In the 21st century, 2022 was the best year for manufactured housing production since 2007 – when manufactured housing produced 117,373 new HUD Code manufactured homes – while 2022 produced 112,882 new manufactured homes per annual production data found at the link here. That noted, the manufactured housing “industry’s production collapse in 2023…corresponded directly with a spike in interest rates on manufactured home purchase money loans, demonstrating – again — the price sensitivity of manufactured housing consumers.” The quoted statement is from the detailed and footnoted remarks about the Duty to Serve (DTS) manufactured housing ‘mandated’ by Congress and which statement below was provided by the Manufactured Housing Association for Regulatory Reform (MHARR) found in Part II of this report below. Some, perhaps even many, in manufactured housing have made themselves comfortable out of necessity or other motivations to the fact that manufactured home lending is not as competitive as it could be. Be it right or wrong, higher cost lending causes some potential manufactured home buyers to look elsewhere for affordable housing. That’s based on research from third-party sources such as the Niskanen Center and the Urban Institute which have cited zoning barriers and the relatively higher cost of financing as two of the reasons that limit manufactured housing production. While Freddie Mac has made it clear that the majority of Americans are willing to buy a manufactured home, per their research which can be found at this link here, nevertheless it is clear that image/stigma remain an issue too. There is demonstrably a combination of internal issues within manufactured housing and external factors such as zoning, financing, and the pending DOE energy rule for manufactured housing challenges that are limiting the industry to a small fraction of the robust levels of performance experienced in the mid-to-late 1990s, or for the vast majority of the 20th century for that matter. While MHARR’s focus is production and regulations, due to a perceived failures on the part of the Manufactured Housing Institute (MHI) that even a prominent member of MHI has repeatedly exposed, MHARR has apparently felt the need to spend some of its time on issues related to the post-production side of the industry, which ought to be the province of MHI which collects dues from “all segments.”

As the post linked here and in our analysis of what follows from MHARR in Part III will point out, even Warren Buffett led Berkshire Hathaway, parent conglomerate to Clayton Homes and their affiliated lending of 21st Mortgage Corporation and Vanderbilt Mortgage and Finance (VMF), has publicly stated on video that lower interest rates would likely cause more manufactured homes to be sold. As MHProNews has noted, several firms beyond Clayton-linked brands have worked to shore up and provide lending in order to make some sales of manufactured homes. But what is perhaps missing in the strategies of C-suite level leaders in MHVille is this obvious truth that ironically Buffett himself alluded to in his video recorded remarks. Some profit might be ‘lost’ by financing fewer homes in house by some vertically integrated firms, but more profit may be generated as a result of lower rates and more sales. Additionally, more new manufactured home sales can still generate more insurance and other ancillary business. Given the fact that some potential customers that don’t qualify for the best rates will still likely be turning to chattel lenders who offer higher rate loans for the added risk involved, it is entirely possible that as much or more lending could be done by the industry’s lenders should DTS and FHA Title I reform move from words to reality.

Put differently, it ought to be obvious that having more options that drive more new home sales including through more competitive lending viz a vis conventional housing should be desirable for all those who are sincerely organic industry growth oriented. The problem, of course, is that several in MHVille appear to be more focused on limiting industry growth as part of their corporate strategies, and they have all but stated as much to investors in several cases. More on that in Part III.

Part I below is MHARR’s press release to MHProNews and others in manufactured housing.

Part II is MHARR’s detailed and arguably insightful remarks in support of DTS implementation.

Part III is a focused MHProNews analysis and commentary in brief.

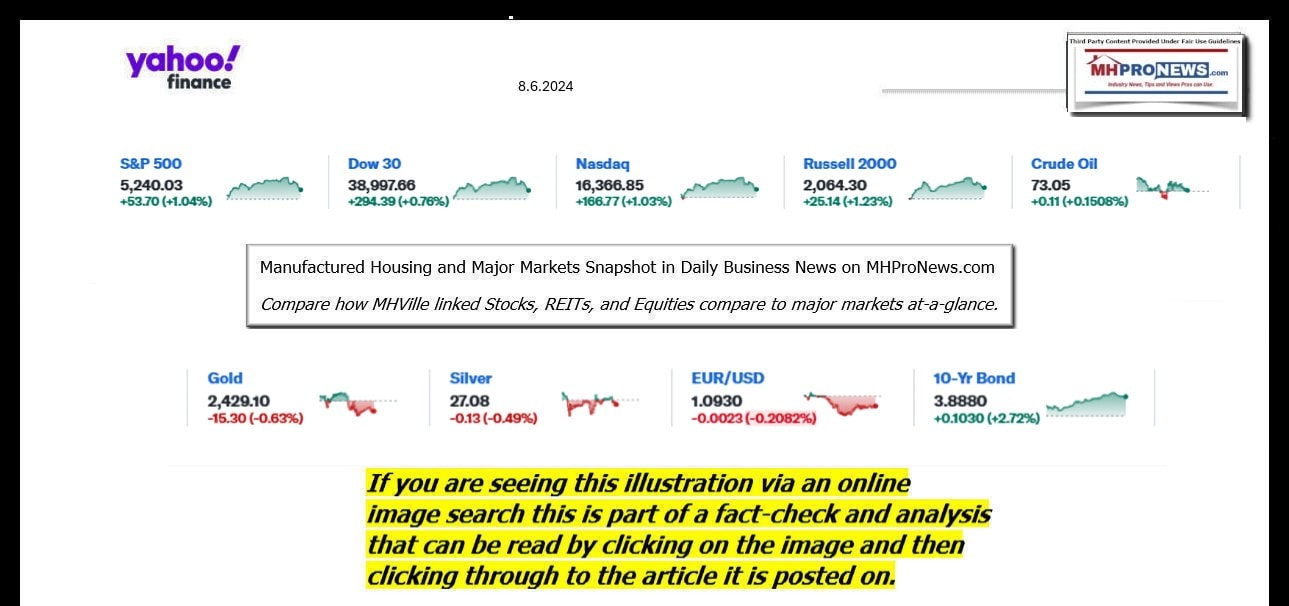

Part IV is our Daily Business News on MHProNews macro- and manufactured housing markets report that spotlight a relatively better day after a dark Monday downturn.

