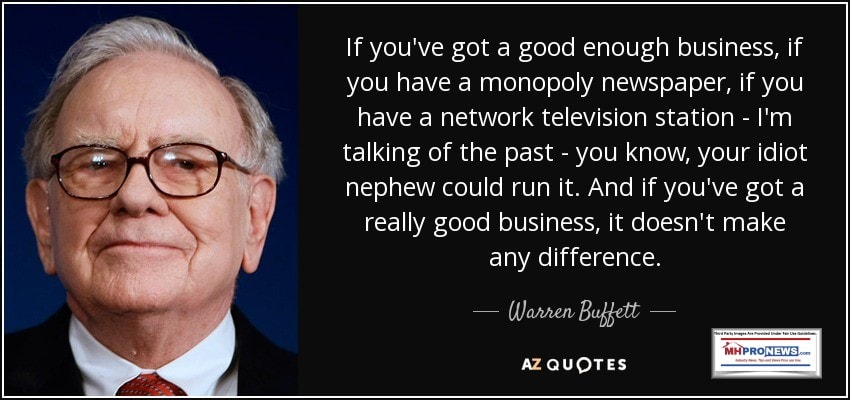

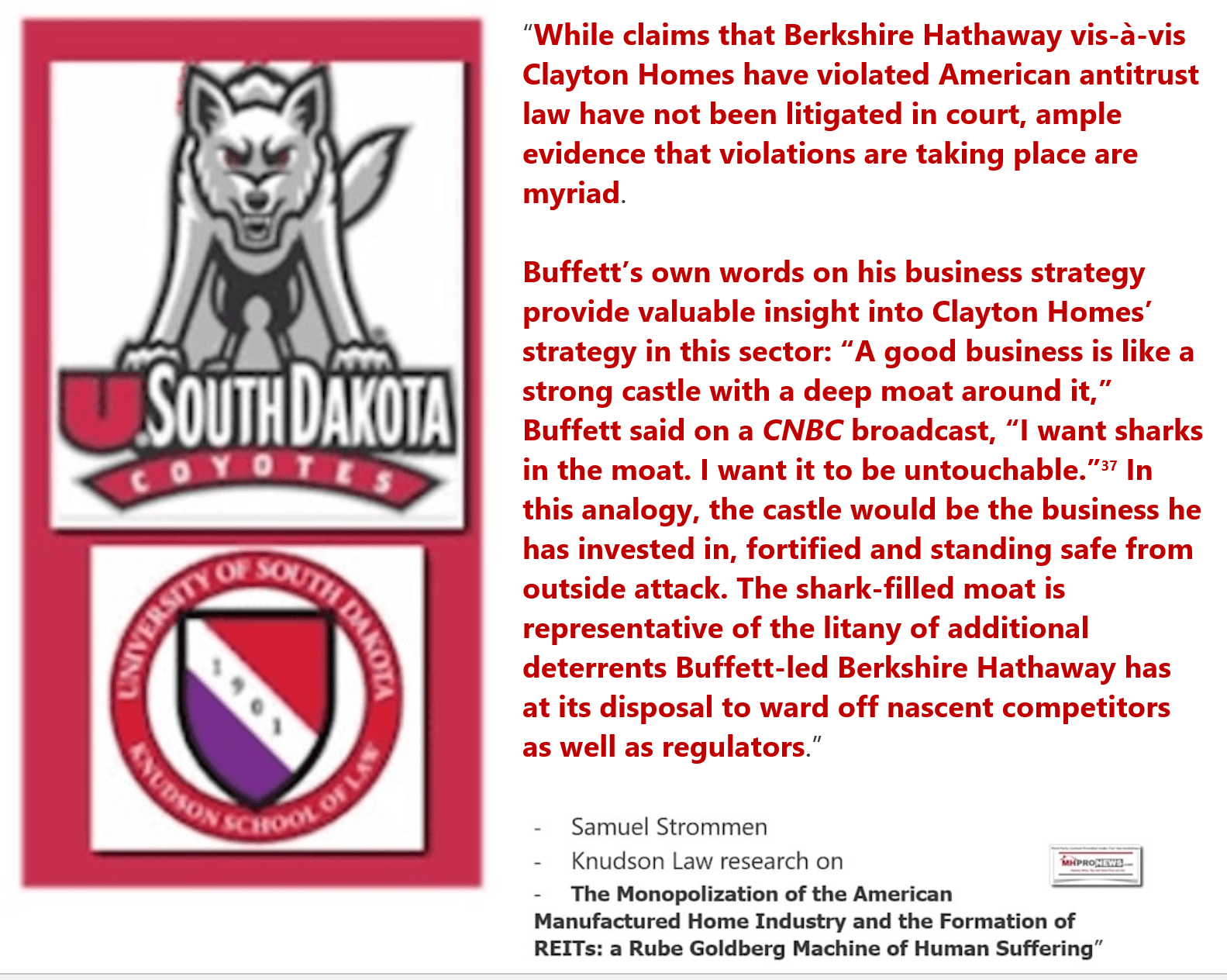

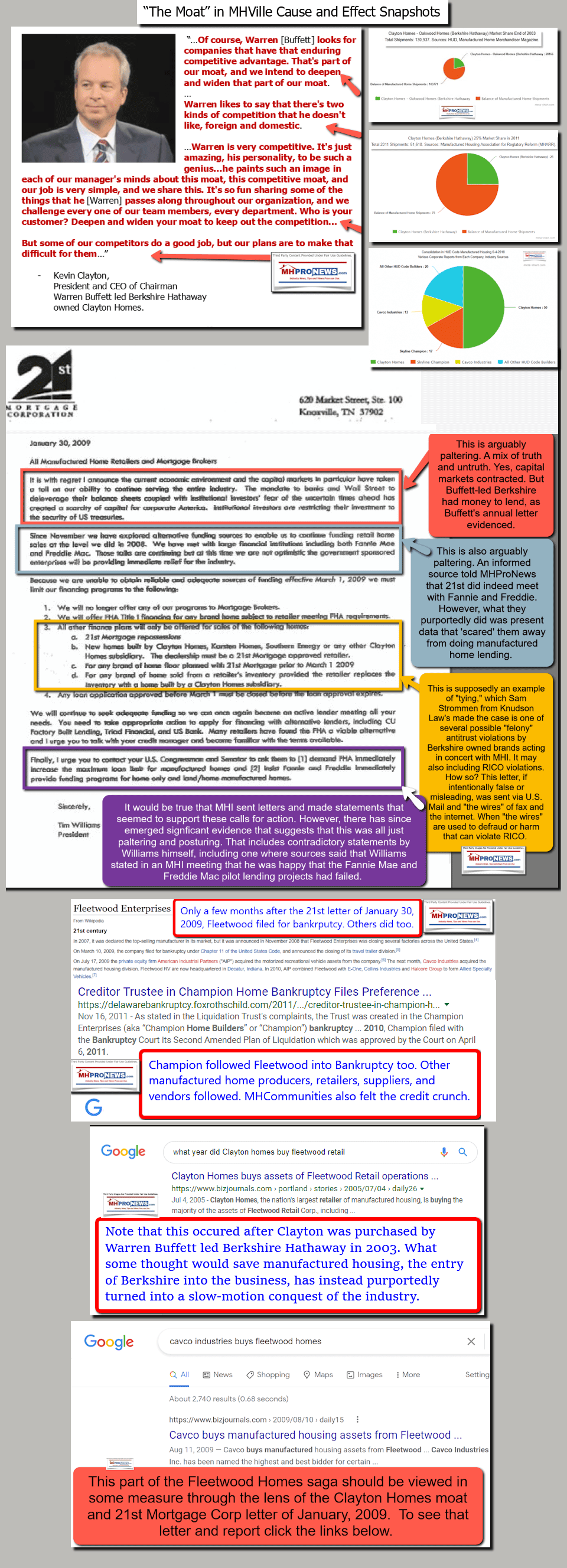

“Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has faced allegations related to insider trading and potential violations of the company’s conflict of interest policies. Confidential records reveal that, on at least three occasions, Buffett privately sold millions of dollars’ worth of shares in stocks that Berkshire was also trading1.” So said left-leaning Microsoft’s Bing artificial intelligence (AI) powered Copilot on 6.30.2024. Copilot cited and linked left-leaning ProPublica, which gives this self-description: “ProPublica is an independent, non-profit newsroom that produces investigative journalism in the public interest.” More specifically, as the content that follows from cited sources will reflect, Buffett is accused of frontrunning stocks from his personal account that the firm that he leads, Berkshire Hathaway (BRK), would subsequently trade in. According to Investopedia: “Front-running is trading stocks or any asset based on insider knowledge of a future transaction that will affect its price. It is illegal in most cases.” The yellow highlighting emphasis was added as part of this news-factcheck-analysis by MHProNews, and the italics was added by Google. Note that Microsoft’s cofounder, William “Bill” Gates III is a longtime ally of Buffett’s, served on the Berkshire board of directors for years, and he and the Gates Foundation have significant holdings in Berkshire stock. According to Copilot, as will be explored in Part II below, the possible consequences of insider trading include fines, various forms of possible penalties, or even prison. Obviously, legal proceedings would need to occur for any such outcomes, and so far, the federal agencies and justice system have been silent about these Buffett-linked matters. That noted, this discovery based on “confidential records” are among the more