“Facts are stubborn things.” According to the Consumer Financial Protection Bureau (CFPB): “In 2022, about 189,000 loans secured by manufactured homes were originated, compared to 228,000 such loans in 2021. About 142,000 manufactured home loans were originated for home purchase, down slightly from 148,000 in 2021. Among them, about 79,000 were secured by both a manufactured home and land, while 56,000 were secured by a manufactured home but not land. In 2022, about 41,000 manufactured home loans were originated for refinance purpose, down by 45.7% from 75,000 in 2021.” The CFPB maintains Home Mortgage Disclosure Act (HMDA) data. In consider their data that follows, manufactured housing industry pros should keep in mind that in 2022, according to new home production statistics organized by the Manufactured Housing Association for Regulatory Reform (MHARR) month-by-month at this link here, there were 112,882 new manufactured homes produced.

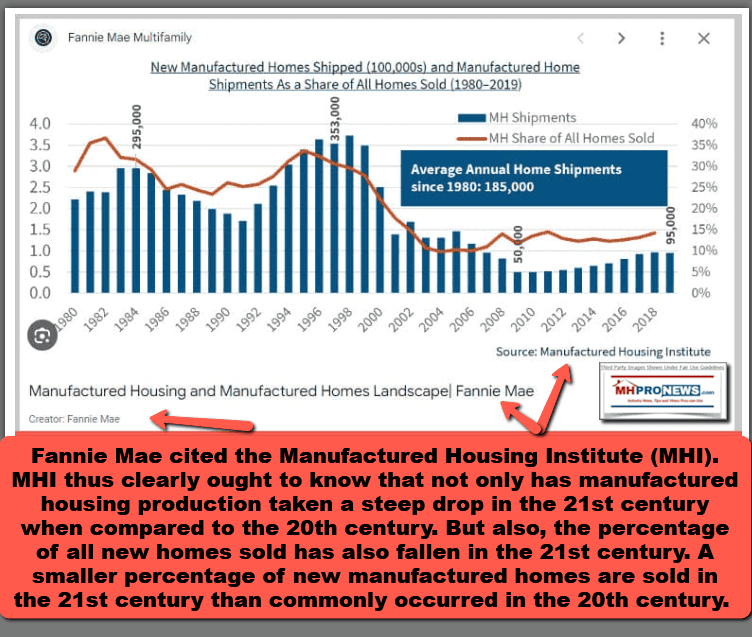

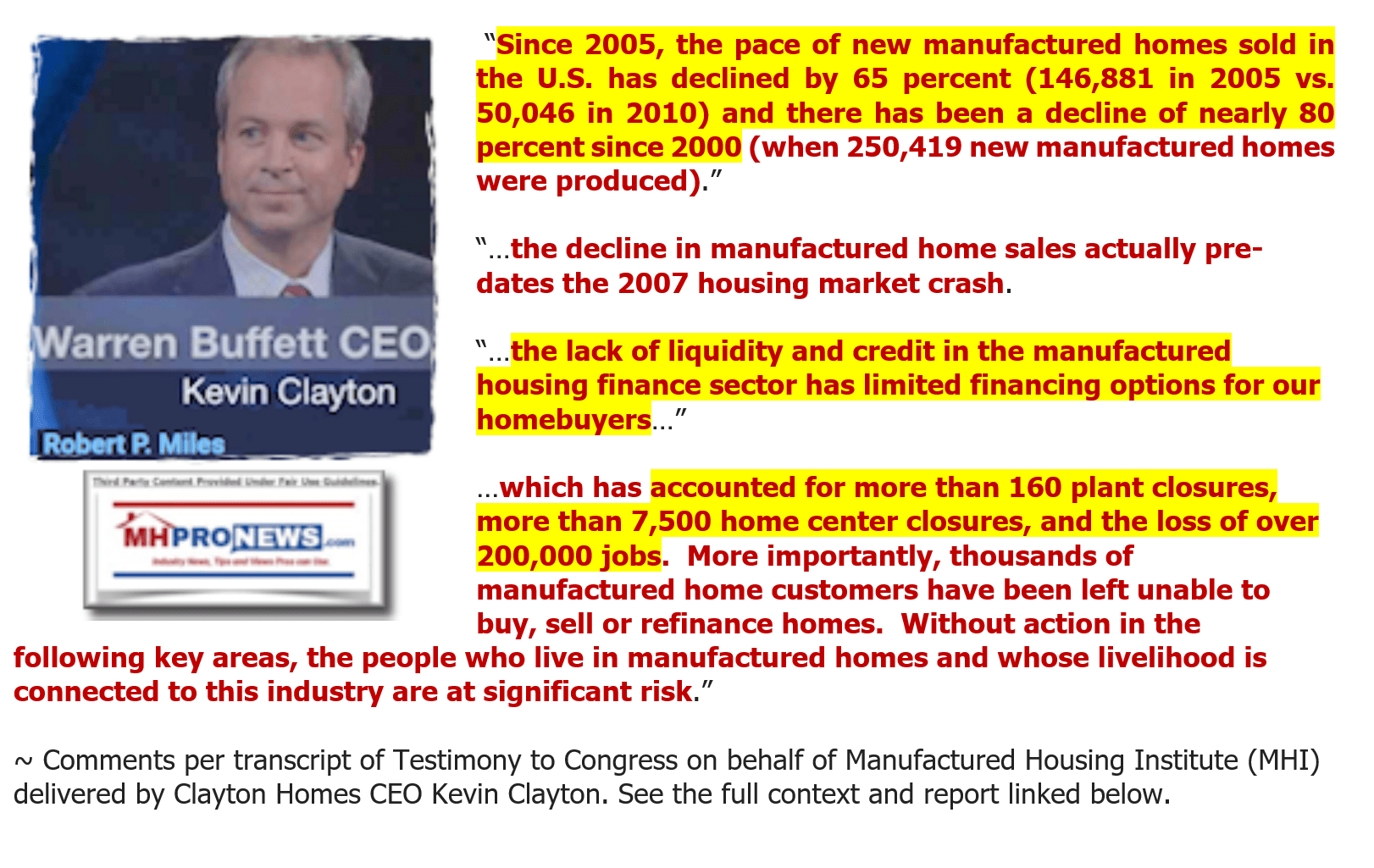

Those 112,882 new manufactured homes built in 2022 failed to surpass the 2006 production levels of 117,373 and was lower still than manufactured home production in 2005 which official sources stated were 146,881. But 2022 represented the best outcome since 2006 and thus the best outcome for 16 years.

For those independents in business in MHVille who were planning their 2023 based on what occurred in 2021 (when 105,772 new homes were produced) and 2022 (117,373) the sharp fall in 2023 to 89,169 was jarring. Time and again, in the 21st century, manufactured housing was moving toward recovery and then some event or events occurred that became the latest excuse for the industry’s overdue recovery to occur.

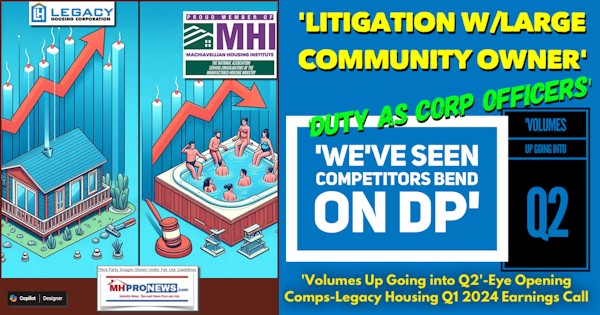

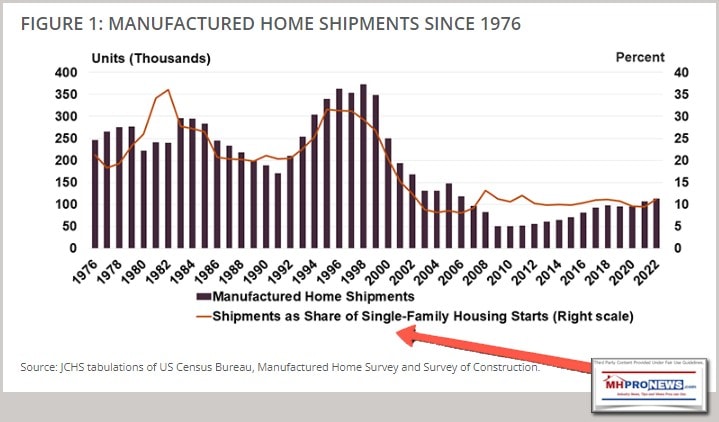

Note that since Warren Buffett led Berkshire Hathaway directly entered the manufactured home industry in 2002 and 2003, manufactured home production has not recovered to its early 21st century or 2oth century annual production levels. That’s despite the fact that prior Manufactured Housing Institute (MHI) President and CEO, Chris Stinebert predicted in 2004 that the industry was poised to recover to and get ready to surpass its late 1990s highs. But it isn’t just the total production that fell in the 21st century, as this graphic from Fannie Mae Multifamily reveals. The percentage of the new home market commanded by manufactured housing has also taken a hit compared to what was common for most of the 20th century.

