Noteworthy headlines on CNNMoney – Anti-trust suit filed against DIRECTV. Venezuela is running out of time and money. The Wall Street Journal trims paper – and staff. Oil dives seven percent this week.

Some bullets from MarketWatch – Whole Foods eliminates co-CEO structure, names John Mackey CEO. Fed says it doesn’t need much more evidence before hiking rates. Nasdaq, Goldman Sachs agree to major “dark pool” deal. There’s something strange about the stock market’s long losing streak.

Oil down 2.50%. Gold up 0.79.

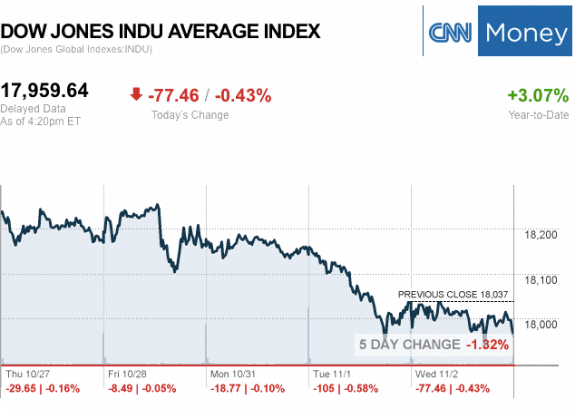

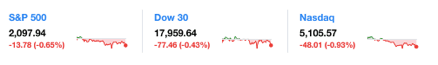

Three Major U.S. Market Tickers and closing numbers at the bell today…

S&P 500 2097.94 -13.78 (-0.65%)

Dow JIA 17,959.64 –77.46 (-0.43%).

Nasdaq 5,105.57 –48.01 (-0.93%).

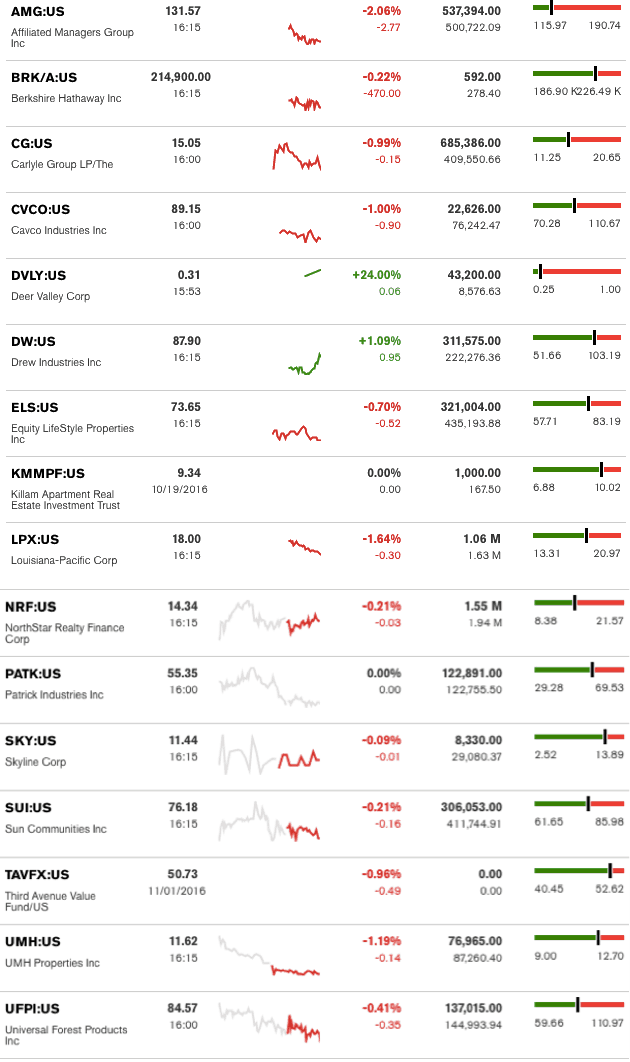

The MH Industry – Today’s Risers and Sliders

Top gainer for the day was Drew Industries Inc. (DW). The top two sliders for the day were Affiliated Managers Group Inc. (AMG) and Louisiana-Pacific Corp. (LPX). Killam held steady, as the stock is only being bought/sold periodically. (Note: ALWAYS look at the date on the Bloomberg chart below, as some stocks aren’t traded daily, etc.).

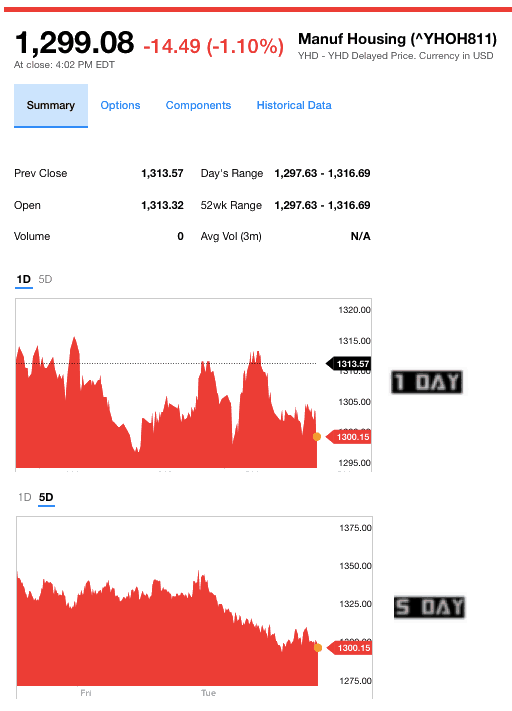

Manufactured Housing Composite Value Ticker

Note: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing-related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.