Investment management leader, Robert Robotti’s firm acquired 15,865 additional shares in Cavco Industries during the most recent quarter end according to SEC filings, reports TradeCalls. That places the firm’s total stake in the #2 producer of HUD Code manufactured homes at $18,886,291, or about 6.41% of Robotti’s portfolio.

Other hedge funds boosting their stake in Cavco included:

- Credit Suisse Ag, of 18,834 shares, valued at $1,891,310.

- Friedberg Investment Management, 12,645 shares valued at $1,269,811.

Trexquant Investment, LP shed all of its holdings in CVCO, selling 4,469 valued $448,777.

Cavco hit a new 52-week high, with a $165.35 target or about 58.00% higher than their recent close of $104.65 share price, states the PressTelegraph, which says the 5 months bullish chart reflects low risk for the $956.88 million company.

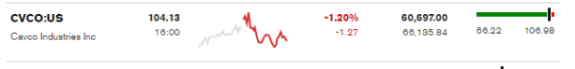

The Daily Business News, which noted that publicly-traded Deer Valley Homebuilders lead gainers on Friday, reported Cavco’s close at the bell as shown below.

As many factory-built home industry professionals know, Cavco builds and sells federally regulated HUD Code manufactured homes, state-coded modular homes, park models and systems-built commercial structures. The homes are sold through both 47 company owned as well as independently owned retail distributors in 44 states, as well as in Canada, Mexico and Japan.

Cavco operates in two primary segments: factory-built housing, which includes wholesale and retail systems-built housing operations, plus financial services, which include consumer housing finance and insurance.

For an in depth report from their recent quarterly results, click here. For the interview with the firm’s chairman and CEO – A Cup of Coffee with…Joe Stegmayer, please click here. ##

(Image credits are as shown.)

(Editor’s Note: Matthew Silver is taking some much needed and well-earned time off, and L. A. “Tony” Kovach will be helping fill the Daily Business News role in the interim).

Article submitted by L. A. “Tony” Kovach, to Daily Business News for MHProNews.