The three Cs, as longer-term manufactured housing pros may recall, are Clayton-Champion-Cavco. The so-called three Cs never really left, although for a time with the merger of Skyline and Champion to get the publicly traded (SKY) name made it expedient and legally accurate to call it Skyline Champion (SKY). From time to time, industry pros would refer to Skyline Champion as just Champion. As the deal with Triad emerged, the signals of the recent formal change by that firm’s corporate board announced the change of the company’s main name in the press release and quarterly report that follows in Part I back to Champion Homes. Hold those thoughts for several beats as we pull back the curtain on some behind-the-scenes realities here at MHProNews, and how it relates to the timing of Part I of this report with analysis.

There are several reports and a range of topics that we routinely have in draft or pending mode. For instance. On this date, 10.5.2024, there are per our editing software a total of 217 articles in Drafts. Some have been there for months, others are more recent, meaning just a few days old. As regular readers on MHProNews know, we obviously ‘like’ to do quarterly reports on publicly traded companies at MHProNews, because they often have keen insights that when carefully examined cut against the stated narrative of the Manufactured Housing Institute (MHI), their blogger and trade media allies, and the corporate insiders that rule the roost at MHI. But MHProNews is under absolutely no obligations to publish quarterly reports for any company. We could, as a runaway #1 independent publisher of manufactured housing “Industry News, Tips, and Views Pros Can Use” © simply stop doing quarterly reports anytime we in our sole discretion want to do so. They are often, on the one hand, a lot of work. Especially doing quarterly earnings call takes hours and hours of detail-oriented effort.

Despite the time and effort needed, those quarterly reports are often among the most popular articles we do in a given month. As noted, some keen insights often emerge from those and other corporate documents which to an expert in manufactured housing reveal clear contradictions between what certain (not all) manufactured housing industry leaders may say and what manufactured housing corporations, trade groups, and others may do.

That said, before diving into Skyline Champion-turned Champion Homes belated quarterly press release, a few more facts and notions are in order.

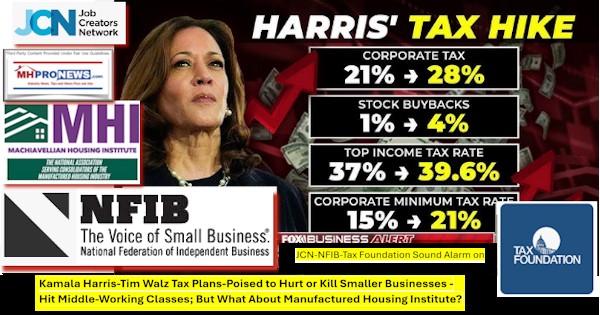

In the industry-expert editorial view of this publication, the pending 2024 election (November 5, 2024, with many states offering options for early voting which is already underway or soon will be) will be highly consequential for our nation and our industry. There is an evidence-based case to be made that if one political party keeps power the vexing status quo of the last 3½ years of inflation-immigration-international or domestic crises including higher debts with higher interest rates and increasing consolidation of power over the mechanisms of American society will obviously continue. If the currently problematic and harmful to tens of millions of Americans status quo is to be changed, then the control of the U.S. Senate and White House must be changed and ideally the control by the opposition party of the current political regime needs to be expanded.

With that in mind, for months, MHProNews has woven in periodic reports on those macro-US and even occasionally on international issues. While that is unique in the diminished MHVille trade media circles, certainly other trade media in other professions may do something similar to what MHProNews does as an informative service for our industry’s professionals, advocates, and others keen on understanding why HUD Code manufactured homes are demonstrably underperforming during an affordable housing crisis despite significant support made potentially available by existing federal laws that are largely improperly enforced. To anyone that ponders the reality of our leaky borders the failure of this regime to control the flow of migrants into our nation in a lawful and orderly manner it is quite understandable that other federal laws can be downplayed, ignored, or even radically twisted beyond their original intention.

That improper enforcement of existing federal laws is the sad but apparently accurate reality of manufactured housing today.

