — | 34,500 | — | ||||||||||||

| Other (income) | (217 | ) | — | — | (972 | ) | ||||||||||

| Adjusted EBITDA | $ | 53,148 | $ | 76,157 | $ | 245,264 | $ | 545,011 | ||||||||

| SKYLINE CHAMPION CORPORATION

RECONCILIATION OF NET INCOME TO ADJUSTED EARNINGS PER SHARE (Unaudited, dollars and shares in thousands, except per share amounts) (Certain amounts shown net of tax, as applicable) |

||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||

| March 30,

2024 |

April 1,

2023 |

March 30,

2024 |

April 1,

2023 |

|||||||||||||

| Net income | $ | 2,788 | $ | 57,746 | $ | 146,696 | $ | 401,802 | ||||||||

| Adjustments: | ||||||||||||||||

| Transaction costs | — | — | 2,489 | 255 | ||||||||||||

| Equity in net loss of affiliate | 7,023 | — | 7,023 | — | ||||||||||||

| Product liability – water intrusion | 26,393 | — | 26,393 | — | ||||||||||||

| Other (income) | (217 | ) | — | — | (732 | ) | ||||||||||

| Adjusted net income attributable to the

Company’s common shareholders |

$ | 35,987 | $ | 57,746 | $ | 182,601 | $ | 401,325 | ||||||||

| Adjusted basic net income per share | $ | 0.62 | $ | 1.01 | $ | 3.18 | $ | 7.04 | ||||||||

| Adjusted diluted net income per share | $ | 0.62 | $ | 1.01 | $ | 3.15 | $ | 6.99 | ||||||||

| Average basic shares outstanding | 57,835 | 57,109 | 57,492 | 56,987 | ||||||||||||

| Average diluted shares outstanding | 58,342 | 57,250 | 57,978 | 57,395 | ||||||||||||

| SKYLINE CHAMPION CORPORATION

RECONCILIATION OF GROSS PROFIT TO ADJUSTED GROSS PROFIT (Unaudited, dollars in thousand) |

||||||||||||||||

| Three months ended | Twelve Months Ended | |||||||||||||||

| March 30,

2024 |

April 1,

2023 |

March 30,

2024 |

April 1,

2023 |

|||||||||||||

| Reconciliation of Adjusted Gross Profit: | ||||||||||||||||

| Gross Profit | $ | 98,360 | $ | 141,151 | $ | 485,794 | $ | 818,681 | ||||||||

| Product liability – water intrusion | 34,500 | — | 34,500 | — | ||||||||||||

| Adjusted Gross Profit | $ | 132,860 | $ | 141,151 | $ | 520,294 | $ | 818,681 | ||||||||

##

Part II – Additional Information with More MHProNews Analysis and Commentary in Brief

As a programming note, MHProNews plans a follow up report on Skyline Champion based upon their latest earnings call as well as the information provided herein. Our earnings call reports have often been quite popular with readers, as the analysis of those calls have revealed insights routinely missed by others in MHVille trade media and/or in more mainstream financial news reports. Watch for it.

