According to Skyline Champion (SKY) President and Chief Executive Officer (CEO) Mark Yost in their most recent earnings call (found in Part I below) are remarks like the headline topics outlined in this preface and unpacked in Part II of this report. More manufactured home street retailers are expected to exit the industry, said Yost, and Skyline Champion has a plan for that developing scenario. Yost stated that the decline in business in 2023 was driven mostly by the drop in purchases from land-lease communities, plus a loss of some governmental (i.e.: FEMA et al) orders. Executive Vice President and Chief Financial Officer (CFO) Laurie Hough said the drop in the average selling price of Skyline Champion (SKY) homes are being driven by a shift to smaller homes with fewer options. That happens to be a pattern also described by Cavco Industries of lower ASPs due to a shift in product sales toward smaller homes with more basic options. Apparent disconnects between the various remarks that follow is that Hough said that “Interest rates continue to have an impact on our core product ASPs as consumers are focused on maintaining affordable monthly payments,” but Yost indicated that they are capturing ‘step down buyers’ from the conventional housing world. If so, then Yost didn’t explain why isn’t there an increase in multi-sectional homes with more options, because of the increased affordability of HUD Code manufactured homes? Yost asserted in response to an inquiry from an analyst during their most recent earnings call that the M&A pipeline is healthy – but didn’t specify if those mergers and acquisitions (M&A) would be in retail, production, other sectors of the industry, or some combination of those possibilities. For the detail minded that have a reasonable understanding of the realities of manufactured housing instead of the narratives, competing pitches, and myths spun by whomever that may be contradicted by the truth, there are concerns and contradictions to be found in their earnings call that will be explored in Part II.

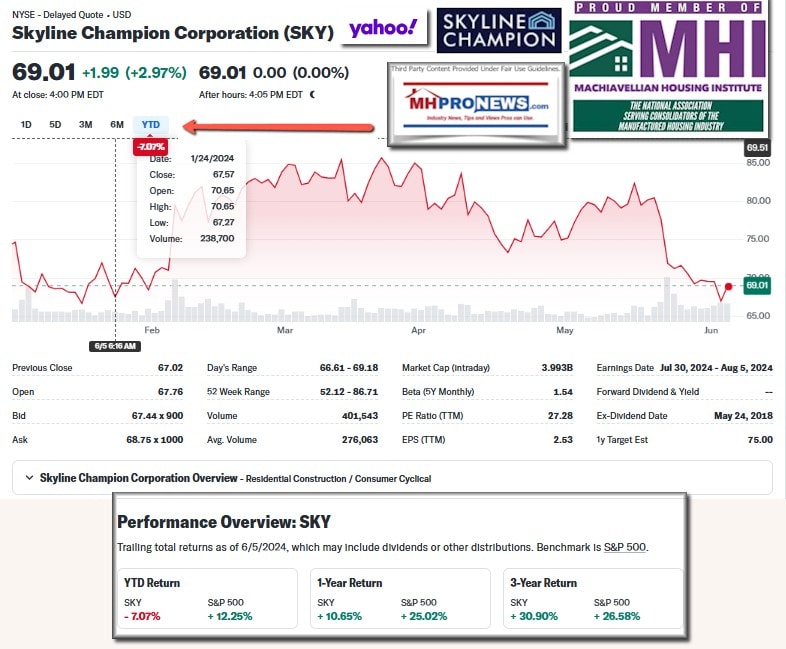

For instance, for those who grasp that $100 million in stock buybacks being authorized means that Skyline Champion are a clear signal – and again similar to one from Cavco Industries (CVCO) – that neither of those higher profile Manufactured Housing Institute (MHI) member firms have any stated plans to increase market penetration through legal efforts to force HUD and/or FHFA to enforce federal laws that MHI claims it wants enforced. but has done little more than posture, do photo ops, and otherwise talk about for years on end.

Insights on Blackstone, Carlyle, and Triad ECN related insights are part of what follows in their most recent earnings call.

Some of what is said is, or should be, stunning to well informed and longer term manufactured housing industry professionals. Watch carefully what is said about retail and potential manufactured housing prospects. Stunning.

Among the typos corrected below is small r “regional” which should have been Regional and is shown as [R]egional below. Highlighting in what follows is added by MHProNews, which can be explored further in Part II.

Part I

Skyline Champion Corporation (SKY) Q4 2024 Earnings Call Transcript

May 22, 2024 3:35 PM ET Skyline Champion Corporation (SKY) Stock

Skyline Champion Corporation (NYSE:SKY) Q4 2024 Earnings Conference Call May 22, 2024 9:00 AM ET

Company Participants

Mark Yost – President & CEO

Laurie Hough – EVP & CFO

Conference Call Participants

Phil Ng – Jefferies

Mike Dahl – RBC Capital Markets

Christopher Kalata – RBC Capital Markets

Daniel Moore – CJS Securities

Elizabeth Langan – Barclays Bank

Danny Eggerichs – Craig-Hallum Capital Group

Jay McCanless – Wedbush Securities

Operator

Good morning, and welcome to Skyline Champion Corporation’s Fourth Quarter and Full Year Fiscal 2024 Earnings Conference Call. The company issued its earnings press release yesterday after the close.

I’d like to remind everyone that today’s press release and statements made during this call include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties that could cause actual results to differ materially from the company’s expectations and projections. Such risks and uncertainties include the factors set forth in the earnings release and in the company’s filings with the Securities and Exchange Commission.

Additionally, during today’s call, the company will discuss non-GAAP financial measures, which it believes can be useful in evaluating its performance. A definition and reconciliation of these measures can be found in the earnings release.

I would now like to turn the call over to your host, Mr. Mark Yost, Skyline Champion’s President and Chief Executive Officer. Please go ahead.

Mark Yost

Thank you for joining our earnings call, and good morning, all. I am pleased to have Laurie Hough, our EVP and CFO, with me today. On this call, I will briefly cover the highlights from the full year and the fourth quarter. I will also update you on our progress in the first quarter of fiscal 2025 and share some insights on our expectations for the remainder of the year.

In fiscal 2024, Skyline Champion made significant strides in executing our strategic vision through investments in integrated turnkey solutions for retail, financial services and home completion. These efforts not only broaden our geographical reach and enhanced our market approach, but also upgraded our digital lead management systems, improving service to customers and expanding the market for our products.

In line with our investment priorities, we also approved a share repurchase program for up to $100 million of our common stock. This decision reflects our strong balance sheet, robust cash generation while returning excess capital to shareholders after investing in strategic and growth priorities.

For the year, we were able to provide 21,845 customers and families with a place to call home and reported over $2 billion in top line revenue. The year-over-year decrease in unit volume was driven by the community and government channels as builder developer and retail unit volumes grew year-over-year based upon the strength of demand for affordable housing.

From a market perspective, consumer demand remains healthy in the face of housing shortages and a growing base of potential homeowners. The challenges posed by higher interest rates further highlight the need for accessible housing options. Our strategic efforts to enhance the home buying experience has significantly increased the visibility of our solutions in this competitive economic environment.

Demand this quarter was reinforced by a 16% sequential increase in orders and a 118% organic rising year-over-year, reflecting sustained demand for affordable housing and the growth in emerging channels like builder developer sector, which was our fastest-growing segment.

Despite these gains, the quarter presented challenges, including adverse weather conditions and longer cycle times for our [R]egional acquisition, which temporarily reduced net sales and led to higher levels of finished good inventory.

Our U.S. home sales in the quarter increased year-over-year by 15% to 5,652 units. This growth was supported by our strategic acquisition and enhanced manufacturing capabilities. Though our process was tempered by inclement weather, which disrupted the shipping and setting of our homes.

Additionally, weaker demand in Canada contributed to sales figures that did not meet our expectations. Nonetheless, the positive trends in organic net order volume growth at our manufacturing plants are driving the future outlook.

During the fourth quarter, we recorded $34.5 million reserve for estimated remediation costs related to a water intrusion issue. This issue was isolated involving materials that did not perform in accordance with the manufacturer’s contractual obligations and was limited to homes constructed at one of our manufacturing facilities.

We discontinued the use of this material in our production process in March of 2021. We are actively seeking recoveries from various parties, including the supplier, their insurance provider and our own insurance provider. Laurie will elaborate on this shortly.

Our gross profit margin adjusted for the water intrusion remediation costs indicate sustainable profitability as we continue to navigate shifts in product mix driven by consumer affordability. As operations at our new plants ramp up, we expect some margin impact, but the increased volumes should help us maintain our backlog lead times within the usual four to 12 week range.

Our year-end backlog stood at $316 million, marking a 9% sequential increase with current lead times averaging nine weeks. The integration of our recent investments is a top priority. We are focusing on capturing synergies and aligning cultures and systems capabilities. We have made significant progress in achieving operational and purchasing efficiencies at the [R}egional manufacturing facilities and are on track to achieve the upper end of our original synergy target of $10 million to $15 million by the end of fiscal 2025 ahead of schedule.

This quarter, we also expanded our financial services through our partnership with Triad, introducing new programs that include floor plan financing for our independent dealers and consumer financing for selected national products.

Although, these initiatives are in the early stages, they have been well received in the market and show great potential in attracting new home customers and meeting the comprehensive needs of homebuyers. These strategic actions, supported by our order growth, affirm our commitment to strengthening our market position and delivering on our promise of accessible, comprehensive housing solutions.

Moving into our first fiscal quarter. We are seeing healthy demand from both retailers and builder developers. Their consistent ordering patterns are key drivers of our growth. Additionally, with a year-over-year increase in orders from our community partners, we are starting to ramp production in our manufacturing facilities.

Looking ahead, we anticipate low double-digit sequential revenue growth. This will be driven by the order growth we have seen partially tempered by a growing backlog as we balance between increasing production while maintaining our high standards of quality.

On the macroeconomic front, job and wage growth remains strong, especially in critical sectors like health care, manufacturing and retail, which are foundational to our customer base. Given recent inflationary pressures and robust employment data, we anticipate the Federal Reserve will maintain higher interest rates for an extended period. These dynamics support the stability of future demand for our products.