What makes the HMDA data (see below), monthly or annual production levels, community data, and other hard facts about manufactured housing revealing for those who keep an eye on the industry’s historic achievements as well as recent stats is this. What is routinely revealed to the objective observer is that manufactured housing is underperforming at a shockingly low level compared to its past accomplishments and current potential. Yet some have the nerve to proclaim their expertise in manufactured housing ‘education,’ ‘marketing,’ webtech, digital media production, customer relationship management (CRM), etc. often with little or no mention of that history when compared to more recent manufactured housing industry accomplishments. Those pesky facts prove to be stubborn things, and thus a common tactic used by those in the MHI orbit is to ignore those far more impressive results of the 20th century compared to the 21st century. It is literally the rise and fall of manufactured housing. While the total housing picture has many missing elements that contribute to the lack of housing affordability, a factually accurate point can be made that if manufactured housing production had kept the pace of the late 20th century and population growth, there may be no affordable housing crisis today. When was the last time you saw that in mainstream media? Odds are excellent that it was only so stated in op-eds and reports based on those op-eds by this writer for MHProNews/MHLivingNews. That’s a fact evidenced by Deseret News, MSN News, Yahoo News, Florida Trend, the Ledger and others.

Solutions must be inherently affordable. Decades of subsidies for costly housing have never solved the affordability crisis and never will. | By L. A. “Tony” Kovach https://t.co/nAPLMIgotU

— Deseret News (@Deseret) April 30, 2024

Those facts should not be mistaken for bragging, but rather should be examples that beg the question. What are all of those people at MHI and in the MHI orbit who claim to be advocates, marketers, and educators doing with their time to actually tell the public the fact- and evidence-based stories that could help grow the industry? Check those examples above and below out and then hold those thoughts in mind as this probe of the HMDA data and what it reveals to objective thinkers who want robust growth over the status quo in MHVille.

MHARR has aptly observed that two industry challenges have been the primary roadblock to manufactured housing industry growth, the lack of financing options in MHVille is one and zoning/placement barriers is the other. It just so happens that a report and related op-ed by the Niskanen Center on housing and others have pointed to those same barriers holding back manufactured housing. So, understanding the financing, the money trail, is important. Without sufficient and hopefully affordable financing, large numbers of homes don’t get sold.

Following the Money

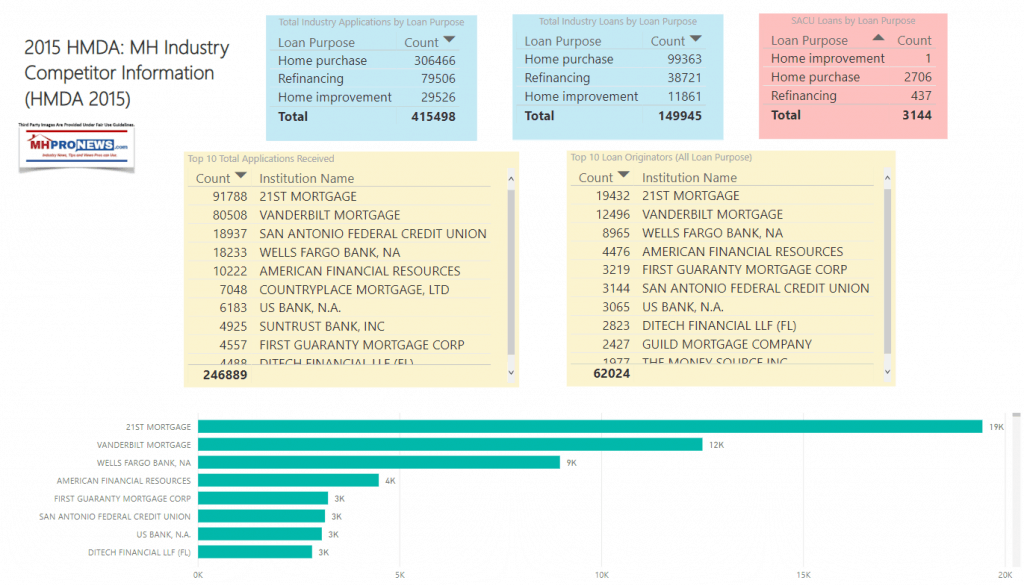

To illustrate recent vs. prior trends, the HMDA data for manufactured housing per the CFPB below is from 2015. It showed the largest lenders at that time that were operating in manufactured housing.

To see this image below in a larger size, depending on your device,

click the image and follow the prompts. For instance, you may be able

to click the image below, select ‘open image in new tab’ and then click the plus sign to expand the image

into a larger or the largest size.

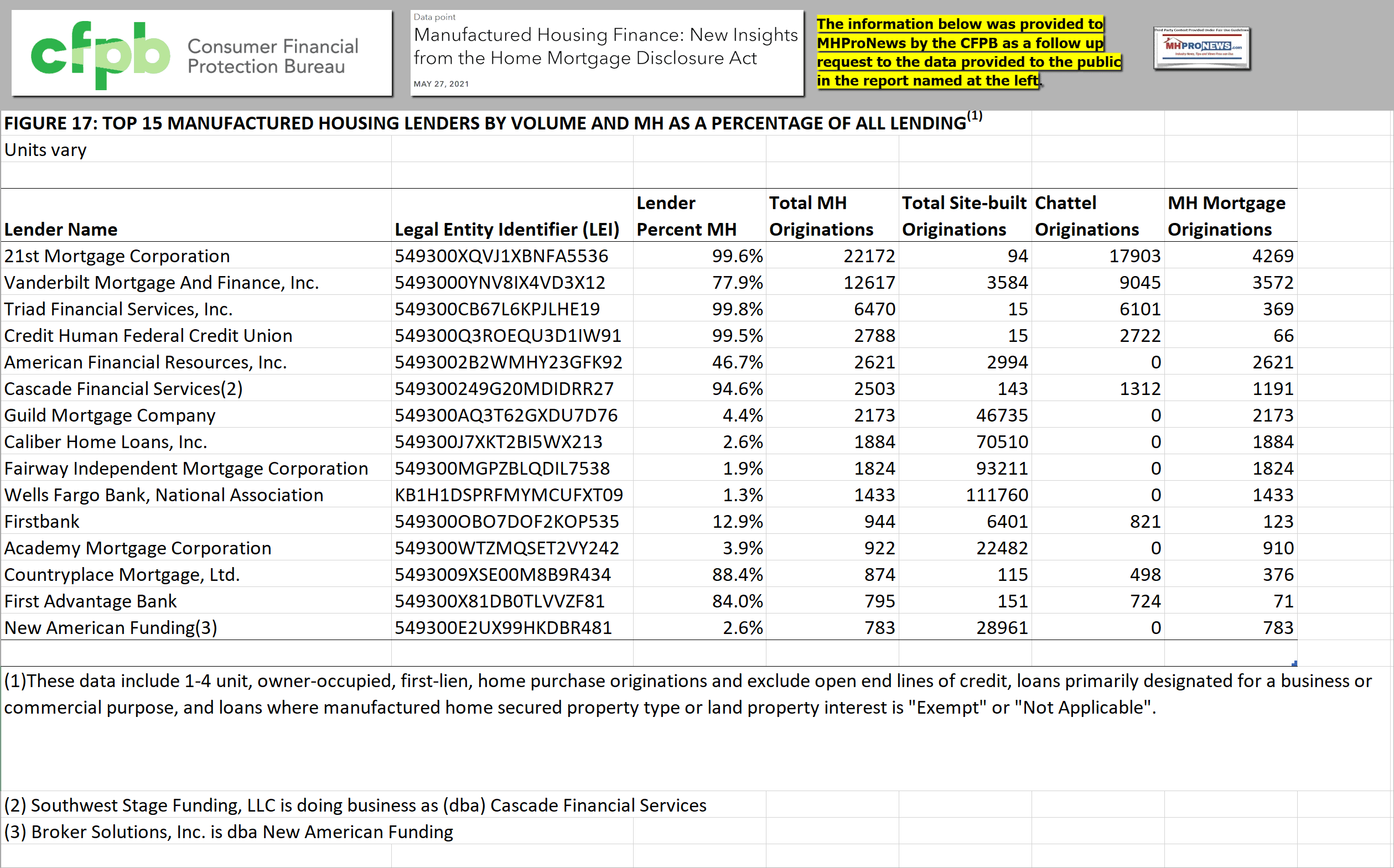

By comparison, the following is from the CFPB dated May 27, 2021.

To see this image below in a larger size, depending on your device,

click the image and follow the prompts. For instance, you may be able

to click the image below, select ‘open image in new tab’ and then click the plus sign to expand the image

into a larger or the largest size.

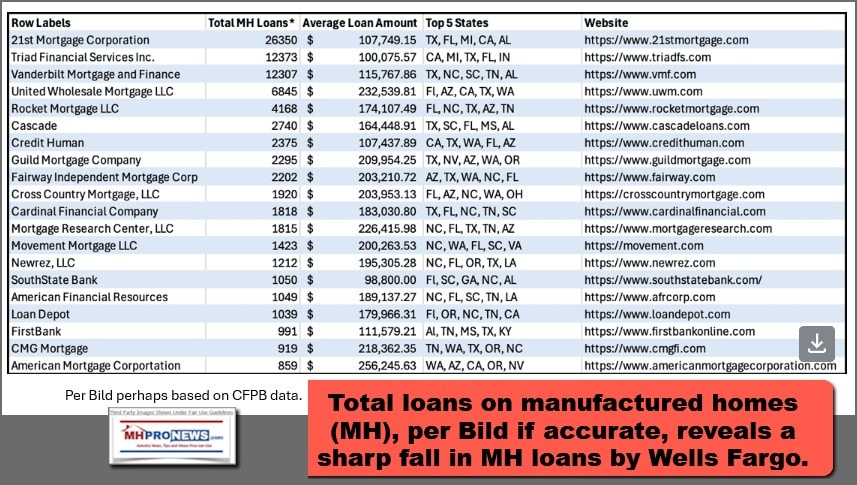

With that brief over the shoulder look at what used to be in MHVille in this introduction, it is almost time to look at the more recent CFPB HMDA data, which the newer data that Bild (see Part I) and others spotlighted, which with these added insights from the CFPB can come into sharper focus.

