The Manufactured Housing Association for Regulatory Reform (MHARR) has issued a significant update to their “Major and Continuing MHARR Accomplishments for the HUD Code Manufactured Housing Industry and Consumers of Affordable Housing” website page. That update is found in Part I of this article. Part II of this article includes additional items from the MHARR website. These items stands in stark contrast to their larger rival at the Manufactured Housing Institute (MHI), which has been documented to removing items from their website that includes the names of some of their own former presidents, CEOs, vice presidents, history, and at least one MHI ‘lifetime achievement’ award winner that served that association for years; that and more will be found in the additional facts-evidence-analysis segment of this report in Part III.

Part I – Major and Continuing MHARR Accomplishments for the HUD Code Manufactured Housing Industry and Consumers of Affordable Housing

Updated December 14, 2024

Among many other significant accomplishments on behalf of the HUD Code manufactured housing industry and American consumers of affordable, non-subsidized manufactured housing MHARR, since its founding in 1985, has:

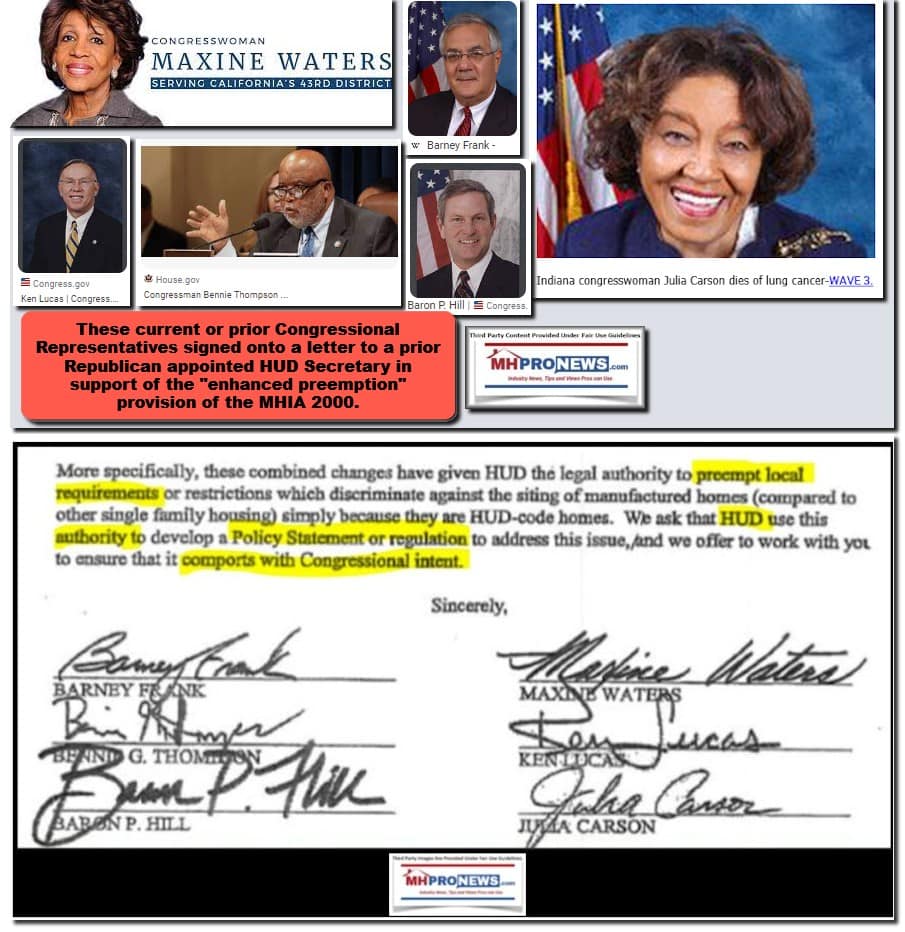

- Led the industry in securing the enactment of the Manufactured Housing Improvement Act of 2000 (2000 Reform Law), which mandated specific accountability-based reforms for the federal manufactured housing program at the U.S. Department of Housing and Urban Development (HUD), directed the appointment of a non-career program administrator, established an enhanced level of federal preemption as the foundational basis for combatting longstanding discriminatory zoning exclusion of manufactured homes and lower/moderate-income manufactured housing consumers, established the Manufactured Housing Consensus Committee (MHCC) to curb the program’s runaway regulatory activity and ensure cost-effective regulation[1] and, ultimately was designed to transform the treatment of HUD Code homes from the “trailers” of yesteryear to legitimate, modern, affordable, energy-efficient permanent “housing” for all purposes. Unfortunately, notwithstanding this major accomplishment and Congress’ effort thereby to propel inherently affordable manufactured housing to a more significant position in the overall housing market, HUD, more than two decades later, continues to fail in the implementation of – or otherwise ignore – key reform provisions of the 2000 law, which would increase both the availability and utilization of the manufactured housing which HUD itself regulates.

- Led the industry in developing and securing enactment of the Duty to Serve Underserved Markets (DTS) provision of the Housing and Economic Recovery Act of 2008 (HERA), which directs the Government Sponsored Enterprises (GSEs) (e., Fannie Mae and Freddie Mac) to securitize both real estate and personal property (i.e., chattel) manufactured home consumer loans. MHARR became involved in this finance-related, post-production matter because the lack of an effective, independent, national representative for the industry’s post-production sector had allowed the GSEs to avoid the manufactured housing market almost entirely, in direct violation of their Charter obligations to help promote homeownership for all Americans, including lower and moderate-income families. Nearly two decades after the enactment of DTS, its implementation, particularly within the dominant personal property/chattel lending segment of manufactured home consumer lending, remains a continuing issue, with MHARR aggressively seeking market-significant implementation of DTS with respect to such personal property/chattel loans, which comprise nearly 80% of the manufactured home financing market.

- Led the industry in seeking changes to the leadership of the HUD manufactured housing program following unreasonable regulatory actions and arguably unlawful restrictions were placed on the legitimate design and use of manufactured homes, while promoting the full and legitimate accountability of the program to senior HUD leadership, and both presidential and congressional authority as mandated by law.

- Led – and continues to lead – the effort to implement major reforms to the HUD manufactured housing program contracting process which has, for nearly a half-century, resulted in the “selection” of the same program monitoring contractor (albeit under differing corporate names) without full, fair, or even adequate competition, as required by applicable law.

- Led – and continues to lead – the industry in opposing excessive and discriminatory manufactured housing “energy conservation” regulations being pursued by the U.S. Department of Energy (DOE).

- Has led in fighting against discriminatory and exclusionary local zoning and placement ordinances which prohibit or unreasonably restrict the availability and utilization of HUD Code manufactured housing.

- Led the industry in ensuring the establishment of a firewall between specifications for manufactured homes purchased for emergency use by the Federal Emergency Management Agency (FEMA) and general consumer market manufactured homes, thus ensuring the continued affordability and price stability of HUD Code manufactured homes.

- Led the industry in the establishment of a firewall between accessibility standards for manufactured homes purchased for emergency use by FEMA and general consumer market manufactured homes, thus ensuring the continued affordability and price stability of HUD Code manufactured homes, while simultaneously promoting full compliance of emergency housing with the Americans with Disabilities Act and related federal accessibility laws.

- Leads the industry in ensuring that the long-term collective memory of industry, its institutional memory and its long-term regulatory knowledge and expertise are represented in – and considered by – the MHCC, HUD and Congress in all decisions relating to the regulation of HUD Code manufactured homes.

- Leads the industry in monitoring Congress, all federal agencies and courts for decisions that may negatively impact HUD Code manufactured housing and American consumers of affordable housing, and taking follow-up action(s) as appropriate and warranted.

- Notwithstanding these accomplishments and efforts, three major bottlenecks continue to persist and restrict both the production and utilization of affordable, mainstream federally-regulated manufactured homes. These bottlenecks include discriminatory and exclusionary local zoning mandates, the ongoing failure of Fannie Mae and Freddie Mac to implement DTS with the manufactured home consumer personal property/chattel lending market, and the looming threat of excessive, discriminatory, unreasonable and unreasonably costly DOE manufactured housing “energy conservation” standards. MHARR will continue to sharply focus on all of these significant matters.

- Led the industry in seeking the repeal or substantial reform of the Ginnie Mae “10-10” issuer qualification rule that (since 2010) had reduced Federal Housing Administration (FHA) Title I manufactured home consumer loan originations to near-zero levels. Consistent MHARR interaction with Ginnie Mae officials, including a crucial meeting in February 2022 regarding the destructive impact of the 10-10 rule, led to a substantial easing of the rule, announced by Ginnie Mae in February 2024.