recent discoveries that point to concerns raised by MHProNews and some others for years. They could, perhaps should, have serious implications for several Berkshire-linked firms in manufactured housing, including Kevin Clayton led Clayton Homes, Tim Williams led 21st Mortgage Corporation, Vanderbilt Mortgage and Finance (VMF) and others. Kevin Clayton is on record describing Buffett as a “genius” in the context of his explanation of Buffett’s preached “moat” methods.

According to Business Insider:

- Leaked IRS data seen by ProPublica showed that Buffett sold shares in stocks that Berkshire was trading.

- Buffett has previously said that trading the same stocks as Berkshire would pose a conflict of interest.

The company did not immediately respond to Insider’s request for comment. Buffett also didn’t respond to ProPublica’s request for comment.” No response, doesn’t that sound like something that the Manufactured Housing Institute (MHI) and several of their consolidation-focused brands does?

Part I of this report provides elements of ProPublica’s report on this topic. MHProNews delayed to see what developments might occur in the wake of this, since experience showed that MHI, pro-Clayton and pro-MHI bloggers and trade media were unlikely to mention a syllable about an issue that could mire others in litigation and/or prosecution. Two of the videos posted in Part II reflect several prior actions by Buffett-Berkshire linked entities that also looked like scandals at the time, but which pro-Buffett’s influence was used to keep him out of legal hot water. Jake Tran’s “How Warren Buffett Destroyed America” obviously has hyperbole in the title, but much of the video raises factually accurate incidents on how Buffett is a ‘hypocrite and a fraud’ hiding behind a ‘nice guy billionaire’ image that is phony, carefully crafted, and rehearsed. That phony image, per Tran and his video. Recall that left-leaning financial-business news publication Barron‘s, in a report that MHProNews reported earlier this year, made the allegation that Buffett was risking his nice guy image too.