Higher income levels, coupled with sustained high interest rates and the shortage of affordable housing align well with our pricing and product offerings. As we continue to integrate our acquisitions and enhance our integrated turnkey solutions across retail, financial services and home completion, we are not only broadening our geographical reach, but also reinvesting and reinventing our approach to the market.

A pivotal aspect of this progress is strengthening our digital lead management system. This enhanced platform is now more robust, better introducing our customers to our products and expanding our total market presence. The successful integration of these turnkey solutions has increased our capture rate of both channel partners and end consumers.

The positive reception at recent industry events, coupled with the launch and early capture rates of Champion Financing highlights the effectiveness of our strategies. These achievements have ignited considerable market interest, open new paths for growth and further expanded our opportunities in the housing market.

I will now hand the call over to Laurie, who will provide more detail and insights into our quarterly financial performance.

Laurie Hough

Thanks, Mark, and good morning, everyone. I’ll begin by reviewing our financial results for the fourth quarter, followed by a discussion of our balance sheet and cash flows. I will also briefly discuss our near-term expectations. During the fourth quarter, net sales increased 9% to $536 million compared to the same quarter last year, with U.S. factory built housing revenue increasing 12%.

The number of homes sold increased 15% to 5,652 homes in the U.S. compared to 4,900 homes in the prior year period. U.S. home volume during the quarter was supported by additional retail and manufacturing capacity resulting from the Regional Homes acquisition that contributed approximately $108 million to net sales during the quarter as well as the opening of our Bartow, Florida and Decatur, Indiana facilities earlier this year.

The average selling price per U.S. home sold decreased by 3% to $89,800 due to changes in product mix and reduced material surcharges compared to the prior year. On a sequential basis, U.S. factory-built housing revenue decreased 3% in the fourth quarter compared to the third quarter of fiscal 2024. Interest rates continue to have an impact on our core product ASPs as consumers are focused on maintaining affordable monthly payments.

On a sequential basis, the average selling price per home decreased 3%. And going forward, we expect revenue and ASPs to continue to be impacted by a mix of lower optioned homes. Capacity utilization was 57%, which was flat compared to the sequential third quarter of fiscal 2024. Current utilization rates primarily reflect the increased capacity brought online through acquisitions and newly opened plants.

Canadian revenue during the quarter was $23 million, representing a 23% decline in the number of homes sold, which was partially mitigated by a 4% increase in the average home selling price. The average home selling price in Canada increased to $121,200 due to a shift in product mix. The reduction in sales volume can be attributed to a combination of factors, including higher interest rates that have tempered buyer enthusiasm.

In addition, economic uncertainties driven by the current drought in the Prairies and Western Canada are causing rural homebuyers to delay their purchases. These conditions are anticipated to continue to impact the housing market dynamics in these regions in the near term.

Consolidated gross profit decreased 30% to $98 million in the fourth quarter, and our gross margin contracted by 1,040 basis points from 28.7% in the prior year period. The change in gross profit and gross margin reflects the impact of the estimated liability of $34.5 million recorded in the fourth quarter of fiscal 2024 related to the remediation costs for water intrusion issues in homes produced at one of our plants from 2016 to early 2021.

We’ve developed a remediation plan that calls for inspection and repair or mitigation of affected homes. We estimated the charges by establishing a range of total expected costs using an actuarial analysis. The analysis resulted in a range of losses between $34.5 million and $85 million. We were not able to determine a value in the range that was more likely than any other value and as prescribed by accounting guidance recorded the charge based on the low end of the range.

We will monitor the results of the inspection and repair activities and may revise the amounts of the estimated liability, which could result in an increase or decrease in the estimated liability in future periods. As Mark mentioned, we’re pursuing recoveries from the manufacturer, the distributor and the related insurance companies, but cannot estimate or record those potential recoveries in this period.

Adjusted gross profit decreased by 6% to $133 million, and adjusted gross margin was 24.8% of net sales, a 390 basis point contraction compared to the prior year period. The contraction in adjusted gross margin was primarily due to lower average selling prices in the U.S. and the shift in product mix to less optioned homes, as well as the ramping of our previously idled facilities and the impact of the Regional Homes acquisition.

Regional Homes core product gross margins are generally lower than the legacy Skyline Champion margins. In addition, consolidated margins were impacted by the effect of purchase accounting increases to the carrying value of [R]egional finished goods inventory, which had a negative 80 basis point impact on consolidated gross margins during the quarter. We expect this purchase accounting impact to continue in the near term as we sell off the finished goods inventory acquired.

SG&A in the fourth quarter increased $18 million to $91 million, primarily due to the Regional Homes acquisition, partially offset by lower variable compensation at existing operations. Net income for the fourth quarter decreased 95% to $3 million or $0.05 per diluted share compared to net income of $58 million or earnings of $1 per share during the same quarter period last year. The decrease in EPS was driven by the decline in sales and gross profit, including the impact of the estimated remediation costs for the water intrusion issue.

Adjusted net income per diluted share was $0.62, excluding the estimated remediation costs for the water intrusion liability and the company’s share of ECN’s calendar fourth quarter loss of $7 million. As a reminder, we record the impact of our equity investment in ECN’s common shares on a one quarter lag. The company’s effective tax rate for the quarter was 19.2% versus an effective tax rate of 24.5% for the year ago period. The decrease in the effective tax rate is primarily due to equity compensation and tax credits.

Adjusted EBITDA for the quarter was $53 million compared to $76 million in the prior year period. Adjusted EBITDA margin was 9.9% compared to 15.5% in the prior year period, which was impacted by lower gross margins and higher SG&A. As we’ve noted in previous quarters, we expect a continued decline in our gross margin in the near term. This trend is influenced by homebuyers increasingly selecting homes with fewer options driven by inflationary pressures and persistently high interest rates.

Additionally, the ramp-up of our new plant operations and the sale of finished goods inventory from the acquisition of Regional Homes retail sales centers contribute to this outlook. Collectively, these dynamics are likely to push our gross margins down in the short term, 100 to 150 basis points versus the sequential fourth quarter. Despite these headwinds, we remain confident in reaching our long-term structural margin targets, bolstered by ongoing enhancements in our operational capabilities and strategic investments in the business.

As of March 30, 2024, we had nearly $500 million of cash and cash equivalents and long-term borrowings of $25 million with no maturities until 2026. We generated $4 million of operating cash flows for the quarter compared to $52 million for the prior year period. Operating cash flows were adversely impacted by the growth in our captive retail inventory balances and growth in our independent dealer floor plan receivables.

On May 16, 2024, our Board of Directors approved a share repurchase program for up to $100 million of our common stock. The share repurchase program may be amended, suspended or terminated by the Board of Directors at any time. We plan to fund the program from existing cash on hand and future cash generation. This program represents a logical evolution of our capital allocation strategy as our strong balance sheet and cash generation allows us to maintain a balanced approach to returning capital to shareholders, reinvestment and growth initiatives.

I’ll now turn the call back to Mark for some closing remarks.

Mark Yost

Thanks, Laurie. The long-term outlook looks bright for our company. With demand from retailers and builder developers, the return of more normal ordering volumes from our community partners and the enduring need for affordable housing, we are well positioned for continued growth and success.

Furthermore, our strategic expansions into digital and consumer retail, along with financing are poised to further enhance our competitive edge and drive value for our stakeholders. We remain steadfast in our commitment to deliver sustainable growth and value creation, and we’re excited about the opportunities that lie ahead.

Before we move on to the Q&A section, I would like to express our gratitude to the entire Skyline Champion team for their exceptional efforts this year as we drive for long-term success.

And with that, operator, you may now open the lines for Q&A.

Question-and-Answer Session

Operator

Thank you. At this time, we will be conducting a question-and-answer session. [Operator Instructions] Our first question comes from Phil Ng with Jefferies. Please proceed with your question.

Philip Ng

Hey, guys. I appreciate the color that, Mark, you provided perhaps that weighed on results from a top line perspective, weather and stuff of that nature. And the low double-digit sequential growth is actually quite strong, but given some of the noise you saw in the fourth quarter, is the spring selling season kind of shaping up as you thought? And the elongated cycle time you called out — dynamic you called out in this past quarter, is that largely flushed out at this point?

Mark Yost

Yeah, Phil. Thank you and good morning. I think the spring selling season and demand-wise is shaping up as we thought very healthy demand overall. The tie-up with weather and other things is really just a timing issue. So if you look at our inventory balances on the balance sheet, you’ll see an increase sequentially quarter-over-quarter. That was largely driven by just timing of retail inventory getting delivered and not yet set and finished. So that cycle time is a little longer than we expected. I expect that this quarter will work through some of that. But I think demand at retail is very strong. So it will probably be rather balanced through the quarter.

Philip Ng

Okay. And then you talked about the REIT channel, perhaps activity picking up a little bit, Mark. It’s been lots of hits and goes in that channel. Can you just provide a little more color what you’re seeing on that front and how your customers are reacting? Have you started seeing them kind of step-up order activity and where to kind of — how they’re managing that business?

Mark Yost

Yeah, Phil. I think the REIT customers are starting to return to market in a decent way. Actually, some of our plants, you’ll see backlogs probably grow this quarter in addition to the sequential growth in revenue just because those customers are starting to return this quarter kind of in the April — March, April time period and forward. Not everybody has returned, but I would say most of them have started to return to ordering. And so I would expect that volume to ramp up into our second — first and second quarters. It will ramp through.

Interest rates are not really impacting them to a great deal, most of them. I think it’s really the ones that are focused on rentals are very strong. And actually, given the Champion Financing partnership with Triad and some of the other turnkey services we’re offering, we’ve actually signed up some new communities that are now approaching us because of those additional offerings.