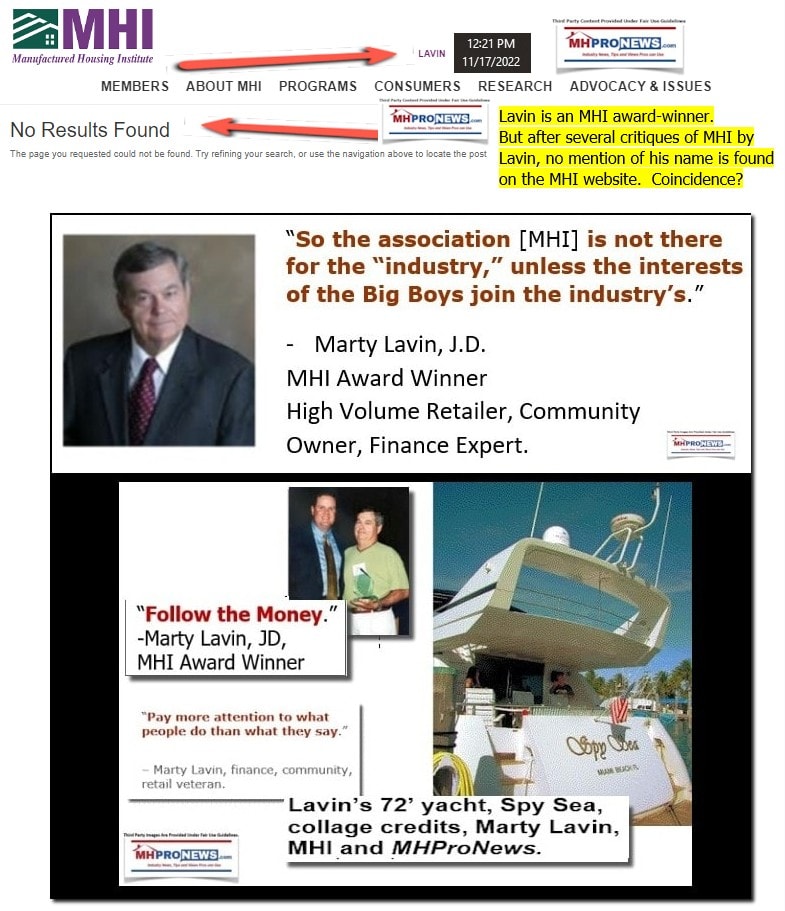

1) “There’s a sucker born every minute” is a phrase closely associated with P. T. Barnum, an American showman of the mid-19th century, said left-leaning Wikipedia. GD3 noted that: “Closely related [to P.T. Barnum’s attributed observation] is W.C. Fields in “Never Give A Sucker An Even Break.”” Be that as it may, it seems that several MHI member brands enjoy rolling out the ‘now you see it, now you don’t’ claims that manufactured homes are ready to break through to help solve the affordable housing crisis. To be clear, it isn’t that manufactured housing is able to fill that role, it has for decades and barring a calamity, they will for some years to come. But the ‘now you see it, now you don’t’ purported ‘sucker’ plays relate to how an array of excuses can be rolled out and the prior narratives – if closely examined fall apart.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

2) Any time companies can gleefully create disillusionment among their own team members, despite their happy talk, why should it be a surprise if the same firms might fail their shareholders too? For instance. How long can MHI linked Big Three brands keep playing their outrageous higher cost CrossMods “joker” card, when their own quarterly reports indicate that the average selling price and product mix are moving toward smaller lower cost units? How long will Skyline Champion talk about Genesis, when the talk was similar over 2 decades ago about that same model name?

3) In the interim, consider the following reports on rivals of Skyline Champion that are publicly traded. They will offer clues as to what has occurred and what lies ahead. Stay tuned for that pending MHProNews exclusive analysis of their latest quarterly earnings call report.

4) The insiders at MHI might share with their buddies what the latest scheme is, but to careful observers there is an apparent and ongoing set of often self-contradictory remarks, or statements/behaviors made that defy evidence and logic.

5) Not as a defense or excuse, but at least site builders admitted that they were (and still are to some extent?) throttling sales, and why. But several key MHI insider member posture one thing, do another, some get left in the dirt, and others go laughing to the bank because they appear to know which way their internal winds are blowing. Where are those regulators? Twice in recent years, MHI tells the industry that they have “momentum” and twice following those declarations of “momentum” months of extended downturns followed. What does that look like? MHProNews clearly warned the industry about the 2nd downturn ahead, based on the snake bite from the first “momentum” fiasco.

6) In the dictionary, next to the words “Rigged System” there ought to be an example of how that applies to manufactured housing. Who says? Some of MHI’s own members.