Part I

MHARR PRESSES CASE FOR DTS CHATTEL IN LATEST

COMMENTS AND IN-PERSON MEETING WITH FHFA DIRECTOR

Washington, D.C., August 7, 2024 – In a meeting with Federal Housing Finance Agency (FHFA) Director Sandra Thompson on August 1, 2024, Manufactured Housing Association for Regulatory Reform (MHARR) President and CEO, Mark Weiss, called for decisive action by Fannie Mae, Freddie Mac and FHFA, the Government Sponsored Enterprises’ (GSEs) federal regulator, to finally implement the statutory Duty to Serve Underserved Markets (DTS) mandate within the dominant chattel lending sector of the HUD Code manufactured housing market.

Despite the fact that Congress, in adopting DTS as part of the Housing and Economic Recovery Act of 2008 (HERA), specifically included manufactured housing personal property (or “chattel”) consumer loans – comprising nearly 80% of the entire HUD Code market — within the scope of the DTS mandate, Fannie Mae and Freddie Mac, for nearly twenty years (with FHFA’s direct or tacit approval) have obstinately refused to provide any level or degree of support for that market and its millions of lower and moderate-income consumers. And now, under new proposed DTS “implementation” plans for 2025-2027, submitted to FHFA for approval, that discriminatory and unlawful de facto ban on DTS secondary market and/or securitization support for manufactured home personal property loans would be extended – without explanation or justification of any kind — until at least 2027.

Both in its written comments opposing approval of the proposed 2025-2027 DTS plans (copy attached) and in its meeting with Director Thompson, MHARR stressed that the “duty” imposed on the GSEs by the statutory DTS mandate, is to “serve” the manufactured housing consumer finance market as it actually exists today, not as Fannie Mae, Freddie Mac, or FHFA might like it to exist in some “ideal world” as defined by them. And that manufactured housing “real world,” as it exists today, is dominated by personal property purchase money loans, to the point that the GSEs’ failure to serve that sector, for a period extending nearly 20 years after the adoption of the DTS mandate, is tantamount to a total and complete violation of both the letter and purpose of DTS.

Moreover, as MHARR further stressed, there is no valid or legitimate excuse for either Fannie Mae or Freddie Mac to continue this unlawful de facto embargo on manufactured home chattel loan support. The GSEs’ former claim of a lack of performance information is no longer applicable. Further, even if it were, the GSEs, by now, could have developed all of the information they claim to need via DTS-chattel pilot (or test) programs. Yet, both Fannie Mae and Freddie Mac, while promising such programs “in the future,” under previous DTS plans, have failed to ever stand-up and implement such a program. And beyond even that, as both the GSEs and FHFA are well aware, existing portfolio lenders within the existing manufactured housing chattel finance market have been able to operate profitably within acceptable risk tolerances for years.

Ultimately, the GSEs’ refusal to properly implement DTS within the HUD Code manufactured housing market not only stunts the growth and expansion of the industry itself but, more importantly, harms moderate and lower-income American consumers of affordable housing, who are either excluded from homeownership altogether by unnecessarily high borrowing rates, or forced to pay higher-than-necessary rates because of the discriminatory absence of secondary market and/or securitization support for manufactured home loans – a de facto penalty imposed on HUD Code buyers simply because they choose to purchase an affordable mainstream manufactured home.

This is a blatant violation of Congress’ DTS directive which must be remedied, and remedied now. The time has come for the industry and especially its post-production sector to seek relief from Congress to make it clear that DTS means what it says and that its “implementation” thus far, within the manufactured housing sector, is inadequate, insufficient and not at all in compliance with what Congress wants and rightfully expects.

In Washington, D.C., MHARR President and CEO, Mark Weiss, stated: “For far too long, Fannie Mae and Freddie Mac have gotten away with outright defiance of Congress’ DTS directive to serve the bulk and the core of the HUD Code manufactured housing consumer financing market in a market-significant manner. MHARR encourages all industry members to submit comments to FHFA, to serve notice, clearly and without equivocation, that this failure to serve American consumers of affordable mainstream manufactured housing in accordance with the law is unacceptable and must end now.”

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 —

Part II – MHARR’s Comments Letter to FHFA as Provided to MHProNews

August 1, 2024

VIA FEDERAL EXPRESS

Ms. Marcea Barringer

Supervisory Policy Analyst

Attn. Duty to Serve 2025-2027 RFI

Federal Housing Finance Agency

Ninth Floor

400 Seventh Street, S.W.

Washington, D.C. 20219

Re: Request for Input — Proposed 2025-2027 Duty to Serve Plans

Dear Ms. Barringer:

The following comments are submitted on behalf of the Manufactured Housing Association for Regulatory Reform (MHARR). MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of manufactured housing regulated by the U.S. Department of Housing and Urban Development (HUD) pursuant to the National Manufactured Housing Construction and Safety Standards Act of 1974 as amended by the Manufactured Housing Improvement Act of 2000 (2000 Reform Law).[1] MHARR was established in 1985. Its members include manufactured housing producers located in all regions of the United States.

I. INTRODUCTION

On June 11, 2024, the Federal Housing Finance Agency (FHFA) issued a Request for Input (RFI) regarding proposed 2025-2027 Duty to Serve Underserved Markets Plans submitted for FHFA approval (i.e., non-objection) by Fannie Mae and Freddie Mac (collectively “the Enterprises”) pursuant to the statutory Duty to Serve (DTS) mandate and related FHFA implementing regulations.[2] For the reasons set forth and explained in greater detail below, the proposed plans are wholly inadequate to serve the manufactured housing market as directed by DTS, fail to comply with the full extent, scope and purpose of the DTS mandate, and continue the Enterprises’ unabated multi-decade history of flouting the DTS manufactured housing mandate to the detriment of its intended beneficiaries – lower and moderate-income consumers of affordable, mainstream manufactured housing.