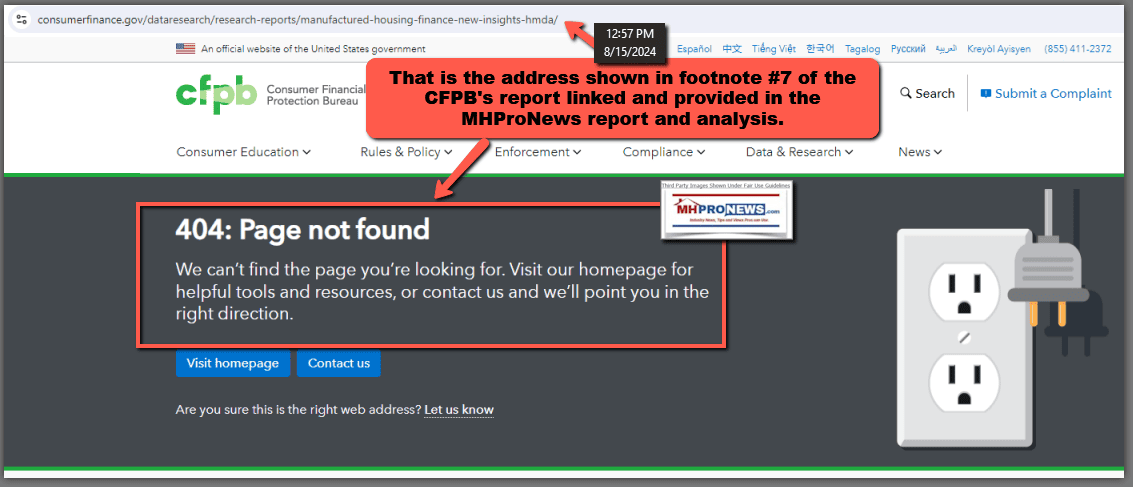

It may be an innocent glitch or change, but just as the FHFA was recently revealed to have moved some information related to manufactured housing on their website, so too some prior manufactured housing specific information has been moved on the U.S. Government’s CFPB website. That was brought to MHProNews attention by their own footnote 7 from the report show below. The CFPB footnote said the following.

[7] Manufactured-home lending differs from lending for site-built homes. Furthermore, even among the manufactured home loans, chattel-secured lending differs greatly from those that are not chattel secured. Chattel-secured lending typically carries higher interest rates and shorter terms to maturity. The rest of this article focuses almost entirely on site-built mortgage originations, which constitute most originations. For more information on manufactured housing, see “Manufactured Housing Finance: New insights from the Home Mortgage Disclosure Act,” available at https://www.consumerfinance.gov/dataresearch/research-reports/manufactured-housing-finance-new-insights-hmda

To see this image below in a larger size, depending on your device,

click the image and follow the prompts. For instance, you may be able

to click the image below, select ‘open image in new tab’ and then click the plus sign to expand the image

into a larger or the largest size.

MHProNews has contacted the CFPB about the above. Some federal agencies are reasonably responsive. Once the CFPB advises us, we’ll plan to report.

Back to the CFPB’s HMDA data. The bold is added by MHProNews.

Within closed-end transactions, we further divide by property type: a site built one-to-four family unit, manufactured home, or multifamily transactions. We also categorize by loan purpose: home purchase, home improvement, refinance, and other purpose. …

For manufactured home originations, we disaggregate by whether manufactured home loans are secured by land (non-chattel loans) or not secured by land (chattel loans).[7]

The information in the opening paragraph followed.

In 2022, about 189,000 loans secured by manufactured homes were originated, compared to 228,000 such loans in 2021. About 142,000 manufactured home loans were originated for home purchase, down slightly from 148,000 in 2021. Among them, about 79,000 were secured by both a manufactured home and land, while 56,000 were secured by a manufactured home but not land. In 2022, about 41,000 manufactured home loans were originated for refinance purpose, down by 45.7% from 75,000 in 2021.

Highlighting in what follows is added by MHProNews.

TABLE 1: APPLICATIONS, ORIGINATIONS, PRE-APPROVALS, AND LOAN PURCHASES (IN THOUSANDS)

| Home Purchase | Refinance | Total(1) | |||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2018 | 2019 | 2020 | 2021 | 2022 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| A. Closed-end excluding reverse mortgage | |||||||||||||||

| SITE BUILT 1-4 FAMILY | |||||||||||||||

| Applications | 5,652 | 5,837 6,453 6,977 | 5,852 | 3,708 | 5,803 | 13,216 | 13,097 | 4,330 | 10,060 | 12,373 | 20,262 | 20,700 | 11,021 | ||

| Originations | 4,136 | 4,307 4,693 5,127 | 4,129 | 1,880 | 3,381 | 8,423 | 8,280 | 2,220 | 6,349 | 8,023 | 13,380 | 13,696 | 6,729 | ||

| First lien, principal residence | 3,594 | 3,736 4,101 4,378 | 3,533 | 1,605 | 3,052 | 7,849 | 7,605 | 1,902 | 5,330 | 6,928 | 12,088 | 12,137 | 5,565 | ||

| Conventional(2) | 2,410 | 2,489 2,755 3,097 | 2,542 | 1,245 | 2,292 | 6,416 | 6,309 | 1,528 | 3,774 | 4,907 | 9,303 | 9,553 | 4,192 | ||

| Conventional conforming | 2,222 | 2,311 2,591 2,846 | 2,344 | 1,180 | 2,144 | 6,227 | 6,066 | 1,468 | 3,514 | 4,575 | 8,942 | 9,048 | 3,925 | ||

| Conventional jumbo | 188 | 178 164 251 | 198 | 65 | 148 | 189 | 242 | 59 | 259 | 332 | 360 | 505 | 267 | ||

| Nonconventional | 1,184 | 1,247 1,346 1,281 | 991 | 359 | 760 | 1,433 | 1,297 | 375 | 1,556 | 2,021 | 2,785 | 2,584 | 1,373 | ||

| FHA | 712 | 752 796 754 | 576 | 188 | 343 | 485 | 514 | 192 | 909 | 1,106 | 1,286 | 1,272 | 773 | ||

| VA | 370 | 397 426 422 | 362 | 170 | 415 | 938 | 774 | 182 | 544 | 814 | 1,366 | 1,199 | 545 | ||

| FSA/RHS | 102 | 98 124 104 | 54 | 1 | 2 | 10 | 8 | 1 | 103 | 101 | 133 | 113 | 55 | ||

| First lien, second residence | 173 | 178 227 256 | 148 | 31 | 56 | 159 | 144 | 35 | 212 | 241 | 394 | 413 | 195 | ||

| First lien, investment property | 286 | 293 268 399 | 373 | 172 | 203 | 370 | 495 | 211 | 484 | 522 | 657 | 919 | 610 | ||

| Junior lien, all

occupancy types |

83 | 100 98 94 | 74 | 72 | 69 | 45 | 36 | 72 | 323 | 332 | 240 | 228 | 360 | ||

| MANUFACTURED

HOMES |

|||||||||||||||

| Applications | 415 | 445 505 542 | 557 | 75 | 77 | 107 | 140 | 91 | 504 | 536 | 622 | 694 | 663 | ||

| Originations | 125 | 128 137 148 | 142 | 34 | 38 | 56 | 75 | 41 | 165 | 173 | 197 | 228 | 189 | ||

| “Manufactured home loans secured by land | 64 | 67 71 82 | 79 | 26 | 30 | 45 | 64 | 34 | 94 | 101 | 118 | 148 | 117 | ||

| “Manufactured home loans not secured by land | 49 | 52 57 59 | 56 | 2 | 2 | 4 | 5 | 2 | 51 | 54 | 61 | 64 | 59 | ||

| Land secured status unknown | 12 | 10 9 8 | 7 | 6 | 7 | 7 | 7 | 5 | 20 | 18 | 18 | 16 | 14 | ||

| MULTIFAMILY(3) | |||||||||||||||

| Applications | 28 | 29 24 32 | 32 | 31 | 33 | 37 | 37 | 32 | 61 | 65 | 64 | 72 | 68 | ||

| Originations | 22 | 23 19 27 | 27 | 25 | 27 | 31 | 32 | 28 | 50 | 53 | 52 | 61 | 58 | ||

| B. Open-end excluding reverse mortgage | |||||||||||||||

| Applications | 110 | 98 92 103 | 127 | 554 | 508 | 416 | 376 | 455 | 2,258 | 2,100 | 1,655 | 1,762 | 2,476 | ||

| Originations | 60 | 52 52 58 | 66 | 326 | 299 | 243 | 232 | 289 | 1,124 | 1,042 | 869 | 962 | 1,358 | ||

| Home Purchase | Refinance | Total(1) | |||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2018 | 2019 | 2020 | 2021 | 2022 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| C. Reverse mortgage | |||||||||||||||

| Applications | 3 | 3 3 4 | 2 | 49 | 48 | 58 | 75 | 82 | 57 | 55 | 64 | 85 | 93 | ||

| Originations | 2 | 2 2 4 | 2 | 28 | 29 | 39 | 50 | 52 | 33 | 35 | 43 | 59 | 59 | ||

| Total applications | 6,208 | 6,412 7,077 7,659 | 6,570 | 4,418 | 6,469 | 13,834 | 13,725 | 4,992 | 12,940 | 15,129 | 22,667 | 23,313 | 14,322 | ||

| Total originations | 4,345 | 4,513 4,904 5,364 | 4,366 | 2,293 | 3,774 | 8,791 | 8,670 | 2,630 | 7,721 | 9,325 | 14,541 | 15,007 | 8,394 | ||

| Purchased loans | 1,386 | 1,396 1,189 1,374 | 1,143 | 358 | 674 | 1,189 | 1,172 | 315 | 2,003 | 2,266 | 2,756 | 2,680 | 1,558 | ||

| Requests for preapproval(4) | 467 | 445 366 406 | 475 | <1 | <1 | <1 | <1 | <1 | 467 | 445 | 366 | 406 | 475 | ||

| Requests for preapproval that were approved but not acted on | 75 | 74 71 96 | 129 | <1 | <1 | <1 | <1 | <1 | 75 | 74 | 71 | 96 | 129 | ||

| Requests for preapproval that were denied | 102 | 77 58 53 | 72 | <1 | <1 | <1 | <1 | <1 | 102 | 77 | 58 | 53 | 72 | ||