Whatever develops from the allegations and evidence uncovered by ProPublica and others, there are apparent implications for manufactured housing. More on that in Part II, along with additional insights from Copilot and other sources.

Part I Insights from ProPublica, Business Insider, and the New York Times

Robert Faturechi and Ellis Simani published a report for ProPublica entitled “How Warren Buffett Privately Traded in Stocks That Berkshire Hathaway Was Buying and Selling.” While the headline appears to be factually accurate, based on the evidence ProPublica’s writers say they have seen, it arguably might have been more compelling had it said something like ‘Investigation Reveals Evidence Warren Buffett Apparently Violated Insider Trading plus Berkshire Hathaway Ethical Trading Standards.’ That noted, The following are pull quotes from that report.

But roughly two decades of Buffett’s personal trades were included in a leak of IRS data obtained by ProPublica. Those records show that the nation’s best known and most respected investor has sometimes said one thing in public and done another in private.

On at least three occasions, Buffett has traded stocks in his personal account in the same quarter or the quarter before Berkshire bought or sold shares of the same companies, doing so before the conglomerate’s moves were disclosed to the public.”

MHProNews notes that according to left-leaning Wikipedia: “David L. Sokol is an American business executive. He is a Chairman of Teton Capital LLC, headquartered in Wilson, Wyoming. He served as chairman, president, and CEO of NetJets, as well as a chairman of MidAmerican Energy Holdings Company, of which Berkshire Hathaway holds a 100% and 89.8% stake respectively.” Sokol plays a role in the next segment of the Faturechi and Simani report for ProPublica.