7) Every serious (as in less rigged) industry or profession glances at how other professions and industries do things in order to see what they might learn to improve. Every serious industry and business also look at their own history objectively, in order to see how they could improve. But magically, during a well-documented affordable housing crisis, manufactured housing manages to surprise (often badly) those who trust MHI’s Bush-era “read my lips” lesson when they ought to be monitoring the actual behavior more closely.

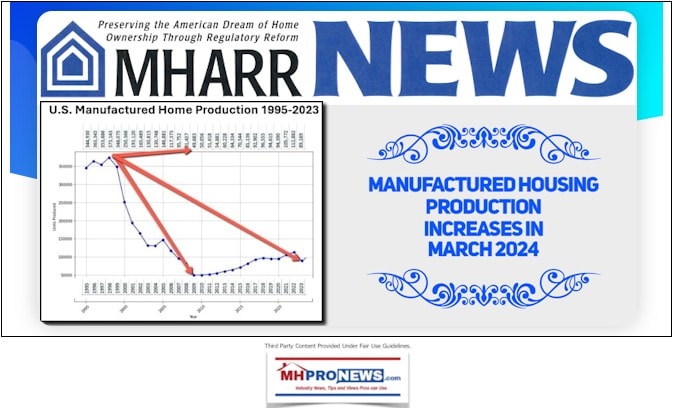

8) The smaller and more nimble rival national trade group, the Manufactured Housing Association for Regulatory Reform (MHARR) has repeatedly exposed MHI. They have at times brought things down to very basic lessons to learn and actions to be taken to advance the industry’s interests back to the sorts of levels that were common in the late 1990s.

9) Warren Buffett said it. Be fearful when others are greedy and be greedy when others are fearful. Buffett also said bad guys know more tricks. Buffett knows what manufactured housing is capable of doing, but he apparently has no interest in seeing it return to its former glory any time soon. Meanwhile, consolidation of the industry continues.

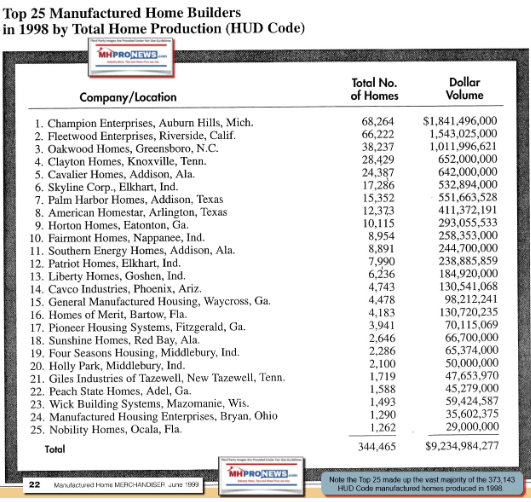

10) Champion and Skyline of yesteryear once produced almost as many homes between the two of them as the entire industry did in 2023. That’s just one reason why the rearview mirror is so important. It gives context. It can shed light on what happened before and what led us to this current set of what Yost called “headwinds.” What Yost didn’t say is arguably far more important than what he did, because those headwinds were dealt with by Congress in widely bipartisan ways in 2008 and 2000. Isn’t 15+ and 23+ years enough time for MHI to get good laws properly implemented? How much of a sucker do they want the trusting in the industry and among investors in the industry to be?

11) Smiles can be cheap, or smiles can be costly, take your pick. Far better to have an honest person not smile, and tell things as they are, then to listen to the talking heads with their smiles and watch your business, career, or investment values to erode. Watch for the upcoming special on Skyline Champion’s earnings call, and in the meantime book up on the reports linked above and below. As Donald Trump is credited with observing, a man who is learning the hard way just how rigged the system can once be said (paraphrased), you should know the details of your profession down to the paper clips. Buffett may be a scoundrel, but he is right about the need for reading for understanding. Careful reading yields details. That’s why the industry has turned to this platform for over 14 years to learn more, so pros can earn more. It is readers like you, public officials, attorneys, and others who have made and kept us the runaway most-read, most-pageviews #1 trade media serving manufactured housing since after we launched in mid-October 2009. Truth telling is not only marvelous, but it is also magnetic. The truth may not always be popular with some circles, but liars and palters hate to be exposed. Come discover more truth, day by day. ##