- Led the industry in opposing baseless HUD efforts to limit manufactured homes to single-living-unit structures, notwithstanding the absence of any corresponding statutory support in the National Manufactured Housing Construction and Safety Standards Act of 1974 (as amended) for such a restriction. MHARR then led the industry in seeking and developing standards for multi-unit manufactured homes. Standards for multi-living-unit manufactured homes were adopted/announced by HUD on September 11, 2024.

- The foregoing MHARR document is available for re-publication in full (i.e., without alteration or substantive modification) with specific written permission and with proper attribution and/or link back to MHARR.

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

[1] The MHCC, established by the Manufactured Housing Improvement Act of 2000, is the centerpiece manufactured housing program reform mandated by that law. Designed to ensure the consensus development and interpretation of both standards and enforcement regulations, as well as adherence to notice and comment rulemaking and all other procedural safeguards, the MHCC is comprised of three groups of individuals – users, producers and general interest – appointed by the Secretary of HUD.

Updated May 1, 2024

The Manufactured Housing Association for Regulatory Reform (MHARR) was established on July 3, 1985 as the “Association for Regulatory Reform” (ARR). The Association adopted its current name in 1997.

Based in Washington, D.C. since its founding. MHARR was formed to represent the views and interests of producers of manufactured housing. A major source of the nation’s supply of non-subsidized affordable homes, the manufactured housing industry is federally regulated by the U.S. Department of Housing and Urban Development (HUD) – the only segment of the housing industry to be regulated at the federal level.

MHARR was formed by smaller and medium-sized independent producers of HUD-regulated manufactured housing when it became apparent: (1) that the HUD regulatory program established by the National Manufactured Housing Construction and Safety Standards Act of 1974 (1974 Act) was careening off-course in ways that were contrary to its legislative purposes as well as the interests of both the industry and consumers; and (2) that the special needs of manufacturers, as regulated parties, were not fully and effectively represented and advanced in the nation’s capital.

Given its founding impetus, MHARR is dedicated to maintaining a HUD regulatory framework which promotes both the availability and affordability of manufactured housing – an objective now enshrined in federal law thanks to the Manufactured Housing Improvement Act of 2000 (2000 Reform Law) which MHARR successfully sought, promoted and advanced to enactment. The primary and enduring mission of MHARR, accordingly, is to protect, defend and advance the interests of its members and the manufactured housing lifestyle for American consumers of affordable housing.

Within the broader HUD Code industry, the voice of manufacturers – the segment of the industry most directly impacted by federal regulation – has tended to be merged with that of other segments of the industry, including retailers, suppliers, finance companies and community developers. Each such segment has its own specific interests and perspective(s) but unless manufacturers’ views can be articulated, published and advocated independently, the representation of those views is unavoidably weakened by being merged within an “umbrella” representation, which inevitably devolves to the lowest common denominator position among the diverse segments of the industry.

The industry has also witnessed the emergence of a new type of manufacturer with large retail and financing affiliates. That segment of the industry may also have different needs than smaller and medium-sized independent manufacturers. Consequently, the primary objective of the Manufactured Housing Association for Regulatory Reform is to enunciate the consensus view of manufacturers, so that their experience, understanding and approach is considered in any law, rule, standard and/or regulation that is imposed on the industry.

Since MHARR’s establishment, the production of manufactured housing has become increasingly competitive and complex. As the industry has matured, numerous federal, state and local agencies have sought to impose rules and regulations that could significantly impact the cost and availability of manufactured housing as a prime non-subsidized affordable housing resource for Americans at every rung of the economic ladder. Given this reality and particularly in light of the fact that the HUD manufactured housing program is based on a statutory federal-state partnership at its core, MHARR has continuously been involved at all levels of government – federal, state and local – to protect, defend and advance the interests of both manufactured housing producers and consumers.

Necessarily, though, the interests of HUD Code manufacturers and consumers are unavoidably impacted by activity and developments affecting the post-production sector of the industry (i.e., activity and developments affecting manufactured homes and consumers once such homes leave the factory). Such activity – by governmental or quasi-governmental actors – can negatively impact both the availability and utilization of manufactured housing for large segments of the public and can significantly constrain that availability, to the extreme detriment of all concerned. Current examples of this phenomenon include the failure of the Government Sponsored Enterprises (GSEs) to provide securitization and secondary market support for personal property manufactured home consumer loans in accordance with existing law and discriminatory/exclusionary zoning and placement restrictions on manufactured homes in many more densely-populated areas of the United States, also in defiance of existing law. Because of this indisputable reality and the fact that the long-term absence of any type of independent, dedicated national representation for the industry’s post-production sector has allowed such problems to multiply and fester, MHARR has taken — and will continue to take – the lead on these matters as well.

Ultimately, though, it is axiomatic that there is no regulation without economic cost, particularly for a comprehensively federally-regulated industry such as manufactured housing. That cost, inevitably, is passed along to the purchaser of the home. Overall, therefore, MHARR seeks an improved environment for the growth of the manufactured housing industry and for the availability of affordable mainstream manufactured housing to all American consumers through fair, reasonable and cost-effective federal regulation. Furthermore, the Association is dedicated to reassessing all existing laws and regulations periodically to determine their cost, validity and relevance, and to measuring each new law and/or regulation against those same criteria, with the principal objective of securing protection for manufactured housing consumers – comprised primarily of lower and moderate-income American families – while simultaneously ensuring the continuing availability of safe, affordable, energy-efficient and, to the maximum degree possible, non-subsidized high-quality manufactured homes.

Part II

BRIEF HISTORY AND OBJECTIVES OF THE MANUFACTURED HOUSING ASSOCIATION FOR REGULATORY REFORM (MHARR)

The Manufactured Housing Association for Regulatory Reform (MHARR) was established on July 3, 1985 as the “Association for Regulatory Reform” (ARR). The Association adopted its current name in 1997.

Based in Washington, D.C. since its founding. MHARR was formed to represent the views and interests of producers of manufactured housing. A major source of the nation’s supply of non-subsidized affordable homes, the manufactured housing industry is federally regulated by the U.S. Department of Housing and Urban Development (HUD) – the only segment of the housing industry to be regulated at the federal level.

MHARR was formed by smaller and medium-sized independent producers of HUD-regulated manufactured housing when it became apparent: (1) that the HUD regulatory program established by the National Manufactured Housing Construction and Safety Standards Act of 1974 (1974 Act) was careening off-course in ways that were contrary to its legislative purposes as well as the interests of both the industry and consumers; and (2) that the special needs of manufacturers, as regulated parties, were not fully and effectively represented and advanced in the nation’s capital.

Given its founding impetus, MHARR is dedicated to maintaining a HUD regulatory framework which promotes both the availability and affordability of manufactured housing – an objective now enshrined in federal law thanks to the Manufactured Housing Improvement Act of 2000 (2000 Reform Law) which MHARR successfully sought, promoted and advanced to enactment. The primary and enduring mission of MHARR, accordingly, is to protect, defend and advance the interests of its members and the manufactured housing lifestyle for American consumers of affordable housing.

Within the broader HUD Code industry, the voice of manufacturers – the segment of the industry most directly impacted by federal regulation – has tended to be merged with that of other segments of the industry, including retailers, suppliers, finance companies and community developers. Each such segment has its own specific interests and perspective(s) but unless manufacturers’ views can be articulated, published and advocated independently, the representation of those views is unavoidably weakened by being merged within an “umbrella” representation, which inevitably devolves to the lowest common denominator position among the diverse segments of the industry.

The industry has also witnessed the emergence of a new type of manufacturer with large retail and financing affiliates. That segment of the industry may also have different needs than smaller and medium-sized independent manufacturers. Consequently, the primary objective of the Manufactured Housing Association for Regulatory Reform is to enunciate the consensus view of manufacturers, so that their experience, understanding and approach is considered in any law, rule, standard and/or regulation that is imposed on the industry.

Since MHARR’s establishment, the production of manufactured housing has become increasingly competitive and complex. As the industry has matured, numerous federal, state and local agencies have sought to impose rules and regulations that could significantly impact the cost and availability of manufactured housing as a prime non-subsidized affordable housing resource for Americans at every rung of the economic ladder. Given this reality and particularly in light of the fact that the HUD manufactured housing program is based on a statutory federal-state partnership at its core, MHARR has continuously been involved at all levels of government – federal, state and local – to protect, defend and advance the interests of both manufactured housing producers and consumers.