The question came up a second time at a Berkshire shareholder meeting that year, and Buffett gave almost the same answer. He said he preferred Wells Fargo, but Berkshire was “buying Wells Fargo stock and that takes me out of the business of buying Wells Fargo,” so he bought shares of Chase for his personal account because it was his second choice.

“That’s one of the problems I have,” he said. “I can’t be buying what Berkshire is buying and I’ve got some money around and therefore I go into my second choices or into tiny little companies.”

Only a year earlier, the issue of personal trading had given rise to a rare scandal for Berkshire Hathaway. Buffett’s heir apparent at the time, David Sokol, resigned under a cloud after making personal stock trades, which Berkshire ultimately determined had violated its insider trading policy. Berkshire is a sprawling conglomerate, with $300 billion in 2022 revenues, that wholly owns some businesses and has stakes in a number of publicly traded companies. Sokol, who denied his trades were improper, had purchased shares of a chemicals company that Berkshire acquired soon after.

“Sokol episode could dent Berkshire reputation,” read one headline. “Say it ain’t so, Warren,” read another.

In the wake of such articles, Buffett defended his company’s personal trading policies and the firm’s controls to ensure those rules were followed. “I don’t think you’ll find that the problem is in the rules. The problem is in people breaking the rules,” he said. “People break rules…the job is to find them.”

In 1999, a lawsuit was filed against MidAmerican Energy when David Sokol was CEO. Last year, a lawsuit was filed against another Berkshire Hathaway company, NetJets. Sokol was in charge of the company at the time.

Legal disputes are not evidence of a pattern of anything necessarily, but several lawsuits involving Sokol since he became a member of the Berkshire family, “suggest that management had some warnings about his rules-pushing nature long before his resignation last week for buying stock in a company shortly before Berkshire acquired it,” the New York Times reports.

Sokol suddenly resigned from Berkshire last week amid questions over his purchase of Lubrizol shares before Warren Buffett bought the chemical company for $9 billion. Sokol made almost $3 million from his investment.”

The most serious lawsuit centered on the accounting of an irrigation project by MidAmerican Energy, where Mr. Sokol was chief executive when Berkshire bought it in 1999…[L]ast year the judge ruled in that case that MidAmerican had improperly changed its accounting on the project and criticized Mr. Sokol directly.

The change in accounting was “intended to eliminate the minority shareholders’ interests,” the judge wrote, awarding more than $32 million to the minority shareholders. The case had taken more than five years to work its way through the courts. During that time, Warren E. Buffett… expressed confidence in Mr. Sokol by broadening his portfolio beyond MidAmerican to include Netjets.”

Schroeder told the NYT that the various legal actions would have been “yellow lights: if not danger signals, at least warning signs. Disputes in business are common, but both of these speak to the integrity of the management, not just ordinary business wrangling.”

Business Insider also said: “Yet ProPublica reported that Buffett made at least $466 million in personal stock sales between 2000 and 2019, though the records it viewed didn’t include securities he bought and held.

In August 2009, Buffett personally sold $25 million in Walmart stock. It’s not clear which came first, but that same quarter, Berkshire roughly doubled its stake in the retailer.

In October 2012, Buffett privately sold $35 million of Johnson & Johnson shares, which Berkshire also sold. A filing at the end of the quarter did not specify a date. The conglomerate later sold millions more shares in the subsequent two quarters. ##

ProPublica’s report also said:

Business Jet Online said of Sokol’s resignation over the apparent front-running controversy the following.

“Dave’s contributions have been extraordinary,” Buffett wrote in his statement. “At NetJets, Dave resurrected an operation that was destined for bankruptcy, absent Berkshire’s deep pockets.” Buffett’s statement also concerned Sokol’s involvement in Berkshire Hathaway’s March 14 offer to purchase Lubrizol, a specialty chemicals company. (That deal is now awaiting approval by Lubrizol’s shareholders.)

According to Buffett, “Dave’s letter was a total surprise to me, despite the two earlier resignation talks…This time, however, I did not attempt to talk him out of his decision and accepted his resignation.””

As Wikipedia noted, today Sokol is “Chairman of Teton Capital LLC, headquartered in Wilson, Wyoming.”