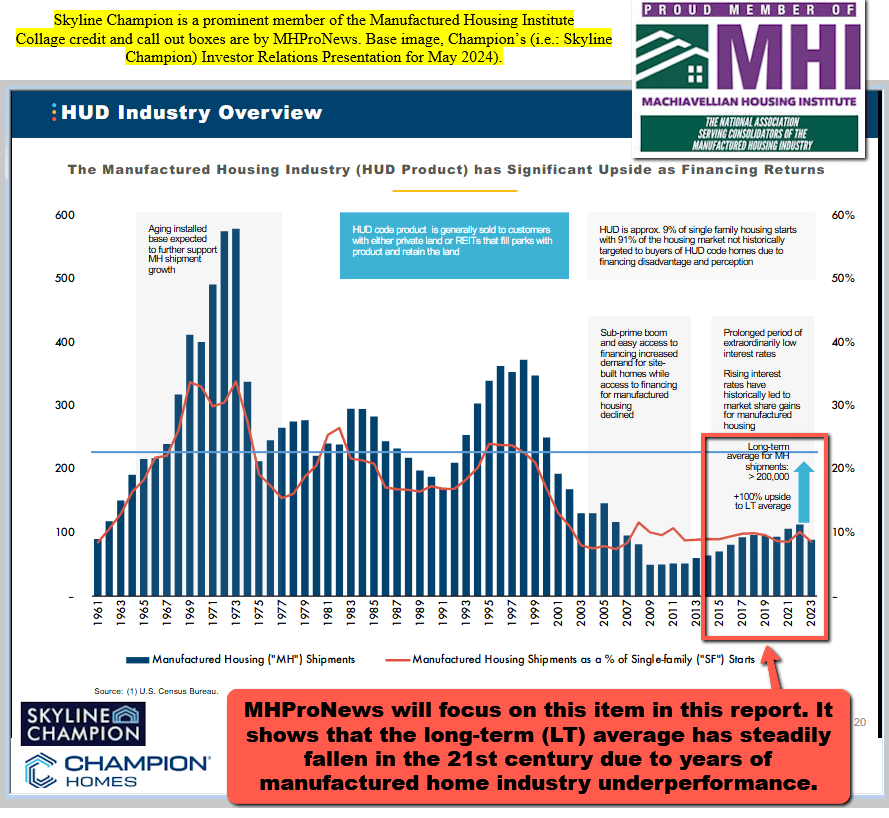

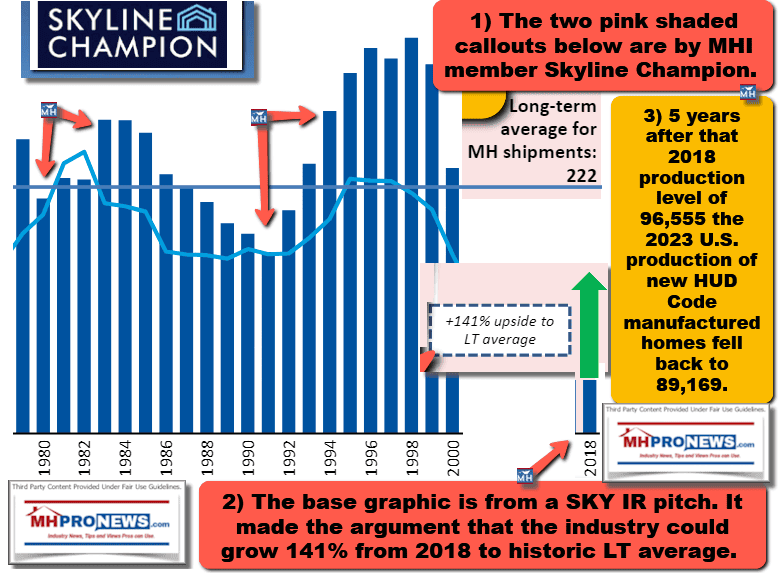

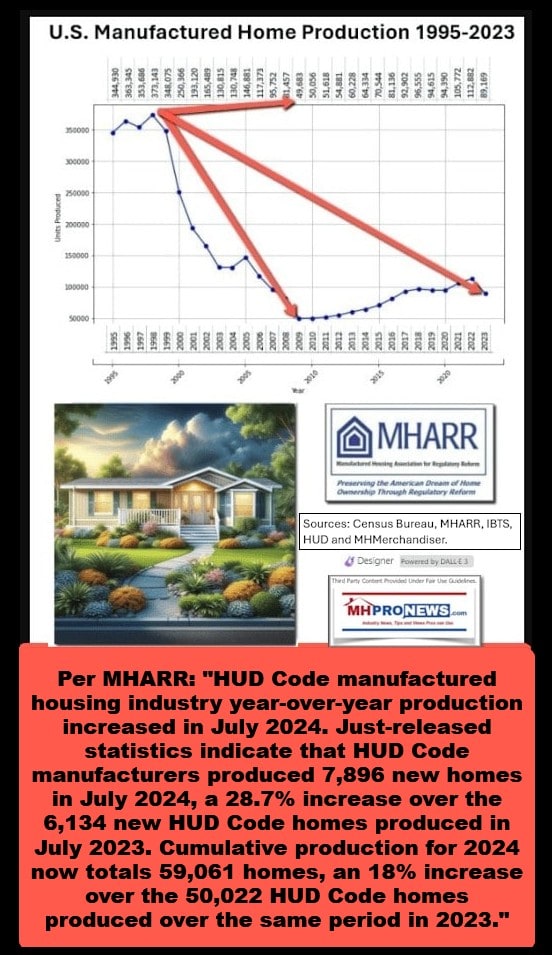

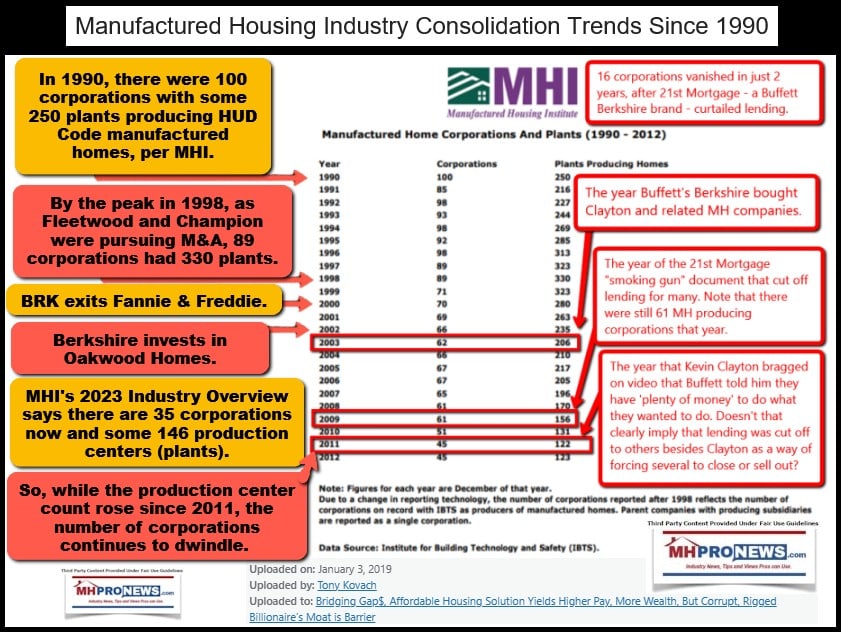

The manufactured home industry is operating at less than 30 percent of its prior peak in 1998 year to date in 2024 despite the fact that technology and quality has improved, supportive laws have been enacted, and the U.S. population has grown significantly. Why do we have an affordable housing crisis in the U.S.? It could be boiled down to the following.

- A lack of proper enforcement by federal officials of existing laws,

- a lack of proper and clear reporting on those concerns by scores of sources (corporate, associations, non-MHProNews/MHLivingNews trade media and bloggers that are basically (albeit crudely) in bed with MHI,

- and a lack of proper efforts to correct the barriers that keep the manufactured housing industry from achieving its authentic potential.

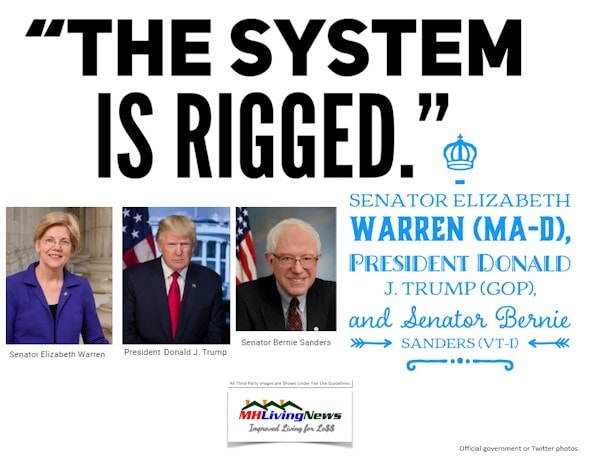

Mildly like Democrats have Republicans as a so-called opposition party in U.S. politics, in the manufactured housing industry, the opposition of the status quo ‘celebrated’ by the Manufactured Housing Institute (MHI) on their home page for weeks on end of their self-proclaimed “partnership” with HUD (and by extension, a similar implication with other federal agencies and officials), the smaller Manufactured Housing Association for Regulatory Reform (MHARR) may act as a counterweight to a corrupted system of advocacy and regulations. MHARR has for years laid out the facts on low new home production that MHI has for years avoided sharing monthly with the public. MHARR has for years laid out the facts and then editorialized about how MHI is failing the industry‘s pro-growth and pro-consumer agenda.

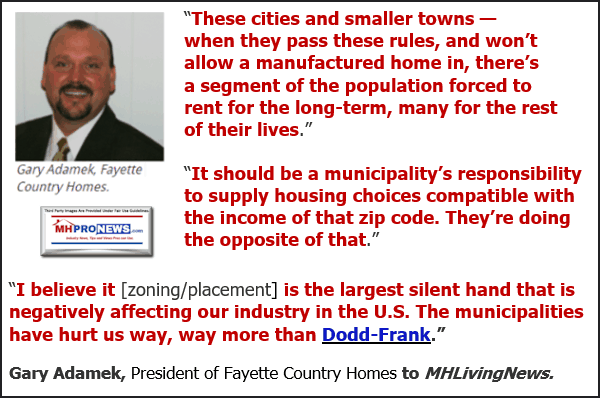

But it isn’t just MHARR – or for that matter, MHProNews/MHLivingNews – that have publicly raised concerns about these issues. Some within MHI have over the years made statements and remarks that point to similar issues that MHARR, MHProNews, and MHLivingNews have documented and reported. For example, during MHI’s once much ballyhooed Preserving Access to Manufactured Housing Act fiasco, MHI and MHI-linked state association members said the following.

As MHProNews/MHLivingNews, then multi-year members of MHI, would ask questions and raise issues, MHI leaders would respond. MHI senior staff and corporate board members of MHI would respond to inquiries at meetings. They would respond to inquiries by phone or email. But as their responses became apparently more and more disconnected with the apparent realities of manufactured housing, The relationship, for some time, seemed rather comfortable. Tim Williams CEO at Berkshire Hathaway owned 21st Mortgage Corporation, a longtime board member, prior chairman, and long a power-broker at MHI and at state associations too, publicly came to the defense of this writer and MHProNews’ reporting of Preserving Access when then vice president Lesli Gooch, Ph.D., publicly questioned this writer’s handling of reports and an interview with MHI award winner Marty Lavin, J.D., a well-known longtime expert in manufactured home lending who had years of experience in communities and with retailing too. Williams said the following in a statement for publication that countered Gooch’s verbal miscue at a Boca Raton FL MHI meeting.

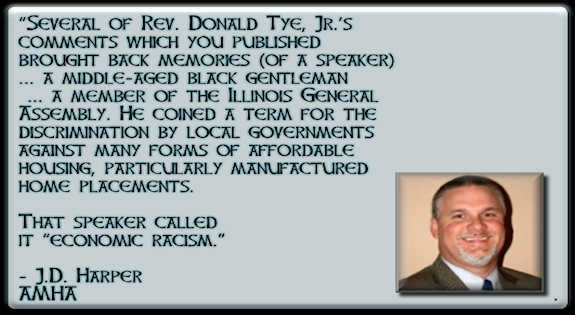

Note that when J.D. Harper, executive director of the MHI-member Arkansas Manufactured Housing Association (AMHA) praised what Rev. Donald Tye had to say, that was a statement made to MHProNews about articles published by MHProNews.

MHI at times sponsored MHProNews, as did several MHI-linked state associations trade show venues, because we turned out the crowds when the industry was at or near its lowest ebb in the 21st century. This is undeniable historic fact. MHI would ask MHProNews to run certain articles, likely because they knew then (and now), that we have the runaway largest audience of its kind in the industry. One of those items that MHI asked to be published included the following pull quote.

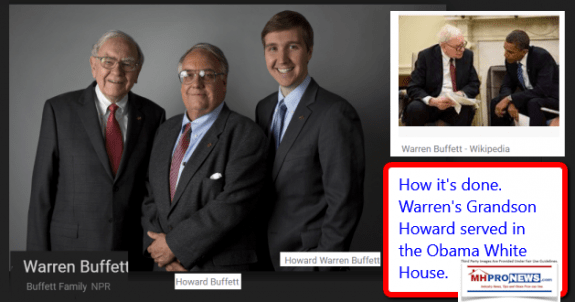

You don’t have to have a Ph.D., as Lesli Gooch and her supporters like to tout, to realize that when the President of the United States (POTUS) (at that time, Barack Obama (D) with his then VP Joe Biden (D) 1-2009 to 1-2017) is saying that he will veto such legislation if it ever hits his desk, that a different approach is required. But stop and think. As a U.S. Senator, Joe Biden (DE-D) voted in support of the Housing and Economic Recovery Act of 2008. Biden voted in support of the Manufactured Housing Improvement Act of 2000 (a.k.a.: MHIA, 2000 Reform Act, 2000 Reform Law, etc.) and its enhanced preemption provision. MHI has for years touted their access, which they have aptly demonstrated. Which begs the question. What have they actually accomplished with that access? Furthermore, with MHI members Clayton Homes, 21st Mortgage Corporation, and Vanderbilt Mortgage and Finance (VMF), besides Shaw and other firms owned by Warren Buffett led Berkshire Hathaway (BRK), it seems obvious in hindsight that access to the Obama-Biden era White House, HUD, FHFA, CFPB, DOE, or whomever was all but assured. Yet, Buffett supported Obama-Biden for reelection. Buffett may be many things, but dumb is not one of them. In essence, MHI leaders were pushing a policy that was demonstrably flawed from the start.