Rather than serve the mainstream, affordable manufactured housing finance market as directed by Congress via DTS, both Fannie Mae and Freddie Mac have instead sought to divert DTS to a minute sub-segment of the manufactured housing market comprised of boutique, higher-cost, real estate-titled manufactured homes that are not inherently affordable for lower and moderate income consumers, are not representative of the HUD Code market as a whole, and far exceed the cost of mainstream, conventional manufactured housing. As a consequence, neither Fannie Mae or Freddie Mac have ever served the vast bulk of the mainstream manufactured housing market under DTS and, under their 2025-2027 proposed plans, will continue that total failure indefinitely. As a result, mainstream manufactured housing consumers continue to be either excluded from the HUD Code market altogether by unnecessarily high (and some would maintain quasi-“predatory”) interest rates fueled by the discriminatory absence of DTS-based securitization and secondary market support, or forced to pay unnecessarily higher rates in a less-than-fully competitive manufactured housing consumer financing market.

This ongoing failure by Fannie Mae and Freddie Mac – sanctioned, approved and abetted by FHFA as the Enterprises’ federal regulator — is in direct violation of the DTS mandate, stands in defiance of Congress’ statutory directive and is unacceptable. As a result, Congress should conduct immediate oversight of the failure of both the Enterprises and FHFA to implement DTS within the mainstream manufactured housing market and act to advance any necessary legislative enhancements to, clarifications of, and the full, market-significant implementation of the DTS manufactured housing statutory mandate.

II. COMMENTS

It has now been 16 years since Congress enacted the statutory Duty to Serve Underserved Markets mandate, directing Fannie Mae and Freddie Mac to provide securitization and secondary market support for very low, low and moderate-income families in three enumerated markets, including HUD-regulated manufactured housing. And yet, more than a decade-and-a-half later, the vast bulk of the mainstream manufactured housing consumer financing market, representing nearly 80% (or more) of all new manufactured home purchases, remains completely unserved by the Enterprises. Even worse, under the proposed 2025-2027 DTS “implementation” plans submitted by Fannie Mae and Freddie Mac, the vast bulk of the manufactured housing consumer financing market represented by personal property or “chattel” loans would remain completely unserved, in violation of both the letter and purpose of DTS.

In adopting DTS for the manufactured housing market, Congress expressly included within its scope, personal property purchase money loans for such homes,[3] in recognition of the fact that such loans have historically comprised not only the vast bulk of manufactured housing consumer loans, but also provide consumers with direct access to the industry’s most affordable mainstream homes (which is why they are predominate within the manufactured housing market). Obviously, if Congress had wished to exclude manufactured home personal property loans from DTS, it could have done so, but did not. The express inclusion of such loans, conversely, demonstrates that Congress expected and intended that manufactured housing personal property loans would be included as part of the Enterprises’ compliance with – and implementation of — the DTS mandate.

Congress’ express inclusion of manufactured home personal property loans within the scope of DTS is hardly surprising, in view of the fact that such loans – both at the time of enactment of DTS and historically – have constituted the vast bulk of all manufactured housing consumer purchase loans. Indeed, since the enactment of DTS in 2008, the proportion of manufactured homes financed and titled as personal property has actually increased. According to data compiled by the U.S. Census Bureau, the proportion of manufactured homes financed and titled as personal property in 2008, was 62%.[4] By 2014, that proportion had grown to 80% and has varied only slightly since that time, standing at 73% in 2022, the last year for which annual figures are currently available.[5] Conversely, over the same timeframe, the proportion of new manufactured homes financed and titled as real estate has rarely exceeded 20%.[6] This lopsided, nearly 80/20 proportion of manufactured homes titled and financed as personal property versus real estate, should have led the Enterprises – and FHFA as their federal regulator – to include personal property loans within any legitimate and credible implementation of DTS since its inception 16 years ago.

The Enterprises, though, despite offering lip service to the importance and prevalence of personal property loans within the mainstream manufactured housing market,[7] have yet to provide any DTS support for such loans, thereby abandoning and themselves discriminating against millions of lower and moderate-income manufactured housing consumers who already – and long have been – victims of financing discrimination, disproportionate and unnecessarily-high interest rates, government discrimination in the form of discriminatory and exclusionary zoning[8] and other unaddressed and unresolved impediments and roadblocks to affordable homeownership. Instead, then, of remedying the consumer financing aspect of these bottlenecks, as was intended by Congress, Fannie Mae and Freddie Mac are – and continue to be — part of the problem, extending and exacerbating the discrimination that chattel/personal property buyers already face, while doing virtually nothing to correct the problem and cruelly failing to fulfill Congress’ promise of DTS relief to American consumers of affordable housing.

Mainstream HUD Code manufactured homes, unlike other types of housing that are propped-up and supported by government subsidies and other taxpayer-funded initiatives, are inherently affordable. According to the latest available annual compilation of U.S. Census Bureau data (2022) the average sales price of a new, mainstream manufactured home is $127,300.[9] That amount is just 23% of the average (2022) sales price of a new site-built home including land (i.e., $540,000) and 29% of the average (2022) sales price of a site-built home without land (i.e., $430,808).[10] Yet, notwithstanding this intrinsic affordability; notwithstanding the demonstrated long-term stability of the manufactured housing consumer financing sector; and notwithstanding the demonstrated long-term ability of existing manufactured housing lenders to earn market-competitive returns at acceptable risk levels, DTS implementation within 80% or more of the manufactured housing consumer financing market represented primarily by personal property loans (but also other portions of the manufactured housing financing market), remains an illusory pipe dream.