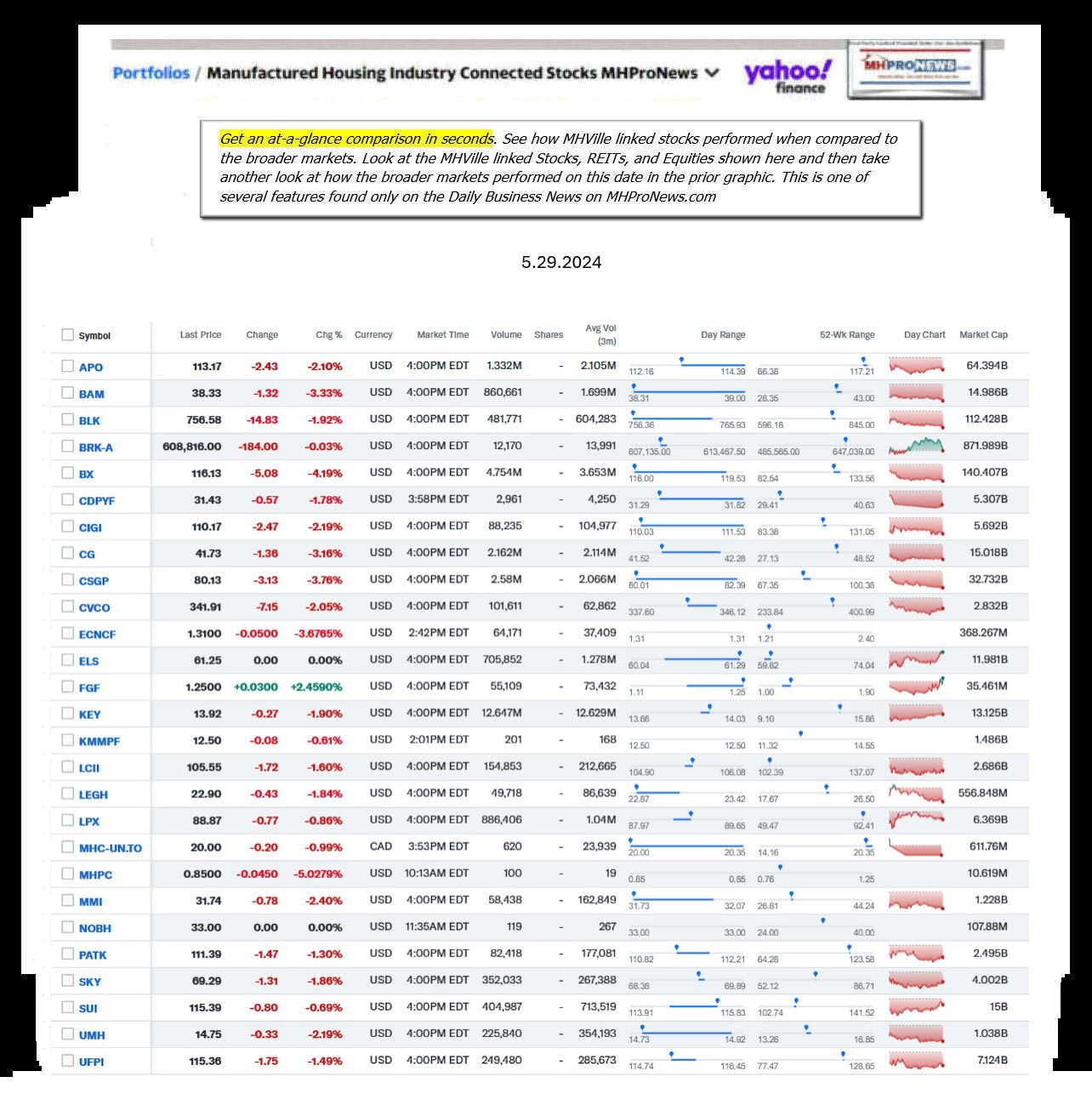

Part III – Our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that may be impacting manufactured housing connected investing.