TABLE 1: APPLICATIONS, ORIGINATIONS, PRE-APPROVALS, AND LOAN PURCHASES (IN THOUSANDS) (continued)

| Home Improvement | Other Purpose | Total(1) | |||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2018 | 2019 | 2020 | 2021 | 2022 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| A. Closed-end excluding reverse mortgage | |||||||||||||||

| SITE BUILT 1-4 FAMILY | |||||||||||||||

| Applications | 343 | 340 289 303 | 374 | 344 | 378 303 319 | 462 | 10,060 | 12,373 | 20,262 | 20,700 | 11,021 | ||||

| Originations | 180 | 170 142 152 | 192 | 149 | 160 121 136 | 187 | 6,349 | 8,023 | 13,380 | 13,696 | 6,729 | ||||

| First lien, principal residence | 70 | 66 72 77 | 57 | 61 | 70 66 77 | 72 | 5,330 | 6,928 | 12,088 | 12,137 | 5,565 | ||||

| Conventional(2) | 60 | 59 68 73 | 54 | 57 | 65 64 75 | 68 | 3,774 | 4,907 | 9,303 | 9,553 | 4,192 | ||||

| Conventional conforming | 59 | 57 67 71 | 53 | 52 | 60 58 65 | 59 | 3,514 | 4,575 | 8,942 | 9,048 | 3,925 | ||||

| Conventional jumbo | 2 | 1 1 2 | 2 | 5 | 5 6 10 | 8 | 259 | 332 | 360 | 505 | 267 | ||||

| Nonconventional | 9 | 7 4 4 | 3 | 4 | 5 3 3 | 4 | 1,556 | 2,021 | 2,785 | 2,584 | 1,373 | ||||

| FHA | 6 | 5 2 2 | 2 | 3 | 4 2 2 | 4 | 909 | 1,106 | 1,286 | 1,272 | 773 | ||||

| VA | 3 | 2 2 2 | 1 | <1 | 1 <1 1 | <1 | 544 | 814 | 1,366 | 1,199 | 545 | ||||

| FSA/RHS | <1 | <1 <1 <1 | <1 | <1 | <1 <1 0 | <1 | 103 | 101 | 133 | 113 | 55 | ||||

| First lien, second residence | 2 | 2 2 2 | 3 | 5 | 5 6 10 | 9 | 212 | 241 | 394 | 413 | 195 | ||||

| First lien, investment property | 13 | 14 11 13 | 12 | 11 | 10 8 11 | 13 | 484 | 522 | 657 | 919 | 610 | ||||

| Junior lien, all

occupancy types |

95 | 88 57 60 | 121 | 73 | 75 41 39 | 93 | 323 | 332 | 240 | 228 | 360 | ||||

| “MANUFACTURED HOMES | |||||||||||||||

| Applications | 6 | 6 5 5 | 7 | 7 | 8 6 6 | 8 | 504 | 536 | 622 | 694 | 663 | ||||

| Originations | 3 | 3 2 2 | 3 | 3 | 3 2 3 | 3 | 165 | 173 | 197 | 228 | 189 | ||||

| “Manufactured home loans secured by land | 2 | 2 1 2 | 2 | 2 | 2 1 1 | 2 | 94 | 101 | 118 | 148 | 117 | ||||

| Manufactured home loans not secured by land | <1 | <1 <1 <1 | <1 | <1 | <1 <1 <1 | <1 | 51 | 54 | 61 | 64 | 59 | ||||

| Land secured status unknown | 1 | 1 1 1 | 1 | 1 | 1 1 1 | 1 | 20 | 18 | 18 | 16 | 14 | ||||

| MULTIFAMILY(3) | |||||||||||||||

| Applications | 2 | 2 1 2 | 2 | 1 | 1 1 1 | 1 | 61 | 65 | 64 | 72 | 68 | ||||

| Originations | 2 | 2 1 1 | 2 | <1 | <1 1 <1 | <1 | 50 | 53 | 52 | 61 | 58 | ||||

| B. Open-end excluding reverse mortgage | |||||||||||||||

| Applications | 828 | 793 619 751 | 1,089 | 763 | 698 527 532 | 804 | 2,258 | 2,100 | 1,655 | 1,762 | 2,476 | ||||

| Originations | 384 | 366 310 390 | 584 | 352 | 324 264 282 | 419 | 1,124 | 1,042 | 869 | 962 | 1,358 | ||||

| Home Improvement | Other Purpose | Total(1) | |||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2018 | 2019 | 2020 | 2021 | 2022 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| C. Reverse mortgage | |||||||||||||||

| Applications | 1 | 1 1 2 | 2 | 4 | 3 2 4 | 6 | 57 | 55 | 64 | 85 | 93 | ||||

| Originations | 1 | 1 1 2 | 1 | 3 | 2 2 3 | 4 | 33 | 35 | 43 | 59 | 59 | ||||

| Total applications | 1,18 1 | 1,143 915 1,063 | 1,475 | 1,120 | 1,088 839 861 | 1281 | 12,940 | 15,129 | 22,667 | 23,313 | 14,322 | ||||

| Total originations | 570 | 541 456 547 | 783 | 508 | 490 389 424 | 613 | 7,721 | 9,325 | 14,541 | 15,007 | 8,394 | ||||

| Purchased loans | 15 | 8 7 7 | 10 | 10 | 11 12 13 | 21 | 2,003 | 2,266 | 2,756 | 2,680 | 1,558 | ||||

| Requests for preapproval(4) | <1 | <1 <1 <1 | <1 | <1 | <1 <1 <1 | <1 | 467 | 445 | 366 | 406 | 475 | ||||

| Requests for preapproval that were approved but not acted on | <1 | <1 <1 <1 | <1 | <1 | <1 <1 <1 | <1 | 75 | 74 | 71 | 96 | 129 | ||||

| Requests for preapproval that were denied | <1 | <1 <1 <1 | <1 | <1 | <1 <1 <1 | <1 | 102 | 77 | 58 | 53 | 72 | ||||

NOTE: Components may not sum to totals because of rounding. Applications include those withdrawn and those closed for incompleteness. FHA is Federal Housing Administration; VA is U.S. Department of Veterans Affairs; FSA is Farm Service Agency; RHS is Rural Housing Service.

- The “Total” columns represent the sum of Home Purchase, Refinance, Home Improvement, and Other Purpose columns. The sum of individual columns may not sum to Total columns because a small number of records reported loan purpose as “NA”. For instance, in 2021 HMDA data, a little over 1,500 originations had loan purpose reported as “NA”, likely due to reporting errors. In addition, for purchased loans where the origination occurred before January 1, 2018, reporters are allowed to report the loan purpose data point as “NA”. About 234,000, 177,000 and 358,000, 113,000 purchased loans had loan purpose reported as “NA” in 2018, 2019, 2020, and 2021 HMDA data respectively.

- The sum of conventional conforming and conventional jumbo rows may not sum to the conventional row because a small number of records had an unknown conforming loan status. The conventional conforming loan is a closed-end forward mortgage (i.e., excluding reverse mortgage) transaction whose loan type is reported as conventional and whose loan amount is below the conforming loan limit, making it eligible to be purchased by Fannie Mae or Freddie Mac (collectively known as Government Sponsored Enterprises, or GSEs). The conventional non-conforming or jumbo loan is a closed-end forward mortgage transaction with its loan type reported as conventional and a loan amount above the conforming loan limit, making it ineligible to be purchased by the GSEs.

- A multifamily property consists of site-built five or more units.

- Consists of all requests for preapproval. Preapprovals are not related to a specific property and thus are distinct from applications.

SOURCE: Here and in subsequent tables and figures, except as noted, Federal Financial Institutions Examination Council, data reported under the Home Mortgage Disclosure Act (www.ffiec.gov/hmda).

Some potentially relevant pull quotes that frame manufactured housing’s plight as well as that of other affordable housing seekers.

CFPB said:

Mortgage interest rates rose sharply in 2022.”

