Canadian Apartment Properties Real Estate Investment Trust (“CAPREIT”) (TSX:CAR.UN) announced an agreement on “with an entity controlled by TPG Real Estate to sell its manufactured home community (“MHC”) portfolio for a gross purchase price of $740.0 million (excluding transaction costs)” on 7.15.2024. Yahoo said C$740.0 million (Canadian dollars) “is about $556.5 million in U.S. dollars.” TPG has been significantly involved in manufactured home land-lease communities in the U.S. While the two nations are obviously distinct in several respects, as Parts II, III, and IV will reflect, there are possible insights for a range of professionals, consumer advocates, and others who are probing what is behind the curtain in this development. Part I is CAPREIT’s press release. The manufactured housing and macro-markets report will be in Part V today.

Part I

CAPREIT Announces Strategic Sale of MHC Portfolio for $740 Million

Company Release – 7/15/2024 7:30 AM ET

Canadian Apartment Properties Real Estate Investment Trust (“CAPREIT”) (TSX:CAR.UN) announced an agreement on “with an entity controlled by TPG Real Estate to sell its manufactured home community (“MHC”) portfolio for a gross purchase price of $740.0 million (excluding transaction costs)” on 7.15.2024. Yahoo said C$740.0 million (Canadian dollars) is about $556.5 million in U.S. dollars.

Company Release – 7/15/2024 7:30 AM ET

This news release constitutes a “designated news release” for the purposes of CAPREIT’s prospectus supplement dated February 22, 2024, to its short form base shelf prospectus dated May 9, 2023.

Toronto, July 15, 2024 (Globe Newswire) – Canadian Apartment Properties Real Estate Investment Trust (“CAPREIT”) (TSX:CAR.UN) announced today that it has entered into an agreement with an entity controlled by TPG Real Estate to sell its manufactured home community (“MHC”) portfolio for a gross purchase price of $740.0 million (excluding transaction costs). The unencumbered MHC portfolio is comprised of 12,138 residential lots spread across 75 community sites located throughout Canada.

The purchase price will be satisfied in part through an interest-only vendor take-back loan of $140.0 million, bearing interest at a rate of 3.0% per annum for a five-year term, with the remaining $600.0 million to be satisfied in cash.

CAPREIT intends to utilize the net sale proceeds for: (1) the repayment of the balance outstanding on its Canadian revolving credit facility (approximately $187.0 million as of June 30, 2024); (2) future acquisitions of on-strategy rental properties in Canada; and (3) general business purposes, which may include capital expenditures, debt repayment and the repurchase of trust units under its normal course issuer bid.

“We look forward to a smooth and successful transition with TPG Real Estate. TPG Real Estate has advised CAPREIT that, as a longstanding investor in the Canadian real estate sector, it intends to partner with the existing team to manage and grow the MHC portfolio going forward,” said Mark Kenney, President and Chief Executive Officer of CAPREIT.

“We intend to use the net proceeds from this strategic sale to strengthen our balance sheet, enhance our liquidity and further fuel our high-grading capital allocation strategy,” added Julian Schonfeldt, Chief Investment Officer of CAPREIT. “This pivotal transaction is not only providing CAPREIT with a significant amount of capital, but it also increases management’s focus as a pure play apartment REIT. We’re excited to be simplifying our story and dedicating our resources to our core business, where our competitive advantages are strongest.”

The transaction is subject to compliance with the Competition Act (Canada) and other closing conditions customary in transactions of this nature. Subject to the receipt of all regulatory approvals and satisfaction of customary closing conditions, closing is anticipated in the fourth quarter of 2024. There can be no assurance that all conditions to closing will be satisfied or waived.

About CAPREIT

CAPREIT is Canada’s largest publicly traded provider of quality rental housing. As at March 31, 2024, CAPREIT owns approximately 64,200 residential apartment suites, townhomes and manufactured home community sites well-located across Canada and the Netherlands, with approximately $16.7 billion of investment properties in Canada and Europe. For more information about CAPREIT, its business and its investment highlights, please visit our website at www.capreit.ca and our public disclosure which can be found under our profile at www.sedarplus.ca.

Cautionary statements regarding forward-looking statements

Certain statements contained in this press release constitute forward-looking statements within the meaning of applicable Canadian securities laws. Forward-looking statements generally can be identified by the use of forward- looking terminology such as “outlook”, “objective”, “may”, “will”, “expect”, “intent”, “estimate”, “anticipate”, “believe”, “consider”, “should”, “plans”, “predict”, “estimate”, “forward”, “potential”, “could”, “likely”, “approximately”, “scheduled”, “forecast”, “variation” or “continue”, or similar expressions suggesting future outcomes or events. Forward-looking statements in this press release include, but are not limited, statements with respect to the closing of the MHC portfolio sale, the intended use of net disposition proceeds thereof and the timing of the sale transaction. The forward-looking statements made in this press release reflect CAPREIT’s current expectations and projections about future results and events based on information available to CAPREIT as of the date on which such statements are made. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward- looking statements contained in this press release. Any number of factors could cause actual results to differ materially from these forward-looking statements. Although CAPREIT believes that the expectations reflected in forward-looking statements contained herein are reasonable, it can give no assurances that the expectations of any forward-looking statements will prove to be correct. Accordingly, readers should not place undue reliance on such forward-looking statements.

Forward looking statements in this press release are subject to certain risks and uncertainties, many of which are beyond CAPREIT’s control, which could result in actual results differing materially from these forward-looking statements. These risks and uncertainties include, but are not limited to, the risks and uncertainties described under the heading “Risks and Uncertainties” in CAPREIT’s 2023 Annual Report and under the heading “Risk Factors” in CAPREIT’s Annual Information Form for the year ended December 31, 2023, each of which is available under CAPREIT’s profile on SEDAR+ at www.sedarplus.ca.

Except as specifically required by applicable Canadian securities law, CAPREIT does not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. These forward-looking statements should not be relied upon as representing CAPREIT’s views as of any date subsequent to the date of this press release.