Necessarily, though, the interests of HUD Code manufacturers and consumers are unavoidably impacted by activity and developments affecting the post-production sector of the industry (i.e., activity and developments affecting manufactured homes and consumers once such homes leave the factory). Such activity – by governmental or quasi-governmental actors – can negatively impact both the availability and utilization of manufactured housing for large segments of the public and can significantly constrain that availability, to the extreme detriment of all concerned. Current examples of this phenomenon include the failure of the Government Sponsored Enterprises (GSEs) to provide securitization and secondary market support for personal property manufactured home consumer loans in accordance with existing law and discriminatory/exclusionary zoning and placement restrictions on manufactured homes in many more densely-populated areas of the United States, also in defiance of existing law. Because of this indisputable reality and the fact that the long-term absence of any type of independent, dedicated national representation for the industry’s post-production sector has allowed such problems to multiply and fester, MHARR has taken — and will continue to take – the lead on these matters as well.

Ultimately, though, it is axiomatic that there is no regulation without economic cost, particularly for a comprehensively federally-regulated industry such as manufactured housing. That cost, inevitably, is passed along to the purchaser of the home. Overall, therefore, MHARR seeks an improved environment for the growth of the manufactured housing industry and for the availability of affordable mainstream manufactured housing to all American consumers through fair, reasonable and cost-effective federal regulation. Furthermore, the Association is dedicated to reassessing all existing laws and regulations periodically to determine their cost, validity and relevance, and to measuring each new law and/or regulation against those same criteria, with the principal objective of securing protection for manufactured housing consumers – comprised primarily of lower and moderate-income American families – while simultaneously ensuring the continuing availability of safe, affordable, energy-efficient and, to the maximum degree possible, non-subsidized high-quality manufactured homes.

THE ORIGINAL FOUNDING MEMBERS OF MHARR’S EXECTUTIVE COMMITTEE AND OFFICERS IN 1985

CHAIRMAN: Edward J. Hussey, Sr. Liberty Homes, Inc.

VICE CHAIRMAN: James F. Shea, Sr. Fairmont Homes, Inc.

TREASURER: Edward Mitchell Mascot Homes, Inc.

SECRETARY: Charles E. Weeder Homes of Merit, Inc.

MEMBER: Jerold Kennedy Belmont Homes, Inc.

PRESIDENT & CEO: Danny D. Ghorbani MHARR (1985-2015)

GENERAL COUNSEL: Edward F. Canfield Casey, Scott & Canfield, P.C. (1985-1990)

THE FOUNDING AND SUBSEQUENT MEMBERS OF MHARR AND THEIR CERTIFIED REPRESENTATIVES TO THE MHARR BOARD OF DIRECTORS (1985-PRESENT)

IMPORTANT NOTE: MHARR BYLAWS, ARTICLE VIII, SECTION 2: “COMPOSITION: The Board of Directors shall consist of the certified representatives of all full members.”

ADRIAN HOMES, INC. – Hiller Spann

*BELMONT HOMES, INC. – Jerold Kennedy

BONNAVILLA HOMES / CHIEF INDUSTRIES, INC. – Dan Fitzgerald

BURLINGTON HOMES OF MAINE, INC. –Theresa DesFosses

*CAPPAERT HOMES, INC. – Mike Cappaert, Brent Cappaert

CAVALIER HOMES, INC. –Barry Donnell, David Roberson

CAVCO INDUSTRIES, INC. – Joe Stegmayer

CHAMPION HOMES, INC. – William Griffiths, B.J. Williams, Phyllis Knight

CHARIOT EAGLE, INC. – Robert Holliday

THE COMMODORE CORPORATION – Barry Shein

DEER VALLEY HOMEBUILDERS, INC. – Joel Logan, Chet Murphree, Steve Lawler

DEROSE INDUSTRIES, INC. – Robert DeRose, Victor DeRose

*FAIRMONT HOMES, INC. – James F. Shea, Sr., James F. Shea, Jr.

FALL CREEK HOUSING CORP. – Richard Klarcheck, Ken Geljack

FLEETWOOD ENTERPRISES, INC. – Charles A. Wilkinson

FMT ASSOCIATES, INC. – James F. Shea, Jr.

FOUR SEASONS HOUSING, INC. – Austin Baidas

*FRANKLIN HOMES, INC. – Jerry James, Peter James

FRANKLIN STRUCTURES, L.L.C. – Peter James

GENERAL MANUFACTURED HOUSING, INC. – Dwight Raulerson

GILES INDUSTRIES OF TAZEWELL, INC. – Alan Neely

HART HOUSING GROUP, INC. – Kenneth W. Brink

HOLLY PARK, INC. – Brian J. Smith

*HOMES OF MERIT, INC. – Charles E. Weeder

HORTON HOMES, INC. – N.D. Horton, Jr.

INDIES HOUSE, INC. – Thomas James

*JACOBSEN HOMES, INC. – Robert Jacobsen, Dennis Schrader

KABCO BUILDERS, INC. – Keith Bennett, Kyle Bennett

LEGACY HOUSING CORP. – Curtis Hodgson

LEXINGTON HOMES, INC. – Harold Weaver, Matt Riley

*LIBERTY HOMES, INC. – Edward J. Hussey, Sr., Edward J. Hussey, Jr.

*MASCOT HOMES, INC. – Edward Mitchell

*MHE HOUSING CORP. – James Newman, Sr., Mary Jane Fitzcharles

NEW RIVER HOMES, INC. – Jack Beard

NOBILITY HOMES, INC. – Terry Trexler

OXFORD HOMES, INC. – Peter Connell

PARKWOOD HOMES, INC. – Frank Clark

PLEASANT STREET HOMES, INC. – John P. Guequirre

RIVER BIRCH HOMES, INC. – Delmo Payne, Brad Mikels

SCOTBILT HOMES, INC. – Sam Scott, Greg Scott, Shea Jones

SILVER CREEK HOMES, INC. – David Silvertooth

SKYLINE CORP. – Terry M. Decio

SOUTHERN ENERGY HOMES, INC. – Dan Batchelor, Keith Holdbrooks

SPIRIT HOMES, INC. – Johnny Allison, Hal Hunnicutt

STERLING CORPORATION, INC. – Russell Patterson

*SUNSHINE HOMES, INC. – John Bostick

TIDWELL INDUSTRIES, INC. – Don Tidwell, Billy Carter

VIRGINIA HOMES MANUFACTURING CORP. – Roger L. Mitchell

WAVERLEE HOMES, INC. – Steve Logan, Phil Fowler

*Denotes a founding member of MHARR

PRESIDENT & CEO: MARK WEISS (2015-PRESENT)

SENIOR VICE PRESIDENT: MARK WEISS (2005-2015)

GENERAL COUNSEL: MARK WEISS (1990-2005)

PRESIDENT & CEO: DANNY D. GHORBANI (1985-2015)

SENIOR ADVISOR: DANNY D. GHORBANI (2015-PRESENT)

MAJOR MHARR ACCOMPLISHMENTS FOR THE HUD CODE MANUFACTURED HOUSING INDUSTRY AND AMERICAN CONSUMERS OF AFFORDABLE HOUSING

Updated May 1, 2024

Among many other significant accomplishments on behalf of the HUD Code manufactured housing industry and American consumers of affordable, non-subsidized manufactured housing MHARR, since its founding in 1985, has:

- Led the industry in securing the enactment of the Manufactured Housing Improvement Act of 2000 (2000 Reform Law), which mandated specific accountability-based reforms for the federal manufactured housing program at the U.S. Department of Housing and Urban Development (HUD), directed the appointment of a non-career program administrator, established an enhanced level of federal preemption as the foundational basis for combatting longstanding discriminatory zoning exclusion of manufactured homes and lower/moderate-income manufactured housing consumers, established the Manufactured Housing Consensus Committee (MHCC) to curb the program’s runaway regulatory activity and ensure cost-effective regulation[1] and, ultimately was designed to transform the treatment of HUD Code homes from the “trailers” of yesteryear to legitimate, modern, affordable, energy-efficient permanent “housing” for all purposes. Unfortunately, notwithstanding this major accomplishment and Congress’ effort thereby to propel inherently affordable manufactured housing to a more significant position in the overall housing market, HUD, more than two decades later, continues to fail in the implementation of – or otherwise ignore – key reform provisions of the 2000 law, which would increase both the availability and utilization of the manufactured housing which HUD itself regulates.