The results of this inexcusable failure for both the industry and American consumers of affordable housing have been devastating. Since the enactment of the DTS directive in 2008, annual industry production has fallen below the historical 100,000-home benchmark in 14 of 16 years.[11] Thus, manufactured housing production has failed to meet or exceed the thirty-year consensus industry benchmark level for nearly 90% of the time that DTS has been law. Worse yet, after rising minimally above the 100,000 annual level in 2021 and 2022, production levels retreated below the 100,000 home benchmark once again in 2023, reaching only 89,169 homes, a 21% decline from total industry production in 2022.

Not surprisingly, the industry’s production collapse in 2023, representing nearly one-quarter of the entire 2022 HUD Code market, corresponded directly with a spike in interest rates on manufactured home purchase money loans, demonstrating – again — the price sensitivity of manufactured housing consumers and the extreme price elasticity of the manufactured housing market. Specifically, the Federal Reserve, as documented by multiple media reports,[12] began increasing interest rates in March 2022 and continued with rate increases through July 2023. Over that period, the Federal Funds rate increased from 0.25% to 6.5%, with consumer loan rates at even higher levels. Almost simultaneously, manufactured home production rates slowed and then turned sharply negative – and remained sharply negative for all of 2023.[13]

This strong correlation between interest rates on manufactured home consumer loans and manufactured housing production/sales levels, demonstrates the profound impact that full, market-significant implementation of the DTS mandate could have on the manufactured housing market and, conversely, the highly negative impact that its non-implementation is having.

As MHARR has demonstrated repeatedly in prior DTS comments, and as both the Enterprises and FHFA well know, the absence of securitization and secondary market support within the dominant manufactured housing personal property consumer financing market resulting from the non-implementation of DTS, means that existing portfolio lenders must retain all market risks associated with such loans. As a result, such loans are priced with higher interest rates to account, among other things, for the projected cost of that retained risk. Further, the absence of DTS-based securitization and secondary market support – and the retained risk reduction that would be provided by such support, but is not and will not be provided under the proposed 2025-2027 DTS implementation plans — keeps many lenders out of the HUD Code financing market. This de facto market exclusion diminishes overall lender participation in the mainstream manufactured housing market which, in turn, diminishes the level and degree of competition within that market and, again, promotes needlessly higher (and some argue predatory) interest rates on manufactured home consumer loans.[14]

Consequently, the policies and actions of Fannie Mae, Freddie Mac and FHFA with respect to DTS and its non-implementation for the vast bulk of the manufactured housing market and the vast bulk of mainstream manufactured housing consumers, have not only failed to lower the needlessly higher interest rates charged on consumer loans within the manufactured housing market, but has actually helped to sustain – and arguably even increase those rates – directly contrary to the intent and purposes of Congress with respect to DTS.

For over a decade after its adoption, Fannie Mae, Freddie Mac and FHFA maintained that DTS could not be implemented within the vast bulk of the manufactured housing market because of the unavailability of “information” from industry lenders concerning the performance of mainstream manufactured housing personal property loans. In the absence of such information, the Enterprises contended that such loans could not be securitized or provided secondary market support consistent with the “safety and soundness” required by other aspects of federal law. This excuse, however – if it was ever legitimate – is not legitimate or valid now. Years worth of loan performance information has reportedly been provided to the Enterprises. Moreover, the real world track record of the industry for nearly two decades again shows that manufactured housing consumer lenders have been able to function safely within that market while generating profits and providing reasonable returns for investors. Thus, it is self-evident that the Enterprises could serve the manufactured housing personal property lending sector consistent with “safety and soundness” if they wanted to.

Therein lies the problem, however, as it is evident, after nearly two decades, that the Enterprises simply do not wish to serve the vast bulk of the manufactured housing market and are using phony, feigned ignorance (among other things) as an excuse. The reality, by contrast, is that Freddie Mac had sufficient data on the manufactured housing personal property consumer financing market to produce a “due diligence and feasibility assessment” regarding support for such loans.[15] Inexplicably, however, while continuing its failure to serve the bulk of the manufactured housing consumer financing market, Freddie Mac has failed to publicly release that assessment, including its (alleged) factual inputs and/or conclusions. Fannie Mae, by contrast, does not even purport to have conducted or produced a study or assessment of its ability to provide support for the manufactured housing personal property market, simply asserting in conclusory fashion in its 2025-2027 proposed plan that chattel loan support was “considered but not included.” (Emphasis added).

There is, however, no evidence whatsoever, either in the 2024-2027 proposed plan or otherwise to establish that Fannie Mae (or Freddie Mac for that matter) has ever considered, evaluated, studied or contemplated manufactured home chattel loan support in good faith.[16] Instead, millions of Americans – and millions more with an interest in mainstream affordable manufactured housing — are instead told dismissively that they must accept the word of the Enterprises on good faith, when neither Fannie Mae or Freddie Mac have ever demonstrated one iota of good faith on the entire subject of chattel loan support.

Instead of serving the vast bulk of the mainstream manufactured housing market represented by chattel loans, both Enterprises have instead sought to divert DTS to the extremely narrow segment of the HUD Code market represented by real estate loans and, within that narrow sector, to an even more miniscule segment comprised of higher-cost “boutique” or specialty manufactured homes that are not within the mainstream of either the industry or the manufactured housing market.

For example, FHFA and the Enterprises recently touted their support – under DTS – for a new manufactured housing development in Maryland, featuring upgraded manufactured homes titled as real estate.[17] Those homes, however, based on information from the community developer’s own internet website, are priced from a low of $306,967,or 240% of the average (2022) sales price of a new mainstream manufactured home financed as personal property according to the Census Bureau data, to a high of $375,678, or nearly 300% of the average sales price of a new mainstream manufactured home financed as personal property.[18]

Consequently, instead of providing support for hundreds of thousands of mainstream manufactured home consumers under DTS, Fannie Mae and Freddie Mac are instead supporting a minor sliver of the manufactured housing market with offerings that are not inherently affordable, are much closer to the price of an “average” site-built home, according to the Census Bureau data, and have not been well-received within the market, as both Fannie Mae and Freddie Mac concede in their proposed DTS plans.[19]

Again, Fannie Mae and Freddie Mac are not providing any DTS support for the vast bulk of the mainstream manufactured housing consumer financing market and are not planning to provide any such support for yet another three years pursuant to their proposed 2025-2027 DTS plans.