For more information, please contact:

CAPREIT

Mr. Mark Kenney

President & Chief Executive Officer

(416) 861-9404

Mr. Stephen Co

Chief Financial Officer

(416) 306-3009

Mr. Julian Schonfeldt

Chief Investment Officer

(647) 535-2544 ##

Part II – More About CAPREIT per CAPREIT

1) Per Capreit’s 2023 annual report is the following graphic, which indicates the share of that firm’s holdings in manufactured home communities (MHCs). Per their investor relations document, MHCs were 4.2 percent of their property allocation.

2) Some posts from Facebook by Capreit’s land lease manufactured home communities (MHCs).

Part III CAPREIT Resident Bill of Rights — For our Land Lease Communities

The following bill of rights for their manufactured home communities (MHCs) is thought provoking. Their title is as shown above and is otherwise posted as shown below (sans photos).

- CAPREIT

CAPREIT cares about its residents.

And we care about protecting their rights.

Throughout CAPREIT, we have formalized processes and policies that outline the way in which we interact with our residents, and what they can expect from us, and what we ask of them.

The purpose of the Bill of Rights is to showcase for our land lease community residents, the many ways we provide residents choice in how they interact with CAPREIT, the respect they can expect, and the many services that are provided to them to provide feedback and escalate their concerns.

This Bill of Rights remains subject to the rights of our residents under applicable laws.

CAPREIT will uphold the following rights:

- Right to Access to Information

- Right to Tenure

- Right to No Renoviction

- Right to Fair Legal Proceedings

in Eviction - Right to Provide Feedback &

Communicate with CAPREIT

Right to Human Rights

Right to Fair Treatment & Respect

Right to Privacy

CAPREIT respects our residents’ right to privacy. This includes physical privacy as well as data privacy.

If you rent the land and your home from CAPREIT, we are permitted to enter a resident’s home ONLY for these reasons: a) to make repairs, b) inspections, c) showings to prospective residents, d) for emergencies or e) for such other reasons as may be permitted by law.

If you only rent the land from CAPREIT and you own your own home, CAPREIT will not enter your home, except in the company of police authorities for the purpose of eviction or a wellness check.

Unless it is an emergency, which does not require 24 hours written notice, CAPREIT will always provide at least 24 hours’ notice of entry into a resident’s home or such longer notice as may be required under applicable laws.

CAPREIT will also employ reasonable measures to protect a resident’s identity and data. CAPREIT does not sell resident data to third party organizations. CAPREIT employs privacy personnel that residents can contact at any time at privacy@capreit.net

Right to Ombudsman Support

CAPREIT offers CAPCares, an ombudsperson program that is managed by a third-party organization. This ombudsperson program is specifically designed to assist residents who do not feel they are receiving support from their property management office. If a resident has first submitted a work order, and they have not received a response or a reasonable resolution to their issue, they can escalate their concern by calling this free service. Their complaint will be recorded and reviewed by members of senior operations and customer experience management and appropriate steps will be taken to work with the resident to resolve the issue. Residents can call the CAPCares toll-free phone number at 1 855 227 6478. Residents are also welcome to contact wecare@capreit.net.

Right to Choose Homeowners’ Insurance Provider to Protect Belongings

CAPREIT does not impose upon residents their choice of homwowners’ insurance providers. Homeowners insurance may be a mandatory part of a resident’s lease. In the event of an emergency such as a fire, water damage, or theft, it can replace a resident’s belongings, provide alternative housing, and cover necessary expenses, as well as pay for liability if a resident causes the damage. CAPREIT does not mandate who the insurer is residents have free choice to choose the policy that is right for them at the cost that is right for them.’

Right to Advance Notice on Rent Changes

CAPREIT provides residents with proper advance notice of any rent increase adjustments, in clear, easy to understand language that outlines the reason for the adjustment, the new amount, and the effective date. If we fail to provide residents with the proper advance notice required by the laws of the province in which the resident resides, their rent increase is not enforceable on the effective date

noted on the notice. A new notice will be issued with a new rent increase effective date, if required.

CAPREIT will follow all legislative guidelines in issuing a notice on a rent increase and we strongly encourage our residents to know what rules and legislation applies to them in their province.

Right to Access to Information

Right to Tenure

Right to No Renoviction

Right to Fair Legal Proceedings in Eviction

Residents will generally only be evicted or asked to leave their home for the

following reasons (subject to the laws applicable in the province where the

resident resides):

- breach of their tenancy agreement (example: failure to pay rent) or their other

obligations under the laws applicable in the province where the resident resides; - violence or harassment of staff or fellow residents;

- illegal conduct;

- safety concerns;

- destruction or significant damage to the resident’s home or property in which it is

situated; - major structural repairs, demolition or conversion;

- if the term of their tenancy expires and is not renewed; or

- if required or permitted by applicable law.

Residents in breach of their rental obligations have a right to be heard by

the appropriate regulatory body in their province that handles disputes

between housing providers and residents. CAPREIT will present itself and

the dispute in a fair and reasonable manner, with our preference to work

with residents so that these matters are resolved prior to the involvement

of legal proceedings.

Right to Provide Feedback & Communicate with CAPREIT

CAPREIT has a number of ways that residents can provide CAPREIT

feedback. These include:

- Administration Office

Contact information is posted in common areas and includes a phone number and email address. - WeCare

Residents can email wecare@capreit.net and their request will be provided to senior operations management - CAPCares

CAPREIT’s ombudsperson program that escalates resident complaints if there are any outstanding work orders regarding issues in the suite and around the property. Residents are encouraged to call 1 855 227 6478 - National Resident Survey

Conducted annually in the fall, CAPREIT sends notices through the Resident Portal and social media to advertise the survey, in addition to signage around the property and in common areas. - Resident Portal

Residents have access to CAPREIT’s Resident Portal to log service issues. Residents must register with the rental office to obtain a unique username and password. Residents can access the Portal once those are obtained online at: capreit.residentonline.ca/ - Maintenance Survey

every resident can complete a survey on their maintenance experience after their Resident Portal maintenance ticket has been closed. At the end of this survey, in addition to rating the performance, a resident can ask for follow up with a member of the operations team. ##

Part IV – Additional Information with More MHProNews Analysis and Commentary in Brief

In no particular order of importance are the following facts and insights.