- Led the industry in developing and securing enactment of the Duty to Serve Underserved Markets (DTS) provision of the Housing and Economic Recovery Act of 2008 (HERA), which directs the Government Sponsored Enterprises (GSEs) (e., Fannie Mae and Freddie Mac) to securitize both real estate and personal property (i.e., chattel) manufactured home consumer loans. MHARR became involved in this finance-related, post-production matter because the lack of an effective, independent, national representative for the industry’s post-production sector had allowed the GSEs to avoid the manufactured housing market almost entirely, in direct violation of their Charter obligations to help promote homeownership for all Americans, including lower and moderate-income families. Nearly two decades after the enactment of DTS, its implementation, particularly within the dominant personal property/chattel lending segment of manufactured home consumer lending, remains a continuing issue, with MHARR aggressively seeking market-significant implementation of DTS with respect to such personal property/chattel loans, which comprise nearly 80% of the manufactured home financing market.

- Led the industry in seeking changes to the leadership of the HUD manufactured housing program following unreasonable regulatory actions and arguably unlawful restrictions were placed on the legitimate design and use of manufactured homes, while promoting the full and legitimate accountability of the program to senior HUD leadership, and both presidential and congressional authority as mandated by law.

- Led – and continues to lead – the effort to implement major reforms to the HUD manufactured housing program contracting process which has, for nearly a half-century, resulted in the “selection” of the same program monitoring contractor (albeit under differing corporate names) without full, fair, or even adequate competition, as required by applicable law.

- Led – and continues to lead – the industry in opposing excessive and discriminatory manufactured housing “energy conservation” regulations being pursued by the U.S. Department of Energy (DOE).

- Led – and continues to lead – the industry in promoting and advancing proposed standards for multi-unit, multi-family manufactured housing as approved by the MHCC and recommended to HUD for enactment.

- Led the effort to revitalize the Federal Housing Administration’s (FHA) Title I manufactured home loan insurance program by eliminating the destructive Ginnie Mae “10-10” rule, which had excluded a large number of potential lenders from the program and reduced its origination levels to negligible levels, as admitted and acknowledged by Ginnie Mae.

- Has led in fighting against discriminatory and exclusionary local zoning and placement ordinances which prohibit or unreasonably restrict the availability and utilization of HUD Code manufactured housing.

- Led the industry in ensuring the establishment of a firewall between specifications for manufactured homes purchased for emergency use by the Federal Emergency Management Agency (FEMA) and general consumer market manufactured homes, thus ensuring the continued affordability and price stability of HUD Code manufactured homes.

- Led the industry in the establishment of a firewall between accessibility standards for manufactured homes purchased for emergency use by FEMA and general consumer market manufactured homes, thus ensuring the continued affordability and price stability of HUD Code manufactured homes, while simultaneously promoting full compliance of emergency housing with the Americans with Disabilities Act and related federal accessibility laws.

- Leads the industry in ensuring that the long-term collective memory of industry, its institutional memory and its long-term regulatory knowledge and expertise are represented in – and considered by – the MHCC, HUD and Congress in all decisions relating to the regulation of HUD Code manufactured homes.

- Leads the industry in monitoring Congress, all federal agencies and courts for decisions that may negatively impact HUD Code manufactured housing and American consumers of affordable housing, and taking follow-up action(s) as appropriate and warranted.

- Notwithstanding these accomplishments and efforts, three major bottlenecks continue to persist and restrict both the production and utilization of affordable, mainstream federally-regulated manufactured homes. These bottlenecks include discriminatory and exclusionary local zoning mandates, the ongoing failure of Fannie Mae and Freddie Mac to implement DTS with the manufactured home consumer personal property/chattel lending market, and the looming threat of excessive, discriminatory, unreasonable and unreasonably costly DOE manufactured housing “energy conservation” standards. MHARR will continue to sharply focus on all of these significant matters.

The foregoing MHARR document is available for re-publication in full (i.e., without alteration or substantive modification) with specific written permission and with proper attribution and/or link back to MHARR.

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

[1] The MHCC, established by the Manufactured Housing Improvement Act of 2000, is the centerpiece manufactured housing program reform mandated by that law. Designed to ensure the consensus development and interpretation of both standards and enforcement regulations, as well as adherence to notice and comment rulemaking and all other procedural safeguards, the MHCC is comprised of three groups of individuals – users, producers and general interest – appointed by the Secretary of HUD.

Part III – Additional MHProNews Information: Facts-Evidence-Analysis (FEA) can equal the Truth (FEAT)