Headlines from left-of-center CNN Business – 5.29.2024

- Wall Street is about to see its biggest trading change in years

- Footlong Cookies have returned to menus nationwide following months of incredible demand.

- Subway is bringing back the footlong cookie after it disappeared for four months

- Black passengers sue American Airlines, alleging they were thrown off a plane because of false body odor complaint

- MacKenzie Scott upended philanthropy as we know it. Melinda French Gates is catching on

- People shop in a 99 Cents Only store on April 19, 2024 in Los Angeles, California. 99 Cents Only stores are closing and liquidating all 371 of their locations, located in California, Texas, Nevada, and Arizona, after four decades in business. Around 14,000 employees are affected.

- Dollar Tree is moving into 99 Cents Only stores

- ‘It’s putting patients’ lives in danger’: Nurses say ransomware attack is stressing hospital operations

- The Federal Reserve Bank of Cleveland announced the appointment of Beth Hammack as its next president and chief executive officer.

- Cleveland Fed taps Goldman Sachs veteran Beth Hammack as new president

- Tyler Winklevoss, left, and Cameron Winklevoss launched the crypto exchange Gemini in 2014.

- Winklevoss crypto firm customers will get back triple the value of their frozen assets

- An inmate at Maryland’s Correctional Institution for Women wears a virtual reality headset during job training.

- Prisoners are using VR to prepare them for life after release

- A union holds a placard that says “stop union busting” in front of the Samsung Electronics Seocho Building in Seoul on May 24, 2024.

- Samsung union calls first ever strike after pay negotiations stall

- ConocoPhillips is buying Marathon Oil in $22.5 billion deal

- Walgreens is cutting prices on 1,500 items, joining Target, Walmart and Amazon

- After a string of safety issues, Boeing is about to release a plan to fix its quality problems

- Analysts are feeling good about the stock market because of this economic signal

- What Vivek Ramaswamy really wants with his activist stake in BuzzFeed

- Britain’s 500-year-old Royal Mail is being bought by a Czech billionaire

- Apple slashed iPhone prices in China. Sales are bouncing back

- Harvard to stay silent on issues that don’t impact university’s ‘core function’

- Former FTX executive Ryan Salame sentenced to seven and a half years in prison

- OpenAI’s Sam Altman vows to give away most of his wealth through the Giving Pledge

- Americans are feeling better about the economy for the first time in four months

- Melinda French Gates explains why she resigned from the Gates Foundation — and what she’ll do now

- Porsche reveals a new hybrid 911 as more consumers embrace hybrids over electric vehicles

Headlines from right-of-center Newsmax – 5.29.2024

- Justice Alito Rejects Dem Calls to Recuse From Election Cases

- Justice Samuel Alito is rejecting calls to step aside from Supreme Court cases involving former President Donald Trump and Jan. 6 defendants because of the controversy over flags that flew over his homes. [Full Story]