Philip Ng

Got you. And on that note, Mark, how are you set up on Triad? I know early on, as you kind of integrated, you were kind of working through that. How are you set up perhaps now as you kind of head to a very busy time of the year and appreciate any color in terms of opportunities and wins you’ve seen with this acquisition you guys made or a partnership you’ve made, obviously?

Mark Yost

Yeah. It’s been – I think that the system integration or kind of setup is behind us, that’s done. Their team at Triad has done a great job on that. I think we’ve rolled out some new programs. So those have been very well received. Early innings on that, but the traction has been exceptional. And actually, I think one of the key surprises or maybe not surprises, but good conclusions coming from that is given that we have this partnership, we’re getting kind of customers that we couldn’t attract previously are now looking to do business with us or more business with us because of those relationships.

Philip Ng

Okay. Appreciate all the color, guys. Thank you.

Mark Yost

Thank you.

Operator

Our next question comes from Mike Dahl with RBC Capital Markets. Please proceed with your question.

Christopher Kalata

Hi. It’s actually Chris on for Mike. Maybe just going back to the volume outlook this quarter — or results this quarter. I think the industry kind of came up low double digits. You guys looks like on an organic basis, saw volumes down mid-single digits. So could you just help us bridge the gap? I know weather was an issue, but just maybe put some quantification around the relative performance versus the industry.

Mark Yost

Yeah. I think if you take a look at our top line and if you just adjust it for the finished good inventory build during the quarter, you’ll see that we’re right on par. So it’s really just a timing issue with its cycle time through the inventory channel and through the retail channel. They really created that.

Christopher Kalata

Got it. So does that imply that next quarter, you’re assuming to outperform the market, just given that timing dynamic?

Mark Yost

Yeah. I think if you take a look — it depends on the timing of backlog as well on that, Chris. But yes, I think if you look at kind of how we’re talking sequential growth, I think you’ll see some of that freed-up demand coming through how we’re thinking about this upcoming quarter.

Christopher Kalata

Appreciate that. And then just on the water intrusion remediation costs, I know you guys said you’re expecting some recoveries to cover that just given the wide range of outcomes, and I know it’s still early on, but is your base case expectation today that you’ll — the recoveries you’ll get from suppliers will kind of cover the potential range of outcomes on the liability side or is it — just some help on understanding the ultimate cash flow impacts to expect from you guys.

Laurie Hough

Hi, Chris. Yeah. So we’re really in the early stages of development of understanding what the total impact is going to be and what the recoveries are. So at this point, we’re — we just want to see how the repairs and communications develop.

Christopher Kalata

And I guess, timing of that clarity. Just do you have a sense of kind of when you’ll have a better sense of…

Laurie Hough

Yeah. So the first step is for — was our communication to HUD, and that happened recently. And so they need to come back to us and give us approval on our plan for remediation. And then the next step after that will be communication to the customers of the homes. And then we need to understand what reply rate we get. And from there, we’ll go out and inspect the homes and do whatever the appropriate level of mitigation is.

Christopher Kalata

Understood. Appreciate the color.

Operator

Our next question is from Daniel Moore with CJS Securities. Please proceed with your question.

Daniel Moore

Yes. Thanks, Mark. Thanks, Laurie. Good morning. You touched on it, obviously, but maybe just drill down into the cadence of kind of retail traffic and demand through the quarter as well as overall orders, including community business and how that’s trended thus far in April and May, as we get more into the spring selling season as they continue to kind of tick higher sequentially. What are you seeing there at the ground level?

Mark Yost

Yeah. The ground level — and good morning, Dan. The ground level has been good and healthy. I would say that the — through the first calendar quarter, our fourth fiscal quarter, we saw demand kind of steadily increasing in the quarter, as you would normally see during kind of the spring ramp. I will say January was a little slower than expectations, mainly driven by the weather, which kind of created a backlog of kind of some activity flowing through our retail orders.

But as far as demand activity, retail is very healthy. Builder is very good. Communities, like I said earlier, are starting to ramp. So I think we’ll see not only the sequential revenue growth that I mentioned earlier, but we’ll see an increase in backlog as well. So I think the order rates are fairly healthy.

Daniel Moore

Okay. And I know this is a little bit crystal ball and early, but in the past, you’ve sort of given a little bit of a maybe a one or two quarter look. Are you given current trends, would you expect to continue to ramp production through at least kind of the September quarter at this stage or TBD?

Mark Yost

No. I think that’s a fair depiction of how we would do it. We’re slow and steady in our ramping in production. I think we’re very focused on quality, especially with the traction we’ve made in our branding processes and our social media followings now up to 1.5 million, so I think across our brands. So we’re really getting that end consumer buyer who is not our traditional customer. So we want to make sure to really emphasize a slow and steady ramp and keep our backlogs in that four to 12 week range.

Daniel Moore

Very good. And then obviously, you’re excited about — I feel like you’ve got your DTC initiatives in a better position at this point. Any metrics that you can share or even anecdotes of how that’s starting to drive demand from clients that you would not have necessarily reached otherwise directly to your company-owned retail, but as well as your kind of retail partners? Thanks, again.

Mark Yost

Yeah. Thanks, Dan. I don’t have specific necessarily metrics. I will say, certain indicators such as phone call return time and other things like that or contact return time, e-mail contact return time has improved drastically, 30% plus from our independent retailers and captives as we’ve driven these leads to them, and it’s turning into higher conversion rates. So I think those kind of signs are really healthy.

And I think some of the things we’re implementing in terms of our call centers and other things are really impacting the customers to take away the confusion of how to buy our homes and help them – help hand them off to a retailer who can drive that customer home.

Daniel Moore

All right. I’ll jump back with any follow-ups. Thank you.

Operator

Our next question is from Matthew Bouley with Barclays. Please proceed with your question.

Elizabeth Langan

Good morning. You have Elizabeth Langan on for Matt today. Thank you for taking the questions. I was wondering if you could just kind of speak to how you’re thinking about industry volumes as we head into fiscal ’25?

Mark Yost

Yeah. I think industry volumes as a whole I think should pick up, really driven by the community channel and healthy retail activity. So the community channel was off significantly in fiscal 2024 and calendar last year. So they were down significantly in volume, which is really the whole driver of the industry’s year-over-year decreases in absolute volume that we saw.

So I think as they return, you’ll see kind of the industry get back to where it was in probably gradually, so maybe not on a full year basis, but gradually towards the late half of the year, we should get back to kind of a normal cadence in terms of demand activity versus what we saw last year.

Elizabeth Langan

And then on the builder developer channel, have you kind of seen anything — I know that you mentioned that the demand has been good so far this year. Have you won any like incremental business? I know you have one business from like a top 100 builder previously. Is there anything kind of in the works or any momentum around any more wins like that coming forward?

Mark Yost

Yeah, there is. I think this quarter, we won awards from several builders in several subdivision development. So I think that momentum is starting to increase. It takes a little bit of time for those orders to process through. They’re not as quick as one might think just because of the cycle time of land development and other things, but we’re starting to gain traction and actually conversion with our builder channel.

Elizabeth Langan

Thank you very much.

Mark Yost

Thank you, Elizabeth.

Operator

Our next question is from Greg Palm with Craig-Hallum Capital Group. Please proceed with your question.

Danny Eggerichs

Hi. This is Danny Eggerichs on for Greg today. Thanks for taking the questions. I was hoping to kind of dig in on now that we have more [R]egional inclusion, maybe just how the strategy shifts a little bit more towards pushing homes through company-owned stores. Just any kind of progress update on that and how you think about that moving forward. And how, if anything, it kind of shifts the strategy in the business?

Mark Yost

Thanks, Dan. I don’t know that it shifts the strategy of the business. We have excellent independent retail partners throughout the country. I think in the parts of the country, I’ll call it, Mississippi, Alabama, that region, we had a very small presence, generally speaking. So having retail in that area or that distribution area is critically important. I do think, over time, we will see expansion of our captive retail. There’s several or many retail — independent retailers who will look in the next few years to retire and maybe exit the business.

So we want to have a strategy to make sure to capture those. And given the success and traction we’ve had with our digital lead management, the conversion rates with our captive versus independents being higher conversion at a captive store with that digital channel, I think it bears some fruit for us and really drives that synergy between them. But we’re seeing the independents really adapt to the digital strategy as well. So I think it’s a win-win.

Danny Eggerichs

Got it. That’s helpful. And I think last quarter, you had kind of mentioned maybe expectation for fiscal year ’25 of maybe 10% to 15% revenue growth. Anything over the last couple of months that has kind of changed that outlook or you still feel confident in that kind of growth this year?

Mark Yost

Yeah. I think general industry growth should be in that range, and we should be in line with that kind of industry range as well.

Danny Eggerichs

Okay. Great. And then maybe one last one. In terms of kind of SG&A, another step-up in the quarter, I know you mentioned. Is that kind of the new level to go off of? Or was there anything in there that kind of makes it one timey or how should we think about that as we move throughout the year?

Laurie Hough

So sequentially, we did see SG&A pick up because we had an additional couple of weeks for the full impact of Regional given the timing of the close in mid-October. And then in addition to that, in the March quarter, we also have our two large industry shows, Louisville in January and Biloxi in March. So that’s something that occurs annually, but sequentially was an add for the quarter. But barring those couple of items, this is closer to the new normal.

We are going to see a slight reduction in fixed SG&A. We did do some headcount reductions for overlap related to the Regional acquisition at the end of the March quarter that we will see a benefit of coming into subsequent quarters.

Danny Eggerichs

Okay. Very helpful. Thank you.

Operator

Our next question comes from Jay McCanless with Wedbush Securities. Please proceed with your question.

Jay McCanless

Hey, good morning, everyone. So I wanted to ask with the community business potentially coming back and — but at the same time, it sounds like in the retail channel, you’re selling maybe homes with less options, less frills on them. What does that gross margin differential look like now between the retail channel and the community channel?

Laurie Hough

Not significantly different, Jay.