Remarkably, instead of providing urgently needed, real-world DTS support for personal property manufactured housing consumer loans and the industry’s most affordable mainstream homes, Fannie Mae’s 2025-2027 proposed DTS plan includes an objective which would pursue consumer outreach and “industry engagement” to promote the “conversion of personal property MH to real estate.”[20]While again targeting only a miniscule segment of the manufactured housing market,[21] this initiative is breathtaking for its pure arrogance. Simply put, Fannie Mae, through this “objective,” effectively concedes: (1) that it has no interest in serving manufactured home personal property loans under DTS; (2) that it is biased against such loans and such borrowers; and (3) that instead of serving the broader HUD Code manufactured housing market under DTS as it actually exists, Fannie Mae wishes to use DTS as a weapon to remake that market into something that it considers more palatable (i.e., a real estate-based market). They do this not for the intended beneficiaries of DTS, but to suit themselves and their own self-serving preferences. Again, therefore, this initiative reveals an underlying intent on the part of the Enterprises to undermine, subvert and divert DTS support within the manufactured housing market, away from mainstream manufactured housing and mainstream manufactured housing consumers and to the unrelated aims and prejudices of both Fannie Mae and Freddie Mac.

III. CONCLUSION

Based on the foregoing (and incorporating by reference herein its prior DTS comments), MHARR strongly opposes the approval of the proposed 2025-2027 DTS Implementation Plans in their current form.

Far from implementing DTS within the overwhelming bulk of the statutory manufactured housing market, those plans, as submitted, would continue the Enterprises’ longstanding defiance of the DTS mandate and Congress’ directive to begin serving the manufactured housing market and millions of manufactured housing consumers on a non-discriminatory basis. Rather than benefiting manufactured housing consumers by expanding the availability of competitively-priced manufactured home loans and engendering increased competition within the manufactured housing consumer financing market, the Enterprises’ defiance of DTS has materially harmed American consumers by supporting and sustaining needlessly high purchase loan interest rates within the HUD Code market. This failure is inexcusable and based on the 2025-2027 proposed plans, represents continuing defiance of both Congress and the DTS mandate with no end in sight, as the proposed plans would extend the non-implementation of DTS within the vast bulk of the mainstream manufactured housing market indefinitely with no valid, sufficient or legitimate reason, explanation or even excuse.

As a result, MHARR will strongly urge Congress to engage in meaningful oversight with respect to DTS and its non-implementation by the Enterprises within the manufactured housing market, and will seek necessary reforms to ensure that the Enterprises and FHFA are no longer able to subvert, distort and/or ignore DTS to the extreme detriment of the manufactured housing market and American consumers of affordable housing.

Sincerely,

Mark Weiss

President and CEO

cc: Hon. Sandra Thompson

Hon. Adrianne Todman

Hon. Sherrod Brown

Hon. Tim Scott

Hon. Patrick McHenry

Hon. Maxine Waters

Other Interested HUD Code Manufactured Housing Industry Members

[1] See, 42 U.S.C. 5401, et seq.

[2] See, 12 U.S.C. 4565; 12 C.F.R. 1282.32.

[3] See, 12 U.S.C. 4565(d)(3): “In determining whether an enterprise has complied with the duty under subparagraph (A) of subsection (a)(1), the Director may consider loans secured by both real and personal property.” (Emphasis added). This clause reflects an unambiguous expectation on the part of Congress that manufactured housing personal property loans – which predominate within the mainstream manufactured housing consumer financing market — would be included as part of the Enterprises’ implementation of DTS. Even if this clause were to be deemed “ambiguous,” however, any claim by FHFA or the Enterprises that the “duty” mandated by DTS with respect to manufactured housing personal property loans is somehow “permissive,” would no longer receive any type of deference or deferential consideration by a reviewing court. See, Loper Bright Enterprises v. Raimondo, 603 U.S. ___ (2024).

[4] See, Attachment 1, hereto, U.S. Census Bureau, Size and Cost Comparison: New Manufactured Homes and New Single-Family Site Built Homes (2007-2014) and (2014-2022).

[5] Id.

[6] Id.

[7] See, Fannie Mae 2025-2027 Duty to Serve Underserved Markets Proposed Implementation Plan at p. MH-39.

[8] Freddie Mac’s proposed DTS Plan, in fact, recognizes and acknowledges the impact of zoning discrimination on manufactured housing and manufactured housing residents, yet does nothing to counteract that discrimination. See, Freddie Mac 2025-2027 Duty to Serve Underserved Markets Proposed Implementation Plan at p. MH-22.

[9] See, Attachment 1, supra.

[10] Id. It should be noted that Census Bureau monthly data for 2023 shows that the average sales price of a new HUD Code manufactured home fell to $124,133, or a further reduction of 2.5% from the 2022 annual price level.

[11] See, Attachment 2, hereto, HUD-compiled manufactured housing production statistics for the period 2008-2023.

[12] See, e.g., The Street, “A Timeline of the Fed’s ’22-’23 Rate Hikes and What Caused Them,” (April 12, 2024).

[13] Freddie Mac’s 2025-2027 Duty to Serve Underserved Markets Proposed Implementation Plan fully acknowledges this correlation, but fails to connect the interest rate spike in the manufactured housing market – and its dire consequences – with its own failure (and that of Fannie Mae) to implement DTS, at all, within the broadest segment of the manufactured housing market, stating: “Interest rates rose rapidly starting in 2022, more than doubling from 3.8% in second quarter 2022 to 7.79% in fourth quarter 2023. They have receded slightly since then but remained near 7% at the end of first quarter 2024. During those years … manufactured housing supply and production remained tight…. Loan originations and Freddie Mac’s loan purchases significantly contracted as a result….” Id. at p. MH-20.