1) Fannie Mae Multifamily said on August 15, 2019 that “TPG Capital, an institutional equity fund based in Fort Worth, was the top MHC investor over the past 24 months, investing almost $390 million on about 78 MHC properties.”

2) While there may be some similarities, Canadian law is obviously distinct from U.S. law. This deal is for Canadian properties.

In Canada, there is an analogous institution called the Canada Mortgage and Housing Corporation (CMHC). Like Fannie Mae and Freddie Mac, CMHC was established to address housing needs. However, there are some differences:

- Ownership: CMHC is a government-owned corporation, whereas Fannie Mae and Freddie Mac were originally private entities (though they are now under government conservatorship)2.

- Public Trading: CMHC is not publicly traded; there is no IPO for its equity. While it may issue bonds, its equity remains non-public3.

So, while Canada has its own housing agency, it doesn’t operate exactly like Fannie Mae and Freddie Mac. If you’re interested in Canadian mortgage securities, you might explore CMHC’s debt securities offerings for investment professionals3. …”

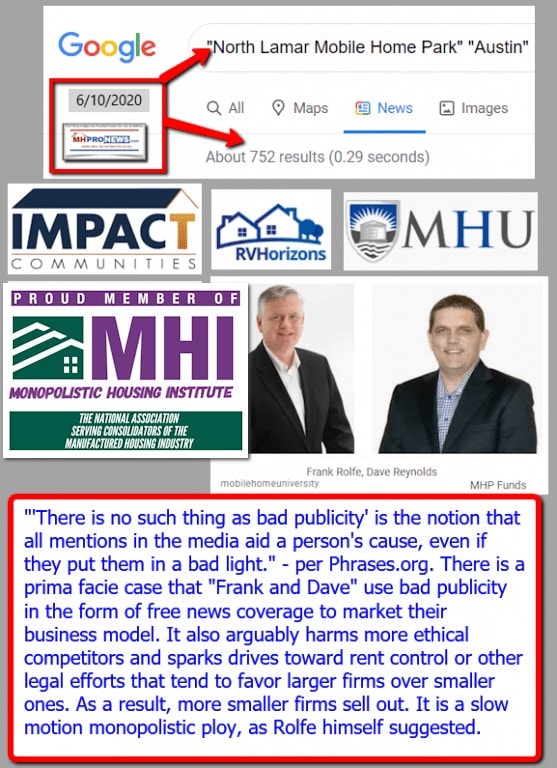

6) The Private Equity Stakeholder Project (PESP) previously released a document with the following facts, claims, and insights on TPG and its relationship with RV Horizons, Rolfe and Reynolds.

TPG CAPITAL PARTNERS WITH RVHORIZONS ON MANUFACTURED HOUSING COMMUNITY PURCHASE

KEY POINTS

- Since 2018, private equity firm TPG Capital has invested in a portfolio of 78 manufactured home (i.e. mobile home) communities with thousands of home sites across the US.

- TPG’s partners in the deal, RVHorizons and StriveCommunities, have previously drawn criticism for aggressively raising rent on the mobile home residents.

- Strive Communities VP Dave Reynolds also runs Mobile Home University with longtime partner Frank Rolfe. Materials from Mobile Home University note that owners have residents “hostage,” enabling them to raise lot rents.

- The predatory practices have caught the attention of US lawmakers including Senator Elizabeth Warren and Representative Dave Loebsack, who sent a letter to TPG in May 2019 raising questions about the firm’s manufactured housing investments.

- In 2018, a TPG Capital affiliate drew scrutiny after foreclosing on hundreds of homeowners in Puerto Rico in the aftermath of Hurricane Maria.

According to Fannie Mae’s August 2019 multifamily market commentary, released in August 2019, TPG was the top manufactured home community purchaser over the past 24 months.4

TPG Capital purchased a portfolio of communities in Colorado, Illinois, Indiana, Iowa, Kansas, Kentucky, Minnesota, Missouri, Nebraska, North Dakota, Texas, Virginia, West Virginia, and Wisconsin from manufactured home community operator RVHorizons and affiliate MHP Funds.5

RVHorizons, renamed Strive Communities, continues to manage the properties. Strive Communities reports that it has more than 120 communities across 16 states.

TPG lists Strive Communities as a portfolio company.6 RVHorizons (and Mobile Home University) co-founder Dave Reynolds served as VP of Licensing at Strive Communities as of March 2019.7

STRIVE/RVHORIZONS MANAGEMENT CRITICIZED FOR PUSHING SIGNIFICANT RENT INCREASES ON “HOSTAGE” RESIDENTS

Strive Communities/ RV Horizons is headed by Frank Rolfe and Dave Reynolds, who have been criticized for their Mobile Home University (MHU), which teaches prospective manufactured home community investors about how to best extract profits from community ownership. Rolfe, for example, is known for likening a manufactured home park to “a Waffle House where everyone is chained to the booths,” emphasizing how residents have few options but to pay rent increases.8

More, materials from Reynolds’ and Rolfe’s MHU for a “boot camp” for aspiring mobile home park investors note: “the fact that tenants can’t afford the $5,000 it takes to move a mobile home … makes it easy to raise rent without losing any occupancy.”9

In February 2019, Last Week Tonight with John Oliver featured TPG Capital’s investment with RV Horizons as part of a broader segment on private equity investment in manufactured home communities. In a clip from an MHU seminar played on Last Week Tonight, Rolfe notes, “One of the big drivers to making money is the ability to increase the rent. If we didn’t have them hostage, if they weren’t stuck in those homes in the mobile home lots, it would be a whole different picture.”10

RV HORIZONS/ STRIVE COMMUNITIES RESIDENTS COMPLAIN OF AGGRESSIVE RENT PRACTICES

Urbana, Illinois

Terry Baker and Char Pekoz live in a TPG Capital-owned manufactured home community managed by Strive Communities in Urbana, Illinois.