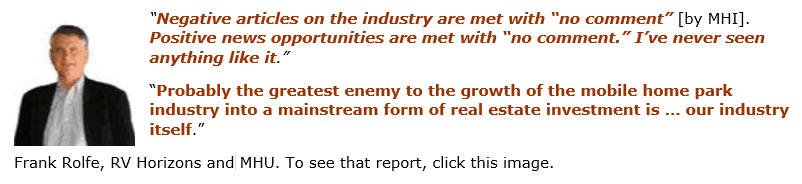

Frank Rolfe may be notorious and have some terrible business practices with respect to his land-lease manufactured home community residents. But Rolfe has at times said some pretty insightful things about MHI.

While there is more evidence, and one might wish that there were still more that would come forward to openly complain about MHI’s performance, there is ample evidence to make the points previously made.

Often using MHI’s own members, statements, and examples, there is evidence that manufactured housing is suffering at historically low levels for the following reasons.

- A lack of proper enforcement by federal officials of existing laws,

- a lack of proper and clear reporting on those concerns by scores of sources (corporate, associations, non-MHProNews/MHLivingNews trade media and bloggers that are basically (albeit crudely) in bed with MHI,

- and a lack of proper efforts to correct the barriers that keep the manufactured housing industry from achieving its authentic potential.

And MHI pays lip service and postures efforts to grow the industry organically. They do so via meetings, messages, their own website, occasional op-eds, and events. But all the while what is occurring in the 21st century is the apparent facilitation or steady consolidation of manufactured housing into ever fewer hands.

Investors, investment analysts, affordable housing advocates, public officials, independents, and top MHI insiders alike are all among the readers here at MHProNews. They don’t come for conspiracy theories or mere speculation. They come because they find authentic manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © Those thousands of professionals come because of tons of facts that are outlined with expert insights that help make sense of the facts.

![DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPut[HUDCodeManufactured]HomesMHProNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2023/11/DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPutHUDCodeManufacturedHomesMHProNews.jpg)

The latest new home production data is found at this link here: https://www.manufacturedhomepronews.com/embarrassing-corruption-collusion-cronyism-charged-as-new-hud-code-manufactured-home-industry-production-increases-in-august-2024-manufactured-housing-facts-critical-analysis-plus-mhmarkets/

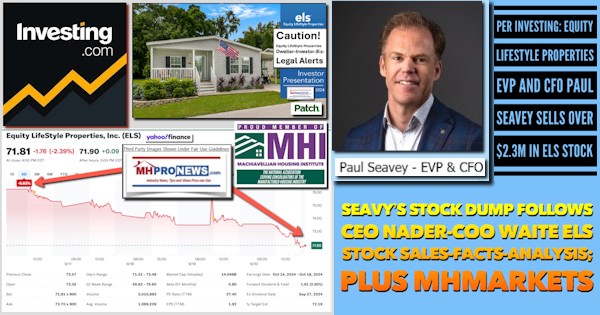

At the current pace, manufactured housing may finish around the 100,000 new home mark (+/-). That would be akin to a return to the last year of the Trump Administration. The regulatory and economic environment are major hurdles for our industry. That is why we as a publication have for years invested the time and expertise in reporting on macro-issues instead of just manufactured housing industry specific facts alone. This article could have been published in about 1/6th of the time (maybe less) if all we did is provide the Champion press release, which follows in Part I. The problem, however, for readers would be this. Even if every single thing that Champion said might be accurate or true, lacking context, information alone may be misleading or meaningless. If the major players (beyond Berkshire and the huge asset management titans like BlackRock, Vanguard, or State Street, etc.) in manufactured housing were so enraptured with the future potential for growth of the industry, why are so many corporate insiders selling stocks instead of buying shares?

MHI may pretend to be nonpartisan, and they arguably should be nonpartisan. But there are apparent reasons to believe that MHI leaders are more aligned with Democrats than Republicans.

MHARR doesn’t get directly involved in party and partisan politics. Neither should MHI. It is understandable that MHI’s PAC donates to members of both major parties. But in doing so, MHI should expect in return that those politicians push openly, loudly, and routinely for the full and proper enforcement of existing federal laws that would unleash manufactured housing. MHI’s prior president and CEO all but said as much.

MHI President and CEO Chris Stinebert said in an interview almost exactly 20 years ago that the industry would be returning to its production levels achieved in the late 1990s. Meanwhile, an MHI insider said that it is ‘f-cking greedy’ insiders who since Stinebert left MHI have turned MHI into a tool for their own benefit.

The irony is this. The industry’s insiders would make more money by doing the commonsense things that MHARR and MHProNews/MHLivingNews have editorially long championed. That begs the question. Why aren’t they doing that? Multi-year MHI member Andy Gedo helped explain it. It is due to barriers of entry, persistence, and exit. But the rest of the puzzle may well be supplied by those institutional giants that have sizable stakes not only in manufactured housing, but also in conventional builders, real estate, and rental housing. While someone can certainly debate the use of the term ‘private equity’ in the headline below, what is not debatable is the point that institutional investors and/or private equity are an apparent barrier to affordable housing. And thus, Frank Rolfe’s points linked above and here holds true.

Is there more to know about industry consolidation and related? Absolutely. See that in Part II following the belated publishing of this Champion (SKY) press release shown in Part I below.

Part I

Champion Homes Announces First Quarter Fiscal 2025 Results

TROY, Mich.–(BUSINESS WIRE)–Champion Homes, Inc., formerly known as Skyline Champion Corporation (NYSE: SKY) (“Champion Homes”), today announced financial results for its first quarter ended June 29, 2024 (“fiscal 2025”).

“Management’s Discussion and Analysis of Financial Condition and Results of Operations”

Skyline Champion Corporation Changes Corporate Name Change to Champion Homes, Inc.

First Quarter Fiscal 2025 Highlights (compared to First Quarter Fiscal 2024)

- Net sales increased 35.1% to $627.8 million

- U.S. homes sold increased 35.7% to 6,538

- Total backlog increased 28.2% to $405 million from the sequential fourth quarter

- Average selling price (“ASP”) per U.S. home sold increased 3.0% to $91,700

- Gross profit margin contracted by 170 basis points to 26.2%

- Net income decreased by 10.7% to $45.8 million

- Earnings per diluted share (“EPS”) decreased 11.2% to $0.79

- Adjusted net income increased 3.5% to $53.0 million

- Adjusted earnings per share (“Adjusted EPS”) increased 2.2% to $0.91

- Adjusted EBITDA increased 12.2% to $75.0 million

- Adjusted EBITDA margin contracted by 250 basis points to 11.9%

- Net cash generated by operating activities of $84.6 million during the quarter

- Repurchased $20.0 million of shares under the previously announced share repurchase program

“I am excited to announce that our shareholders approved our corporate Company name change to Champion Homes, Inc. during our annual meeting this year. The name change aligns with our previously launched Champion Homes flagship brand supporting a unified Company, our purpose of championing home attainability and the customer experience, as well as the Company’s direct-to-consumer marketing and digital expansion,” said Mark Yost, Champion Homes’ President, and Chief Executive Officer. “In addition, I am pleased to report Champion Homes delivered strong results for the first quarter of fiscal 2025. Throughout the quarter, we experienced an increase in demand for our homes evidenced by growing sales and backlog. This positive trend reflects the benefits of our strategic investments in expanding our retail footprint and capitalizing on the growing need for attainable housing in the market. As we continue to advance our strategic initiatives, expand our capabilities, and strengthen our value proposition, Champion Homes is ideally positioned to drive growth and deliver value to our shareholders for the foreseeable future.”

First Quarter Fiscal 2025 Results

Net sales for the first quarter fiscal 2025 increased 35.1% to $627.8 million compared to the prior-year period. The number of U.S. homes sold in the first quarter fiscal 2024 increased 35.7% to 6,538 driven by sales of $151.5 million from the Regional Homes acquisition and healthy demand in the community sales channel. The ASP per U.S. home sold increased 3.0% to $91,700 primarily due to the higher mix of retail units sold during the quarter. The number of Canadian factory-built homes sold in the quarter decreased to 167 homes compared to 221 homes in the prior-year period due to softening demand in certain markets.

Gross profit increased by 26.6% to $164.2 million in the first quarter fiscal 2025 compared to the prior-year period. Gross profit margin was 26.2% of net sales, a 170-basis point contraction compared to 27.9% in the first quarter fiscal 2024. Gross margin contraction reflects lower ASPs on wholesale new homes sold, a shift in product mix, the ramping of previously idle facilities and the impact of purchase accounting from the Regional Homes acquisition.

Selling, general, and administrative expenses (“SG&A”) in the first quarter fiscal 2025 increased to $108.8 million from $70.4 million in the same period last year. SG&A during the quarter increased due to the Regional Homes acquisition, including a charge of $7.9 million for the change in the fair value of the contingent consideration, as well as higher variable compensation. SG&A as a percentage of net sales was 17.3%, compared to 15.2% in the prior year period.