Part II – Additional Information with More MHProNews Analysis and Commentary

In no particular order of importance are the following background items, which will be framed in a manufactured housing industry context further below. Note that this history is significant, as Buffett himself preaches the importance of reading a lot on a subject and more specifically knowing the history of a company.

1) According to Copilot:

- In 1987, Berkshire Hathaway acquired a 12% interest in the investment banking firm Salomon Brothers.

- In 1990, it was revealed that a rogue trader at Salomon Brothers had submitted bids exceeding Treasury rules.

- The CEO at the time, John Gutfreund, failed to take disciplinary action in response to the trader’s actions12….”

2) In reply to follow up inquiries from MHProNews, Copilot elaborated as follows.

- Warren Buffett:

- As the Chairman and CEO of Berkshire Hathaway, Buffett was directly involved in the situation.

- His reputation as a prudent investor and ethical leader was at stake.

- Buffett had to address the issue transparently and take decisive action to protect Berkshire Hathaway’s interests.

- Berkshire Hathaway:

- Berkshire Hathaway held a significant stake in Salomon Brothers.

- The rogue trader’s actions violated Treasury rules, potentially exposing Berkshire Hathaway to legal and regulatory risks.

- The company needed to assess the impact on its investment and reputation.

- Salomon Brothers:

- The rogue trader’s behavior jeopardized Salomon Brothers’ integrity and credibility.

- Legal and regulatory investigations ensued, leading to fines and penalties.

- Salomon Brothers faced reputational damage and had to implement corrective measures….”

3) As a result of this scandal, the following enthused.

Let’s rephrase. Has there been litigation against 21st Mortgage Corporation and/or Vanderbilt Mortgage and Finance that resulted in fines, settlements, or judgments since Berkshire became involved with the company?

- Salomon Brothers:

- As we discussed earlier, the Salomon Brothers scandal in the early 1990s involved fraudulent actions related to Treasury securities. Berkshire Hathaway faced significant penalties due to its stake in Salomon Brothers1.

- Blue Chip Stamps:

- In the 1970s, Blue Chip Stamps (a company partially owned by Berkshire Hathaway) faced antitrust allegations.

- The case reached the Supreme Court, which ruled that Blue Chip Stamps could not be sued by consumers for antitrust violations because they were not direct purchasers of the company’s products2.

- Clayton Homes-21st Mortgage Corporation:

- …

- Real Estate Commissions:

- Recently, Berkshire Hathaway Energy (which owns HomeServices of America) was added to a lawsuit accusing real estate brokerages (including HomeServices) of conspiring to keep real estate commissions artificially high nationwide.

- The lawsuit challenges the practice of having home sellers pay combined 5% to 6% commissions for their own agents and buyers’ agents1.

In summary, Berkshire Hathaway’s involvement in various industries has led to legal scrutiny, and antitrust concerns have been part of that landscape. …”

Note that MHProNews edited out 3 bullets under Clayton Homes and 21st Mortgage Corporation, because the information provided on that were apparently errant. Copilot acknowledged that error, when asked, by saying in response to MHProNews the following.

5)

Let’s rephrase. Has there been litigation against 21st Mortgage Corporation and/or Vanderbilt Mortgage and Finance that resulted in fines, settlements, or judgments since Berkshire became involved with the company?

6) With that backdrop, let’s pivot for the next few moments to the Jake Tran video flamboyantly entitled:

How Warren Buffett Destroyed America

Perhaps a more accurate phrasing for the title might have been something like: ‘How Warren Buffett Led Berkshire Hathaway Undermined America.’ Hyperbole in headlines, in fairness to Tran, is not uncommon. Our publications prefer to use headlines that accurately cite some person’s or entities statements and then provide the evidence.

7) Tran’s video dated Feb 12, 2024 slams Buffett led Berkshire for the ProPublica revelations, for his manipulative communications methods, for making himself look folksy and nicer by tactics such as so-called philanthropy that his own son Peter has undermined in media remarks, as MHProNews has previously reported. Among the firms named in Tran’s video are Coka-Cola, Kraft Heinz, Goldman Sachs, and others.

Among the remarks in response to Tran’s video, for and against, are as follows. Typos are in the original.

