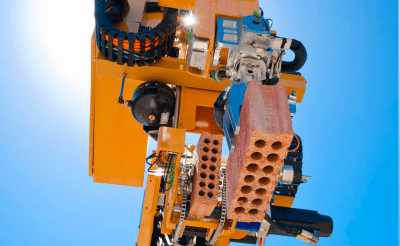

So says inventor Mark Pivac to PerthNow DigitalTrends tells the MH Industry’s Daily Business News that a brick-laying robot has demonstrated how it can build a house in two days.

FastBrick Robotics says that a robot named Hadrian reduced construction time, because it works 24/7, can lay 1000 bricks per hour. This allows for more flexibility and time/cost savings to builders and their customers. Operators, they say, will likely still be required.

The implications on the house-building industry in general are many. But what might this looming development signal for manufactured housing?

Last summer, MHProNews featured a report entitled The High Cost of Low Volume Sales in manufactured housing. In the wake of that report, the industry witnessed the withdrawal of U.S. Bank from the manufactured housing finance space. While some factories are advancing, others have closed or have been bought up by larger firms. The combination of regulatory burdens and low volume were cited by U.S. Bank in its exit message. The regulatory side of that equation was cited by numerous other MH lenders in the article linked here as to why thy withdrew from the man lending space.

The Wisconsin Housing Alliance’s Ross Kinzler has cited statistics from his state that clearly show that local MH lending has been dramatically and negatively impacted since the Consumer Financial Protection Bureau (CFPB) regulations began hitting manufactured housing about 18 months ago.

How much could robot housing or other technological developments like 3D housing potentially impact manufactured or modular home building? The precise answer is unknown. But what is certain is that greater sales volume is the best protection for manufactured and modular home builders. More sales equals potentially greater efficiencies of scale. Thus the need for regulatory relief sought by the industry in the face of what looks like conflict of interest between the CFPB and CFED, and the tandem need for growth projects such as the MH Alliance/Partners in Manufactured Housing Progress become more evident. ##

(Hadrian brick laying robot photo credit, Digital News)