Net income decreased by 10.7% to $45.8 million for the first quarter fiscal 2025 compared to the prior-year period. The decrease in net income was driven by lower gross margin as a percentage of sales and higher SG&A expenses for the quarter.

Adjusted EBITDA for the first quarter fiscal 2025 increased by 12.2% to $75.0 million compared to the first quarter fiscal 2024. Adjusted EBITDA margin for the quarter was 11.9%, compared to 14.4% in the prior-year period.

As of June 29, 2024, Champion Homes had $548.9 million of cash and cash equivalents, an increase of $53.9 million in the current quarter. The Company repurchased approximately 292,000 shares of its common stock during the quarter for approximately $20 million. On August 1, 2024, the Board of Directors refreshed the amount of the share repurchase program back up to an aggregate amount of $100 million.

Conference Call and Webcast Information

Champion Homes’ management will host a conference call tomorrow, August 7, 2024, at 9:00 a.m. Eastern Time, to discuss Champion Homes’ financial results and an update on current operations.

Investors and other interested parties can listen to a webcast of the live conference call by logging onto the Investor Relations section of Champion Homes’ website at skylinechampion.com. The online replay will be available on the same website immediately following the call.

The conference call can also be accessed by dialing (800) 274-8461 (domestic) or (203) 518-9814 (international) and using the conference ID: SKYLINE. A telephonic replay will be available approximately two hours after the call by dialing (844) 512-2921, or for international callers, (412) 317-6671. The passcode for the live call and the replay is 11156397. The replay will be available until 11:59 P.M. Eastern Time on August 21, 2024.

About Champion Homes, Inc.

Champion Homes, Inc. (NYSE: SKY) is a leading producer of factory-built housing in North America and employs approximately 8,800 people. With more than 70 years of homebuilding experience and 48 manufacturing facilities throughout the United States and western Canada, Champion Homes is well positioned with an innovative portfolio of manufactured and modular homes, ADUs, park-models and modular buildings for the single-family, multi-family, and hospitality sectors.

In addition to its core home building business, Champion Homes provides construction services to install and set-up factory-built homes, operates a factory-direct retail business with 72 retail locations across the United States, and operates Star Fleet Trucking, providing transportation services to the manufactured housing and other industries from several dispatch locations across the United States.

Champion Homes builds homes under some of the most well-known brand names in the factory-built housing industry including Skyline Homes, Champion Homes, Genesis Homes, Regional Homes, Athens Park Models, Dutch Housing, Atlantic Homes, Excel Homes, Homes of Merit, New Era, Redman Homes, ScotBilt Homes, Shore Park, Silvercrest, Titan Homes in the U.S. and Moduline and SRI Homes in western Canada.

Presentation of Non-GAAP Financial Measures

In addition to the results provided in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) throughout this press release, Champion Homes has provided Non-GAAP financial measures, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, and Adjusted EPS, (collectively the “Non-GAAP Financial Measures”) which present operating results on a basis adjusted for certain items. Champion Homes uses these Non-GAAP Financial Measures for business planning purposes and in measuring its performance relative to that of its competitors. Champion Homes believes that these Non-GAAP Financial Measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that Champion Homes believes are not representative of its core business. These Non-GAAP Financial Measures are not intended to replace, and should not be considered superior to, the presentation of Champion Homes’ financial results in accordance with U.S. GAAP.

Champion Homes defines Adjusted EBITDA as net income or loss plus expenses or minus income, (a) the provision for income taxes, (b) interest income or expense, net, (c) depreciation and amortization, (d) gain or loss from discontinued operations, (e) non-cash restructuring charges and impairment of assets, (f) equity in net earnings or losses of ECN, (g) charges related to the remediation of the water intrusion product liability claims; and (h) other non-operating income and costs, including but not limited to those costs for the acquisition and integration or disposition of businesses, including the change in fair value of contingent consideration, and idle facilities. Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided by net sales reported in the income statements.

Champion Homes defines Adjusted Net Income as net income or loss plus expenses or minus income (net of tax where applicable), (a) gain or loss from discontinued operations, (b) non-cash restructuring charges and impairment of assets, (c) equity in net earnings or losses of ECN, (d) charges related to the remediation of estimated water intrusion product liability, and (e) other non-operating income or expense including, but not limited to those costs for the acquisition and integration or disposition of businesses, including the change in fair value of contingent consideration, and idle facilities. Champion Homes defines Adjusted EPS as Adjusted Net Income divided by shares outstanding.

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and Adjusted EPS are not measures of earnings calculated in accordance with U.S. GAAP, and should not be considered an alternative to, or more meaningful than, net income or loss, net sales, operating income or earnings per share prepared on a U.S. GAAP basis. These Non-GAAP Financial Measures do not purport to represent cash flow provided by, or used in, operating activities as defined by U.S. GAAP. Champion Homes believes that similar Non-GAAP Financial Measures are commonly used by investors to evaluate its performance and that of its competitors. However, Champion Homes use of Non-GAAP Financial Measures may vary from that of others in its industry. The Non-GAAP Financial Measures are reconciled from the respective measure under U.S. GAAP in the tables below.

Forward-Looking Statements

Statements in this press release, including certain statements regarding Champion Homes’ strategic initiatives, and future market demand are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by use of words such as “believe,” “expect,” “future,” “anticipate,” “intend,” “plan,” “foresee,” “may,” “could,” “should,” “will,” “potential,” “continue,” or other similar words or phrases. Similarly, statements that describe objectives, plans, or goals also are forward-looking statements. Such forward-looking statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of Champion Homes. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, implied, or projected by such forward-looking statements. Risks and uncertainties include regional, national and international economic, financial, public health and labor conditions, and the following: supply-related issues, including prices and availability of materials; labor-related issues; inflationary pressures in the North American economy; the cyclicality and seasonality of the housing industry and its sensitivity to changes in general economic or other business conditions; demand fluctuations in the housing industry, including as a result of actual or anticipated increases in homeowner borrowing rates; the possible unavailability of additional capital when needed; competition and competitive pressures; changes in consumer preferences for our products or our failure to gauge those preferences; quality problems, including the quality of parts sourced from suppliers and related liability and reputational issues; data security breaches, cybersecurity attacks, and other information technology disruptions; the potential disruption of operations caused by the conversion to new information systems; the extensive regulation affecting the production and sale of factory-built housing and the effects of possible changes in laws with which we must comply; the potential impact of natural disasters on sales and raw material costs; the risks associated with mergers and acquisitions, including integration of operations and information systems; periodic inventory adjustments by, and changes to relationships with, independent retailers; changes in interest and foreign exchange rates; insurance coverage and cost issues; the possibility that all or part of our intangible assets, including goodwill, might become impaired; the possibility that all or part of our investment in ECN Capital Corp. (“ECN”) might become impaired; the possibility that our risk management practices may leave us exposed to unidentified or unanticipated risks; the potential disruption to our business caused by public health issues, such as an epidemic or pandemic, and resulting government actions; the possibility our share repurchase program will not enhance long-term stockholder value, could increase the volatility of our stock price, and diminish our cash reserves; and other risks set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section, and other sections, as applicable, in our Annual Reports on Form 10-K, including our Annual Report on Form 10-K for the fiscal year ended March 30, 2024 previously filed with the Securities and Exchange Commission (“SEC”), as well as in our Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, filed with or furnished to the SEC.

If any of these risks or uncertainties materializes or if any of the assumptions underlying such forward-looking statements proves to be incorrect, then the developments and future events concerning Champion Homes set forth in this press release may differ materially from those expressed or implied by these forward-looking statements. You are cautioned not to place undue reliance on these statements, which speak only as of the date of this release. We anticipate that subsequent events and developments will cause our expectations and beliefs to change. Champion Homes assumes no obligation to update such forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, unless obligated to do so under the federal securities laws.

CHAMPION HOMES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, dollars and shares in thousands)

|

|

|

June 29, 2024 |

|

|

March 30, 2024 |

|

||

|

ASSETS |

|

|

|

|

|

|

||

|

Current assets: |

|

|

|

|

|

|

||

|

Cash and cash equivalents |

|

$ |

548,933 |

|

|

$ |

495,063 |

|

|

Trade accounts receivable, net |

|

|

72,706 |

|

|

|

64,632 |

|

|

Inventories, net |

|

|

319,958 |

|

|

|

318,737 |

|

|

Other current assets |

|

|

34,331 |

|

|

|

39,870 |

|

|

Total current assets |

|

|

975,928 |

|

|

|

918,302 |

|

|

Long-term assets: |

|

|

|

|

|

|

||

|

Property, plant, and equipment, net |

|

|

293,390 |

|

|

|

290,930 |

|

|

Goodwill |

|

|

357,973 |

|

|

|

357,973 |

|

|

Amortizable intangible assets, net |

|

|

73,459 |

|

|

|

76,369 |

|

|

Deferred tax assets |

|

|

27,645 |

|

|

|

26,878 |

|

|

Other noncurrent assets |

|

|

258,735 |

|

|

|

252,889 |

|

|

Total assets |

|

$ |

1,987,130 |

|

|

$ |

1,923,341 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

||

|

Current liabilities: |

|

|

|

|

|

|

||

|

Floorplan payable |

|

$ |

92,858 |

|

|

$ |

91,286 |

|

|

Accounts payable |

|

|

61,448 |

|

|

|

50,820 |

|

|

Other current liabilities |

|

|

264,388 |

|

|

|

247,495 |

|

|

Total current liabilities |

|

|

418,694 |

|

|

|

389,601 |

|

|

Long-term liabilities: |

|

|

|

|

|

|

||

|

Long-term debt |

|

|

24,684 |

|

|

|

24,669 |

|

|

Deferred tax liabilities |

|

|

7,060 |

|

|

|

6,905 |

|

|

Other liabilities |

|

|

85,945 |

|

|

|

79,796 |

|

|

Total long-term liabilities |

|

|

117,689 |

|

|

|

111,370 |

|

|

|

|

|

|

|

|

|

||

|

Stockholders’ Equity: |

|

|

|

|

|

|

||

|

Common stock |

|

|

1,598 |

|

|

|

1,605 |

|

|

Additional paid-in capital |

|

|

574,365 |

|

|

|

568,203 |

|

|

Retained earnings |

|

|

889,837 |

|

|

|

866,485 |

|

|

Accumulated other comprehensive loss |

|

|

(15,053 |

) |

|

|

(13,923 |

) |

|

Total stockholders’ equity |

|

|

1,450,747 |

|

|

|

1,422,370 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

1,987,130 |

|

|

$ |

1,923,341 |

|

CHAMPION HOMES, INC.