Since RV Horizons took over Terry Baker’s mostly senior community, Baker and neighbor Char Pekoz have seen lot rent and fees increase by more than 25% to a total of almost $300 a month. Baker is on a fixed income of $1,000 month and was paying $142 in rent when she moved into the community. Additionally, rent had previously included water, sewer, and garbage, which RV Horizons (now Strive

Communities) now charges as separate fees.11

“I am now starting to have more anxiety going to the mailbox at the end of the month to get the new bill,” said Pekoz, who is also retired, and purchased her manufactured home 30 years ago. “I am now hating this community.”12

“The bottom line is the rent will continue to rise unless corporate or state policies change, and I just won’t be able to afford it,” said Pat Bohlen, who lives in another TPG Capital-owned and Strive Communities-managed community in Urbana, Illinois.13

Canon City, Colorado

At RV Horizons’ Central Manufactured Home Community in Canon City, Colorado, homeowners lease the land their manufactured homes sit on. RV Horizons has raised lot rent twice, implemented a fee for water, sewer, and trash removal in the year following its 2017 purchase of the community.14

“The rent keeps going up and it’s going to make people lose their homes,” said homeowner Scott Winborne.

One resident, Dawn Ketcham, whose monthly expenses had increased by $79 after RV Horizons took over, is on a fixed income and has little money to cover the increases. “I get $750 a month to live on and my rent is almost $400 right now,” said Ketcham.15

Aside from rent increases and new fees tacked onto those increases, residents in August 2018 complained that the community no longer had a property manager or on-site office.16 “They’ve had 10 and half months to get a manager on site and they’ve neglected to do that,” Ketcham said.17

Austin, Texas

RV Horizons purchased North Lamar Mobile Home Park, a manufactured housing community in Austin, Texas, in 2015.

Married residents Margarita and Roberto Sanchez had been paying $390 a month for the land their home sat on, including utilities. The community’s new owners soon added a $120 rent increase and implemented a new rule for water and sewage, adding an additional $150 each month for the Sanchez family. Along with other fees including extra costs for having more than four residents, the Sanchez family saw their rent more than double after RV Horizons took over.18

But North Lamar MHP residents, assisted by the legal aid center, claimed that their existing leases were broken by the new owners. They sued RV Horizons in May 2015, alleging they breached existing contracts by imposing the rent hikes.

Tenants won, and original rent was maintained for the remainder of 2015.19

TPG CAPITAL FACES INQUIRIES FROM US SENATE, CONGRESS OVER MANUFACTURED HOUSING INVESTMENTS

Last year, TPG Capital, along other private equity firms invested in manufactured home communities, drew questions from members of Congress over the impacts of its investments in the sector.

In May 2019, US Senator Elizabeth Warren (D-MA) and US Representative Dave Loebsack (D-IA) requested information from several private equity firms including TPG Capital, noting that TPG and others “are some of the country’s wealthiest firms, preying on rural and lower-income communities to turn a profit.”20

Senator Warren’s and Representative Loebsack’s letter stated, “MHC residents’ lack of economic mobility also makes them vulnerable to exploitation-and investment firms often engage in predatory management practices that boost profits at the expense of manufactured home owners. Investment firms exploit residents’ ‘limited mobility’ by ‘dramatically increase[ing] rents to quickly increase profits.’”

In the letter to TPG co-founder David Bonderman, Warren and Loebsack asked as series of questions about the manufactured home communities that TPG owned, increases in lot rents at the communities, additional fees charged to residents, and profits generated for investors.

TPG CAPITAL DRAWS CRITICISM FOR FORECLOSING ON HOMEOWNERS IN PUERTO RICO IN THE AFTERMATH OF HURRICANE MARIA

TPG Capital’s acquisition of dozens of manufactured home communities is not the private equity firm’s first foray into investing in housing.

In 2018, TPG drew scrutiny from key investors such as the New Jersey Division of Investment and the New York State Common Retirement fund over its mortgage foreclosures in Puerto Rico.21

After Hurricane Maria struck Puerto Rico in September 2017, an estimated third of the territory’s homeowners (90,000 homeowners) were behind on mortgage payments.22 At the time, December 2017, over a third of the entire island still had no power. But lenders, including TPG Capital affiliate Roosevelt, which had acquired thousands of mortgages in Puerto Rico, “have ignored federal moratoria on foreclosures; placed notices of default in newspapers where they’re unlikely to be seen; sent files to homeowners in English rather than Spanish, and require residents to complete tasks that are borderline impossible without electrical power yet fully restored, among other abuses.”23

Roosevelt Cayman Asset Co in the months following Hurricane Maria had more than 300 active Puerto Rican home loan servicer for TPG’s loans. Rushmore and TPG shared several executives.24 TPG Capital ultimately halted foreclosures on the island for several months and committed to reducing mortgage principal and taking other steps to enable borrowers to stay in their homes.

The balance of the document and its footnotes is linked here.