“Hes not leaving his kids any money, hes donating to charity!” He kids own the charities and he is donating it to them to keep the money in tax havens. They dont own the money but have complete control over it

@moondog573

Imagine living in 2024 and believing the bill and Melinda gate’s foundation is good for humanity.

@banquo60615

Kraft Heinz is the biggest marketer of processed foods in the US. Processed foods is, by far, the greatest cause of premature death in the United States.

@gjd424

1st the comparison of sees candy to a life saving drug price is absurd. 2nd billionaires don’t buy mansion in LA and leave them empty “for whatever reason” they typically have multiple mansions so they aren’t always at the same one AND more importantly mansions in LA are assets that go up in value!

@T2theG123

Takes 20 years to make a reputation and 28:48 to expose it

@lifeisshort.9869

I completely lost my respect for Warren Buffett when I saw him pretend to drink Coca-Cola and eat at McDonald’s on a daily basis. I knew right then and there that he is a straight-up liar and that everything he says or does is only for PR purposes.

@1boi593

I find it very comforting that no matter how much money he still makes and has he does not have much time left and will soon kick the bucket like his friend charlie munger. This billionaires would like to live forever but they all will vanish into dust.

@MaxHF

Warren Buffet has invested in thousands of companies over his career, so I imagine there might be a few that turned bad. I wouldn’t say the few that were selected are the norm of his investments.

@speakingBuddha916

Sorry…but, I don’t find anything wrong here, except maybe the insider trading incidents. I actually wanted to see something truly negative about him. Wanting to maintain a good public image is not a crime. Investing in cigarette companies or CocaCola is not a crime. I know they are harmful to society overall, but it is the government’s job to limit their usage somehow (through taxes or regulation). If some profitable business is legal, a smart investor would invest in it. Looking for pricing power is not a crime. Pricing power just indicates the superiority of the product. There is nothing wrong with increasing candy prices. You can price candies as high as you want (basically until people are willing to buy them). With pharmaceuticals though, it is not right, as they are essentials – but again, it is the job of the government to control prices/make drugs accessible to everyone. And most importantly, none of these investments is private; he has openly discussed them publicly multiple times. The insider trades though are wrong imo, if they really happened. You should have talked more about them – If they truly happened and clearly proved, what happened with the investigations? What was the size of these trades? Honestly, I don’t see an incentive for him to buy these shares with personal money before/after Berkshire has bought them, considering most of his money is in Berkshire itself. I was expecting something actually bad about him, unfortunately there is nothing here…

@bradleygt1070

“Behind every great fortune there is a crime” Balzac

@makabongwengcobo6792

I said it on the Finiuas documentary on Warren & I’ll say it here, watching Billions will desensitise you to such. The man is a shark.

@futuristicperson3375

i stopped using Geico when they kept increasing my Insurance cost every 6 months. They definitely follow ruthless business tactics…”

Those are just some out of over 730 posted comments.

It is a fair remark that this video by Tran could have been better organized with its evidence and arguments. That said, it does raise several insightful points which will be elaborated on further below.

With respect to the comments that ‘defended’ Buffett, this next video explained in greater detail Buffett’s role in Solomon Brothers.

8)

The YouTube page with that video above said the following: “In 1991, Warren Buffett (CEO of Berkshire Hathaway) got caught up in a scandal that nearly destroyed his career. Salomon Brothers (of which Buffett was a director and major shareholder) had broken U.S. securities laws around trading of Treasury Bonds, but hid their wrongdoing from the Federal Reserve, the Treasury and the SEC. In the fallout that followed, Warren Buffett was almost faced with being the figurehead of an imploding Salomon, an event that would have tarnished his reputation forever. So, how did Buffett turn the situation around?” Some of what follows confirms points raised by Tran’s video.