CONDENSED CONSOLIDATED INCOME STATEMENTS

(Unaudited, dollars and shares in thousands, except per share amounts)

|

|

|

Three months ended |

|

|||||

|

|

|

June 29, 2024 |

|

|

July 1, 2023 |

|

||

|

Net sales |

|

$ |

627,779 |

|

|

$ |

464,769 |

|

|

Cost of sales |

|

|

463,564 |

|

|

|

335,096 |

|

|

Gross profit |

|

|

164,215 |

|

|

|

129,673 |

|

|

Selling, general, and administrative expenses |

|

|

108,827 |

|

|

|

70,439 |

|

|

Operating income |

|

|

55,388 |

|

|

|

59,234 |

|

|

Interest (income), net |

|

|

(4,249 |

) |

|

|

(9,301 |

) |

|

Other (income) |

|

|

(1,219 |

) |

|

|

— |

|

|

Income before income taxes |

|

|

60,856 |

|

|

|

68,535 |

|

|

Income tax expense |

|

|

13,719 |

|

|

|

17,266 |

|

|

Net income before equity in net loss of affiliates |

|

|

47,137 |

|

|

|

51,269 |

|

|

Equity in net loss of affiliates |

|

|

1,343 |

|

|

|

— |

|

|

Net income |

|

$ |

45,794 |

|

|

$ |

51,269 |

|

|

Net income per share: |

|

|

|

|

|

|

||

|

Basic |

|

$ |

0.79 |

|

|

$ |

0.90 |

|

|

Diluted |

|

$ |

0.79 |

|

|

$ |

0.89 |

|

CHAMPION HOMES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, dollars in thousand)

|

|

|

Three months ended |

|

|||||

|

|

|

June 29, 2024 |

|

|

July 1, 2023 |

|

||

|

|

|

|

|

|||||

|

Cash flows from operating activities |

|

|

|

|

|

|

||

|

Net income |

|

$ |

45,794 |

|

|

$ |

51,269 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

||

|

Depreciation and amortization |

|

|

10,612 |

|

|

|

7,592 |

|

|

Amortization of deferred financing fees |

|

|

93 |

|

|

|

69 |

|

|

Equity-based compensation |

|

|

6,090 |

|

|

|

5,428 |

|

|

Deferred taxes |

|

|

(653 |

) |

|

|

(997 |

) |

|

Loss on disposal of property, plant, and equipment |

|

|

43 |

|

|

|

1 |

|

|

Foreign currency transaction loss (gain) |

|

|

212 |

|

|

|

(207 |

) |

|

Equity in net loss of affiliates |

|

|

1,343 |

|

|

|

— |

|

|

Dividends from equity method investment |

|

|

522 |

|

|

|

— |

|

|

Change in fair value of contingent consideration |

|

|

7,912 |

|

|

|

— |

|

|

Change in assets and liabilities: |

|

|

|

|

|

|

||

|

Accounts receivable |

|

|

(8,088 |

) |

|

|

16,676 |

|

|

Floor plan receivables |

|

|

(10,603 |

) |

|

|

— |

|

|

Inventories |

|

|

(1,375 |

) |

|

|

6,173 |

|

|

Other assets |

|

|

5,541 |

|

|

|

(6,974 |

) |

|

Accounts payable |

|

|

10,950 |

|

|

|

1,375 |

|

|

Accrued expenses and other liabilities |

|

|

16,223 |

|

|

|

(5,548 |

) |

|

Net cash provided by operating activities |

|

|

84,616 |

|

|

|

74,857 |

|

|

Cash flows from investing activities |

|

|

|

|

|

|

||

|

Additions to property, plant, and equipment |

|

|

(10,712 |

) |

|

|

(10,341 |

) |

|

Investment in floor plan loans |

|

|

— |

|

|

|

(18,466 |

) |

|

Proceeds from floor plan loans |

|

|

1,606 |

|

|

|

3,184 |

|

|

Proceeds from disposal of property, plant, and equipment |

|

|

24 |

|

|

|

8 |

|

|

Net cash used in provided by investing activities |

|

|

(9,082 |

) |

|

|

(25,615 |

) |

|

Cash flows from financing activities |

|

|

|

|

|

|

||

|

Changes in floor plan financing, net |

|

|

1,573 |

|

|

|

— |

|

|

Payments on long term debt |

|

|

(1 |

) |

|

|

— |

|

|

Payments on repurchase of common stock |

|

|

(20,000 |

) |

|

|

— |

|

|

Stock option exercises |

|

|

75 |

|

|

|

— |

|

|

Tax payments for equity-based compensation |

|

|

(2,251 |

) |

|

|

(961 |

) |

|

Net cash used in financing activities |

|

|

(20,604 |

) |

|

|

(961 |

) |

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

(1,060 |

) |

|

|

1,983 |

|

|

Net increase in cash and cash equivalents |

|

|

53,870 |

|

|

|

50,264 |

|

|

Cash and cash equivalents at beginning of period |

|

|

495,063 |

|

|

|

747,453 |

|

|

Cash and cash equivalents at end of period |

|

$ |

548,933 |

|

|

$ |

797,717 |

|

CHAMPION HOMES, INC.

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA

(Unaudited, dollars in thousand)

|

|

|

Three months ended |

|

|||||

|

|

|

June 29, 2024 |

|

|

July 1, 2023 |

|

||

|

Reconciliation of Adjusted EBITDA: |

|

|

|

|

|

|

||

|

Net income |

|

$ |

45,794 |

|

|

$ |

51,269 |

|

|

Income tax expense |

|

|

13,719 |

|

|

|

17,266 |

|

|

Interest (income), net |

|

|

(4,249 |

) |

|

|

(9,301 |

) |

|

Depreciation and amortization |

|

|

10,612 |

|

|

|

7,592 |

|

|

EBITDA |

|

|

65,876 |

|

|

|

66,826 |

|

|

Equity in net loss of ECN |

|

|

1,179 |

|

|

|

— |

|

|

Change in fair value of contingent consideration |

|

|

7,912 |

|

|

|

— |

|

|

Adjusted EBITDA |

|

$ |

74,967 |

|

|

$ |

66,826 |

|

CHAMPION HOMES, INC.

RECONCILIATION OF NET INCOME TO ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER SHARE

(Unaudited, dollars and shares in thousands, except per share amounts)

(Certain amounts shown net of tax, as applicable)

|

|

|

Three months ended |

|

|||||

|

|

|

June 29, 2024 |

|

|

July 1, 2023 |

|

||

|

|

|

|

|

|

|

|

||

|

Net income |

|

$ |

45,794 |

|

|

$ |

51,269 |

|

|

Adjustments: |

|

|

|

|

|

|

||

|

Equity in net loss of ECN |

|

|

1,179 |

|

|

|

— |

|

|

Change in fair value of contingent consideration |

|

|

6,088 |

|

|

|

— |

|

|

Adjusted net income attributable to the Company’s common shareholders |

|

$ |

53,061 |

|

|

$ |

51,269 |

|

|

Adjusted basic net income per share |

|

$ |

0.92 |

|

|

$ |

0.90 |

|

|

Adjusted diluted net income per share |

|

$ |

0.91 |

|

|

$ |

0.89 |

|

|

Average basic shares outstanding |

|

|

57,865 |

|

|

|

57,183 |

|

|

Average diluted shares outstanding |

|

|

58,335 |

|

|

|

57,658 |

|

Part II – Additional Information with More MHProNews Analysis and Commentary in Brief

1) The late, great sales, motivational coach, speaker and author Zig Ziglar used to talk about those who will get ‘around to it.’ Ziglar turned that phrase into various objects that included a circle with the letters TUIT inside. As a closing technique, he would say to a prospect, okay, now you have your round tuit so you can take that next step now.

2) Ziglar also championed (pardon the pun) the ideal that people could get everything out of life that they wanted if they could help enough other people get out of life what those potential clients desired.