Jay McCanless

Okay. And I guess, Mark, could you quantify how much community orders are up? I mean are we talking low-single digit gains. What are we talking about here? Because I’d say this is probably second or third quarter where people think the communities are coming back and it turns out to be a head fake. So what type of numbers are we seeing?

Mark Yost

I don’t have — I’m not going to give specific numbers, Jay. But I think if you just look at the combination of our revenue during the quarter, our backlog growth and combine that with the finished good inventory growth that we see on the balance sheet, just kind of add those few numbers up and understand that a good portion of that or a decent portion of that is driven by the community volume. That gives us a lot of confidence that they’re returning. But yes, I would say it’s been strong growth in orders for communities on a year-over-year basis.

Jay McCanless

Great. And then could you tell us where channel rates are sitting right now? And also, is the manufactured housing industry starting to see any type of interest rate buydowns like we’ve seen from the stick builders?

Mark Yost

So there — I’d say rates right now for a good healthy customer is about 8.5% today. We really have not seen industry rate buydowns. I will tell you that we have some national products that we’ve launched very selectively with our partnership with Triad, that we are doing a test pilot rate buydown just to see the difference in traction between does that really draw that consumer in versus doesn’t it.

So we’re kind of getting some data from a test pilot program to do that. But as a whole, the industry really has not done that in any meaningful way. I think the price point that we have as an industry is really helping the consumer and getting that step-down buyer who’s kind of disenfranchised with site-built homes, rent or other price points.

Jay McCanless

With that trial with Triad, are you writing only pristine customers? Or are you trying to maybe write across the FICO spectrum to see what kind of results you get, how — what customers are you targeting with that trial?

Mark Yost

No. It’s really just — it’s no different in the FICO scores than Triad’s normal customer base. We’re really just doing test pilots to say, with these products we’re going to do a small buy down, with these we’re not, and just see the incremental difference between those trajectories. It’s really not a — Triad sells or passes their loans through to Blackstone, community banks, Carlyle, others. So they already have a defined risk matrix and FICO score matrix. So we’re just fitting in with that matrix box and just doing test pilots in conjunction with them to see how that goes.

Jay McCanless

Got you. And then, Laurie, could you remind me what you said in terms of the gross margin in the first quarter, did you say down 100 basis points to 150 basis points sequentially?

Laurie Hough

Yeah. Over the next couple of quarters, Jay, we’re going to see some declines in gross margin. And we’ve got to continue to work through the Regional inventory that we purchased as part of the acquisition that was marked to fair value. So we’re going to continue to see that. But also, we’re seeing more — a larger decrease in options as interest rates remain higher. So that’s the primary impact. So we expect the ASPs to come down a bit as well as gross margins.

Jay McCanless

Okay. And then the last one I have, just thinking about the input cost, OSB looks like it’s rolled over a little bit. Could you maybe talk about what you’re seeing on the lumber front as well as some of the other major inputs? And if those could be a tailwind or a headwind to that gross margin over the next couple of quarters?

Laurie Hough

Yeah. No, we’re really expecting pretty modest inflation on the 2% range, and we feel that we can pass that on as it comes in. So not big movers from an inflation perspective on input.

Jay McCanless

That’s all I had. Thank you.

Mark Yost

Thanks, Jay.

Operator

Our next question is from Daniel Moore with CJS Securities. Please proceed with your question.

Daniel Moore

Thanks, again. Quick follow-up or two. Just housekeeping. On the remediation, how many homes are we talking about between 2016 and 2021? And I assume whatever the net cash impact is, net of recovery, it’s fair to assume that will be over several years rather than several quarters?

Laurie Hough

So we’re not disclosing the homes at this point, Dan, and the recovery, yes, several years.

Daniel Moore

Okay. And then just capital allocation. Are you still looking at M&A right now or more focused on ramping capacity utilization as demand returns at their existing footprint? And then just how you’re thinking about deploying the buyback? Is that kind of a one year time frame in your mind or more open ended? Thank you, again.

Mark Yost

Yeah, Dan. Thank you. I think — no, our M&A pipeline is still healthy and robust. I think we still have good cash generation happening and probably, as you’re noting, kind of an increased outlook going forward. So I think those factors play into it as well as the success with our integration with Regional and Champion Financing. So I think M&A is definitely always on the table. And then as far as the share buyback, there’s — it’s open-ended as far as the timing of that.

Daniel Moore

Thanks, again.

Mark Yost

Thank you.

Operator

We have reached the end of the question-and-answer session. I’d now like to turn the call back over to Mark Yost for closing comments.

Mark Yost

I want to thank everyone today for your attention, and we look forward to updating you on our progress on our first fiscal quarter earnings call. Thank you, and have a great day.

Operator

This concludes today’s conference. You may disconnect your lines at this time, and we thank you for your participation.

Part II Additional Information with More MHProNews Analysis and Commentary

In no particular order of importance are the following observations and linked related items. Broadly speaking, there are remarks made that seem plausible and reasonable. There are statements made that the properly informed about manufactured housing should be concerned about. There are some items not mentioned at all that should be areas of concern too. Briefly, the above is a mixed bag which will be unpacked both through the lens of Skyline but also for its broader implications for manufactured housing and the Manufactured Housing Institute, because Skyline Champion is an MHI member with a MHI board position.

To see the item below in a larger size, click the image and follow the prompts.

1) Blackstone and Carlyle are among the firms that were tagged by the Securities and Exchange Commission (SEC) for using messaging systems and failing to retain those messages. More on that is found in the report linked below.

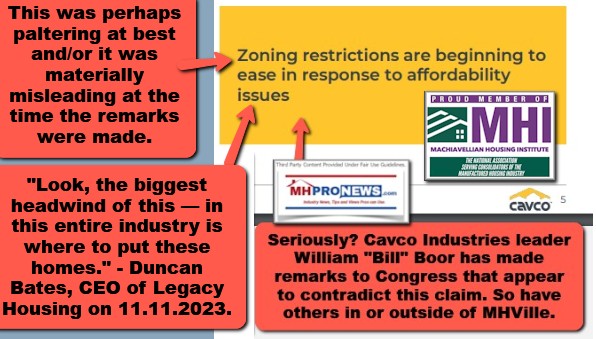

2) It should be obvious that so long as the numbers of HUD Code street retailers apparently continue to decline that the potential number of manufactured homes being sold is being limited through that process. That the loss of street retailers is part of their strategy, said Yost above. It is an issue periodically raised by MHProNews over the course of years, illustrating the point by citing the remarks of others. Some examples are as follows.

