Deer Valley Homebuilders is a HUD Code manufactured and modular home producer and is traded as an over-the-counter (OTC) stock. In recent months, it’s only periodically traded, as those who regularly follow the Daily Business News market report with a keen eye know.

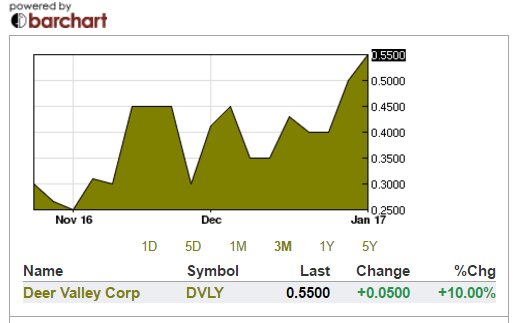

The DVLY stock has had two sizable jumps in less than a week, which suggests why this deeper look at this market mover is warranted.

The firm’s website states that, “Deer Valley Homebuilders, Inc. was founded in 2004 by eight gentlemen with over 125 years of home building experience.” Conversations with the firm’s executives will reveal that their experience shows.

The BarChart below reflects their stocks swings during the last two months, their data is from 1.3.2017.

Seeking Alpha’s data last week includes the following facts.

Trading Data

| Today’s Volume | 22,684 |

| Average Volume (3 month) | 4,562.89 |

| Average Volume (10 days) | 750 |

| Previous Close | 0.40 |

| Open | 0.45 |

| Day Range | 0.45 – 0.55 |

| 52 Week Range | 0.25 – 1 |

| 52 Week Performance | -42.03% |

| 36M Beta | 0.11 |

| 60M Beta | 0.46 |

| 50 Day Moving Average | 0.38 |

| 200 Day Moving Average | 0.52 |

Share Statistics

| Shares Outstanding | 15.51M |

| Shares Outstanding Current | 15.51M |

| Float Current | 2.64M |

| % Held by Insiders | 82.95% |

| % Held by Institutions | 86.42% |

| Shares Short | – |

| Short Ratio | – |

| Short % of Float | – |

Valuation

| Market Cap | 6.20M |

| Enterprise Value | 3.28M |

| PE Ratio | 3.12 |

| PEG Ratio | 0.03 |

| Price/Sales | 0.22 |

| Price/Book | 0.62 |

| Price/Tangible Book | 0.62 |

| Price/Cash Flow | 4.12 |

| Enterprise Value/Sales | 0.09 |

| Enterprise Value/EBITDA | 1.47 |

Profitability

| Gross Profit Margin | 22.37% |

| Operating Margin | 5.63% |

| Pretax Margin | 7.39% |

| Return on Assets | 12.14% |

| Return on Equity | 17.05% |

| Asset Turnover Ratio | 2.05% |

Income Statement

| Revenue | 35.66M |

| Revenue Growth | 17.90% |

| Net Income | 1.96M |

| Revenue Per Share | 2.30 |

| Gross Profit | 7.98M |

| EBITDA | 2.23M |

| Operating Income | 2.01M |

| Net Income Avail. to Comm. | 1.96M |

| EPS | 0.13 |

| Earnings Growth | 156.80% |

Balance Sheet

| Total Cash | 5.88M |

| Total Cash Per Share | 0.38 |

| Total Debt | 330,333 |

| Total Debt to Equity | 2.65 |

| Short Term Debt | 330,333 |

| Long Term Debt | – |

| Current Ratio | 2.44 |

| Quick Ratio | 2.16 |

| Covered Ratio | 63.06 |

| Book Value Per Share | 0.80 |

| Debt/Free Cash Flow | 0.17 |

| Long Term Debt/Total Capital | 0.03 |

Cash Flow Statement

| Net Operating Cash Flow | 2.15 |

| Free Cash Flow | 1.89M |

Beyond that basic understanding, in the case of Deer Valley Homebuilders, MHProNews’ publisher has a higher level of knowledge, having interviewed their Vice President/ General Manager and Chet Murphree, see link here (note: this link includes a 10 minute version of the shorter, edited video, posted above.)

Since the time the video above was captured and produced, several changes have taken place in the marketplace which may explain why independent manufactured and modular producers such as Deer Valley, Nobility and Sunshine Homes (among others) have seen a jump in business.

To see an outside analysts view of new construction in housing, see this link here.

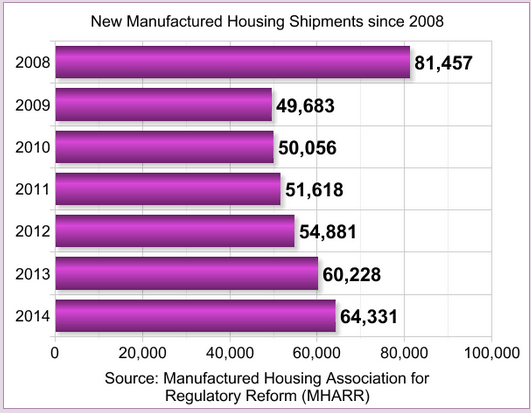

All of manufactured housing has seen a steady rise from its bottom in 2009. Based upon the most recent SAAR, an estimated 80,000 homes (+/-) could be the final new home shipment numbers for 2016.

Given:

- the rising demand in affordable homes,

- the quality, energy and money saving value that third parties

- and regulators recognize,

- plus the fact that several mainstream media outlets have touted manufactured homes as the solution to affordable homes,

all of these reasons and more may be factors sparking investor interest in a firm such as Deer Valley. It should also be noted that international interest by investors in domestic manufactured housing is growing.

There are the typical MH Industry headwinds. For example, a recent negative media report by NPR that unjustly tagged investor-owned manufactured housing communities. Without question, misunderstandings and outdated facts about manufactured homes costs the industry billions a year in potential new home sales.

But a closer look at the industry in general, and independents such as Deer Valley Homebuilders – which has built well over 7,000 homes – are reasons why the future looks bright for the factory-built home sector. The firm has retailer/builders in about 15 states, and is based in growing Guin, AL.

For the latest manufactured housing industry connected stock market overview and closing data, please click here.

“We Provide, You Decide.” © ##

(Image credits are as shown above.)

(Editor’s note: RC Williams is scheduled to be back in the saddle on the Daily Business News next week. Williams’ Home Builders Confidence report, is linked here.)