3) Those ideals were at the root of millions of smaller American businesses thinking for generations. Serve your customer well. Let happy customers refer their friends. The tragic irony of the manufactured housing industry’s consolidation focused insiders turns those ideals on their head. They champion instead underperformance that leads to consolidation and creates scarcity.

Fresh take? This story above has been told for years. Clearly, a better effort is needed.

4) UMH Properties (UMH) is at least philosophically stating and making their evidence-based case that older properties where mom and pops want to exit can be consolidated, but also that new developments are needed and are profitable. For making that heretical statement that goes against the consolidation with minimal development grift, Rolfe called the Landys plan “asinine.”

5) As MHARR via their efforts, MHProNews/MHLivingNews via ours – which more recently has included utilizing this writer’s status as a contributing writer for the Patch, a systematic exposure of self-imposed low production status quo that MHI insiders and various federal and other public officials all too gladly cooperate with. MHI and their allies gets to occasionally slam public officials. But the status quo of historic underperformance remains the same.

Speaking of historic, a new research report has been provided to MHProNews by one of the co-authors of that research. It makes a fresh, detailed, and evidence-based case for manufactured housing potential. Watch for it here on MHProNews, because like quarterly reports or other facts that may require time, effort, or serious analysis, the odds that you will find it from MHI or an MHI linked trade publication are close to nil.

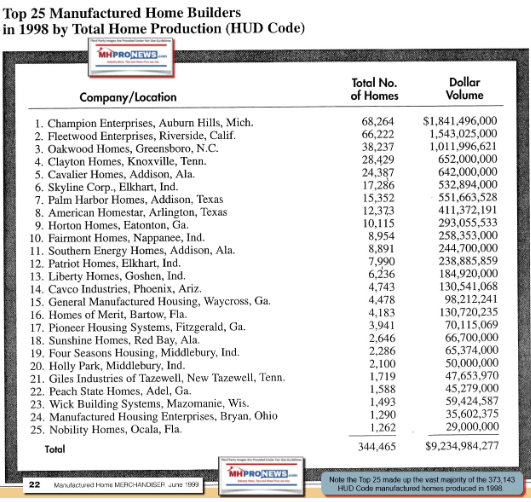

6) Let’s make just one more point from the facts provided by Champion above. In the late 1990s, Champion and Fleetwood were neck and neck as the #1 and #2 producers of HUD Code manufactured homes. The entire manufactured home industry today is operating at a lower production rate than Champion and Fleetwood used to produce between the two of them in the late 1990s. Embarrassing! But that is why only MHProNews and/or MHLivingNews shares such factual insights. Because if someone gets enough facts in their minds, and if that person begins to question some MHI corporate or association narrative, the narrative falls apart under the weight of common sense and evidence.

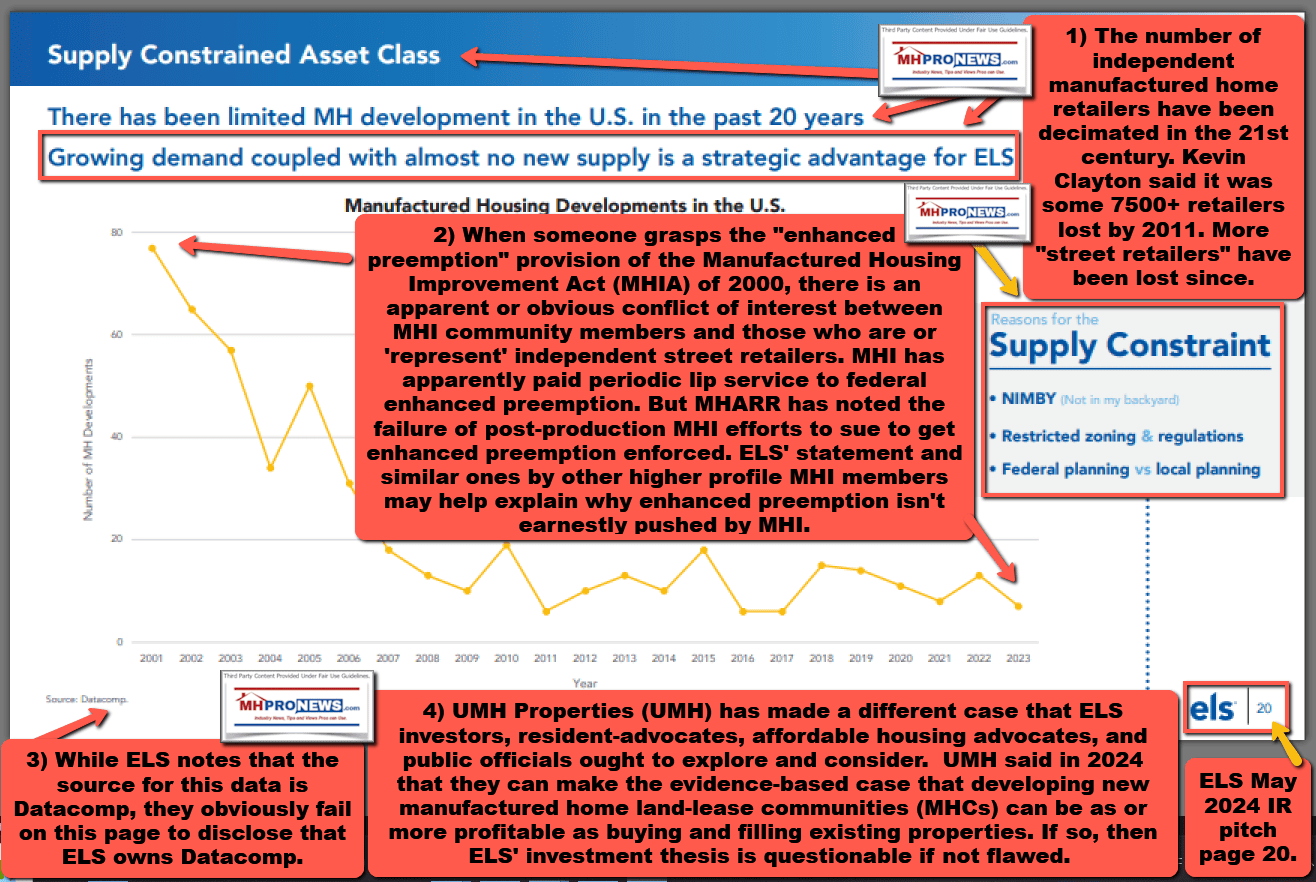

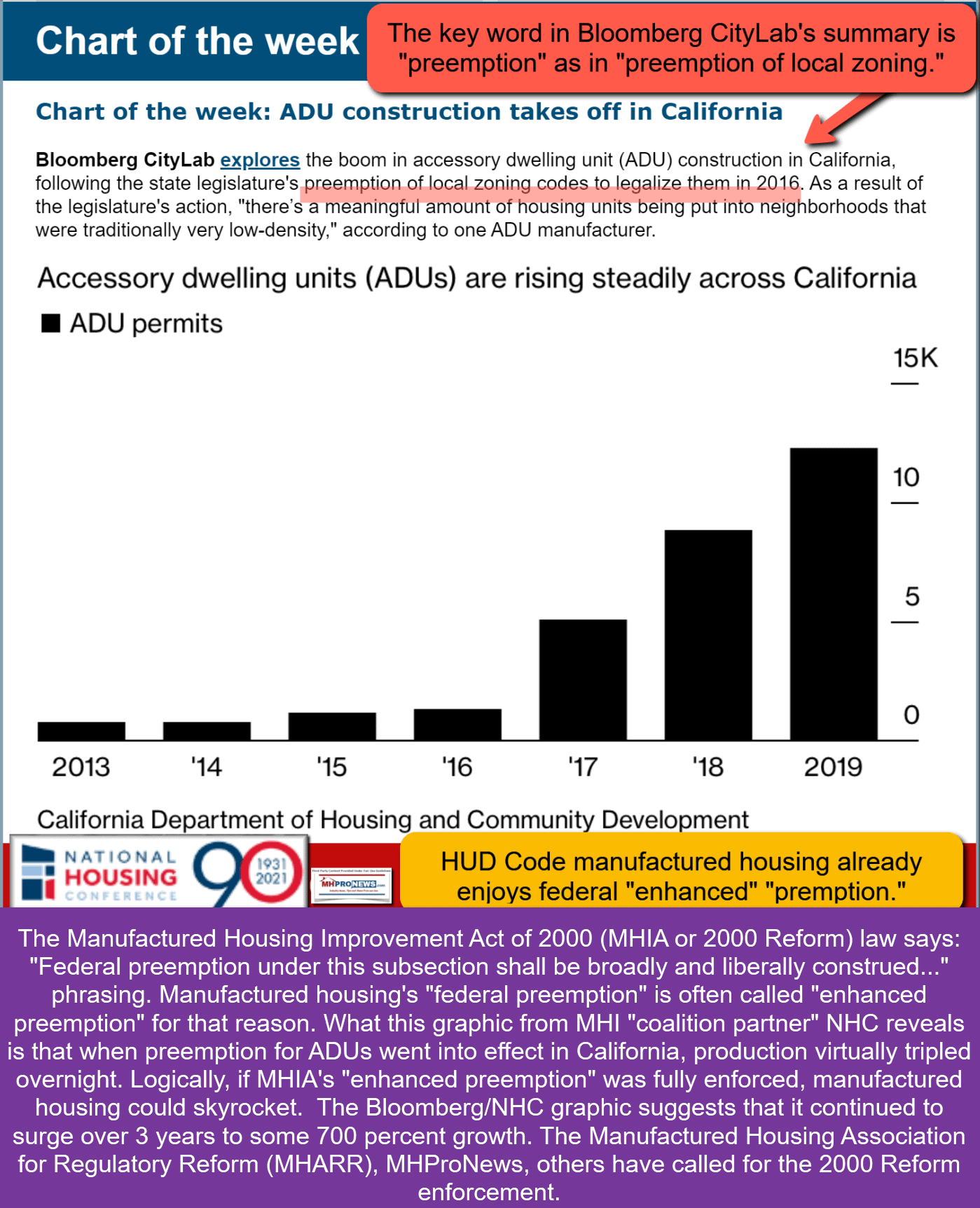

If the federal enhanced preemption provision of MHIA of 2000 were routinely enforced, as statewide preemption for ADUs were enforced in California, manufactured housing production would soar. That’s not to say that financing and the DOE energy rules aren’t important. They are. But federal preemption enforcement alone could create a boom of unprecedented proportions for manufactured housing.