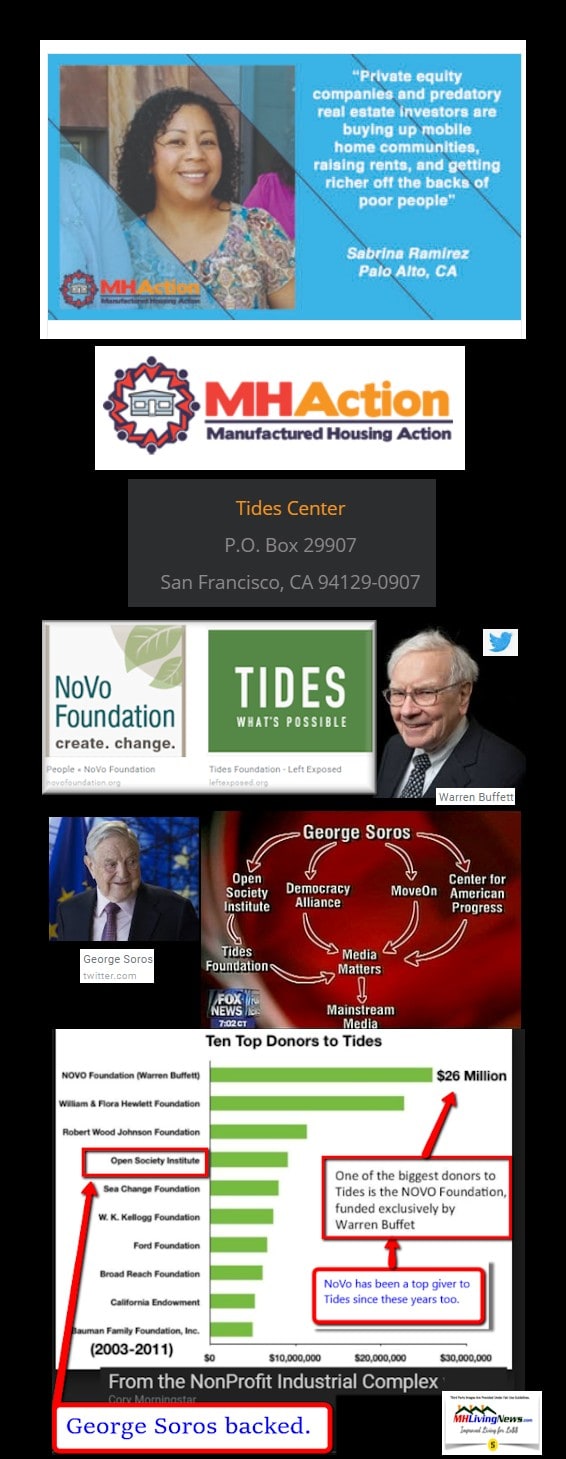

7) MHLivingNews and MHProNews have also pulled back the veil on the behind-the-scenes links between the funding for the research that MHAction and PESP are engaged in. See that in the reports linked here.

8) TPG is one of the firms that is reportedly being scrutinized by the Securities and Exchange Commision (SEC), with a possible deal in the works. While it may be coincidental, note that Carlyle (CG), Blackstone (BX) and TPG Capital (TPG) are the same firms shown in that screen grab above with John Oliver from the satirical viral hit that is provided and unpacked for its links to Manufactured Housing Institute (MHI) member firms at this link here.

9) While there are similarities and differences between issues in Canada and the U.S., this announced deal with TPG and CAPRIET has numbers of potential implications for businesses, consumers, and investors on both sides of the border. MHProNews plans to monitor, report and provide expert analysis as deemed appropriate based on emerging and competing events. To learn more, see the linked and related reports. The market report follows in Part V below.

PS – and not directly related to the report above. Per the left-leaning Associated Press (AP): “Usha Chilukuri Vance, Yale law graduate and trial lawyer, was thrust into the spotlight this week after her husband, JD Vance, was chosen as Donald Trump’s running mate in the 2024 presidential election.” According to Law360: “Usha Chilukuri Vance, the wife of vice presidential candidate J. D. Vance, has resigned as a litigator at Munger Tolles & Olson LLP…” (MTO) Longer term and detail-minded readers of MHProNews and MHLivingNews may recall that the Munger in MTO Law is the late Charlie Munger, and Olson is Ron Olson, both with apparent ties to Berkshire Hathaway. FWIW and worth keeping an eye on to see what, if anything, those ties and actions may mean.

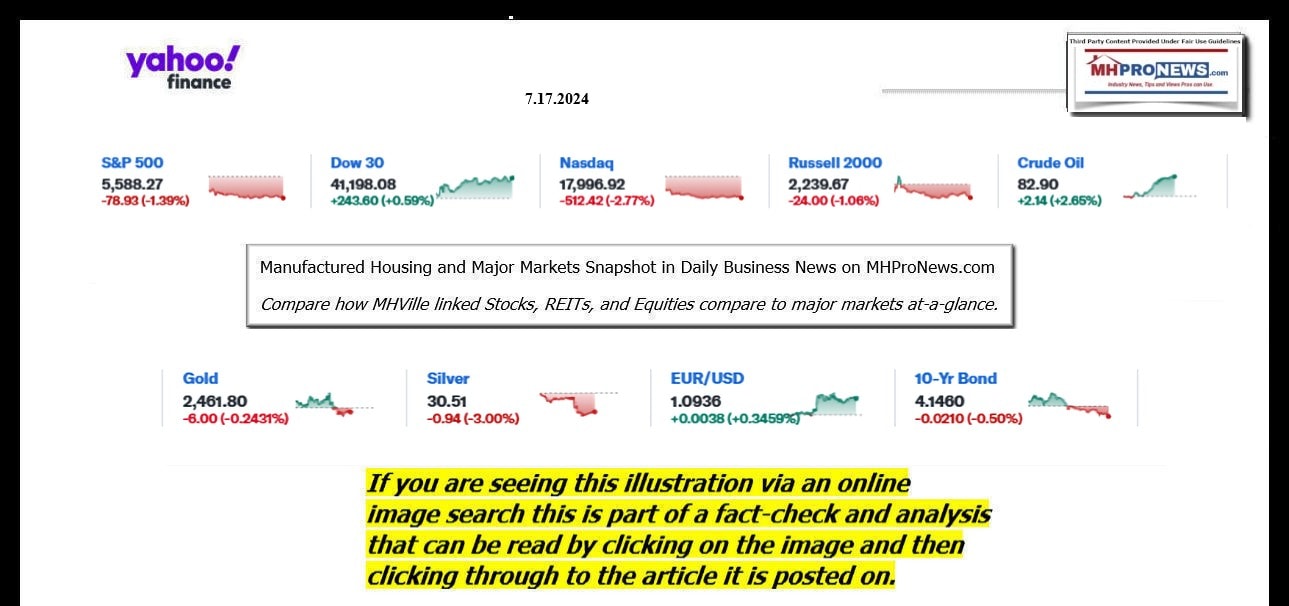

Part V – Our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report at the closing bell, so that investors can see-at-glance the type of topics may have influenced other investors. Our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines for a more balanced report.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day, readers can get a good sense of significant or major events while keeping up with the trends that may be impacting manufactured housing connected investing.

MHProNews note, bold emphasis added below.

Headlines from left-of-center CNN Business – 7.17.2024

- Tech stocks dive after report that Biden administration plans to crack down on China chipmakers

- A 2019 photo shot shows the Joliet ExxonMobile oil refinery.

- Chicago gas prices could soar after tornado narrowly misses refinery

- Amazon’s same-day delivery warehouse in the Bronx borough of New York, pictured on July 16, 2024.