[14] See, e.g., MHARR July 15, 2021 written comments, “Request for Input: Fannie Mae and Freddie Mac Proposed 2022-2024 Duty to Serve Plans” at pp.3-5.

[15] See, Freddie Mac 2025-2027 Duty to Serve Underserved Markets Proposed Implementation Plan at p. MH-14

[16] Indeed, all promises of future chattel loan programs in the out-years of previous DTS implementation plans have turned out to be empty window dressing, having never been implemented.

[17] Both Fannie and Freddie describe these so-called “Cross-Mod” homes as having “the features and aesthetics of a site-built home.” See, e.g., Freddie Mac 2025-2027 Duty to Serve Underserved Markets Proposed Implementation Plan at p. MH-11.

[18] With the reduction in the average price of mainstream manufactured homes indicated by the 2023 monthly census bureau statistics, these percentages become even more stark, with the lowest-cost Maryland home exceeding the average price of a new mainstream HUD Code home by 247% and the highest cost Maryland home exceeding the mainstream average by nearly 303%.

[19] See, e.g., Fannie Mae 2025-2027 Duty to Serve Underserved Markets Proposed Implementation Plan at p. MH-41: “Much of Fannie Mae’s prior efforts in the MH market have focused on attempting to impact the supply of new manufactured homes, oftentimes through large scale marketing and industry engagement efforts related to our MH Advantage loan product. …[T]hese efforts have produced modest results….” (Emphasis added).

[20] See, Fannie Mae 2025-2027 Duty to Serve Underserved Markets Proposed Implementation Plan at pp. MH-49-50.

[21] Id. at p. MH-49, noting that this initiative targets “roughly 17% of all landowning [MH] borrowers.” Again, therefore, rather than serving the vast bulk of the mainstream manufactured housing market, this misdirected and insulting effort targets a small subset of an already miniscule pool of landowning chattel borrowers.

III. Additional Information with More MHProNews Analysis and Focused Commentary

For years, MHProNews has sought and published the remarks of both business-focused national trade associations. Additionally, MHProNews and our MHLivingNews sister-site have for over a decade provided insights from consumers, consumer advocacy organizations, and also third-party research work product on manufactured housing, and/or the broader housing market. It is our competitors and outside researchers that have said that no one in manufactured housing provides as much detail and information as our platforms do. That noted, MHProNews will plan a report that showcases MHI’s statements on the DTS topic planned for the near term.

That said, it is apparent from over 15 years of MHI’s posturing, their comments, and apparently unforced fumbles by MHI, combined with insights from a range of other sources that make it clear that MHI is not serious about getting DTS properly enforced at this time. Certainly, there is an evidence-based argument MHI is not interested in getting DTS enforced as swiftly and robustly as MHARR would desire. Evidence for that is found in the linked reports.

MHProNews issued a press release yesterday that will be republished soon, perhaps on our MHLivingNews website. It will provide a relatively focused and shorter than is typical for us snapshot of the information that is shared in more detail in the report linked below. Watch for that update and what will accompany it.

In brief, manufactured housing is demonstrably underperforming. The reasons are increasingly clear and with ever-more documentation to support the concerns reported here over 7 years ago. It is simply not plausible that Manufactured Housing Institute corporate and staff leaders are so inept that they can’t get existing federal laws enforced. It is not plausible. But their own statements make it clear that out of one mouth, some in the MHI orbit claim to want DTS and the “enhanced preemption” provision of federal law enforced. But words alone have very little meaning when other words plus deeds reveal that the opposite is the actual agenda.

Meaning, some in manufactured housing clearly want the status quo, because they think that the status quo benefits them. While that is debatable (see the report linked above and here), that is nonetheless their stated views. There are already multiple antitrust lawsuits that sprouted last year against several MHI members. A report on another new antitrust lawsuit is pending.

Giant Google has just lost a major antitrust suit, which will also be explored by MHProNews in the near term as it could well shed useful light on MHVille’s woes. While it is obvious that Google will appeal, the fact that they lost is relevant and the reasons that they lost are relevant to MHVille.

“Frank and Dave” have not yet responded to inquiries that they are rumored to be exiting the land-lease community sector. Whatever they say, or don’t, whatever they do, or don’t do, what should be apparent even to them is that the tide toward more antitrust enforcement may be turning. Stay tuned for several planned reports, because it is MHProNews’ evidence-based editorial stance that some in manufactured housing have subverted the industry’s growth for their own reasons. That statement must be taken in the light of other obvious realities, namely, that there are competitors and other forces that are also limiting manufactured housing. If not for MHARR, one wonders if there would be as many independents left in the industry as there are now?

As far as DTS is concerned, if Warren Buffett said – and he did – that implementing DTS would be good for the industry and that more homes would be sold, it should be obvious that it is doable. The question is does the will exist to make existing laws a sufficient priority for either public officials to enforce and/or for the industry’s ‘leaders’ to take the legal steps necessary to get them enforced. Stay tuned as the battle for the future of manufactured housing continues. ##

Part V

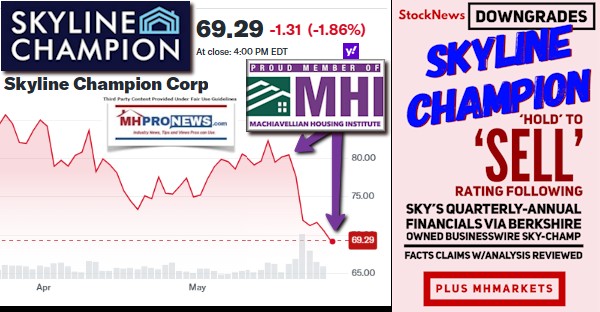

Our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

NOTICE: following the TPG deal with CAPREIT, TPG has been added to our tracked stocks list below.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report at the closing bell, so that investors can see-at-glance the type of topics may have influenced other investors. Our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines for a more balanced report.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

- In minutes a day, readers can get a good sense of significant or major events while keeping up with the trends that may be impacting manufactured housing connected investing.