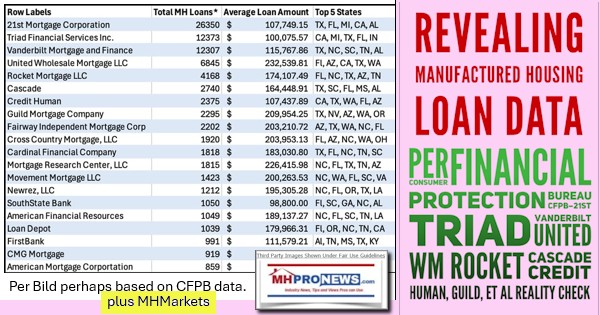

Note that there are thousands of financial institutions serving the mortgage market, yet only a far more limited number of lenders serving manufactured housing?

In 2022, 4,451 financial institutions reported closed-end applications and originations excluding reverse mortgages[19], up from 4,332 in 2021 and close t0 4,466 in 2020.

[19] Reverse mortgages can be structured as either closed- or open-end transactions. Tables 5a and 5b exclude reverse mortgages. There is no separate reporting threshold for reverse mortgages. 23 Data on bank assets were drawn from the Federal Deposit Insurance Corporation’s Reports of Condition and Income. The $1 billion threshold is based on the combined assets of all banks within a given banking organization. Fed. Fin. Inst. Examination Council, HMDA Data Publication, https://ffiec.cfpb.gov/data-publication/ (data from the HMDA Reporter Panel can be used to help identify the various types of institutions).

Now, with those facts and introductory insights, per BILD on 8.8.2024 is the following.

Part I

1) According to a BILD Media email on 8.8.2024 and sources as cited are the following.

2023 Manufactured Housing Loan Data Summary

2) The following quotes are also per the BILD email, unless otherwise shown. A link to the National Association of Realtors (NAR) website was removed as it was deemed irrelevant for this MHProNews report.

How Complete is the Dataset?

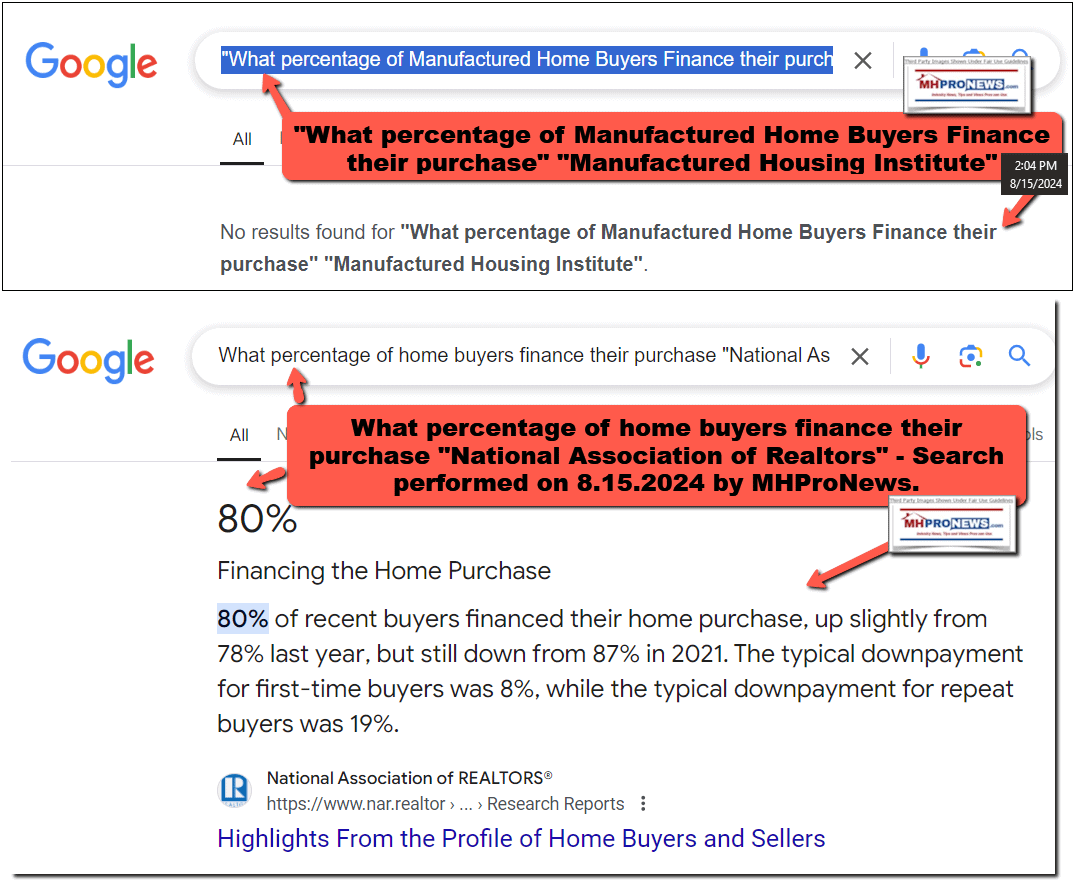

According to the National Association of Realtors, nearly 90% of borrowers will finance their home purchase. And 96% of buyers under the age of 53 will finance their home purchase. This means that close to 90% of home sales will be captured by the HMDA data.

While the dataset does not include ALL manufactured home buyers, it does include most of them. What it misses is the cash buyer, of which there are a few, but not enough to make this dataset inaccurate. It’s not perfect, but it’s close enough for marketing analytics. If we’re looking at trends, it is accurate enough for our needs.

3) Note that BILD cited NAR, why? Perhaps because there is apparently no similar study or statement on the public side of the Manufactured Housing Institute (MHI) website.

To see this image below in a larger size, depending on your device,

click the image and follow the prompts. For instance, you may be able

to click the image below, select ‘open image in new tab’ and then click the plus sign to expand the image

into a larger or the largest size.

4) From the MHI 2023 “Industry Overview” are these remarks, but they also lack the facts that NAR provides, per BILD.

Financing:

- Manufactured homes can be financed as personal property. Even when the home and land are financed together, the home can be secured as personal property and the land as real property. Traditional manufactured home personal property lenders offer land-and-home financing.

- Homebuyers may also finance their home and land together as real property using conventional mortgage financing obtained through a traditional mortgage lender. …”

5) Also, per MHI Industry Overview for 2023 is the following. While for the years covered it says that breakdown of homes titled as personal property vs. real estate, it does not indicate the mortgage/loan financing percentages that BILD cited from NAR. Note that while the following from MHI is of interest, it is also data generated by cited federal sources. It isn’t like MHI is busy doing research that they then turn around and use to effectively promote manufactured housing. That is demonstrated by cold, hard facts that for two decades, manufactured housing in the 21st century has been dramatically underperforming compared to the 2oth century, despite the fact that the U.S. population has grown substantially since then.

Cost & Size Comparisons:

New Manufactured Homes and New Single-Family Site-Built Homes 2014 – 2021

| 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | |

| New Manufactured Homes

All1 Avg. Sales Price |

$ 108,100 | $ 87,000 | $ 81,900 | $ 78,500 | $ 71,900 | $ 70,600 | $ 68,000 | $ 65,300 |

| Avg. Square Feet | 1,497 | 1,471 | 1,448 | 1,438 | 1,426 | 1,446 | 1,430 | 1,438 |

| Avg. Cost per Sq. Ft. | $ 72.21 | $ 59.14 | $ 56.56 | $ 54.59 | $ 50.42 | $ 48.82 | $ 47.55 | $ 45.41 |

| Single

Avg. Sales Price |

$ 72,600 | $ 57,300 | $ 53,200 | $ 52,400 | $ 48,300 | $ 46,700 | $ 45,600 | $ 45,000 |

| Avg. Square Feet | 1,084 | 1,085 | 1,072 | 1,072 | 1,087 | 1,075 | 1,092 | 1,115 |

| Avg. Cost per Sq. Ft. | $ 66.97 | $ 52.81 | $ 49.63 | $ 48.88 | $ 44.43 | $ 43.44 | $ 41.76 | $ 40.36 |

| Double

Avg. Sales Price |

$ 132,000 | $ 108,500 | $ 104,000 | $ 99,500 | $ 92,800 | $ 89,500 | $ 86,700 | $ 82,000 |

| Avg. Square Feet | 1,794 | 1,760 | 1,747 | 1,747 | 1,733 | 1,746 | 1,713 | 1,710 |

| Avg. Cost per Sq. Ft. | $ 73.58 | $ 61.65 | $ 59.53 | $ 51.26 | $ 53.55 | $ 51.26 | $ 50.61 | $ 47.95 |

| Housing Starts vs. MH Shipments

(Thousands of Units) New Single Family Housing Starts |

1,127 | 991 | 888 | 876 | 849 | 782 | 715 | 648 |

| Percent of Total | 91% | 91% | 90% | 90% | 90% | 91% | 91% | 91% |

| Manufactured Home Shipments

Shipped |

106 | 94 | 95 | 97 | 93 | 81 | 71 | 64 |

| Percent of Total | 9% | 9% | 10% | 10% | 10% | 9% | 9% | 9% |

| Total | 1,233 | 1,085 | 983 | 973 | 942 | 863 | 786 | 678 |

| New Single-Family

Site-Built Homes Sold (Home and Land Sold as Package) Avg. Sales Price |

$ 464,200 | $ 391,900 | $ 383,900 | $ 385,000 | $ 384,900 | $ 360,900 | $ 352,700 | $ 347,700 |

| Derived Average Land Price | $ 98,296 | $ 83,303 | $ 84,485 | $ 87,253 | $ 91,173 | $ 82,491 | $ 80,246 | $ 84,444 |

| Price of Structure

Avg. Square Feet |

2,544 | 2,527 | 2,518 | 2,602 | 2,645 | 2,650 | 2,724 | 2,707 |

| Avg. Price per Sq Ft. (excl. land) | $ 143.83 | $ 122.12 | $ 118.91 | $ 114.43 | $ 111.05 | $ 105.06 | $ 100.02 | $ 97.25 |

| Manufactured Home Shipments

Total |

105,772 | 94,390 | 94,615 | 96,555 | 92,902 | 81,136 | 70,544 | 64,331 |

| Single-Section | 44,755 | 42,578 | 42,930 | 44,979 | 46,305 | 38,944 | 32,210 | 30,218 |

| Multi-Section | 61,017 | 51,812 | 51,685 | 51,576 | 46,597 | 42,192 | 38,334 | 34,113 |

| New Manufactured Homes Placed

(For Residential Use) Located in Communities |

51% | 27% | 31% | 37% | 32% | 34% | 34% | 33% |

| Located on Private Property | 49% | 73% | 69% | 63% | 68% | 66% | 66% | 67% |

| Titled as Personal Property | 77% | 78% | 76% | 77% | 76% | 77% | 80% | 80% |

| Titled as Real Estate | 19% | 19% | 19% | 17% | 17% | 17% | 14% | 13% |

1 Includes manufactured homes with more than two sections.

Note: The Census Bureau has reviewed this data product for unauthorized disclosure of confidential information and has approved the disclosure avoidance practices applied. (Approval ID: CBDRB-FY22-278)

Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Survey of Construction, https://www.census.gov/construction/chars/; https://www.census.gov/construction/nrc/xls/starts_cust.xls.

Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Manufactured Housing Survey.

6) So, MHI’s lack of relevant data in some ways confirms what BILD said: “While the dataset does not include ALL manufactured home buyers, it does include most of them.” Perhaps, close enough for proverbial government work?

But there is more to know about that graphic, because that graphic doesn’t clearly say its source. It thus can’t be readily verified.

7) When someone personalizes a report like this, it is sometimes referred to as going Gonzo, as in Gonzo journalism. It can be folksy and a way for a writer to ‘connect’ to the reader.

The Bild article finishes by saying that “David Finney is the founder and owner of Bild Media, a digital marketing agency for the manufacture housing industry.” The apparent typo is in the original (manufacture vs manufactured). That is who the person the following personal reference is from. Note, we get typos too. Finney appears to have several ties to MHI linked state associations (examples: WHA and KMHI), and thus, is linked to MHI.

MH Loan Data Summary

Nationwide in 2023, there were approximately 171,100* consumer loans originated for the purchase of a new OR used manufactured home. There were 2863 lenders that originated at least 1 manufactured home loan, new or used, up from 2347 in 2022, an increase of 18%. New lenders in the industry is great news.

Does the number of lenders seem high? I’m guessing so. It certainly surprised me the first time I started reviewing this data. There are a few key lenders with whom we’re all familiar, but based on the data, there are thousands more that are willing to help manufactured home buyers finance their home purchase.

Before we look at the top lenders, let’s look at some data summaries that may be useful for your own marketing. First, we’ve got the median income of all manufactured housing buyers. It comes in at right around $55,000, which is less than nationwide median income of $74,580. (Source: Federal Reserve Bank of St Louis) This should not be a surprise. Manufactured Housing is a value driven product, and those in lower income tiers put value and affordability at the top of their home requirements list.

Like last year, the median income of a manufactured home buyer increased at much larger rate than the increase in the overall median family income. In 2022, the median annual income of a manufactured home buyer was right around $50,000. In 2023, it’s nearly $55,000, an increase of almost 10%. What this means is that higher income earners are taking interest in manufactured housing. This is a trend we want to continue.

8) What Finney and his Bild didn’t specify there in his pitch is that while there are local banks, credit unions, or other financial institutions that may loan money on a manufactured home in a specific scenario, purchase money lending on manufactured housing is dramatically limited when compared to conventional housing. That’s what the CFPB data actually points toward, the limited nature of purchase money lending in MHVille.

That limitation on manufactured home lending is why companies like Legacy Housing, Nobility Homes, UMH Properties, Clayton Homes, Cavco Industries, and Skyline Champion–Triad Financial (ECN Capital) have established vertically integrated lending, as have some others in MHVille. Indeed, the now Skyline Champion linked Triad Financial Services made the point just weeks ago that there is what they said are ‘significant barriers to entry” in manufactured housing caused by the limited nature of manufactured home lending.

So, once again, what Finney/Bild provided is at best incomplete. When someone keeps in mind that Finney/Bild appear to be marketing themselves, the data provided, which is apparently based on CFPB data but that isn’t stated under each of the illustrations as is common in an authoritative report, it may undermine their own credibility. He cited the source for the income data as the St. Louis Federal Reserve, but then fails to clearly state the source of some other graphics and information. That’s something Finney might want to fix in his next such marketing pitch.

9) Information can be accurate yet misleading.

Finney/Bild saying: “2863 lenders that originated at least 1 manufactured home loan, new or used, up from 2347 in 2022, an increase of 18%” may be accurate, but it does not necessarily follow that these are “New lenders in the industry” which is thus as he put it, “great news.”

Triad Financial, a publicly traded firm which by law is not supposed to materially mislead or misinform investors and potential investors, said there are barriers to entry. Believe them on that point.

MHARR and others in MHVille have made that point too.

For whatever reason, Finney/Bild is correct on some things in that emailed pitch/message, but that same emailed-pitch is apparently missing significant insights, something that someone with his stated background ought to know better.

Quoting his own email: “He’s spent time on the finance side of the industry, as well as marketing, and believes that manufacture housing is the next step for housing in the US” (again, note the typo on “manufacture[d] housing”).

For both a marketer and someone with lending (“finance) experience, it is a baffling at best to ponder his phrasing his message on the ‘thousands’ of lenders and ‘new’ lenders.

When the Niskanen Center, Harvard’s Joint Center for Housing Studies, the Urban Institute, MHARR, and others have contradicted that misleading impression from Finney, isn’t it common sense to believe them over Finney/Bild?

Hmm…Bild vs. Build…perhaps the repeated “manufacture” vs manufactured home typo is deliberate? Surely, not…but either way, let’s dig deeper.

On the limited number and competitiveness of lending in manufactured housing, sorry, but Finney Bild are wrong.

Even Warren Buffett, not to mention Doug Ryan while still at CFED/turned Prosperity Now, have made the admission/point that competitive lending is holding manufactured housing sales and thus production back. Does Finney/Bild think he knows something Buffett and Ryan don’t? Hopefully, not.

10) Per Finney/Bild:

Like last year, the median income of a manufactured home buyer increased at much larger rate than the increase in the overall median family income. In 2022, the median annual income of a manufactured home buyer was right around $50,000. In 2023, it’s nearly $55,000, an increase of almost 10%. What this means is that higher income earners are taking interest in manufactured housing. This is a trend we want to continue.

Pardon me, David? What about the effects of inflation? What about the fact that Cavco Industries (CVCO) and Skyline Champion (SKY), among others, have clearly stated that they are selling lower average priced homes that they were after the post-Covid 19 surge. What about mentioning that as prices and finance rates have risen that the average selling prices have gone down? “This is a trend we want to continue,” said Finney – seriously? Did he look at those pesky facts, like Skyline Champion plainly saying there is a trend to lower cost homes?

11) Per Finney/Bild, again, no clear attribution to the CFPB (or other possible source).

The chart below is the number of manufactured homes purchased by each age group. The median age of a manufactured home buyer was between 25 and 34. This shouldn’t be too shocking, as that’s the median age group purchasing site built homes as well. The 25-34 year old has had a career for a few years, and is looking to purchase a home as they start to settle down.

12) Said Finney/Bild:

It’s important to remember this age group in your marketing. Remember that you’re speaking to someone that’s never known life without the Internet or a cell phone, likes green products, and will likely do most of their purchase research online. You have to have an excellent digital experience to appeal to the 25-34 home buyer.

Oddly, Finney failed to mention that a large segment of that younger age group lacks a down payment. Fox Business, citing Redfin said on Apr 22, 2024 — “About 36% of younger buyers plan to receive a cash gift from their family to help with the down payment on a home, a Redfin study found.”

Lending Tree said on October 9, 2023: “78% of Gen Z Homeowners Had Down Payment Help.”

Per Finney:

I’ve been in this industry awhile, and I know that many of us (most?) are not in the 25-34 age group. This means that when you’re choosing products, marketing, etc. you need to realize that you are talking to someone that is different from you. You need to think like a 25-34 year old in order to sell to a 25-34 year old.

Got it. Did he?

13) Per that same Finney/Bild email of 8.8.2024. Note that the follow makes no distinction between new home purchase money originations vs. loans for existing loans.

Top States for Manufactured Homes Loans

14) According to Finney/Bild. Again, look at the top 10 states for new shipments per MHARR. The following may be a ‘home purchase,’ but numbers of those purchases are potentially of existing housing, not new home sales. While some sellers in MHVille may participate in a real estate style deal, that certainly won’t apply to numbers of others.

15) Ibid (same source as before).

But compare that list from BILD above with the following from MHI-connected MHInsider, keeping in mind that MHInsider is a party line publication that have their own problems. There is a big variation in those two top ten lists, isn’t there? So, which of those two MHI linked operations should someone trust? Or are both leaving out key information that would clarify what they are saying, which is what a pro-growth professional should do?

16) Per Finney/Bild.