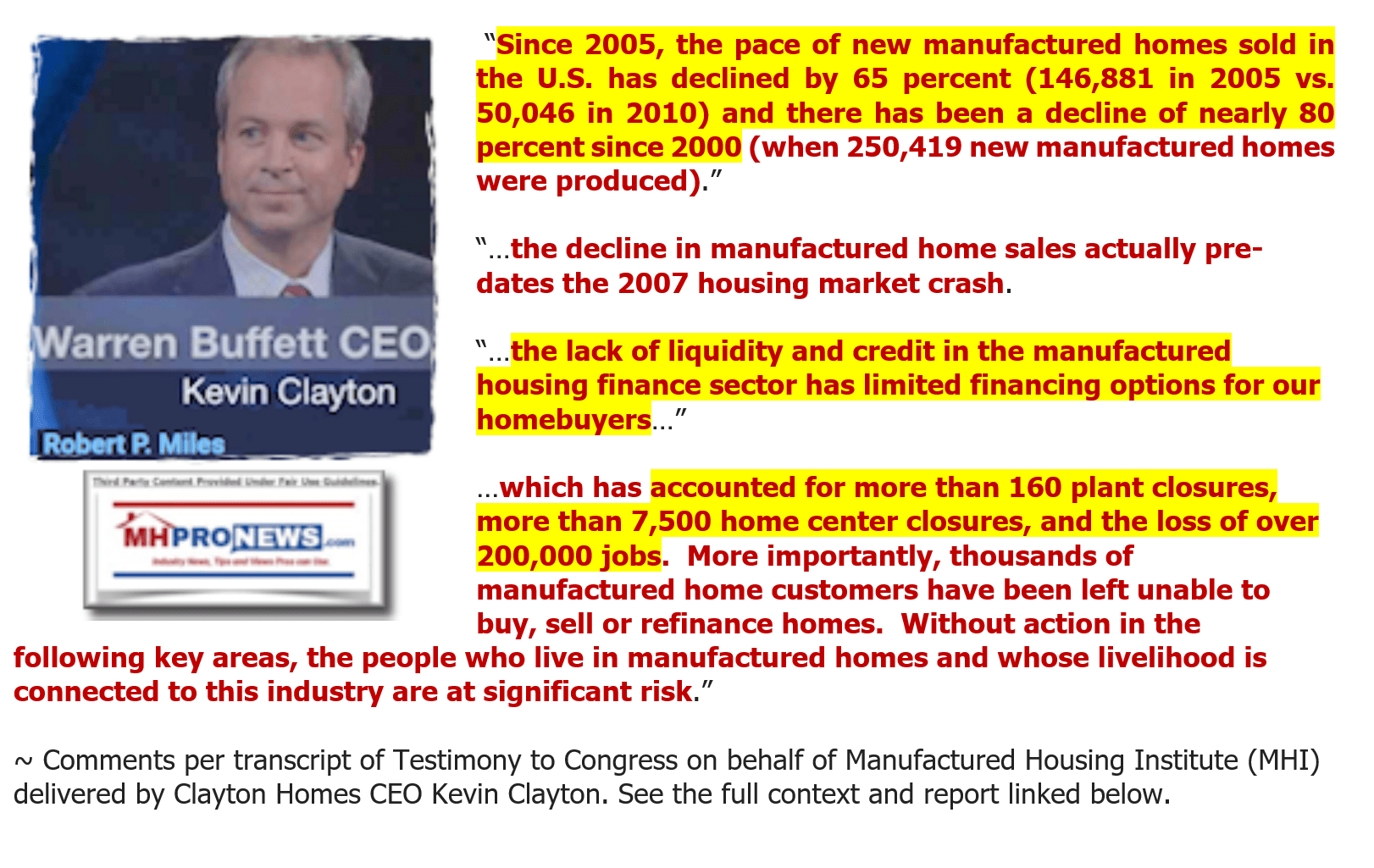

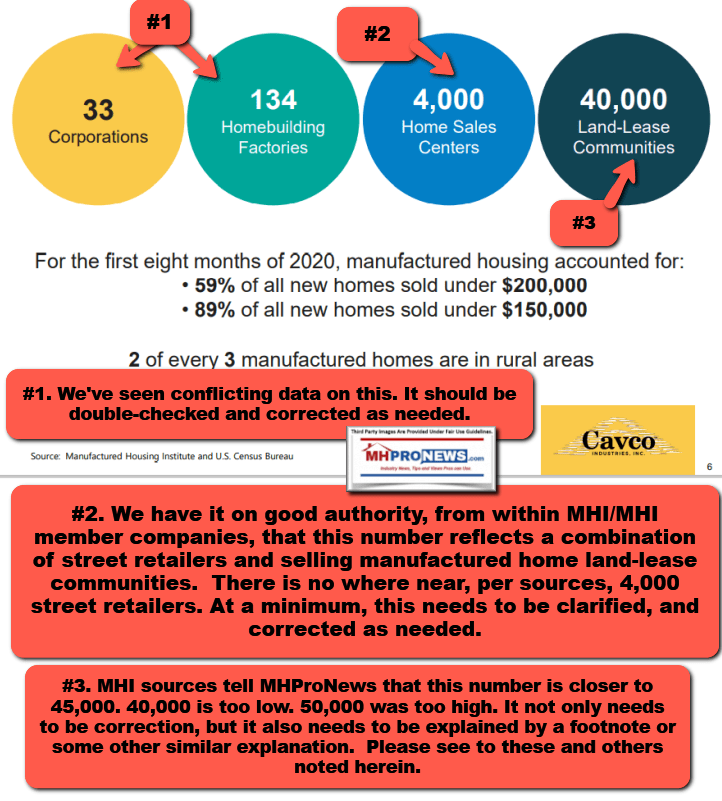

MHI-linked Ken Corbin has said that the number of lost retailers is 10,000, meaning thousands more than Kevin Clayton and Tom Hodges said. Some say that roughly 20,000 street retailers existed in the waning days of the 20th century. If so, then some 16,000 (+/-) street retailers have been lost.

3) The actual number of street retailers, likely known by MHI and some MHI linked entities, is not a published total. Instead, what is sometimes seen is a remark like the one shown from MHI member Cavco Industries, which says there are 4000 retailers, but that fails to state how many of those ‘retailers’ are in fact land-lease communities that are selling primarily or exclusively in manufactured home community they are located. The screen capture below was uploaded by MHProNews on December 13, 2020. Note that since those comments were posted by MHProNews the #3 call out has been clarified. There are, per FEMA and the Lincoln Institute a few hundred over 50,000 land lease manufactured home communities of all sizes in the U.S.

It is entirely possible that there are less than 1500 U.S. ‘street retailers,’ meaning ‘captive’ stores that are corporate owned plus those owned by independent retailers. When manufactured housing statistics are considered, the paucity of street retailers is a factor. As a comparison, per First Research: “The US RV dealer industry includes about 2,600 establishments (single-location companies and units of multi-location companies) with combined annual revenue of about $26 billion.” Per IBIS World: “There are 69,865 New Car Dealers businesses in the US as of 2023…” Statista provides added insight to the prior data: “In 2023, the auto industry in the United States sold approximately 15.5 million light vehicle units. This figure includes retail sales of about 3.12 million passenger cars and just under 12.4 million light trucks.”

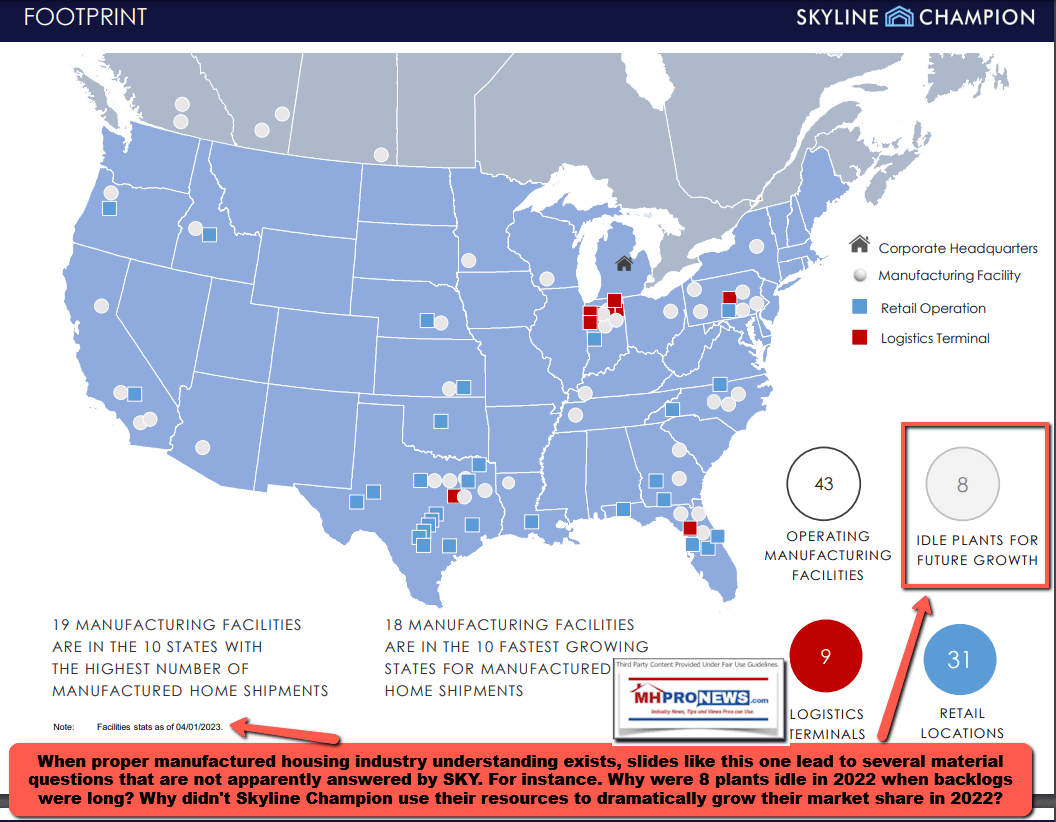

4) Skyline Champion (SKY) reportedly had production centers that were idle during parts of 2021 and 2022 when backlogs in manufactured housing extended to months creating a ripple wave of effects for retailers and their customers.

To see the item below in a larger size,

click the image and follow the prompts.

5) The dominating consolidator-MHI wing of the industry happens to have several bloggers and publishers in their camp. They often (not always) appear to run cover for MHI, failing to provide historical or factual insights that when lacking can make what is said by certain leaders (corporate or association) seem reasonable. But once information is presented that is demonstrably factual, then the behavior of certain brands and MHI-linked trade groups can seem to be curious, odd, or even treacherous. Per Oxford Languages, treacherous means: “guilty of or involving betrayal or deception” and “hazardous because of presenting hidden or unpredictable dangers.” It is akin to the notion of ‘sabotaging monopoly‘ tactics that MHProNews and MHLivingNews, but not others in MHVille trade media that are in the MHI-amen corner, has reported.

For instance. In 1998 Champion was the largest producer of HUD Code manufactured homes. That year, Champion produced 68,264 new HUD Code homes in the U.S. Fleetwood was #2 and produced 66,222 manufactured homes. All told, #1 Champion and #2 Fleetwood produced 134,486 homes in 1998 (68264 + 66222 =134486). By way of comparison, all of U.S. manufactured housing produced on 89,169 homes in 2023. It is stunning to be speaking in such a matter-of-fact fashion about their so-called performance when such facts are omitted. More specifically, when Yost said: “With demand from retailers and builder developers, the return of more normal ordering volumes from our community partners and the enduring need for affordable housing, we are well positioned for continued growth and success.” that seems laughable.

6) Daniel Moore with CJS Securities asked: “Are you still looking at M&A right now or more focused on ramping capacity utilization as demand returns at their existing footprint?” Yost’s reply is revealing: “Yeah, Dan. Thank you. I think — no, our M&A pipeline is still healthy and robust. I think we still have good cash generation happening and probably, as you’re noting, kind of an increased outlook going forward. So I think those factors play into it as well as the success with our integration with Regional and Champion Financing. So I think M&A is definitely always on the table.” (Emphasis added). Meaning, even with plant utilization at under 60 percent, M&A (more consolidation) are “always on the table.” So too are stock buybacks. More on those below. If anyone is wondering how important the consolidation of the industry is to the #2 brand in the Big Three, now you know that it is “always on the table.”

To see the item below in a larger size,

click the image and follow the prompts.

7) Yost also made observations like these: “I think the price point that we have as an industry is really helping the consumer and getting that step-down buyer who’s kind of disenfranchised with site-built homes, rent or other price points.” Pardon me, Mark, but it seems that if manufactured housing were getting a steady and sizable stream of ‘step down buyers’ who are being priced out of ‘site-built housing,’ then why is it that the ASP (average selling price) of manufactured homes falling? Why is it that manufactured housing’s production has fallen so sharply in 2023 vs. 2022? These seem to be questionable if not downright contradictory remarks that ought to be explored through the lens of if they were materially inaccurate at the time they were made. In fairness to Yost and Skyline, something similar has been mouthed by Cavco Industries.

8) Another stunning remark by Yost is this one: “I think some of the things we’re implementing in terms of our call centers and other things are really impacting the customers to take away the confusion of how to buy our homes and help them – help hand them off to a retailer who can drive that customer home.”