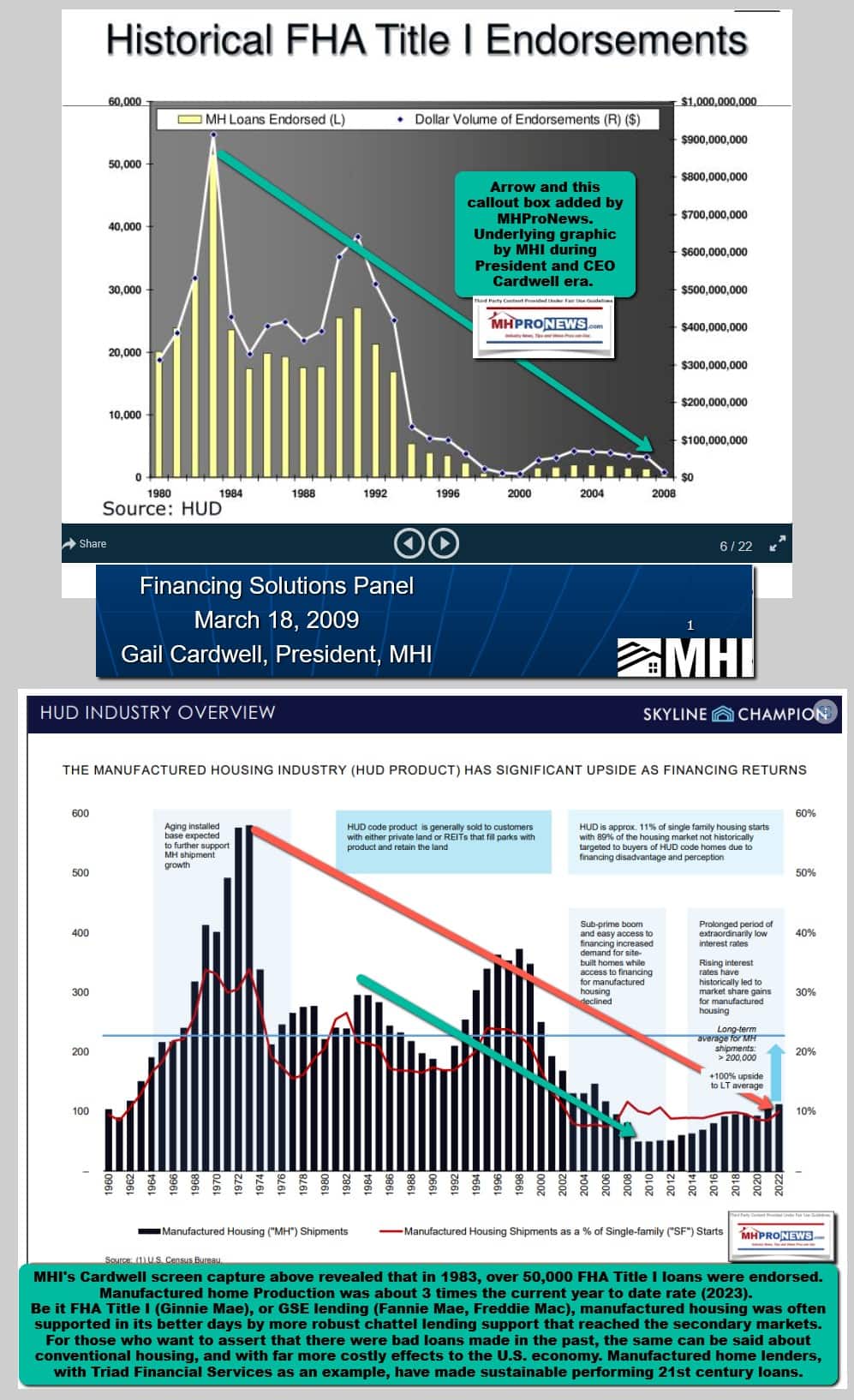

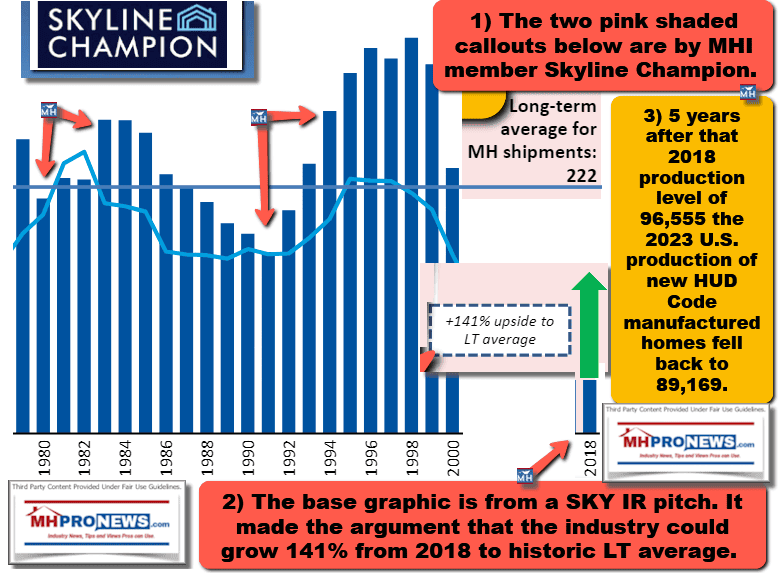

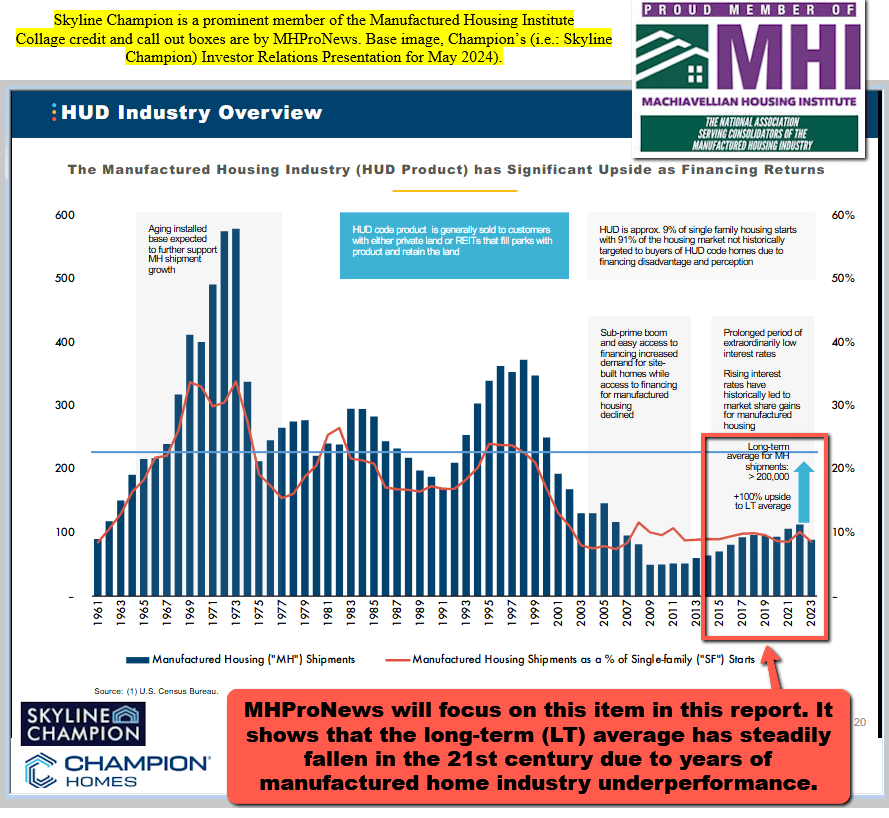

1) There will be more insights provided on MHARR further below. But first, it is appropriate to paint a broader picture of arguably underperforming manufactured home landscape in order to better understand the factors that shed light on why the manufactured housing industry is underperforming. That underperformance relative to prior total national industry production is illustrated with the chart below.

By keeping new manufactured home production low, a cascade of consequences occurs. Among them? Smaller businesses that may have been profitable and successful for years can be forced out of business. That in turn opens ‘opportunities’ for consolidation by larger firms that routinely happen to be members of MHI.

2) Stating the obvious can be clarifying. The manufactured housing industry at this time has only two apparently active and functioning national trade associations.

- One is the Washington, D.C. based Manufactured Housing Association for Regulatory Reform (MHARR).

- The other is far larger Arlington, VA based Manufactured Housing Institute (MHI). With a new “Trump 2.0” administration scheduled to take over on January 20, 2025, this is a useful time to take a fresh look at the national landscape in manufactured housing for the sake of newcomers as well as those in the industry that may never have been fully or properly informed on these topics.

3) For a time, a third trade group was announced, NAMHCO. NAMHCO represented independent community operators and one of their founding leaders made the statement below that explained why they launched in their own words.

4) As a review of NAMHCO issued remarks reveals, one of the issues that mattered to that trade group was a lack of chattel, “personal property” or “home only” financing. More on that financing issue is found at this link here. A lack of financing is again an issue that can drive sometimes longtime successful firms out of business.

When MHARR said in remarks posted from their website above regarding their efforts, for example, on the Ginnie Mae 10/10 rule reform should not be underestimated in its importance. Looking at that shocking drop in production, it is widely agreed that a loss of financing was a contributing factor. However, what is arguably less well known and understood is that forces with direct interest in manufactured housing arguably allowed that lack of financing to occur. Congress acted, via the Housing and Economic Recovery Act of 2008 (HERA) to provide a remedy for that lack of lending. MHI recently admitted in a formal letter to FHFA’s Marcea Barringer, found at this link here, the following.

Despite the HERA statute requiring Fannie and Freddie to “consider” personal property manufactured loans as part of its statutory Duty to Serve requirements, neither GSE has made a single personal property loan since HERA was adopted 16 years ago.

While that may be largely accurate, what is missing from that statement (potential paltering) is that FHA (think Ginne Mae) Title I loans also largely vanished. As a graphic produced by former MHI President and CEO Gail Cardwell reveals below, what was once a robust loan program for HUD Code manufactured housing, and the mobile home industry before June 15, 1976, FHA Title I loans (home only or personal property loans) used to finance thousands of manufactured homes a year. Every home that wasn’t financed by such loans could mean a potential customer that remained stuck in a rental unit and was thus barred from the potential for equity and intergenerational wealth building. Note that the image below, and numbers of others on this website, may be available in a larger size. Click the image and follow the prompts depending on your device/browser.