- Amazon Prime Day ‘major cause of injuries’ for workers, Senate finds

- Supreme is being bought by EssilorLuxottica for $1.5 billion.

- Streetwear brand Supreme is getting a surprising new owner

- An Armani store in Milan, Italy, pictured in May 2020.

- Armani and Dior probed in Italy following worker exploitation claims

- One of the world’s biggest booze makers is ditching wine brands as the world drinks less

- HSBC names third CEO in less than eight years

- Cesar Conde Chairman of NBCUniversal International Group and NBCUniversal Telemundo Enterprises speaks at the new Telemundo Center during the ribbon-cutting ceremony. NBCUniversal Telemundo Enterprises announced the official inauguration of Telemundo Center, its new global headquarters on Monday, April 9, 2018, in Miami.

- ‘Morning Joe’ backlash is latest mess for NBC and Comcast executives

- The Mirage hotel and casino is closing Wednesday, ending 34 years in business.

- The iconic Mirage in Las Vegas is closing today after 34 years

- Sen. JD Vance is widely viewed as the vanguard of a Millennial far right that ostensibly champions blue-collar workers and chastises greedy executives. But it’s complicated.

- JD Vance’s populist persona leaves pro-worker groups skeptical

- Chaos on social media platforms after Trump shooting is a mess of their own making

- Work from home could lead to more homes in vacant offices

- China probes companies for allegedly giving pregnancy tests to job seekers

- JD Vance’s ‘Hillbilly Elegy’ tops Amazon book and Netflix film charts following Trump’s VP appointment

- Ozy Media founder Carlos Watson convicted in New York fraud trial

- It’s not just Bob Menendez: Americans really love gold bars

- Elon Musk says he’s moving SpaceX and X out of California

- Dow and S&P 500 close at record highs as investors bet on September rate cut

- ‘Morning Joe’ hosts take on-air swipe at NBC leadership after program was pulled from air

- Elon Musk is going all-in on Donald Trump

- New inflation warning: Get used to high interest rates, IMF says

- Stocks surge after retail sales data shows Americans are still shopping

- The Dow’s surge is a calculated response to political turmoil

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

Headlines from right-of-center Newsmax – 7.17.2024

- Biden Opens Door for First Time to Dropping Out

- President Joe Biden, who has been insistent that he’s staying in the race for president, on Wednesday revealed that he would drop out if a “medical condition” were to emerge. [Full Story]

- Related Stories

- AP Poll: Nearly Two-Thirds of Democrats Want Biden to Drop Out

- Pelosi Ally Rep. Schiff Calls on Biden to Quit Race

- Trump: Dems’ Move to Dump Biden ‘Unprecedented’

- Dems’ Virtual Biden Roll Call Won’t Come Before August

- NY Times: Democrat Donors Plot to Push Out Biden

- Trump Assassination Attempt

- Speaker Johnson: Secret Service Director Should Resign

- Grassley Launches Secret Service Investigation

- House Panel Subpoenas Secret Service Chief

- Ronald Kessler: Remove USSS’s Cheatle Immediately | video

- Slippery Rock, Pa., Mayor: ‘Shock, Disbelief’ at Shootings | video

- Authorities No Closer to Finding Trump Shooter’s Motive

- Trump’s Heightened Security Apparent

- What Is Known About the Attempt on Trump’s Life

- DHS Watchdog Probes Secret Service’s Handling of Rally

- Don Jr.: ‘How Did Someone Get That Close?’

- Iran Threat Prompted Increased Protection of Trump

- FBI, DHS Warn of Retaliation After Trump Shooting

- Newsmax TV

- Mercedes Schlapp: Delegates Needed to Hear Haley Endorse Trump

- NYPD’s Chell: ‘Made Moves’ Fast to Protect Trump in NYC | video

- Fry: Diversity Shouldn’t Not Determine Secret Service Agents | video

- Britt: Trump-Vance Ticket Will Fight for America | video

- Barr: Vance Has ‘Appalachia Grit’

- Rick Scott: Vance Will Be ‘Great’ VP | video

- Sullivan: Stop Appeasing Iran | video

- James: Dems ‘Can’t Win on Ideas’ | video

- Comer: ‘No One Is Ever Held Accountable’ by Biden | video

- Will Scharf: Trump Deserves Apology For Mar-a-Lago Raid | video

- Newsfront

- Gizzi: Delegates Say GOP More Unified Than Ever

- Noting the speeches Tuesday night by former rivals of Donald Trump such as Nikki Haley and the general agreement on the Trump-crafted platform, delegates to the Republican National Convention who spoke to Newsmax agreed the party was unified going into the fall…. [Full Story]

- Related Stories

- VP Pick Vance Poised to Take Trumpism Into Future

- Rick Scott to Newsmax: Vance Will Be ‘Great’ VP

- DeSantis: We Can’t Afford ‘Weekend At Bernie’s’ Presidency

- Emphasis on National Security on Day 3 of RNC

- Order Dismissing Trump Classified Docs Case Won’t Be Final Word; Long Court Fight Awaits

- A judge’s stunning decision to dismiss the classified documents case [Full Story]

- AP-NORC Poll: Nearly Two-Thirds of Dems Want Biden to Drop Out

- Nearly two-thirds of Democrats say President Joe Biden should [Full Story]

- Related

- Biden: I Would Drop Out if ‘Medical Condition’ Emerged

- Dems’ Virtual Biden Roll Call Won’t Come Before August |video

- Dem Rep. Schiff Calls on Biden to End Reelection Bid

- GOP Senators Worry Trump Coattails Not Carrying in Polling

- Report: Biden Meeting With Dems ‘Worse Than Debate’

- BlueLabs Poll: Nearly Every Democrat Better Than Biden

- NY Times: Democrat Donors Plot to Push Out Biden

- Nielsen: Newsmax Ratings Up in 2024

- Newsmax is seeing massive growth, Neilsen data show… [Full Story]

- Trump Meets With CEOs, Eyes 15% Corporate Tax

- Former President Donald Trump last month met privately with dozens of [Full Story]