If after decades in the manufactured home business Champion is only now implementing steps to “take away the confusion of how to buy our homes and help them – help hand them off to a retailer who can drive that customer home” that’s an epic fail. It also goes to points raised by SECO-linked David Roden and remarks by MHARR and others.

9) It is marvelously convenient for the insiders and consolidators of the industry to have the backlog issue followed by the drop in retail issue followed by the drop in communities order issue. What’s next?

10) More could be said about the above, but let’s pivot to some Q&As with artificial intelligence (AI) powered Copilot. As a brief background, even though MHI leaders praised MHProNews for years, as MHProNews’ critiques and questioning of MHI leaders increased, MHI has in recent years consistently declined comment direct comment, or even dramatically avoided comments to MHProNews. So, in the age of AI, MHProNews has used Copilot in the last year-plus to search the internet and provide information and insights that are logical and in keeping with the known facts expressed by MHI and their leading brands. What has emerged is arguably embarrassing for MHI and their corporate/staff leaders. As the MHI website screen capture graphic of their board leaders above indicated, Skyline Champion has a board seat. So do multiple consolidators of the industry.

11) Some three years ago, MHProNews produced a variation of the remark below. It has more recently been updated with two pull quotes from Copilot. Those AI powered insights clearly indicated that what MHI needs to do is relatively simple. “Prioritizing enforcement of existing laws can have a more immediate impact on affordability and access to manufactured housing” said Copilot on 5.1.2024. “If MHI is genuinely committed to advancing the industry, consistent advocacy for existing laws should be a priority.” Pages of commentary and observations could be boiled down to those remarks.

12) But for those who may not grasp why those AI powered remarks quoted above in that graphic make good sense, a few examples of what Copilot has said on this date is useful, again, noting that Skyline Champion is one of the Big Three which seems to work in concert with Clayton Homes and Cavco Industries at MHI.

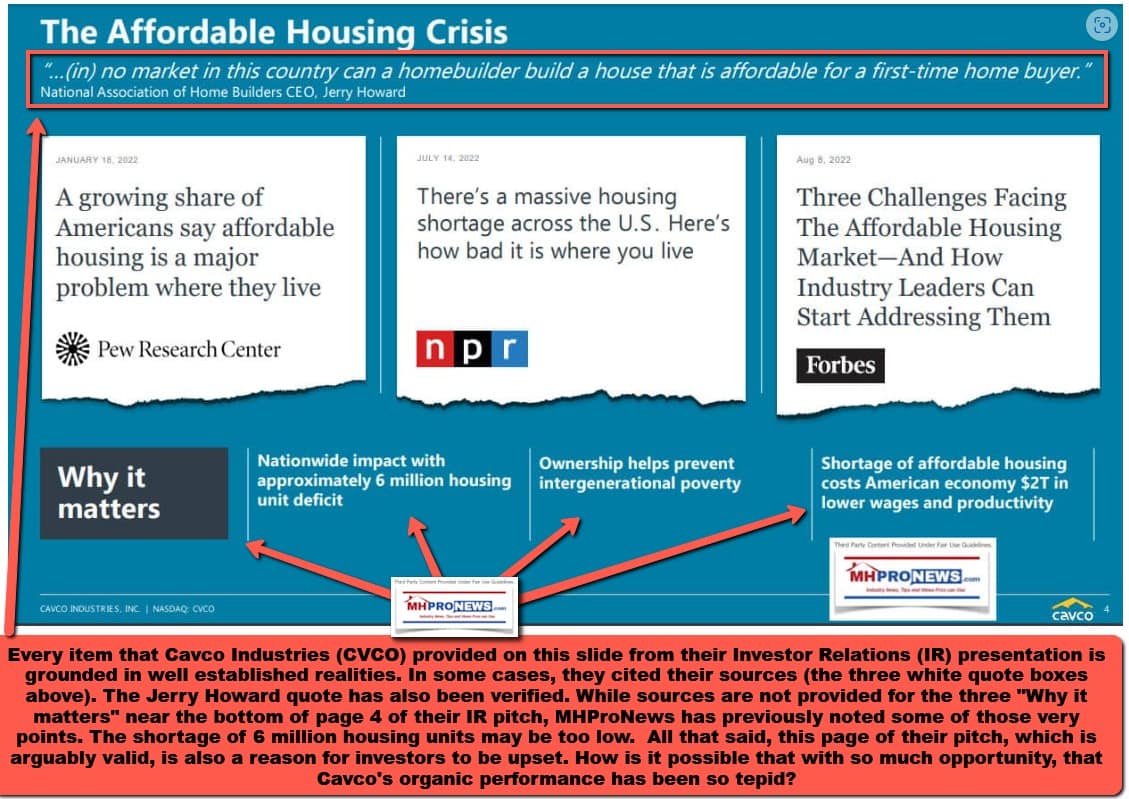

You (i.e.: MHProNews)

Copilot, there is a well-documented affordable housing crisis in the U.S. Perhaps 6 to 10 million more affordable units are needed, depending on the source. Jerry Howard, when he was with the National Association of Home Builders, said in 2022 that conventional ‘site builders’ can’t produce a house affordable for a first-time buyer anywhere in the U.S. HUD Code manufactured homes are apparently the best documented solution for permanent and affordable homes that don’t require federal subsidies. Several researchers, trade groups, and reports have said that manufactured homes are being limited by artificial barriers that include zoning/placement restrictions and a lack of competitive financing. Yet there are two federal laws – the Manufactured Housing Improvement Act of 2000 (a.k.a.: MHIA, 2000 Reform Law) and its “enhanced preemption” provision and the Duty to Serve (DTS) Manufactured Housing (part of the Housing and Economic Recovery Act (HERA) of 2008) that are arguably not been properly enforced. The Manufactured Housing Institute (MHI) and the Manufactured Housing Association for Regulatory Reform (MHARR) are both on record with remarks that indicate they want to see DTS and “enhanced preemption” enforced. The lack of enforcement of enhanced preemption was a key part of the issues probed by Congress that drew remarks from MHI and MHARR members, with the industry’s members asking Congress to see to it that enhanced preemption would be routinely enforced. In 2023, Cavco’s CEO Bill Boor again asked Congress to see to it that HUD is instructed to enforce federal preemption for manufactured homes. Yet, when MHARR offered to partner with a MHI-state association affiliate (and by implication, MHI itself) to litigate enforcement of enhanced preemption as needed, MHARR says there were no takers. To compare and contrast, the Institute of Justice (IJ) has filed suit against municipalities that have established barriers to tiny house placement, which has no federal enhanced preemption support. Confirm and/or clarify these issues as needed, explain and link the results that outline why these are important issues and what the implications of these topics are for those who want to see the affordable housing crisis solved instead of just being a talking point.

Copilot

The affordable housing crisis in the U.S. is a pressing issue affecting millions of Americans. Let’s break down the key points and explore the implications:

- Affordable Housing Crisis:

- The availability of affordable housing is a major concern for many Americans. Approximately 49% of adults consider it a significant problem in their local communities, according to a Pew Research Center survey conducted in October 20211.

- Factors like rising home prices, supply shortages, and increased demand contribute to this crisis.

- Manufactured Homes as a Solution:

- HUD Code manufactured homes offer a potential solution. These factory-built homes provide quality amenities at an affordable price, making them an alternative to traditional site-built homes2.

- However, barriers hinder their widespread adoption, including zoning restrictions and financing challenges.

- Federal Laws and Their Enforcement:

- The Manufactured Housing Improvement Act of 2000 (MHIA) introduced “enhanced preemption,” allowing federal standards to override local requirements that interfere with manufactured housing3.

- Despite this provision, enforcement has been lacking. The Duty to Serve (DTS) Manufactured Housing, part of the Housing and Economic Recovery Act (HERA) of 2008, also aims to promote affordable housing but faces similar challenges4.

- Importance of Enhanced Preemption:

- Enhanced preemption ensures that manufactured homes comply with federal standards, regardless of local regulations. It allows manufacturers to deliver homes built to the Federal Code, streamlining the process5.

- Proper enforcement would remove artificial barriers and expand affordable housing options.

- Industry Perspectives:

- The Manufactured Housing Institute (MHI) and the Manufactured Housing Association for Regulatory Reform (MHARR) both advocate for enforcing enhanced preemption and DTS6.

- However, collaboration between these industry groups remains limited, hindering effective litigation efforts.

- Comparing to Tiny Houses:

- The Institute of Justice (IJ) has challenged local barriers to tiny house placement, despite lacking federal enhanced preemption support6.

- Advocates for manufactured homes should similarly push for consistent enforcement.

- Implications:

- Access to Affordable Housing: Properly enforced enhanced preemption would increase access to affordable housing, benefiting families across income levels.

- Economic Impact: A robust manufactured housing sector could stimulate economic growth, create jobs, and address housing shortages.

- Policy Advocacy: Industry stakeholders, policymakers, and advocates must collaborate to ensure effective enforcement and overcome barriers.

In summary, enforcing enhanced preemption and supporting the DTS program are critical steps toward solving the affordable housing crisis. By prioritizing these efforts, we can make affordable homeownership a reality for more Americans74. 🏡🌟

Learn more

1pewresearch.org 2 manufacturedhomes.com 3 hud.gov 4 fhfa.gov 5 manufacturedhomepronews.com 6 manufacturedhomepronews.com 7 hud.gov 8gao.gov 9 nlihc.org 10 housingmatters.urban.org 11 bing.com 12 titanhomes.com 13 oakwoodmhp.com 14 winterhavenmhc.com 15 claytonhomesoflakeland.com 16 housingwire.com 17 theledger.com 18 manufacturedhousingassociationregulatoryreform.org 19 manufacturedhousingassociationregulatoryreform.org 20 govinfo.gov 21 congress.gov 22 tnmobilehomebuyer.com 23 fanniemae.com 24 sf.freddiemac.com 25 fanniemae.com

MHProNews Note: some of those links (Clayton Homes of Lakeland, Winter Haven MHC, etc.) may seem odd at first. But Copilot doubtlessly has IP recognition. So, they know that the questions being asked by MHProNews in these Q&As (“chat”) are from a location near those businesses.