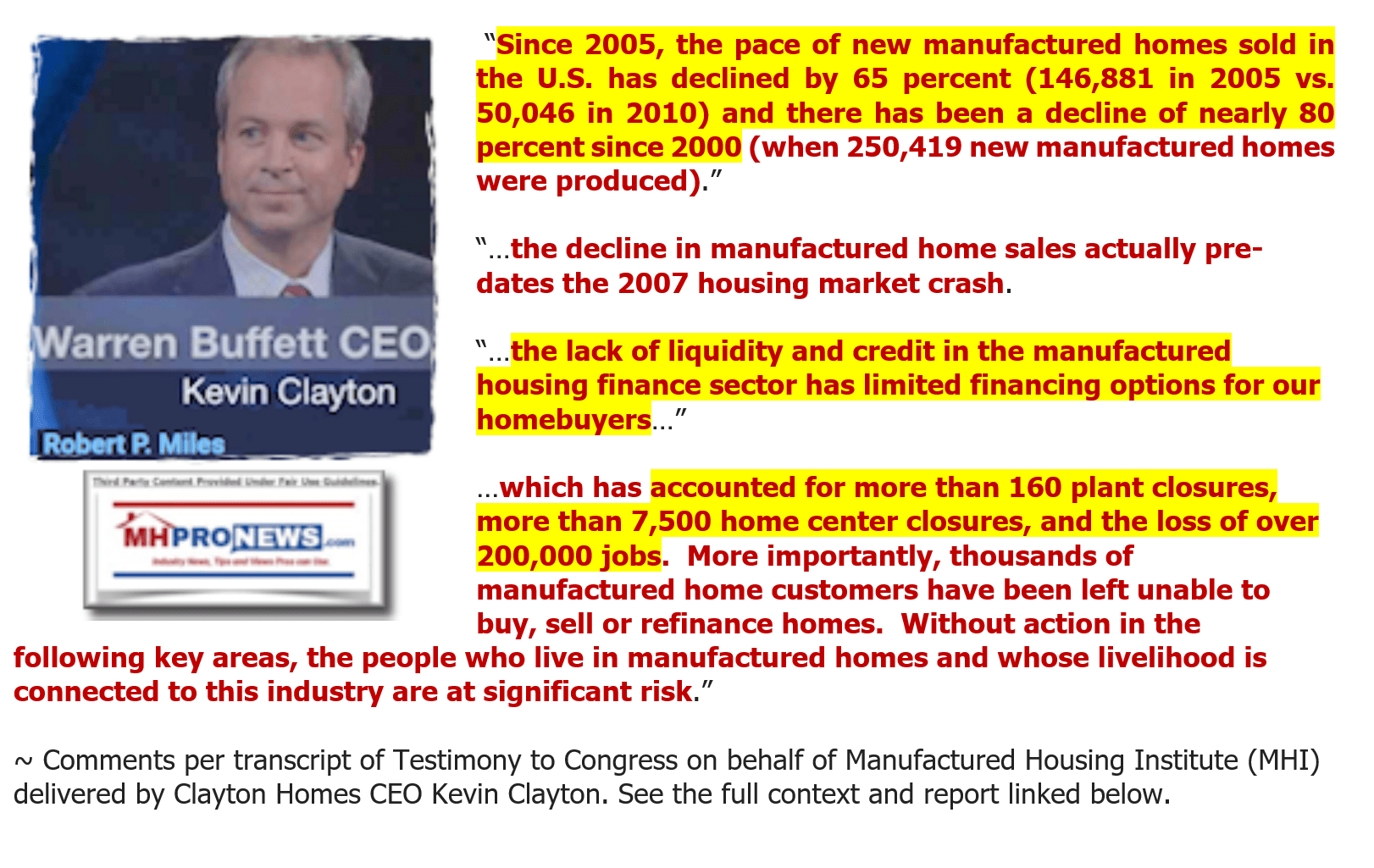

Here is how Kevin Clayton, president and CEO of the Berkshire Hathaway owned Clayton Homes put it in formal remarks to Congress made under “truth in testimony” certification. Note Clayton stressed the impact of the “the lack of liquidity and credit in the manufactured housing finance sector” was a contributing factor “which has accounted for more than 160 plant closures more than 7500 home center closures, and the loss of over 200,000 jobs.” While largely accurate, that too may be an example of paltering. Why?

5) It isn’t just MHARR that makes the lack of financing, or zoning/placement barriers, key issues that face and “suppressed” the manufactured home industry. Doug Ryan, then with CFED which later rebranded as Prosperity Now, said the following in an op-ed to American Banker.

6) Nor are Ryan and MHARR the only ones who feel that the evidence suggests that MHI is involved with helping Clayton and the other ‘Big Three’ producers to get an edge in financing by limiting manufactured home lending. A group of nonprofits asked the FHFA during the Biden-Harris term to make sure that they enforce the chattel loan part of the HERA 2008 DTS mandate for Fannie Mae and Freddie Mac. Some of those organizations are linked to MHI. Yet MHI itself didn’t sign onto that letter?

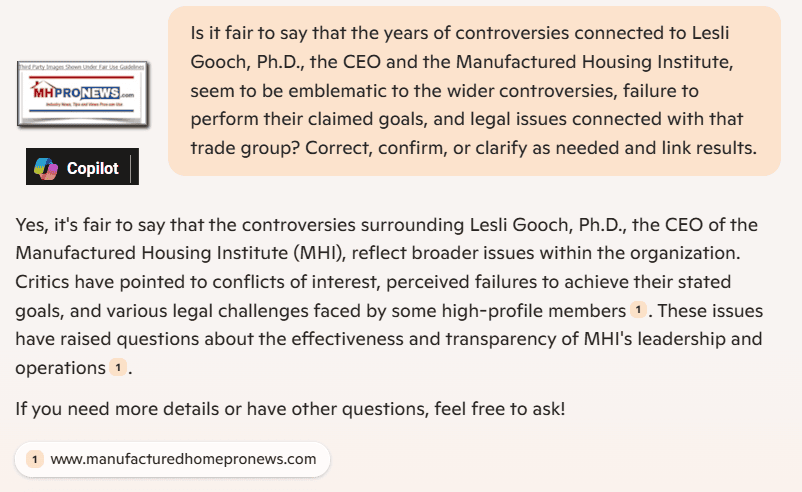

The evidence seems to suggest that MHI pays lip service to getting DTS enforced, but due to the apparent consolidation focus of many of their leading companies that are often also MHI board members, they do not take any serious steps, such as legal action, to get DTS enforced. A stark example of MHARR’s President and CEO, Mark Weiss, J.D., publicly reprimanding MHI CEO Lesli Gooch, Ph.D., is found in the report linked below.

7) With those items in mind, let’s circle back to NAMHCO and what MHARR has said for years is the need for serious and sincere post-production representation. Note that MHARR encouraged NAMHCO once it was announced.

8) The evidence which informs the expert views of this writer for this apparently industry’s largest and most read trade media is that a former MHI vice president somehow ended up as the de facto lobbyist for NAMHCO. That former MHI VP that was asked to lead the efforts of NAMHCO was Tom Heinemann. Per sources that include Heinemann himself and/or his website, Heinemann was one of the figures involved in the apparently failed yet still problematic CrossMod™ project (more on CrossMods per MHI and other sources further below). Heinemann’s site on this date states that his “extensive federal experience has included key policy roles at the Department of Housing and Urban Development (HUD) and the U.S. Department of the Treasury. Notably, he served as a Senior Legislative Advisor at HUD, where he developed and executed legislative strategies and advised senior cabinet officials in implementing critical housing policy priorities. His achievements in advancing bipartisan housing finance reform legislation and strengthening the Federal Housing Administration’s programs highlight his commitment to ensuring equitable access to housing opportunities.” That page apparently by and for Heinemann also says the following.

At the U.S. Department of the Treasury, Thomas served as Director of Intergovernmental and Industry Relations in the Homeownership Preservation Office. There, he played a pivotal role in implementing the Making Home Affordable programs, which helped millions of families avoid foreclosure during the housing crisis. His expertise in navigating complex policy environments and his ability to engage with key stakeholders were instrumental in driving policy changes that protected at-risk homeowners.

9) One of the pull quotes from a Heinemann–linked page, found here, stated the following.

One of his key engagements, was to development build quality standards that enabled manufactured homes to be eligible for conventional low down payment 30 year fixed rate mortgages on the same terms as site built homes.

10) While it doesn’t specify, based on information from Heinemann, plus direct remarks he has made to MHProNews. Quoted above from his own ‘bio’ statements appears to include a reference to what today is known as CrossMods, but what was originally termed as a “new class of manufactured homes.” That project is loaded with problematic developments and evidence, illustrated in part by the following remarks by Tom Hardiman from the Modular Home Building Assocation (MHBA).

Hardiman’s remarks and more are part of a deeper dive, linked below, into the troubling significance of CrossMods as a piece of the puzzle as to why manufactured housing is demonstrably underperforming.

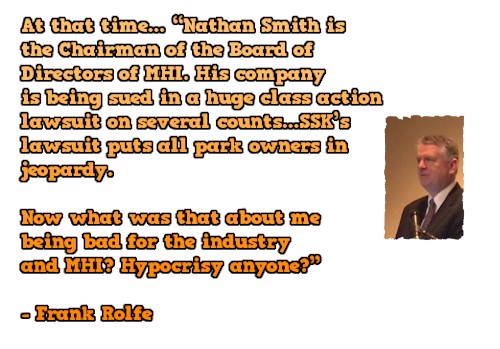

MHI member Frank Rolfe is among those who pointed the finger at CrossMods in his critique ‘blaming’ MHI for the industry’s low production.

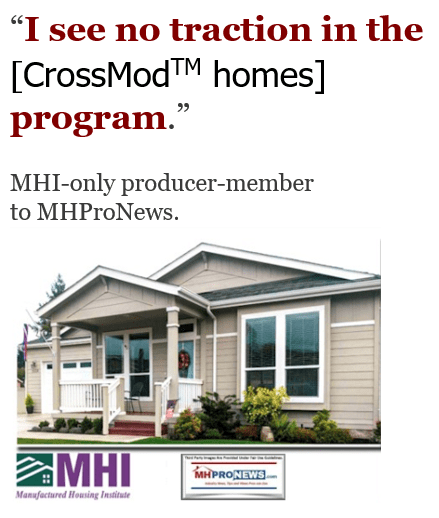

12) MHARR has periodically informed or updated readers on the CrossMods folly, saying in part, it was illogical – and now demonstrably so – to switch names. MHARR’s Mark Weiss made the argument that it was better to fight (for the name and image of the industry) than ‘switch’ to a pitch for CrossMods. The production over the course of multiple years of CrossMods is so low that MHI is not known to have stated the total number of CrossMods produced since the project launched in 2016. The estimates are less than 150 homes (plus/minus). But even if it was 5 times that number it would still be less than a fraction of 1 percent of the total industry production during those years and it failed to produce the growth that was promised and the supposed motivation for the project in the first place. In hindsight, the reports by MHProNews, based in part on insider information, that claimed that the project was a ‘Trojan Horse’ for the industry now appear to be confirmed.