- Israel at War

- Reports: Israel Used US-Made Weapons in Rafah Strike

- US: Algeria’s Proposed UN Resolution to Halt Rafah Op Unhelpful

- 3 IDF Soldiers Slain in Rafah

- Gen. Avivi Hamas Stockpile Fire Killed Refugees

- Israel Accused of Waging 9-Year ‘War’ Against ICC

- Israel Sends Tanks Into Rafah on Raids

- Irish, Norwegian Christians Reject Palestinian State Recognition

- US-Built Pier Will Be Removed From Gaza Coast for Repairs

- US Specifies What Would Force Israel Policy Change

- US Condemns Loss of Life, but No Policy Changes on Israel

- Newsmax TV

- Dershowitz: Trump Prosecutors Misled Jury

- RNC Chair Whatley: Nev. Suit Aims to Ensure ‘Fair’ Election

- Fred Fleitz: Biden Won’t Press Iran Due to Oil Price Fear

- Huckabee: De Niro Talking ‘Nonsense’ About Trump | video

- Pam Bondi: Quick Verdict Likely Good for Trump | video

- Trump Lawyer Scharf: Prosecutors Haven’t Proven Case | video

- Newsfront

- Report: DOJ Tracked Moms for Liberty as Hate Group

- The conservative education policy group Moms for Liberty was tracked by the Department of Justice’s unit tasked with responding to “hate crimes” through alerts triggered by signals such as the Confederate flag, a noose, or a swastika, according to internal emails…. [Full Story]

- Report: One Juror Seems to Agree With Defense

- A hung jury in former President Donald Trump’s New York criminal [Full Story]

- Related

- Trump Jury Begins Deliberations

- Elise Stefanik Files Misconduct Complaint Against Trump Judge

- Trump: ‘Mother Teresa Could Not Beat These Charges’ |video

- Trump Faces Possibility of Jail Time if Convicted

- Biden Campaign Plots Stay-the-Course Strategy After Trump Verdict

- Trump Jury Asks to Rehear Testimony as Deliberations Get Underway

- Crandall: Heart Attack Symptoms Differ for Women

- Signs of a heart attack are different for women and men. While the [Full Story]

- Lawsuit: N.Y. AG Censoring Anti-Abortion Groups

- New York Attorney General Letitia James is using the power of her [Full Story]

- RFK Jr. Files FEC Complaint Claiming Debate Collusion

- Robert F. Kennedy Jr.’s presidential campaign filed a Federal [Full Story]

- Related

- Biden, Harris to Launch Black Voter Outreach Effort as They See Signs of Diminished Support

- De Niro Does Biden Fundraiser, Trump ‘Monster’

- Dems Working to Keep Senate Despite Biden’s Low Numbers

- Trump Talks to Musk About Advisory Role

- Ukraine Front Line ‘Worse Than Hell’ as Russia Advances

- Now in the third year of full-scale war, Ukraine’s top military [Full Story]

- Related

- Sweden to Donate $1.23 Billion in Military Aid to Ukraine

- Russia May Speed Up Missile Construction, Deployment in Response to NATO

- US Accuses China’s Leadership Over Ukraine, Delivers New Sanctions Warning

- Justice Alito Rejects Calls to Recuse From Election Cases Over Flag Flap

- Justice Samuel Alito is rejecting calls to step aside from Supreme [Full Story]

- Expect ‘Continuity’ Under New Taiwanese President

- While Taiwan’s new president Lai Ching-te may initially be “more [Full Story] | Platinum Article

- Stocks End Lower Amid Rate Angst, Higher Bond Yields

- S. stocks fell Wednesday amid further gains in Treasury yields and [Full Story]

- AOC Touts Bill to Fight AI Deepfake Pornography

- Alexandria Ocasio-Cortez, D-N.Y., is pushing for federal [Full Story]

- Judge Deals Setback to Fani Willis in Georgia Case

- A judge’s ruling Tuesday marked a setback for Fulton County District [Full Story]

- OpenAI Inks Content Deals With The Atlantic, Vox Media

- Sam Altman-led OpenAI said Wednesday it has signed content and [Full Story]

- Charges Dropped Against Golf Champ Scottie Scheffler

- Criminal charges against Scottie Scheffler have been dismissed, [Full Story]

- Florida: Say Bye to Your Car Insurance Bill if You Live in These Zip Codes

- Otto Quotes

- Fed Survey: US Firms More Pessimistic on Economy

- S. economic activity continued to expand from early April through [Full Story]