- Related

- Trump: Taiwan Should Pay US for Defense

- Trump Says ‘I’m for TikTok’ as Potential US Ban Looms

- GOP Looks to Expand Election Map Into Dem Districts Now

- Biden Aims to Cut Voter Disenchantment With Latino Voters in Las Vegas

- Trump Shooter Spotted Just Before Pa. Rally

- New video surfaced showing Thomas Matthew Crooks, who attempted to [Full Story]

- Eric Trump: Dad Has ‘Nice Flesh Wound,’ No Stitches

- Eric Trump, the son of former President Donald Trump, said his father [Full Story]

- Ruddy: I Spoke With President Trump

- President Trump understands God’s role in our lives and in our [Full Story]

- Afghan Generals: Al-Qaida Re-emerging as Global Threat

- The global threat of al-Qaida has returned, thanks to Iranian backing [Full Story] | Platinum Article

- Russia, Ukraine Swap 95 POWs

- Russia and Ukraine have exchanged 95 prisoners of war Wednesday in a [Full Story]

- Related

- Ukraine Faces Twin Challenges of Fighting Russia and Shifting Political Sands in the US

- Russia’s Medvedev Says Ukraine Joining NATO Would Mean War

- Russia’s Lavrov Welcomes Vance Stance on Ukraine Amid European Concern

- IDF: Half of Hamas Military Leaders Killed Since Oct. 7

- Israeli forces have killed half of Hamas’s military leadership in [Full Story]

- Related

- Haredi Protest Blocks Highway After IDF Announces Draft Orders

- Israel’s Defense Minister: Gaza Operations Allow Hostage Deal

- Israel Pounds Central Gaza, Sends Tanks Into North of Rafah

- Anti-Israel Group Ordered to Release Records

- Reuters Poll: 80% Say US ‘Spiraling Out of Control’

- Americans fear their country is spiraling out of control following an [Full Story]

- ‘I Can’t Breathe’: Eric Garner Dead 10 Years Ago Today

- Wednesday marks 10 years since the death of Eric Garner at the hands [Full Story]

- Guaranteed Income Hawk Launches Calif. Lt. Gov. Bid

- Michael Tubbs is running for lieutenant governor of California, [Full Story]

- $5B Going to Revamp Aging, Failing Bridges in 16 States

- Dozens of aging bridges in 16 states will be replaced or improved [Full Story]

- US: ISIS Attacks in Iraq, Syria Will Double This Year

- The U.S. Central Command said Wednesday that the Islamic State group [Full Story]

- Kremlin: Trump Did Nothing Good for Russia, but Spoke

- The Kremlin said on Wednesday that nothing good for Russia had come [Full Story]

- Trump: Taiwan Should Pay US for Defense

- Taiwan should pay the U.S. for its defense as it does not give the [Full Story]

- VP Pick Vance Poised to Take Trumpism Into Future

- When Sen. J.D. Vance, R-Ohio, takes the stage at the Republican [Full Story]

- Fmr WH Official Indicted for Acting as SKorea Agent

- Fmr WH Official Indicted for Acting as SKorea Agent

- A foreign policy specialist who once worked for the CIA and on the [Full Story]

- Biden: I Would Drop Out if ‘Medical Condition’ Emerged

- President Joe Biden says he would drop out of the presidential race [Full Story]

- House Oversight Committee Subpoenas Secret Service Chief

- Secret Service Director Kimberly Cheatle has been subpoenaed to [Full Story]

- GOP Looking to Expand Election Map Into Dem Districts

- As Democrats continue to argue about whether President Joe Biden [Full Story]

- Sued for Rejecting Petitions on an Abortion-Rights Ballot Measure

- Arkansas is being sued for rejecting petitions in favor of a proposed [Full Story]

- Appeals Court Won’t Hear Arguments on DA Willis’ Role in Ga. Trump Case Before Election

- A Georgia appeals court has set a December hearing for arguments on [Full Story]

- Trump Jr.: Let’s Not Get Complacent

- On Tuesday, Donald Trump Jr. warned Republicans not to get complacent [Full Story]

- Delegate Reaction to Trump’s VP Pick: ‘We Love J.D.!’

- Once Donald Trump announced his choice of Ohio Sen. J.D. Vance as his [Full Story]

- Donald Trump Jr.: ‘How Did Someone Get That Close?’

- Donald Trump Jr. said the biggest question he wants answered [Full Story]

- Trump VP Pick Vance Rips Student Loan Forgiveness

- J.D. Vance, R-Ohio, chosen Monday as Donald Trump’s running mate [Full Story]

- Gold at All-Time High as Rate-Cut Hopes Boost Demand

- Gold prices rose more than 1% to a record high Tuesday, as investors [Full Story]

- Democrats Reignite Calls for Biden to Drop Out

- Following a brief reprieve as the nation focused on the attempted [Full Story]

- More Newsfront

- Finance

- 5 Ideas on How to Invest if Trump Is Reelected

- Everyone is asking the same question, “What stocks or sectors do I own if former President Trump is reelected in November?” Our answer is to keep it macro on a sector and/or thematic level…. [Full Story]

- Related Stories

- Trump Meets With CEOs, Eyes 15% Corporate Tax

- 21 Reasons Trump Will Go Down as the Greatest Leader of the Free World

- Investors Ride the ‘Trump Trade’ as Expectations Grow for a 2nd Term

- Powell and Trump Command Market Attention

- Trump Policies Stimulative, Says Possible Treasury Pick

- Big Tech Stocks Dive Again, Nasdaq Down 503 Points

- US Single-family Housing Starts at 8 Month Low

- US Plans to Boost Semiconductor Output in the Americas

- More Finance

- Health

- Longevity Has Become a Competitive Sport

- The Summer Olympics are starting soon, but a new anti-aging competition has become popular. You can try your hand at the “Rejuvenation Olympics” founded by Bryan Johnson, an entrepreneur and anti-aging aficionado right now. The contest is open to anyone who completes a…… [Full Story]

- How Neurologists Keep Their Brains Sharp

- Health Experts Slam Doping-Friendly Enhanced Games

- Irregular Sleep May Raise Your Risk for Diabetes

- Beware of These Nursing Home Red Flags

click the image and follow the prompts.