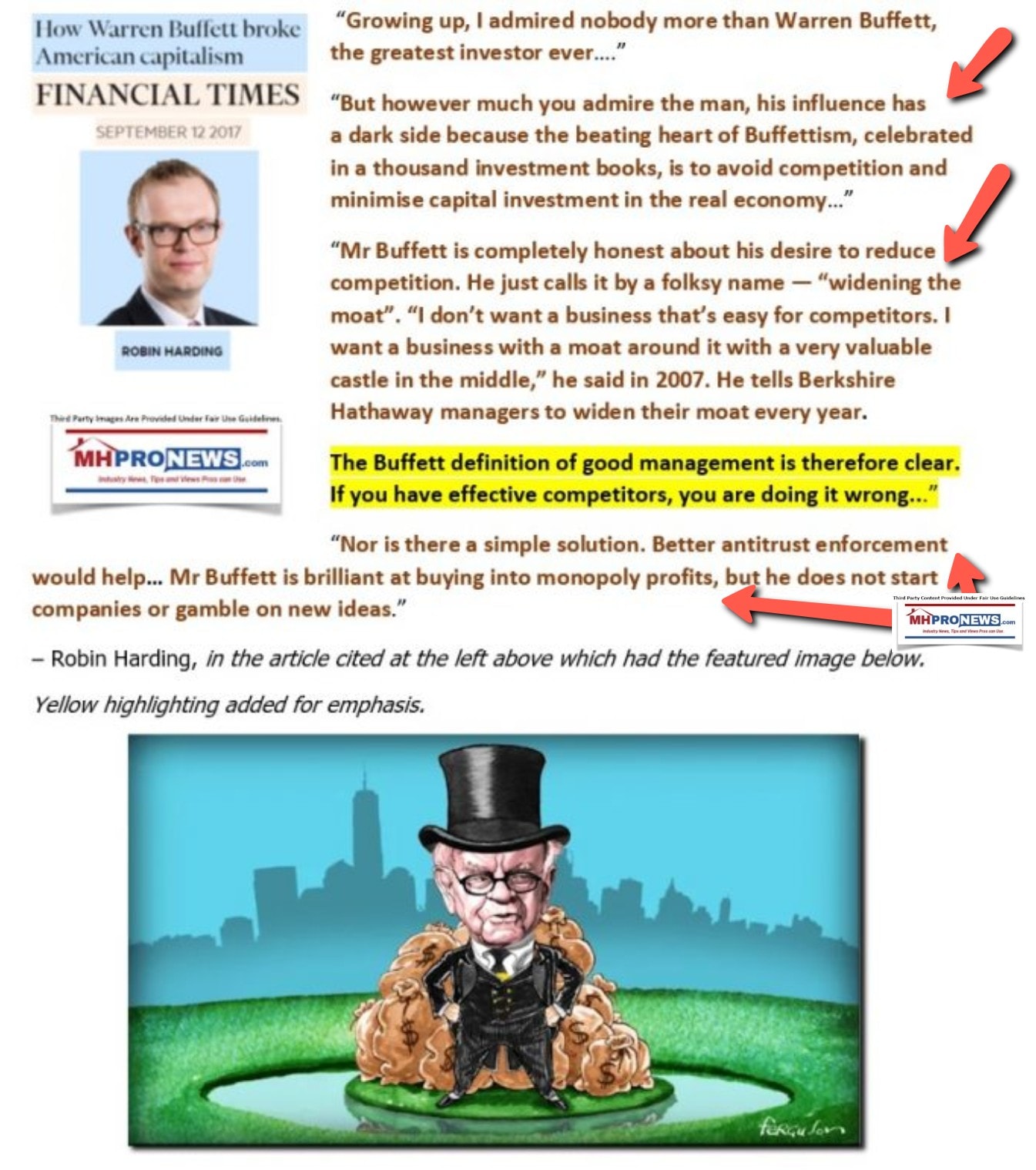

9) Then, consider what Robin Harding, previously reported by MHProNews on several occasions, had to say about the man he once admired. Harding took a very similar stance that Jake Tran did. Namely, accusing Buffett of ruining capitalism in the sense of a description for the free enterprise system.

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

10) Then, no less a figure than Buffett’s apparent ally in investing, politics, media, and philanthro-capitalism (a.k.a.: philanthro feudalism) is William “Bill” Gates description of the man.