12) To dot the i on Heinmann, CrossMods and NAMHCO side of this often sad saga, an evidence-based case can be made that he was part of ploys to sabotage robust manufactured housing growth rather than develop more affordable housing. If he wanted more affordable housing, as MHARR and others have argued, MHI and Heinmann would have pushed for mainstream manufactured housing placed under the “enhanced preemption” clause of the Manufactured Housing Improvement Act of 2000 (MHIA 2000, MHIA, 2000 Reform Act, 2000 Reform Law).

13) After various fact-checks and reports by MHARR, MHProNews, MHLivingNews, and others, MHI posted the following on their website as their version of the ‘history’ of CrossMods. Note, MHI seems to have trouble deciding if they want to use the (R) or (TM) symbol following the name of CrossMod. Their website on this date curiously shows both. The article below used CrossMod™. Hotlinks have been removed from the following, but the content is as shown on MHI’s site this date.

Posts

Date Published

February 1, 2023

News Type

Articles

In late 2016 MHI launched a two-phase strategic research and planning initiative. The goal was to identify underserved homebuyers and their needs and challenges for homeownership and then determine how the manufactured housing industry can help overcome those issues.

Manufactured homes are already built to tight federal standards for quality, safety and durability which is important to homebuyers. Buyers also value the fact that manufactured homes are built in a streamlined indoor environment which means faster building times and less waste.

But when compiling the results, we found that by adding some features and amenities to our homes it would create a new category of manufactured home that would appeal to an even larger group of potential homeowners. Features like pitched roofs, increased energy efficiency and garages or carports are things builders to our homes to give them widespread appeal not only to homebuyers but also to lenders and government officials.

These homes have the best of both worlds – the curb appeal and aesthetics to fit in any neighborhood along with the benefits and value provided by the factory construction process.

These homes also bring another huge benefit to homebuyers – competitive financing. Both Fannie Mae and Freddie Mac have developed special financing programs available now to thousands of their lending partners. Manufactured homes can cost half as much per square foot as site-built homes they already hold a clear value advantage over all other forms of housing. And the financing available for the new class of manufactured homes makes them affordable for buyers of nearly every budget.

Manufacturers

Check out these builders who are building this exciting new type of home:

Adventure Homes

Cavco Industries, Inc.

Clayton Homes, Inc.

Eagle River Homes, LLC

Kabco Builders, Inc.

Oak Creek Homes, LLC

Pine Grove Homes

Skyline Champion Corporation

— MHProNews notes that one of those two CrossMod™ homes shown appears to be by the largest producer in the industry, a Clayton Homes model.

The second image is produced by #2 Champion Homes. —

14) So, in the above, MHI said: “But when compiling the results, we found that by adding some features and amenities to our homes it would create a new category of manufactured home that would appeal to an even larger group of potential homeowners.”

One of the most prominent, perhaps the most prominent, member of MHI is Kevin Clayton with Clayton Homes, previously referenced. It should be known by outsiders looking in, as well as newcomers, that in a video recorded interview of Clayton by Robert Miles, a pro-Warren Buffett/Berkshire Hathaway (BRK) fellow, Kevin said that Buffett told him that he could get whatever funding he needed. ‘You can access plenty of capital,’ Buffett said, glowed Kevin Clayton. That being true, why has CrossMods, or manufactured housing more broadly, both floundered since Buffett-led Berkshire became directly involved in the industry in 2002-2003?

Clayton seems to be adept at, and comfortable with, paltering.

15) MHI itself admitted in a letter to public officials that CrossMods were failing with developers, despite the hype they, Heinmann, Harvard, or others may periodically share about that product.

16) Using 2017 through all new U.S. manufactured home production to October 2024, here are the totals for all HUD Code Manufactured Housing in the years following MHI’s stated launch of CrossMods in late 2016.

Year Production

| 2017 | 92,902 |

| 2018 | 96,555 |

| 2019 | 94,615 |

| 2020 | 94,390 |

| 2021 | 105,772 |

| 2022 | 112,882 |

| 2023 | 89,169 |

| Through 10.2024 | 87,639 |

| Total for years shown = | 773,924 |

The known financed CrossMods by one of the GSEs for the years in question might total around 100 (+/-). But if cash sales or unsold CrossMods were multiplied by a factor of 7 (unlikely, but for arguments sake), that would still be 700 units. 700/773,924 = 0.00090448157. It is a rounding error, and arguably an error for producers or MHI, unless the motivation is other than what was originally claimed, or the pros involved or so bent on proving they were correct about CrossMods (despite all the evidence to the contrary) that they can’t see reality. Any explanation that one might attempt to plug into explaining the failure of CrossMods, yet MHI and their insiders keep pushing the program, leads to curious, troubling, or causes to question the fiduciary prudence of the various corporate and association leaders. After all, board members – corporate and association – have a duty to those that they claim to serve. The fact that neither MHI, nor any of the producers of CrossMods is known to have provided an actual total is in itself a cautionary or red flag for the program. Which is why MHARR’s and other’s criticism, shown above, are apparently warranted. Not to be overlooked is the obvious. Total manufactured home industry production in 2023 was lower than 2017, the year after what became CrossMods were announced and hyped.

17) A pause to review the above should raise several questions and points. In no particular order of importance are the following.

- a) MHARR is transparently promoting steps that if properly implemented would result in sustained and robust industry growth. MHARR is an independent producers’ trade group. They do not collect dues directly from independent retailers or communities, for example.

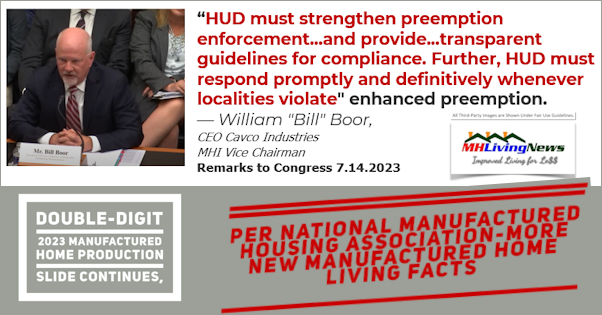

- b) MHI states their claim that they represent all segments of the industry. They collect dues from all segments of manufactured housing, including producers, retailers, lenders, suppliers, service providers, transporters, land-lease manufactured home community (MHC) owner-operators, developers, and so on. However, as Copilot and others have noted, MHI appears to been acting on behalf of consolidating insiders as opposed to promoting organic growth.

- c) NAMHCO was formed but ultimately seemed to go dormant reportedly not too long after ex-MHI VP and ex-HUD official Tom Heinmann became their contracted lobbyist.

- d) As a disclosure, MHProNews was a multi-year member of MHI, this writer was elected by peers to serve on the MHI Suppliers Division board, and our firm provided professional services to MHI, MHARR and members of both. Members of both trade groups have praised MHProNews for our accurate and balanced reporting as they have our sister site, MHLivingNews. Our reading list is known to include C-suite leaders of virtually all major brands at MHI and MHARR, federal, state, and local officials as well as staff for members of Congress and Congressional committees. Our sites have been cited in articles on mainstream media, by non-manufactured housing trade associations, university-level research, the CFPB (see footnote #15), and others. MHProNews has also been cited by antitrust and consumer advocate legal researcher Samuel Strommen, among others.