| APO = Apolo Global Management – bought Inspire Communities |

| BAM = Brookfield Asset Management – owns and invests in manufactured home communities (MHCs). |

| BLK = BlackRock – conglomerate has investments in firms and operations involved in manufactured housing. |

| BRK-A = Berkshire Hathaway – includes outright ownership of Clayton Homes, 21st Mortgage Corp, Vanderbilt Mortgage and Finance, other manufactured home industry linked firms (MHC brokerage, suppliers, etc.). |

| BX = Blackstone – Blackstone Group LP has made its first big bet on manufactured housing by buying a portfolio of communities sold by Tricon Capital Group Inc. |

| CDPYF = Canadian Apartment Properties Real Estate Investment Trust – also has manufactured home communities (MHCs). |

| CIGI = Colliers International Group Inc. – The Manufactured Housing and RV Group “We Assist Owners and Investors with Disposition, Acquisition, and Financing for Manufactured Housing Communities and RV Parks.” |

| CG = The Carlyle Group – has manufactured home communities investments. |

| CSGP = CoStar Group – is commercial real estate’s leading provider of information, analytics and online marketplaces. They acquired listing service Homes.com. |

| CVCO = Cavco Industries – manufactured home and other factory-built housing production, retail, finance, insurance. |

| ECNCF = ECN Capital Group – includes manufactured home lender Triad Financial Services. |

| ELS = Equity LifeStyle Properties – includes land lease manufactured home communities (MHCs), but also RV and marine slips holdings. Also has captive manufactured home retail operations, and parent to Datacomp/MHVillage. |

| FGF = FG Financial Group – FG Communities “Owns and Operates Growing Portfolio of Manufactured Housing Communities.” KEY = KeyCorp – manufactured home community financing and manufactured home single-family mortgage financing. |

| KMMPF = Killam Apartment REITs- (includes manufactured home communities (MHCs). |

| LCII = LCI Industries – components for the manufactured home industry and others (RVs, housing, etc.). |

| LEGH = Legacy Housing – produces manufactured homes, tiny houses, retail, and captive finance operations. |

| LPX = Louisiana Pacific Corporation – components for the manufactured home industry and others (housing, etc.). |

| MHC-UN.TO = Flagship Communities Real Estate Investment Trust (REIT). |

| MHPC = Manufactured Housing Properties – land lease manufactured home communities (MHCs). |

| MMI = Marcus and Millichap – commercial real estate brokerage services that include land lease manufactured home communities (MHCs). |

| NOBH = Nobility Homes – produces and offers captive retail, financing, and insurance services for HUD Code manufactured homes and modular homes. |

| PATK = Patrick Industries – components for the manufactured home industry and others (RVs, housing, etc.). |

| SKY = Skyline Champion – produces and offers captive retail, financing, and insurance for HUD Code manufactured homes and modular homes. |

| SUI = Sun Communities – includes land lease manufactured home communities (MHCs), but also RV and marine slips holdings. Also has captive manufactured home retail operations. |

| UMH = UMH Properties – includes land lease manufactured home communities and captive manufactured home retail, leasing, and financing operations. |

| UFPI = UFP Industries – components for the manufactured home industry and others (housing, etc.). |

-

-

- NOTE 1: Chart above of manufactured housing connected equities includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry finance lender.

- NOTE 2: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE 3: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

- Note 4: some recent or related reports to the REITs, stocks, and other equities named above follow in the reports linked below.

- Note 5: Gifts of Sight and Insights, What’s in Store for 2024? Including 2023 Year End Reflections, manufactured homes, manufactured housing, mobile homes, MHVille, USA Snapshots, Manufactured housing industry year in review 2023.

-

2023 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

2022 was a tough year for many stocks. Unfortunately, that pattern held true for manufactured home industry (MHVille) connected stocks too. See the facts, linked above.

====================================

Disclosure. MHProNews holds no positions in the stocks in this report.

· For expert manufactured housing business development or other manufactured housing professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

- Note 1: MHVille means manufactured housing industry, MHVille also means artificially smaller manufactured housing (MH) industry,

- Note 2: Manufactured housing, building, factories, retail, dealers, manufactured home, communities, passive mobile home park investing, suppliers, brokers, finance, financial services, macro-markets, manufactured housing stocks, Manufactured Home Communities Real Estate Investment Trusts, MHC REITs.

- Note 3:

APO, Apollo Global Management, BAM, Brookfield Asset Management, BLK, BlackRock, BRK-A, Berkshire Hathaway, BX, Blackstone, CDPYF, Canadian Apartment Properties Real Estate Investment Trust, CIGI, Colliers International Group Inc, CG, The Carlyle Group, CSGP, CoStar Group, CVCO, Cavco Industries, ECNCF, ECN Capital Group, ELS, Equity LifeStyle Properties, FGF, FG Financial Group, FG Communities, KEY, KeyCorp, KMMPF, Killam Apartment REITs, LCII, LCI Industries, LEGH, Legacy Housing, LPX, Louisiana Pacific Corporation, MHC-UN.TO, Flagship Communities Real Estate Investment Trust (REIT), MHPC, Manufactured Housing Properties, MMI, Marcus and Millichap, NOBH, Nobility Homes, PATK, Patrick Industries, SKY, Skyline Champion, SUI, Sun Communities, UMH, UMH Properties, UFPI, UFP Industries.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports linked herein. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards, honors and numerous public recognitions for his achievements in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. Kovach is a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHLivingNews.com and MHProNews. MHProNews is ranked as the runaway most read trade media in modern manufactured housing history. Manufactured Home Pro News (MHProNews) is the documented #1 largest and most read source for manufactured housing industry News Tips and Views Pros Can Use, per Webalizer 2.23 (on 5.22.2024) and known data. MHProNews gets millions of visits a year and has significantly more pageviews per visit than CNN or Fox per SimilarWeb’s stats for those two sites (but in fairness CNN and Fox sites get more much more total traffic). Statistics – Data – Infographics – Research – Facts – Evidence – Trends – and manufactured housing industry expert Analysis make us and keep us the runaway most read in MHVille trade media. This article reflects the LLC’s and/or the writer’s editorial views and may or may not reflect the views of sponsors or supporters.