Cavco Industries (NASDAQ: CVCO) reported financial results for Q2 2016 on November 8th.

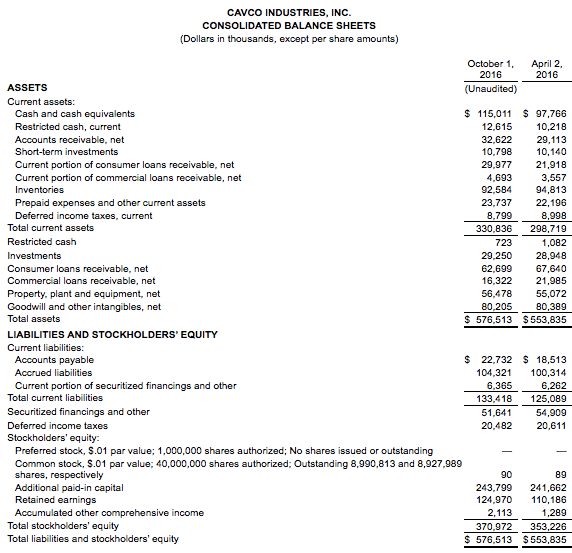

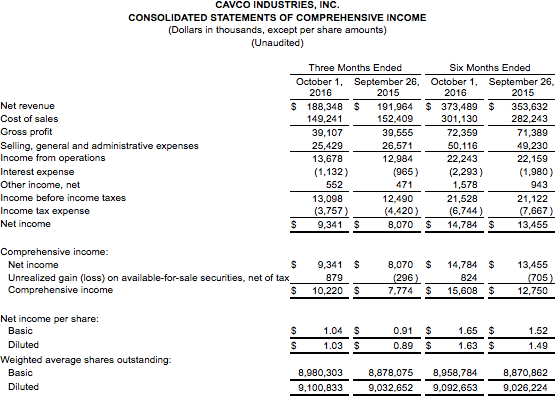

Net revenue for the second quarter was down 1.9 percent from Q2 2015 to $188.3 million, while net revenue was up 5.6% for the first six months of the year compared to the same period in 2015.

Pretax income was up 4.8% to $13.1 million, powered by operating leverage from homes sales volume. Net income was up 14.8 percent to $9.3 million.

Net income per share for the second quarter, based on basic and diluted weighted average shares outstanding, was $1.04 and $1.03 respectively, compared to net income per share of $0.91 and $0.89 for the comparable quarter last year.

Net income per share for the six months ended October 1, 2016, based on basic and diluted weighted average shares outstanding, was $1.65 and $1.63, respectively, versus basic and diluted net income per share of $1.52 and $1.49 for the prior six-month period.

“We are pleased to report improved profitability this quarter while still operating in a highly competitive housing market,” said Cavco Chairman, President and Chief Executive Officer Joe Stegmayer.

“We remain encouraged by the continued housing recovery and our solid backlogs. Interest from manufactured home retailers, developers and community operators for our product offerings remains strong heading into the winter season.”

As Daily Business News readers are aware, Phoenix, AZ-based Cavco Industries produces manufactured homes, modular and park model homes, vacation cabins and commercial structures. Factory-built homes are designed and produced under such brand names as Cavco Homes, Fleetwood Homes and Palm Harbor Homes.

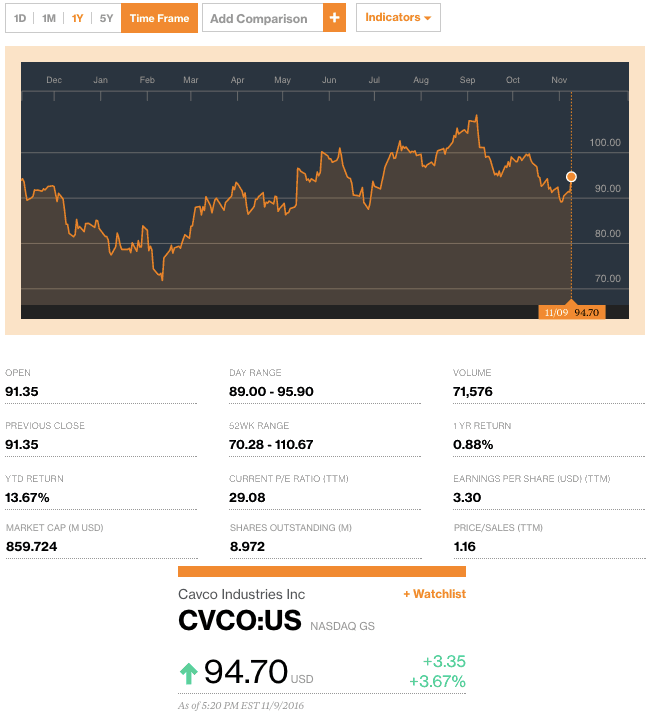

Cavco is also one of the manufactured home industry connected stocks tracked every business day by the Daily Business News, with the most recent report, linked here.

For an exclusive interview with Joe Stegmayer, click here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.