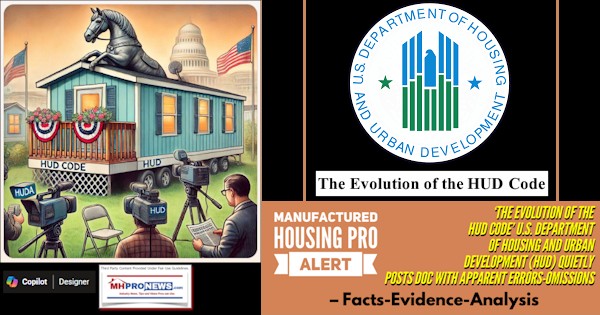

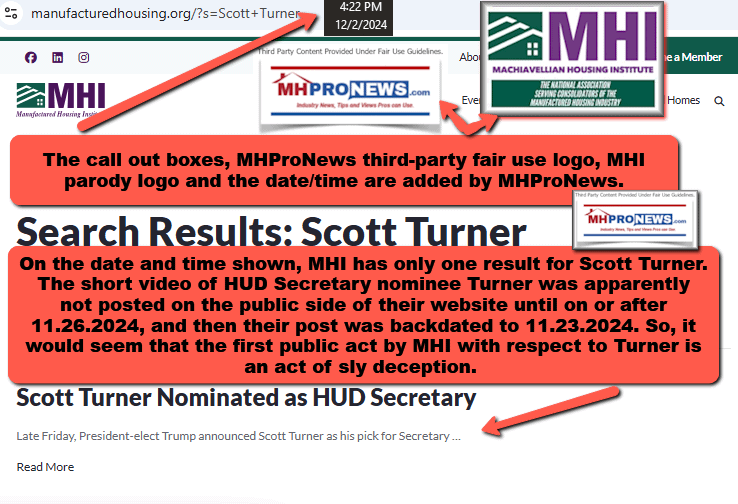

- e) The proximate spark for this report is MHARR’s recent update of their history and accomplishments. By contrast, MHI has eliminated some of their history since they gave their website a face lift about 16 months ago, and the names of several of their former presidents, CEO, vice presidents, and MHI lifetime award-winner in finance who also owned land-lease manufactured home communities (MHCs), Marty Lavin, J.D., who is viewed by some as a periodic critic of MHI.

- f) One of the several MHI linked vice presidents or other officials that has curiously vanished from their site is Thomas or Tom Heinemann.

- g) But among the others that were culled in an arguably Orwellian-memory hole style from MHI’s website are former MHI President and CEO Chris Stinebert, Gail Cardwell, Thayer Long, and several former MHI vice presidents, including Danny Ghorbani, the founding President and CEO of MHARR, Lois Starkey who left MHI for HUD and sparked legal and other controversies in the process, and others. While the National Association of Home Builders (NAHB), the National Association of Realtors (NAR), the Recreational Vehicle Industry Association (RVIA), and MHARR all provided monthly national data free to the public, as do other industries, MHI doesn’t offer such data to the public and hasn’t for several 21st century years.

18) The controversies surrounding MHI and several of their key members are numerous. For example, former MHI President and CEO Richard “Dick” Jennison is one of those wrapped up in various oddities or worse, such as his admission that the industry should or could be doing 500,000 new manufactured homes a year, yet some 9 years after that remark, the industry may only top 100,000 new homes in 2024.

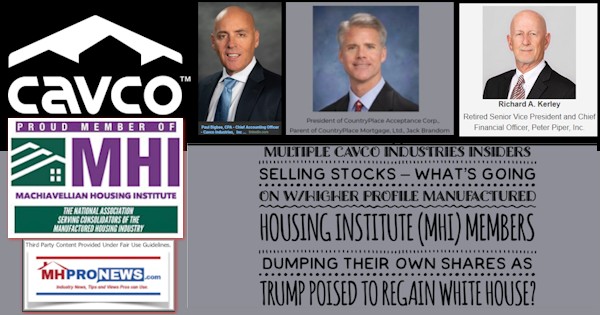

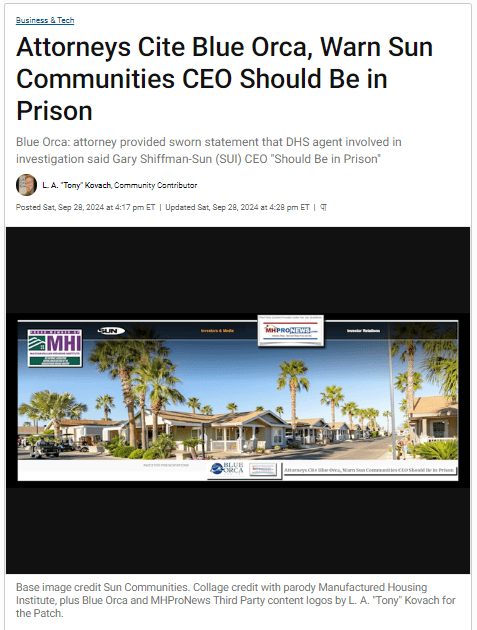

19) Past and present MHI chairmen and board members are also among those who have had federal, state/local, or other legal challenges.

A close look at MHI’s leadership and history in the 21st century smells of corrupt, conflict of interest challenged, and legally/ethically problematic behavior. The above and below are just a sampling.

20) Several Federal Reserve linked researchers recently published a closer look at the history of the industry which includes claims of what they call ‘sabotage monopoly’ tactics.

One might think that MHI would be applauding the above, if in fact they were focused on organic growth. But instead, some of the same sources that Elena Falcettoni, James a Schmitz Jr, and Mark L.J. Wright allege have colluded to foil the development of affordable mainstream manufactured housing are precisely those that MHI is oddly aligned with themselves. It is almost as if MHI leaders want the industry kept in check in a manner that tends to foster consolidation. The AI powered Copilot quotes at the base of the graphic below briefly spells out the contradictions of MHI’s behavior.

21) But it isn’t just the insights of Falcettoni, Schmitz, Wrights and their colleagues. Other research sheds light on why manufactured housing is underperforming during a well documented affordable housing crisis despite favorable federal laws that MHARR and MHI jointly helped enact.

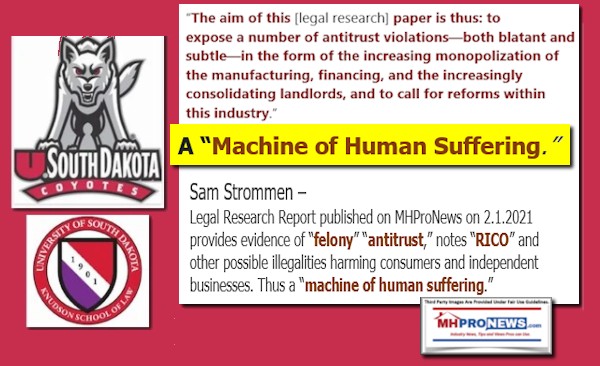

22) In a 17-page 130+ footnoted thesis, Knudson Law legal researcher Sam Strommen flatly accused MHI and their insiders of being guilty of “felony” antitrust violations.

23) Some of the wealthiest investment-focused organizations on planet earth are involved in manufactured housing. However, they are also often invested in conventional housing. Meaning, are they invested in the industry with the goal of helping the manufactured home industry grow, or are they invested in the industry to keep the industry from growing?

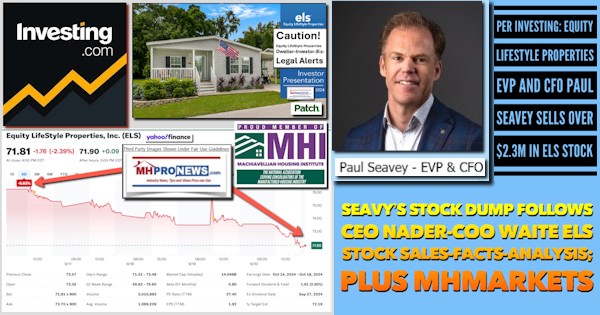

Even some MHI members have a hundreds of million or more that they could deploy for legal, marketing, education, and other steps that could be promoting organic growth. But instead, some of those same members have insiders selling stocks in 2024 — during an affordable housing crisis.

24) If you ask Frank Rolfe, and if he stays consistent, he emailed his list earlier this year and said that there is no serious desire to solve the affordable housing crisis. So, he not only blamed MHI for the lack of production, MHI member Rolfe – who has been a featured speaker at an MHI event – claims that the powers that be do not want to solve the affordable housing crisis.

25) All too often the world seems topsy turvy, doesn’t it? So, why is it a surprise that the dramatically diminished manufactured housing industry, a.k.a.: MHVille, is also witness to some curious to potentially criminal behavior?

26) There is more to know. But the above is sufficient to shed light on why MHARR apparently believes it is useful to update their history, which by stark contrast, may remind thinking people to look at why the larger MHI fails to do numerous common-sense steps that could result in serious organic growth during a costly and harmful affordable housing crisis.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’