Affiliated Managers Group Inc. (NYSE:AMG) has seen a flurry of activity recently.

Per Baseball News Source, CEO Sean M. Healey sold 62,000 shares of stock on December 15th. The stock was sold at an average price of $154.84, for a total transaction of $9,600,080.00. Healey now directly owns 122,292 shares in the company, valued at approximately $18,935,693.28.

Director Dwight D. Churchill sold 3,125 shares on December 12th, with an average price of $160.23, for a total value of $500,718.75. Churchill now directly owns 6,667 shares in the company, valued at approximately $1,068,253.41.

AMG’s most recent earnings report was release on October 31st and the company reported $3.02 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.00 by $0.02.

The company had a return on equity of 18.04 percent and a net margin of 21.10 percent and earnings of $613.10 million during the quarter, compared to analysts’ expectations of $565.44 million.

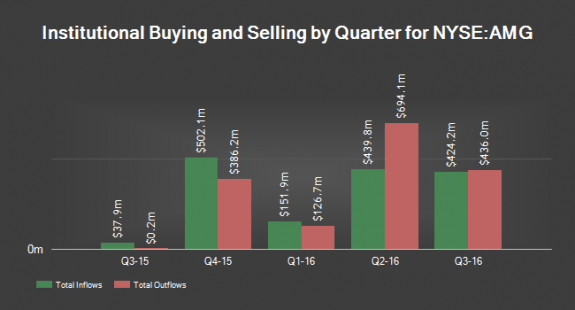

Investors also made moves related to AMG:

- Quantbot Technologies LP bought a new in the company during the second quarter valued at approximately $2,583,000;

- North Star Asset Management Inc. increased its stake in the company by 2.5 percent in the second quarter valued at $11,150,000;

- Sumitomo Mitsui Trust Holdings Inc. increased its stake by 3.2 percent in the second quarter, and now owns 181,419 shares of the company’s stock valued at $25,538,000;

- Channing Capital Management LLC increased its stake in the company by 16.1 percent in the second quarter, valued at $11,831,000.

AMG is one of the various industry-connected stocks monitored each business day on the industry’s only daily market report, featured exclusively on the Daily Business News.

For AMG’s most recent quarterly report, click here. For the most recent closing numbers on all MH industry-connected tracked stocks, please click here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.