![DidntWantToMeetWarren[Buffett]BecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2020/07/DidntWantToMeetWarrenBuffettBecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews.jpg)

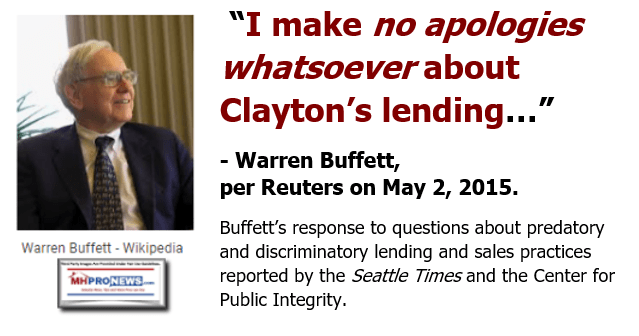

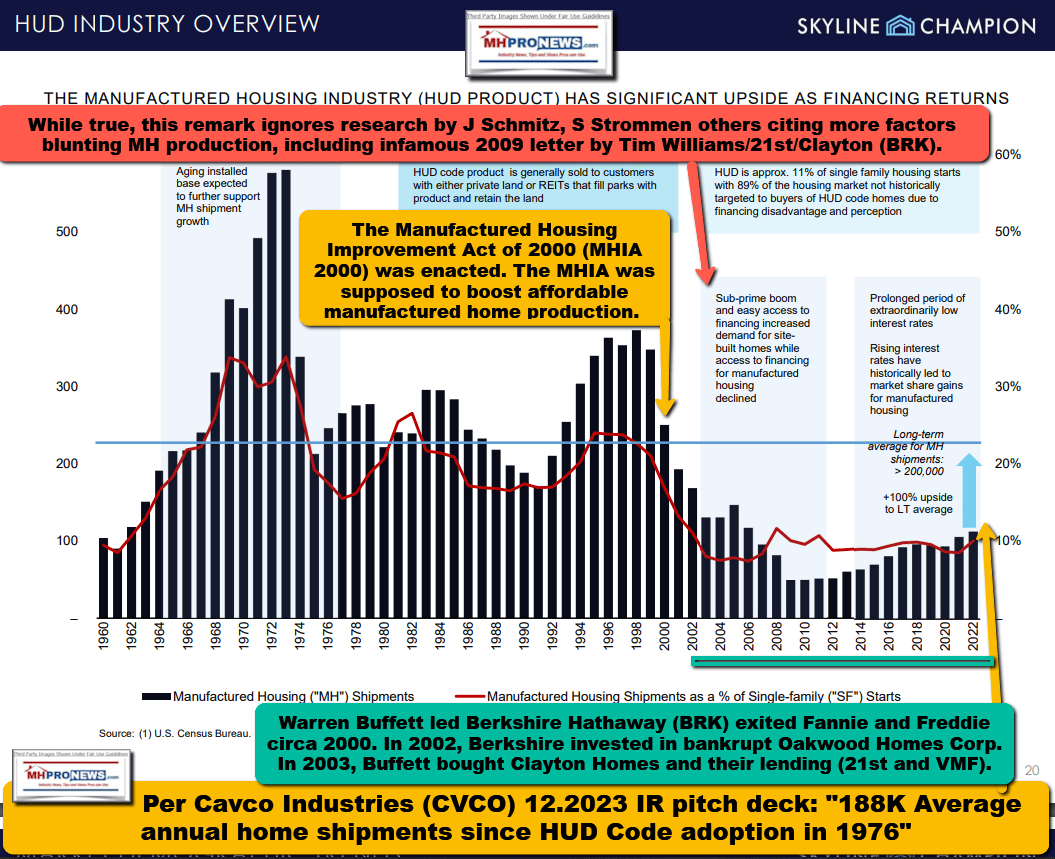

11) With those points in mind, pivot anew to what has occurred in the manufactured housing industry in the 21st century. Perhaps no other figure has single-handedly caused more harm to modern manufactured housing than Warren Buffett. That noted, it is also apparent that his lieutenants in that operation, men such as Kevin Clayton of Clayton Homes and Tim Williams of 21st Mortgage Corp., obviously have their hands dirty too.

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

A still relevant flashback report that brought together an array of Buffett-Berkshire-Rep. Maxine Waters (CA-D) and company report linked below.

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

12) To Tran’s point on putting on a fake supposed ‘nice guy’ image, MHProNews and our MHLivingNews sister site has periodically pulled back the veil of posturing and pretense and looked at the sobering evidence of harms done to millions of affordable housing seekers, not to mention smaller businesses. See the linked reports to learn more. ##

In several devices the image below can be opened to a larger size.

In many cases you can click the image and follow the prompts.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’