13)

You raised important points, but didn’t link the evidence for them. Please do link results. Note that in recent earnings calls, prominent MHI members such as Cavco Industries (CVCO) and Skyline Champion (SKY) have said that they are or have allocated $100 million dollars to stock buybacks. Even a fraction of those funds were allocated toward effective litigation and messaging, these artificial barriers could be resolved, correct? Furthermore, in an op-ed via Market Watch, entitled “Corporations have broken capitalism. Here’s how to fix it” by Hunter Hastings made the point that stock buybacks often benefit insiders but fail to advance the broader interest of that firm and its shareholders and the public. Can’t Hastings point be applied to manufactured housing and companies like Cavco and Skyline Champion? Additionally, MHI member UMH Properties leaders Sam and Eugene Landy have made the point that their results demonstrate that new developing for manufactured housing communities is not only achievable but routinely returns a better return on investment (ROI) than M&A activity (consolidation) does. They specifically pointed to Sam Zell and ELS’ thesis, saying their results at UMH demonstrate that more money can be earned by both developing new communities and selling/renting new manufactured home units to fill those communities. Explore and explain those issues and link the results.

Copilot

Certainly! Let’s explore the evidence and implications related to stock buybacks, corporate behavior, and the impact on the manufactured housing industry:

- Stock Buybacks and Corporate Behavior:

- Cavco Industries (CVCO) recently announced a share repurchase program, allocating up to $100 million for stock buybacks1.

- Skyline Champion (SKY) has also engaged in stock buybacks2.

- While buybacks can increase share prices, they have drawn scrutiny. Critics argue that they benefit insiders more than broader shareholders and the public3.

- Hunter Hastings’ Perspective:

- In his op-ed, Hastings highlights that stock buybacks often favor company executives with large stakes in their own firms.

- The broader interests of shareholders and the public may not align with these buybacks.

- Application to Manufactured Housing:

- The manufactured housing industry, represented by companies like Cavco and Skyline Champion, should consider the broader impact of stock buybacks.

- Allocating funds toward litigation, messaging, or community development could address artificial barriers and benefit the entire sector.

- UMH Properties’ ROI and Community Development:

- UMH Properties, led by Sam and Eugene Landy, demonstrates that developing new manufactured home communities yields better ROI than consolidation (M&A) activities.

- Their results challenge the notion that consolidation is the sole path to profitability.

- By focusing on community development and home sales/rentals, UMH exemplifies an alternative approach.

In summary, stock buybacks, corporate behavior, and investment strategies play crucial roles in shaping the manufactured housing industry. Balancing insider interests with broader stakeholder benefits is essential for sustainable growth and affordable housing solutions345. 🏠📈

Learn more

1 marketscreener.com 2 ycharts.com 3 business.vanderbilt.edu 4 finance.yahoo.com 5 streetinsider.com 6 finance.yahoo.com 7 marketbeat.com 8 hbr.org 9 finance.zacks.com 10 sfmagazine.com 11 wallstreetoasis.com—

14)

You

Antitrust concerns and failure of MHI board members to fulfill their fiduciary duties are also part of these evidence based concerns, correct? Again, confirm or clarify as needed, and link results.

Copilot

Indeed, antitrust concerns and potential failures by MHI board members to fulfill their fiduciary duties are critical aspects of the evidence-based concerns surrounding the manufactured housing industry. Let’s explore these points further:

- Antitrust Concerns:

- Allegations of anticompetitive behavior or antitrust violations within the industry raise serious questions.

- If MHI’s actions or lack thereof contribute to market consolidation or hinder competition, it warrants scrutiny.

- Fiduciary Duties of Board Members:

- Board members of any organization, including MHI, have fiduciary responsibilities to act in the best interests of their constituents (members, industry, and consumers).

- Failure to fulfill these duties could impact the industry’s overall health and affordability.

- Implications:

- Transparency and Accountability: Industry stakeholders should demand transparency and hold board members accountable.

- Consumer Impact: Any actions that harm affordability or limit consumer choices directly affect those seeking affordable housing solutions.

In summary, addressing antitrust concerns and ensuring proper governance are essential for a thriving, accessible manufactured housing sector. 🏠🔍

15)

You

You raised important points, but didn’t link the evidence for them. Please do link results. Note that in recent earnings calls, prominent MHI members such as Cavco Industries (CVCO) and Skyline Champion (SKY) have said that they are or have allocated $100 million dollars to stock buybacks. Even a fraction of those funds were allocated toward effective litigation and messaging, these artificial barriers could be resolved, correct? Furthermore, in an op-ed via Market Watch, entitled “Corporations have broken capitalism. Here’s how to fix it” by Hunter Hastings made the point that stock buybacks often benefit insiders but fail to advance the broader interest of that firm and its shareholders and the public. Can’t Hastings point be applied to manufactured housing and companies like Cavco and Skyline Champion? Additionally, MHI member UMH Properties leaders Sam and Eugene Landy have made the point that their results demonstrate that new developing for manufactured housing communities is not only achievable but routinely returns a better return on investment (ROI) than M&A activity (consolidation) does. They specifically pointed to Sam Zell and ELS’ thesis, saying their results at UMH demonstrate that more money can be earned by both developing new communities and selling/renting new manufactured home units to fill those communities. Explore and explain those issues and link the results.

Copilot

Certainly! Let’s explore the evidence and implications related to stock buybacks, corporate behavior, and the impact on the manufactured housing industry:

- Stock Buybacks and Corporate Behavior:

- Cavco Industries (CVCO) recently announced a share repurchase program, allocating up to $100 million for stock buybacks1.

- Skyline Champion (SKY) has also engaged in stock buybacks2.

- While buybacks can increase share prices, they have drawn scrutiny. Critics argue that they benefit insiders more than broader shareholders and the public3.

- Hunter Hastings’ Perspective:

- In his op-ed, Hastings highlights that stock buybacks often favor company executives with large stakes in their own firms.

- The broader interests of shareholders and the public may not align with these buybacks.

- Application to Manufactured Housing:

- The manufactured housing industry, represented by companies like Cavco and Skyline Champion, should consider the broader impact of stock buybacks.

- Allocating funds toward litigation, messaging, or community development could address artificial barriers and benefit the entire sector.

- UMH Properties’ ROI and Community Development:

- UMH Properties, led by Sam and Eugene Landy, demonstrates that developing new manufactured home communities yields better ROI than consolidation (M&A) activities.

- Their results challenge the notion that consolidation is the sole path to profitability.

- By focusing on community development and home sales/rentals, UMH exemplifies an alternative approach.

In summary, stock buybacks, corporate behavior, and investment strategies play crucial roles in shaping the manufactured housing industry. Balancing insider interests with broader stakeholder benefits is essential for sustainable growth and affordable housing solutions345. 🏠📈

Learn more

1marketscreener.com2ycharts.com3business.vanderbilt.edu4finance.yahoo.com5streetinsider.com6finance.yahoo.com7marketbeat.com8hbr.org9finance.zacks.com10sfmagazine.com11wallstreetoasis.com

16) MHProNews has developed a new quote graphic to illustrate several of the points made above. For instance, MHI has said that they want to see the “enhanced preemption” provision of the Manufactured Housing Improvement Act of 2000 enforced. If that were enforced, Copilot said that is potentially the fastest way to boost the industry’s production and address the affordable housing crisis. That is in clear keeping with MHARR’s stance, which Copilot cites at various times in its fact-checks and analysis.

To see the item below in a larger size,

click the image and follow the prompts.

17) It is arguably increasingly difficult for MHI leaders and insiders – including Skyline Champion (SKY), but not limited to them – to intelligently deny the evidence that they have in various ways colluded to manipulate and suppress manufactured housing in order to consolidate the industry for their own selfish reasons. Snapshots of evidence are above. More on this is planned for a special report coming in the days ahead. Don’t miss it. In the meantime, MHProNews has previously invited, and hereby does extends to Skyline Champion and other implicated MHI member brands to respond to these evidence-based allegations directly to MHProNews. Until then, see more evidence in the reports that are linked above and below. Because this costs the economy trillions of dollars and harms millions of souls. Who says? It is the implied logic of Cavco Industries, one of the brands involved.

![DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPut[HUDCodeManufactured]HomesMHProNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2023/11/DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPutHUDCodeManufacturedHomesMHProNews.jpg)

Programming Notice: a fresh expose on another MHI-Linked Brand is Pending that’s drawn MSM attention. Stay tuned for another report you are unlikely to read about from anyone else in MHVille trade media.

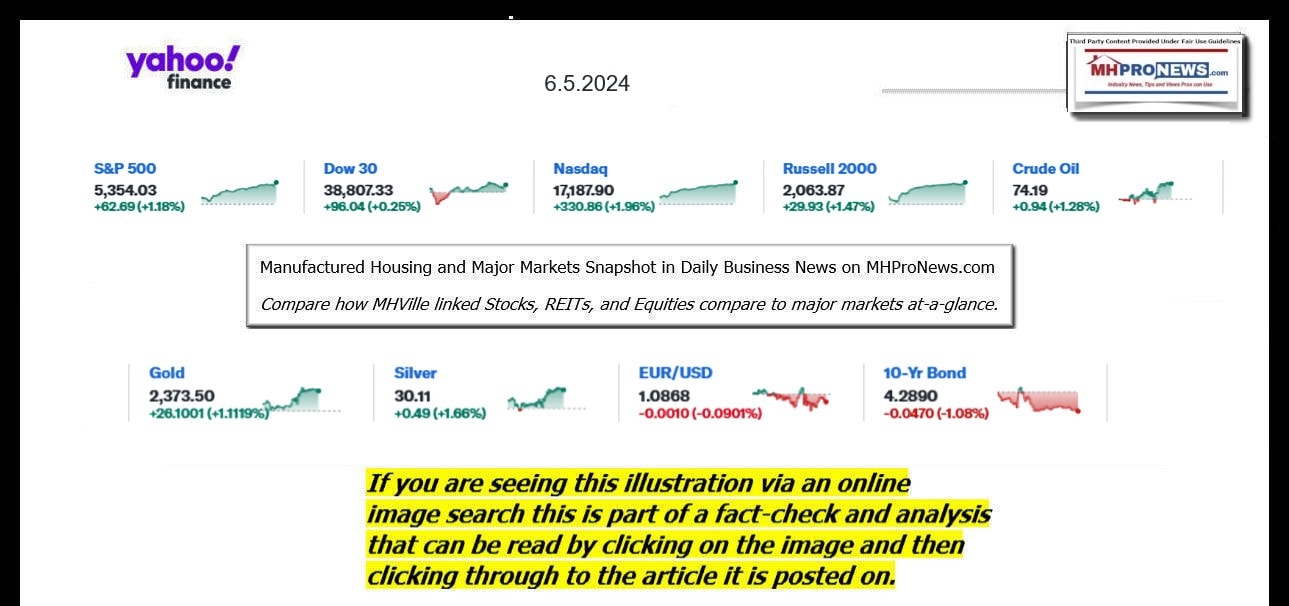

Part III – Our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that may be impacting manufactured housing connected investing.

