As the manufactured housing (MH) industry develops its value proposition as a solution to the waning American dream of home ownership, a recent comparison of company stock value and ROI, sheds light on just how powerful the industry’s potential could be.

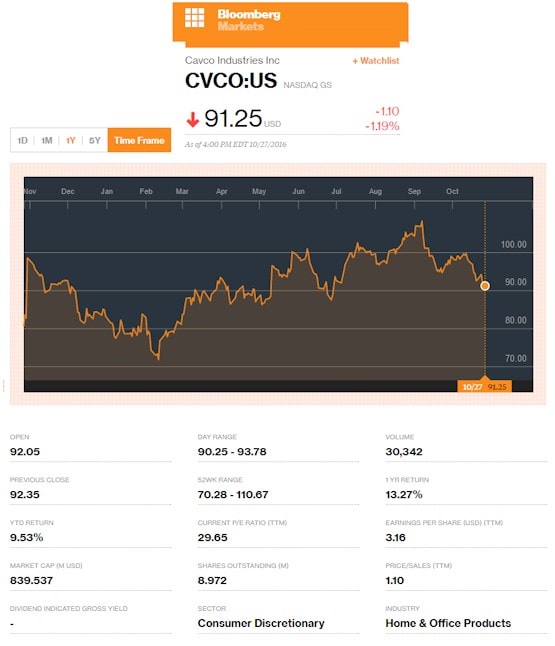

According to Capital Market Labs, in a recent comparison of Cavco Industries Inc. (CVCO), a leader in the MH Industry and MDC Holdings Inc. (MDC), a leader in the site-built housing, mortgage and insurance industries, Cavco Industries’ stock price was 3.5 times higher than MDC Holdings as of October 26th, 2016.

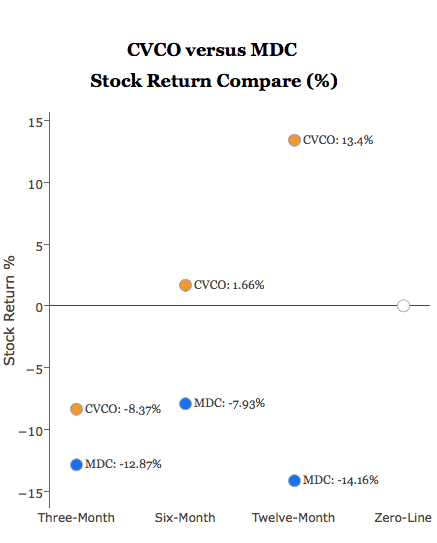

Cavco also outperformed MDC in 6 and 12 month return averages. Both companies had negative returns for the most recent 3 month quarter.

This comparison shows that:

- Both Cavco Industries Inc. and MDC Holdings Inc. have negative returns over the last quarter but CVCO has outperformed MDC.

- Cavco Industries Inc. has a positive six-month return while MDC Holdings Inc. is negative.

- Cavco Industries Inc. has a positive one-year return while MDC Holdings Inc. is negative.

Image credit, from Cavco investor report, for most recent Cavco

quarterly report by the Daily Business News, click here.

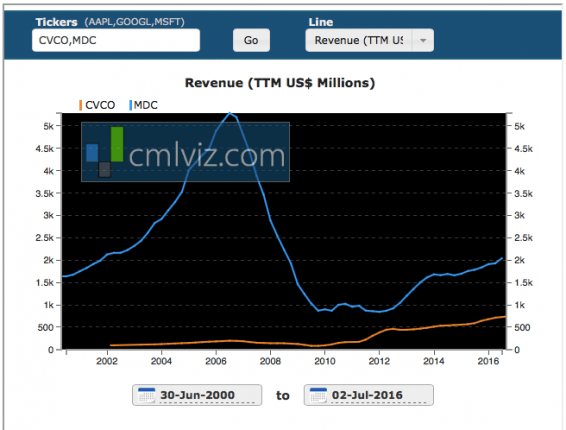

In addition to these metrics, the Capital Market Labs report also looks at revenue for Cavco and MDC from June of 2000 to July of 2016.

MDC has generated $2.04 billion in revenue over the last 12 months, while Cavco has generated $736 million over the same period.

Cavco is also one of the manufactured home industry connected stocks tracked every business day by the Daily Business News, with the most recent report, linked here. For an exclusive interview with Cavco’s Chairman, Joe Stegmayer, click here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.