- Mayorkas Admits ‘Reality’: Migrants ‘Try to Game System’

- Homeland Security Secretary Alejandro Mayorkas recently said some [Full Story]

- Drag Queen Wins $1.1M in Case Against Idaho Blogger

- A drag queen won more than $1.1 million in damages after a jury in [Full Story]

- A new study released this week found that practicing yoga can improve

- Crandall: Improve Heart Health With Prayer

- A new study released this week found that practicing yoga can improve [Full Story]

- Lingering Inflation Keeping Fed Rate Cuts on Pause

- Hopes for interest rate cuts this year by the Federal Reserve are [Full Story]

- Dennis Quaid Endorses Donald Trump

- Actor Dennis Quaid said he plans to vote for former President Donald [Full Story]

- Former Trump Spokesperson Wins Texas Race

- Katrina Pierson, a former Trump 2016 national campaign spokesperson, [Full Story]

- Detransitioner Lawsuit to Move Forward in N.C.

- A North Carolina judge earlier this month ruled that a lawsuit filed [Full Story]

- Biden, Harris to Launch Black Voter Outreach Effort as They See Signs of Diminished Support

- President Joe Biden and Vice President Kamala Harris are stepping up [Full Story]

- Indian Capital Temps Burn Higher Than 126 Degrees

- Record heat seared parts of the Indian capital for a second day on [Full Story]

- Dems’ Super PAC Plans $100M Abortion Rights Push

- The House Majority PAC is starting a $100 million fund that will [Full Story]

- GOP Sen. Wicker Seeks ‘Generational’ $55B for Military

- The top-ranking Republican on a Senate committee that oversees the [Full Story]

- MLB Adding Negro Leagues Stats to Official Records

- Catcher Josh Gibson is now officially one of the major leagues’ [Full Story]

- Giant Pandas Returning to Washington’s National Zoo

- Two giant pandas are coming to Washington’s National Zoo from China [Full Story]

- Weinstein Will Appear in Same Courthouse as Trump

- Harvey Weinstein is expected to appear before a judge Wednesday [Full Story]

- Biden Giving Schools $900M for Electric School Buses

- The White House on Wednesday unveiled nearly $900 million in awards [Full Story]

- GOP Rep. Gonzales Narrowly Wins Texas Primary Runoff

- Tony Gonzales, R-Texas, barely survived a far-right primary [Full Story]

- Fmr Trump Attorney Ellis Disbarred for 3 Years in Colo.

- Jenna Ellis, a former attorney for former President Donald Trump, has [Full Story]

- Finance

- Lingering Inflation Keeping Fed Rate Cuts on Pause

- Hopes for interest rate cuts this year by the Federal Reserve are steadily fading, with a stream of recent remarks by Fed officials underscoring their intention to keep borrowing costs high as long as needed to curb persistently elevated inflation. A key reason for the delay…… [Full Story]

- Related Stories

- Fed Survey: US Firms More Pessimistic on Economy

- Fred Fleitz to Newsmax: Biden Won’t Press Iran Due to Fear of Higher Oil Prices

- Tyson Accused of Favoring Illegals Over US Workers

- Visa, Mastercard Settle ATM Fee Lawsuit for $197M

- Trump Talks to Musk About Advisory Role

- Big Tech Inks Deal With Duke Energy on Clean Energy

- More Finance

- Health

- Prunes and Other Surprising Foods Boost Bone Health

- As May ─ and Osteoporosis Awareness and Prevention Month ─ come to an end, knowing your bone health is important. Osteoporosis, which causes bones to become weak and brittle, happens when the creation of new bone doesn’t keep up with the loss of old bone. Approximately 54…… [Full Story]

- Eating Sugar Does Not Make Kids Hyperactive

- Kids in Noisy Neighborhoods More Prone to Anxiety

- Face-to-Face Friendships Best for Our Health

- Light Therapy Helps Heal Concussions

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.