Compare this to the lists in the introduction, which what MHProNews posted above is clearly based on CFPB data. In the intro to this report with analysis, note that Wells Fargo has long been among the top 10 manufactured homes as single-family housing lenders. Now, they are gone from that lofty perch, if this from Bild is accurate? What does that tell us about Wells Fargo and their recent interest in the manufactured housing lending market? Does that signal the same things that Finney/Bild do? There are plenty of questions, but no clear answers based on Bild’s pitch.

17) Nearing the end of the email from Finney/Bild.

See any surprise on the list? I saw some. In the past 10+ years, the quality of manufactured homes has advanced by leaps and bounds, and lenders are starting to notice. They’re starting to notice that a customer with a decent credit score and a good job will pay their manufactured home mortgage just as well as a site built mortgage. And as affordable housing continues to be a tremendous issue across the country, I have no doubt that more lenders will enter into the manufactured housing market.

*Please note that this data is approximate. For our purpose, as consumer marketers, we try to filter out any commercial/investor purchases, but it is possible that some of those purchases remain. This data is also self reported, and while we certainly trust the integrity of all lenders, there is always potential for human error.

… Again, note that the typos and other purported errors are in the original. Note that Finney said “we try to filter out any commercial investor purchases” which tends to imply that he ran a filter of HMDA data, but that is arguably less than clear.

Part II – Additional Information with More MHProNews Analysis and Commentary

1) Give Finney credit for putting together a report on the important topic of lending in manufactured housing. Financing is an important topic, per MHARR, Harvard, the Urban Institute, Prosperity Now, Niskanen and others.

2) That said, as noted above, each graphic he provided should be clearly labeled as to the source and timeframe. Did Finney do each of those as screen grabs from the CFPB? Where these searches using a filter and then screen grabbed? Those sorts of details should be clearly stated, and other pertinent information reflected as needed. Research without proper sourcing is akin to talking about online marketing with ever mentioning SEO.

While what Finney provided is presumably from the CFPB HMDA data, the fact that other sources (NAR, St. Louis Federal Reserve) have been cited, it is not entirely clear. As noted, did he run a filter? Did he do so correctly? Was any or all of the above a graphic from a CFPB document? If so, which one(s)?

3) Finney’s emailed article on the manufactured home loan market and the wonders of the need for good marketing and websites is potentially useful and is a natural pitch for a self-proclaimed marketer (note, as a disclosure, MHProNews provides such professional services too and arguably offer advantages others in MHVille don’t, such as one of the demonstrably largest audiences in all of MHVille).

That said, for even for a brief article on manufactured home lending, consider the following topics Finney/Bild didn’t cover at all.

a) A “Word search” of the Bild pitch reveals no apparent mention of the Duty to Serve (DTS) manufactured housing.

b) There is also no apparent mention of third-party research/comments on how the lack of competitive lending is ‘holding back‘ manufactured housing (see preface/intro to this article).

c) There is no distinctive mention of FHA, VA, USDA/Rural Housing, Fannie Mae, Freddie Mac and what each of those mean in terms of potential markets. There is no mention of reverse mortgages or other loans that most people never think about when it comes to manufactured housing, and what some of the many kinds of lesser-known loan programs could mean for potential manufactured housing industry growth. If Finney wanted to use a curiosity approach, he could have said something like: ‘look at all these lenders, per CFPB’s HMDA data, but do you know what sorts of loan programs they do and don’t do? Are you familiar with all of the lending options in manufactured housing? If not, how many deals per month are you losing for a lack of a better grasp of the lending opportunities in your market?’

Meaning, even as a brief emailed pitch for clients, there are ways that it could be improved.

d) There is no mention, much less a critical analysis of the factors that are holding manufactured housing back in the 21st century. Nor any mention that manufactured housing is underperforming in the 21st century. To be fair and balanced, there are several possible reasons why a marketer may not want to mention such potentially sensitive topics. There may be reasons, for instance, why Finney doesn’t mention why Wells Fargo isn’t visible on his list, when Wells used to be one of the largest lenders serving single-family manufactured home lending. But it may also be that Finney simply didn’t know that there were so many disconnects between his pitch and what is provided herein based on clearly stated sources.

e) Presuming the accuracy of their respective claims, about 80 percent of the new HUD Code manufactured housing production market is now in the hands of Berkshire-owned Clayton Homes, Cavco, and Skyline Champion. Those firms are vertically integrated. The retail base of the industry has been decimated, as Kevin Clayton himself said.

f) So, who exactly is Finney’s target audience? The shrinking numbers of independently owned communities and retailers? The sharply limited number of independent producers of HUD Code manufactured homes since the start fo the 21st century? Or is he yet another insider-nurtered and paid shill for one or more MHI-linked organizations? We aren’t saying at this point, MHProNews is merely analyzing the obvious facts and arguably pertinent questions.

g) MHProNews will plan to ask, Finney and others. Let’s see what the response will be, shall we? Stay tuned for a planned follow up. Manufactured housing should be booming, but instead it is snoozing. If Finney, or others in the MHI orbit of so-called marketers are such genisues, then why is the manufactured housing industry underperforming? Accountabity is in part based on stats. The full picture and related stats are an embarrasment for MHI-linked insiders. Because “Facts are stubborn things.” The MHVille markets report follows in Part III. ###

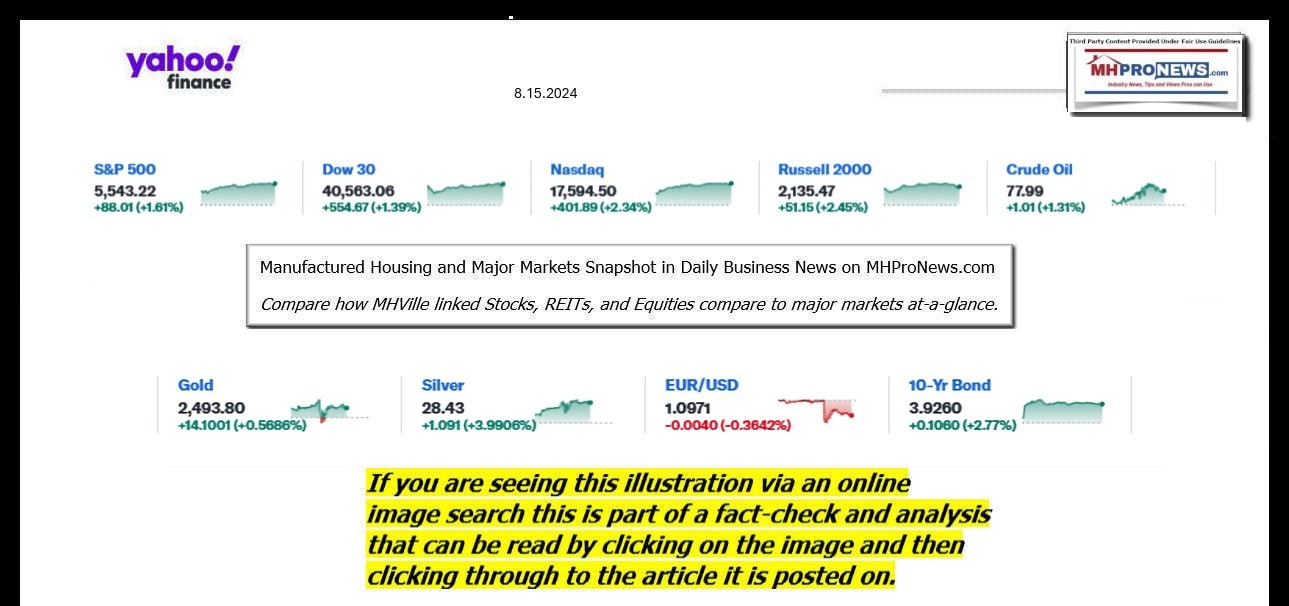

Our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

NOTICE: following the TPG deal with CAPREIT, TPG has been added to our tracked stocks list below.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report at the closing bell, so that investors can see-at-glance the type of topics may have influenced other investors. Our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines for a more balanced report.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

- In minutes a day, readers can get a good sense of significant or major events while keeping up with the trends that may be impacting manufactured housing connected investing.

Headlines from left-of-center CNN Business – 8.15.2024

- Sales at stores are suddenly surging in the US economy’s latest show of strength

- A construction worker takes a sip of water while repairing a road that was damaged from the heat in Houston, Texas on June 27, 2023.

- Despite rising temperatures, an inconsistent patchwork of guidelines puts workers in danger

- Residential homes in Crockett, California, on Thursday, June 6, 2024.

- Homeowners are rushing to refinance their mortgages after rates finally dropped

- Amos shows off a sheet of cookies in his home office in the Lanikai section of Kailua, Hawaii, in 2007.

- Wally Amos, founder of Famous Amos cookies, dies at 88

- A woman walks past Israeli and US flags alongside portraits of Israelis taken hostage by the militant Palestinian group Hamas in front of the pro-Palestinian encampment at the Columbia University on April 28 in New York City.

- This school year is starting like the last one ended: In chaos

- The Grok AI logo is seen in this photo illustration taken on 06 November, 2023.

- Elon Musk’s AI photo tool is generating realistic, fake images of Trump, Harris and Biden

- A Walmart Superstore in Secaucus, New Jersey, Thursday, July 11, 2024.

- Americans are still shopping. They’re just going to Walmart

- People shop in a supermarket in the Manhattan borough of New York city on January 27, 2024.

- The war on inflation has been won. It’s OK if you’re still angry

- Columbia University President Nemat “Minouche” Shafik testifies before a House Education and the Workforce Committee hearing on Capitol Hill on April 17, 2024.