Watch for the pending special report mentioned earlier. Watch for a follow up on Champion Homes that will reveal factual insights not likely to be found elsewhere. In the meantime, if you have early voting in your state, register and then vote wisely. A rigged system will not be corrected by those who rigged it.

https://vote.gov

PS: according to: “This Day in History” per Real Clear Politics (RCP) the trends are “a potential problem” for Kamala Harris (D) and Governor Tim Walz (MN-D).

TDIH – Oct 4: 2024: Harris +2.2 | 2020: Biden +8.1 | 2016: Clinton +3.8 | Map

Trump (R) has routinely outperformed polling. Trump won in 2016. Despite projections in 2020, and even if you believe the results were not tainted by election fraud, he only lost narrowly in 2020. Kamala Harris (D) is doing worse than Biden or Clinton.

See the linked and related reports to learn more. Or check out our popular series on the Patch.

The market report is up next.

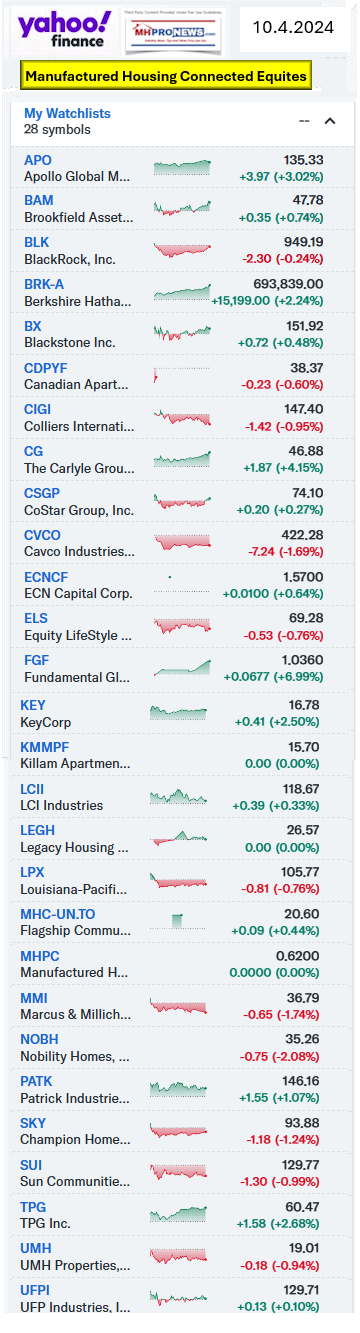

Part III

Our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

NOTICE: following the TPG deal with CAPREIT, TPG has been added to our tracked stocks list below.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report at the closing bell, so that investors can see-at-glance the type of topics may have influenced other investors. Our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines for a more balanced report.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

- In minutes a day, readers can get a good sense of significant or major events while keeping up with the trends that may be impacting manufactured housing connected investing.

Headlines from left-of-center CNN Business – 10.4.2024

- Mark Zuckerberg joins exclusive $200 billion club, is second-richest person in world

- US economy added a whopping 254,000 jobs last month

- Not using these job interview tips can reduce your chances of getting that job

- The port strike is over. Here’s what happens next

- Economists projected that the US added 140,000 jobs in September and that the unemployment rate held steady at 4.2%.

- US economy added 254,000 jobs in September, logging surprisingly robust growth

- New York City Mayor Eric Adams arrives at federal court for his arraignment on Sept. 27, 2024, after he was charged with bribery and illegally soliciting a campaign contribution from a foreign national.

- The New York Times won’t endorse in local races. A group of prominent journalists aims to fill the gap

- The OpenAI website displayed on a laptop screen in Krakow, Poland on September 9.

- OpenAI just secured a ton of new cash. Now it needs to wow us

- Red Lobster’s new CEO, Damola Adamolekun.

- Red Lobster is a mess. Here’s why the new 35-year-old CEO wanted the job anyway

- An agricultural vehicle harvests hay in front of an Israeli army battle tank in southern Israel near the border with the Gaza Strip, as smoke rises above the Palestinian territory on May 15, 2024, amid the ongoing conflict between Israel and the Hamas movement.

- Israel’s economy is paying a high price for its widening war

- Striking workers hold up signs and march in front of the Bayport Container Terminal in Seabrook, Texas, on October 3, 2024. The International Longshoremen’s Association (ILA), 85,000 members strong, has launched its first strike since 1977 after weeks of deadlocked negotiations over a six-year labor agreement.

- Striking port workers to return to work Friday as negotiators reach an agreement on wages

- Five things to know as the massive port strike enters its third day

- Howard Schultz violated labor law by telling employee ‘if you’re not happy at Starbucks, you can go work for another company’

- Meet Harold Daggett, the colorful and controversial union boss leading the port strike

- People are panic-buying toilet paper because of the port strike. There is no need for that

- Costco is now selling platinum bars for $1,089

- $100 oil could be the October surprise no one wanted

- Logan Paul and MrBeast have a Lunchables competitor that they say is healthy

- Vatican Bank fires couple whose marriage breached new workplace ban

- Tesla recalls 27,000 Cybertrucks due to a rearview camera issue

- McDonald’s is finally selling the Chicken Big Mac in the US

- Friday’s jobs report could be the last normal one for a while

- How Trump consolidated control over his party and right-wing media in a ‘cloud of confusion’

- Louis Vuitton owner clinches 10-year sponsorship deal with Formula 1

Headlines from right-of-center Newsmax – 10.4.2024

-

- Musk Accuses FEMA of Obstructing Helene Aid Efforts in N.C.

- Tech billionaire Elon Musk took to X on Friday afternoon to claim the Federal Emergency Management Agency (FEMA) is “actively blocking” volunteers who try to help the struggling citizens of western North Carolina in the wake of Hurricane Helene. [Full Story]

- Related Stories

- Pat Fallon to Newsmax: Biden, Harris Behind FEMA ‘Cataclysm’

- Think Tank Targets NASA’s Comms on Musk, Trump

- Musk to Attend Trump’s Return to Bulter Rally Saturday

- Trump in Michigan: Disaster Relief Money Spent on Illegals

- Gov. Kemp: Had to Call WH for More Helene Money

- Trump Campaign: FEMA Broke Due Migrant Freebies

- Trump Seeks to Regain Momentum in North Carolina

- Schlapp: Biden, Harris Callous Toward Victims

- Chopper Pilot Threatened With Arrest Over Rescues

- N.C. Rep. Edwards: Radio Silence From Biden

- Israel at War With Iran

- Emails: Early US Concerns Over Israel’s Gaza Offensive

- Gen. Clark: Israel Must Establish Escalation, Dominance

- Col. Shaffer: Israel to ‘Directly’ Strike Iran

- US Confirms It Hit Yemen’s Iran-Backed Houthi Rebels

- Blaine Holt: Houthi Strike Shows US-UK Getting Involved

- Fmr Israeli Diplomat: Oct. 7 Attack on Civilization

- John Bolton: Israel Sees Biden’s Stance as ‘Irrelevant’

- IDF: Around 250 Hezbollah Terrorists Killed in Lebanon

- Israeli Strike Cuts Off Route From Syria to Lebanon

- Iran: Cease Fire in Lebanon, Gaza at Same Time

- Khamenei: Iran, Its Allies Won’t Back Down From Israel

- ’10/7: Evil Unveiled’ to Debut Saturday on Newsmax

- IDF Confirms Hezbollah Communication Chief’s Death

- More Israel at War With Iran

- Election ’24: Race for White House

- Biden Not Sure of ‘Peaceful’ Transition of Power

- Harris to Meet Arab American Leaders in Flint, Mich.

- Biden: Is Bibi Holding Up Peace Deal to Sway US Election?