Headlines from left-of-center CNN Business – 6.5.2024

- Lululemon dominated the pricey athleisure market for years. Now it faces big competition

- Nvidia surpasses Apple to become the second-largest public company in the US

- Palestinian-American sues Meta, alleging speech discrimination on platform

- A person holds some of the newly released banknotes, featuring the portrait of King Charles III, outside the Bank of England, London, Wednesday June 5, 2024.

- British banknotes featuring King Charles III enter circulation

- Pedestrians cross a street past traffic in the Chinatown neighborhood of New York, US, on Saturday, June 17, 2023. New York City’s congestion pricing plan for the central business district is expected to get final approval this month.

- NY Gov Hochul delays controversial NYC congestion pricing plan ‘indefinitely’

- Black workers sue, claiming White racists run a General Mills plant in Georgia

- Axon Body Workforce

- Workers at TJ Maxx and Marshalls are wearing police-like body cameras. Here’s how it’s going

- Columbia Law Review website is taken down after publishing a story criticizing Israel

- UK Prime Minister Rishi Sunak was just fact-checked by his own government

- Champion sportswear sold in deal worth up to $1.5 billion

- Janet Yellen warns AI in finance poses ‘significant risks’

- Family Dollar is up for sale

- People are exiting the stock market in droves

- How a pro-Trump media outlet allegedly funneled tens of millions in an illicit money laundering scheme

- Duolingo deletes LGBT references in Russia after warning from Moscow

- ‘Still a strong story.’ Why India’s election shock won’t derail its economic boom

- A Chinese agency working with Russia has been trying to source drone jammers

- ‘It is alarming:’ After second outage this year, experts say AT&T risks customer loyalty

- What happened to the UK economy? 5 charts break down the key election issue

- Australia drops legal fight against X over church stabbing video

- The American shopping spree is losing steam

- AT&T resolves outage that left some customers without service across the US

- In a first, Special K features pregnant woman on cereal box

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Headlines from right-of-center Newsmax – 6.5.2024

- In Blow to Biden Plan, Hamas Leader Demands Full End to Gaza War

- Israel at War

- Dems Furious With Schumer, Jeffries Over Netanyahu Invite

- Blow to Biden Plan: Hamas Leader Demands Full End to War

- Bibi: Israel Prepared for ‘Intense Action’ Against Hezbollah

- Syrian Gunman Shot, Detained After US Embassy Attack

- Israeli Troops Hit Central Gaza, Widening Offensive

- Biden: Netanyahu Intentionally Prolonging War

- Israel, US Ink $3 Billion Deal for 25 More F-35 Fighter Jets

- Israel Estimates 43 of 120 Still-Missing Hostages Are Dead

- UN Rights Chief Expresses Support for Biden’s Gaza Cease-Fire

- Newsmax TV

- Lankford: Polls Driving Biden Border Action

- Grenell: Americans See ‘One-Sided’ DOJ, Legal System | video

- Malliotakis: Biden Border Order ‘Window Dressing’

- Biggs: Hur-Biden Tapes Will Show President Is Unfit | video

- Jason Miller: Attorney General Garland ‘Lying’ to US | video

- Jordan: Garland Doesn’t Understand America | video

- Dean Cain: Biden Set to Lose in Nov, | video

- Newsfront

- Pelosi, Top Democrats: WSJ Didn’t Include Pro-Biden Comments

- Democrats expressed outrage Wednesday, a day after a Wall Street Journal report showed President Joe Biden is slipping cognitively behind the scenes…. [Full Story]

- Related Stories

- WSJ: Biden ‘Slipping’

- House GOP Leaders Make Criminal Referrals Against Bidens

- The heads of three key House committees forwarded criminal referrals [Full Story]

- Related

- Biden Family Troubles May Just Be Starting

- Feds Widen Probe in Jim Biden’s Americore Dealings

- WHO Confirms First Fatal Human Case of Bird Flu A (H5N2)

- The World Health Organization said on Wednesday a death was caused by [Full Story]

- Newsmax Seeks Sanctions Against Smartmatic Over DOJ Bribery Claims

- Newsmax Media Inc.recently filed in Delaware Superior Court a motion [Full Story]

- Poll: RFK Jr. Could Threaten Trump in Swing States

- Could Robert F. Kennedy Jr., who is running as an independent for [Full Story]

- House Panel to Jen Psaki: Testify or Be Subpoenaed

- Former White House press secretary Jen Psaki was threatened with a [Full Story]

- Putin Says Courts Are Being Used Against Trump

- President Vladimir Putin said on Wednesday that Russia did not care [Full Story]

- Related

- Relations Between Moscow and Washington Won’t Change, No Matter Who Wins US Election, Putin Says

- Putin Warning: Russia Could Give Long-Range Weapons to Others to Strike West

- Biden Lands in France for D-Day Anniversary Speech

- President Joe Biden landed in France on Wednesday to commemorate the [Full Story]

- Related

- Rotterman: Let’s Never Forget D-Day’s Battle for Freedom

- Last WWII Vets Converge on Normandy for D-Day and Fallen Friends

- Hunter Biden’s Exes Are Called as Witnesses in His Federal Gun Trial

- Hunter Biden’s ex-wife was called Wednesday to testify in his federal [Full Story]

- Russians Hack Spain Firm Preparing Tanks for Ukraine

- A unit of General Dynamics, Spain-based Santa Barbara Systems, which [Full Story]

- Related

- Ukraine Peace Summit Aims to Open Door to Talks With Russia

- Rasmussen Poll: Trump Leads Biden by 5 Points

- In a two-way contest between President Joe Biden and former President [Full Story]

- Related

- Chuck Schumer Plans to Weaponize Dead-End Votes for Election

- Trump MAGA Inc. Raises $70M in May, Plans $100M Ad Campaign

- Trump Campaign Seeing ‘Tremendous Momentum’ in New Jersey

- Companies Start to Push Back on Employee Activism

- The days of employees outwardly taking a stand on an issue while on [Full Story] | Platinum Article

- Kim, Bashaw Win N.J. Primary for Senate Seat Held by Indicted Menendez

- Democratic Rep. Andy Kim won New Jersey’s Senate primary Tuesday, [Full Story]

- Related

- Big GOP Funders Send Millions Into Missouri’s AG Primary

- GOP’s Downing to Face Dem Driscoll for Mont. Rep. Rosendale’s Seat

- Trump-Backed Sheehy to Face Mont. Dem Sen. Tester in Key Race

- Trump-Backed Navy Vet Targets Dem Sen. Kaine’s Virginia Stranglehold

- Trump Wins GOP Primary in N.J.; Biden Wins Dem Race There and in D.C.

- Son of Embattled Sen. Menendez Wins N.J. Dem House Primary

- Pentagon Chief of Staff Magsamen Stepping Down

- Kelly Magsamen, a key figure in the scandal surrounding Defense [Full Story]

- Boeing Launches NASA Astronauts After Years of Delays

- Boeing launched astronauts for the first time Wednesday, belatedly [Full Story]

- Illinois City Faces Lawsuit Over Reparations Plan

- The city of Evanston, Illinois, is facing a lawsuit from conservative [Full Story]

- Phil: Trump Conviction ‘Judicial Travesty’

- Talk show host Dr. Phil McGraw this week criticized the [Full Story]

- Colorado GOP: Burn Pride Flags in June

- The Colorado Republican Party is calling on people to burn pride [Full Story]

- NYC Congestion Pricing Plan on Hold

- New York Democrat Gov. Kathy Hochul has postponed a plan to toll [Full Story]

- NY Prosecutors Oppose Lifting Trump Gag Order

- Prosecutors in Manhattan are rejecting calls from former President [Full Story]

- Ernst Plans Contraception Bill Before Test Vote

- Joni Ernst, R-Iowa, plans to introduce a bill designed to [Full Story]

- Muslim Dem Conn. Rep. Attacker Gets 5 Years in Prison

- A Connecticut man who attacked Democrat state Rep. Maryam Khan [Full Story]

- 13 Anti-Israel Protesters Arrested at Stanford

- Anti-Israel demonstrators occupied a building that houses the offices [Full Story]

- ICE Directive Aids Migrants Seeking Asylum

- The Biden administration sent a memo to border security officials [Full Story]

- Alec Baldwin Case DA Wins New Mexico Dem Primary

- An incumbent district attorney pursuing an involuntary manslaughter [Full Story]

- Newsmax Viewers Shunned From Trump, Biden Juries

- Newsmax viewers were among the people disqualified or not included on [Full Story]

- Biden Got $64M From Mystery Donor to Stop Trump

- Four years after President Joe Biden won the 2020 election, mystery [Full Story]

- Fired Meta Staffer Sues for Bias Against Palestianians