MHProNews note, bold emphasis added below.

Headlines from left-of-center CNN Business – 8.6.2024

- ‘Cockroaches of the factory’: Workers paint a picture of chaos and dysfunction at Boeing

- Elon Musk’s X sues ad industry group over alleged advertising ‘boycott’

- Microsoft lashes out at Delta: Your ancient tech caused the service meltdown

- Beginning in mid-October, US subscribers to Disney+ will pay $2 more per month for its advertising-supported plan.

- Disney hikes price for Disney+, Hulu and ESPN+ subscription services

- Charles Barkley cancels his retirement plans, says he’ll stay with TNT Sports for long term

- Police hold back rioters near a burning police vehicle after disorder broke out on July 30, 2024, in Southport, England.

- Elon Musk says ‘civil war is inevitable’ as UK rocked by far-right riots. He’s part of the problem

- A stock sell-off on Monday led to questions about the health of the tech industry. Analysts say not to panic.

- Tech had a rough day. But don’t call it a dot-com meltdown moment yet

- Taco Bell could hold the secret formula for bringing customers back to fast food

- A laptop keyboard and Twitter X logo displayed on a phone screen are seen in this illustration photo taken in Warsaw, Poland on July 26, 2023.

- ‘White Dudes for Harris’ said their account was targeted by X for the second time

- A woman passes the logo from the web search engine provider Google during the digital society festival ‘re:publica’, at the Arena Berlin in Berlin, Germany June 9, 2022.

- Google has an illegal monopoly on search, judge rules. Here’s what’s next

- Bloomberg gives $600 million to 4 Black medical schools’ endowments

- The stock market panicked, but you shouldn’t

- Japanese stocks rebound from worst crash since 1987 while global markets are mixed

- Bloomberg News dismisses reporter, disciplines other staffers after breaking embargo on US-Russia prisoner swap

- Why the Fed almost certainly isn’t going to do an emergency rate cut

- Why the stock market is freaking out again

- CrowdStrike fires back at Delta, claiming the airline ignored offers of help during service meltdown

- Elon Musk files new lawsuit against OpenAI and Sam Altman

- Kamala Harris’ economic pitch just got a lot more complicated

- We’re about to get the most detailed explanation yet for Boeing’s terrifying mid-air blowout

- New homes are getting smaller. That could be big news for first-time buyers

- Japanese stocks crash in biggest one-day drop since 1987 as global market rout intensifies

- ‘Charger hogs’ are ruining the electric vehicle experience. One company is clamping down on bad manners

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

Headlines from right-of-center Newsmax – 8.6.2024

- Trump Believed to Have Been Target of Foiled Assassination Plot

- U.S. officials have warned for years about Iran’s desire to avenge the 2020 killing of Qassem Soleimani, who led the Iranian Islamic Revolutionary Guard Corps’ Quds Force. That strike was ordered by Trump. [Full Story]

- Israel at War

- Austin, Gallant: Attack on US Base in Iraq a ‘Dangerous Escalation’

- Israeli Strike on Southern Lebanon Town Kills 4 Men

- Report: IDF Leaders Suggested Preemptive Strike on Hezbollah

- US Personnel Wounded in Attack Against Base in Iraq

- Lebanon Aims to Ensure Hezbollah Won’t Bring Wider War

- Delta Pauses JFK-Tel Aviv Flights Through Aug. 31

- Hezbollah Big Is Taken Out

- US to Iran: Don’t Escalate at ‘Critical Moment’ for Mideast

- Newsmax TV

- Emmer: Walz Is ‘a Gift to Republicans’

- Stauber: Walz Has Already Failed Minnesota | video

- Fmr Rep. Mike Rogers: Autoworkers Will Support Trump | video

- Wilkie: Biden/Harris Leave US Troops as ‘Sitting Ducks’ | video

- D’Esposito: Harris Surge Temporary | video

- Steil: Dems’ ActBlue Probed for Possible Fraud | video

- Steve Forbes: Jobs Report Spurred Market Slowdown | video

- Tom Bevan: Market Instability, War Hurt Harris | video

- DiGenova: Suit Alleging AOC, Squad Incitement Inevitable | video

- More Newsmax TV

- Newsfront

- Milley, Eric Schmidt: US Unprepared for Future Wars

- The United States military remains unprepared for the rapidly changing face of war in which autonomous weapons systems such as drones and powerful algorithms increasingly dominate, Foreign Affairs has warned in its current edition…. [Full Story]

- CNBC’s Cramer: Vote Trump If You Care About Your Paycheck

- After the Dow and other stock markets melted down Monday, CNBC’s “Mad [Full Story]

- Trump Believed to Have Been Target of Foiled Assassination Plot

- Trump Believed to Have Been Target of Foiled Assassination Plot

- A Pakistani man alleged to have ties to Iran has been charged in a [Full Story]

- UK Urges Musk to Act Responsibly Amid Provocative Posts as Unrest Grips Country

- The British government has called on Elon Musk to act responsibly [Full Story]

- Harris Wins Democrat Presidential Nomination in Virtual Roll Call

- Democrat delegates have selected Vice President Kamala Harris to be [Full Story]

- Related

- Siena Poll: Harris Leads Trump by 14 Points in N.Y.