- Abortion Ballot Backers Outraise Opponents 8-1

- Trump: Dems Led by Harris, Jack Smith ‘Lying’ About Jan. 6

- Musk to Attend Trump’s Return to Butler Rally Saturday

- Firefighters Union Won’t Endorse Harris or Trump

- Harris, Trump Battle for Labor, Union Support

- Bruce Springsteen Endorses Kamala Harris

- More Election ’24: Race for White House

- Fallon: Biden, Harris Behind FEMA Shortfall ‘Cataclysm’

- Brian Mast: Curb Foreign Aid, ‘Put America First’

- Blaine Holt: Yemen Houthi Strike Likely US-UK

- Jack Bergman: Michigan ‘Voting With Their Pocketbook’

- Mike Rogers: US Catches Cold,’ Michigan Gets ‘Pneumonia’

- Andrew Napolitano: Trump ‘Justified’ in Jack Smith Protest

- Andy Harris: Port Worker Raise Drives Up Prices

- Harris: Spend FEMA Funds on Emergencies, Not Migrants

- Lisa McClain: Harris Economy Doesn’t Work for Mich.

- Retired Brig. Gen. Chris Eddy: Stop Funding Iran

- ‘Average Joe’ Coach Kennedy: America Worth Fighting For

- Newsfront

- Biden: I Don’t Know If Israel Is Holding Up Peace Deal to Sway November Election

- President Joe Biden had terse words for Prime Minister Benjamin Netanyahu on Friday, and said he didn’t know whether the Israeli leader was holding up a peace deal in order to influence the outcome of the 2024 U.S. presidential election.”No administration has helped Israel…… [Full Story]

- Stocks End Higher as Jobs Data Eases Economic Worries

- Stocks End Higher as Jobs Data Eases Economic Worries

- U.S. stocks closed solidly higher Friday as a stronger-than-expected [Full Story]

- Stellantis Sues UAW in Federal Court for Strike Threats

- Chrysler parent Stellantis filed a federal lawsuit against the United [Full Story]

- GOP Senators Press FBI’s Wray Over Sex Abuse Cases

- Eric Schmitt, R-Mo., and 10 other Republican senators are [Full Story]

- ’10/7: Evil Unveiled’ to Debut Saturday on Newsmax

- The Newsmax original 10/7: Evil Unveiled, set to premiere Saturday at [Full Story]

- Andy Harris to Newsmax: Longshoremen’s Raise Will Drive Up Prices

- Andy Harris, R-Md., told Newsmax on Friday that the tentative [Full Story]

- Related

- Dockworkers Suspend Strike Until January

- Trump: Dems Led by Harris, Jack Smith ‘Lying’ About J6

- After the release of a 135-page filing from special counsel Jack [Full Story]

- Related

- Andrew Napolitano to Newsmax: Trump ‘Justified’ in Smith Filing Protest

- Trump: Lack of Security Limited Wisconsin Rally Size

- Trump Rails on Timing of DOJ’s Jan. 6 Docs Unsealing

- Fmr Va. Gov. Gilmore to Newsmax: Debates ‘Setup’ on GOP

- Obama to Hit Campaign Trail for VP Harris

- Bruce Springsteen Endorses Kamala Harris

- IDF: 2 Israeli Soldiers Killed in Northern Israel

- Israel’s military announced on Friday that two of its soldiers from [Full Story]

- Related

- Emails Show Early US Concerns Over Israel’s Gaza Offensive

- Musk: FEMA ‘Actively Blocking’ Volunteer Help in N.C.

- Tech billionaire Elon Musk took to X on Friday afternoon to claim the [Full Story]

- Rob Finnerty to Lead Newsmax Primetime Lineup

- Newsmax announced Wednesday that veteran news anchor and broadcaster [Full Story]

- Russia Warns Ukraine for Attack Near Nuclear Plant

- The Kremlin on Friday accused Ukrainian authorities of playing with [Full Story]

- Related

- Poland to Boost Northeastern Defenses by Year’s End

- Russia Removes Taliban From Terrorist Organization List

- Boris Johnson: Trump Presidency Prevented Ukraine Invasion

- Biden-Harris Foreign Policy Made World Dangerous |Platinum Article

- ‘Average Joe’ Coach to Newsmax: Fight for US

- America is worth fighting for despite all the divisiveness, says [Full Story]

- Related

- Pastors: Reelecting Trump Key in Spiritual Battle

- Vatican Synod Begins With Radical Agenda for Church

- Father Murray to Newsmax: Church Doctrine Under Microscope

- Think Tank Targets NASA Comms on Musk, Trump

- An influential conservative think tank has asked the National [Full Story]

- Related

- NASA to Launch $5.2 Billion Mission to Jupiter’s Moon

- Google Tests Verified Check Marks in Search Results

- Google Tests Verified Check Marks in Search Results

- Alphabet’s Google is testing showing check marks next to certain [Full Story]

- Supreme Court to Review Nuclear Waste Storage Ruling

- The Supreme Court agreed on Friday to step into a fight over plans to [Full Story]

- Helene’s Powerful Storm Surge Killed 12 Near Tampa

- Aiden Bowles was stubborn, so even as Florida officials told [Full Story]

- Related

- Hurricane Kirk Now Category 4 Storm in Atlantic

- Hurricane Helene’s Death Toll Reaches 215

- Helicopter Pilot Threatened With Arrest Over Helene Rescues

- Trump Camp: FEMA’s Broke Due to Harris Migrant Freebies

- Chuck Edwards to Newsmax: Radio Silence From Biden

- Helene Exposes Federal Assistance Gap in Appalachia

- Biden Admin Races to Spend $10B in Climate Change Cash

- Musk to Attend Trump’s Rally in Butler, Pennsylvania

- Elon Musk said late on Thursday he will attend Donald Trump’s rally [Full Story]

- Related

- Threats, Assassins Add Hurdles for Trump Campaign

- Trump Slams Walz’s ‘I’m Friends With School Shooters’

- Musk to Attend Trump’s Rally in Butler, Pennsylvania

- Elon Musk said late on Thursday he will attend Donald Trump’s rally [Full Story]

- Related

- Threats, Assassins Add Hurdles for Trump Campaign

- Trump Slams Walz’s ‘I’m Friends With School Shooters’

- Abortion Ballot Backers Outraise Opponents 8-1

- Abortion-rights ballot measure supporters across the country have [Full Story]

- Related

- Melania Urges Defending Abortion in New Book

- Job Growth Surges, Unemployment Falls to 4.1 Percent

- U.S. job growth accelerated in September and the unemployment slipped [Full Story]

- Trump Works to Regain Momentum in North Carolina

- Donald Trump is heading to North Carolina on Friday for the fourth [Full Story]

- US Launches Air Attacks on Yemen’s Iran-backed Houthis

- The U.S. military struck a number of Houthi targets in Yemen on [Full Story]

- House VA Panel: Need Answers on Assaults, Conditions

- Ongoing complaints about “filthy” surgical conditions, whistleblower [Full Story] | Platinum Article

- Harris and Trump Battle for Labor, Union Support

- Vice President Kamala Harris will visit the union stronghold of [Full Story]

- Spirit Talking Bankruptcy Months After Govt Spiked Sale

- Spirit Airlines is in talks with bondholders over terms of a [Full Story]

- Rescued From Gaza, Yazidi Woman, 21, Returns Home

- A 21-year-old Yazidi woman who was held for more than 10 years by a [Full Story]

- Boris Johnson: Trump Presidency Could Have Prevented Ukraine Invasion

- Former British Prime Minister Boris Johnson has claimed that Donald [Full Story]

- Tim Walz’s Verbal Gaffes Frustrate Campaign

- Minnesota Democrat Gov. Tim Walz was chosen by Vice President Kamala [Full Story]

- LA DA Reviewing Menendez Brothers’ Parricide Case

- Prosecutors in Los Angeles are reviewing new evidence in the case of [Full Story]

- 3 Ex-Memphis Officers Convicted of Witness Tampering in Nichols’ Beating

- Three ex-Memphis officers were convicted Thursday of charges of [Full Story]

- Baldwin’s ‘Rust’ Debuts 3 Years After Fatal Shooting

- The movie “Rust,” starring Alec Baldwin, is set to make its world [Full Story]

- More Newsfront

- Finance

- Investors Look to Earnings to Support Record Stock Prices

- A high-stakes corporate earnings season kicks into gear next week, with bullish investors hoping results will justify increasingly rich valuations in a U.S. stock market near record highs…. [Full Story]

- Facebook Seeks to Attract Young Adults With New Community, Videos

- The Surprising Truth About Car Leather Interiors

- The Yacht Industry is Booming: A Report from the Monaco Yacht Show

- Gold Prices Climb on Safe-Haven Demand

- More Finance

- Health

- Sitting Less May Stop Back Pain From Worsening

- Avoiding couches and chairs might be a good way of keeping your back pain from getting worse, new research suggests. Finnish researchers found that when people with back pain sat even a little less each day, their pain was less like to progress over the next six months. “If…… [Full Story]

- California Dairy Workers Latest Human Bird Flu Cases

- How Hearing Loss Raises Risk for Cognitive Decline

- Even Low Radon Levels Raise Children’s Leukemia Risk

- Water Fluoridation Not as Beneficial as in Past

- Mpox Vaccine’s Protection Wanes Within 1 Year

- Survey: Food Allergies Cause Serious Anxiety

- New Flu Shot Cuts Hospitalization Risk By 35 Percent

- CDC: Online Pharmacies Selling Fake, Dangerous Drugs