- Columbia President Minouche Shafik steps down months after protests over Israel-Hamas war gripped campus

- A photo shows Bank of Japan (BOJ) headquarters in Chuo Ward, Tokyo on July 25, 2024.

- Japan’s economy bounces back, supporting case for more rate hikes

- Young people in China aren’t spending on romance. That’s a problem

- Disney wants wrongful death suit thrown out because widower bought an Epcot ticket and had Disney+

- Berkshire invests in Ulta Beauty, Heico as it retreats from Apple

- ‘I’m down to eating ramen’: Social Security benefits aren’t keeping up with inflation

- LA residents: Your next Shake Shack order could be delivered by a robot

- Cisco to cut 7% of its global workforce

- Inflation milestone: Consumer Price Index slows below 3% for first time since March 2021

- Why car insurance is still so expensive even as car prices are dropping

- LL Flooring files for bankruptcy and will close 94 stores

- Chili’s take on the Big Mac is beating McDonald’s at its own game

- Texas sues General Motors, alleging illegal selling of driver data

- Mars agrees to buy Pringles maker Kellanova in $36 billion deal

- Starbucks is struggling. So it hired fast food’s Mr. Fix-It

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

Headlines from right-of-center Newsmax – 8.15.2024

- Biden-Harris Drug Plan Is Price Fixing, Says House GOP Leadership

- Israel at War

- Gaza Cease-Fire Talks Underway in Doha as Deaths Top 40,000

- Netanyahu Denies Report He Spoke to Trump Wednesday

- IDF Drone Kills Terrorist Freed in November Hostage Deal

- IDF Kills 20 Terrorists, Dismantles Tunnel in Rafah

- Columbia U. President Quits, Months After War Protests

- US Envoy: Israel, Hezbollah Can Avoid War

- Top Hamas Official: Losing Faith in US as Mediator

- Hamas Out of Gaza Truce Talks, Iran Considers Israel Attack

- Netanyahu Denies Changing Hostage Deal Parameters

- Blinken OKs Sale to Israel of $20B in Military Equipment

- Newsmax TV

- Wesley Clark: Afghan War a ‘Tragedy’

- Wilkie: Trump Wouldn’t Have Tolerated Houthi Attacks

- Bergman: Walz Has ‘Reputation as a Liar’

- Gold Star Dad: Taliban Parade ‘Disgusting’

- Jailed Minnesota Woman: Walz ‘Tyrant of Tyrants’

- Eric Hovde: Walz Won’t Help Dems in Wisconsin

- Gold Star Father: Harris Won’t Be Getting My Vote

- Slain Marine’s Mother-in-Law: Afghanistan a ‘Catastrophic Failure’

- Newsfront

- Report: Trump Seeks to Delay Sentencing in N.Y. Case

- Former President Donald Trump is seeking to delay sentencing in his New York criminal case until after the Nov. 5 presidential election, citing “election-interference objectives,” ABC News reported on Thursday…. [Full Story]

- Facebook: Did Limit Ads for Quaid’s ‘Reagan’ Movie

- Facebook on Tuesday admitted to limiting ads for Dennis Quaid’s new [Full Story]

- Vance, Walz Agree to CBS News Debate on Oct. 1

- Minnesota Gov. Tim Walz and Ohio Sen. J.D. Vance have agreed to [Full Story]

- Related

- Google Ads From Harris Campaign Rewrite Headlines

- Trump: Harris’ Editing of Google Headlines ‘Illegal’

- AP Poll: Dems See Harris as More of Climate Hawk Than Biden

- Cook Report: Harris Leads Trump in 5 Swing States

- Musk-Backed Pro-Trump Super PAC Boosts Spending

- AARP Poll: Trump Leads Harris by 2 Points in Michigan

- Vivek Ramaswamy to Trump: Focus on Policy Differences

- Election-Prediction Historian: Ukraine Raid Could Help Harris

- RFK Jr. Rebukes Democrats, Won’t Endorse Kamala

- Walz Spent COVID Funds on Abortion Doulas

- Stocks End Higher as Retail Sales Allay Slowdown Fears

- Wall Street’s main indexes closed higher Thursday, with the Nasdaq [Full Story]

- NYC Mayor to Kamala: Embrace Tough-on-Crime History

- Vice President Kamala Harris is being advised to play the role of a [Full Story]

- Dennis Quaid: Facebook Censoring ‘Reagan’ Film Promos

- Actor Dennis Quaid and the marketing team behind his upcoming film [Full Story] | Platinum Article

- Zelenskyy: Ukraine Has Full Control of Russia’s Sudzha

- Ukrainian President Volodymyr Zelenskyy said Thursday that the [Full Story]

- Related

- Ukraine Speaks With Defense Secretary Austin About Battlefield Needs

- Ukraine Denies Nord Stream Sabotage, Blames Russia

- Ukraine: Heavy Fighting on Eastern Front Amid Russia Incursion

- Ukraine Gambles Incursion Deep Into Russia to Change the War

- Report: Secret Service Agent Found Breastfeeding

- A female Secret Service agent on duty to protect former President [Full Story]

- House GOP Leadership: WH Drug Plan Is Price Fixing

- The House Republican leadership is hitting back at the White House [Full Story]

- Google Says Iran Hackers Targeted Trump, Harris Campaigns

- Google on Tuesday confirmed that Iranian-backed hackers are targeting [Full Story]

- UK Seeks to Extradite American Involved in Crash

- An American who fled the United Kingdom for the United States after [Full Story]

- 5 Charged in Matthew Perry’s Overdose Death Probe

- A prosecutor said five people were charged in connection with actor [Full Story]

- US to Replenish Strategic Petroleum Reserve Into 2025

- The U.S. is slowly replenishing the Strategic Petroleum Reserve, [Full Story]

- ‘Hollywood Squares’ Host Peter Marshall Dies at 98

- Peter Marshall, the actor and singer turned game show host who played [Full Story]

- Report: Drunken Plot Led to Nord Stream Sabotage

- For two years, theories swirled about the sabotage that destroyed the [Full Story]

- Trump: Biden Is ‘An Angry Man, as He Should Be’

- Former President Donald Trump came out swinging against the [Full Story]

- Antifa Member Found Guilty After Oregon Park Riot

- An Antifa member was found guilty on charges related to a 2021 clash [Full Story]

- PM Modi Calls for Ending India’s Religion-Based Laws

- Prime Minister Narendra Modi reiterated his call to substitute [Full Story]

- FDA Moves to Further Reduce Salt Levels in Food

- Emboldened by success in its initial efforts to cut dietary salt [Full Story]

- Montana Poll: Sheehy Up 6 Points in Senate Race

- Republican candidate Tim Sheehy holds a 6-point lead over incumbent [Full Story]

- Musk, Rowling Named in Olympic Boxer’s Lawsuit

- Elon Musk and Harry Potter author J.K. Rowling are among those named [Full Story]

- Texas Busing Fewer Migrants to Blue Cities

- Texas’ busing of migrants to Democrat-controlled cities has decreased [Full Story]

- Iranian Military Adviser Injured in Syria Dies

- A military adviser from Iran’s Revolutionary Guard’s Aerospace Force [Full Story]

- ‘The Notebook’ Star Gena Rowlands Dead at 94

- Gena Rowlands, hailed as one of the greatest actors to ever practice [Full Story]

- Poll: Inflation, Economy, Immigration Top Issues

- Inflation, the economy and immigration are the top three most [Full Story]

- Blaine Holt to Newsmax: Biden’s Israel-Hamas Conflict Handling Lax

- Billy Graham’s Son Rips ‘Evangelicals for Harris’ Ad

- The son of late evangelist Billy Graham is hitting back after a group [Full Story]

- Wally Amos of Cookie Fame Dies in Hawaii at 88

- Wallace “Wally” Amos, the creator of the cookie empire that took his [Full Story]

- Meta Scraps Misinformation Tracking Tool CrowdTangle

- Facebook and Instagram parent Meta Platforms has shut down [Full Story]

- Police ID Suspect in Trump Campaign Office Break-In

- Police in northern Virginia said Wednesday they were looking for a [Full Story]

- Kids Online Safety Act Stalls in the House

- The Kids Online Safety Act has hit resistance in the House of [Full Story]

- More Newsfront

- Finance

- House GOP Leadership: Biden-Harris Drug Plan Is Price Fixing

- The House Republican leadership is hitting back at the White House over its plans to save $6 billion on prescription drugs through Medicare, calling it “price fixing,” The Guardian reported…. [Full Story]

- Political Vendettas Put Small Business in the Crossfire

- Retirement Red Zone: Will Your Savings Hold Up?

- Memo to Kamala Harris: Collectivism Isn’t Freedom

- How to Make a Big Impact via Community-Focused Charitable Giving

- More Finance

- Health

- Frequent Coffee Drinkers Could Put Their Hearts at Risk

- Chugging coffee, swilling colas or pounding down energy drinks could cause heart damage over time, a new study warns. All of these drinks contain caffeine, and a new study finds that folks who drink more than 400 milligrams of caffeine a day appear more likely to develop…… [Full Story]

- Country Music Legend Jeannie Seely Hospitalized

- Medicare Deals Could Save $6B in Popular Drug Costs

- The Best Time to Shower for a Good Night’s Sleep

- High Blood Pressure Raises Odds for Alzheimer’s Disease

To see this image below in a larger size, depending on your device,

click the image and follow the prompts. For instance, you may be able

to click the image below, select ‘open image in new tab’ and then click the plus sign to expand the image

into a larger or the largest size.