- Sanders Pushing Harris on Left-Wing Agenda

- Biden Senior Adviser Leaving for Kamala’s Team

- Wisconsin, Pennsylvania Elections Vulnerable to Lawsuits

- GOP Strategists: Focus on Economy, Answer Harris ‘Freedom’ Message

- Hospitality Union Endorses Harris, Dismissing Trump’s Tax-Free Tips

- Carville: Kamala Should Conditionally Accept Debate

- Trump Agrees to ‘Major’ Interview With Elon Musk

- Kamala Harris Picks Tim Walz as Running Mate

- Vice President Kamala Harris has chosen Minnesota Gov. Tim Walz as [Full Story]

- Related

- Vance Congratulates Walz After VP Announcement |video

- Trump: Walz ‘Would Be Worst Vice President’ Ever

- Obamas: Walz ‘Ideal Partner’ for Harris

- Speaker Johnson: Harris-Walz ‘Most Radical Left-Wing Ticket’

- Marist Poll: 71 Percent of Americans Have Never Heard of Walz

- NRSC: Harris Caves to ‘Pro-Hamas Contingency’ With Walz

- Republican Jewish Coalition Hits Walz Choice

- Wall Street Bounces Back, With Dow Rising 573 Points

- U.S. stocks are bouncing back, and calm is returning to Wall Street [Full Story]

- Related

- US Treasury Yields Rise as Markets Stabilize

- Major Brokerages Now Expect Fed to Cut Rates in Sept.

- Nikkei Enjoys Biggest Increase a Day After Biggest Loss

- Trump, GOP Looking to Rebrand Market’s Steep Slide as ‘Kamala Crash’ |video

- Venezuela to Probe Those Contesting Maduro’s Victory

- Venezuela’s top prosecutor Monday announced a criminal investigation [Full Story]

- Schumer Sees Chance to Pass AI Bills Before Election

- With the window for legislative action quickly closing this calendar [Full Story] | video

- Russia Claims 162 Square Miles in Ukraine in 2 Months

- Related

- Russian Military Chief Gerasimov Inspects Forces in Ukraine

- Anti-war Russian Pianist Dies in Prison After Hunger Strike

- Larry Elder Back on Radio After 2-Year Hiatus

- Conservative radio talk show star Larry Elder returned to the [Full Story]

- CCGA Poll: Majority Says No to US Troops in Israel

- A majority of Americans oppose sending U.S. troops to defend Israel [Full Story]

- Trump-Appointed Hostage Envoy Defends Prisoner Swap

- Roger Carstens, special presidential envoy for Hostage Affairs, [Full Story]

- UK Expands Jail Capacity for Anti-Muslim Rioters

- The British government has increased its prison capacity to help [Full Story]

- Simple Method Can Restore Your Vision Naturally (Watch)

- Hungary Blocks Censure of Venezuela Over Stolen Election

- In a display of support for Venezuelan totalitarian President Nicols [Full Story]

- Related

- WashPost: Maduro Lost Election, Opposition Tallies Show

- Venezuela’s Maduro Arrests 2,000 Protesters in Election Crackdown

- Texas Trooper Reinstated in Uvalde After Suspension

- The Texas Department of Public Safety reinstated a state trooper who [Full Story]

- Trump Aims to Oust One of ‘Impeachment 10’

- Dan Newhouse, R-Wash., is just one of two Republican congressmen [Full Story]

- Judge: Harvard to Face Lawsuit Over Campus Antisemitism

- A judge on Tuesday refused to dismiss a lawsuit in which Jewish [Full Story]

- US Household Debt Levels Rise in Q2: New York Fed

- Total U.S. household debt levels edged up in the second quarter but [Full Story]

- Marsha Blackburn Urges NCAA to ‘Protect’ Women

- Marsha Blackburn, R-Tenn., is leading a coalition of almost two [Full Story]

- Judge in Trump’s N.Y. Case Delays Immunity Ruling

- The judge in Donald Trump’s business accounting trial is pushing back [Full Story]

- Election First Since 1976 Sans a Bush, Clinton or Biden

- The 2024 presidential race will be the first in almost half a century [Full Story]

- Josh Hawley: Why Is Butler Rally Chief Still Active?

- The Secret Service’s lead site agent for former President Donald [Full Story]

- Incoming Archbishop Henning: Excited for New Ministry

- The newly named seventh archbishop of Boston, Bishop Richard Henning [Full Story]

- New Biomaterial Mimics, Regenerates Knee Cartilage

- A newly developed biomaterial might be able to treat crippling [Full Story]

- Michigan Primaries Set Nov. Races Key to Congress

- Michigan voters on Tuesday will decide which Republican and Democrat [Full Story]

- Iraq Condemns ‘Reckless’ Actions Targeting Bases

- Iraq said Tuesday it rejects all “reckless” actions that target Iraqi [Full Story]

- Debby May Stall, Bring Record-Setting Rainfall in SE

- Northern Florida, the coastal regions of Georgia and South Carolina [Full Story]

- Gun Background Checks Top 1M for 60th Month Straight

- The National Shooting Sports Foundation (NSSF) announced Monday that [Full Story]

- NM Governor Targets Texas Docs with Abortion Rights Ads

- New Mexico Democrat Gov. Michelle Lujan Grisham is trying to lure [Full Story]

- Fake News: Washington Post Victim of Image Hoax

- The Washington Post does not have a column ready to go promoting [Full Story]

- More Newsfront

- Finance

- Amid Intense Stock Volatility, Look to the Long Game

- U.S. stocks are bouncing back after the market experienced its worst day in two years on Monday, but the average investor may still be understandably spooked…. [Full Story]

- Trump Agrees to ‘Major’ Interview With Elon Musk

- Harris Is Quickly Wearing Out Her Welcome

- Thanks to Biden-Harris, World Is on Fire

- 2% of Americans Have No Health Insurance

- More Finance

- Health

- Mental Exertion Can Make Your ‘Brain Hurt’

- Folks who rub their forehead and complain that a complex problem is making their brain hurt aren’t overstating things, a new review suggests. Mental exertion appears to be associated with unpleasant feelings in many situations, researchers reported Aug. 5 in the journal… [Full Story]

- Uninsured Americans Rose to 8.2 Percent in 2024

- Filmmaker David Lynch Reveals Emphysema Diagnosis

- 4 Social Factors Influence How Long You’ll Live

- How Fruits, Veggies Lower Blood Pressure, Heart Risks

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.